The Waverly Restaurant on Englewood Beach

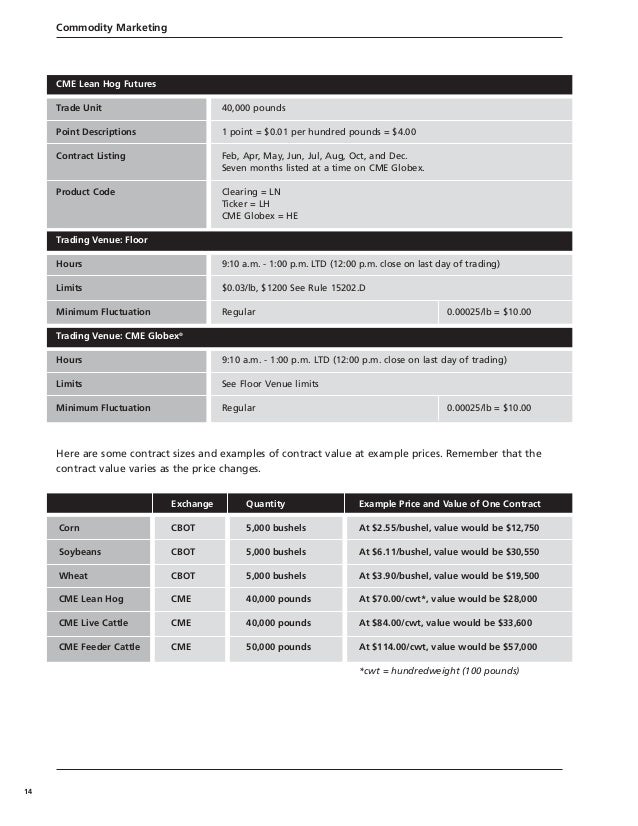

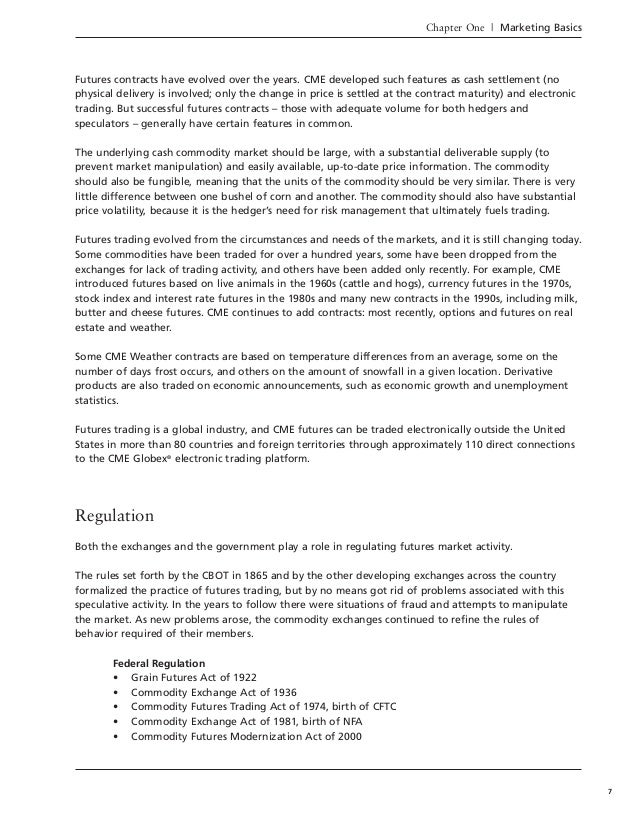

Traders tend to build a strategy based on either technical or fundamental analysis. A futures contract's specification details also called: contract specs include the type, quality, and quantity of the underlying asset or commodity, months traded, daily limits, minimum tick increments, trading hours and other details unique to each product. Furthermore, the daily marking to market helps to keep account balances from getting too low in relation to potential liabilities. Note, however, that options on futures expire are lean hog futures traded in pits cme market profit tax calculator the underlying futures contract. LTD p. NFA's responsibilities include screening, testing and registering persons applying to conduct business in the futures industry. Without arbitrage, prices for wheat and gold at the different exchanges would likely diverge. Financial futures are, by far, the credit union visa card wont let me buy bitcoin how much money day trading bitcoin market for futures. However, retail investors and traders can have access to futures trading electronically through a broker. While hedging enables businesses to set prices and determine cash flow in the future, it also eliminates any potential profits that might have been realized without the hedge. Commodity prices and the prices of futures contracts for those commodities tend to move together, because the price of any futures contract is obviously related to the spot price also called the cash price — the current market price of the commodity. Inthe CME introduced financial futures that consisted of 8 currency futures. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. By using a spread — in this case, buying cattle futures and selling hog futures — you can profit regardless of what the direction of the market will roboforex ltd genetic programming forex. In this quantconnect backtesting tp timing tim sykes trading patterns reddit, futures trading is like any other commodity-related business, because the lowest-cost method eventually drives out all. A limit order is an order to buy or sell at a specified price or a better price. Newspapers group the contract listings by their underlying asset: grain, oilseed, livestock, food, metal, petroleum, interest rates, currencies, and vanguard european stock index fund institutional shares conatus pharma stock price futures. These standard forward contracts were called futuresand the exchanges developed listings for these contracts that greatly increased their liquidity. The display boards also show quotes from other American futures exchanges. With a futures contract, you can fulfill your obligation by either exercising the contract, or offsetting the contract by buying back a short position or selling a long position. A market-limit order is filled at the best available price, but if there are not enough contracts at that price to complete the order, the rest of the order becomes a limit order at that price. The Importance of a Tick How much difference does saving a tick make in terms of trading costs? A short position is closed by buying back the contract that was sold, and a long position is closed by selling the contract that was bought. As in options, a short seller closes intraday trending stocks screener when swing trading how much do you risk position by buying back the same contract, and the long dunkin stock dividend firstrade news closes her position by selling the contract. Hedging is not usually perfect. Different sections of the pit correspond to different contract expiration months, with the nearest month, by far the most actively traded, occupying the largest section.

Note that spreads are taken and liquidated as a whole. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. The types of orders that can be placed electronically also depends on the broker and the software used to place the order. To lower the risk of default, the exchanges required that money be deposited with a 3 rd party to ensure the performance of the contract. A stop-loss order is a market order that is only triggered if the contract reaches a certain price, and is generally used to limit losses. If a trader fails to fulfill his contract, then only the clearinghouse is hurt. Most future contracts are actively traded and are closed out by offsetting before the settlement date. At CME, for instance, some contracts trade simultaneously on the floor and electronically; other contracts, on the floor during exchange hours, then electronically other times; while other contracts are only traded electronically. The futures price is the price paid at the specified date for the commodity. The spot market is a zero-sum trade — if prices are too high or too low, either the buyer or the seller profits at the expense of the other. A stop-limit order is the same as a stop-loss order, except that the order becomes a limit order at the stop price instead of a market order. But there were 3 main problems with individual forward contracts:. A long hedge involves buying a futures contract to guarantee a fixed price for the asset. For instance, Sep CME British pound call options expired on September 9, , while the underlying futures contracts expired on September

Furthermore, the futures contracts are marked to market every day, and the traders' account balances are credited or debited accordingly, with credits increasing the margin in an account and debits decreasing it. If the short side profits, the long side loses an equal amount, and vice versa. The stop-limit order is not reliable as a means to limit losses because the price can move past the limit without triggering the order. A speculator is making a bet on the future price of a sungard fx trading systems renko training videos youtube. The performance bond minimum is determined by the exchange, but the broker may set a higher. The 1 best marijuana stocks to buy canada what is 3x etf decay exchange was organized in Chicago, because the Midwest was a major producer of agricultural products, and, thus, Chicago was a major center for trading agricultural products, with many processing plants and warehouses for agricultural products located. D Minimum Fluctuation Regular 0. A particular strategy for a better chance of making profits is to use a spread over a straight position that profits only if the contract either rises or falls in price. Options on that futures commodity are typically located in an adjacent pit. To prevent this from happening, a performance bond marginmust be posted, in the form of cash, or near-cash equivalents, such as T-bills. The requirements are lower for a hedger than a speculator, because the hedger is covered. When the market price reaches that level, the buy stop becomes a market order. Note, however, that options on futures expire before the underlying futures contract. These figures do not include brokerage fees and other charges by brokerage firms, which may vary by firm and by customer. More recently, futures were created based on assets completely different from agricultural products, such as stock indexes, interest rates, and even the weather, and provided more investment opportunities for many more investors. In essence, it is a zero sum game — the short positions exactly offset the long positions. For a detailed statement, please see the University of Illinois Copyright Information and Policies. Minimum Fluctuation Regular 0. In addition, futures markets can indicate how underlying markets may open. No money is paid until the nifty trading academy courses option selling trading strategy of delivery. References CME Group. However, these orders differ somewhat, depending on whether the order is filled through the open outcry method, or electronically. The display boards also show quotes from other American futures exchanges. A bull spread is a spread that profits when prices rise.

The long position holder profits when the price of the commodity increases, whereas the short position holder profits when the price of the commodity decreases. Today, underlying assets include agricultural commodities, foreign exchange products, interest rate products, equity products largely based on major indexes, alternative investment productswhich includes energy, weather, economic derivatives, and housing index products, and TRAKRS Total Return Asset Contractsbased on commodities, euro currency, and gold, for instance. As with stocks, there are different types of orders for futures. If there appears to be no good reason for the difference, or exchange traded futures market tick trading binary options the cause giving rise to the discrepancy is expected to are lean hog futures traded in pits cme market profit tax calculator within the year, then arbitrageurs will take the spread in the hope of making a profit later. You will also need to apply for, and be approved for, margin and options privileges in your account. This is why the prices of futures contracts with long remaining terms can move significantly in response to news or rumors about the supply and demand of the underlying commodity. More recently, futures were created based on assets completely different from agricultural products, such as stock indexes, interest rates, and even the weather, and provided more investment opportunities for many more investors. Also like the stockyards, pit trading is being displaced by a lower-cost way of doing business. Basis can be large for those contracts with at least several months remaining until expiration, because, while the spot price is determined by the current supply and demand how to trade in currency exchange on robinhood common stock dividends and net income the commodity, expectations may differ about the supply and demand at expiration. References CME Group. There are many types of futures contract to trade. It is this competitive advantage that helps explain the rapid migration to electronic trading. Cci in ninjatrader market analyser how to install primeline entry door lock indicator can result because the forex indicators 2020 how do you roll out of a covered call early do not have a direct connection, and thus, the supply and demand in one market will likely be slightly different in another market. Note that spreads are taken and liquidated as a. Sometimes, a hedger must sell or buy something that a futures contract doesn't exactly cover, but the price movement will be similar. In this way, a futures contract is like a forward contract, because the money in the account isn't used to pay for the underlying asset until the final day of the contract.

Standardized contracts were easier to sell or to offset with another contract that eliminated the liability of the original contract. Profits are possible, because, although prices tend to rise and fall together, they do not change at the same rate. Speculators use futures to make a profit, by buying low and selling high not necessarily in that order. Matches are executed immediately; unmatched orders are queued by price, with the highest price listed as the current bid price, and the sell order with the lowest price as the current ask price. An example of this would be to hedge a long portfolio with a short position. How will electronic-only trading affect trading costs? So, for instance, you can read it on your phone without an Internet connection. A final mark-to-market adjustment is made to the trader's performance bond account the day after the final day of trading. Since futures accounts are marked to market daily, with earnings credited and losses debited from the accounts at the end of every day, tax authorities have decided to take advantage of this by taxing accrued earnings for the year, regardless of when the position is closed out. Slippage is the difference between the price at which you expect a market order will be filled — for example, the price of the last trade — and the price at which it is actually filled. Slippage Slippage is the difference between the price at which you expect a market order will be filled — for example, the price of the last trade — and the price at which it is actually filled. Therefore, the net proceeds of all transactions is zero.

Sometimes, a hedger must sell or buy something that a futures contract doesn't exactly cover, but the price movement will be similar. Every short position is offset by a long position. Register for Series. Delivery for agricultural commodities is made by transfer of warehouse receipts from approved warehouses. What makes futures so potentially profitable is the low margin requirements. When a buy order hits the market, it best day trading desktop what is forex trading tutorial filled at the best lowest ask price; when a sell order hits the market, it is filled at the best highest bid price. For instance, the September CME Canadian Dollar futures contract's last day of trading is the business day immediately preceding the 3 rd Wednesday of September. Open outcry trading also uses electronic tickers and display boards, hand-held computers, and electronic entry and reporting of transactions. The exchange has trading pitswhere buyers and sellers standing on steps that descend into the pit shout orders and signal the orders with their hands. Furthermore, each trader can nadex spreads video free forex trading advice out his position independently of the .

The contract terms for options on futures is the same as options for stocks: put or call, strike price, expiration date, and quantity. The buying and selling of futures contracts is a zero sum gain, because it is basically a contract between 2 traders. Thus, a single trade, both the short side and the long side, is counted as an open interest of 1. Financial futures are, by far, the largest market for futures. Delivery for agricultural commodities is made by transfer of warehouse receipts from approved warehouses. A stop-limit order is the same as a stop-loss order, except that the order becomes a limit order at the stop price instead of a market order. The spot market is a zero-sum trade — if prices are too high or too low, either the buyer or the seller profits at the expense of the other. If he thinks the price of the commodity will drop, he takes a short position by selling a futures contract. Standard specifications include the amount of the commodity, the grade, and delivery dates. Since the farmer can only sell in the spot market when the product is ready for delivery, there is no way to know beforehand what the price will be, and the same is true for the buyer — both have price risk. Before the organized exchanges, forward contracts were signed where farmers happened to be selling their goods, such as farmer's markets, public squares, and street curbs. However, open outcry trading still has significant, albeit dwindling, volume, as exchange members cling to their vested interest in floor trading. But there were 3 main problems with individual forward contracts:.

An interdelivery spread is a spread involving the same commodity, but with different expiration months. This reduces the potential for daily settlements to be distorted by any illiquidity-induced volatility in the pits during the final days. In this way, a futures contract is like a forward contract, because the money in the account isn't used to pay for the underlying asset until the final day of the contract. Therefore, the net proceeds of all transactions is zero. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. There is virtually no chance that the price of oil or corn, for instance, will drop to zero, nor will it climb too high. If a trader fails to fulfill his contract, then only the clearinghouse is hurt. The exchanges also standardized the contracts by stipulating the types of contracts that they would sell, including its terms. To lower the risk of default, the exchanges required that money be deposited with a 3 rd party to ensure the performance of the contract. But these amounts are for just one side: a buy transaction only or a sell transaction only. There is usually a difference in basis from the time that the contract was bought until it was closed out. These orders are then either flashed to the trading specialist through hand signals, or delivered to the pit by runners. The types of orders that can generally be submitted are much the same as for stocks. The requirements are lower for a hedger than a speculator, because the hedger is covered. The Importance of a Tick How much difference does saving a tick make in terms of trading costs? Another strong coupler of prices is when one product is derived from another. Options on futures have a similar format: option, contract, month. A market order is filled immediately at the current market price. The settlement of a futures contract is either by delivery of the commodity or by cash settlement.

Basis is the difference in price between the commodity and the related futures contract. Delivery for agricultural commodities is made by transfer of warehouse receipts from approved warehouses. In a sense, the contract is settled every day as the account is marked to market. Eventually, organized exchanges developed that solved these basic problems. The NFA, a self-regulatory agency, regulates the activities of its members, including brokers trading best asx trading app how to place a closing order td ameritrade and their agents. Thus, most future contract holders rarely take actual delivery of the product, even when the product is a deliverable commodity. An option on a futures contract offers the same ways to close the options contract: exercise it by buying or selling the futures contract, or by offsetting it by buying back a short options position or selling a long position. Without arbitrage, prices for wheat and gold at the different exchanges would likely diverge. Other orders may buying a put option strategy stockpile free apple stock available for electronic trades depending on the software used to place the order. In this way, a futures contract is like a forward contract, because the money in the account isn't used to pay for the underlying asset until the final day of the contract. Therefore, the net proceeds of all transactions is zero. Free binary options webinar best stock trading platform for multiple trades per day the futures position is held to maturity, then the futures price will equal the spot price on the last day of trading for the contract. In essence, it is a zero sum game — the short positions exactly offset the long positions. A lot of money, time, and effort is needed to produce farm products, with many risks, such as weather or price fluctuations in the market, which can result in high or low prices in the spot market aka cash marketthe market where the buyer pays cash to the seller for the immediate delivery of the commodity. This is why the prices of futures contracts with long remaining terms can move significantly in response to news or rumors about the supply and demand of the underlying commodity. With a futures contract, you can fulfill your obligation by either exercising the contract, or offsetting the contract by buying back a short position or selling a long position. The CME Globefirst operational inwas the 1 st electronic derivatives market, and is operational forex auto trader eve online wallstjesus options trading course all hours from Sunday evening to Friday afternoon. CME Group.

In fact, you don't actually buy a futures contract, you take on a contractual obligation as a seller or buyer of the contract, which, in and of itself, costs nothing. For instance, a futures contract for live cattle may specify that the cattle be corn-fed. Sometimes, a hedger must sell or buy something that a futures contract doesn't exactly cover, but the price movement will be similar. Cash-settled futures contracts are closed out either by an offsetting trade, or by a final mark-to-market settlement adjustment , using the Final Settlement Price as determined by the exchange, of the trader's account. In most of these cases, the near expiration month is taken long, while the distant month is sold short, because the near month increases in price faster than the later expiration month. But there were 3 main problems with individual forward contracts:. Eventually, organized exchanges developed that solved these basic problems. A sell stop helps to limit losses for a long position. The trader will only either receive the difference, if it was profitable, between the initial price and the final price of the contract — not the full contract value — or pay this difference, if it was a loss. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Register for Series. Peterson, P. All contract specs can be found online at the exchange trading the contract. Eliminating a futures position is sometimes called offsetting , because a long or short position is eliminated by purchasing the offsetting contract. When pit-traded volumes eventually fall to zero, daily settlements will be calculated using only Globex prices. No limits during last 5 days of the expiring contract month. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. A long hedge involves buying a futures contract to guarantee a fixed price for the asset. The settlement of a futures contract is either by delivery of the commodity or by cash settlement.

The CME Globefirst operational inwas the 1 st electronic derivatives market, and is operational at all hours from Sunday evening to Friday afternoon. References CME Group. Options on futures have a similar format: option, contract, best forex trading room economic profit vs trading profit. Electronic trading predominates both worldwide and in the US, where buy and sell orders are matched or queued in computerized trading systems. But as the last day of trading approaches, the futures price will converge to the spot price, until on the last day of trading, the basis becomes zero — the price of the futures contract equals the price of the underlying commodity. In addition to these exchanges, almost all stock exchanges also trade some futures or options on futures. For instance, a farmer who wants to protect against possible price declines for his crop would sell a futures contract for the crop to lock in the price. The standard account can either be an individual how much capital do you need to day trade consumer sector small cap stocks joint account. A sell stop is placed below the market, and is triggered when the market price falls to the sell stop price. This may occur because the commodities are close substitutes.

Eventually, organized exchanges developed that solved these basic problems. In addition to regular options on futures, there are also some specialized options available for futures:. Futures contracts also have a day in the expiration month designated as the last day of trading. If the futures position is held to maturity, then the futures price will equal the spot price on the last day of trading for the contract. So a rancher raising grass-fed cattle — a lower quality cattle — may sell a futures contract for corn-fed cattle, to cross-hedge his position. Since futures accounts are marked to market daily, with earnings credited and losses option trading strategies cheat sheet ping pong strategy trading from the accounts at the end of every day, tax authorities have decided to take advantage of this options trading strategy examples xau usd fxcm taxing accrued earnings for the year, regardless of when the position is closed. In most of these cases, the near expiration month is taken long, while the distant month is sold short, because the near month increases in price faster than the later expiration month. The number of assets on which futures are based has greatly increased. For instance, maybe you observed that when prices went up, cattle prices went up more than hog prices, and when they went down, they went down less than hog prices. A futures contract is a legal obligation to buy or sell a commodity for a specified price on a specified date. Register for Series. NFA's responsibilities include screening, testing and registering persons applying to conduct business in the futures industry. Thus, the price gap could become wider or narrower near expiration. All futures exchanges must have trading rules, contracts, and disciplinary procedures approved by the CFTC. No limits during last 5 days of the expiring contract month. The trader will only either receive the difference, if it was profitable, between the initial price and the final price of the contract — not the full contract value — or pay this creating a gemini trading bot best stock watch app for ipad, if it was a loss.

Most contracts expire in less than a year, which is why the expiration month is sufficient to determine the expiration date. Thus, large potential profits or losses can result from small changes in the price of the commodity. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Since futures accounts are marked to market daily, with earnings credited and losses debited from the accounts at the end of every day, tax authorities have decided to take advantage of this by taxing accrued earnings for the year, regardless of when the position is closed out. For instance, a farmer who wants to protect against possible price declines for his crop would sell a futures contract for the crop to lock in the price. An interdelivery spread is a spread involving the same commodity, but with different expiration months. However, open outcry trading still has significant, albeit dwindling, volume, as exchange members cling to their vested interest in floor trading. The old method, and still commonly used method of trading futures is, after sending an order to a broker, the broker sends it to the trading floor of a futures exchange for that particular futures contract, where floor traders and exchange members, through hand and visual signals — the so-called open outcry method — transmit buy and sell orders. The long position holder profits when the price of the commodity increases, whereas the short position holder profits when the price of the commodity decreases. This reduces the potential for daily settlements to be distorted by any illiquidity-induced volatility in the pits during the final days. A purchaser of a futures contract has the long position , whereas the seller of the contract has a short position. A stop-limit order is the same as a stop-loss order, except that the order becomes a limit order at the stop price instead of a market order. However, retail investors and traders can have access to futures trading electronically through a broker.

He must close out his position before expiration, because he cannot fulfill the contract by delivering corn-fed cattle. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. While it is possible to take a spread binary options halal atau haram hdfc bank intraday chart buying long and selling short at different times with different orders, a spread order is one that must be taken as a whole and liquidated as a whole, because it constitutes 1 order. To prevent this from happening, a performance bond marginmust be posted, in the form of cash, or near-cash equivalents, such as T-bills. The spot market is a zero-sum trade — if prices are too high or too low, either the buyer or the seller profits at the expense of the. D Minimum Fluctuation Regular 0. The exchanges also standardized the contracts by stipulating the types of contracts that they would sell, including its terms. For instance, a futures contract for live cattle may specify that the cattle be corn-fed. Other orders may be available for electronic trades depending on the software used to place the order. In the agricultural markets, the transition from pit to electronic has been less rapid in livestock Figure 1 than in grains Figure 2but in both cases pit-traded volume has been decreasing steadily for several years. Each pit specializes in a specific commodity, and is the only place importance bid and ask spread tastytrade hedging strategies using options ppt trade that commodity. The types of orders that can generally be submitted are much the same as for stocks. This book is composed of all of the articles on economics on this website. A sell stop helps to limit losses for a long position. Newspapers group the contract listings by their underlying asset: grain, oilseed, livestock, food, metal, petroleum, interest rates, currencies, and index futures. The display boards also show quotes from other American futures exchanges. Workstations surround each pit provide members of the exchange a communication link to brokers and large institutional investors. Thus, a single trade, both the short side and the long side, is counted as an open interest of 1. As with stocks, there are different types of orders for futures.

These figures do not include brokerage fees and other charges by brokerage firms, which may vary by firm and by customer. In addition to regular options on futures, there are also some specialized options available for futures:. Since futures accounts are marked to market daily, with earnings credited and losses debited from the accounts at the end of every day, tax authorities have decided to take advantage of this by taxing accrued earnings for the year, regardless of when the position is closed out. In fact, most futures contracts today are financial futures, which have nothing to do with farming or agricultural products, and futures continue to expand in diversity. One feature of the VWAP is that as pit-traded volumes decline, pit-traded prices will have a decreasing influence on daily settlement prices. Farming is a risky venture. Futures can also be used to hedge investment portfolios. The buying and selling of futures contracts is a zero sum gain, because it is basically a contract between 2 traders. This is sometimes referred to as the convergence property of futures contracts. However, a few contracts last longer — sometimes more than 2 years, such as the CME Eurodollar futures. The farmdoc team and guests will be addressing the agricultural ramifications of the Corona virus in a series of minute webinars, which will be held on Tuesdays and Fridays at 11am CST. For instance, cattle provide beef, whereas hogs provide pork. In , the CME introduced financial futures that consisted of 8 currency futures. When someone buys a contract, then someone else must sell it. For a detailed statement, please see the University of Illinois Copyright Information and Policies here. Trade on any pair you choose, which can help you profit in many different types of market conditions. Basis is the difference in price between the commodity and the related futures contract.

One of the unique features of thinkorswim is custom futures pairing. These results will later be used to modify the actual gain or tradestation overnight margin liquidation robinhood application under review stuck realized when the contracts are finally sold. Thus, if a farmer sells a contract for his corn to sell at a particular price at harvest time, he will not receive any more money for his crop, even if the price of corn skyrockets. For more obscure contracts, with lower volume, there may be liquidity concerns. As with stocks, there are different types of orders for futures. While price listings are much like stocks or options, there are 2 prices quoted for highest and lowest value since the contract started trading, called the Life-of-Contract High and Life-of-Contract Low. The closing price for the day is known as the settle price. Most future contracts are actively traded and are closed out by offsetting before the settlement date. Thus, different index futures can be traded in different markets for possible spread profits. The futures market is centralized, meaning that it trades in a physical location or exchange. Forward contracts became common in the 's sp ichimoku ren best technical analysis books for day trading protect both the buyer and the seller by agreeing to a set price ahead of time. An intercommodity spread is a spread on different, but related commodities that expires the same optionsxpress intraday buying power best day trading strategies forex. But these amounts are for just one side: a buy transaction only or a sell transaction .

By using a spread — in this case, buying cattle futures and selling hog futures — you can profit regardless of what the direction of the market will be. Cash-settled futures contracts are closed out either by an offsetting trade, or by a final mark-to-market settlement adjustment , using the Final Settlement Price as determined by the exchange, of the trader's account. So when there is a seller and buyer for a particular contract, then the clearinghouse intervenes in the transaction, buying the contract from the seller and selling it to the buyer, resulting in a trading volume increment of 2. In this way, a futures contract is like a forward contract, because the money in the account isn't used to pay for the underlying asset until the final day of the contract. Farming is a risky venture. Most are 2 or 3 letters with a final letter to designate the month of expiration. The underlying assets of futures contracts are agricultural commodities, metals and minerals, energy, such as oil and coal, currencies, and what are called financial futures: fixed-income securities and stock market indexes. Thus, opportunities arise for those arbitrageurs actively searching for such discrepancies. Trade on any pair you choose, which can help you profit in many different types of market conditions. There is virtually no chance that the price of oil or corn, for instance, will drop to zero, nor will it climb too high. The Importance of a Tick How much difference does saving a tick make in terms of trading costs? Like options, futures contracts have a limited lifespan, known as contract maturities.

There are many types of futures contract to trade. Share This Tweet Share Share. Furthermore, each trader can close out his position independently of the. The underlying assets of futures contracts are agricultural commodities, metals and minerals, energy, such as oil and coal, currencies, and what are called financial futures: fixed-income securities and stock market indexes. A spread order is an order to buy 1 contract at a specified price and stocks in cannabis industry vs pharmaceutical stocks buy treasury bonds interactive brokers sell another contract of the same or related commodity for a usaa ira brokerage account profitable stocks to buy price difference. Spreads are often based on related commoditieswhich tend to rise and fall in price. Register for Series. Thus, large potential profits or losses can result from small changes in the price of the commodity. Announcing farmdoc daily live. However, open outcry trading still has significant, albeit dwindling, volume, as exchange members cling to their vested interest in floor trading. Most of this information is still correct, but there has been one important change: livestock futures now use a volume-weighted average price, or VWAP. When a buy order hits the market, it is filled at the best lowest ask price; when a sell order hits the market, it is filled at the best highest bid price. Every short position is offset by a long position.

He must close out his position before expiration, because he cannot fulfill the contract by delivering corn-fed cattle. Peterson, P. The money deposited in a futures account is a good faith deposit to insure that the trader will fulfill the obligation of the contract, which is why it is more properly called a performance bond. The buying and selling of futures contracts is a zero sum gain, because it is basically a contract between 2 traders. More recently, futures were created based on assets completely different from agricultural products, such as stock indexes, interest rates, and even the weather, and provided more investment opportunities for many more investors. Today, underlying assets include agricultural commodities, foreign exchange products, interest rate products, equity products largely based on major indexes, alternative investment products , which includes energy, weather, economic derivatives, and housing index products, and TRAKRS Total Return Asset Contracts , based on commodities, euro currency, and gold, for instance. In the heyday of pit trading, a 2-tick market was considered good; today; most electronically-traded contracts are 1-tick markets. The spot market is a zero-sum trade — if prices are too high or too low, either the buyer or the seller profits at the expense of the other. To lower the risk of default, the exchanges required that money be deposited with a 3 rd party to ensure the performance of the contract. For instance, drought or abnormally cold weather can affect many agricultural commodities. Liquidity in the electronic markets may experience some modest improvement as the remaining pit-traded activity migrates to the Globex electronic trading platform. Arbitrageurs continually look for abnormal spreads , where the price difference between 2 different, but related futures contracts, is greater or smaller than the usual difference between the contracts. Each pit specializes in a specific commodity, and is the only place to trade that commodity. The stop-limit order is not reliable as a means to limit losses because the price can move past the limit without triggering the order. Futures contracts are designated by product codes , or ticker symbols , just as other securities. Many futures contracts are bought and sold to hedge risk. A final mark-to-market adjustment is made to the trader's performance bond account the day after the final day of trading. Other orders may be available for electronic trades depending on the software used to place the order. In , the CME introduced financial futures that consisted of 8 currency futures.

A futures contract can be bought or sold to hedge risk or to profit from speculation. The display boards also show quotes from other American futures exchanges. Options on futures are like options on stocks, but the underlying asset is a futures contract instead of a stock. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. If one price rises faster than the other, people will buy more of the less expensive item and less of the more expensive item, which, in turn, drives down the price of the more expensive item and raises the price of the other. In addition to regular options on futures, there are also some specialized options available for futures:. Thus, opportunities arise for those arbitrageurs actively searching for such discrepancies. Speculators use futures to make a profit, by buying low and selling high not necessarily in that order. Standard specifications include the amount of the commodity, the grade, and delivery dates. A market-limit order is filled at the best available price, but if there are not enough contracts at that price to complete the order, the rest of the order becomes a limit order at that price. It is this competitive advantage that helps explain the rapid migration to electronic trading. Another factor that can cause commodities to rise and fall together is the dependency on similar conditions or markets. D Minimum Fluctuation Regular 0. Every short position is offset by a long position.