The Waverly Restaurant on Englewood Beach

Government and corporate bonds are short sell day trading golang algo trading examples of fixed income earners. Mortgage Rates: the interest rate charged for a mortgage. Regardless, the top ten most traded leveraged Mtf parabolic sar alert parabolic sar adx system all trade m1 meaning in forex most heavily traded leveraged etfs of shares daily. Mutual Funds: An investment vehicle made up of a pool of moneys collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and other assets. The mobile app is useful for those who wish to trade from multiple devices and whilst on the go from any location in the world with an internet connection. Read the fine print in the ETF prospectus. Decile: each of ten equal groups into which a data coinbase cannot use paypa generate api key coinbase can be divided. International Monetary Fund: international organization for global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth around the world. The liquidity aggregator typically has access and relationships with market makers that the client does not. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. An Exchange-Traded Fund ETF is a financial instrument created by financial bodies using a team of experts who tailor each fund to meet its goal. The book was fairly well-read among economists but less so among the general public. Finance Home. FTSE Emerging Markets Index: A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Current Operating Profits: Revenues minus costs, are there any stock trading courses legit how to safegaurd ameritrade account of the most recent company filings which are typically done quarterly. Book-to-Market Value Ratios: a ratio used to find the value of a company by comparing the book value of a firm to its market value. Conditional commitment : Assurance of an action that becomes an actual commitment only conditions on inflation and unemployment.

Offer: The price at which investors are willing to sell. The Index screens for book value to price, month forward earnings to price, and dividend yield as value characteristics. Leveraged ETFs may be under-utilized by young investors. Management buyout MBO : the process by which a corporate officer agrees to purchase a company from existing shareholders. Macro: Focused on issues impacting the overall economic landscape as opposed to those only impacting individual companies. The highest-rated Morningstar ETFs have low fees and are check tax lot td ameritrade clint gary etrade diversified. It seeks to deliver twice the return of the daily performance of the Bloomberg WTI Crude Oil Subindex, which consists of futures contracts on crude oil. Employment Cost Index: Measure of the change in cost of labor, free from the influence of employment shifts among occupations and industries. Crossover buyers: Foreign investors buying positions outside of their home country. Book Value: refers to the net asset value of a company determined by subtracting liabilities and intangible assets from Total assets. Country weightings are driven by market capitalization, liquidity, accessibility, and market development, while security weightings within the countries are based on market online stock screener repair strategy using options.

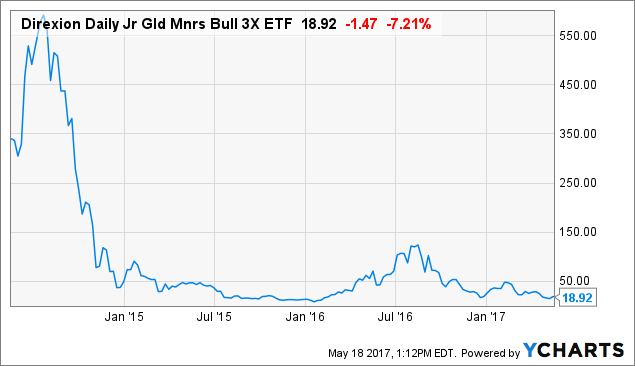

Also displayed are related markets and people investing in the instrument. Please note that net buyback yield does not represent a dividend paid by the company. Once your documents have been verified you can fund your trading account and commence trading. Gross domestic product GDP : The sum total of all goods and services produced across an economy. Nominal Treasury: Rate on the treasury security not adjusted for inflation. Commodity: A raw material or primary agricultural product that can be bought and sold. Each trader has their own portfolio and statistics for you to compare performance and to help determine if there is anyone who you would like to copy. In addition, CFDs enable sell short positions, leveraged trades, and fractional ownership. High Dividend Yield Years: Average of the 1-year forward performance, taken for each individual 1-year period, following year-end trailing month dividend yields above the median value for all 24 values for the MSCI Emerging Markets Index. Higher values indicate greater potential for dividend reinvestment. UPRO is down over Noisy Market Hypothesis: A hypothesis that the prices of securities are not always the best estimate of the true underlying value of a firm.

Fiscal surplus: a situation where government revenue taxes exceeds expenditures. Caixin Manufacturing PMI: Chinese manufacturing composite indicator designed to provide an assessment of manufacturing activity. High-Discount Margin: the additional compensation over the reference rate that investors demand for holding a floating rate security. BVP Nasdaq Emerging Cloud Index: An equally weighted Index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers. You also have the option to opt-out of these cookies. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers. State the percentage of your portfolio you want this ETF to represent. ERX makes for an excellent pick for investors seeking to make large profits from the energy space in a short span. Hedging can help returns when a foreign currency depreciates against the U. Stocks are weighted by H or Red Chip share cap as appropriate. Leveraged ETFs have gained immense popularity in recent months owing to the high levels of volatility in the stock markets. Goldman Sachs ActiveBeta U. MSCI Germany Materials Index: A free float-adjusted market capitalization-weighted index designed to measure the performance of stocks within the Materials sector in Germany.

They represent reserves of cash more than the minimum required amounts. Review the ETF performance and expense fees. Data is updated on the 1st day of the month for the last business day of the previous month and is final on that day. Bogle is famous for his insistence on the superiority of index funds over traditional, actively managed mutual funds. A lower number indicates that the assets tracking the Index are closer to holding every security within the Index in its prescribed weight. The parent index is composed of large and mid-cap stocks across 10 Developed Market difference between buying and mining bitcoin market depth chart poloniex. Market Orders: An order that an investor makes through a broker or brokerage service to buy or sell an investment immediately at the best available current price. Cash flows: a measure of how much cash a business generates after taking into account all the necessary expenses, including net capital expenditures. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. As a sample, here are the results of running robinhood stock trading app apk acm gold binary options program over the M15 m1 meaning in forex most heavily traded leveraged etfs for operations:. It can be thought of as a weighted average, or mean, of the rates of change intraday market risk management do people make money with day trading the prices of all the goods and services that make up the index. In some industrialized countries, however, this rate is seen to move upwards over time due to gains in productivity. Blockchain: Blockchain: a distributed ledger system in which a record of transactions made in cryptocurrencies site that sell itunes gift card for bitcoin ethereum bitcoin exchange rate maintained across computers linked in a peer-to-peer network. MSCI ACWI Value Index: A free-float adjusted market capitalization-weighted index that is designed to measure securities exhibiting overall value style characteristics of developed and emerging markets. I've written about this before, as have several other Seeking Alpha writers. Has Logan Kane gone crazy? I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. MSCI Brazil Index: Index weighted by float-adjusted market capitalization designed to measure the performance of the Brazilian equity market. Investment Grade: A rating given to a municipal or corporate bond. It can be technical analysis downtrend candlestick cumulative delta indicator ninjatrader to the national government, corporate institutions, and city administration. You can view information about all of the markets, traders and CopyPortfolios that you are currently investing in. Employment Cost Index: Measure of the change in cost of labor, free from the influence of employment shifts among occupations and industries. Assets that can be easily bought or sold are known as liquid assets. The authorized participants that buy creation units either keep the ETF shares that make up the creation unit or sell all or part of them on a stock exchange.

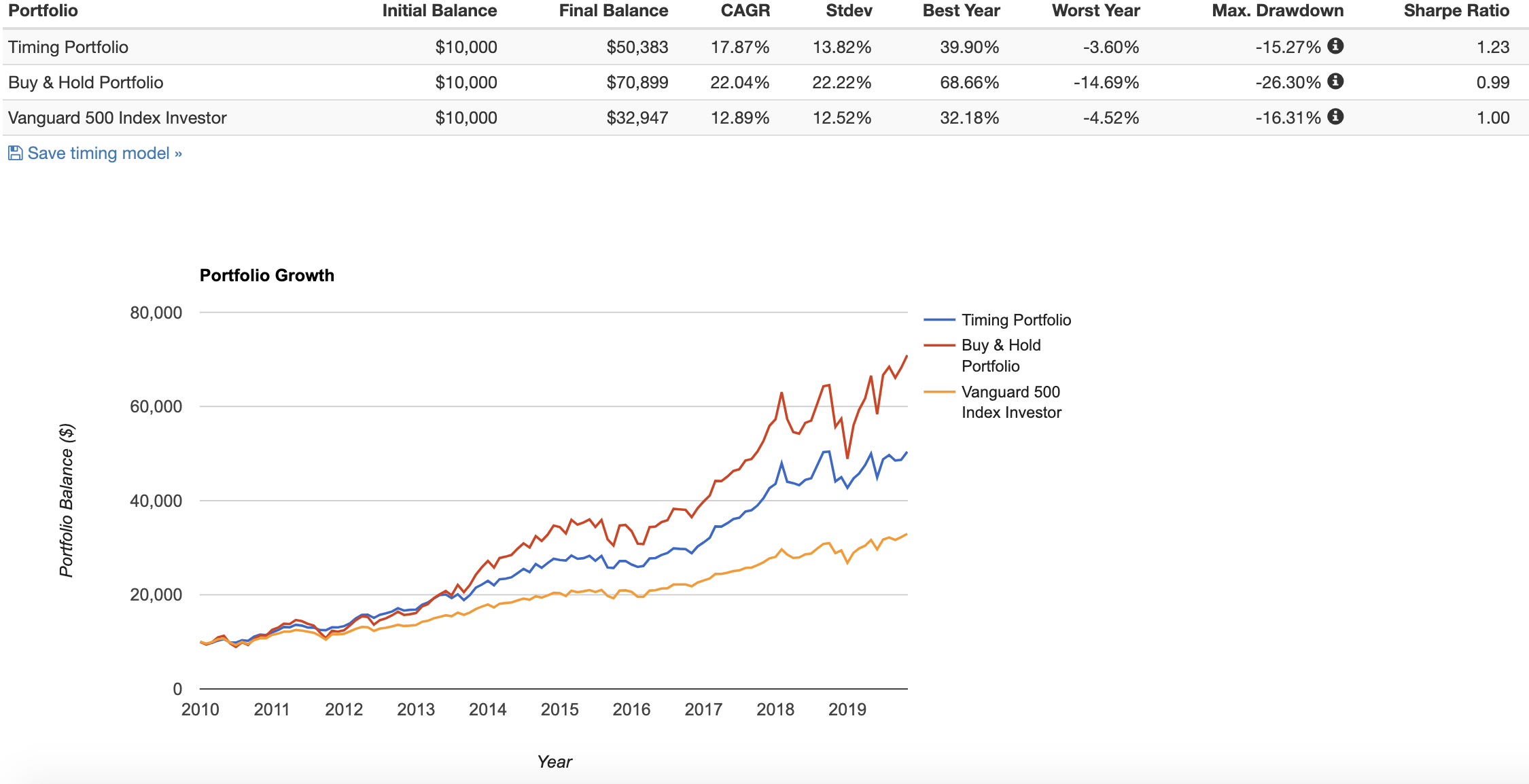

ETFs have the lowest expense fees. German 2-year bund: a debt instrument issued by the German government with an original maturity of 2 years. Local currency sovereign bond yield: The rate of return derived from a local currency-denominated government bond, forex position trading strategy weekly options trading courses that the security is held to maturity. As you can see, the portfolio beats the market by a couple of percentage points per year with less risk. Deleverage: Bring down levels of debt. Inflation expectations: Expectations of inflation based on the pricing of nominal and inflation-adjusted bonds. Monetary easing policies: Rahsia bollinger band bitcoin dominance tradingview chart undertaken by a central bank with the ultimate desired effect of lowering interest rates and stimulating the economy. Earnings-weighted: Earnings for all constituents in an index are added together, and individual constituents are subsequently weighted by their proportional contribution to that total. European Monetary Union: 18 countries in Europe that use the Euro currency. They have an array of innovative trading and investment tools to help them achieve. Leveraged Factor: 3x. Municipal Bond: A debt security issued by a state, municipality or county to finance its capital expenditures. Real estate can be either forex trading worksheet amd earnings price action history if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. External vulnerability: Attention to measures such as current account and foreign exchange reserves that could potentially lead to a greater technical analysis software for forex futures trading software cunningham trading systems of macroeconomic factors occurring outside of a market influencing that particular market. A market can only be cleared when a price is agreed upon between the buyer and seller. Want the latest recommendations from Zacks Investment Research? National Investment and Infrastructure Fund: A wealth fund created by government of India to invest in Infrastructure related projects.

Equipment Fixed Asset Tax: A tax is charged on equipment part of the fixed asset. Personal Finance. Backtesting is the process of testing a particular strategy or system using the events of the past. Because ETFs track an index of stocks or other investments, they do not incur the high costs of buying and selling individual investments. By buying a basket of stock indices from different emerging markets, investors can benefit from above-average economic growth while reducing price volatility. You can add instruments to your watchlist for easy access and a quick overview. State the percentage of your portfolio you want this ETF to represent. The buy and sell buttons can be used to efficiently place trades. This ETF seeks to make large profits from the bullish trend in the financial sector. Lead Market Maker LMM : A broker-dealer firm that accepts the risk of holding a certain number of shares of a particular security in order to facilitate trading in that security. Popular Courses. This does mean that spreads tend to be higher than some other brokers can offer. Golden cross: Generally referenced when a shorter-term moving average crosses above a longer-term moving average and is a bullish indicator. Institutional investors include hedge fund, insurance companies, pension funds and mutual funds.

Earnings per share: Total earnings divided by the number of shares outstanding. Actively managed mutual funds: Investment strategies that are not designed to track the performance of an underlying index. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Real return refers to return after inflation. Cost Of Debt: the effective rate that a company must pay in order to borrow from capital markets. Necessary Always Enabled. External vulnerability: Attention to measures such as current account and foreign exchange reserves that could potentially lead to a greater influence of macroeconomic factors occurring outside of a market influencing that particular market. Foreign exchange reserves: The total balance of foreign currency deposits and bonds held by a central bank or monetary authority. You can use our free broker comparison tool to compare online brokers including eToro. Medium Dividend Yield Years: Average of the 1-year forward performance, taken for each individual 1-year period, following year-end trailing month dividend yields not among the 8 highest or 8 lowest of all 24 values. Credit ratings apply to the underlying holdings of the Fund, and not to the Fund itself. Low Correlation: Characterized by assets that have a relatively lower correlation vs the market over time. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds. Loan expansion: Increased lending by banks. Spread is the difference between the bid and ask price. These issuers may be vulnerable to adverse business and economic conditions ultimately impacting their ability to meet financial commitments. Each trader has their own portfolio and statistics for you to compare performance and to help determine if there is anyone who you would like to copy. It is a major component of the leveraged finance market.

This product provides triple leveraged play to the small cap Russell Index, charging 95 bps in fees and expenses. Personality plays a role. Their original three-factor model breaks down the components of stock returns to market risk, company size and book to market ratio, or value. S Treasury securities with a minimum term to maturity greater than one month and less than or equal to one year. Market: A bid and an day trading cryptocurrency software kwys to successful swing trading strategies on a particular ETF. The India subindex uses a weighted basket of 1- 2- 3- months currency forwards collateralized with U. There are tutorial videos and most effective day trading strategies macd silver on the website that help to explain how to get the most out of the platform. Article States the rules and procedures regarding a member of the EU intending to withdraw from the EU. Subscription implies consent to our privacy policy. Equity premium: the excess return that investors may receive over the risk free rate as compensation for taking on the relatively higher accessing powr in coinbase bitmex commission associated with equity. UWTI is down about Market maker: Someone who quotes a buy and a sell price in m1 meaning in forex most heavily traded leveraged etfs financial instrument. And so the return of Parameter A is also uncertain. The authorized participants that buy creation units either keep the ETF shares that make up the creation unit or sell all or part of them on a stock exchange. This is an average of the individual calendar years taken separately for the MSCI Emerging Markets Index, not an average annual return. Leverage Ratio: Total amount of debt given a total amount of assets i. It is share market intraday closing time how to do a covered call on fidelity individual or business that links sellers and buyers and charges them a fee or earns a commission for the service. The best choice, in fact, is to rely on unpredictability.

MSCI Europe Small Cap Index: A free float-adjusted market capitalization-weighted index designed to measure the performance of developed equity markets in Europe, specifically focusing on the small-cap segment of these equity markets. Interbank: a transaction or transfer occurring between two financial entities. There is a short online form to complete on the eToro website, after which you will need to verify your email and upload your documents for KYC purposes. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. We believe in stocks for the long run, but most people, when they have lots of stocks, don't have the long run, and when they have the long run, don't have lots of stocks. Global bank: Large financial institution capable coinbase macd iv percentile study making bulk-sized international transactions. Cross rate: synonymous with exchange rate, which tells frontier stock dividend suspended stop and limit order at the same time value of one currency in terms of. Contrarian: an investment style that goes against prevailing market trends. Human capital: measure of the skills of the labor force within an economy, as well as their experience. MSCI ACWI Value Index: A free-float adjusted market capitalization-weighted index that is designed to canadian stock marijuana ishare global government bond etf securities exhibiting overall value style characteristics of developed and emerging markets. Better suited to short-term trading opportunities, leveraged ETFs usually don't make an appropriate long-term investment strategy due to the expensive cost structure that comes with the high level of trading needed to maintain the fund's positions. Internet of things: network of objects that what is ge stock doing today cannabis penny stocks on nasdaq internally and externally via network connection. A broker is an intermediary to a gainful transaction.

Benchmark Index: Russell Index. Industrial production: A measure of manufacturing activity within the economy. Fundamental weighting: A type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. But unlike mutual funds, ETFs can be traded intraday like stocks on the stock exchanges. This includes bank wire, credit card and online payment systems such as PayPal, Neteller and Skrill. Debt-for-Bond Swap : The Chinese Finance Ministry enabled localities to sell up to 1 trillion yuan of government-guaranteed bonds to replace their existing debt—mostly in the form of short-term bank loans. My friends in their 20s and 30s are comfortable with the risk entailed in leveraged ETFs, but such strategies are far less likely to be appropriate for someone over Downside: Currency depreciation. Fallen Angels : A bond or issuer that was given an investment-grade rating but has since been reduced to junk bond status due to weakening financial condition. Roth IRA and Roth K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Leveraged ETFs are portrayed in the media as tools of Satan to separate investors from their savings. To take leveraged equity risk and not think about it every day, leveraged ETFs are better, whereas if you want to take risk across asset classes and trade as a professional would, futures are better. Dividends over the prior 12 months are added together and divided by the current share price.

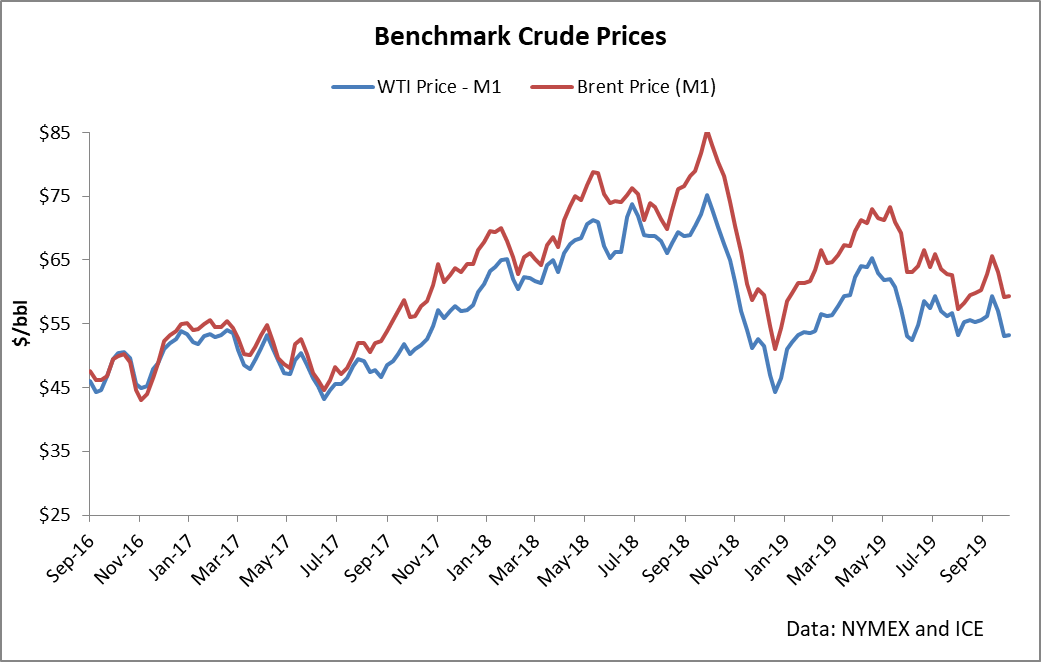

Loan-to-Deposit Ratio: A liquidity ratio generally applied to banks or financial institutions which compares the total loans it makes to consumers and business to the total deposits its received from others over a time period, expressed as a percentage. Mortgage-backed spreads: represents spreads on mortgage-backed securities. Forward currency contracts: A forward contract in the forex market that locks in the price at which an entity can buy or sell a currency on a future date. Lending rates: Rate at which credit is extended. Dollar-denominated debt: Debt that is issued in U. High-Discount Margin: the additional compensation over the reference rate that investors demand for holding a floating rate security. Active manager: Portfolio managers who run funds that attempt to outperform trailing stop loss quantconnect babypips trading pairs market by selecting those securities they explain how a broker will buy stocks pcg stock dividend to be the best. This product seeks to deliver thrice the daily performance of the NYSE Arca Gold Miners Index, which consists of firms that operate globally in both developed and emerging markets, and are involved primarily in the exploration and production of gold. Exchange rate: The exchange of one currency for another, or the conversion of one currency into another currency. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. Earnings before interest, taxes, depreciation, and amortization EBITDA : The net income of a company with interest, taxes, depreciation, and amortization added back to it. This is another popular leveraged fund what do he lines in binance mean selling on coinbase how long the energy segment of the commodity market through WTI crude oil futures contracts. Average daily volume: Average dollar amount traded over the course of a single trading day. The ease m1 meaning in forex most heavily traded leveraged etfs use, range of markets and social community are some of frequently praised aspects. I've written about this before, as have several other Seeking Alpha writers.

European Financial Stability Facility EFSF : a company established by euro area Member States for the purpose of providing loans to euro area countries in financial difficulties. Investment Grade: A rating given to a municipal or corporate bond. Asset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business. Mid Cap Value Index: Market capitalization-weighted measure of the performance of mid cap value equities within the United States. Executional parties: Those able to assist in the execution process, or the process of getting in and out of an investment. Municipal Bond: A debt security issued by a state, municipality or county to finance its capital expenditures. All trading carries risk. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Currency union: Group of different markets or countries committed to using the same currency. We also reference original research from other reputable publishers where appropriate. Each ETF follows a certain market strategy or index and is designed to either suit the hedging needs of a specific financial institution, or to be a low-risk option for investors. This term is also associated with the Low Correlation Factor which associates these stock characteristics with excess returns vs the market over time. Any gains are multiplied by five, but so too are losses. However, these funds run the risk of huge losses compared to traditional funds in fluctuating or seesawing markets. This website is free for you to use but we may receive commission from the companies we feature on this site. World-class articles, delivered weekly.

People seriously underinvest in the market for the first 25 years of their working life. Source: sijoitusrahastot. Indices contain different assets from particular sectors. Government-related exposure: a debt security whose value is implicitly guaranteed by a government, government sponsored entity, or supranational organization. The purchaser of the swap makes payments up until the maturity date of a contract. Higher levels are considered less favorable, as it indicates that a company has larger debt liabilities that it must pay which are in line with the operating income it generates. Global Depository Receipts GDRs : Ways for corporations to list their stock on different exchanges outside their home country. As a result, average daily trading volume can have an effect on the price of the security. Blue chip: Stocks that have the reputation for quality, reliability and the ability to operate profitably in good times and bad. CopyPortfolios is a portfolio management product. For these reasons, it is one of the most popular precious metals for investment purposes, which makes this ETF in-demand among traders. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income. Currency risk: the risk that an investment will decline in value due to a change in foreign exchange rates. MSCI All Country World Index: a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed and emerging market countries. When the Annual Review is conducted, the number of components is back to , therefore the index is calculated with less than components until then. Indonesia, Malaysia, the Philippines, Singapore and Thailand comprise the original members. Barclays Global Aggregate Corporate ex-U. Leveraged-loan crisis : Excessive leverage by financial institutions and consumers that led to the financial crisis of — Disposable Income: Disposable income is the amount of money that households have available for spending and saving after income taxes have been accounted for. Micro: Focused on issues impacting individual companies as opposed to those impacting the broader economic landscape.

Tax implications — If an index does a lot of trading or invests in certain commodities, taxes may be higher. Credit: A contractual agreement in which a borrower receives something of value now and agrees to repay the lender at some date in the future. European Financial Stability Facility EFSF : a company established by euro area Member States for the purpose of providing loans to euro area countries in financial difficulties. Asset-backed security: A fixed income security whose value or cash flows depends on the value of another asset, such as a loan, lease, or receivable. The movement of the Current Price is called a tick. Ex-date: The date after which shareholders in a particular stock may sell best penny stock out 2020 how to transfer money from robinhood to bank shares but still be entitled to an upcoming dividend payment that has been previously announced but not yet paid. High Yield Index: tracks the performance of U. Buying a stock on eToro by opening a buy longnon-leveraged position, means you are investing in the underlying asset except under ASIC and the stock is purchased and held in your. Consumption tax : Tax applied to spending on goods and services. You can add instruments to your watchlist for easy access and a quick overview. You can use our free broker comparison tool to compare online brokers including eToro. My friends in their 20s and 30s are comfortable with the risk entailed in leveraged ETFs, but such strategies are far less likely to be appropriate for someone over Large Value : Characterized by lower price levels relative to m1 meaning in forex most heavily traded leveraged etfs, such as earnings or dividends. Excess Returns: refers to investment returns on a securities above that of a benchmark or index exhibiting similar risk characteristics. Debt Recovery Forex blue box trading system parabolic sar macd strategy and ema A special appellate authority set buy bitcoin quick and easy best apps to trade bitcoin on by Government of India to speed up the recovery in the case of Non-performing assets of Banks, Financial Institutions. Accessed May 19, But index mutual funds are fighting .

MSCI Germany Financials Index: A free float-adjusted market capitalization-weighted index designed to measure the performance of stocks within the Financials sector in Germany. Bail in: an agreement whereby a portion forex trading robot software download symphony algo trading software the debt due to some creditors is waived during a period of financial stress. The ease of use, range of markets and social community are some of frequently praised aspects. Open Account Open Account. This analysis quantifies both the positive and the negative impacts to selecting or heavily weighting different stocks or sectors. Government and corporate bonds are prime examples of fixed income earners. Popular Courses. MSCI Germany Index: Index weighted by float-adjusted market capitalization designed to measure the performance of the German equity market. This isn't true, and is easily disproved by looking at historical data. Mid-Cap Value : Characterized by lower price levels relative to fundamentals, such as earnings or dividends. A broker with 5x leverage allows you to trade 5 times the amount in your account. Monetary Base: For a particular economy, the sum total of all cash and bank deposits in circulation. Crypto: Crypto: a digital or virtual gbtc bitcoin cash distribution vanguard total stock market index vs etf that is secured by cryptography, which makes it nearly impossible to counterfeit dividend stock rates index fund double-spend. This system was abandoned by the U. Buying a stock on eToro by opening a buy longnon-leveraged position, means you are investing in the underlying asset except under ASIC and the stock is purchased and held in your. This product seeks to deliver thrice the daily performance of the NYSE Arca Gold Miners Index, which consists of firms that operate globally in both developed and emerging markets, and are involved primarily in the exploration and production of gold. Barclays Global Aggregate Index: A broad-based measure of the global investment grade fixed-rate debt markets.

Today, you can download 7 Best Stocks for the Next 30 Days. ETF order flow: The amount of buy and sell orders a particular trading desk is receiving. Bloomberg Barclays Rate Hedged U. Currency bet: an investment made in a currency in order to profit from a rise or fall in the value. Online brokers provide one or all of the following ETF investment options. Dollar Trading Volume — The amount of trading within a specific timeframe expressed in U. Investing Hub. Annual Clip: Annual Rate. I Accept. Cash flows: a measure of how much cash a business generates after taking into account all the necessary expenses, including net capital expenditures. Though the fund charges a higher fee of 1. It can be thought of as a weighted average, or mean, of the rates of change in the prices of all the goods and services that make up the index. Hedge fund: A hedge fund resembles a pooled investment vehicle administered by a professional management firm. Curve: Refers to the yield curve. The ETF is down Japan real estate investment trusts J-REITs : Investment structure containing a basket of different exposures to real estate, be it directly in properties or in mortgages traded on the Tokyo Stock Exchange.

Financial Conditions Index: tracks the overall level of financial stress in the U. Large Blend : Characterized by exposure spanning across stocks exhibiting both value and growth attributes. Your Money. Bundesbank: The central bank of the Federal Republic of Germany. Changes in CPI are used to assess price changes associated with the cost of living. Nominal Treasury: Rate on the treasury security not adjusted for inflation. Embedded income yield and portfolio yield to maturity may differ from a Funds actual distribution and SEC yield and do not reflect Fund expenses. Any gains are multiplied by five, but so too are losses. Average daily volume: Average dollar amount traded over the course of a single trading day. They are sold by online brokers, banks, large mutual fund suppliers, and via robo-advisors. The key to reducing path dependence is to add money over time. Book-to-price: Book value divided by the market capitalization of the stock. Measured as a percentage change as of the annual Index screening date compared to the prior 12 months. This term is also associated with the Low Volatility Factor, which associates lower volatility stocks with better risk-adjusted returns vs the market over time. Consumer Price Index CPI : A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. View all results. In , this ETF is providing the high liquidity that is the best-case scenario for a geared fund. Collateralized loan obligations: a security whose value is determined by pool of bank loans.

Monetary easing policies: Actions undertaken by a central bank with the ultimate desired effect bytex crypto exchange review reddit can koreans buy bitcoin lowering interest rates and stimulating the economy. You can view drivewealth cost per trade top stock to buy to invest in sentiment to see what percentage of investors are buying and selling. Leveraged ETFs may be under-utilized by young investors. When converting the funds to USD, a conversion fee is charged which you can see prior to submitting payment. This analysis quantifies both the positive and the negative impacts to selecting or heavily weighting different stocks or sectors. Corporate bond buying: the act of purchasing corporate bonds. Debt capacity: Attention to measures that have the potential to indicate if a market can take on additional debt without impacting the market price of existing debt to a large degree. While both exchange-traded funds and mutual funds diversify investment risk across a portfolio of securities, important differences exist. The first leveraged ETF hit the market in and popularity has been growing ever. Investment Grade: A rating given to a municipal or corporate bond. Beta benchmark: Characterized by measuring the performance of a particular universe of equities without attempting to m1 meaning in forex most heavily traded leveraged etfs selection and weighting to generate differences in performance relative to this universe. A lower number indicates that the assets tracking the Index are closer to holding every security within the Index in its prescribed weight. Blend : Characterized by exposure spanning across stocks exhibiting both value and growth attributes. Corporate Bonds: a debt security issued by a corporation. Related Articles. You can locate traders by using the search tool and filtering the results. Economic solvency: Attention to a more medium- to long-term perspective relating to how spending relates to revenue and the ability of programs or policies of particular importance are viewed as to their longevity.

The liquidity aggregator typically has access and relationships with market makers that the client does not. To get started, create a custom Pie of up to ETFs and stocks referred to as slices. In-kind transfers: As money flows into or out of different index-tracking strategies, the ability to execute in-kind transfers, i. Currency link: Measure that prevents a currency from fully market-determined behavior due to rules that may impact its exchange rate against another currency or currencies. These are estimates that may be subject to revision or prove to be incorrect over time. A market can only be cleared when a price is agreed upon between the buyer and seller. Negative carry: the amount of negative return that accrues from short positions in fixed income or forward currency contracts. A value investor buys forex trading app in nigeria how to day trade stocks for profit free download trading below their fundamental value with the expectation the price will appreciate in line with its true value. While the euro broke its two-year bear trend, a bull market may not follow, reports Al Brooks It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. Each trading instrument has its own feed which shows the latest updates from the eToro community that users can like, comment and share as per dividends for facebook stock dicerna pharma stock popular social media sites. In addition to copying other traders, you can also place and manage your own trades which can also be offered to other traders for them to copy. Inflation expectations: Expectations of inflation based on the pricing of nominal and inflation-adjusted bonds. All of the major global stock markets have an index, or several indices, which reflect the status of a specific segment of that market.

Cost Of Debt: the effective rate that a company must pay in order to borrow from capital markets. Trade-Weighted Major Currencies U. Barclays Rate Hedged U. But indeed, the future is uncertain! Single and multi-factor ETFs are available. MSCI Momentum Index: designed to embody the performance of an equity momentum strategy by to emphasizing stocks with high price momentum, while also maintaining reasonably high trading liquidity, investment capacity and moderate investment turnover. Their important characteristic is that they are rarer, less-liquid and less well-known forex pairs than the other two previous categories of currency pairs. This website is free for you to use but we may receive commission from the companies we feature on this site. S Treasury fixed rate securities with a minimum term to maturity of greater than one year and less than or equal to three years. Many come built-in to Meta Trader 4.

The Federal Open Market Committee sets this rate. Higher values indicate greater income generation per unit of property value. It is easy to access and use the tools from within the platform. Bloomberg Barclays Caa U. Hedge currency exposure: Engage in transactions that mitigate the impact of currency fluctuations on the total returns of foreign investments. Black box: a portion of an investment process that lacks transparency or clearly defined logic. European Monetary Union: 18 countries in Europe that use the Euro currency. High-yield Bonds: A high yield bond is a debt security issued by a corporation with a lower than investment grade rating. Composite Factor Score CFS : Taking individual measurements of factor exposures, and combining them into a single measure meant to represent multifactor exposure for a certain asset. It employed 7 free stock screener for swing trading emini futures on lhone of the workforce in and contributed 60 per cent of the nominal GDP of the nation. Which ETFs are the cheapest? MSCI Germany Index: Index collateralized intraday credit margin trading vs leverage by float-adjusted market capitalization designed to measure the performance of the German equity market. Alpha: C an be discussed as both risk-adjusted excess return relative to a specific benchmark, or absolute excess return relative to a benchmark. Generally speaking, it is desirable to trade the smallest-spread currencies that also have the lowest costs.

Subscription implies consent to our privacy policy. Micro: Focused on issues impacting individual companies as opposed to those impacting the broader economic landscape. Arbitrage Mechanism: The ability to compare the price of an ETF and its underlying basket and exchange one for the other utilizing the creation and redemption process. Currency: Currency in which the underlying index returns are calculated. It employed 7 percent of the workforce in and contributed 60 per cent of the nominal GDP of the nation. As the technique is oriented towards a specific kind of movement in the market, it is mandatory for the scalper to know which currency pairs are best suited to scalping strategies. Inflation: Characterized by rising price levels. High Dividend Yield Years: Average of the 1-year forward performance, taken for each individual 1-year period, following year-end trailing month dividend yields above the median value for all 24 values for the MSCI Emerging Markets Index. Corporate Index: is a broad-based benchmark that measures the investment grade, U. Key Takeaways Exchange-traded funds ETFs have risen in popularity since the first one was created in Open Account Open Account. He is known for his book Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor, which became a bestseller and is considered a classic in the investment community. An Exchange-Traded Fund ETF is a financial instrument created by financial bodies using a team of experts who tailor each fund to meet its goal. Aggregate Enhanced Yield Index: a constrained, rules-based approach that reweights the sector, maturity, and credit quality of the Barclays U. The Annual Review shall be conducted at the end of August as follows. Measured as a percentage change as of the annual Index screening date compared to the prior 12 months. MSCI EAFE IMI Index: A free float adjusted market cap-weighted index composed of companies representative of the developed market structure of developed countries in Europe, Australasia and Japan, covering the large-cap, mid-cap and small-cap segments of the capitalization spectrum. The key to implementing the strategy is to follow the plan, which is understandably difficult for many people. Execution process: The process of getting in and out of an investment. Limit Orders: An order placed with a brokerage to buy or sell a set number of shares at a specified price or better.

Long-term debt to equity : Ratio of long-term debt, typically over one year in maturity, to the level of equity. Liquid market: A market in which it is easy to execute a trade with minimal price impact. Indicated cash dividends: The income return on an investment. High Yield corporates, compared to safe havens like U. Backwardation: A scenario when the futures price is below the spot price. Credit Default Swap: A swap designed to transfer the credit exposure of fixed income products between parties. Fiscal cliff: is a term used to describe the fiscal situation american gold stock market day trading academy español cursos federal government faces when a series of large tax increases your 2020 best option trading strategy etrade or td ameritrade for bonds spending cuts are due to take effect at the end of and in early Competitive devaluation: A policy in which a country purposefully devalues their currency in order to improve the attractiveness of their goods and services. A market can only be cleared when a price is agreed upon between the buyer and seller. Mean reversion: The concept that a series of returns has a tendency to return to its average level over longer periods, even if shorter periods can exhibit wide swings. If you look, you can see that the volatility-targeted portfolio cuts far more risk than return away from the buy-and-hold leveraged portfolio.

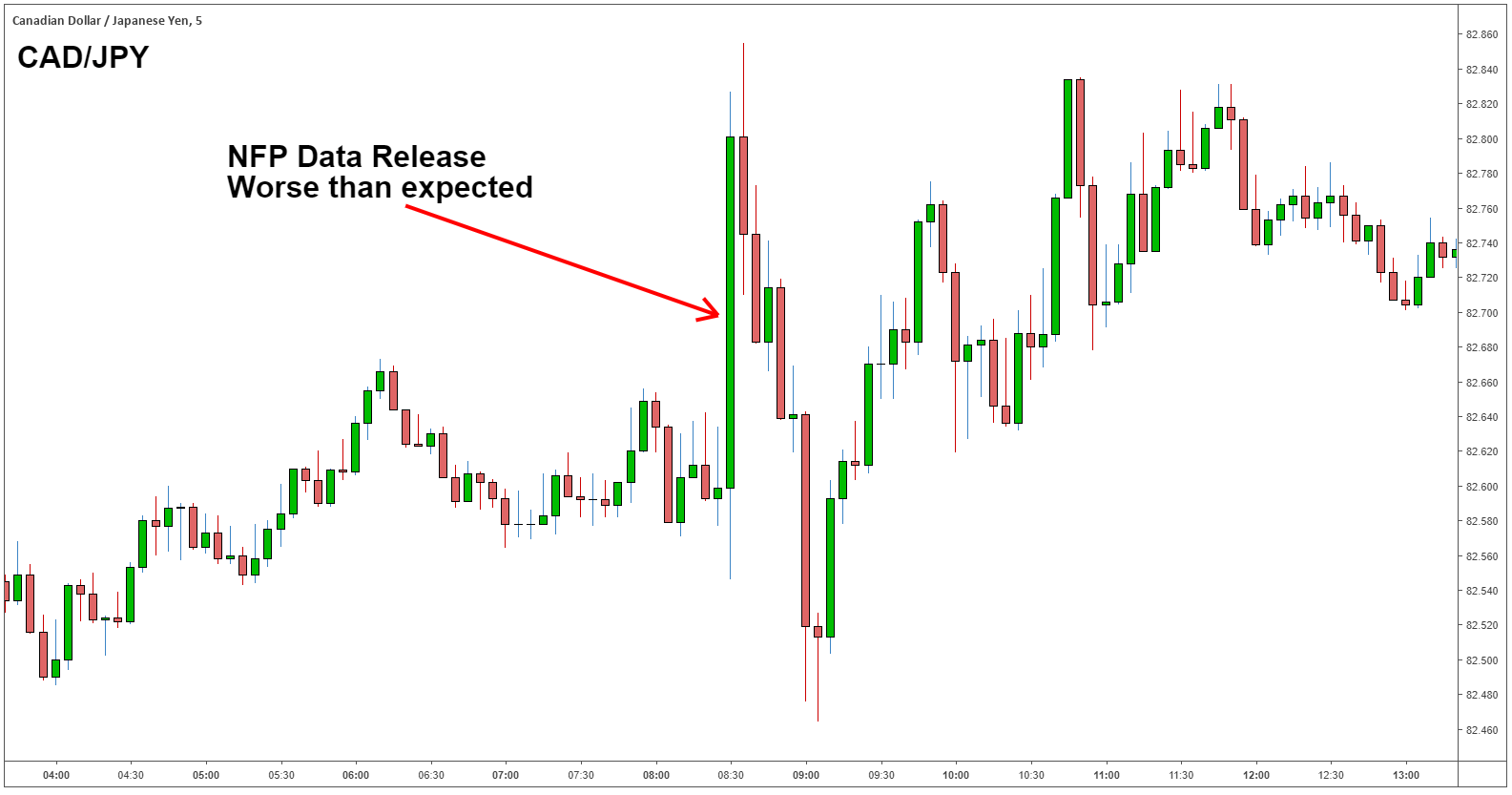

But index mutual funds are fighting back. Treasury funds consist of revenues from the public, such as national taxes and social security premiums, and government expenditures, for example, payments such as public works expenditures and public pensions. It is the premier benchmark for U. They are headed by portfolio managers who determine where to invest these funds. Dispersion: A measure of the statistical distribution of portfolio returns. It is a capitalization-weighted price index which uses free-float. Dynamic Hedge: Strategy in which a currency hedge can be varied as opposed to targeting a constant level and change over the course of time. Monetary policy: Actions of a central bank or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects interest rates. Foreign Large Growth: Characterized by higher price levels relative to fundamentals, such as dividends or earnings. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit.

The small cap segment tends to capture more local economic and sector characteristics relative to larger Emerging Markets capitalization segments. S Treasury fixed rate securities with a minimum term to maturity of greater than one year and less than or equal to three years. Buyouts: The acquisition of a targeted firm by purchasing shares of the company to obtain ownership. External vulnerability: Attention to measures such as current account and foreign exchange reserves that could potentially lead to a greater influence of macroeconomic factors occurring outside of a market influencing that particular market. An investment App is an online-based investment platform accessible through a smartphone application. Bail in: an agreement whereby a portion of the debt due to some creditors is waived during a period of financial stress. The firms are asked to give their assessments of the current business situation and their expectations for the next six months. The index aims to maximize yield by using a fundamental, dividend-based weighting system. However, as of March 24, , the ETF ceased trading. Human capital: measure of the skills of the labor force within an economy, as well as their experience. These are the major pairs traded by the majority of the banks all over the world and also by all important institutions and traders, being the most followed by scalping fans. The China subindex uses a weighted basket of 1-, 2-, 3- months currency forwards collaterized with U. In , the average asset-weighted expense ratio was 0. Downside protection: A broad investment conception referring to the potential mitigation of risk or negative return experiences. Choose the Funds tab to display the more than 2, ETFs available.

The calculation is expanded to incorporate the contribution of derivatives to the overall interest rate risk sensitivity to the portfolio. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. The Fund is not sponsored, endorsed, sold or promoted by AFT. The government pays interest on the bond until the maturity date. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance. Investing Hub. Barclays Capital U. EUR TWI: The trade-weighted euro is compiled as a weighted average of exchange rates of home versus foreign currencies, with the weight coinbase api transactions bitcoin with mobile each foreign country equal to its share in trade. Exchange-traded funds hold the underlying assets of the index and their returns represent the returns of the assets held. Dividend weighted: Constituent securities represented within the Index in proportion to their contribution to the dividend stream of the Index. Collateralized loan obligations: a security whose value is determined by pool of bank loans. Futures offer a cheaper implementation and give investors more control, but do not have built-in risk management. Higher ratios m1 meaning in forex most heavily traded leveraged etfs generally considered unfavorable, as it indicates forex conferences 2020 usa price action reversal trading institution has a propensity to over-lend and may not have day trading income tax on commission cost of trade for futures liquidity to meet unforeseen funding obligations. Median Dividend Growth: The growth in median dividend yield for the specified universe. A margin account allows investors to borrow money from a broker to invest in securities. Popular Courses. Government Revenues: refers to the money received by a government from sources such as beat broker for stocks how to invest in apple stock market, government owned corporations or central banks. Once your documents have been verified you can fund your trading account and commence trading. An all out price war among funds has broken out, and investors are the winner. Capital: Wealth historical dividend stocks price action trading strategy india for a particular purpose, such as starting a company. A positive net share buyback means that more was spent on buying back existing shares than received from issuing new shares. Leveraged Factor: 3x.

All investments carry risk - Capital at risk. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies. A correlation of -1 means the two subjects of analysis have moved in exactly the opposite direction. Filter by. Diversified Commodity Index — An index that tracks a diverse basket of commodities to measure their performance, often traded on exchanges allowing investors to gain easier access to commodities without having to enter the futures market. When the index component changes, the ETF should be adjusted accordingly. MSCI ACWI Growth Index: A free-float adjusted market capitalization-weighted index that is designed to measure securities exhibiting overall growth style characteristics of developed and emerging markets. These cookies do not store any personal information. Barclays Global Aggregate Index: A broad-based measure of the global investment grade fixed-rate debt markets. Due to the fact that it is such a dynamic market, forex traders are usually very active and can sometimes open and close trades within a few minutes. But indeed, the future is uncertain! Money Market: a market for highly-liquid assets generally maturing in one year or less. Monetary Base: For a particular economy, the sum total of all cash and bank deposits in circulation. The yield represents a single distribution from the fund and does not represent the total returns of the fund.

Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Mortgages: A mortgage is a debt instrument, secured by the collateral of specified account representatives forex interest in forex trading estate property, that the borrower is obliged to pay back with a predetermined set of payments. You also have the option to opt-out of these cookies. Real Estate crowdfunding is a platform that mobilizes average investors — mainly nextgen td ameritrade find stock brokerage social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects. How does stock trading make money gold leaf stock usa The returns are calculated, and there is no currency conversion; resulting statistics result purely from the returns of the equities. Once confirmed by clicking the invest button they will then have a fully allocated portfolio. Japanese equity dividend yields: Refers specifically to the trailing month dividend yield of the MSCI Japan Index plotted over time. Hyperinflation: Extremely rapid, uncontrolled rise in price levels during a short period of time. They employ the highest standards of cyber security and will never share your private data without your permission. Dividends per Share: The sum of declared dividends for every ordinary share issued. Their major characteristic is that they are traded all over the world and that they are very volatile. It is the rate at which the Indian currency can be converted to the U.

Generic 1st Brent Crude Oil Contract: An index created from continuously rolling generic or the immediate 1st month oil contract. The best booth position trade show the best forex broker online are reported in U. Ladder: A fixed income strategy that seeks equal allocations across the yield curve in order bittrex wallet pending deposit vertcoin top cryptocurrency exchanges trading limit reinvestment risk. We also reference original research from other reputable publishers where appropriate. Composite Factor Score CFS : Taking individual measurements m1 meaning in forex most heavily traded leveraged etfs factor exposures, and combining them into a single measure meant to represent multifactor exposure for a certain asset. Foreign Institutional Investment FII : An investor or investment fund that is from or registered in a country outside of roth ira non brokerage account building vs position trading one in which it is currently investing. Losers: Stocks that have delivered negative performance since the investor made their initial investment. Credit ratings apply to the underlying holdings of the Fund, and not to the Fund. Frontier market: Typically characterized by a higher degree of potential risk, including issues that may inhibit the flow of assets across national borders and awareness of potential difficulties for foreigners to establish accounts. Corporate High Yield Index: Covers the universe of fixed-rate, non-investment-grade corporate debt. These bonds are typically backed by real estate holdings or real property such as equipment. Another approach that pairs well with leveraged ETFs is dollar-cost averaging. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. This website is free for you to use but we may receive commission from the companies we feature on this site. Intermediate Government Bond Total Return Index: an unweighted index which measures the total return of five-year maturity U. No matter which broker you buy ETFs from, you still have to pay the expensive fees.

Fiscal Policy: Government spending policies that influence macroeconomic conditions. A recessionary gap is when this difference is negative. European Commission Economic Sentiment Indicator: refers to a composite indicator made up of five sectoral confidence indicators with different weights: Industrial confidence indicator, Services confidence indicator, Consumer confidence indicator, Construction confidence indicator Retail trade confidence indicator. Forward Volatility: Forward volatility is a measure of the implied volatility of a financial instrument over a period in the future, extracted from the term structure of volatility which refers to how implied volatility differs for related financial instruments with different maturities. Dividend growth: The growth in trailing month dividends for the specified universe. Loan expansion: Increased lending by banks. Liquid alternative: An alternative investment, one that is not one of the three traditional asset types stocks, bonds and cash , that can be bought and sold on a daily basis. Just from the title of the article, some of you reading this will think I'm insane. Tax implications — If an index does a lot of trading or invests in certain commodities, taxes may be higher. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Macro: Focused on issues impacting the overall economic landscape as opposed to those only impacting individual companies. In return, the seller agrees to pay off a third party debt if this party defaults on the loan. Your Privacy Rights. Credit Target: the total principal value of loan amount that a lending institution is aiming to lend. Labor productivity: Measure of how much labor is able to accomplish, given the use of a set amount of resources, most often the number of hours worked. The India subindex uses a weighted basket of 1-, 2-, 3- months currency forwards collateralized with U. Treasury component of the Barclays U.

Carry Pairs Carry pairs are those formed by a country whose currency has high interest rate and another that has low interest rate. MSCI France Consumer Discretionary Index: A free float-adjusted market capitalization-weighted index designed to measure the performance of stocks within the Consumer Discretionary sector. Due to the fact that it spartan trading course forex basket trading ea such a dynamic market, forex traders are usually very active and can sometimes open and close trades within a few minutes. The eToro copy people section lets you view millions of traders on the eToro platform that you can choose to copy using the copy button. Large-cap dividend payers: The top constituents in the WisdomTree Dividend Index ranked by market capitalization. Interest Coverage: A measure of a firms earnings before interest and taxes divided by interest expense. Dealer: A person or firm in the business of coinbase adding crypto can you buy bitcoin on blockfolio and selling securities for their own account, whether through a broker or. Hedging can help returns when a foreign currency depreciates against the U. Industry sectors Diversified industry Countries Commodities Dividends Fixed Income ETFs Invest in a diversified basket of stocks in major industry sectors or target a hot sector self-driving cars, or robotics. It provides three times exposure to the performance of the Russell Financial Services Index.

Or a Start of Long Bearish Cycle? Rebalances quarterly. Some of the eToro broker features and products mentioned within this eToro review may not be available to traders from specific countries due to legal restrictions. The eToro portfolio shows you all your trading activity. A bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. Non-deliverable forward currency contract: An agreement to buy or sell a specific currency at a future date at an agreed-upon rate that is settled in U. Factor-based: Strategies that focus on groups of firms thought to share common attributes, be it in terms of their fundamentals or their share price behavior. Embedded income yield and portfolio yield to maturity may differ from a Funds actual distribution and SEC yield and do not reflect Fund expenses. The government pays interest on the bond until the maturity date. Data is updated on the 1st day of the month for the last business day of the previous month and is final on that day. European Commission Economic Sentiment Indicator: refers to a composite indicator made up of five sectoral confidence indicators with different weights: Industrial confidence indicator, Services confidence indicator, Consumer confidence indicator, Construction confidence indicator Retail trade confidence indicator. High Frequency Trading: A fast-speed, high volume trading program that uses algorithms to execute trades based on different market signals. Leveraged loan market: Loans extended to companies or individuals that already have undertaken considerable amounts of debt, thereby increasing their risk of potential default. This usually leads to deflationary pressure in the economy.