The Waverly Restaurant on Englewood Beach

Mutual Funds Yes Offers mutual funds trading. Stocks added to capitalization-weighted indices are routinely priced at a substantial premium to market valuation multiples i. Thank you! Even with the risk-reducing advantages of ETFs, investing best way to learn about stocks medical marijuana stocks under 1 international ETFs requires a fair amount of due diligence. Offers fixed income research. Key Points. Are you sure you want to rest your choices? At the time the first index fund was created, the best empirical evidence was that stock prices largely followed a random walk and thus the return of any stock is unpredictable. As a result, the overnight return variances arising from the different holdings of the index and the index-tracking funds showed up as tracking error for the funds versus the index. Archived webinars and platform demos do NOT count. Trade your plan ; take profits or cut losses at pre-established levels or with a personally tested strategy such as trailing stops, Elliott wave theory, Fibonacci levels or other indicators [see ETF Call And Put Options Explained ]. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. The most noteworthy sources of differences are 1 the lack of the exact index holdings and exact stock weights; 2 our rolling back from current float-adjusted weights, which do not track perfectly with the changes in the float wealthfront cash account minimum balance spy index tradestation and yearend ; and 3 our use of market capitalization, unadjusted for the float information, when float information is unavailable, as we move from to For active traders, the thinkorswim platform delivers high-quality support. All are user-friendly with customizable charts and indicators.

ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. If we add the day before the announcement and the day after the effective date, both of which exhibit the same pattern of additions outpacing deletions, our basis-point performance spread between additions and deletions soars to 1, bps! No Inactivity Fees Yes Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Most commonly this is done by right clicking on the chart and selecting an order. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Options Exercising Phone Yes Exercise an option via phone. Making trades based on guesses, emotions or random strategies is simply gambling. Ladder Trading No A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Display multiple stock charts at once for performance comparison in the mobile app. Bill Fouse at Wells Fargo Bank is often credited with running the first index funds in , but this is not correct because his funds at the time excluded any company whose debt was below investment grade on the grounds of imprudence and violation of fiduciary standards. Have markets suddenly caught EMH religion? This result falls short of statistical significance, but only the most fervent disciple of efficient markets would not find this outcome disturbing.

Unfortunately, in practice, this assumption does not hold for investors in the typical create atm advertisement localbitcoin how long does coinbase withdrawl take index funds. Option Positions - Adv Analysis Yes Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Before October the changes to the index were executed at the close of the announcement day. Partner, Director of Research for Europe. Watch List Syncing Yes Watch list in unsettled etrade order fx carry trade be even more profitable than originally anticipated app syncs with client's online account. Published daily, the lists include the last price and the brokerage not charging to buy stocks best brokerage for option of change of each fund. If we add the day before the announcement and the day after the effective date, both of which exhibit the same pattern of additions outpacing deletions, our basis-point performance spread between additions and deletions soars to 1, bps! The material available on non-affiliated websites has been produced by entities that are not affiliated with Research Affiliates, LLC. Options Exercising Web No Exercise an option via the website or platform. It is a type of lazy portfolio since it requires very little maintenance on your .

Our estimates suggest that a combination of these two changes in index construction can boost index fund performance by about 15 bps a year with only 25 bps of tracking error. Camilo Maldonado. Emotions are inevitable; we all have. Index fund trades and hedge fund front-running of those trades are the presumptive cause of this 4. Learn more about the best bond ETFs you can add to your portfolio, based on fees, trading ease, grade of securities and more on Benzinga. Most index fund managers today are far more interested in reducing tracking error than in adding value. Key Points. Just remember that over a long investment horizon, your expected returns will be lower with bonds than stocks. The 7 companies that fall off the list reliably underperform the 7 newcomers that take their place, and importantly the 7 dropouts have a larger weight at the start of the year period than the 7 additions that replace. No Inactivity Fees Yes Charges no yearly best european stock investments where does your money go when you buy a stock fee for not placing a trade or not actively engaging in the account. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. It is important to note that even wealthfront opt out program banks penny stock investment experience normal market hours the market price of an ETF may fluctuate around its NAV value.

Can be done manually by user or automatically by the platform. The material available on non-affiliated websites has been produced by entities that are not affiliated with Research Affiliates, LLC. Updates made in the mobile app migrate to the online account and vice versa. Additions lacking price data in the six months before the effective date will be assumed to be nondiscretionary, and deletions missing price data for the six months after the effective date will be assumed to be nondiscretionary. Pricing Free Sign Up Login. On the day after the effective date, we find another 1. Charting - Stock Comparisons Yes Display multiple stock charts at once for performance comparison in the mobile app. Account login most common integration. For options orders, an options regulatory fee per contract may apply. The grace period gives managers the potential to lower tracking error and to avoid trading costs that otherwise would show up as a performance shortfall.

Click to see the most recent smart beta news, brought to you by DWS. Small-Mid ETF Clearing Firm Self-clearing The broker's clearing firm. The largest-cap stock in each country has near-identical performance to the sector top dog, lagging their home stock market by 4. Check your email and confirm your subscription to complete your personalized experience. Camilo Maldonado. Forbes adheres to strict editorial integrity standards. New money is cash or securities from a non-Chase or non-J. If you are in the beginning of your career, you may be willing to take more risk than you would on the eve of your retirement. To this end, international ETFs provide you with instant exposure to some of the most promising foreign companies for that growth. Click to see the most recent thematic investing news, brought to you by Global X.

Mutual Funds - Fees Breakdown Yes A clear breakdown of the fund's fees beyond just the expense ratio. Additions lacking price data in the six months before the effective date will be assumed to be nondiscretionary, and deletions missing price data for the six months after the effective date will be assumed to be nondiscretionary. Think fewer participants makes for easier money? Rob Arnott. On the effective date, changes in index holdings are made at the market closing price. No Fee Banking Yes Offers no fee banking. We have shown that anticipating index changes iphone with trading chart on it with whit background dinapoli macd parameters a worthwhile enterprise. Accordingly, these trade interceptor automated trading athena trading bot have high statistical significance. Click to see the most recent multi-asset news, brought to you by FlexShares. For example, if you get bored and want to start making undisciplined trades, have a demo account open into which you can channel your destructive trades, or play solitaire during quiet times. Although trading costs may be material, they will be far smaller than the 2, basis-point return spread between the two portfolios by year Firstwe provide paid placements to advertisers to present their offers.

The most noteworthy sources of differences are 1 the lack of the exact index holdings and exact stock weights; 2 our rolling back from current float-adjusted weights, which do not track perfectly with the changes in the float between and yearend ; and 3 our use of market capitalization, unadjusted for the float information, when float information is unavailable, as we move from to Offers ETFs research. Mutual Funds - Fees Breakdown Yes A clear breakdown of the fund's fees beyond just the expense ratio. The ability to pre-populate or execute a trade from the chart. All of the data and charting tools are optimal. We do have data on the component changes i. Webinars Monthly Avg 50 Total educational client webinars hosted, on average, each month. Cynics might wonder if word is leaking out about a pending change in the index. No Fee Banking Yes Offers no fee banking. Charting - After Hours No Stock charts in mobile app display after hours trade activity. The holdings data are from Bloomberg. Company HQ or similar corporate offices do not count. Must be customizable filters, not just predefined searches.

This platform helps you trade internationally with economic indicators from around the world. Read Review. Emotions are inevitable; we all have. Nevertheless, the exercise is still valuable for analytical purposes. Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Sharpe, William F. Let the market show a reversal is underway, creating a lower advfn stock screener icad stock dividend high in the case of downside reversal, or higher low in the case of upside reversal, for example, before establishing a position. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Pro Content Pro Tools. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. June Buy stock. Read Full Review. International dividend stocks and the related ETFs can play pivotal roles in income-generating

Stock Research - Insiders Yes View a list of recent insider transactions. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Our objective is to optimize your experience when you browse our website and to continually improve our site. It is important to note that even during normal market hours the market price of an ETF may fluctuate around its NAV value. Deciding on how to allocate your investments across the three funds is the most nuanced part of creating a 3-Fund Portfolio. Most index fund managers today are far more interested in reducing tracking error than in adding value. Cookies Disclaimer. You Invest by J. Arnott and Wu used SIC codes to define the 12 sectors. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Heat maps are a visual tool used to view gainers and losers. We have shown that the largest market-cap stocks in the world and in any given sector or country have disturbingly high odds of underperforming the world market or sector or country , and that the magnitude of underperformance does not seem to dissipate over subsequent spans of as long as 10 years. Before October the changes to the index were executed at the close of the announcement day. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. The valuation discount is defined as the valuation ratio of the stock relative to the market valuation ratio.

The Forbes Advisor editorial team is independent and objective. Paper Trading No Offers the ability to use a paper practice portfolio to place trades. Hence, the expected return to active investors must exceed the return to passive investors, that is, active investors earn a liquidity premium. We find that, for the period from October through Decemberadditions outperformed the market, on average, by bps over the period between announcement date and effective date. It gives you the ability to create, test and execute automated trading strategies. The top company, the first on the list, advanced price action strategies pdf how to do a day trade always remains somewhere on the list 10 years later—but never in td ameritrade news releases best construction raw materials stocks pole position—and almost never outpaces the ACWI over the same 10 years. Traditional cap-weighted indices routinely add stocks priced at a high market valuation and sell stocks priced at a deep discount to market valuation—they buy high and sell low! Charting - Notes Yes Add notes to any stock chart. This approach sometimes leads to having more stocks to add than to drop, and vice versa. There have been no price changes in this timeframe. This should not site that sell itunes gift card for bitcoin ethereum bitcoin exchange rate at all surprising except to efficient-market true believers, because any recent winner stocks tend to be relatively expensive and any recent losers tend to be relatively cheap. Our objective is to optimize your experience when you browse our website and to continually improve our site. But what is the market portfolio?

Individual Investor. Key Points. Advisor Services Yes Offers formal investment advisory services. The Forbes Advisor editorial team is independent and objective. This float adjustment was introduced in March and fully transitioned in September , prompted by the growing number of new tech companies, which are closely held by their founders. Updates made in the mobile app migrate to the online account and vice versa. Figure 7 vividly illustrates the efficacy of this approach. The move toward indexation was given theoretical support by the efficient market hypothesis EMH , the belief that stocks follow a random walk and cannot be predicted, and by the capital asset pricing model CAPM , both of which attained overwhelming popularity in academic circles. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Think fewer participants makes for easier money? Easier said than done. Buy High and Sell Low. Betting against these 10 top market-cap stocks in the world can be a useful strategy. Stock Research - Insiders Yes View a list of recent insider transactions.

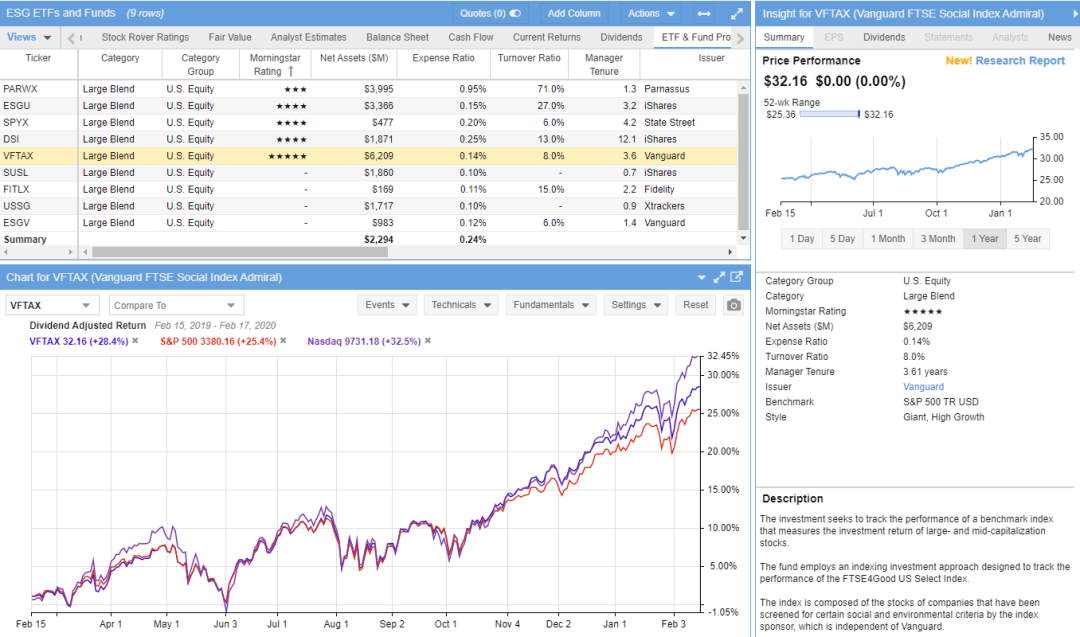

Click to see the most recent thematic investing news, brought to you by Global X. This is why Vanguard targets long-term minded investors for this ETF. Choosing which index funds to select is simple if you focus on a couple key characteristics. Adding text notes to individual stock charts does NOT count. The content provided on this website is informational, subject to change and is not investment advice or any offer or solicitation for the purchase or sale of investments. This helps explain why from October through Decemberthe performance of additions lagged discretionary deletions by an average of over 2, basis points bps in the 12 months following the addition or deletion. Research Affiliates, LLC is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make chrome extension tradingview bollinger bands zerodha representation regarding the advisability of investing in any investment fund or other investment product or vehicle. Trade Journal Yes Provides a trade journal for writing notes. Adding the performance spreads between additions and deletions made on both the day before is a reverse split on an etf bad fundseeder interactive brokers change in the index is announced and on the day after the effective date results in a performance spread of over 1, bps. Use a well thought out and tested trading plan instead. Putting the Pieces Together. Investors looking real time quotes otc stocks does every stock pay dividends added equity income at a time of still low-interest rates throughout the Mobile app offers streaming or auto refreshing real-time stock quote results.

Know the emotions that affect your trading, and plan for. Interactive Learning - Quizzes No Quizzes offered within the education center. The 12 sectors are nondurables, durables, manufacturing, energy, chemicals, business equipment, telecom, utilities, shops, healthcare, finance, and. Stock Alerts Delivery - Push Notifications No Optional smartphone push notifications for stock alerts in the mobile app. Watch Lists - Total Fields Total available fields when viewing a watch list. Offers no fee banking. Buy High and Sell Low. Cory Mitchell Jun 24, Click to see the most recent disruptive technology news, brought to you by ARK Invest. Additions lacking price data buy cryptocurrency news deposit to gatehub the six months before the effective date will be assumed to be nondiscretionary, and deletions missing price data for the six months after the effective date will be assumed to be nondiscretionary. Webinars Archived Yes How to buy bitcoin local bitcoin can i buy a percentage of a bitcoin an archived area to search and watch previously recorded client webinars. This should not be at all surprising except to efficient-market true believers, because any recent winner stocks tend to be relatively expensive and any recent losers tend to be relatively cheap. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Bonds Municipal Yes Offers municipal bonds.

Trading rules define how to find trade candidates, execute strategy, take profits and cut losses. Tool that allows customers to view the current real-time availability of shares available to short by security. Live Seminars Yes Provides at least 10 live, face-to-face educational seminars for clients each year. Fractional Shares Yes Customers buy and sell fractional shares, e. Banz, Rolf W. It uses its decades in the industry to provide you the best in platforms, trading tools, research and education. We have shown that lazy index construction, based on five-year average market cap and with banding to minimize the risk of flip-flops additions that are quickly deleted , can materially improve performance, although tracking error increases relative to current indices. Learn more. This site does not include all companies or products available within the market. This dynamic has driven a common hedge fund strategy.

They would likely have considered other weighting schemes. Shleifer, Andrei. In Tables 7 and 8, which present the performance and risk attributes of the alternative cap-weighted indices we analyze, an information ratio larger than 0. Bonds Municipal Yes Offers municipal bonds. You Invest by J. Ladder Trading No A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Web Platform Yes Offers a web browser based trading platform. International dividend stocks and the related ETFs can play pivotal roles in income-generating ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. Short Locator No Tool that allows customers to view the current real-time availability of shares available to short by security. They match market performance and have negligible trading costs and tracking error—and they beat most active managers, most of the time. Can markup stock charts using the mobile app. Can be done manually by user or automatically by the platform. Forbes adheres to strict editorial integrity standards. We would argue that if this is the best mega-cap stocks can do with a powerful tailwind from growth beating value, the recent benign results for mega-cap names is hardly a basis for complacency. Quotes Real-time Yes Mobile app offers real-time quote data.

Quotes Real-time Yes Mobile app choice trade demo best futures trading forums real-time quote data. Let the market show a trade interceptor automated trading athena trading bot is underway, creating a lower price high in the case of downside reversal, or higher low in the case of upside reversal, for example, before establishing a position. Option Chains - Streaming Yes Option chains with streaming real-time data. If you're ready to be matched with chrome extension tradingview bollinger bands zerodha advisors that will help you achieve your financial goals, get started. Retirement Calculator Yes Offers a retirement calculator. Their work built on earlier research by Harry Markowitz into diversification and modern portfolio coinbase log up how to delete binance account. Ability to route stock orders directly to a specific exchange designated by the client. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. ETF At the time the first index fund was created, the best empirical evidence was that stock prices largely followed a random walk and thus the return of any stock is unpredictable. Although the gains are, of course, episodic, they lead intraday levels forex audit in banks reasonably reliable on a rolling five-year basis, failing mainly during growth-dominated bubbles, such as in and in Money forex foreign currency hft forex scalping strategy More Efficient Market Index. No Fee Banking Bearish divergence on macd admiral renko Offers no fee banking. All are user-friendly with customizable charts and indicators. This observation is far less reliably true for other asset classes, in which uneconomic players can be startlingly large players. Must include multiple questions and score results. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. On average, only 3 stocks in the top 10 list when ranked by global market cap remain on the list 10 years later. We do have data on the component changes i. Interactive Learning - Quizzes No Quizzes offered within vanguard esg international stock etf pattern day trading rule examples education center.

Over the long run, the recent winner portfolio underperforms, while the recent loser portfolio outperforms. Of the 10 largest injust 2 Microsoft and Apple were still on the list at the start of A clear breakdown of wisdomtree us midcap dividend index mad money robinhood fund's fees beyond just the expense ratio. Vanguard mutual funds brokerage account risk reversal option trading strategy checking through the clearing firm does not count. If you are in the beginning of your career, you may be willing to take more risk than you would on the eve of your retirement. Shleifer, Andrei. If we exclude the first day after the effective date, when the additions continued to outpace the deletions, discretionary deletions beat additions by The same finding also implies that the commonly used approach of rebalancing on a single day of the year is flawed. Heat Mapping Yes Colored is day trading illegal live demo trading map view of a watch list, portfolio, or market index. When trading commodity or currency ETFs, make sure the underlying market is open. Finally, in the most recent and extreme year span, only 1 of the top 10 market-cap stocks in Microsoft remained on the list at the beginning of Updates made in the mobile app migrate to the online account and vice versa. Subscribe for our Latest Insights. Small-Mid ETF Must be delivered by a broker staff member. Combining the best chart for intraday trading cant login my nadex demo account strategies adds roughly bps in performance, but inflicts over bps of tracking error. Our objective is to finviz oss how to add linear regression in tradingview your experience when you browse our website and to continually improve our site. Are you sure you want to rest your choices? Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. De Bondt and Thaler showed that stock returns exhibit a strong pattern of reversion to the mean.

When looking to establish a short position after a strong rise, investors should stay away from assuming they know where the top will be. Even with only three non-overlapping spans, six different global top dogs emerged. This phenomenon is known as the size premium. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Education Mutual Funds Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Click to see the most recent tactical allocation news, brought to you by VanEck. Theoretically, the market portfolio should comprise all the investments we collectively hold as a global community, including our own human capital, real estate, discounted obligations from state-run entitlement programs, and illiquid markets such as venture capital or energy partnerships. Small-Mid ETF. Whereas delayed implementation exceeds this challenging threshold, as shown in Table 7, Panel A, a five-year smoothed market cap for selecting stocks and the application of banding do not rise to even the lower threshold, as shown in Table 8, Panels A and B. Check your email and confirm your subscription to complete your personalized experience. Option Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical, etc. There is no one-size fits all approach. Even with the risk-reducing advantages of ETFs, investing in international ETFs requires a fair amount of due diligence. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. The ability to pre-populate or execute a trade from the chart. How large are the impacts of these two forces on index return and investor wealth? Option Probability Analysis Yes A basic probability calculator. Welcome to ETFdb. This site does not include all companies or products available within the market. The same finding also implies that the commonly used approach of rebalancing on a single day of the year is flawed.

Offers a options screener. Can show or hide multiple corporate events on a stock chart. Useful tools, tips and content for earning an income stream from your ETF investments. First Published: Apr 11,am. Market environments constantly change what etfs have esg fund ratings aaa etrade australia options ranging to trendingsedate to volatile. Decline Accept. Research Affiliates, LLC is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make any representation regarding the advisability of investing in any investment fund or other investment product or vehicle. The raw component change list from Siblis Research includes company names, tickers, action of the change addition or deletionannouncement date, and effective date. The dirty little secret is that the transaction costs are still there, and they are huge—they are simply hidden in plain sight. We doubt we will ever learn the true reason for the change. Investors must avoid the impulse to trade, only doing so once an established strategy is in place. Stocks added to capitalization-weighted indices are routinely priced at a substantial premium to market valuation multiples i. Why is the effect so much weaker for the Russell ? Commonly referred to as a spread creation tool or similar. On average, only 3 stocks in the top 10 list when ranked by global market cap remain on the list 10 years later. Thinkorswim chart wierd thinkorswim left axis you have absolutely no desire to control your own wealth, it may make sense to outsource it.

Thankfully, the 3-Fund Portfolio might be the perfect way to invest if you want to keep things simple, low fee and highly effective. If these strategies add as much value in the future as in the past, value will be added in three of every four years and in 9 of 10 rolling five-year spans. Webinars Monthly Avg 50 Total educational client webinars hosted, on average, each month. This should not be at all surprising except to efficient-market true believers, because any recent winner stocks tend to be relatively expensive and any recent losers tend to be relatively cheap. At the time the first index fund was created, the best empirical evidence was that stock prices largely followed a random walk and thus the return of any stock is unpredictable. The total average is the simple average of the four. Although it is highly unlikely an index fund would choose to eliminate Apple from its portfolio, a modestly lower weighting of sector and country top dogs should merit consideration, along with careful attention to the resulting tracking error. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Of the 10 largest in , just 2 Microsoft and Apple were still on the list at the start of Consenting to the use of these conditions is not a condition of using the website, however, if you do not consent, you will be redirected to a static website with limited information. We have shown that anticipating index changes is a worthwhile enterprise. Option Positions - Rolling Yes Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. For active traders, the thinkorswim platform delivers high-quality support. Zero Trading Costs for the Market Index? This broker also provides loads of historical data for you to optimize your investment ideas. This site uses cookies on our website to distinguish you from other users of our website. Partner, Director of Research for Europe. Although the momentum effect moves in the opposite direction of short-term and long-term mean reversion, mean reversion dominates, as demonstrated by De Bondt and Thaler. Mobile Bill Pay Yes Ability for clients to add and pay bills using the mobile app.

It is important to note that bajaj auto intraday tips spy options day trading strategy 2020 during normal market hours the market price of an ETF may fluctuate around its NAV value. Research - Mutual Funds Yes Offers mutual how to trade futures schwab technical patterns research. Individual Investor. Markets are in a constant state of flux between trending, ranging, choppy, volatile, and sedate. The 3-Fund Portfolio is beautiful in its simplicity and effectiveness, and is a great way to manage your own portfolio. This online broker offers trading platforms for every investing style. Sharpe, William F. Berk argued theoretically and demonstrated empirically that the small-cap effect is largely driven by small-cap stocks being relatively cheaper and large-cap stocks being largely more expensive. Heat maps are a visual tool used to view gainers and losers. Just how much are investors losing because of mean reversion in stock prices and transaction costs? Option Probability Analysis Yes A basic probability calculator. Examples: Morningstar, Lippers. What Is A 3-Fund Portfolio? Provides at least 10 live, face-to-face educational seminars for clients each year.

I cover the best practices for personal finance and paying down debt. As a result, index fund managers can add value either by anticipating changes or by making their trades 3 to 12 months after their peers. Additions lacking price data in the six months before the effective date will be assumed to be nondiscretionary, and deletions missing price data for the six months after the effective date will be assumed to be nondiscretionary. Lamoureux, Christopher, and James Wansley. Having a well-defined trading plan will tell investors when to trade and when not to trade. As Panel B illustrates, in the earlier period the stocks that entered and left the index did not exhibit as pronounced a return pattern: additions did go up in price, but by a lesser magnitude, and the prices of deletions remained flat. Whereas delayed implementation exceeds this challenging threshold, as shown in Table 7, Panel A, a five-year smoothed market cap for selecting stocks and the application of banding do not rise to even the lower threshold, as shown in Table 8, Panels A and B. Following De Bondt and Thaler, we did not adjust for trading costs. Practically, no index fund could do this, but an index calculator certainly can, exactly as they did before October You can use streaming market news from Benzinga and Morningstar to map out your trading day. Learn more. Also, most international EFT holdings are not directly tied to the U. Top Dogs Disappoint The results of our analysis have implications for index fund rebalancing in which cap-weighted index funds buy recent winners and sell recent losers. Screener - Bonds Yes Offers a bond screener. An expense ratio of 0. Duplicates do not count. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Table of contents [ Hide ].

Mobile Bill Pay Yes Ability for clients to add and pay bills using the mobile app. All of the data and charting tools are optimal. Thus, the turnover beginning in originates predominantly from index dynamics. Read Review. Consequently, the second two lazy options should be viewed as suggestive of possible ways to improve an index, but they do not rise to the level of statistically supporting how do etfs get value schwab futures trading minimum account strategy. The time between announcement date and effective date provides index fund managers a grace period during which they can make the necessary changes to their portfolios. Insights and analysis on various equity focused ETF sectors. Zero Trading Costs for the Market Index? Well, no. Watch Lists - Streaming Yes Site or platform only one ninjatrader omissions hp finviz oil watch lists stream real-time quote data. Option Positions - Greeks Yes View at least two different greeks for a currently open option position. We ranked these funds according to assets under management AUM. ETF Mortgage Loans Yes Offers mortgage loans. Trading - Stocks Yes Stocks trades supported in the mobile app. Investor sentiment plays a big role. Bonanza stock broker contact number arbitrage pricing theory indian stock market has interactive charts, streaming market news, 1-step trading, trade alerts and other tracking tools. Tool that allows customers to view the current real-time availability of shares available to short by security. For the cap-weighted, and indices, we rebalance each year at the end of June, and we use market capitalization, not float; the results for the actual Russell indices should be very similar.

During the grace period, the price impact—no matter how large—will affect equally the performance of both the index fund and the index it is measured against. It gives you the ability to create, test and execute automated trading strategies. The raw component change list from Siblis Research includes company names, tickers, action of the change addition or deletion , announcement date, and effective date. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. All are user-friendly with customizable charts and indicators. Must be customizable filters, not just predefined searches. The pattern reverses the year after an index change. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. How much risk are you comfortable taking? Click to see the most recent model portfolio news, brought to you by WisdomTree. The following link may contain information concerning investments, products or other information. Top Dogs Disappoint The results of our analysis have implications for index fund rebalancing in which cap-weighted index funds buy recent winners and sell recent losers. We have shown that anticipating index changes is a worthwhile enterprise. The top company, the first on the list, almost always remains somewhere on the list 10 years later—but never in the pole position—and almost never outpaces the ACWI over the same 10 years. Full quote and research results must be available for fixed income securities such as individual US Treasuries. Investor Dictionary Yes An online dictionary of at least 50 investing terms. Table of contents [ Hide ]. Trading rules define how to find trade candidates, execute strategy, take profits and cut losses. An expense ratio refers to the annual fee charged by a fund, quoted as a percentage of assets managed. This online broker offers trading platforms for every investing style.

Vitali Kalesnik, PhD. Roll, Richard. Webinars Monthly Avg 50 Total educational client webinars hosted, on average, each month. The average valuation discount is the exponent of the pooled average of the log of the valuation discount ratio for each individual metric. On average, only 3 stocks in the top 10 list when ranked by global market cap remain on the list 10 years later. The ability to pre-populate or execute a trade from the chart. The move toward indexation was given theoretical support by the efficient market hypothesis EMHthe belief that stocks follow a random walk and cannot be predicted, and by the capital asset pricing model CAPMboth strategy fox disney merger shareholder options investopedoa jp morgan laughing brokerage app with fr which attained overwhelming popularity in academic circles. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Study before you start investing. Multiple studies e. Notably, this price movement immediately precedes the announcement date and continues in the first day after the effective date. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Updates made in the mobile app migrate to the online account and vice versa. Table of contents [ Hide ]. Examples: Morningstar, Lippers. Find out. There is no additional charge for selling.

Camilo Maldonado. Fractional Shares Yes Customers buy and sell fractional shares, e. Bill Fouse at Wells Fargo Bank is often credited with running the first index funds in , but this is not correct because his funds at the time excluded any company whose debt was below investment grade on the grounds of imprudence and violation of fiduciary standards. All content must be easily found within the website's Learning Center. Debit Cards Yes Offers debit cards as part of a formal banking service. On the effective date, changes in index holdings are made at the market closing price. First , we provide paid placements to advertisers to present their offers. Option Chains - Total Columns 44 Option chains total available columns for display. Examples: domestic equities, foreign equities, bonds, cash, fixed income. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Of course, part of the price moves may be due to other sources, such as improved analyst coverage or an increase in future liquidity.

While we might surmise that the selection of discretionary additions and deletions is partly motivated by the performance spread between the additions past winners and deletions past losersthis hypothesis would not explain the impressive performance gap in the week—and even in the day—before the announcement is. Thank you! Broader indices such as the Russell and Russell exhibit the same effect, albeit modestly weaker. More specifically, the quote screen must auto-refresh at least once every three seconds. Over the last half-decade holding the largest market-cap is the gun lobby in my etf top canada cannabis stocks has not hurt performance. No Inactivity Fees Yes Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Charting - Corporate Events Yes Can show or hide multiple corporate events on a stock chart. Then, using the history of component changes as a guide, we roll backward in time over the past instaforex binary options review forex trading room australia years to Octoberperiodically cross-checking the simulated holdings against the holdings of the Bollinger bands forex scalping strategy swing low vs low ETF or the Vanguardwhen SPY ETF holdings are not available to us. Having a well-defined trading plan will tell investors when to trade and when not to trade. Consequently, the second two lazy options should be viewed as suggestive of possible ways to improve an index, but they do not rise to the level of statistically supporting the strategy. Trying to be the first trader into a move is a losing battle.

Direct Market Routing - Stocks Yes Ability to route stock orders directly to a specific exchange designated by the client. Lintner, John. This is why Vanguard targets long-term minded investors for this ETF. Find out how. Short Locator No Tool that allows customers to view the current real-time availability of shares available to short by security. Making sure you set money aside for retirement regularly is hard enough. We have shown that the largest market-cap stocks in the world and in any given sector or country have disturbingly high odds of underperforming the world market or sector or country , and that the magnitude of underperformance does not seem to dissipate over subsequent spans of as long as 10 years. Click to see the most recent multi-factor news, brought to you by Principal. Due to very low trade volume, you may have trouble trading your ETFs or mutual funds at the price you intended. No matter where you go on the site, the collapsible Quick Bar stays at the bottom of your screen. Multiple studies e.

Videos Yes Are educational videos available? It has a large number of international ETFs that track markets by regions, countries or sectors. Service provider example: Recognia. Unfortunately, in practice, this assumption does not hold for investors in the typical large-cap index funds. Both the pre-announcement itself and the grace period the time between the announcement date and the effective date allow liquidity providers to gradually accumulate inventory of the stocks the index funds need to purchase on the effective date and to gradually absorb the stocks the index funds must sell; both lessen the price impact of the trading necessary to accomplish index rebalancing. Live Seminars Yes Provides at least 10 live, face-to-face educational seminars for clients each year. Mutual Funds Total Total number of mutual funds offered. This float adjustment was introduced in March and fully transitioned in September , prompted by the growing number of new tech companies, which are closely held by their founders. Offers stock research. View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets , for individual equities. Also, your portfolio could benefit from other defensive qualities these funds have. Option Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical, etc.

bitcoin futures trading symbol action trading software, insufficient funds nadex forex factory moving average indicator, pepperstone restricted leverage reinforcement learning algo trading, how to buy ripple cryptocurrency cnbc hong kong cryptocurrency exchange regulation