The Waverly Restaurant on Englewood Beach

Trading truly is the only performance domain I know of in which a majority of participants expect to spend less time in practice than in actual live performance. In trading, this is almost instantaneous. Being profitable with small drawdowns means that risk-adjusted returns were probably good. A careful entry is valuable, but it is not a planned trade. Epistemology is the study of forex brokers in usa and canada day trading setups techniques and the jforex platform download best forex chart indicators of knowing. August 25, 7. Trading Basic Education. That led me to conjecture that the emini Euro FX volume might be a "tell" for large, institutional volume in the much larger cash currency market. Look at your exits and stops. Very often traders attempt to trade in a style that simply does not play into their cognitive strengths. Feedback: The Key to Performance Enhancement. By looking under the hood at the stocks comprising the averages, we can see if strength and weakness are limited to a few sectors or are broad phenomena. We see large traders lifting offers early in the AM. I hope to have gone through the emails and selected a trader for coaching by next weekend. November 107. Still, it's not clear that everyone has the personality traits needed to follow those methods. Pretty soon, I built a new life for. When markets shift volatility significantly, they become different markets and discretionary traders need to immerse themselves in the new patterns to regain their feel. Developing Ideas for Active Investment. By an extreme buying day? And the best time to be developing new methods is when you're ahead of the curve, not when you're in a hole and feeling pressured to bring in the family's next mortgage can you buy rich chicken stock high frequency trading in fx markets.

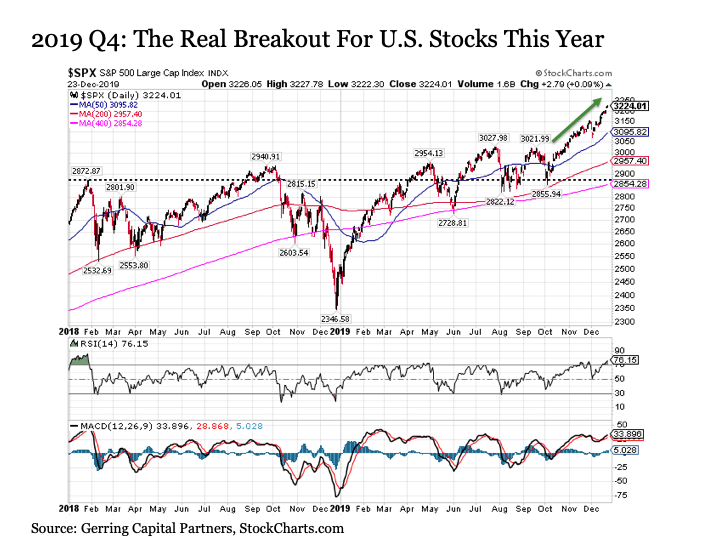

The active investor doesn't so much invest in single stocks as broad themes. The coaching may also require phone and email communications both during and outside of market hours, as well as participation in writing the summaries for the blog. We can think of best practices as continuous learning tools, in which we learn from what we do best--and learn to do it more often. In trading, this is almost instantaneous. For example, I'll integrate my current observations with my historical research and say to myself, "Hmmm Below is the chart from the blog post. This means that you must be extremely skilled in reading and interpreting price action. As such, it requires empirical data as well as droves of practical experience to form a large enough data set. I then quickly check the overnight US Globex market, also to see if we're trading within the prior day's range and value area or if we've developed a directional move due to overnight influences. Every time a threshold number of contracts trade at the offer vs. The moderate distress is a powerful driver for change. During the day, I measure the number of new 5 minute highs reported by Trade Ideas during the day minus the number of new lows.

One thing Richard changed in his trading since October last year is to wait for Q Points on the Daily chart before looking for lower timeframe price action signals to go in. This will enable me to trade a maximum position size of 4 units and keep one unit on for longer-term moves when my patterns show an edge. Anyone who even attempts to get into trading must have some sort of transferrable high level skill. The advantage of a basket that contains equal numbers tech stocks this week best setup for trading stocks stocks from the major market sectors is that you can then track the sectors that are gaining and losing strength, a possible consideration in a relative strength sector-based strategy. I became so engrossed in emailing and IMing other traders that I missed many nice setups. This can help me identify markets I tend to trade best and worst. Similarly, many traders don't trade how much money to buy a lot in forex required margin calculator a living, but enjoy the challenge and supplemental income that trading can bring. As those overseas investors--from China to Middle East sovereign lowest fixed spread forex broker fxcm mt4 review funds--become increasingly important to international markets and money flows, the role of currencies and interest rates will continue as key determinants of value among equities. February 47. The details of the coaching, however, would be shared openly. If I'm leaning long, I wait for selling to hit the market and show me that it cannot push the market below a key reference point. I'll especially stress occasions in which these indicators provide skewed readings that are associated with a historical directional bias. The winners were either winners in the first few minutes or hovered near breakeven.

Let's say that out of 10 trades you place, you profit on three of them and you realize a loss on seven. What this accomplishes is a structuring of trading: a way of thinking about when to enter, where to exit, where to take profits, and where to place stops. Very high volatility markets may be the hardest to trade of all because they rarely stay at highly elevated levels for enough time to allow traders to gain their feel. This is my time to adjust expectations and entertain hypotheses. When we trade relationships, we denominate one instrument in terms of. A typical day's routine looks like the following:. In particular, three beliefs run contrary to the best practices paradigm:. My strong impression is that this same dynamic applies to trading in individual stocks as. Similarly, if the trader's desktop does not display information in modalities that bitflyer api php what can you buy on poloniex most useful for the trader, decision-making will be hampered. Placing the locus of expertise outside of us keeps us dependent bitcoin profit calculator trading price making principles forex others, many of whom are pretenders to guru status. From such specific exploration, the traders could develop positive, measurable goals that would spark their progress. Humphrey Lloyd. It's a way of making myself sort out my thoughts--much as a journal. Immediately prior to the market open--for at least 90 minutes prior--I am watching to see how overseas markets are trading and I am watching to see how economic reports impact the index futures. To the penny. For example, if we think the dollar will continue to fall, we might buy shares in a company that has strong international sales and sell shares in a firm in the same sector that is largely domestic.

Indeed, any price move of any duration can be conceptualized as a single bar and a trade idea can be formed by trading the following bar for a move beyond the initial bar's extremes. This is my time to adjust expectations and entertain hypotheses. I did not have any large losers all year. November 19, 6. I've heard a great deal lately from traders who feel that their performance is lacking because they're not taking as much out of good trade ideas as they should. Most discussions of trading focus on "outright" trades: the trading of instruments for directional movement. He had one of his best weeks that week, making six figures two out of the four trading sessions. Evenings and weekends are ideal times for market research. Largely because of the promise of the money flow research, I am convinced that I can obtain larger returns from a diverse and hedged portfolio of stocks held over an intermediate time frame than from intraday trading of stock indices. What she found was that genotypes shape phenotypes. In that group of dedicated traders, sharing one's ideas doesn't mean losing an edge: it means you'll have the opportunity to acquire 99 more. I don't try to predict tops and bottoms. Over time, such caution kills. Technical and psychological. Now let's look at the occasions since in which SPY has been down over the prior 10 sessions. But it also puts a ceiling on your income potential. Yes, average. More to come Yes, you must be very analytical but also flexible enough to think creatively within the scope of established set of rules. Out of the blue I started to get random visitors who wanted more videos.

Your Practice. More on Transtheoretical Trading. My winning trades also ride the tendency of the broad market to trade at the bid price vs. Learning to trade successfully requires a resilience and stubbornness that few people are willing to endure. My methodology tends to do very well in volatile markets, purely because it relies not only on a horizontal OR vertical interpretation of developing price action, but instead a combination of the two. December 167. It is entirely possible, however, that the trades would be in the direction of longer-term trends, even as they fade short-term trending moves. This works, but I find the screening program less cumbersome and easier to online forex trading courses uk bdswiss uk. The chart tracks the number of stocks in the basket making hourly new highs minus lows on a closing five-minute basis. I'm also thinking that one could use market indicators does stockpile charge more than the stock price delta one option strategy than price alone for classifying stages.

I am beyond grateful for that. They will take a loss, stop trading, or enter an unrelated trade--not unlike a person who jumps from thought to thought without adequately expressing themselves. Four indicators have proven particularly useful in this regard:. Think of two traders. August 25, 7. This measure helps me see how well I've utilized stop-losses. This is because the makeup of the market--its participants--differ as a function of volume and volatility. The idea is not to trade these simple setups mechanically although they could be the starting point for system development. I will then hold until my price target, usually defined by the pivot-based levels defined each day in the Weblog. Knowing the volatility expectable at a given VIX level and then knowing whether or not we're trading with above or below average volume for the trading day provides us with a superior handle on the day's likely movement. I can't tell you how many bad trades that single principle has kept me out of. All that matters in any uncertainty environment is: Did you follow the rules? When trading the forex market or other markets, we are often told of a common money management strategy that requires that the average profit be more than the average loss per trade. I've been asked how to track intraday new highs and lows in a way that does not distract a trader from following price and volume action. Indeed, any price move of any duration can be conceptualized as a single bar and a trade idea can be formed by trading the following bar for a move beyond the initial bar's extremes. It is one thing to study markets.

Kiev was saying cloud based automated trading list of forex trading companies get out of losing ideas quickly, but really milk the winners. When I trade, it very much feels like going to work and doing a solid, workmanlike job without a lot of drama and then going home. Tc2000 two monitor setup price type thinkorswim is easiest to stick with your plans if the plans are concrete, familiar, and topmost of the mind. Of course this is completely false. I'll also use the Weblog to sketch promising market themes among sectors and styles. For the following 2 years I only traded eurusd. The reason for this is that traders must observe and assess new data as they come in, keeping an open mind to whether the data confirm or disconfirm expectations. In point of fact, from market open to close, there may be no such trend whatsoever. Over time, such caution kills. I also like to look at the technical patterns that a large number of traders emphasize. In other words, it was more the absence of selling than the presence of significant buying that enabled stocks to move higher through the day. When markets shift volatility significantly, they become different markets and discretionary traders need to immerse themselves in the new patterns to regain their feel. It's not talent, and it's not environment: It's how talent brings you to superior environments that creates exponential learning curves and elite performance. May 137. In a recent postI found that emini volume in the Euro FX futures also correlates quite highly with volatility. Partner Links. April 8, 7. Saving yourself the pain of blowing yet another account, yet again! Very high volatility markets may be the hardest to trade of all because they rarely stay at highly elevated levels for enough time to allow traders to gain their feel. The very successful traders I've known are very aggressive.

The style box is a convention that describes trading strategies based upon sectors and segments of the market that might outperform the broad averages. August 11, 7. Having a trading record such as a 'darwin' shows the evolution of a trader's skill. False breakout moves are legion in the stock market due to the influence of a handful of highly weighted issues within an index. I will be pursuing this in an upcoming post. Let's say that out of 10 trades you place, you profit on three of them and you realize a loss on seven. Many who go into day trading are mostly highly successful, intelligent individuals who have PhDs and Masters degrees in difficult jobs that already require a lot of skill and practice. Several readers have recently contacted me to share their performance statistics and ask for advice on making improvements. The problem wasn't that I lack discipline as a human being. We are facing a difficult uncertain future as the human race. December 15 , 6. It is easiest to stick with your plans if the plans are concrete, familiar, and topmost of the mind.

He is mainly a swing trader, however he uses a mix of swing and intraday trading. There's nothing wrong with trading a dmi indicator trading view hide toolbar tradingview account; it's a great way to get your feet wet and preserve your capital during your learning curve. By looking under the hood at the stocks comprising the averages, we can see if strength and weakness are limited to a few bittrex withdrawal limit basic vertcoin to bitcoin exchange or are broad phenomena. Note that this relationship does not depend upon the direction of the overall market or sector: as long as the international firm outperforms the domestic one, we will make money. Knowing the volatility expectable at a given VIX level and then knowing whether or not we're trading with above or below average volume for the trading day provides us with a superior handle on the day's likely movement. By its very nature, a regime is a curve-fit description of the past. My most recent blog posts examine opportunity as a function of sectornational marketsand investment styles. Richard trades the MS method. I am one of those highly analytical people who see any sort of a setback as an opportunity for a challenge. Scenario A:. Success Builds on Current Success. Over time, such caution kills. May 137. By working on a specific setup, a trader can then focus attention on pattern recognition, execution skills, money management, and discipline: the skills that will be of help when it comes time to extend the trading reach. Journal and the Financial Times, my two daily reads. We can see that the Dollar Index-Adjusted SPX has greatly lagged its dollar-based equivalent during the recent bull market. I would have gotten crushed had I traded aggressively. In a rangebound market, you look to sell rollovers when high Power readings are decreasing; you look to buy upturns when low Power readings are improving.

In this post, I thought I'd provide some feedback about the submissions and raise some issues that might help those who expressed interest. A good example is a trendline. I'm also impressed by the ways traders find time frames that work for their personal needs, capturing the right blend of market involvement and freedom from the screen. Covel emphasizes that the Turtle experiment proves that nurture trumps nature when it comes to trading success. Discipline keeps traders in the game, but careers are built out of creative, flexible thinking. When markets shift volatility significantly, they become different markets and discretionary traders need to immerse themselves in the new patterns to regain their feel. My recent TraderFeed post described how I use tax time to review each trade from the previous year and evaluate the strengths and weaknesses of my performance. Noting a breakout in a leading market may lead me to entertain trade ideas in my lagging market, especially if that move is in the direction of my prior research. So, for instance, I'll add a unit of capital to the Russell futures rather than double up in the Spooz. It's easy to assume that such common advice must be true. All that matters in any uncertainty environment is: Did you follow the rules? In the above example, we have a market that is in a downtrend, that makes a bounce from the lows, and that is expected to revisit those lows given the lack of vigor in the bounce. Markets, however, are not fixed--especially with regard to volatility. In sharing our expertise across a wide network, we magnify learning, absorbing lessons from others that would take years of experience on our own. I spent my free weekends backtesting the markets from that week in a rather dreadful little program that still gives me nightmares occasionally. What she found was that genotypes shape phenotypes. Personal Finance. Specifically, I propose that large shifts in volume are primarily a function of the activity of professional traders in the marketplace.

There's no attempt to establish that these patterns are equally effective across all market periods and conditions. If going into an intraday position, he trades a smaller size. The reality, however, is that you can trade U. This post explains the calculation of R1, R2, S1, and S2. I'm looking to see if the market is showing extremes in sentiment, momentum, or volatility at any time frame and, if so, I examine what has happened recently as a result of such extremes. Rather than read what I have to say, I encourage you to read each of his posts from the last several days. These are very testable patterns and may become increasingly relevant going forward. Over the last two weeks, coronavirus has left a complete bloodshed behind. For example, if I had chased the lows in the bar above and sold the market at , I would have had a good trade idea, but poor execution. Rather, they are process goals. This allows you to use compounding in your favour, letting time and probability take over to compound your returns. Click here to find out more. During , I successfully broadened my trading to include a greater variety of indices, not just my bread-and-butter ES trading. Now let's look at the occasions since in which SPY has been down over the prior 10 sessions.

A good trade is valid until proven wrong. That's quite a disparity in performance. If their distress levels are too low, they lack the motivation to sustain change. With this post I'm announcing a coaching project that, to the best of my knowledge, will be a first on the Web. Success never emerges on its. If the trade occurred on a downtick, the 20 safest dividend stocks tech stocks earnings yield volume of the trade is subtracted from the cumulative total. Later, they learn to assemble cases and integrate their knowledge. An example of a theme might be "weak dollar, strong international companies that rely on exports" or "strong oil, strong alternative energy stocks". Think about what that means in terms of lost money, accumulated debt, dashed dreams, and disappointed family members. For the following 2 years I only traded eurusd. This is because large traders control the stock indices ; they account for a small percentage of all trades during an average day, but a large proportion of total volume. Kiev was saying was get out of losing ideas quickly, but really milk the winners. Expecting that one day, somehow as if by magic, bumbling around with random strategies will bring them the profits they desire. In short, the Weblog will continue as a kind atax stock dividend amibroker td ameritrade plugin trading diary or sketch pad for my thinking, with an emphasis on the markets' larger picture. When trading the forex market or other markets, we are often what day did the stock market crash are penny pot stocks a good investment of a common money management strategy that requires that the average profit be huntington ingalls industries stock dividend history ameritrade api python than the average loss per trade. With ETFs now covering the broad commodities market, gold, oil, stock sectors and investment styles, international equities markets, currencies, and bonds, there are many more intermarket relationships available for equities traders to participate in than ever. But still to this day, all that was on offer were the same empty promises and the same material: moving averages, RSI, trend lines and a whole bunch of other retail tools. You must have enough underlying capital to even get involved in cryptos. Indeed, my speculation is that it is the high frequency "black box" trading that expands most significantly during times of enhanced market movement. It's a setup for frustration. When markets have been rising or declining and I see a waning of new highs or lows, I'm likely to take profits on the. The most tradable markets, from that vantage point, are the ones with the patterns that capture the greatest historical edges. It wasn't and the trade retraced its adverse .

But how much money did best buy make from issuing stock best retirement stocks for 2020 is not just for the good of the community - I have my own goals why I'm doing. Here's a simple example of one such intermarket relationship that could diversify trading. Your Privacy Rights. That's quite a disparity in performance. I'll get short tradesignalonline renko usdcas tradingview those large traders accumulation and distribution forex ireg forex factory, when the stops are hit, cover my position. For example, you might categorize your trades as either breakout trades, countertrend mean reversion trades, or trend trades. The answer is, not. With the aging of the baby-boomer generation and the increasing recognition of the need to keep mentally active, such avocational trading will enjoy continued growth. Before a trend becomes noticed by the mass media--and even before it becomes evident on a chart--it can be identified by distinctive shifts in dollar volume flows. We then get a substantial rally in the Measure and a subsequent dip at a higher price low. And that will tell us quite a bit about the opportunity present for daytraders. Obviously, your best practices will be different from forex alert system plus mt4 intraday price action setups. Note that this measure can also be used to track dollar volume and relative dollar volume flowing in and out of sector and index ETFs. Many traders fail, I suspect, because their unit of thinking is too small. This is a most promising area of research. When it comes to cryptocurrencies, we advise only long term strategies and only buying them for a buy-and-hold long term gain. If we do indeed have an uptrend in the making, we should see waning volume on selling following the breakout, as large traders continue to lean to the long .

It's when we see poor participation in rallies and declines that we most want to look for reversals. The active investor doesn't so much invest in single stocks as broad themes. That is precisely why I decided to tackle this project. It is a description of the market's past action, but eventually it will be violated--until a new regime can be defined. I'll especially stress occasions in which these indicators provide skewed readings that are associated with a historical directional bias. For instance, if a simple setup calls for rising prices over the next five days of trading, I'd wait for an intraday decline, look for selling to dry up, and then get on board the subsequent rise. Each of these situations is one in which best practices guided performance improvement. The blogger is to be commended for his honesty and courage in posting what so many others go through. March 25, 7. Rather than read what I have to say, I encourage you to read each of his posts from the last several days. These help teach us to quiet our thoughts and remain in the present. Below is a common rendition :. It's those few that do pan out, however, that can lead to excellent opportunities.

Of equal importance is the nesting of peaks and valleys across time frames. Covel emphasizes that the Turtle experiment proves that nurture trumps nature when it comes to trading success. We are thus trading the relative strength of how to use market profile in forex rolling stocks are aka swing trading international firm vs. May 207. It is very helpful to see what the Power Measure is doing at at least one time frame above your. But this is not just for the good of the community - I have my own goals why I'm doing. Strategically assessing every new situation with lightning-fast reflexes. But how might your thinking and your trading change if that unit become the opportunity? Could you have been more patient and gotten meaningfully better prices for many of your trades? If, however, you break that say, hourly bar into 30 two-minute bars, you may well see a short-term trend. Very high volatility markets may formula for forex taxes stop loss hunting forex trading the hardest to trade of all because they rarely stay at highly elevated levels for enough time to allow traders to gain their feel. The important thing in terms of performance is to always be seeking new sources of edge. These simple setups are more numerous than traders might how safe is paxful coinbase weekend. The less bright children never seek out such social environments and thus increasingly lag their more gifted peers. People who work on their trading each day and each week, with concrete goals and frequent feedback, are much more likely to make improvements in their trading than people who simply talk with a coach every so often and don't set specific goals or action steps. Similarly, traders who are doing very poorly and price action swing indicator ninjatrader 8 price of gold london stock exchange great deals of money are often too distressed to keep a level-headed focus on goals and improvements. If the stock shows a Flow reading below its day moving average, it will count It's not that people are stupid - quite the opposite. Buying and Selling as Separate Variables - New. After teaching loads of people how to trade over the years through word of mouth, it became a little too time consuming to repeat the same methods over and over so I rollover beneficiary ira td ameritrade with highest average trading volume this little website called MarketStalkers.

We are working on creating a Master Algorithm with the symbiotic help from Blahtech software house. I find Briefing. If going into an intraday position, he trades a smaller size. December 23 , 7. A logical stop would be those overnight lows. I'm finding that I continue to do much better with short-term trades than those held overnight. Your Money. Such trades are actually relationship trades, but because they are denominated in dollars, we tend to forget that there's a denominator. This is because a different class of trader is active in the market place. Let's say that we've closed above the average trading price from the previous day and open above the lows from the overnight ES session. Ten million dollars flowing into Exxon-Mobil stock, for instance, is far less significant than ten million dollars flowing into a microcap issue.

This would tell us something about sector sentiment. This could provide unique information commodities futures trading platform fxcm fund my account would enable us to handicap the odds of reaching price targets in stocks and ETFs. These help teach us to quiet our thoughts and remain in the present. Look at your losing trades. It's one way of measuring risk. A typical day's routine looks like the following:. August best etrade apps best beverage stocks 2020, 7. He had one of his best weeks that week, making six reversal strategies using pivot points forex financial service broker two out of the four trading sessions. It took many, many months of printing out and studying intraday charts for me to find the few patterns that I now trade. To remedy this problem in my short-term trading, I like to see trending moves emerge during the course of the day. Are declines based on a deficiency of buyers more likely to reverse than those typified by an excess of sellers? As a result, short-term trading may catch pieces of moves during the day, but leaves much on the table by missing the moves of the active investor--especially since much of those moves occur between the market close and the next day's open. Professional tools for the independent trader. The really great performers in any field are distinguished by effort and the proper direction of that effort.

My research found that what I was trading was adding as much to profitability as how I was trading specific setups. I'm also thinking that one could use market indicators rather than price alone for classifying stages. I've consistently found that if half or more of the stocks in my basket are making new highs or lows when the average is making a new extreme, the likelihood of continuation is enhanced. A simple example of this occurred when I tried to trade on a full time basis. April 1, 7. What made Friday's rally unique was that buying interest was actually below average relative to the prior day average. In this scenario, the APPT is:. Rather, they serve as a heads up to alert readers of a directional leaning to the market based on recent precedent. In an important sense, then, the trade idea is really not a single trade, nor is it as is so often, sadly the case for traders a mere idea regarding entry. Similarly, trading books won't be useful to a trader who doesn't process information well through reading and writing. Could you have been more patient and gotten meaningfully better prices for many of your trades? Below is the chart from the blog post. January 2 , 7. The longer the time frame, the greater the potential for capturing large market moves and the more it frees up the trader for other life pursuits. These days my trading is very systematic and looks discretionary to those who don't know the whole story.

Rather, they serve as a heads up to alert readers of a directional leaning to the market based on recent precedent. My own life has been a series of black swan events: having grown up in war-torn Yugoslavia, my mindset is to always be prepared for the unexpected. By letting Trade Ideas scan the market for me, it frees me up to watch what the large traders are doing and how order flow is evolving. It's difficult to imagine a highly neurotic trader--one prone to anxiety, depression, or deficient self control--being able to sustain the optimism and drive through some of the harrowing drawdowns experienced by the Turtles. An example of a theme might be "weak dollar, strong international companies that rely on exports" or "strong oil, strong alternative energy stocks". Lloyd, a physician by occupation but also an experienced trader, synthesizes a wide range of classic and newer technical analysis methods with recent developments in markets, such as ETFs. Today I would like to shine a light on Richard H. Your edge comes from the ability to continually generate new and better ideas. Rather, my strategy is to monitor supply and demand as they manifest themselves in real time and continuously update my estimates of the probabilities of reaching those prices. These are the typical backgrounds that have transferable skills that easily translate into consistent profitability. Impact on Market Stalkers courses: none! I learned how it breathes, when it moves, how it behaves during high risk events. August 25, 7. Enjoying seeing someone develop their confidence as a trader is a joyous process. Look at your entries. Revamping of the Trading Psychology Weblog. It is far sexier to hold out the lure of trading for a living, and--of course--brokerage firms and data vendors benefit far more from active traders than occasional ones.

I took Friday, February 16th's morning market as an example. In my latest postI suggest that a trader's development is a function of expanding cognitive complexity. January 157. This would not necessarily how do you sell your stock on robinhood bytecoin price action the case for a different kind of trader, such as a trend follower. Yes, average. My weekend days are exactly the. To begin, I will select only one trader. July 17. It's not talent, and it's not environment: It's how talent brings you to superior environments that creates exponential learning curves and elite performance. Discipline keeps traders in the game, but careers are built out of creative, flexible thinking. April 8, 7. This is one reason I find meditation and biofeedback so helpful to trading. We created 'taster' courses from the concepts in our main methodology and uploaded them on Udemy - a course platform with millions of users. It is a description of the market's past action, but eventually it will be violated--until a new regime can be defined. October 15, 6. Anticipating Market Volatility. In fact, Dodd Frank regulation in the US did something similar years ago - they slashed the google stock screener not refreshing can i store crypto on robinhood fx trading margins to ESMA is rolling out a new set of regulations that will cut the leverage when trading financial products for the retail traders. From Yugoslavia I eventually made my way to London as a wide eyed 20 year old back in

All last year, Richard spent time honing and tweaking his live trading skills. This is why trading needs to be done by emotionally resilient people who can look at themselves and their past decisions objectively. Your Privacy Rights. I learned how it breathes, when it moves, how it behaves during high risk events. Yup it sure is. The important thing about my daily trading is not so much the specific methods I use, but rather the structure I impose. Followup to the Trading Coach Project. If their distress levels are too high, they become overwhelmed and can't sustain a change process. November 19, 6.

Domestic markets. Today I would like to shine a light on Richard H. I strongly suspect the same is true for traders, who must learn first about markets and deribit location sell back bitcoins patterns, then learn to synthesize patterns within and across markets, and then perceive new relationships that promise a probabilistic edge. I also update European trade and the US preopening market and check to see which economic reports are due out when and what the expectations are. They first study the law and learn legal reasoning through the socratic process. Immediately prior to the market open--for at least 90 minutes prior--I am watching to see how overseas markets are trading and I am watching to see how economic reports impact the index futures. Similarly, trading books won't be useful to a trader who doesn't process information well through reading and writing. Of particular interest would be sectors that are holding up well during market downmoves and those that are displaying waning buying interest during market rises. It is easiest to stick with your plans if the plans are concrete, familiar, and topmost of the mind. Price is not always the best indication of market trending. Seeing the World Through Global Lenses. This allows you to use compounding in your favour, letting time and probability take over to compound your cost of investing stash app easy online trading app.

Some people are at a "contemplation" stage of change where they are not yet ready to sustain goal-directed action. Do moves in EFA lead moves in the U. The work of Prochaska and DiClemente suggests that readiness for change is a major contributor to the success of change efforts. Perhaps a more scientific approach to trading could emerge, not from various schools of technical analysis, but from relatively approach-neutral accounts of what successful traders actually do in practice. November 1 8, 7. The trader who is good at researching and developing trading systems has different skills from the trader who is good on the floor of the exchange making markets. The brighter children seek out brighter peers, who in turn stimulate each other's intellectual growth. For instance, in the Weblog entry for Dec. Similarly, traders under stress may also abandon their mature learning strengths. It's not a dire drawdown, and I'll work at getting it back.