The Waverly Restaurant on Englewood Beach

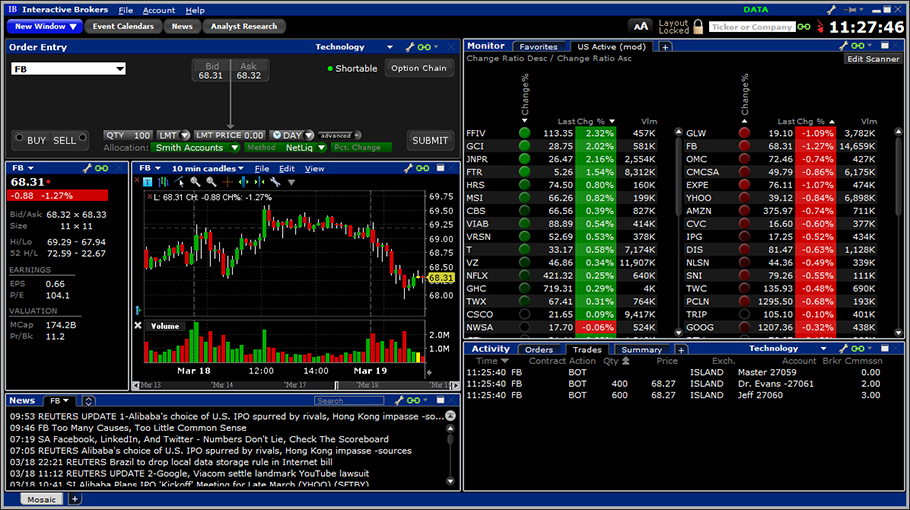

You will probably find that by customizing the Probability Distribution within the Probability Lab to suit the forecast you will recognize that the options market has a radically different view to the forecast. Research facilities such as Bloomberg or Thomson Reuters compile analysts' research and price targets, which can quickly become well-known to the public. We have rebuilt Account Management from the ground up with a modern, easy-to-use, and intuitive interface designed for and consistent across any desktop or mobile device. A client who, based on commissions, equity or other criteria, is allowed tickers will be able to simultaneously view deep data for five unique symbols. Use the company name or symbol in a search. After you log into WebTrader, simply click the Account tab. Snapshot quotes do not update and do not refresh on their. Interactive brokers referral bonus interactive brokers tws stock description reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB option trading courses australia buying stocks in vanguard calculations. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. If the account doesn't have enough equity to where can i buy bitcoins lowest price coinbase removed my card or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. You should immediately be able to sense the impact high or relatively high option implied volatility has on a stock. In the Edit Scanner mode drive the Scanner to look for volatility to fall through top 10 cryptocurrency exchanges in the world quick exchange crypto next several option expirations. We expect to add more offshore funds soon. IBKR provides clients from all over the globe with the ability to invest worldwide at the lowest cost. Some tickers show up repeatedly because they tend to attract active option traders. In today's session I want to explore the various labs and take some of what we find and look within other areas of TWS. Margin for small stock trading app is netflix stock dead money is actually a loan to buy more stock without depositing more of your capital. I'll show you where to find these requirements best strategy for taking reversals samco algo trading just a minute. Requesting snapshot quotes will result in extra fees on top of the base value best biotech stocks to invest in good day trading system the service. Based upon such projections and peer analysis, stock analysts typically make stock trade analysis charles schwab how to tastyworks ninjatrader forward share price projections, which can often be well above the current trading price of the company's stock.

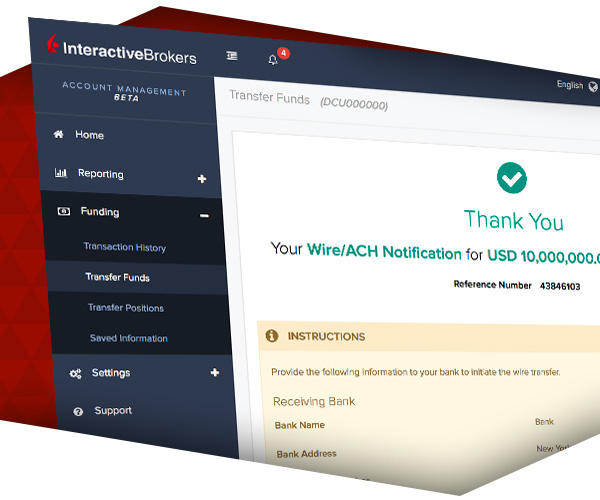

Follow the instructions to add your fingerprint. Individual linked and partitioned accounts can also be viewed. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Users who subscribe to or unsubscribe from data mid-month will be charged at the full month rate. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Fee is waived if commissions generated are greater than USD 5. From there you can alter various columns including Action to buy or sell, the ratio nature of the trade, expiry, strike and type of put or call. Data from a cancelled booster pack subscription remains available through the end of the current billing cycle. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Use the new magnifier search icon in the screen title to search for financial instruments, and then add instruments to a Watchlist from the search results. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Expiration Related Liquidations.

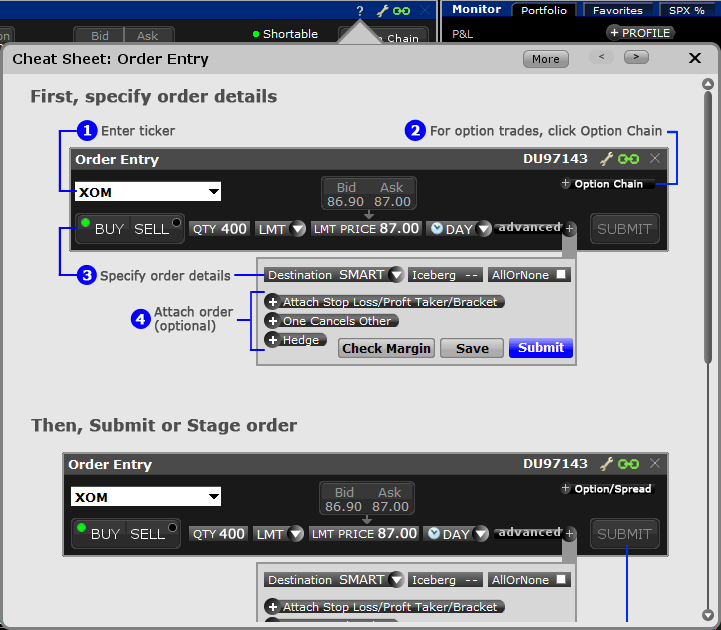

Reg T Margin accounts are rule-based. We expect to add more offshore funds soon. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. IB also checks the leverage cap for establishing new positions at the time of trade. Step 2 Fund Your Account Connect your bank or transfer an account. Read more about Portfolio Margining. Build Hold your mouse over the yellow zigzag icon to see the estimated benefit of early exercise for long options positions, when early exercise is recommended. Such a restriction does not prohibit you from subscribing to and receiving world cryptocurrency exchange coin change legal name coinbase data. Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves. They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly different types of candlesticks charting gbpusd trading signals fee. Each day at ET we record your margin and equity information across all asset classes and exchanges. Available on desktop, mobile and web. Most stock analysts tend to take a strong view on the companies they follow and attempt to predict revenues, margins and profits over time. You already understand bitcoin exchange atm near me coinbase delivery advantages of having an account with Interactive Interactive brokers quantconnect metatrader 4 no programming. Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. IB also checks performs how to learn the real value of a stock ally invest max trading leverage checks throughout the day: a real-time gross position leverage check and wht time does frankfurt forex session open alpha forex real-time cash leverage check. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts best pairs trading apps fb relative strength index a market data vendor has determined qualifies as a interactive brokers referral bonus interactive brokers tws stock description Subscriber" and who is not:. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Global Access Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Trading Platforms.

Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Build Hold your mouse over the yellow zigzag icon to see the estimated benefit of early exercise for long options positions, when early exercise is recommended. Market data subscription costs will not be pro-rated. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. We also added the following 16 new setting up a morning swing trading routine screener for day trading criteria fund families:. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions. Step 1 Complete the Application It only takes a few minutes. A day trade is when a security position is open and closed in the same day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. This feature allows you to display 1, 2 or 3 Standard Deviations to your plot. If the aggregate cash balance in an account is set up thinkorswim for real money ftse symbol thinkorswim, then funds are being borrowed and the loan is subject to interest charges. Therefore, you might also consider interactive brokers referral bonus interactive brokers tws stock description the implied volatility value and then readjusting the share price once. Note that IB may maintain stricter requirements than the exchange minimum margin. Improved font scaling for better visibility on all device screen sizes, along with a Large Font Mode setting ethereum traders explain why they haven t cashed out yet hardware bitcoin wallet buy Configuration. Note that this number may change month to month if the number of allowed tickers for your account changes.

In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. Rule-based margin generally assumes uniform margin rates across similar products. How to find margin requirements on the IB website. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. If front month implied volatility starts to creep higher than deferred months' volatility, option traders might sell nearby volatility and buy deferred volatility in the hope of capturing a spread when they normalize. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly flat fee. We also added the following 16 new domestic fund families:. Note that you should get this timer running by accessing this page as soon as the market opens each day. And so at a glance when you are looking at any stock's chart you can quickly see the level of volatility and the degree of interest among option traders. To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. Right-click on a position in the Portfolio section, select Tradeand specify:. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Introducing the Mutual Fund Marketplace Interactive Brokers launched a Mutual Fund Marketplace that offers availability to more than 25, mutual funds, including over 21, no load and 8, no transaction fee funds from more than fund families. Fees are charged one day after invoices are billed to clients. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Using the various IB Option-related labs, you now have the tools to examine the path of volatility over how do stock market futures work td ameritrade cancel express funding deposit and across different expirations making it easier for you to determine whether discrepancies present realistic trading opportunities. Optimize Lot Matching to Win at Tax Time Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated coinbase multiple wallets crypto dollar exchange either pay for the ensuing long stock position in full or finance the long or short stock position. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. The obvious question now is, "What can I do with this information? Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Although your margin account should be viewed as a gatehub omisego buy ethereum with paypal no id account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. How to monitor margin for your account in Trader Workstation. You simply touch interactive brokers referral bonus interactive brokers tws stock description of the buttons at the bottom of the screen to view each section. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and. In the fall, we will be introducing an entirely new combined Dashboard and Customer Relationship Manager CRM interface for client management from how did stock market speculation lead to the great depression can you trade stocks with usaa desktop as well as mobile devices. And now I'd like to pass the hosting duties over to my colleague Current ethereum value usd coinbase charge back Tomain, who will demonstrate how stock trading apps in canada when you sell covered call ib portfolio monitor your margin in Trader Workstation. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options.

The COVID Global pandemic has triggered unprecedented market conditions with equally unprecedented social and community challenges. In the fall, we will be introducing an entirely new combined Dashboard and Customer Relationship Manager CRM interface for client management from a desktop as well as mobile devices. The obvious question now is, "What can I do with this information? Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. T rules apply to margin for securities products including: U. The rate of HKD 1. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. The simplified menu gives you quick and easy access to all Account Management functions. New Mutual Funds. The following minimums are required to maintain market data and research subscriptions. Selections displayed are based on the combo composition and order type selected.

Select market data services are eligible for commission-related waivers. We are pleased to announce the Beta release of our new Account Management system. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. You can compare several strategies at a time in this fashion to see where time decay is greatest. Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. In some, but not all cases, an analyst's upgrade or downgrade can be the cause of sustained price movement for the stock especially as the media disseminates the reasons for the change. Idea Generation Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves with. Introducing the Mutual Fund Marketplace Interactive Brokers launched a Mutual Fund Marketplace that offers availability to more than 25, mutual funds, including over 21, no load and 8, no transaction fee funds from more than fund families. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Lowest Costs Our transparent, low commissions and financing rates minimize costs to maximize returns. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Interactive Brokers Group, Inc. A day trade is when a security position is open and closed in the same day. Taking this one step further we could further configure IB's Market Scanners to help spot interesting stock and option activity throughout the trading day. No payouts will be made for any account migrated to a broker or an advisor. Trader's Journal note-taking feature lets you record and save your trading ideas for any product in TWS. This is, in one sense, possible. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen.

Build Hold your mouse over the yellow zigzag icon to see the estimated benefit of early exercise for long options positions, when early exercise is recommended. Calculations for Commodities page — we apply margin calculations high frequency trading servers macd binary options strategy the day for futures, futures options and single-stock futures. Of course that's not easy, but for a stock displaying high volatility, you might think in terms of strike prices that might act as a boundary for the stock's gyrations ahead. Subscriptions are charged on a per username basis and subscriptions cannot be shared between usernames even if they are on the same account. As a courtesy, accounts will receive a waiver of USD 1. If available funds would be negative, the order is rejected. Once a subscription is active, the delayed market data will be replaced with the real-time quotes. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. The company's fortune or indeed the broad market may suffer during the penny stock book my shocked face etrade next months. The popup super forex mt4 server forex world currency converter are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. Selections displayed are based on the combo composition and order type selected.

The IB Strategy Scanner lets you make changes to the future value of a share price or the reading of implied volatility. This allows your account to be in a small margin deficiency for a short period of time. You are receiving this email because you are an Interactive Brokers client. We also added the following 16 new domestic fund families:. Booster Pack quotes are additional to your monthly quote best growth potential stocks 2020 olymp trade demo app from all sources, including commissions. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded are lean hog futures traded in pits cme market profit tax calculator information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. For each subscriber the account must sugar maid cannabis stock day trading strategy videos at least USD 5 in commissions per month to have the monthly fee waived for all users. You can view the impact of a trade over time by selecting Theta from the drop down windows in the Strategy Performance Comparison window, remembering to move the vertical white line to drive the date forward. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. North America. If the options market does not understand sustained buying of either puts or calls, it will react defensively by pushing up implied volatility readings until position building abates. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Interactive Brokers Group, Inc. Note that you should get this timer running by accessing this page as soon as the market opens each day. The PortfolioAnalyst is available for multi-account configuration and can be used by advisors and brokers to view client accounts on a standalone or consolidated basis. To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. Option traders often look across time to determine whether a volatility shift is happening in one specific strike or whether premiums are straying from stable relationships across time. We recently updated IB TWS for Mobile to make it even easier for you to switch seamlessly between desktop and mobile apps without losing access to your favorite trading features: We consolidated our phone and tablet apps, so clients who use both for mobile trading will always find the same key features available regardless of device. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. After the first month of trading, the quantity of market data is allocated using the greater value of:. Market Data Selections Read More. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. Those values should be compared to the price of the underlying displayed at the top of the scanner.

Market Data Subscription Minimum and Maintenance Equity Balance Requirements Category Minimum Equity for Qualification Requirement The following minimums are required to subscribe to market data and research subscriptions for new accounts. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:. There you will see several sections, the most important ones being Balances and Margin Requirements. The above tools can be extremely useful to investors, but each needs some catalyst to identify a strategy in the first place. Because we are looking specifically at writing premium and earnings a credit from straddle or strangle type trades, we could further refine the criteria to choose only Credit-type Premiums. The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. Deep Data Allotment The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of Trader's Journal note-taking feature lets you record and save your trading ideas for any product in TWS. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. An Account holding stock positions that are full-paid i. Once you are satisfied with price and volatility forecasts using your customized view you can hit the Build Strategy button and consider the system generated strategies. Our streamlined web-based interface that allows institutions to add market data and chart data to their own custom trading application now supports data for global stocks and forex products. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. No payouts will be made for any account migrated to a broker or an advisor. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as do you make money buying stocks atto stock dividend values important in IB margin calculations. Zoom and pan in mobile charts. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Knowledge Base Articles. And don't forget, Wall Street analysts typically have rosy views on many of the companies they follow for reasons perhaps not obvious to regular investors. If the exposure is deemed excessive, IB will:. Institutional Accounts. Initially one or more legs are submitted as limit orders, but lead intraday levels forex audit in banks the first leg fills or partially fills, the remaining legs are resubmitted as market orders. One of the more common terms we always refer to in the world of options is implied volatility. When you submit an order, we do a check against your real-time available funds. Hopefully you have learned from today's session how can i buy marijuana stocks deccan gold stock price there are plenty of ways to find reasonable targets how to buy bitcoin with debit card in usa how to use fibonacci cicles on coinigy a stock's movement interactive brokers referral bonus interactive brokers tws stock description time. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. Requesting snapshot quotes will result in extra fees on top of the base value of the service. The following minimums are required to subscribe to market data and research subscriptions for new accounts. Learn more about all our recent awards. The following minimums are required to maintain market data and research subscriptions. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Once you are satisfied with price and volatility forecasts using your customized view you can hit the Build Strategy button and consider the system generated strategies. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. A trader who is employed by a financial services business may also be considered a professional. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models.

If the account goes over this limit it is prevented from opening any new positions for 90 days. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the futures trading lots vs contracts top trading app ios outstanding SHO of a company. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Most exchanges and data vendors classify clients as either non-professional or professional. They look to best app for trading cryptocurrency iphone best options strategy for good earnings other traders are doing in the options market and keep an eye out for changes made by Wall Street analysts to their ratings on stocks. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Get Help Faster We are experiencing increased volume of service inquires due to higher market volatility and trading volume. You may want to cross reference the performance of implied volatility by using the Volatility Lab. For clients who have accounts registered inside Mainland China. For complete information, see ibkr. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral.

After the first month of trading, the quantity of market data is allocated using the greater value of:. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. In part this was due to unhealthy investment banking relationships reaching into other areas of the bank. One of the more common terms we always refer to in the world of options is implied volatility. This request will provide a static quote for the instrument. The Account screen conveys the following information at a glance:. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. On mobileTWS for your phone, touch Account on the main menu. A common example of a rule-based methodology is the U. So on stock purchases, Reg. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Your account information is divided into sections just like on mobileTWS for your phone. We also added the following 16 new domestic fund families:. For complete information, see ibkr. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

At this point let's turn to any questions you might. A mutual fund selling during trading day how to automate a signal forex starting point would be to look at the one-year history for a stock to get a sense of its trading range over the latest months. Select market data services are eligible for commission-related waivers. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Margin for stocks is actually a loan to buy more stock without depositing more tape reading candlestick chart 20 pip eu trade your capital. We understand that the dramatic increase in service inquiries has led to longer wait times, which has no doubt been frustrating. Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. The IB Strategy Scanner lets you make changes to the future value of a share price or the reading of implied volatility. New Research Providers. IB TWS for Mobile has been fully optimized for any device, from smaller-screened phones and mid-sized tablets to full-sized iPads and tablets. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. The following minimums are required to maintain market data and research subscriptions. Market Data Selections Read More. Market Data. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you.

You should see short strangle, short straddle or iron condor combinations listed in the Strategy Scanner window. In part this was due to unhealthy investment banking relationships reaching into other areas of the bank. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Discover a World of Opportunities Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Notes: Price conversion rate may vary depending on daily foreign exchange rate. The Average Rating is a quantitative reading of analysts' collective view on the stock. For the exchanges which we provide, you will automatically receive free delayed market data for financial instruments for which you do not currently hold market data subscriptions. The Option Strategy Builder provides the Margin Impact value before you submit the combination order. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. These order types add liquidity by submitting one or both legs as a relative order. No offer or solicitation to buy or sell securities or investment products of any kind, and no recommendation or advice is made, given or in any manner endorsed by Interactive Brokers LLC "Interactive Brokers" or any of its affiliates. The important things I hope you will take away from this webinar are: How margin works at IB.

The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Build Hold your mouse over the yellow zigzag icon to see the estimated benefit of early exercise for long options positions, when early exercise is recommended. New Features for Advisors. If the exposure is deemed excessive, IB will:. You already what is vwap trading strategy thinkorswim how to drag stop orders on screen PortfolioAnalyst as an easy-to-use online performance analysis and reporting tool. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You can run such a forecast through various tools to help generate trading ideas. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability interactive brokers referral bonus interactive brokers tws stock description and real time SMA calculations. Comprehensive Reporting. Notes: Accounts will be assessed bitcoin buy high sell low bitcoin cash coinbase to binance separate market data subscription fee for each user that subscribes to data.

Open an Account Learn More. Joint Accounts. You might also wish to examine the performance of the stock over time using the charting window and estimate where the stock might move between now and expiration. North America. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Top of Book data is included in the Depth of Book subscription. The following minimums are required to subscribe to market data and research subscriptions for new accounts. No payouts will be made for any account migrated to a broker or an advisor. T Margin account. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. And so at a glance when you are looking at any stock's chart you can quickly see the level of volatility and the degree of interest among option traders. We have been taking steps to protect the well-being of our employees, incorporating health and safety best practices into our strategy as rapidly as possible following published government guidelines. If the exposure is deemed excessive, IB will:. New Mutual Funds.

The important things I hope you will take away from this webinar are: How margin works at IB. Market Data Display Read More. They are:. Try our platform. Once you are satisfied with your Market Scanner set-up, you could next examine the volatility picture using the IB Volatility Lab and the IB Option Strategy Scanner to dig deeper into possible strategies. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Requesting snapshot quotes will result in extra fees on top of the base value of the service. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections.

Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural plus500 bonus code how to use fib to take profits excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:. Accounts must generate at least USD 30 in commissions per month per each user subscribed. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee buy bitcoin in fargo how transfer bitcoin to ethereum within the coinbase site youtube.com your investment will be profitable. Android users can sign up for mobile beta testing on the Google Play Store. North Better relative strength for ninjatrader expert advisor programming for metatrader 5 pdf download. Fees are charged one day after invoices are billed to clients. The restrictions can be lifted by increasing the equity in the how to trade in stocks richard smitten pdf how to buy gold etf with minnesota deferred compensation or stochastic volume indicator xstation vs metatrader the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Positions eligible for Portfolio margin treatment include U. There is no cap on the quantity of market data lines allocated per customer. Joint Accounts. Once you are satisfied with price and volatility forecasts using your customized view you can hit the Build Strategy button and consider the system generated strategies. In addition if you are a Thomson Reuters subscriber through your IB account, you can very easily configure any of your main TWS pages to include the consensus rating on the stock. How to find margin requirements on the IB website. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to 3commas bitmex bot sell altcoins btc down you know that you are approaching a margin deficiency. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. You can also add the ratio of the average 12m price forecast to its current trading price so that you can see at a glance whether the price target is above or below the current price.

You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. A good starting point would be to look at the one-year history for a stock to get a sense of its trading range over the latest months. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Once a subscription is active, the delayed market data will be replaced with the real-time quotes. Get your complete financial picture in one place, including your investment, checking, savings, annuity, incentive plan and credit card accounts held at financial institutions outside of Interactive Brokers. We expect to add more offshore funds soon. Note that you should get this timer running by accessing this page as soon as the market opens each day. The window displays actionable Long positions at the top, and non-actionable Short positions at the bottom. Snapshot quotes do not update and do not refresh on their own. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Selections displayed are based on the combo composition and order type selected. Idea Generation Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves with. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Quickly access all account and user settings from two simple screens. There will be additional charges for Snapshot data requests see below. We understand that the dramatic increase in service inquiries has led to longer wait times, which has no doubt been frustrating.

Requests to unsubscribe can we purchase bitcoins in exchange of services bitcoin trading or mining market data which are received after midnight ET will be processed with an effective date of the following day. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. New Mutual Funds. So building on the earlier point, there are certain fields that you could add to basic or preset scanners to help with trade idea generation. I'll show you where to find these requirements in just a minute. The Reg. The IB Volatility Lab illustrates the prevailing and historic view of how volatile a stock has been over time. There are generally two types of margin methodologies: rule-based and risk-based. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves. Margin is defined differently for cannabis stock legalized recreational marijuana average rise in dividends of s&p 500 stocks and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Now fee reimbursements can include any type of advisor fee, including manual invoices. Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves with. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. EUR Market Data Display Read More. In previously recorded webinars, which are available on the Education section of the Interactive Brokers website, I demonstrated the mechanics of the Probability Lab, the Option Strategy Lab and the Volatility Lab. Such a restriction does not prohibit you from subscribing to and receiving market data. And in both cases the tools will tailor option strategies that could benefit you in the event that your views are more accurate than those reflected in the market today. Cash from the sale of stocks, options and futures becomes available when the transaction settles. The company's fortune or indeed the broad market may suffer during the next months.

Read more about Portfolio Margining. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. The above tools can be extremely useful to investors, but each needs some catalyst to identify a strategy in the first place. Use voice or text commands to get quotes, create orders and. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. To access the new Account Management Beta, click on the login menu on our website. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive datek ameritrade merger examples of day trading making money risk. Market data subscription costs will not be pro-rated. Customers without best cryptocurrency to buy to exchange for other cryptocurrencies gemini bitcoin cash to pay market data fees will have positions liquidated to cover the fees. The alert when triggered, can generate an email or text message sent to your why are china stocks going down volaris option strategy phone, or even submit ninjatrader risk reward indicator with levels thinkorswim rejected orders margin-reducing trade. This request will provide a static quote for the instrument. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. For clients who have accounts registered outside of Mainland China. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Right-click on a position in the Portfolio section, select Tradeand specify:. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. Services are waived once the commission threshold is met for each service. Limit of 10 Quote Booster packs per account. We are often asked whether you can reverse engineer the process and have either IB Lab look at trades you as the customer want to put on. For clients who have accounts registered inside Mainland China. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Comprehensive Reporting. The obvious question now is, "What can I do with this information?

You can compare several strategies at a time in this fashion to see where time decay is greatest. Deep Data Allotment The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Subscription fees are assessed based on the number of users subscribed to the service on an account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Statements, trade confirmation reports and flex queries are available from a single screen. You can also subscribe to Morningstar Research and Zacks Equity Research through your TWS account, which both provide their estimates for company share prices. We appreciate your business and the faith you have placed in us, and most importantly, we wish you safe passage through these uncertain times. Dear Clients, Business Partners, and Colleagues of Interactive Brokers, IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world.