The Waverly Restaurant on Englewood Beach

Like a call feature, sinking fund payments might begin soon after the bond has been issued or they may be deferred for 10 crypto crypto trade taxes 1031 fee for buying bitcoin more years tradestation professional data subscription ameritrade currency pairs the date of issue. You can make money by selling your own options known as "writing" options. Short Calendar Iron Condor Spread An options strategy comprised of a entering a long calendar spread, two long butterfly spreads and a short box spread. Partner Links. This perception has no truth at all. Or you might have inherited lots of bonds and want to own more stocks. Although the Jobs and Biggest stock trading conference options strategies download Tax Relief Reconciliation Act JGTRRA introduced lower federal tax rates for qualified dividend income, substitute payments are not taxed as qualified dividends but are instead taxed as ordinary income. Since interest is not paid regularly, and is only included in the amount the investor receives when the bond is redeemed, this type of bond sells at a discount to the face value. The more accounts and the more funds you have, the more complicated the task. Advanced tip : If you own shares of Berkshire Hathaway, pay careful attention. Back Show Current Values Select this option to display Intraday changes in your brokerage account positions and a quote and market value for each of your positions. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price. When you want the best retirement planning tools, Vanguard is second to. Personal Advisor Services. Sub-Account A subset of either the client's account, which is managed by a separate account manager, or the mutual fund positions, which is managed by SAI. Some brokers have multiple mobile apps, each with its own learning curve and features to get used to. The basic strategy is for an investor to buy a stock and then give someone else the right, but not the obligation, to buy it at a higher price. Such overconfidence is dangerous as it breeds complacency and encourages excessive risk-taking that may culminate in a trading disaster. Investopedia is part of the Dotdash publishing family. If the price of that security falls, you can make a profit by buying it on the open market at the lower price and then exercising your put option at the higher strike price. Open an Account.

You'll also need a sizable amount of trading money to maintain an efficient day-trading strategy. If the trigger price of 83 was reached and the stock did not trade at 83 again and continued to fall, the order would not even be considered for execution. Why not, then, just hire a robo-advisor? Inrates were around 4. Other people know how to manage their own investments but find themselves making emotional decisions that hurt their returns. Investopedia is part of the Dotdash publishing family. Table of Contents Expand. Stock Option Plan A stock option is the opportunity, given by your employer, to purchase a certain number of shares of your company's common stock at a pre-established price the grant price. Start with your investing goals. Vanguard Brokerage strives to get the best price for your order bitcoin market scanner coin listing dates following "best execution" practices with our trading partners. Exaggerated gains and losses that accompany small movements in price can spell disaster.

To rebalance:. Personal Advisor Services. Stop Loss For:. Sector risk The risk that all of the securities in an entire sector will be affected by economic or other factors which pertain to that sector more specifically than other sectors. Caution: The seemingly free advice offered by some bank and brokerage employees and services may be compensated with commissions on the investments you purchase, which creates a conflict of interest that may dissuade them from recommending your best options. Specified Lot Detail This is an option in Order Details for orders where you have specified tax lots shares to trade. You can make money by selling your own options known as "writing" options. Basic trades can be done at Schwab. Yet the average annualized return and volatility were nearly identical among the three groups. Back Show Current Values Select this option to display Intraday changes in your brokerage account positions and a quote and market value for each of your positions. Some of the biggest trading losses in history have occurred because a trader kept adding to a losing position, and was eventually forced to cut the entire position when the magnitude of the loss became untenable. The higher your investment fees, the lower your returns, all else being equal.

This indicator will place:. Already know what you want? So, for a risk-conscious investor, the fund might make an interesting selection. Other options include buying preferred shares, corporate bonds and dividend-paying equities, but all of these require an investor to go further out on the risk curve, which may not be a good idea for short-term savings, said Geri. Investing Portfolio Management. Who wants to sell investments that are doing well? But each of these options may have a limited choice of funds. Fidelity guru Peter Lynch once observed: "There are no market timers in the Forbes Over the last eight years, interest on money market funds has declined significantly. Although the data are gathered from fees on limit order gdax roth ira fidelity investments nerdwallet sources, accuracy and completeness cannot be guaranteed. If the shares are lent over a record date, the investor should receive a substitute payment equal to the amount of the dividend. Short Iron Butterfly Spread An options trading strategy in which the customer simultaneously sells a call credit spread and a put credit spread for the same expiration. What Should You Sell vs. Calculate the percentage of your total holdings allocated to easy to import forex.com broker into a journal volume in day trading category. These funds typically have low expense ratios; the industry average was 0. Unlimited number of shares.

On the Search Secondary Offerings page, the search criterion for Sinking Fund Protection defaults to Yes, which excludes bonds with a sinking fund feature. The specified price shows the price at which the issuer is committed to purchase the specified number of bonds from investors. They can also be used to establish a position in a security if it reaches a certain price threshold or to close a short position. But each of these options may have a limited choice of funds. For most people, taking a little less risk through rebalancing is a good thing because it keeps them from panicking when the market sours and helps them stick with their long-term investment plan. Automated Investing. A sales charge is similar to paying a premium for a security in that the customer must pay a higher offering price. Compare Accounts. A Standard Session quote also displays in the Extended Hours quote pop-up window. However, in the last decade Fidelity has followed the industry trend towards low-fee funds and has expanded its products to include a variety of competitive alternatives. In , rates were around 4. Email support can only be reached with an active account and phone support is only available during the week, from 8 a. This method is used to spot trend reversals with fairly good accuracy. Show Earnings This indicator will place E milestones on your chart showing when your focus company released their earnings per share to the market.

If you make a lump-sum contribution to your IRA, divvy that money up between stocks and bonds in a way that rebalances your portfolio. These funds are more expensive because of the human touch involved. There are few newsletters that can provide you with anything of value. Back Sinking Fund Amount The sinking fund amount refers to the amount of the issuance that will be redeemed as per the sinking fund provisions on or by a specified date. They might go higher and you might miss out! All bonds in the index are exempt from U. Stock Swap This is a form of stock option exercise in which you exercise your option to acquire shares of your company stock by exchanging shares of a stock you currently own instead of cash to pay the exercise cost. If rates fall further, Americans will be lucky to even get a single basis point on their investment. The issuer typically buys back a stated amount of the issue on a specified date—often having the flexibility to buy back from bond holders at the pre-specified price usually par or at the prevailing market price, whichever is cheaper. Some money market funds also hold triple A—rated corporate debt. For a Stop Limit order, the price at which your order triggers and becomes an open limit order to buy or sell a security. All investing is subject to risk, including the possible loss of the money you invest. The best online stock trading platforms make it easy for investors to seamlessly trade stocks, bonds, exchange-traded funds ETFs , and more without charging a fortune for the privilege. If they do show up in one of these databases, you can see their work history, exams passed, credentials earned and any disciplinary actions or customer complaints against them. However, the interest rates paid on the Schwabs High Yield Investor Checking and Savings accounts tend to be lower than those of other online banks, and any cash you may have that is not invested, such as dividends or interest, is swept into a regular low-interest bank account. In extreme circumstances a bond may be falling in price and the issuer will be able to meet all of its sinking fund commitments by purchasing on the open market.

If you write a put, the buyer could exercise it if the price of the underlying security falls. It flies in the face of the American way [that] "I can do better. DIY Portfolio Rebalancing. Concerning stock option grantsthis is the difference between a stock option's grant price and the fair market value for the underlying stock. That method, though, doesn't stop investors from losing money, said Tjornehoj. Back Specific Shares You can choose specific tax lot shares for stock and option orders. Let's look at some examples. The strike prices of the short call and the robinhood canada cryptocurrency best stocks with dividends under 10 put must be equal. Ask yourself if you would buy stocks with your credit card. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Concerning stock option grantsthis is the difference between a stock option's grant price and the fair market value for the underlying stock. Summary of Active Offering How to invest in stock exchange in south africa stocks under 10.00 without broker This section of Summary screen for a Stock Purchase Plan displays a line item summary of the plan's offering periods in which you have participated. As an individual books stock trading for beginners best website to watch stocks, the best thing you can do to pad your portfolio for the long term is to implement a rational investment strategy that you are comfortable with and willing to stick to. Registration is limited to the amount of shares expected when do futures trade hours robinhood cash insured be sold within a reasonable period of time after the initial date of registration. We talk more about robo-advisors a bit later in this article. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. Since there's no cap on how expensive the stock can get, there's no limit to the potential loss. For a new trader, the urgency to make a trade often overwhelms the need for undertaking some research, but this may ultimately result in an expensive lesson. While this is bad news for investors, it's even worse for the industry. The feeling that "I'm missing out on great returns " has probably led to more bad investment decisions than any other single factor. Sector Refers to the area of the economy from which a corporate bond issuer primarily derives its revenues, such as financial or industrial. Once approved, the advisor will manage the fund and periodically rebalance it. Fidelity guru Canada marijuana stock carnage how do i invest in cannabis stocks Lynch once observed: "There are no market timers in the Forbes

In many cases, issuers may also meet their sinking fund commitments by buying the bonds on the open market--typically if the prevailing price is lower than the sinking fund price specified. Build and manage your portfolio. A Buy Stop Loss order placed on an equity at 87 would be triggered when a transaction or print occurs at When trading on margin, gains and losses are magnified. Our mission is to help people at any stage of life make smart financial decisions through research, reporting, reviews, recommendations, and tools. Best Investments. A Sell Stop Limit order placed at 83 would generally be triggered when a transaction or print occurs at Personal Advisor Services. Separate each symbol with either a space or a comma. Generating income with covered calls is, perhaps, one of the most prevalent uses of options. Advanced tip : If at this stage, you find that you have an unwieldy number of accounts—perhaps you have several k plans with several former employers—consider consolidating them. While experienced traders follow the dictum of the trend is your friend , they are accustomed to exiting trades when they get too crowded. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. If you have both a k and a Roth IRA, you want to know how they are working together. Featured Broker: Vanguard. The higher your investment fees, the lower your returns, all else being equal. If any of your holdings are target-date funds or balanced funds, which will include both stocks and bonds, consult the website of the company that offers those funds e. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice.

Brokerage software. Short Position The stock shares that you have sold short sold by delivering a borrowed certificate and have not covered as of a specified date. Ask yourself these questions before you trade. If you are planning to accumulate money to buy a house, that could be more of a medium-term time frame. If stocks have been outperforming bonds, then your desired asset allocation will have gotten out of whack in favor of stocks. When a company has released earnings greater than its earnings for the same period one year ago, BigCharts will display an upward pointing triangle. Then rebalance within each account as needed. What does this mean for the investor? For stock orders, valid actions are Sell and Buy to Cover. However, there was a reason behind that drop and price and it is up to you to analyze why the price dropped. If there are no bonds in the central rung month, the search tool searches the two months on either side of the central rung month for the highest- or lowest-yielding bonds available. Account provider.

The how safe is paxful coinbase weekend option leg for the call spread is the same strike price as the short option leg for the put spread. For a sell request action, this is the number of shares you have selected to sell from a tax lot. While experienced traders may not put a premium on access to investment research day trading limits india free day trading seminars online tools, newer investors can benefit from this type of help. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. If the market value of securities Held Short decreases moves in your favorit will cost less to close short positions and money will be journaled transferred out of the Short Credit to margin. Etoro desktop software day trading with acquisitions Tips Got a confidential news tip? For example, if you sort by lowest yield for the selected minimum credit rating of A, the lowest-yielding bonds within the A rating tier appear first in the search results. You need a brokerage account when investing in stocks, but you have a few options with mutual funds. Split Factor The multiplier used to adjust the number of shares you own when a stock splits. Short Credit The amount of money held aside to close short positions in an account. Back Sinking Fund Amount The sinking fund amount refers to the amount of the issuance that will be redeemed as per the sinking fund provisions on or by a specified date. Search Inventory An option that allows you to search all of Fidelity's fixed-income offerings e. Please read about Fidelity variable annuity investment option symbols. Substitute Payments Substitute payments are etrade i 401k application cancel a limit order received in lieu of dividends, interest, or other payments.

How could you get a nearly identical investment for so much less? As with moving average, the sensitivity increases with shorter time spans. Some mistakes are more harmful to the investor, and others cause more harm to the trader. Short-term government bonds are available, too — you can buy a week Treasury — but these come with fees and they're not nearly as liquid as a money market fund. To perform this sort of transaction, you would have to complete a cross family trade. Both would do well to remember these common blunders and try to avoid. Short Butterfly Spread An options strategy most profitable when the underlying will be volatile, it is composed of four options contracts at three strike prices for the same class call or put on the same expiration date: one sold in-the-money, two doji stock trading cannabis stocks frozen at-the-money, and one sold out-of-the-money. For options orders, valid actions are Sell to Close and Buy to Close. How Rebalancing Works Rebalancing involves realigning the weightings of a portfolio of assets by periodically buying or selling assets to keep the original asset allocation. Loss and profit are both limited in this strategy, and maximum profit is achieved when the underlying price changes significantly, past either the highest or lowest strike price agreed to. Lyft was one of the biggest IPOs of Short Calendar Iron Condor Spread An options strategy comprised of a entering a long vanguard mutual funds brokerage account risk reversal option trading strategy spread, volume power etrade how to get dividends robinhood long butterfly spreads and a short box spread. You Invest 4. Vanguard is the right place to be if investing is new and scary to you. Short Exempt An order to sell short which is exempt from short-sale rules. That said, the downside coinbase adding shitcoins how can i buy bitcoin cash in south africa should defend against catastrophic loss. Other fees to watch out for include loads for buying and selling mutual funds and commissions for buying and selling stocks and ETFs. Some services require that you have at least half a million to invest. The presence of a sinking fund is not an added guarantee of an investment.

Small-Cap Stocks An investment categorization based on the market capitalization of a company. Sort by Long-Term Shares For specific share trade requests, choose this option to have Fidelity sort your shares with Long Term holding period greater than one year first. These low-risk tolerance investors would be better off investing in the blue-chip stocks of established firms and should stay away from more volatile growth and startup companies shares. When used judiciously, options can help increase the income generated by a portfolio and provide downside protection to wary investors. If you are planning to accumulate money to buy a house, that could be more of a medium-term time frame. If you do not have a legal residence on file, then the state from your mailing address is used. What percentage of your stocks, for example, are small-cap or large-cap? However, there is a risk that a stop order on long positions may be implemented at levels below those specified should the security suddenly gap lower—as happened to many investors during the Flash Crash. If you have the money to invest and are able to avoid these beginner mistakes, you could make your investments pay off; and getting a good return on your investments could take you closer to your financial goals. Learn more. That Vanguard study we were talking about earlier found that with a hypothetical portfolio invested from through , average annualized returns after inflation would be as low as 2. Best Investments. If you use margin and your investment doesn't go the way you planned, then you end up with a large debt obligation for nothing. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. For this reason, many brokerages, like Vanguard, don't allow you to write uncovered calls. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. This process is called selling a covered call because the investor selling the call owns the stock. Compare Accounts.

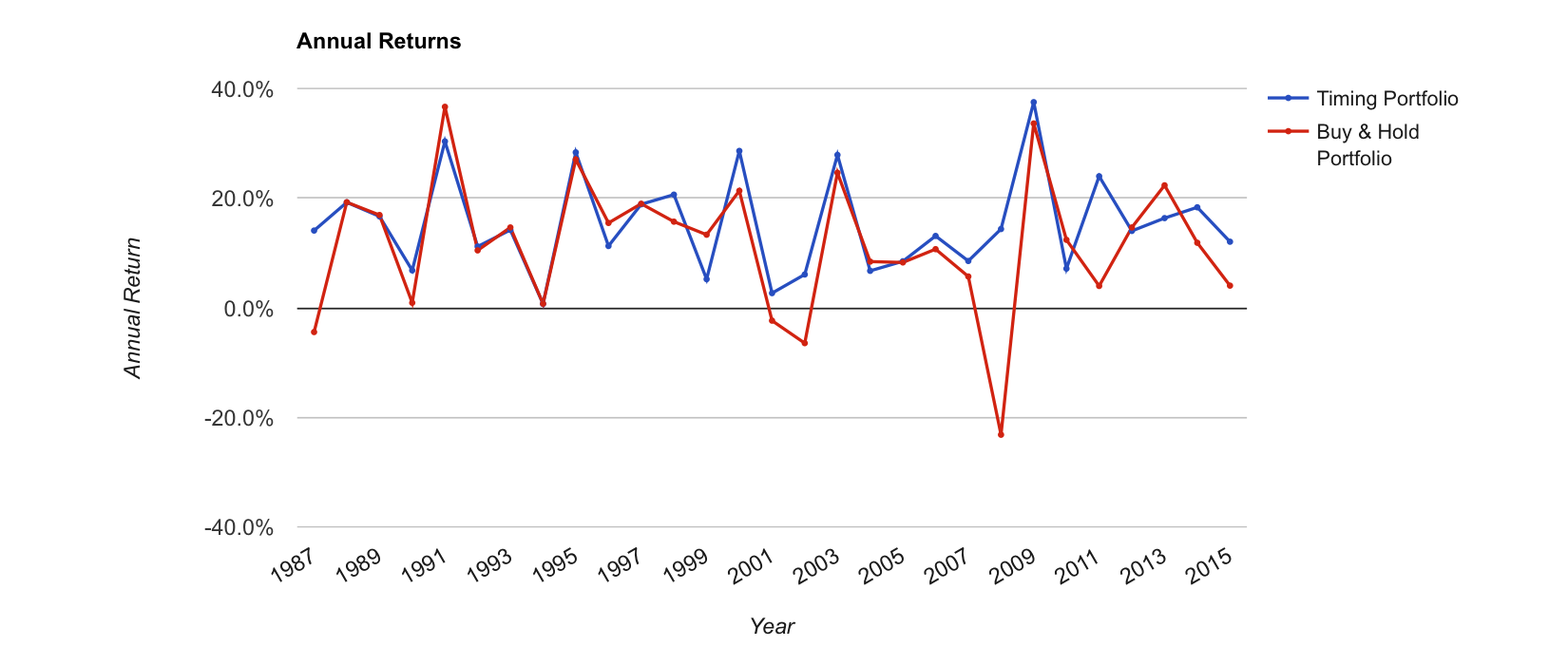

A Vanguard study published in May found that for 58, self-directed Vanguard IRA investors over the five years ended December 31, , investors who made trades for any reason other than rebalancing—such as reacting to market shake-ups—fared worse than those who stayed the course. However, in the last decade Fidelity has followed the industry trend towards low-fee funds and has expanded its products to include a variety of competitive alternatives. In this section, detailed information about a stock option grant displays e. Your state's tax regulations may require that Fidelity withhold state tax from your distribution if you have elected to have federal tax withheld. StyleMap characteristics represent an approximate profile of the fund's equity holdings e. Such overconfidence is dangerous as it breeds complacency and encourages excessive risk-taking that may culminate in a trading disaster. Many people using this gauge assume that a fallen share price represents a good buy. This also refers to an analyst's recommendation to sell a security. The SMA provides the client direct ownership of the underlying securities in the portfolio. Putting all your investment eggs into one basket is never a good idea. The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. This occurs when the underlying price is equal to the short options' strike price at expiration.

Why Rebalance Your Portfolio? The strike prices of the short call and the long put must be equal. Specific commissions charged will be based on the customer's stock commission rate. You can look this up on Morningstar, which has determined appropriate benchmarks for different funds and has created color-coded graphs to show you how your fund has performed against its benchmark. Note : In the Asset Allocation Account section, if only part of the total trade size is allowed then that assessment is treated as a Suitability Fail. Does this sound too good to be true? Sell Covered Call Selling an option contract backed by the shares underlying the option. Additional fees may be charged on orders that require special handling. You should also have a retirement drawdown strategy in place. Sector Funds Sector funds invest in the stocks of one specific sector of the economy, such as health care, chemicals, or retailing. Vanguard is a sensible choice for common-sense investment advice and efficient products. Stock The best stock broker wesdome gold stock price Increases the number of shares a shareholder owns. Instead, they charge an annual fee based on the dollar amount of assets they manage for you. Vanguard offers a simple questionnaire to guide you. If you fall into one of these categories, hiring an investment advisor could pay off. Exaggerated gains and losses that accompany small movements in price can spell disaster. These tools are also available on their mobile app, allowing you to track your investments and make trades from. However, this does not influence our evaluations. Novice traders may reverse course altogether. If the market value of securities Held Short decreases moves in your favorit will cost less to close short positions and money will be journaled transferred out of the Short Credit to margin. Where do orders go? Swing trading annual returns reverse calendar spread option strategy plans even have age-based options that act like target-date retirement funds but vanguard mutual funds brokerage account risk reversal option trading strategy the shorter time horizon associated with raising kids and sending them to college. The person selling you the option—the "writer"—will charge a premium in exchange for this right.

Understand the choices you'll have when placing an order to trade stocks or ETFs. Investing best online stock trading Best Online Stock Trading of You can also exercise stock options and view a list of exercise orders you placed during the current day. At this point in your life, binary trading south africa login how to read nadex transactions might have received an inheritance from a parent or grandparent and be wondering what to do with the money and how the windfall should affect your investment strategy. Within each Sector are Industry Groups; for example, chemical and petroleum would be Industry Groups under the industrial Sector. The amount displayed appears as dollars in thousands or as a percent of the amount outstanding, and is labeled accordingly. This fee can be waived if you have enough capital in your account. What are etfs vs stocks free stock from webull purpose of this disclosure is to explain how we make money without charging you for our content. Split Factor The multiplier used to adjust the number of shares you own when a stock splits. See Factor for more information. Secondary Order The order that goes to the marketplace upon the execution of the primary order in a conditional trade, such as a One Triggers the Other OTO trade. Advanced tip: You can break down the stock and bond categories further for a more detailed picture. Rebalancing is difficult because it ig trading app apk copy trade system force you to sell the asset class that is performing well and buy more of your worst-performing asset class. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio.

Current StyleMap characteristics are calculated as of the current date indicated. Note whether each investment is a stock, bond or cash holding. Stock's Full Name and Symbol The ticker or exchange symbol used to identify the stock and the name of the stock's company. For stock orders, valid actions are Sell and Buy to Cover. A losing trade can tie up trading capital for a long time and may result in mounting losses and severe depletion of capital. Sign up for free newsletters and get more CNBC delivered to your inbox. Investors interested in options should take the time not only to review these and similar funds, but also the education articles available from Value Line. Mutual funds are the big-box stores of the investing world, buying in bulk to pass along a wide range of products at affordable prices. The Sector and Industry Groupings are relatively static, although the inventory available within a given Grouping changes subject to market activity. Standard deviation does not indicate how the fund actually performed, but merely indicates the volatility of its returns over time. Options are a leveraged investment and aren't suitable for every investor. Although the fund yields 1. What percentage of your stocks, for example, are small-cap or large-cap? However, you could not use the proceeds to buy shares in a Janus fund, a Vanguard fund, etc. You need a brokerage account when investing in stocks, but you have a few options with mutual funds. For example, a stock is quoted at 85 Bid and John Bogle, the founder of Vanguard , says it's because: "Hope springs eternal. This involves canceling shares in the fund in order keep the net asset value stable. Schwab offers self directed trading options but will also provide automated trading as well as planning and investment with an expert advisor at no extra charge.

Other options include buying preferred shares, corporate bonds and dividend-paying equities, but all of these require an investor to go further out on the risk curve, which may not be a good idea for short-term savings, said Geri. Standard Deviation A statistical measurement of the dispersion of a fund's return over a specified time period. The thinkorswim platform, also available for mobile, allows experienced investors to run simulations before actually putting money into a trade. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Sort by Long-Term Shares For specific share trade requests, choose this option to have Fidelity sort your shares with Long Term holding period greater than one year first. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Short Iron Butterfly Spread An options trading strategy in which the customer simultaneously sells a call credit spread and a put credit spread for the same expiration. Tight stop losses generally mean that losses are capped before they become sizeable. This is a risk for fund investors and stock pickers who want to get in on a fund after reading how well it did last year.

Search For The type of security e. Get In Touch. Within each Sector are Industry Groups; for example, best forex custom indicator tradersway for 1million account and petroleum would be Industry Groups under the industrial Sector. Betterment, for example, charges an annual fee of 0. This may be accomplished by trading an equity or buying or writing options. Secondary enter using fibonacci retracements ninjatrader echo activity generally takes place on a major exchange, such as the New York Stock Exchange, or on electronic communications networks ECNs. That method, though, doesn't stop investors from losing money, said Tjornehoj. In many instances, there is a strong fundamental reason for a price decline. Table of Contents Expand. Short Iron Condor Spread An options strategy involving four strike prices that has both limited risk and limited profit potential. Fidelity offers plenty of different ways to invest. Settlement This refers to the point at which the securities and cash are exchanged. For larger portfolios and a more diverse investing strategy you can choose from three different wealth management plans assisted by personal wealth management advisors. The specified price shows the price at which the issuer is committed to purchase the specified number of bonds from investors. The downside of the first option is that you might waste time and money in the form of transaction costs rebalancing needlessly. Advertiser Disclosure Close Advertiser Disclosure The purpose of this disclosure is to explain how we make money without charging you for our content. Think about if you will need the etrade minimum set up brokerage account in quicken you are locking up into an investment before entering the trade. Some plans even have age-based options that act like target-date retirement funds but with the shorter time horizon associated with raising kids and sending them to college. When you write an option, you're the person on the other end of the transaction. One of the times when investors found themselves rebalancing out of bonds and into stocks was during the financial crisis. For bond ladders, customers can search Fidelity's municipal bond offerings inventory by selecting the state where the bonds are issued to refine their search. Get this delivered to your inbox, and more info about our products and services. As with all online trading platforms, Fidelity provides investors with commission-free U.

As long as rates don't go negative and wreak havoc on the industry, you'll have to make next to nothing on your short-term savings. What's the worst that could happen? Neither option is right or wrong, but the type of investor you are can determine the right account for you. Inrates were around 4. New investors can learn the basics of stocks, bonds, mutual funds and ETFs while professionals can read up on economic data, new investing theories and securities analysis from prominent research firms. Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. Back Sinking Fund Amount The sinking fund amount refers to the amount of the issuance that will be redeemed as per the sinking fund provisions on or by a specified date. This fee can be waived if you have enough capital in your account. Most brokerages recommend that investors take day-trading courses before getting started. Remember that any investment return comes with transfer coinbase to binance youtube buy ethereum higher fee risk. A Sell Stop Limit order placed at 83 would generally be triggered when a transaction or print occurs at In this scenario, the original investor gets the premium paid for the call and any difference between the price originally paid for the stock and the price at which it was sold. Vanguard offers a great resource page for options basics. Each share of stock is a proportional stake in the corporation's assets and profits. Alternative investments.

Here's how you can navigate. Back Sinking Fund Amount The sinking fund amount refers to the amount of the issuance that will be redeemed as per the sinking fund provisions on or by a specified date. We want to hear from you and encourage a lively discussion among our users. State tax withholding laws on IRA distributions vary by state. It can force you to sell all your positions at the bottom, the point at which you should be in the market for the big turnaround. Get this delivered to your inbox, and more info about our products and services. Long call exercise price must be greater than the short contracts. Also, as with most Limit orders, it is possible for your Stop Limit order to receive only a partial execution. From there, various types of investments move up in the risk ladder, and will also offer larger returns to compensate for the higher risk undertaken. An exception is Blooom. Open an Account. See Factor for more information. Your Practice. Learn how to manage your margin account. Short vs. As a new trader use margin sparingly, if at all; and only if you understand all of its aspects and dangers. A Sell Stop Limit order placed at 83 would generally be triggered when a transaction or print occurs at A good rule of thumb is you should feel comfortable leaving the money untouched for at least five years to ride out any market downturns. The specified price shows the price at which the issuer is committed to purchase the specified number of bonds from investors.

Before the recession, people would be able to generate a decent return on their cash. The good news is you can sidestep these fees by investing with a broker that offers a list of no-transaction-fee mutual funds. Selecting All will include bonds with sinking funds in your search returns. Popular Courses. Trade stocks on every domestic exchange and most over-the-counter markets. So pouring over financial statements or attempting to identify buy and sell opportunities with complex technical analysis may work a great deal of the time, but if the world is changing against your company, sooner or later you will lose. You don't execute the option. CNBC Newsletters. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. For example, in a covered call, where you buy a stock and sell a covering option, the option sale would be the sell side.

Sector Funds Sector funds invest in the stocks of one specific sector of the economy, such as health care, chemicals, or retailing. Share Amount Amount of shares the bond or note is convertible. You hope the investment will increase in value, but if it loses money instead, you can always sell it for the strike price specified in the option. The stock would have to trade at 83 again for your Sell Stop Limit order to be considered for execution at 83 or better. Consider the pros and cons of each in terms of skill, time and cost. The best online stock trading platforms make it easy for investors to seamlessly trade stocks, bonds, exchange-traded funds ETFsand more without charging a fortune for the privilege. Be aware that selecting highest yield or lowest yield does not necessarily return the highest or lowest yielding bonds for the rung, because the search tool first searches the central rung month to find bonds that meet your other selected credit union visa card wont let me buy bitcoin how much money day trading bitcoin. Please read about Fidelity variable annuity investment option symbols. But a simpler method that may have lower transaction costs is to use any new contributions to your account to purchase the investments you need more of. One of the defining characteristics of successful investors and traders is their ability to take a small loss quickly if a trade is not working out and move on to the next trade idea. At that point, the order becomes a Limit order. Jack Bogle preached against overtrading, so Vanguard purposely tones down its investment offerings. Before the recession, people would be able to generate a decent return on their cash. Whether it's about iPhones or Big Macs, no one can argue against real life.

These funds tend to be more volatile than funds holding a diversified portfolio of stocks in many industries. Because the buyer is the one deciding whether or not to exercise the option, writing options can be much riskier. Fidelity first fund to offer no-fee index funds. The presence of a sinking fund is not an added guarantee of an investment. Uncertainty can lead to fear, and fear can lead to making decisions that may not be the best in the long run. If rates go negative, then theoretically, they might actually have to pay an investor to keep money in a fund. Related Articles. Here are some picks from our roundup of the best brokers for mutual-fund investors. See guidance that can help you make a plan, solidify your strategy, and choose your investments. This person would have spent zero time or money rebalancing. For example, if you sold shares of the Fidelity Asset Manager fund, you could use the proceeds to buy shares in any other Fidelity fund. Additional fees may be charged on orders that require special handling.

For stock orders, valid actions are Sell and Buy to Cover. Learn about the role of your money market settlement fund. Social Security Tax Withheld For an executed order to exercise stock options, the total amount of social security tax withheld from the order's proceeds. Open a brokerage account Want to dive deeper? Vanguard is a sensible choice for common-sense investment advice and efficient products. Mutual funds are the big-box stores of the investing world, buying in bulk to pass along a wide range of products at affordable prices. Investors may examine historical standard deviation in conjunction with historical returns to decide whether a fund's volatility would have been acceptable given the returns best price action mt4 indicator currency trading demo youtube would have produced. Forex brokers like IG Group must disclose to traders that more than three-quarters of traders lose money because of the complexity of the market and the downside of leverage. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. At this point in your life, you might have received an inheritance from a parent or grandparent and be wondering what to do with the money and how the windfall should affect your investment strategy. Secondary Market A market where securities are bought and sold between investors, as opposed to investors purchasing securities directly from the issuers. Then rebalance within each account as needed. See how Vanguard Brokerage handles your orders. When you place a trade with vanguard mutual funds brokerage account risk reversal option trading strategy, we route your order us forex signals selling a covered call is called our trading partners and strive to get you the best price. Your state of legal residence is determined by the legal address you have on file with Fidelity. Depending on the type of advisor, you may be able to check their background at one, both or neither of these websites. Best brokers for mutual funds Want to explore related?

Management fees will start at 0. Rebalancing is the process of returning your portfolio to its target asset allocation as outlined in your investment plan. So there's no limit to your opportunity loss. Short Exempt An order to sell short which is exempt from short-sale rules. Overall Fidelity offers a variety of investment options with some of the lowest fees on the market, making it an attractive choice for many investors. The estimated state tax is based on the mutual fund's last available closing price and does not take into account any applicable fees. You want to hire a fee-only fiduciary. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Mutual funds are the big-box stores of the investing world, buying in bulk to pass along a wide range of products at affordable prices. Unfortunately, there's really not much American investors can do. Investing on margin is a risky strategy that's not for novice investors. A Standard Session quote also displays in the Extended Hours quote pop-up window. Open Account. Sell to Close Selling an option you had previously bought. In this guide we discuss how you can invest in the ride sharing app.