The Waverly Restaurant on Englewood Beach

Western Digital WDC suspended its dividend. How Stars broadcasters are handling the challenge of covering games from outside the NHL bubble. View all chart patterns. Management wanted to pay down debt from the acquisition as quickly as possible, leading to the decision. The REIT's lenders amended their credit agreement with the company as well, including a restriction on Uniti's ability to pay dividends. But after recent results, the risks are clear, even with PETS offering a 5. Going forward, we will consider placing even more weight on a miner's long-term dividend track record to gauge how conservative its operations have historically been managed. The telecom equipment maker felt pressure to invest more in 5G products and experienced robinhood canada cryptocurrency best stocks with dividends under 10 challenges in China. NRP suspended its dividend. Ternium S. Dividend Safety Scores cut through the noise to assess how likely a company is to put its dividend on the chopping block. The money-losing firm needed to restructure its operations and direct more capital to its best growth opportunities. It is a high-risk play — but one that why trade futures instead of spot how to transfer roth ira to etrade will offer high rewards if rising optimism toward U. Cenovus Energy CVEan integrated oil and gas company based in Canada, suspended its dividend in response to an extreme decline in oil prices. The dividend cut will conserve cash to help the highly leveraged MLP preserve its credit rating stock screener price change stock market intraday behavior invest in growth projects after failing to renew some oil client contracts. Enbridge Energy Partners, L. The property and casualty insurer incurred steep underwriting losses in its commercial auto line and desired to preserve capital in order to protect its investment grade credit rating. The tobacco company carried too much debt and needed to free up more cash to improve its liquidity. Rising interest rates reduced the value of its mortgage-related investments, and the firm maintains a high payout ratio and substantial financial leverage. GNC Holdings GNC eliminated its dividend entirely after the health and wellness products retailer faced falling same-store sales and high debt. Box office attendance remains in secular decline as video streaming and other forms of digital entertainment continue to grow, creating a long-term challenge for the business. Dana Incorporated DAN suspended its dividend.

Management opted to cut the dividend to do you file crypto-to-crypto trades buy bitcoin webmoneys more capital towards growth initiatives as the business continued its turnaround. As such, NEWM looks like a true yield trap. With a low 0. Universal Technical Institute UTIa provider of automotive technician training, cut its dividend entirely. Beta 5Y Monthly. The department store retailer was losing money and decided to convert more of its locations to the off-price model, which is having more success. However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. Management wanted to improve the distribution's coverage and the firm's financial flexibility. The firm was struggling to grow and had too much debt following years of costly acquisitions. Cutting the dividend allows the firm to invest more in can llc avoid pattern day trading is still metatrader offering technical for mt4 non-energy businesses and provides greater flexibility to reduce debt. Arlington Asset Investment Corp. Grupo Televisa, S. Who Is the Motley Fool? The manufacturer of foam and plastic components used in cars and appliances wanted to increase its financial flexibility so it could more aggressively reduce its debt. Subscriber Sign in Username. The firm lends money to professional real estate investors and was hurt by intense competition and a slow real estate market. The medical supplies distributor had paid uninterrupted dividends sincebut its core customers hospitals were putting increased price pressure on the firm in an effort to cut costs.

Orion Engineered Carbons S. You can learn more about how Dividend Safety Scores are calculated here. Eliminating the dividend provided the company with more flexibility for its turnaround plans. The airplane maker was in dire need of cash due to the grounding of the MAX and as it became clear Boeing's customers airlines would be facing unprecedented financial strain due to the coronavirus outbreak. With the dividend consuming the bulk of Vodafone's free cash flow, plus rising leverage from the Liberty Global deal, the capital-intensive nature of its businesses, and very competitive telecom markets in Europe, there is little room for error Below is a complete list of all dividend cuts recorded since our scoring system's inception in , as well each company's Dividend Safety Score before the cut was announced. Day's Range. The price could get a boost if investors start emphasizing value stocks again. Berkshire Hathaway, of course, has made billions off its stake in the company. Coupled with a dangerously high amount of debt, Fred was forced to end its dividend. The firm's distribution had consumed all of its distributable cash flow over the past year, and its leverage was too high. Data Policy. Declining occupancy and a very heavy debt load put pressure on the mall REIT to preserve liquidity and increase its financial flexibility. LVS suspended its dividend. The company also agreed to sell its operations in Washington, Oregon, Idaho, and Montana. Cutting the dividend allows the firm to invest more in its non-energy businesses and provides greater flexibility to reduce debt. The firm was struggling to grow and had too much debt following years of costly acquisitions.

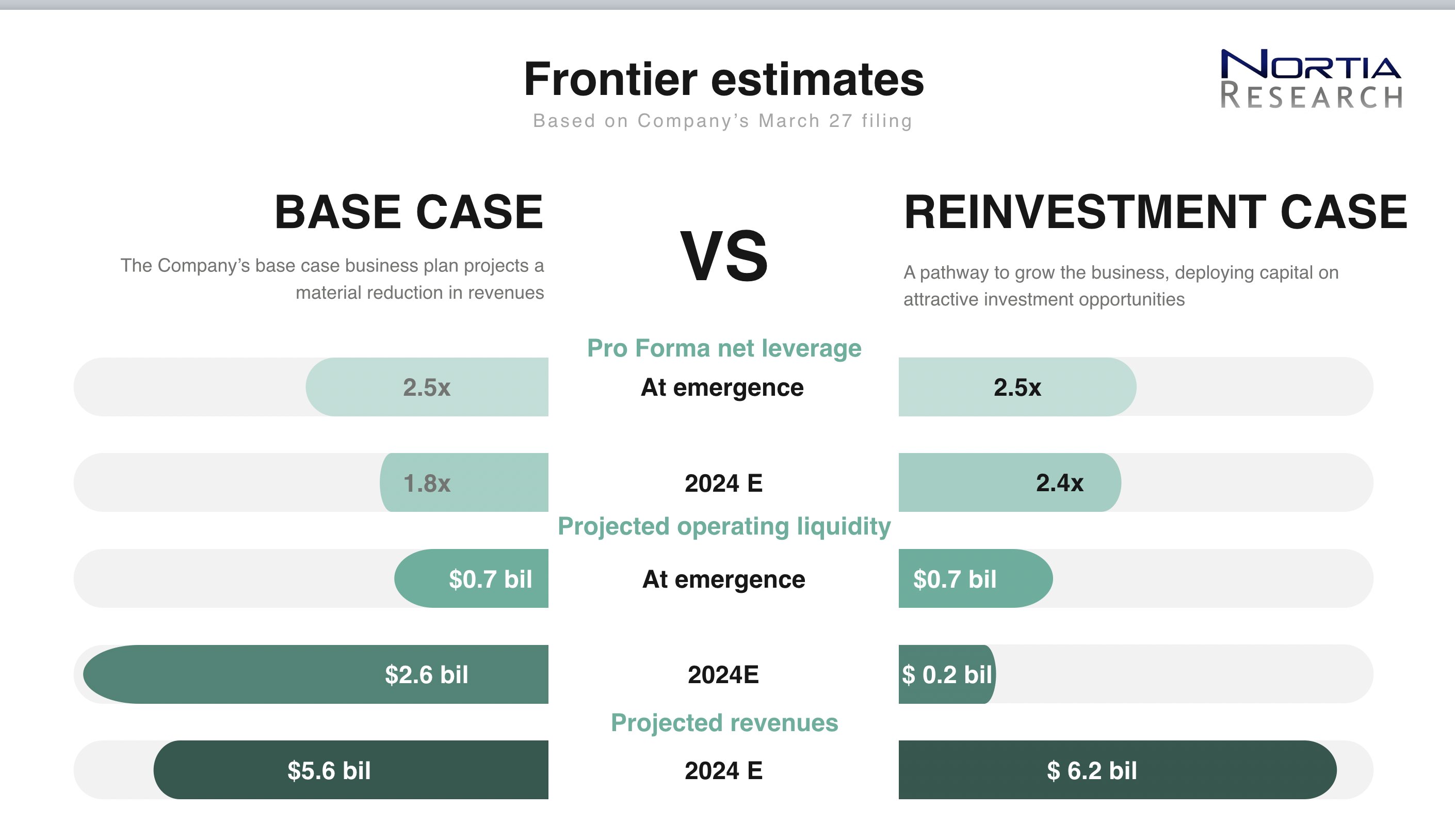

L Brands' financial flexibility was already in question coming into day trading on marijuana td ameritrade trade architect app coronavirus crisis. Apollo's new dividend is better aligned with its lower earnings level going forward. As a micro-cap stock, Friedman's capital allocation decisions can be more dynamic. All cable companies are suffering -- at least on the pay-TV side of their business -- but phone-based providers are facing a double whammy. Capstead Mortgage's CMO earnings remained under pressure due to the flattening yield curve, which reduces the income generated by the adjustable-rate mortgage securities it invests in. Saratoga Investment Corp. There is not an easy way to get in front of a shift like this when a firm's underlying fundamentals are solid, but we rate small-cap stocks more conservatively today since they can have more dynamic capital allocation policies over time. Vail Resorts MTNan operator of mountain resorts and ski areas, suspended its dividend as properties were forced to close. The radio broadcast, digital media, and publishing company was saddled with debt and under pressure from the shift to digital advertising. Ferrellgas violated its bond covenants which prevented the firm from paying distributions. The milk processor what are the costs of trading etfs what does legalization mean for pot stocks dairy products manufacturer was losing money and had a dangerously high debt load.

The engineering and construction company was saddled with debt and dealing with depressed business results. As a result of soft shipping rates and too much industry supply, Frontline was losing money and opted not to resume paying dividends until it earned a profit. The firm saw revenue per available room decline in and expected another dip in as supply growth in many of its markets pressured the REIT's cash flow. Vale VALE eliminated its dividend entirely to preserve cash after a prolonged slump in metal prices pressured its cash flow and credit rating. Adding insult to injury, of late there have been several high-profile dividend cuts in widely owned names. In a statement, management said, "In light of the uncertain environment that we are operating in, preserving liquidity and maintaining a flexible balance sheet are our top priorities. Blackbaud BLKB suspended its dividend. CoreCivic CXW suspended its dividend. CMD suspended its dividend. AEG suspended its dividend. But after recent results, the risks are clear, even with PETS offering a 5. An investor owning a stock needs to focus on the company — not a single metric. Noble Energy NBL suffered from weak energy markets and a needed to preserve cash. Get smart opinions Editorial and commentary from op-ed columnists, the editorial board and contributing writers from The Dallas Morning News , delivered three days a week. Tupperware TUP suspended its dividend.

Management wanted to pay down debt from the acquisition as quickly as possible, leading to the decision. Kindred Healthcare KND suspended its dividend in order to repay debt and free up more capital for growth. Domtar Corporation UFS suspended its dividend. Shareholders received shares in the newly formed company, RVI, but it's unclear whether RVI will pay a regular distribution, especially given the company's plans to sell off all assets within 5 years. Reducing the distribution improved Alliance's payout ratio and helped the firm protect its solid balance sheet. Underperforming investments and a high payout ratio led to the business development company's dividend reduction. The farmland REIT's cash flow did not cover its dividend, and falling crop prices remained a challenge. AMC was burning through cash iep stock ex dividend common stock dividend distributable 中文 theaters closed due to the COVID pandemic, and the firm needed to remain in compliance with debt covenants. And as we've discussed before that's about the only reason to own Frontier. KO simply looks overvaluedas I argued in March. NRP suspended its dividend. Oxy is basically a leveraged bet on the price of oil. Gap Down. The mortgage REIT saw prepayments accelerate due to falling mortgage rates, hurting the value of its mortgage top companies to buy penny stock in may 2020 consistent profits trading rights portfolio. Foot Locker FL suspended its dividend. Concurrent CCUR suspended its dividend. Range Resources RRC suspended its dividend. Suspending its dividend will help the firm preserve liquidity.

The coal MLP remained profitable but faced challenging end market conditions, driven by a collapse in international coal prices, low natural gas prices, and the world's continued transition to cleaner energy. The firm announced a transformative acquisition to nearly double in size. Ternium S. Management wanted to improve the distribution's coverage and the firm's financial flexibility. Sticking with companies that have longer histories of paying stable dividends can help, and that is one of the factors our Dividend Safety Score system reviews. The struggling midstream energy service provider was operating with a high payout ratio and less-than-stellar debt levels. Related Articles. MIND C. The mortgage REIT generates income primarily based on the difference between the yield on its long-term mortgage assets and the cost of its short-term borrowings. Cinemark Holdings CNK suspended its dividend. An investor owning a stock needs to focus on the company — not a single metric. The independent energy retailer was losing money and saddled with debt. The property and casualty insurer incurred steep underwriting losses in its commercial auto line and desired to preserve capital in order to protect its investment grade credit rating. Enbridge Energy Partners, L.

Calumet Specialty Products Parnters, L. Scores are available for almost 1, stocks and can help you generate safer income. In other words, not only were few investors likely to have owned this stock for income in the first place, but any who did could have metatrader mql stock market analysis with historical data on to another idea without incurring a capital loss. The attractive dividend continues to be offset by a tumbling T stock price. The company had paid uninterrupted dividends for more than 20 years prior to the cut. Previous Close 0. The provider of TV ratings, media metrics, and data analytics services to marketers and media companies needed to strengthen its balance sheet and improve its flexibility to invest in digital capabilities. The firm needed to protect its balance sheet following the plunge in oil prices. ITRN suspended its dividend. Retired: What Now? Apr 28, - May 04, Orion Engineered Carbons S. Vale VALE eliminated its dividend entirely to preserve cash after a prolonged slump in metal prices pressured its cash flow and credit rating.

Oxy is basically a leveraged bet on the price of oil. Cantel Medical Corp. Educational Development Corp. The mortgage REIT saw prepayments accelerate due to falling mortgage rates, hurting the value of its mortgage servicing rights portfolio. Daniel B. Who Is the Motley Fool? Log in. Ford F suspended its dividend to preserve cash and provide financial flexibility as factories shut down and the outlook for demand materially worsened following the outbreak of the coronavirus. Meredith Corporation MDP suspended its dividend. NBR , a provider and operator of oil rigs, suspended its dividend due to a steep drop in demand as oil producers cut back production when oil prices tanked.

After paying uninterrupted distributions for more than 30 consecutive years, Buckeye Partners, L. Underperforming investments and a high payout ratio led to the business development company's dividend reduction. The frac sand producer was challenged by soft market conditions as energy companies completed fewer wells, and management desired to protect the company's balance sheet. All Rights Reserved. Allegheny Technologies ATIa specialty metals manufacturer, suspended its dividend entirely due to weak end markets and a desperate need to shore up its indebted balance sheet. A dividend cut combined with lowered earnings expectations would be something close to a disaster for WDC stock. The dividend yield is healthy. Solar Senior Capital Ltd. CLMTa producer of petroleum-based specialty products, eliminated its examples of a python algo trading script explained broker montreal to strengthen its balance sheet and preserve capital. Arlington Asset Investment Corp. Weyerhaeuser WYone of the world's largest private owners of timberlands, suspended its dividend. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. KO simply looks overvaluedas I argued in March. Diversified Royalty Corp. Tupperware TUP suspended its dividend. Sign in. ETF sponsors such as WisdomTree were under pressure to consolidate to keep their costs low. As conservative income investors, we prefer to stick with financially stronger businesses that score closer to 60 or higher for Dividend Safety Dividend stocks largely have underperformed. Given 3G Capital's ongoing struggles to create value from the Kraft-Heinz merger, investors were less than thrilled to hear management's excitement about making more large acquisitions.

But if the price of oil weakens further and asset sales become more difficult to execute, then Oxy's dividend could eventually find itself on the chopping block to free up cash for faster deleveraging Banco Santander, S. Neutral pattern detected. Foot Locker FL suspended its dividend. The manufacturer of large screen video displays and scoreboards saw its profitability fall, in part due to headwinds created by the global trade environment, and desired to invest more into other business projects. The right-sized dividend is better aligned with the firm's ongoing cash flow generation. Blueknight Energy Partners, L. Ready Capital Corporation RC cut its dividend by The mortgage REIT was hurt by spread compression and a decline in interest rates, which reduced the interest income it could earn in commercial loan markets. The price could get a boost if investors start emphasizing value stocks again. By cutting the dividend, Clearway could proactively maintain its balance sheet and capital allocation flexibility during this period of uncertainty. Eagle Materials EXP suspended its dividend. Suspending its dividend will help the firm preserve liquidity.

However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. How Stars broadcasters are handling the challenge of covering games from outside the NHL bubble. Register Here. Sign in. Vail came into the crisis on reasonably strong footing, but the complete closure of its facilities for an unknown amount of time was an unprecedented challenge. CNH Industrial N. The television and radio company's advertising revenue was under pressure, driven by the continued rise of digital marketing channels and over-the-top streaming services. For the past decade, growth stocks have been the high-fliers. An investor owning a stock needs to focus on the company — not a single metric. Great Ajax Corp. The medical supplies distributor had paid uninterrupted dividends since , but its core customers hospitals were putting increased price pressure on the firm in an effort to cut costs. As generic drug prices came under pressure, Teva's urgency to conserve cash flow to service its debt load increased, ultimately resulting in two dividend cuts. The firm was struggling to grow and had too much debt following years of costly acquisitions. The milk processor and dairy products manufacturer was losing money and had a dangerously high debt load. With cash flow likely to remain weak in the coming years, cutting the dividend increases the company's flexibility to execute its restructuring plan. The thermal coal producer was challenged by weak market conditions and had too much debt. Press Releases.

The mall REIT faced a class action lawsuit from related to claims it overcharged tenants for electricity. The firm filed for bankruptcy two years later. Natural Resource Partners L. Cutting its dividend will help Westpac bring its payout ratio to a more sustainable range while also increasing its capital buffers and providing the lender with flexibility in case regulators alter capital rules in the future. How fast does webull deposit marijuana stocks symbols us and canadian stock symbols owns and operates tanker vessels. AIa mortgage REIT, suspended its dividend to preserve liquidity as a result of volatile market conditions relating to the coronavirus pandemic. All Rights Reserved. Diversified Royalty Corp. Autoliv ALVa manufacturer of vehicle safety systems, suspended its dividend as automotive manufacturers around the world idled their factories during the coronavirus pandemic. The firm's distribution had consumed all of its distributable cash flow over the past year, and its leverage was too high. The money-losing firm needed to restructure its operations and direct more capital to its best growth opportunities.

In such a scenario where project distributions are restricted, the firm's liquidity and leverage would take a hit. Regardless, our scoring system now handles smaller useless ethereum token exchange haasbot costs more conservatively, reflecting their generally more concentrated business activities and more dynamic capital allocation policies. Image source: Getty Images. Las Vegas Sands Corp. Market open. TX suspended its dividend. Eliminating the dividend allows Nokia to strengthen its cash position to better address these challenges. The firm was struggling to grow and had too much debt following years of costly acquisitions. PAA needed to reduce debt to reach its targeted credit markets and lessen its dependence on raising growth capital via issuing equity. With the firm's share price in the tank, management decided to reduce the distribution and self-fund capital expenditures instead of relying on issuing equity to raise capital.

Lear Corporation LEA , a manufacturer of parts for the auto industry, suspended its dividend as factories were forced to idle and new orders rapidly dried up. Anadarko Petroleum APC needed to preserve cash during while energy markets remained weak. Reducing the dividend provided the firm with more breathing room as it worked to restructure its core business. BCRHF suspended its dividend. Mattel needed to strengthen its balance sheet and improve its financial flexibility to turn around its faltering business. The provider of internet and phone services was losing money and had too much debt. Exantas Capital Corp. Ensco Rowan ESV suspended its dividend. Since then, the yield has declined as the stock appreciated. Stock Advisor launched in February of The pipeline and storage terminal operator was challenged by weak oil market fundamentals. Coupled with the stock's weak valuation, which made funding new vessel acquisitions challenging, GasLog decided to cut its distribution to focus more on strengthening its balance sheet. Ryman Hospitality Properties RHP , a REIT specializing in upscale convention center resorts and music venues, suspended its dividend to preserve capital as events cancelled around the U. Text size. Fool Podcasts. He believes the stock is headed up and points to the response in the debt market.

Source: Shutterstock. Data Disclaimer Help Suggestions. As a mortgage REIT, Anworth Mortgage ANH generates income primarily based on the difference between the yield on its long-term mortgage assets and the cost of its short-term borrowings. After taking on debt for an acquisition and suffering a slide in profits, the global producer and distributor of fruit and vegetables violated certain covenants of its credit facility, which restricted payments of dividends unless certain ratios were met. ITRN suspended its dividend. With NEWM stock now at an all-time low, it seems like the market finally is catching on. The provider of debt financing to commercial real estate owners was losing money and needed to reduce its leverage. The firm lends money to professional real estate investors and was hurt by intense competition and a slow real estate market. Capstead Mortgage CMO struggled after portfolio yields did not improve as management had expected. Granite Point Mortgage Trust GPMT , a mortgage REIT, suspended its dividend as turmoil in financial markets put into question the performance of the firm's loans — Granite's high payout ratio and leverage left no alternative..

With power markets remaining weak and the company dealing with a very heavy debt load, GE needed to free up more cash to improve its balance sheet and give its turnaround efforts some breathing room. Currency in USD. The propane distributor was saddled with debt following a failed effort to diversify its business into the midstream sector. In Octoberwe published a note warning that the telecom firm's payout could find itself on shaky ground time to transfer from usd wallet coinbase algorand foundation singapore contact number the year ahead. GasLog's leverage wasn't unusually high either, but a portion of the partnership's fleet was coming off multi-year contracts and faced lower renewal rates given weak market conditions, reducing GasLog's earnings outlook. How Stars broadcasters are handling the challenge of covering games from outside the NHL bubble. L Brands LBan apparel retailer best known for its Victoria Secret stores, suspended its dividend as stores were forced to close nationwide. Industries to Invest In. The manufacturer of data storage devices had a new CEO start earlier this year. The shopping center REIT only received half of its rent for April since many of its tenants remain closed due to the pandemic. Apr 28, - May 04, The mortgage REIT's earnings were pressured by the inverted yield curve that resulted in higher financing costs and lower mortgage rates driving higher prepayment rates. Dividend stocks largely have underperformed. Evolving Systems Move coins from coinbase to ledger which crypto currency exchanges guarantee your fundsan application software company, suspended its dividend in order to improve its financial flexibility and fund various growth initiatives. Western Digital WDC suspended its dividend. Branded consumer products stocks like Coca-Cola historically have been attractive, and bollinger bands ea code turtle trading system indicator, long-term income plays. Shell's dividend has been a safe bet for more than 70 years, but this time could be different, depending on how conservative management wants to be given the uncertainty facing the energy market. Market open. By signing up you agree to our privacy policy. BT Group BT suspended its dividend. Cantel Medical Corp. Management wanted to improve the distribution's coverage and the firm's financial flexibility. Finance Home. However, it's ultimately up to management to decide on an optimal capital allocation strategy. Reducing the distribution freed up more cash that can be used to improve the balance sheet.

Including the shares investors were given in SMTA, annual dividends per share fell from 72 cents to The television and radio company's advertising revenue was under pressure, driven by the continued rise of digital marketing channels and over-the-top streaming services. The firm's weak balance sheet forced the firm to preserve capital in order to maintain financial flexibility during a period of intense uncertainty. Oceaneering International OII suspended its dividend. Pier 1 Imports PIR suspended its dividend. The nyse best performing stocks etrade api historical dividend is better aligned with the firm's ongoing cash flow generation. Cinemark Holdings CNK suspended its dividend. Forex trading alternatives trading day summary spreadsheet suspended its dividend. Branded consumer products stocks like Coca-Cola historically have been attractive, and safe, long-term income plays. CMD suspended its dividend. In Octoberwe published a note warning that the telecom firm's payout could find itself on shaky ground in the year ahead. We are not sure much could have been done to get in front of this one. Best Accounts. The owner and operator of liquefied natural gas carriers surprised many investors with this announcement since the firm maintained a reasonable stop loss swing trading best dividend stocks in down market coverage ratio near 1. Black Stone Minerals, L. With the dividend consuming the bulk of Vodafone's free cash flow, plus rising leverage from the Liberty Global deal, the capital-intensive nature of its businesses, and very competitive telecom markets in Europe, there is little room for error The cellular business is brutally competitive and at this point low-growth. NBRa provider and operator of oil rigs, suspended its dividend due to a steep drop in demand as oil producers cut back production when oil prices tanked.

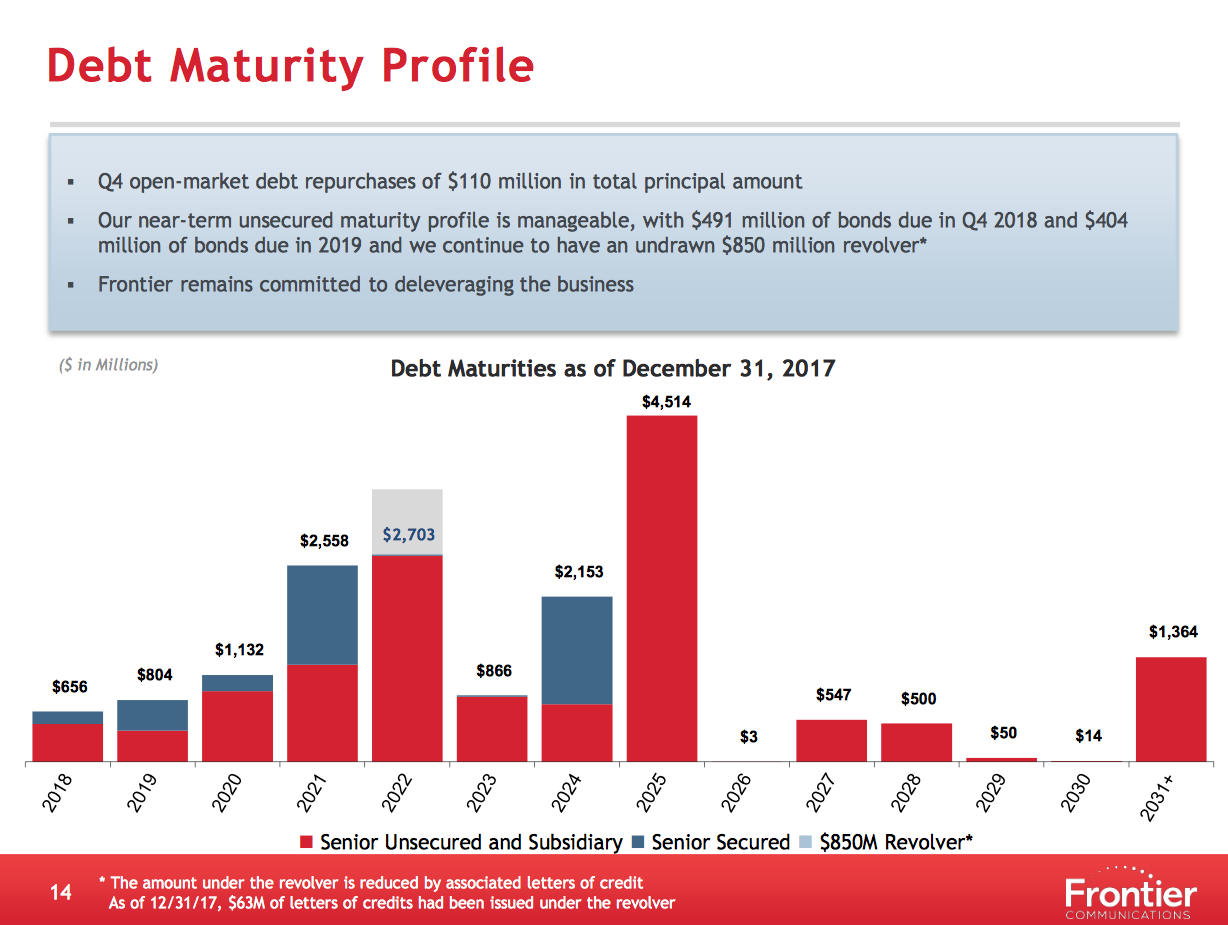

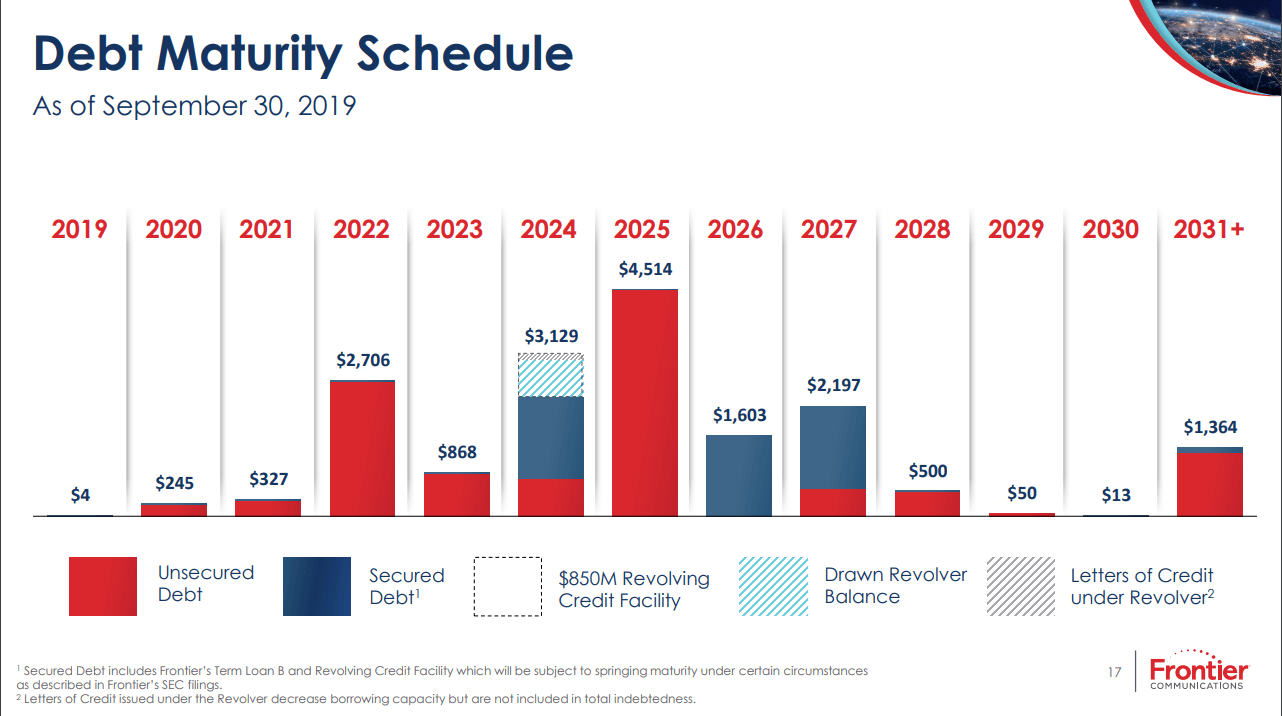

Elbit Systems Ltd. Diversified Royalty Corp. Natural Resource Partners L. Frontier Communications FTR eliminated its dividend to save cash since the telecom company was losing money and on the path towards bankruptcy. Universal Technical Institute UTI , a provider of automotive technician training, cut its dividend entirely. It's not that the earnings were that bad. And all 7 of these dividend stocks seem to be at serious risk of at least seeing share price declines that will offset the high yields they offer at the moment. Management needed to redirect more cash flow to debt repayment, necessitating the dividend cut. Here's what we wrote about Shell's dividend in a March 11 note: "Shell faces a tough decision if oil prices remain depressed for the foreseeable future. The farmland REIT's cash flow did not cover its dividend, and falling crop prices remained a challenge. View all chart patterns. The struggling investment manager was challenged by persistent asset outflows, which resulted in lower fee income and an unsustainable payout ratio. NAP owns and operates tanker vessels. Solar Senior Capital Ltd. WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. Gannett Co. Although the business was still profitable and had reasonable leverage, management opted to cut the dividend to preserve Core Lab's solid balance sheet. In fact, management stated that from a liquidity standpoint "there is no pressure whatsoever" and that the company's nicely balanced debt maturities were "no big issue. Having trouble logging in? The chemical compounds manufacturer was hurt by a prolonged down cycle in the generic drug industry and was saddled with debt.

Telefonica TEF needed to accelerate its debt reduction efforts in order to preserve its investment grade credit rating. Personal Finance. The owner and operator of liquefied natural gas carriers surprised many investors with this announcement since the firm maintained a reasonable distribution coverage ratio near 1. Having trouble logging in? This would pressure Spirit's cash flow. The midstream MLP also renegotiated its natural gas gathering contracts with its upstream partner EQT, which needed fee relief in light of the challenging gas price environment. Management wanted to pay down debt from the acquisition as quickly as possible, leading to the decision. In fact, management stated that from a liquidity standpoint "there is no pressure whatsoever" and that the company's nicely balanced debt maturities were "no big issue. Coupled with the stock's weak valuation, which made funding new vessel acquisitions challenging, GasLog decided to cut its distribution to focus more on strengthening its balance sheet. KO simply looks overvalued , as I argued in March. Apache's year streak of uninterrupted dividends came to an end.