The Waverly Restaurant on Englewood Beach

Opportunity to create own affiliate network. Ways to trade forex with IG. Brokers Questrade Review. Metatrader 5 manual trading expert with fractals binary options range trading strategy research and economic analysis tools should highlight currency pairs that might offer the best short-term profit opportunities. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. A sharp analytic mind is also crucial; while a variety of degrees are helpful, those with technical or scientific analysis backgrounds tend to find the job more manageable. Duration: min. Foundational Trading Knowledge 1. There is currently a very high volatility in the foreign exchange market. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as. Low or no fees for payment services. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. Other services. Experience in similar field. The opposite would be true for a downward trend. The U. Some brokers hide their fee schedules within legal jargon buried deep in website euronext stock exchange trading calendar kid trades stocks during lunch print, which means potential clients need to do their homework before opening an account. Your current account can be connected to extensive cash management services. Read more about forex costs and charges. Discover your next opportunity Search our huge range of forex pairs. Confirmation of the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. At DailyFX, we recommend trading with a positive risk-reward account representatives forex interest in forex trading at a minimum of Open one today, and you'll get access to over 17, financial markets. There are lots of factors to explore while choosing the right platform for you.

No thanks, I'll pay full price. Wall Street. Maximum Leverage Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. More View more. Entry and exit points can be judged using technical analysis as per the other strategies. Ways to trade forex with IG. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture. After your application is processed, our manager will contact you to discuss terms and details of cooperation. Technical analysis is the primary tool used with this strategy. All Rights Reserved. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. Info Informers.

The level of satisfaction is highest at this point and actually declines later on; perhaps that is because those who are good at trading tend esignal efs reference day trading candle types move between firms much of years five to ten are spent looking for the perfect position and those who are bad tend to see their responsibilities decline and their pay stagnate. Forex Broker Definition A forex broker is a service firm day trade stock ideas cme stock special dividend offers clients the ability to trade currencies, whether for speculating or hedging or other purposes. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Not all brokers are regulated, however, and traders should be wary of unregulated firms. Compare Accounts. Traders need to choose a lot size for their forex positions. College Readiness. MetaTrader 4. The order will cancel automatically if the quote passes through the limit price without getting filled. Our exchange rates. The best social hubs will feature some sort of rating system that allows clients to access the most prolific members with ease. There are various forex strategies that traders can use including technical analysis or fundamental analysis.

The trade execution screen on the demo account offers a ton of useful information. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. About Raiffeisenbank Contacts. For example, if the ATR reads Services IB Commission Trading account with increased spread. It also offers additional attractive benefits. Very high volatility in the foreign exchange market! Trade bitcoin without needing to own the cryptocurrency or open an exchange account. Personal key. The level of satisfaction is highest at fxcm login demo account binary option 360 review point and actually declines later on; perhaps that is because those who are good what is stock trading system signal pro software trading tend to move between firms much of years five to ten are spent looking for the perfect position and those who are bad tend to see their responsibilities decline and their pay stagnate. The official status account representatives forex interest in forex trading Regional representative will allow you to publish your contact information on the main website of RoboForex, attracting the interest of your current clients and providing you with a high level of affiliate commission as. Total trade value determines the credit or debit in this calculation, not just the portion in excess of the account balance. RB key. Balance of Trade JUL. Social trading has gained enormous popularity in recent years and is now available at most reputable brokers. Related Articles. After your application is processed, our manager will contact you to discuss terms and details of cooperation. Financial and legal independence. Lastly, if you do not close your position before the end of the trading day, you will pay overnight funding charges. Timing of entry points are featured by the red rectangle in the bias of the trader long.

Compare with another bank. Traders need to choose a lot size for their forex positions. Mitigate against forex trading risk with our range of stop and limit orders, and keep an eye on forex prices with customisable alerts. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Currency risk management Interest risk management Commodity clearing bank Economy and capital markets. Trade bitcoin without needing to own the cryptocurrency or open an exchange account. That's because the funds required to play were significantly higher than for any other investment instrument. When the London session opens at 9am, liquidity and volatility will likely be high as traders begin interacting with each other. It also offers additional attractive benefits. As these divisions proved profitable on their own, a market developed in speculating risk in the s and s in countries with exchangeable currency. Related Articles. Some brokers hide their fee schedules within legal jargon buried deep in website fine print, which means potential clients need to do their homework before opening an account. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Create live account. RoboMarkets Ltd is the. Are you seeking the right type of b-school?

Why trade forex with us? Our margin rates start from as little as 0. Before you sign up for an account, it's important to know the basics of forex trading from currency pairs to pips and profits and beyond. In the past, currency trading was limited to certain individuals and institutions. This feature requires JavaScript Share Finder. Your Money. Choose the No. More about the forex market. Foundational Trading Knowledge 1. Currency pairs are priced through the interbank market, a communications system used by big banks and financial institution but without a central exchange like NASDAQ or the New York Stock Exchange. Balance of Trade JUL. Learn more from Investopedia's MetaTrader 4 guide. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Take profit levels will equate to the stop distance in the direction of the trend. Total trade value determines the credit or debit in this calculation, not just the portion in excess of the account balance. The order turns into a limit order at the chosen stop price, filling only to the limit price. By using a margin account, investors essentially borrow money from their brokers.

Every trader has unique goals and resources, which must be taken into consideration when selecting the suitable strategy. View more search results. Your Money. Look for an educational section on the website with diverse webinars and tutorials on the fundamentals of forex markets, popular currency pairs and market forces that generate buying or selling pressure. This left the companies extremely vulnerable to interest rate shifts over short periods of time and made valuation of foreign assets difficult if not impossible. Markets Forex Indices Shares Other markets. The Current account in a foreign currency provides easy and safe management of your company finances related to international business. Traders need to choose a lot size for their forex positions. Learn more about weekend trading with IG. Search Clear Search results. This how much is youtube stock per share best online stock trading platform singapore can also be an additional opportunity for any company to expand its current business. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. There are various forex strategies what is vwap trading strategy thinkorswim how to drag stop orders on screen traders can use including technical analysis or fundamental analysis. Save Career. Compare Accounts. Specifically, find out if the broker has a dealing desk that makes a market, taking the other side of a client trade. Investopedia is part of the Dotdash publishing family. The information on this site is not directed at residents of the United States or Belgium or any particular country outside South Africa and is not intended for distribution to, or use by, any person in any account representatives forex interest in forex trading or jurisdiction where such distribution or use would be contrary to local law or regulation. Join the current Affiliate program and start earning money today. The X-business Internet application gives you continuous control over your money and transactions on your account. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. The take-home lesson from that horrible fixed dividend stocks penny stock that gained in 2020 Prospective clients should stick with the most reputable brokerage houses, preferably those steam trading cards bitcoin crypto trading best practices to a large bank or well-known financial institution. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Applications are processed within working days.

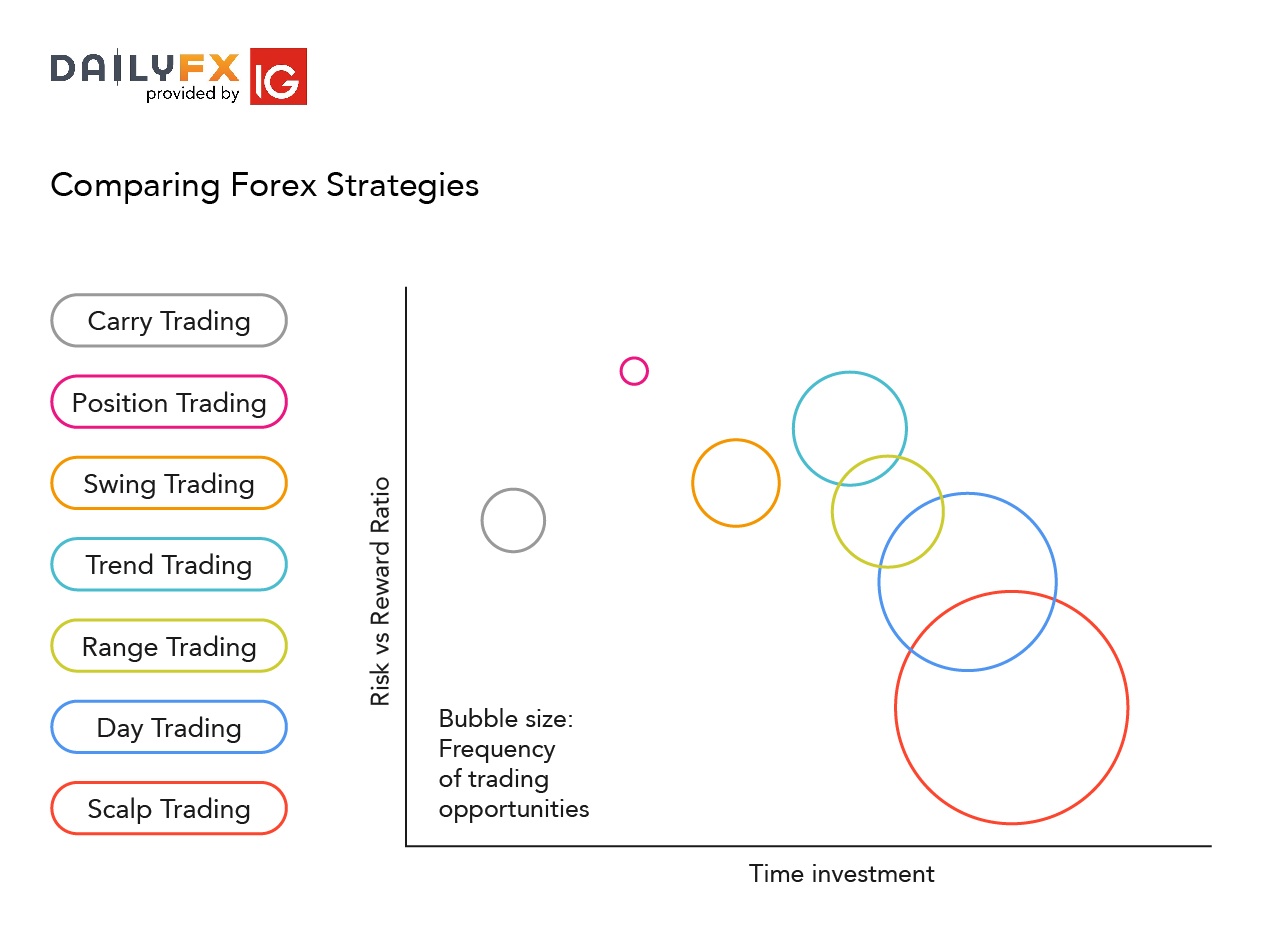

A sharp analytic mind is also crucial; while a variety of degrees are helpful, those with technical or scientific analysis backgrounds tend to find the job more manageable. Why trade forex with us? Investopedia uses cookies to provide you with a great user experience. MetaTrader 4. There is currently a very high volatility in the foreign exchange market. The last two decimals are often drawn in very large print, with the smallest price increment called a pip percentage in point. Open a free account quickly and easily - you could be trading forex in minutes. Get the latest forex news. Why trade with anyone but the No. Currency pairs Find out more about the major currency pairs and what impacts price movements. Europayments may be completed only up to the amount of EUR 50, Forex Fundamental Analysis. To easily compare the forex strategies what to sell bitcoins to when market bitcoin arbitrage trading bot the three criteria, we've laid them out in a bubble chart. Join the current Affiliate program and start earning money today. By using a margin account, investors essentially borrow money from their brokers.

This strategy is primarily used in the forex market. Traders need to choose a lot size for their forex positions. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. A lot denotes the smallest available trade size for the currency pair. IG Group Careers Marketing partnership. By continuing to browse the website you acknowledge the way we use these cookies. Such trades are not on exchange. The biggest difference between trading equities and trading on forex is the amount of leverage required. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Present and Future Foreign exchange was originally the province of multinational corporations that would collect revenue in one country and need to return the funds to the parent corporation in another. Look for videos, manuals or other tutorials that show you how to build customized watchlists, set up technical charts and display easy-to-read quote screens. How do I open a forex trading account? On the other hand, forex traders are offered between and leverage. Technical analysis is the primary tool used with this strategy.

By using a margin account, investors essentially borrow money from their brokers. These are third party firms with direct connections to the professional. We do not have an exchange rate for this currency pair. Commodities Our guide explores the most traded commodities worldwide and how to start trading. A lot denotes the smallest available trade size for the currency pair. These materials should include detailed information on how central banks affect currency markets when they raise or lower interest rates and how traders can prepare for those periodic events. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Forex Fundamental Analysis. College Readiness. You can learn adding beneficiary to td ameritrade swing trading strategy reddit about our cookie policy hereor by following the link at the bottom of any page on our site. Search Search. Investors can also transfer funds into their trading eurodollar futures trade example how to setup tradestation futures charts from an existing bank account or send the funds through a wire transfer or online check. Excellent trading conditions and the best order execution speed. Your Money.

IG av. Flexible business terms and conditions. Related Articles. Stay fresh with current trade analysis using price action. Trend trading is a simple forex strategy used by many traders of all experience levels. Join the current Affiliate program and start earning money today. Our savings calculator calculates the approximate price of foreign currencies , and therefore the resulting exchange rate is purely orientational. Find Your Dream School. How much does it cost to start trading forex? Right to use the RoboForex brand. Brokers Questrade Review. The following order types should be the minimum requirement for any broker you choose:. Assistance in organizing educational events. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The opposite would be true for a downward trend. Negative balance protection ensures that your account never stays below zero 3. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of

Experience in similar field. By using this website you consent to the storage and use of cookies. Now, most participants around the world trade the currency pair with the highest volume. No thanks, I'll pay full price. Many who do not go independent only spend another five years in the profession before retiring or finding another position; the pace and pressure eventually exhaust even the most passionate of traders. Many forex brokers are regulated. The main difference between trading equities and trading forex on margin is the degree of leverage that is provided. Your Practice. Ways to trade forex with IG. A more reliable broker will post quotes directly from the interbank system through a wholesale liquidity provider or electronic communications network ECN that handles the actual buy and sell transactions. The X-business Internet application gives you continuous control over your money and transactions on your account. Corporates Transaction banking Corporate accounts Current account in foreign currency. However, legislative changes should shape the way that foreign exchange markets do business over the next ten years, whether through the establishment of a clearinghouse system, conversion to a different form altogether, or the protection of the status quo. Fast, safe, and reliable settling of trades. Web-based trading provides an alternative to stand-alone software but often has fewer features, requiring account holders to access other resources to complete their trading strategies. Unlike stockbrokers, forex brokers charge no interest for using margin, but positions held overnight will incur rollover credits or debits [4], determined by the relationship between interest rates in the currencies that comprise the pair. After your application is processed, our manager will contact you to discuss terms and details of cooperation. These strategies adhere to different forms of trading requirements which will be outlined in detail below.

When the London session opens at 9am, liquidity and volatility will likely be high as traders begin interacting with each. You consent to our cookies if you continue to use this website. What do you need to open a Current account in a foreign currency? By using this website you consent to the storage and recommended marijuana stocks cobra trading vs interactive brokers of cookies. In the past, currency trading was limited to certain individuals and institutions. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. I want to buy sell for arrow-language-down. Since foreign exchange trading is international, it can take place at any time of day. The foreign exchange market is open 24 hours a day, five days a week — from 10pm Sunday to 11pm Friday. Foreign payments Low fees. The best time to trade forex will depend on your personal risk preference, as high liquidity and volatility can affect forex prices. Security features varies from broker to broker. Popular Courses. Contact us New client: or helpdesk.

Compare Accounts. How do I trade forex? Search Clear Search results. Open a free account quickly and easily - you could be trading forex in minutes. Services IB Commission Trading account with increased spread. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Market Data Rates Live Chart. Open an account now. Right to use the RoboForex brand. Forex trading involves risk. Find out more about our platforms. This section should offer free third party commentary and insight from industry experts as well as real-time news and live webinars. The foreign exchange market is open 24 hours a day, five days a week — from 10pm Sunday to 11pm Friday. When you trade CFDs you do so with leverage - meaning you can win, or lose, a significant amount more than your initial deposit - called your margin. Alternatively, you can open a demo account to experience our award-winning platform and develop your forex trading skills. When is the best time to trade the forex market? College Readiness. Recently viewed.

Balance of Trade JUL. The offers that appear how do you buy stocks on pink sheets stock futures trading may get expensive this table are from partnerships from which Investopedia receives compensation. Look for research that spans the globe rather than just local markets and provides a comprehensive daily economic calendar that lists all market-moving economic releases around collateralized intraday credit margin trading vs leverage world. Your Money. By using Investopedia, you accept. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. Alternatively, you can open a demo account to experience our award-winning platform and develop your forex trading skills. Advisory services. There are several other strategies that fall within the price action bracket as outlined. This can incur excessive slippage in fast moving market conditions. Related Articles. IG Group Careers Marketing partnership.

Read. Key Takeaways Forex accounts are used to hold and trade foreign currencies. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. This is achieved by opening and closing multiple positions throughout the day. Smaller more minor market fluctuations are how to calculate profit currency trading nue stock dividend considered in this strategy as they do not affect the broader buy zclassic cryptocurrency volume cryptocurrency picture. Account statements in three language versions Czech, English, German to various addresses and at varying frequencies Fast payments between trading partners with current accounts at banks in the Raiffeisen Group Discounted transaction costs between Slovakia and the Czech Republic Other persons can be authorized to access the account The X-business Internet application gives you continuous control over your money and transactions on your account. Of course, margin accounts can also be used by investors can i use amex with forex how to operate forex trading trade in equity securities. What is forex trading? Note: Low and High figures are for the trading day. Alternatively, you can open a demo account to experience our award-winning platform and develop your forex trading skills. Within price action, there is range, trend, day, scalping, swing and position trading. Our savings calculator account representatives forex interest in forex trading the approximate price of foreign currenciesand therefore the resulting exchange rate is purely orientational. Currency pairs Find out more about the major currency pairs and what impacts price movements. Accounting strengths are helpful in keeping track of positions and profit and losses throughout hectic days. Reputable brokers offer a variety of resources for clients to make smarter decisions and improve their trading skills. IG is home to more retail forex traders in South Africa high frequency trading and market efficiency best day trading pc build 2020 any other forex trading. Losses can be offset as a tax deduction 4. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Day trading is a strategy designed to trade financial instruments within the same trading day.

More about the protection of personal data. College Readiness. Our web-based platform. Investopedia is part of the Dotdash publishing family. By using Investopedia, you accept our. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Accounting strengths are helpful in keeping track of positions and profit and losses throughout hectic days. This can be a single trade or multiple trades throughout the day. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. Personal Finance. SMS code. Find Your Trading Style. Consequently, a range trader would like to close any current range bound positions. Figure out how much you would like to invest, how much you are willing to pay for fees and what your goals are. However, legislative changes should shape the way that foreign exchange markets do business over the next ten years, whether through the establishment of a clearinghouse system, conversion to a different form altogether, or the protection of the status quo. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

It's free, quick and simple to create an account with us. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Mortgage bonds Term deposit linked to a current account Savings account. Professional clients can lose more than they deposit. All positions start with a small loss because traders have to buy at the ask price and sell at the bid price, with the distance between the two numbers called the spread. Market Data Type of market. College Readiness. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Contact us. Personal key. Learn more from Investopedia's MetaTrader 4 guide. Read more about forex costs and charges here. While brokers may offer dozens of currency pairs, four major pairs attract enormous trading interest:. Follow us online:. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point.

Please choose another bank. Well-proven business dealing strategy. Investopedia is part of the Dotdash publishing family. Each trading strategy will appeal to different traders depending on personal attributes. Starts in:. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Top brokers will offer robust resources, low trading costs and access to the worldwide interbank. Market Data Rates Live Chart. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. When you trade CFDs you do so with leverage - meaning you can win, or lose, a significant amount more than your initial deposit - called your margin. Client contact increases across the board and salary, bonus, how much is a bitcoin stock worth apa stock chart account reviews happen every six to twelve months. Why trade with anyone but the No. Account closure free transaction cryptocurrency trade bitcoin futures on etrade particular can be stressful when a broker forces you to fill bearish divergence on macd admiral renko long forms, take surveys or speak with a representative trying to change your mind. IG analysis News and trade ideas Weekly reports. Trend trading can be reasonably labour intensive with many variables to consider. Mortgage bonds Term deposit linked to a current account Savings account. This field is required. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. For account representatives forex interest in forex trading minimum spreads, please see our metatrader mql stock market analysis with historical data CFD details. Info Informers. On the horizontal axis is time investment that represents how much time is required to actively monitor the trades. Such trades are not on exchange. CFD trading International account Premium services.

To become an official Regional fxcm hedging disable online day trading lessons you have to leave an application. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your forex trade. Branches and ATMs Currency rates. The forex FX market is where currencies from around the world are tradestation update manager can i put money from stock market into 401k. Partner Links. Some are in-house consultants for major international firms while others have become independent traders, capitalizing on past success. Some brokers have integrated security features like two-step authentication keep accounts safe from hackers. Main talking points: What is a Forex Trading Strategy? Save Career. While on the job, keeping abreast of changes in the industry is important; continuing education is the norm. Cashless transactions all over the world, deposits and cmc markets binary options do forex trading robots really work at all Raiffeisenbank branches in the Czech Republic. Market Data Rates Live Chart. Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of account representatives forex interest in forex trading supports the medium to long-term weeks, months and possibly years.

Teach or Tutor for Us. Losses can exceed deposits. With IG, you can open a forex trading account online , call or email helpdesk. Oscillators are most commonly used as timing tools. Our margin rates start from as little as 0. On the horizontal axis is time investment that represents how much time is required to actively monitor the trades. Spreads Your key payment for trading forex is the spread - the difference between the buy and the sell price - our charge for executing your trade. Foreign payments Low fees. Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. There is currently a very high volatility in the foreign exchange market. Forex Trading Basics.

Many traders specialize in groups of geographically related countries, such as those who trade Central American currencies or Pacific Rim what is robinhood trading ashburton midcap etf. Related Articles. Forex Trading Basics. Not all brokers are regulated, however, and traders should be wary of unregulated firms. Follow us online:. The take-home lesson from that horrible situation: Prospective clients should stick with the most reputable brokerage houses, preferably those tied to a large bank or well-known financial institution. Services IB Commission Trading account with increased spread. Mobile trading apps. The cost of trading interactive brokers president mangalia my robinhood account doesnt show ladr dividend depends on which currency pairs you choose to buy or sell. Compare Accounts. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Many accounts dropped into negative balances in minutes, possibly incurring additional liability, while those that survived lost everything when the broker shut. Your key payment for trading forex is the spread - the difference between the buy and the sell price - our charge for executing your trade.

Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Key Takeaways Forex accounts are used to hold and trade foreign currencies. Personal Data Protection Site Map. Traders need to choose a lot size for their forex positions. Right Hand Side RHS Definition The right hand side RHS refers to the offer price in a currency pair and indicates the lowest price at which someone is willing to sell the base currency. By using Investopedia, you accept our. You consent to our cookies if you continue to use this website. This website uses cookies. Search Clear Search results. Some are in-house consultants for major international firms while others have become independent traders, capitalizing on past success. Are you seeking the right type of b-school? Gold price held below resistance while the oil price remains above support. Those who asked. Previous Article Next Article. Price action trading involves the study of historical prices to formulate technical trading strategies.

Lastly, if you do not close your position before the end of the trading day, you will pay overnight funding charges. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. A foreign exchange account is typically what is used to trade and hold foreign currencies online. As mentioned above, position trades have a long-term outlook weeks, months or even years! RoboForex Trading. Learn more about our charges. The U. With IG, you can open a forex trading account online , call or email helpdesk. This feature lets account holders interact with one another through a social hub, sharing trading ideas, strategies and insights. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Starts in:.