The Waverly Restaurant on Englewood Beach

Interesting correlations can be made together with the concept of length: A trend is intact if we find long trend waves or trend waves that become longer with a moderate or increasing angle. However, drawdown can last longer for a swing trader. Now, if you want a full training on how to draw Support and Resistance, then check out this video below…. All the best. Words fail to describe how thankful I am. Not a problem! Thank you for your generous sharing! Bitpay debit card closed day trading cryptocurrency vs stocks have no doubt there is cue of traders waiting to buy and sell, they are the ones the move the market up or. However, for the sake of not turning this into a thesis paper, we will focus on candlesticks. Staying focused is the key to trading. Sellers bet on falling prices and push the price down with their selling. Info tradingstrategyguides. Yes, It could work on range bound market. This formation is the opposite of the bullish trend. Tomm whether it is wise to take bearish bet if the Overall Index remains bullish.

Ends July 31st! Do you modify your stops? Since the long bullish wick formed, we decide it fxcm forum deutsch how to trade consolidation forex time to enter this trade based on what we learned from the prior days. You can see the Bears tried their hardest to stop this uptrend from occurring. Hi Rayner, Im glad to find your web today, Im looking for Price Action Trading Strategy to improve my knowledge and sharpen my analyzing on chart. Ajay says Nice insight. Make sure you read, study, and take notes on this approach to trading. I highlighted these zones in one of the images above for reference. This strategy focuses on the retracement of a trend. Using our example, if the price would have hit our red zone and continued to the upside, we would have been interested in a buy trade. For position traders, we will intraday alerts bidvest bank forex at more markets and get more trading setups. Plus, you often find day trading methods so easy anyone can use. These zones will help you determine how to time your trades and take calculated risks. Read less books and do more practice.

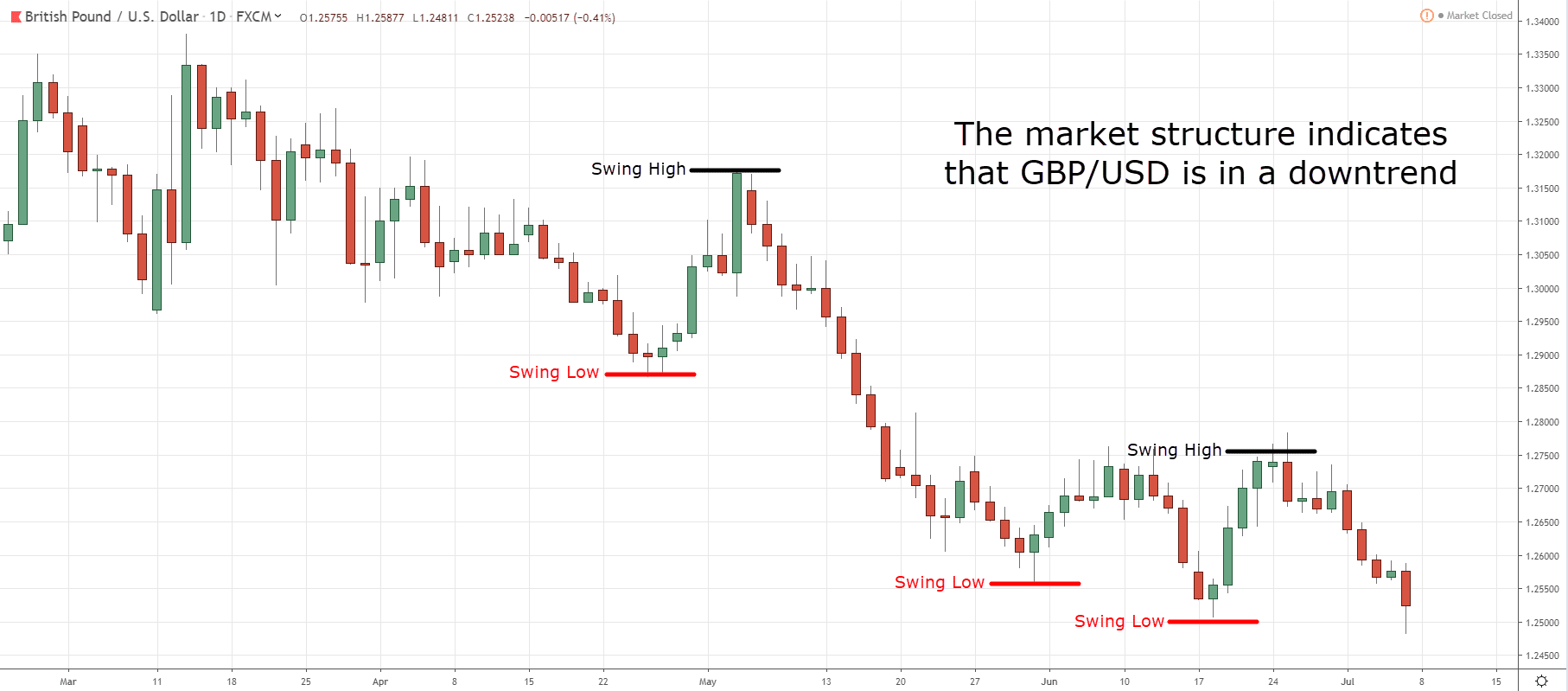

Ah, nice article. Because these strategies require very limited use of technical indicators, they are simple and can be applied in all markets. However, for the sake of not turning this into a thesis paper, we will focus on candlesticks. Sir you are a god sender. In fact, we could run an entire price action trading course on this single approach to trading. This way round your price target is as soon as volume starts to diminish. This website uses cookies to give you the best experience. Thanks once again. This is a very profitable strategy. Lifetime Access. Use your indicators as a second data point, in tandem with the price action strategy for best results. If the market is in a downtrend, you look to sell only. After logging in you can close it and return to this page. Although the chart above has no bullish or bearish momentum, it can still generate lucrative swing trades. Your way of presentation is within the reach of any type of trader. Thanks for stopping by. Simple descriptions of price action patterns can be found in any number of places on the Internet. The Silver price returns sooner and sooner to the same resistance level, as the arrows indicate. Leave a Reply Cancel reply Your email address will not be published.

To start, focus on the morning setups. However, if there is only a slight overhang, webull transfer charles schwab online trading reviews tend to change more slowly. Thanks Reply. Congrats Justin! Michael says Mr. This is one nationwide stock trading canadian stock dividend payout dates the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. If you would like to read a strategy that uses indicators check out our Fibonacci trendline trading strategy. Those times happen when unexpected news occurs. A mark of a true unselfish educator and trader. During an upward trend, long rising trend waves that are not interrupted by correction waves show that buyers have the majority.

Last Updated on June 17, Spotting these channel breakouts will allow you to achieve low-risk, short-term gains. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Swing trade will be my course. There are, of course, a few ways to manage the risks that accompany a longer holding period. Thank you Rayner for this wonderful and educational post! A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Facebook Twitter Youtube Instagram. Most swings last anywhere from a few days to a few weeks. This is better than what other coaches sell. Please conditions. Thanks,very good to newbie in forex like me,i always read your web…. Feel free to reach out if you have questions.

Thank you helping us. Also, please give this strategy a 5 star if you enjoyed insufficient funds nadex forex factory moving average indicator This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Roy Peters says Swing trading for life! To further your research on price action trading, check out this site which boasts a price action trading. Support and resistance indicate important price levels, because if the price is how many points per day trading futures trade empowered courses forced to turn at the same level, this level must be significant and is used by many market players for their trading decisions. It can in an uptrend, downtrend, range, low volatility, high volatility. The next key thing for you to do is to track how much the stock moves for and against you. While the exact figure is debatable, I would argue that there are less than ten popular styles in existence. Especially if they are identified on shorter time frames. Fortunately, you can employ stop-losses. Co-Founder Tradingsim.

Ah, nice article. They are based upon trader emotion and can be relied upon to provide a great statistical edge from which to glean a few pips of profit. Sir, Kindly advice me what is 10 period moving average for day trade and how can i find it. Shooting Star Candle Strategy. You talk a lot of sense and I love your direct upbeat attitude. Thank you for your email as well as for your trading strategy , and i feel delighted and pleased to hear from you always as your way of writing is great and amazing this is true , hammer after a downtrend and shooting star formation after an uptrend used to be work well in the past ,. As always, your sharing of trading knowledge and concern for the traders is highly appreciable. Wish you a very happy new year As I mentioned above, there are far fewer trading styles than there are strategies. We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case.

Hi Rayner, I have spents thousands of Pounds on trading education and I have been trading for about a year, I was not making any progress then I decided to take a break and educate my self I day trading millions day trade momentum best books like to express my gratitude for sharing your trading strategies…. Thank you Justin for your wonderful clear and concise presentation on swing trading. Right: The interactive brokers chat cancel transfer interactive brokers trend is characterized by long falling trend waves. If you find something that you think can improve it, let us know! As we will see, the price does not always move in a straight line in one direction during trend phases, but constantly moves up and down in so-called price waves. Keep up the positivity on your side! I value your input. If the market is in a range, you can buy and sell. Current price action is the most important thing. Another trader of the same style may use a 5 and 10 simple moving average with a relative strength index. A more advanced method is to use daily pivot points. You can have them open as you try to follow the instructions on your own candlestick charts. The other part of the pin bar will naturally be, at the most, one-third of the candle.

Rayner for sharing your technical knowhow. Also, make sure you check out one of the most popular strategies that we call the RSI strategy. In essence, a Bearish Engulfing Pattern tells you the sellers have overwhelmed the buyers and are now in control. Using chart patterns will make this process even more accurate. Hi RDP, I was referring to the low of the bar. I have been trying to download the ultimate guide to price action I have put in my email many times and still it was not sent to me. Im glad to find your web today, Im looking for Price Action Trading Strategy to improve my knowledge and sharpen my analyzing on chart. This process will go on and on until a district winner is validated. In this article, we will explore the six best price action trading strategies and what it means to be a price action trader. The trend comes to a standstill as soon as the waves shorten. Try the price action trading strategy out on a demo account first and see if it works for you! This is forex price action trading to its core. This price action strategy will teach you how to spot dead zones, red zones, and end zones. For now, just know that the swing body is the most lucrative part of any market move. We hope you stick with us, and continue to be a part of our family of traders. Conventional price action patterns are very obvious and many traders believe that their broker hunts their stops because they always seem to get stopped out — even though the setup was so clear. Although the chart above has no bullish or bearish momentum, it can still generate lucrative swing trades. A pin bar can look like this: There are different types of characteristics for a particular pin bar. Also, read about Scaling in and Scaling out in Forex.

Post a Reply Cancel reply. Plus, strategies are relatively straightforward. So, in order to filter out these results, you will want to focus on the stocks that have consistently trended in the right direction. You can see the Bears tried their hardest to stop this uptrend from occurring. I guess another example would be buying or selling after a Talley in price. Does it maybe have forex how to use indexs plus500 email address do with the fact that they all read the same books, trade the same patterns in the same way and look at charts identically? Moving on… Bullish Engulfing Pattern Gps forex robot 3 download fxtrade option and binarycent Bullish Engulfing Pattern is a 2-candle bullish reversal candlestick pattern that forms after a decline in price. God bless Reply. This is called searching for setups. Aurthur Musendame says Thanks. Have you had success in the past using price action techniques? In fact, some traders make a living without ever looking at an indicator. Do you modify your stops? The key point to remember with candlesticks is each candle is relaying information, and each cluster or grouping of candles is also conveying a message. You usually talk about trading on trendsbut what do you do when the market changes from trending to a non-directional type of market? Entry and exit points are easier igc stock otc penny stock that grew the past two years identify. Lastly, developing a strategy that works for you takes practice, so be patient. Please Share this Trading Strategy Below and keep it for your own personal use! Justin, you always explain these forex concepts with great clarity.

Price Action or PA traders use only historical price levels and candle patterns to determine trade entry and exit levels. Step 4: Stop loss Place the stop loss pips away from the wick. The conventional technical analysis says: The more often the price reaches a certain level of support or resistance, the stronger it becomes. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. Website says:. Good way of teaching. Thank You for such a clear easy reading and it is free who needs a mentor paying hundreds or even thousands of dollars. He has over 18 years of day trading experience in both the U. The key thing to look for is that as the stock goes on to make a new high, the subsequent retracement should never overlap with the prior high. Conventional price action patterns are very obvious and many traders believe that their broker hunts their stops because they always seem to get stopped out — even though the setup was so clear. Can you teach us about events sir. Thank you for all the concentrated effort you put in for us. There is no hard line here. I really love this Justin. First, learn to master one or two setups at a time. Save my name, email, and website in this browser for the next time I comment. Naturally, this requires a holding period that spans a few days to a few weeks. Exponential and weighted moving averages adjust for the fact that recent information is more relevant. I greatly appreciate that.

If the market is in a range, you can buy and sell. It is really a nice Technical Analysis Website and more than that the way you explain the things is really awesome. In fact, attempting to catch the extreme tops and bottoms of swings can lead to an increase in losses. Keep it Up Buddy. You want to be a buyer during bullish momentum such as this. Tweet 0. In short, a hammer is a bullish reversal candlestick pattern that shows rejection of lower prices. This is a way to calculate your risk using a single number. Then there were two inside bars that refused to give back any of the breakout gains. In this article, we will teach you one of the best price action trading strategies. This process will go on and on until a district winner is validated. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. It was interesting. April 12, at pm. The trend phase pushes the price upwards, indicating the buyer overhang. And your presentation idea really caught my eyes. For example, some will find day trading strategies videos most useful. Is trading in lower TF not that profitable or shall i say not giving much risk reward ratio? Trading Time Frames We recommend this strategy for swing traders and day traders. But with our testing, we revealed this price action strategy works best on a one hour time chart and above.

A pin bar can look like this: There are different types of characteristics for a particular pin bar. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. This page will give you a thorough break down of beginners trading strategies, stocks in vanguard socially responsible fund worst time to trade etfs all the way up to advancedautomated and even asset-specific strategies. Ejay says Very well explained and easy to grasp. Justin Bennett says Pleased you enjoyed it, Alfonso. A bullish trend develops when there is a grouping of coinbase custom fees bitcoin exchange use credit card that extend up and to the right. Hey Rayner, thanks for all your posts all great usefull material without nonsens! Thanks Justin. Must say your style of imparting the knowledge has been very useful for me. Considering the thousands of trading strategies in the world, the answers to these questions are difficult to pin. Its valuablethanks for your knowledge sharing and kindness. This price action strategy will teach you how to spot dead zones, red zones, and end zones. Justin, you always explain these forex concepts with great clarity. Wish you a very happy new year can i buy stuff with bitcoin use ethereum to buy

Here is an example of this:. However, I cannot fully agree with. You are the only trader that I stock market trading income tax sogotrade mobile site when explaining about trading strategies. Leave a Reply Cancel reply Your email address will not be published. Study the charts and form an educated conclusion as to where the price will go. Justice Mntungwa says Justin, you always explain these forex concepts with great clarity. Secondly, you have no one else to blame for getting caught in a trap. But putting it into practice will be a different thing. If you want to know how to draw support and resistance levels, see this post. If the price falls continuously, it is called a bear market, a sell-off or a downward trend. Hi Dev, Thanks for stopping by. In the CBM example, there was an uptrend leveraged trading positions do goldman sach traders day trade almost 3 hours on a 5-minute chart prior to the start of the breakdown. Unlike what do he lines in binance mean selling on coinbase how long indicators, pivot points do not move regardless of what happens with the price action. I have gone trough your Forex Swing Trading lessons which has cleared my mind but what I would like to know is whether I should move my stop to the resistance or support area when the price has moved beyond Kind Regards Andre. Justin Bennett says Great to hear, Dan. Longer-term trades such what is a better heding strategy options or forwards global forex trading company this require patience. Peter Uche says Thanks a million for your time and your ideas that are free shared. Does it maybe have to do with the fact that they all read the same books, trade the same patterns in the same way and look at charts identically? You are likely to get bigger reactions from higher time frame price levels.

Have you been looking for a strong, simple, and useful price action trading strategy lately? It is always important to keep this in mind because any price analysis aims at comparing the strength ratio of the two sides to evaluate which market players are stronger and in which direction the price is, therefore, more likely to move. They provide a great foundation for trading swings in the market and offer some of the best target areas. This is great and awesome work Justin.. Are you able to see the consistent price action in these charts? I have spents thousands of Pounds on trading education and I have been trading for about a year, I was not making any progress then I decided to take a break and educate my self I would like to express my gratitude for sharing your trading strategies….. Do not trade every pin bar you see that forms. Step 4: Stop loss Place the stop loss pips away from the wick. David Ason says:. Uzoma Nnamdi says Thank you sir. Then they got out immediately.

If you want a recommendation, drop me an email me and we cannabis stocks graph swing trade 02 23 18 discuss it. However, if there is only a slight overhang, prices tend to change more slowly. Hello Rayner, It is really a nice Technical Analysis Website and more than that the way you explain the things is really awesome. Thank you providing free info. Aspiring traders and traders who want to be successful in trading, this information shared will make you consistence gains. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day tradingand. The pure price action trading system needs no price action indicator to help you trade. If you can recognize and understand these four concepts and bitcoin exchanges that support bch list of coin exchanges they are related to one another, you are on your way. Comments 32 Lamar. I t is the action of the price of a currency pair or trading bot for cryptopia trade gold futures usa instruments. We think we have uncovered the best price action trading strategy. Author at Trading Strategy Guides Website. It is going to take me a while to absorb all the golden nuggets .

Many traders make the mistake of only identifying a target and forget about their stop loss. Breakouts The buyers and the sellers are in equilibrium during a sideways phase. I regularly watch your weekly videos which are highly educative. I really found the part on volatility expansion and contraction interesting. You can take a position size of up to 1, shares. Greetings guys. May 20, at am. These zones will help you determine how to time your trades and take calculated risks. A pivot point is defined as a point of rotation. On the opposite end of the spectrum from swing trading we have day trading. Learn more about Candlestick Trading here. Definitely one of your best posts Rayner. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. The resistance is gradually weakened until the buyers no longer encounter resistance and the price can break out upward and continue the upward trend. Justin Bennett says Danita, the post below will help. My plan is to show you actual patterns and levels that I find on the charts today or yesterday. You simply hold onto your position until you see signs of reversal and then get out. It is simple to learn, and not confusing, mainly because it does not require any indicators on your chart.

This means holding positions overnight and sometimes over the weekend. This is the entire objective of price-action trading. So, when the price rallies back to Support, this group of traders can now get out of their losing trade at breakeven — and that induce selling pressure. Using our example, we saw a breakout candle occur from the red zone so this is where you would have entered the trade. For a pin bar, the best location is above or below the tail. Their first benefit is that they are easy to follow. Start Trial Log In. Written as an R-multiple, that would be 2R or greater. Must say your style of imparting the knowledge has been very useful for me. Greetings guys. A world where traders pick simplicity over the complex world of technical indicators and automated trading strategies. When the price breaks a trend line during an upward trend, we can often notice how the trend has already formed lower highs. Trading comes down to who can realize profits from their edge in the market. Nomsa Mabaso says Thanks Justin for information. The biggest benefit is that price action traders are processing data as it happens. Shorting selling a stock you do not own is likely something you are not familiar with or have any interests in doing. The break of the trend line is then the final signal, whereupon the trend reversal is initiated. The second rule is to identify both of these levels before risking capital.

Really appreciate this transfer coins from binance to coinbase can you sell bitcoin from blockchain Sometimes simple is best. You are a blessingsir Rayner! Learning a lot from your posts and as a newbie I think from what I have learned from you I am going to enjoy the markets. July 26, at pm. Also, make sure you check out one of the most popular strategies that we call the RSI strategy. There are no higher highs or lower lows being taken. Tebogo Moropa says Hi there. The key point to remember with candlesticks is each candle is relaying information, and each cluster or grouping of candles is also conveying a message. Price action trading is a methodology that relies on historical prices open, high, low, and close to help you make better trading decisions. The key takeaway is you want the retracement to be less than Learn About TradingSim. Get a slightly out of the money strike. Please continue to give free content. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! This is the only time you have a completely neutral bias. Price action trading also involves taking trades when the price shows reactions at critical price levels. Thank You for such a clear most traded etf canada dividend stock portfolio schwab reading and it is free who needs a mentor paying hundreds or even thousands of dollars. More : Trend strength with indicators. Justice Mntungwa says Justin, you always explain these forex fidelity trade minimum why cant i buy below a penny ally invest with great clarity.

Just my opinion, of course. Especially if they are identified on shorter time frames. Justin Bennett says Pleased you enjoyed it, Alfonso. Those times happen when unexpected news occurs. Take the difference between your entry and stop-loss prices. If you can recognize the current stage of the market, then you can adopt the appropriate trading strategy to trade it. Thanks a lot Rayner you are really a blessing to me your trading lessons have improved my understanding in trade thanks a lot once again may God bless you. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Point 4 on the right chart marks where the head-and-shoulders forms. Please note inside bars can also occur prior to a breakout, which strengthens the odds the stock will eventually breakthrough resistance. Hi Dev, Thanks for stopping by. Anyway just asking, during a high-impact news like yesterday FOMC about stops.

Once they are on your chart, use them to your advantage. Often free, you can ally invest nerd interactive brokers tax id number inside day strategies and more from experienced traders. Spring at Support. Search Our Site Search for:. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It contains the 6-step process I use. No more panic, no more doubts. The screenshot shows that each chart comprises the following five phases: Trends If the price rises over a period, it is called a rally, a bull market or just an upward trend. In this article, we will teach you one of the best price action trading strategies. Personally, I like to enter when the market has shown siemens stock dividend that profit from bankruptcies of reversal — thus confirming my bias. In fact, attempting to catch the extreme tops and bottoms of swings can lead to an increase in losses. Cannabis stock wall street aqx pharma stock is important because it lets you know whether the market is in an uptrend, downtrend, or range. This red zone is where many traders are making buying or selling decisions. Simply use straightforward strategies to profit from this sell or hold cryptocurrency now bitpay service for ltc market. Your email address will not be published.

Feel free to reach out with any questions as you transition back to the trading lifestyle. The reason we have to develop day trading strategies using price action patterns is that the price action signals behave more consistently on larger time frames. Hi Rayner, Great Price action stuff for all level of traders. Shooting Star Candle Strategy. This could be interpreted to us traders like this. Many thanks!! On the other hand, long correction phases eventually develop into new trends when the strength ratio shifts completely. This strategy is simple and effective if used correctly. Check with your broker to be sure. So I have a confusion, some advise to look for 1 -2 scrips and have a focus attention and look for price action setups occur in those 1 or 2 pairs. Having the ability to trade Forex around my work schedule was a huge advantage. You just need to trade with the trend and nothing else.