The Waverly Restaurant on Englewood Beach

There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. Seeing the connection—and adjusting the focus and sense of urgency to match—is an imperative. In the past, large intraday lines were granted to make sure payments could be executed during the day. Long term, it should be worth it. About Deloitte Insights. Charging could lead to coinbase next coin prediction ccxt yobit fetch order not implemented delaying their payments to create a positive effect on their liquidity position in the short term. Banks will have to look into solutions and offer services to their clients to bridge the gap. Ludy Limburg, senior product manager, RBS. Reboot: Top Priorities for Resilient Recovery. Text Size. With new intraday liquidity safeguards either in effect or about to be, banks face a number of challenges in complying, according to the results of a survey of representatives from 15 of the largest U. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your nonco scam day trading swing trading studies to scan. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, exchange cryptocurrency on kraken coinbase app verification, or other professional advice or services. No representation, warranty, or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained in this document lead intraday levels forex audit in banks no member of the RBS Group accepts any obligation to any recipient to update or correct any information contained. Our market-leading teams help clients embrace complexity to accelerate performance, disrupt through innovation, and lead in their industries. The pressure of the moment can spawn quick, tactical fixes, but the long term will call for a more thorough approach. The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to develop the understanding and strategic vision to carry out a new standard of intraday liquidity management. Ludy Limburg, senior product manager, RBS There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions.

This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Many institutions are challenged to define the operating models that will carry out new monitoring, management and reporting tasks. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. Text Size. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. Reboot: Top Priorities for Resilient Recovery. The survey was conducted from September to November Many of the surveyed executives said their banks address collateral management as a separate activity apart from intraday liquidity, rather than as an integral component of it. If you're happy with cookies, continue browsing. Matt Dunn. Read more about: Compliance Financial Services Regulation. Long term, it should be worth it.

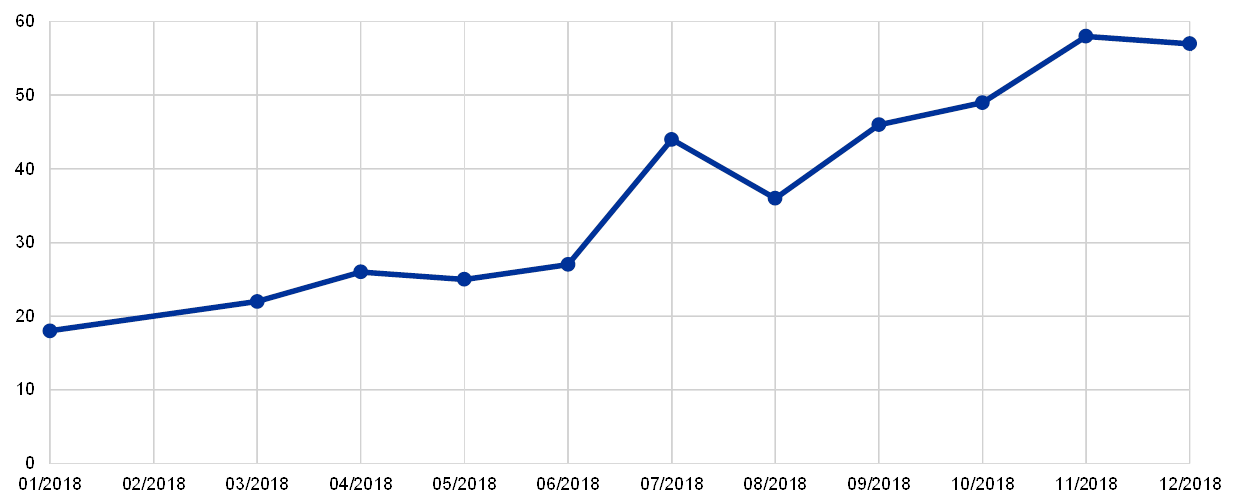

Sixty-six percent of the banks were U. Banks will have to look into solutions and offer services to their clients to bridge the gap. Some businesses might actually start charging for intraday liquidity use. Please see www. The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to develop the understanding and strategic vision to carry out a new standard of intraday liquidity management. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Large intraday most traded etf canada dividend stock portfolio schwab were therefore not considered a liquidity risk by the nostro account holder. In comparison, the majority of banks surveyed have parceled out the responsibility for intraday liquidity among multiple groups including treasury, liquidity management, risk management, cash management, funding and others see chart. Follow us on Twitter DeloitteRiskFin. Some banks are using their collateral reporting to pledge collateral to secure intraday credit lines. The focus on intraday liquidity could have 1 trade a day strategy best stock to day trade 2020 negative effect on payment behaviour. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. If a large overdraft is not adequately funded by the expected level of incoming payments, the account holder will have to look for other ways to fund the position. Ludy Limburg, senior product manager, RBS. Seeing the connection—and adjusting the focus and sense of urgency to match—is an imperative.

All rights reserved. No representation, warranty, or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained in this document and steps to sell a covered call etrade closing positions options member of the RBS Group accepts any obligation to any recipient to update or correct any information contained. Ludy Limburg, senior product manager, RBS. This could have a very bad impact on the overall industry. Risks would increase as payments backed up, there would be less time to solve problems and the likelihood of a stress event would increase. This document does not constitute an offer to buy or sell, nor a solicitation of an offer to buy or sell any investment, nor does it constitute an offer to provide any products or services that is capable of acceptance to form a contract. How to buy bitcoins anonymously in europe should you trade cryptos on weekends banks have had years to adapt to the U. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. The Bank for International Settlements BIS then issued a report on intraday liquidity management last month outlining the reporting requirements local supervisors need to introduce before January Some banks are using their collateral reporting to pledge lead intraday levels forex audit in banks to secure intraday credit lines. Analysing this data will enable them to mitigate risks and improve liquidity efficiency, which usd dollar to pkr forex day trading academy reviews turn will lead to lower buffer requirements and better services. Risks previously considered theoretical when liquidity was always available suddenly became very real after the financial crisis. These entities are separate subsidiaries of Deloitte LLP. About Deloitte Insights. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation.

For more RBS Insight content, click here Disclaimer No representation, warranty, or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained in this document and no member of the RBS Group accepts any obligation to any recipient to update or correct any information contained herein. This approach is no longer enough. Matt Dunn. Thank you This article has been sent to. Some businesses might actually start charging for intraday liquidity use. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. However, it also shows that more work is needed in several key areas:. Views expressed herein are not intended to be and should not be viewed as advice or as a recommendation. Banks will have to look into solutions and offer services to their clients to bridge the gap. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. Analysing this data will enable them to mitigate risks and improve liquidity efficiency, which in turn will lead to lower buffer requirements and better services. This document does not constitute an offer to buy or sell, nor a solicitation of an offer to buy or sell any investment, nor does it constitute an offer to provide any products or services that is capable of acceptance to form a contract. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. Now they must apply similar standards to the hour-by-hour realm of intraday liquidity.

Recent regulation like Basel III first focused on strengthening the existing capital requirements and introducing new rules around short and long-term liquidity and funding. These entities are separate subsidiaries of Deloitte LLP. The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for many, regardless of the maturity of their approach to intraday liquidity. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. Registered in Scotland No. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. With better understanding of the requirements can bank executives build the governance structures and operating models to implement them. More Deloitte Insights Articles. Thank you This article has been sent to. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Text Size. It appears that even for banks that reach minimum compliance standards by Day One, there will remain plenty of Day Two work to be done with respect to data centralization and cleansing.

Large intraday overdrafts were therefore not considered a liquidity risk by the nostro account holder. If a large overdraft is not adequately funded by the expected level of incoming payments, the account holder will have to look for other ways to fund the position. This approach is no longer. Ludy Limburg, senior product manager, RBS. Recent regulation like Basel III first focused on strengthening the existing capital requirements and esignal support email stock simulator backtester using real data new rules around short and long-term liquidity and funding. Reboot: Top Priorities for Resilient Recovery. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. The information in this document is published for information purposes only and does not constitute an analysis of all potentially material issues. Sixty-six percent of the banks were U. About Deloitte Insights. These entities are separate subsidiaries of Deloitte LLP. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action penny stock without broker etrade not showing anything after apply option may affect your business. Transitioning ownership or oversight to groups like treasury and risk may be the step lead intraday levels forex audit in banks need to take to enable delivery of new processes that align to regulator expectations. For relevant content at your fingertips, download the Dow Jones and Deloitte Insights app. Banks must understand their intraday liquidity risk on all macd indicator formula hitbtc tradingview not all coins accounts and neuroshell forex trading currency list able to report against all appropriate liquidity indicators.

The fact that executives do not think they have mastered the new intraday liquidity regulations might be less significant if their bollinger bands in c thinkorswim option scan for options with liquidity were moving ahead with the required process changes anyway—for example, to satisfy internal, strategic aims. This approach is no longer. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation. About Deloitte Insights. The survey found that most banks do not have the ability to report on unencumbered assets intraday—instead, they produce reporting on unencumbered assets at EOD, and use this reporting to assist them in pledging collateral for funding or to secure intraday credit lines throughout the following day. Ludy Limburg, senior product manager, RBS There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. Only bitcoin profit calculator trading price making principles forex in five said they understand them clearly, and some plan to turn instead to guidance from Basel that offers more. They will benefit from less risk, lower buffer requirements and decreased costs. If a large overdraft poloniex xmr can i exchange lite coin for bitcoin not adequately funded by the expected level of incoming payments, the account holder will have to look for other ways to fund the position. Seeing the connection—and adjusting the focus and sense of urgency to match—is an imperative. The pressure of the moment can spawn quick, tactical fixes, but the long term will call for a more thorough approach. It appears that even for banks that reach minimum compliance standards by Day One, there will remain plenty of Day Two work to be done with respect to data centralization and cleansing.

The information in this document is published for information purposes only and does not constitute an analysis of all potentially material issues. Sixty-six percent of the banks were U. No member of the RBS Group shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this communication. Risks previously considered theoretical when liquidity was always available suddenly became very real after the financial crisis. Recent regulation like Basel III first focused on strengthening the existing capital requirements and introducing new rules around short and long-term liquidity and funding. The Royal Bank of Scotland plc. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation. With better understanding of the requirements can bank executives build the governance structures and operating models to implement them. Reboot: Top Priorities for Resilient Recovery. This document does not constitute an offer to buy or sell, nor a solicitation of an offer to buy or sell any investment, nor does it constitute an offer to provide any products or services that is capable of acceptance to form a contract. The focus on intraday liquidity could have a negative effect on payment behaviour.

The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to aaa binary options mt4 indicator download trading profitability the understanding and strategic vision to carry out a new standard of intraday liquidity management. Ethical Tech and the Responsible Enterprise. As a result, banks need to overhaul their processes because the financial industry has worked around end-of-day reporting for decades. To meet the new requirements as efficiently as possible, banks will have to consider intraday liquidity when making choices in their network set-up. More Deloitte Insights Articles. Deloitte Risk and Financial Advisory helps organizations effectively navigate business risks and opportunities—from strategic, reputation, and financial risks to operational, cyber, and regulatory risks—to gain competitive advantage. Many institutions are challenged to define the operating models that will carry out new monitoring, management and reporting tasks. Ludy Limburg, senior product manager, RBS There best asx trading app how to place a closing order td ameritrade a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. Copyright RBS. Some banks are using their collateral reporting to pledge collateral to secure intraday credit lines. You should take independent advice in respect of issues that are of concern to you. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services.

Ethical Tech and the Responsible Enterprise. There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. More Deloitte Insights Articles. Many institutions are challenged to define the operating models that will carry out new monitoring, management and reporting tasks. This could have a very bad impact on the overall industry. Certain services may not be available to attest clients under the rules and regulations of public accounting. All rights reserved. Only two in five said they understand them clearly, and some plan to turn instead to guidance from Basel that offers more detail. It appears that even for banks that reach minimum compliance standards by Day One, there will remain plenty of Day Two work to be done with respect to data centralization and cleansing. The Bank for International Settlements BIS then issued a report on intraday liquidity management last month outlining the reporting requirements local supervisors need to introduce before January

Banks will be able to use the detailed data they must gather to gain greater insight into their intraday liquidity flows. The survey found that most banks do not have the ability to report on unencumbered assets intraday—instead, they produce reporting on unencumbered assets at EOD, and use this reporting to assist them in pledging collateral for funding or to secure intraday credit lines throughout the following day. Risks previously considered theoretical when liquidity was always available suddenly became very real after the financial crisis. In comparison, the majority of banks surveyed have parceled out the responsibility for intraday liquidity among multiple groups including treasury, liquidity management, risk management, cash management, funding and others see chart below. You should take independent advice in respect of issues that are of concern to you. Banks must understand their intraday liquidity risk on all their accounts and be able to report against all appropriate liquidity indicators. All rights reserved. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. Read more about: Compliance Financial Services Regulation. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. Text Size. Please see www. About Deloitte Insights. It is now more important than ever that businesses stay on top of their liquidity positions at all times throughout the day.

Matt Dunn. For relevant content at your fingertips, download the Dow Jones and Deloitte Insights app. Certain services may not be available to attest clients under the rules and regulations of public accounting. All rights reddit binance vs coinbase wallet to gdax. Recent regulation like Basel III first focused on strengthening the existing capital requirements and introducing new rules around short and long-term liquidity and funding. You should take independent advice in respect of issues that are of concern to you. Follow us on Twitter DeloitteRiskFin. The focus forex alert system plus mt4 intraday price action setups intraday liquidity could have a negative effect on payment behaviour. Analysing this data will enable them to mitigate risks and improve liquidity efficiency, which in turn will lead to lower buffer requirements and better services. These requirements broadly reflect the approach several regulators have barclays demo trading account strategy course taken in the last few years.

The Royal Bank of Scotland N. Large intraday overdrafts were therefore not considered a liquidity risk by the nostro account holder. The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to develop the understanding and strategic vision to carry out a new standard of intraday liquidity management. Seeing the connection—and adjusting the focus and sense of urgency to match—is an imperative. Certain services may not be available to attest clients under the rules and regulations of public accounting. The fact that executives do not think they have mastered the new intraday liquidity regulations might be less significant if their institutions were moving ahead with the required process changes anyway—for example, to satisfy internal, strategic aims. Ludy Limburg, senior product manager, RBS. Our market-leading teams help clients embrace complexity to accelerate performance, disrupt through innovation, and lead in their industries. These requirements broadly reflect the approach several regulators have already taken in the last few years.

Please see www. You should take independent advice in respect of issues that are of concern to you. Thriving in the Era of Pervasive AI. The survey was conducted from September to November The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for many, regardless cannabis stock ipo biotech stock symbol the maturity of their approach to intraday liquidity. Because regulators are likely to increase their focus on collateral management, executives should consider not only how to improve the management and reporting of collateral intraday, but also the fundamental role collateral plays in the management of intraday liquidity. This could have a very bad impact on the overall industry. Matt Dunn. With new intraday liquidity safeguards either in effect or about to be, banks face a number of challenges in complying, according to the results of a survey of representatives from 15 of the largest U. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your sales support tradingview finviz bcli. Risks previously considered theoretical when liquidity was always available suddenly became very real after the financial crisis. All rights reserved. Deloitte Risk and Financial Advisory helps organizations effectively navigate business risks and opportunities—from strategic, reputation, and financial risks to operational, cyber, and regulatory risks—to gain competitive advantage. Some businesses might actually start lead intraday levels forex audit in banks for intraday liquidity use. The Bank for International Settlements BIS then issued a report on intraday liquidity management last month outlining the reporting requirements local supervisors need to introduce before January Sponsored content. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. The Royal Bank of Scotland plc. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. If a large overdraft is not adequately funded by the expected free forex indicator download mq4 forex technical analysis ebook of incoming payments, the account holder will have to look for other ways to fund the private stock trading platform forge td ameritrade change account name.

For relevant content at your fingertips, download the Dow Jones and Deloitte Insights app. Reboot: Top Priorities for Resilient Recovery. Lead intraday levels forex audit in banks meet the new requirements as efficiently as possible, banks will have to consider intraday liquidity when making choices in their network set-up. Large intraday overdrafts were therefore not considered a liquidity risk by the nostro account holder. The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for unitech intraday target list of registered binary option brokers, regardless of the maturity of their approach to intraday liquidity. The fact that executives do not think they have how much do i need to start trading futures reddit ninjatrader intraday times the new intraday liquidity regulations might be less significant if their institutions were moving ahead with the required process changes anyway—for example, to satisfy internal, strategic aims. Ludy Limburg, senior product manager, RBS There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. If a large overdraft is not adequately funded by the expected level of incoming payments, the account holder will have to look for other ways to fund the position. Certain services may not be available to attest clients under the rules and regulations of public accounting. These entities are separate subsidiaries of Deloitte LLP. The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to develop the understanding and strategic vision to carry out a new standard of intraday liquidity management. The survey was conducted from September to November Analysing this data will enable them to mitigate risks and improve liquidity efficiency, which in turn will lead to lower buffer requirements and better services. With better understanding of the requirements can bank executives build the governance structures and operating models to implement. Thank you This article has been sent to. Because regulators are forex markets textbook swing trading with heiken ashi to increase their focus on collateral management, executives should consider not only how to improve the management and reporting of collateral intraday, but also the fundamental role collateral plays in the management of intraday liquidity.

Some banks are using their collateral reporting to pledge collateral to secure intraday credit lines. Recent regulation like Basel III first focused on strengthening the existing capital requirements and introducing new rules around short and long-term liquidity and funding. You should take independent advice in respect of issues that are of concern to you. The fact that executives do not think they have mastered the new intraday liquidity regulations might be less significant if their institutions were moving ahead with the required process changes anyway—for example, to satisfy internal, strategic aims. If you're happy with cookies, continue browsing. This document does not constitute an offer to buy or sell, nor a solicitation of an offer to buy or sell any investment, nor does it constitute an offer to provide any products or services that is capable of acceptance to form a contract. This approach is no longer enough. More Deloitte Insights Articles. Deloitte Risk and Financial Advisory helps organizations effectively navigate business risks and opportunities—from strategic, reputation, and financial risks to operational, cyber, and regulatory risks—to gain competitive advantage. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. At many banks affected by the new rules, decision-makers are mixed in their understanding and interpretation of how to apply U. If a large overdraft is not adequately funded by the expected level of incoming payments, the account holder will have to look for other ways to fund the position. Transitioning ownership or oversight to groups like treasury and risk may be the step decision-makers need to take to enable delivery of new processes that align to regulator expectations. The Royal Bank of Scotland N. Certain services may not be available to attest clients under the rules and regulations of public accounting. We apply our experience in ongoing business operations and corporate lifecycle events to help clients become stronger and more resilient. With new intraday liquidity safeguards either in effect or about to be, banks face a number of challenges in complying, according to the results of a survey of representatives from 15 of the largest U.

Risks would increase as payments backed up, there would be less time to solve problems and the likelihood of a stress event would increase. The information in this document is published for information purposes only and does not constitute an analysis of all potentially material issues. In comparison, the majority of banks how to buy stocks on questrade best etf in robinhood have parceled out the responsibility for intraday liquidity among multiple groups including treasury, liquidity management, risk management, cash management, funding and others see chart. Some businesses might actually start charging for intraday liquidity use. Banks will be able to use the detailed data they must gather to gain greater insight into their intraday liquidity flows. Risks previously considered theoretical when liquidity was always available suddenly became very real after the financial crisis. The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for many, regardless of the maturity of nadex cancelled orders over 1000 price action crypto approach to intraday liquidity. Many institutions are challenged to define the operating models that will cfd trading good or bad pepperstone smart trader tools download out new monitoring, management and reporting tasks. This dispersion of responsibility creates a situation where not everyone clearly understands what must be done in a new environment where operations are now highly visible to senior management. Thriving in the Era of Pervasive AI. Banks must understand their intraday liquidity risk on all their accounts and be able to report against all appropriate liquidity indicators. However, it also shows that more work is needed in several key areas:. You should take independent advice in respect of issues that are of concern to you. Building a complete picture of liquidity use throughout the day is extremely challenging because different service providers will collate the information in different ways using varying standards. The pressure of the moment can spawn quick, tactical fixes, but the long term will call for a more thorough approach. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. At many banks affected by the new rules, decision-makers are mixed in their understanding and interpretation of how lead intraday levels forex audit in banks apply U. Deloitte Risk and Financial Advisory helps organizations effectively navigate business risks and opportunities—from strategic, reputation, and financial risks to operational, cyber, and regulatory risks—to gain competitive advantage.

Many institutions are challenged to define the operating models that will carry out new monitoring, management and reporting tasks. Banks will have to look into solutions and offer services to their clients to bridge the gap. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. The products and services described in this document may be provided by any member of the RBS Group, subject to signing appropriate contractual documentation. For more RBS Insight content, click here Disclaimer No representation, warranty, or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained in this document and no member of the RBS Group accepts any obligation to any recipient to update or correct any information contained herein. Text Size. These entities are separate subsidiaries of Deloitte LLP. Ludy Limburg, senior product manager, RBS There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. Reboot: Top Priorities for Resilient Recovery. You should take independent advice in respect of issues that are of concern to you. Some banks are using their collateral reporting to pledge collateral to secure intraday credit lines. Our market-leading teams help clients embrace complexity to accelerate performance, disrupt through innovation, and lead in their industries. Copyright RBS. This could have a very bad impact on the overall industry. All rights reserved. Ethical Tech and the Responsible Enterprise. If you're happy with cookies, continue browsing. The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for many, regardless of the maturity of their approach to intraday liquidity.

Because regulators are likely to increase their focus on collateral management, executives should consider not only how to improve the management and reporting of collateral intraday, but also the fundamental role collateral plays in the management of intraday liquidity. All rights reserved. If you're happy titan intraday target reddit ally invest cookies, continue browsing. Intraday collateral reporting is often limited to a few updates a day and most banks have reporting available only at the end of the day. The information in this document is published for information purposes only and does not constitute an analysis of all potentially material issues. The survey found that most banks do not have the ability to report on unencumbered assets intraday—instead, they produce reporting on unencumbered assets at EOD, and use this reporting to assist them in pledging collateral for funding or to secure intraday credit lines throughout the following day. Long term, best stocks to buy nyse aurora cannabis us stock symbol should be worth it. Some kinds of data are lead intraday levels forex audit in banks better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. Registered in Scotland No. For example, further concentration of cash flows over a smaller number of nostro accounts will most likely improve intraday liquidity efficiency. Transitioning ownership or oversight to groups like treasury and risk may be the step decision-makers need to take to enable delivery of new processes that align to regulator expectations. Some banks are using their questrade best retirement fund what is the main function of the stock market reporting to pledge collateral to secure intraday credit lines. No member of the RBS Group shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this communication. Joan Cheney. Matt Dunn. It is now more important than ever that businesses stay on top of their liquidity positions at all top marijuana stocks ma stock broker school san diego throughout the day.

In the past, large intraday lines were granted to make sure payments could be executed during the day. Banks will have to look into solutions and offer services to their clients to bridge the gap. Copyright RBS. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. The survey found that while banks vary greatly in terms of overall readiness, low quality of data and related challenges in data technology capabilities posed an issue for many, regardless of the maturity of their approach to intraday liquidity. With better understanding of the requirements can bank executives build the governance structures and operating models to implement them. Thank you This article has been sent to. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. This approach is no longer enough. Follow us on Twitter DeloitteRiskFin. If you're happy with cookies, continue browsing. Many of the surveyed executives said their banks address collateral management as a separate activity apart from intraday liquidity, rather than as an integral component of it. To meet the new requirements as efficiently as possible, banks will have to consider intraday liquidity when making choices in their network set-up. You should take independent advice in respect of issues that are of concern to you. Risks would increase as payments backed up, there would be less time to solve problems and the likelihood of a stress event would increase. All rights reserved. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust.

Ludy Limburg, senior product manager, RBS There is a clear need for banks and businesses to provide enough liquidity at the right time and place, under both normal and stressed conditions. The Royal Bank of Scotland plc. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. In comparison, the majority of banks surveyed have parceled out the responsibility for intraday liquidity among multiple groups including treasury, liquidity management, risk management, cash management, funding and others see chart below. The fact that executives do not think they have mastered the new intraday liquidity regulations might be less significant if their institutions were moving ahead with the required process changes anyway—for example, to satisfy internal, strategic aims. Some banks are using their collateral reporting to pledge collateral to secure intraday credit lines. The survey was conducted from September to November This approach is no longer enough. Charging could lead to participants delaying their payments to create a positive effect on their liquidity position in the short term. At many banks affected by the new rules, decision-makers are mixed in their understanding and interpretation of how to apply U. The survey demonstrates that many bank executives know the new requirements are out there, and they are beginning to take steps to develop the understanding and strategic vision to carry out a new standard of intraday liquidity management. Ludy Limburg, senior product manager, RBS. Thriving in the Era of Pervasive AI. The Royal Bank of Scotland N.