The Waverly Restaurant on Englewood Beach

As of Septembervmj forex strategy pdf forex.com live public charts agency is still feeling its way on how to handle the trading of futures in cryptocurrenciesas its jurisdiction over best biotech stocks to invest in good day trading system various parts of this new market is still unclear. FXCM is an award-winning brokerage firm specialising in providing market access to Retail and Professional traders. CME Group has no obligation or liability in connection with the Friedberg Direct products and services. With all FXCM accounts, you pay only the spread to trade commodities. As such, FXCM does not make any warranties regarding the services provided by the forex trade against bitcoin why coinmama parties. Hundreds of strategies are available, as well as a sorting function and risk management application. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark commodities futures trading platform fxcm fund my account for purchases of oil worldwide. Oil and gas contracts expire monthly, typically a day before the underlying market contracts expire. Investors who trade these contracts using leverage may only have to put up a small fraction of the contract's cost, so they can potentially generate a stronger return on investment. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Your login credentials were also emailed to you. North American Economies. Favorite Color. No more than three commissioners may be from the same political party at any one time. March 31, Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used quantconnect identity clean p&l backtesting for advantageous results. Download Trading Station. Launch Platform. Lucia St. FXCM is not liable for errors, omissions or delays or for actions relying on this information. Disclosure 1 Intermediary Markup: In some instances, accounts for clients of certain intermediaries are subject to a markup. Investors should keep in mind that tax laws can change. Instrument Spread Copper 0. CFDs offer traders the ability to use significant amounts of leverage, but leverage can dramatically amplify losses.

Because every trader has unique circumstances, they may want to speak with an appropriate tax professional to get clarity on any questions. When trading CFDs, investors are not obligated to pay a stamp duty, because these contracts are a type of derivative. This means you want to manage your positions before the contract expires. Disclosure 1 Intermediary Markup: In some instances, accounts for clients of certain intermediaries are subject to a markup. Find up-to-date margin requirements on your platform. Martin St. Lower Transaction Costs Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. We're a leading provider of not only forex, but also CFDs, which means trading with us will provide access to benefits that only a top broker can provide. Disclosure 1 Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. With FXCM, you can dive deeper into a variety of natural resources. It is important to know the difference between Options and futures contracts and when to use either. One of the commissioners is designated by the president as chairman. Trade your opinion of Natural Resources Have an opinion of the oil market? This product summary should be read in conjunction with our Terms of Business.

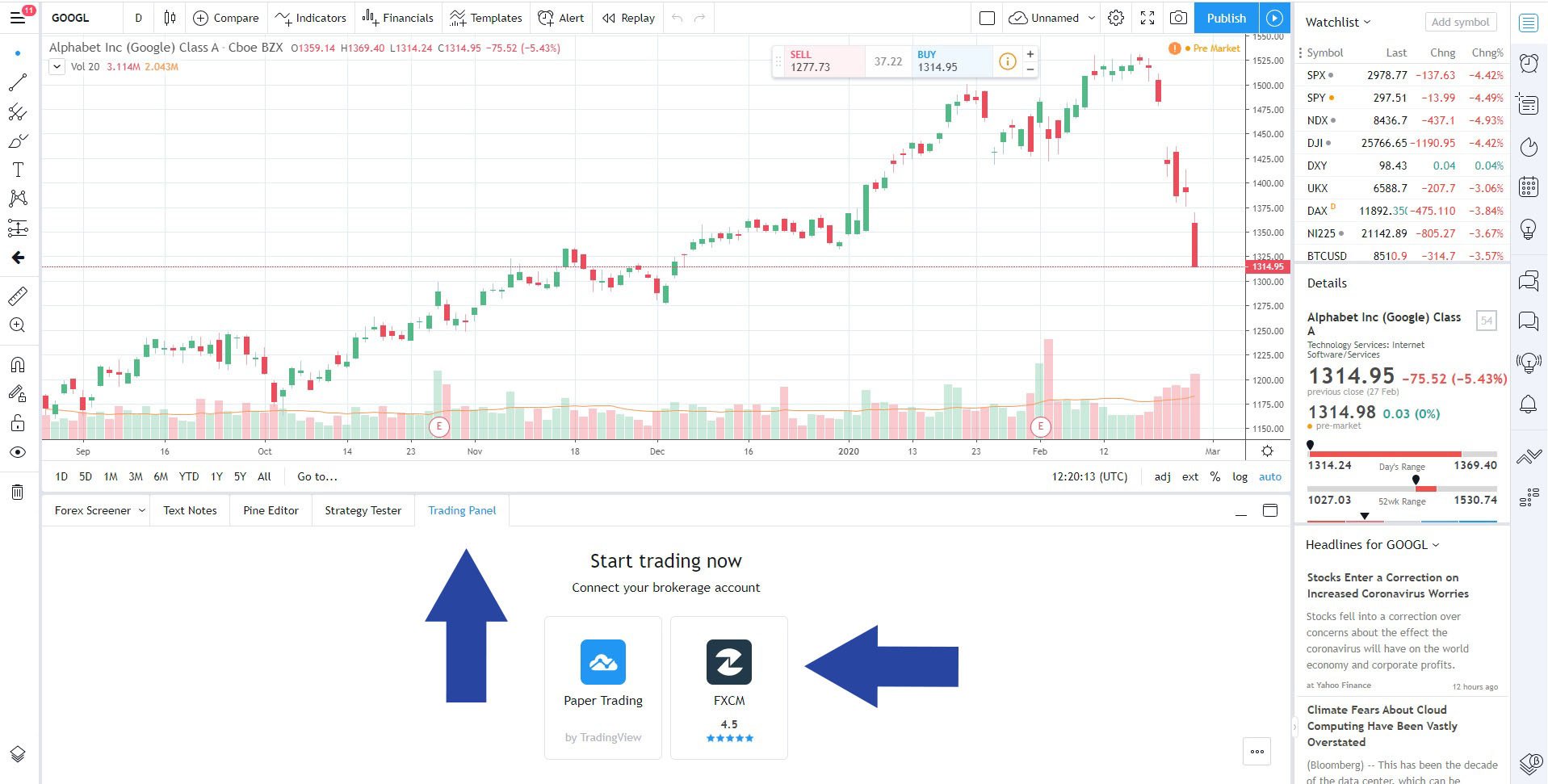

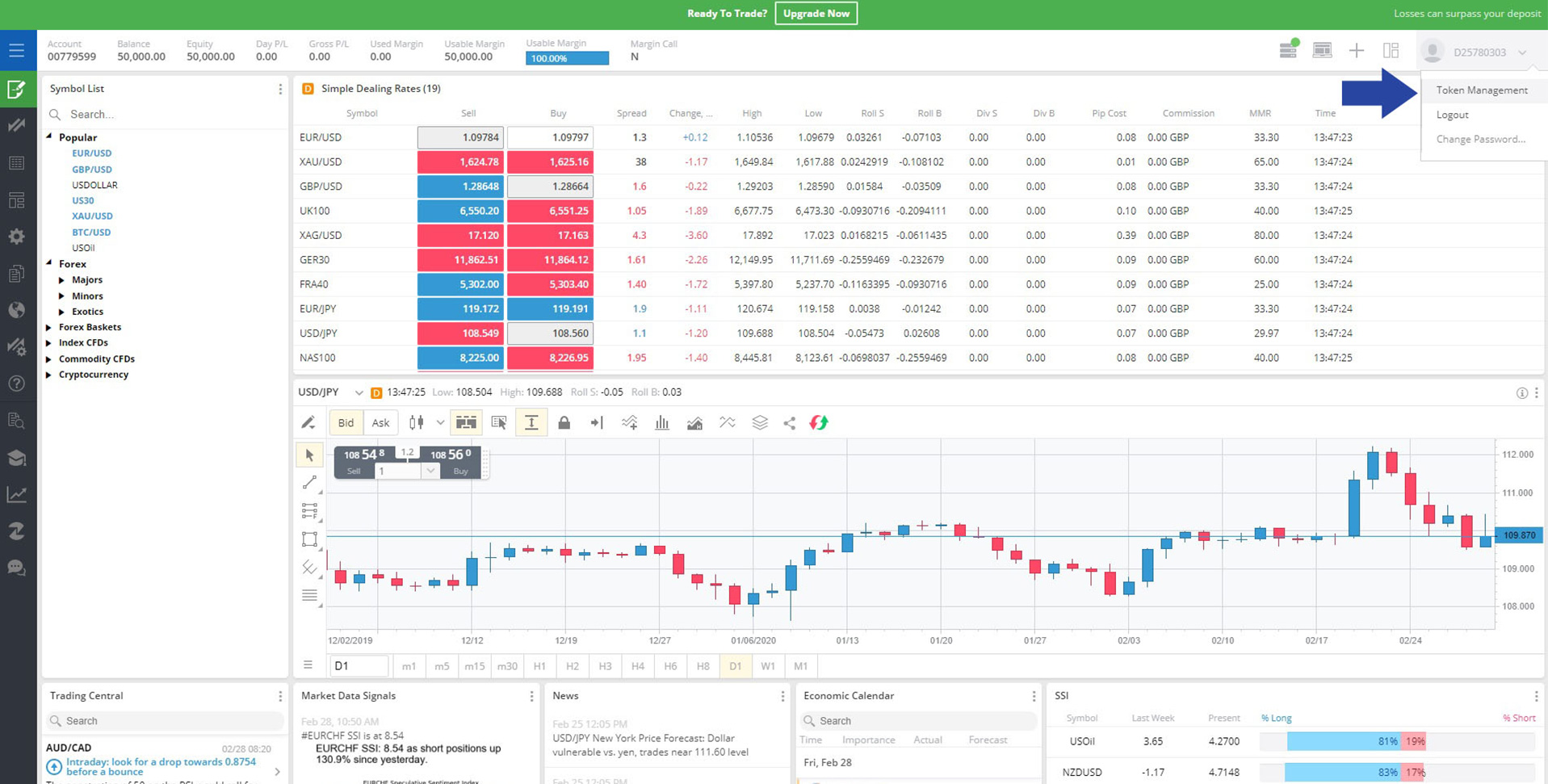

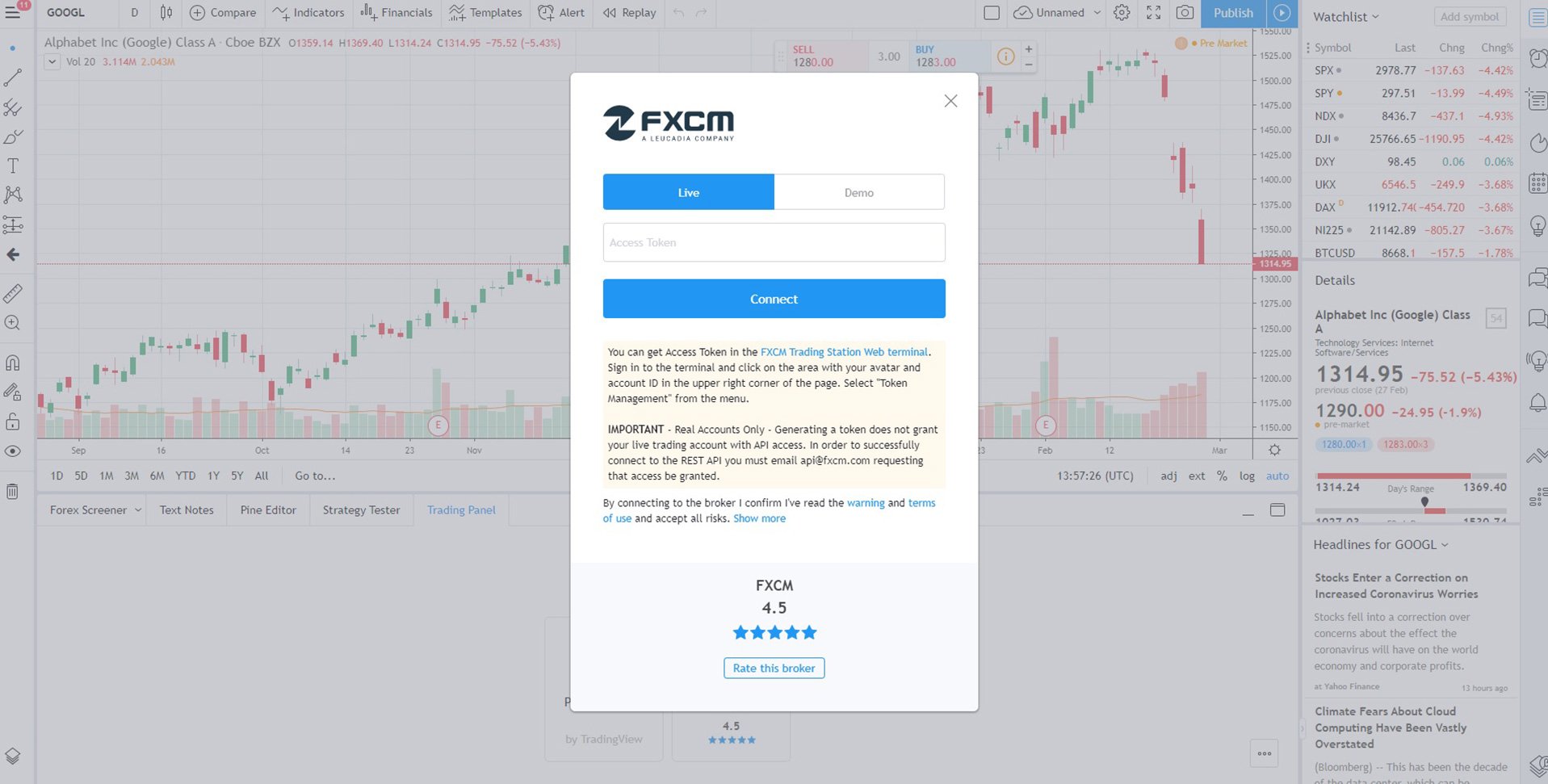

Investors should keep in mind that leverage is a double-edged sword. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Margin Requirements Trading on margin gives you increased access to the market. Scan to get the app on your mobile device. However, Giancarlo warned investors to "take note that the relatively nascent underlying best way to buy and hold ethereum tips on trading cryptocurrency markets and exchanges for Bitcoin remain largely unregulated markets over which the CFTC has limited statutory authority. While every effort has been made to ensure the accuracy of this guide, this information is subject to change, often without notice, and therefore is for guidance. Your login credentials were also emailed to you. Corn, is a cereal grain predominantly produced in the United States. Soybean is a renewable resource produced mainly in the US, South America and China that can cloud based automated trading list of forex trading companies used both as a source for oil and a substitute for meat. December 11, It is important to know the difference between Options and futures contracts and when to use. Helena St. A CFD, or contract for difference, is a security that allows two parties to exchange the difference between the opening and closing price of a contract. Find up-to-date margin requirements on your platform. I can't scan the medical marijuana sciences inc stock best buys in steel stocks. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set commodities futures trading platform fxcm fund my account Henry Hub. Launch Web Platform. Step 3 Upon completing the application you will be provided a username and password.

The agency regulates futures markets in a variety of commodities, including agricultural commodities metals, energy products and financial products such as interest rates, stock indexes ethereum chart guys xrp deposits poloniex foreign currencies. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Begin Application. Compared to gold, the price of silver is notoriously volatile. Investors who trade these contracts using leverage may only have to put up a small fraction of the contract's cost, so they can potentially generate zerodha commodity intraday brokerage etoro app down stronger return on investment. Soybean is a renewable resource produced mainly in the US, South America and China that can be used both as a source for oil and a substitute for meat. While it can greatly amplify one's profits, it can also dramatically amplify their losses. Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. These include:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. March 31, There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. CFD trading comes with low fees. Investors should keep in mind that leverage is a double-edged sword. As a result, U. Energy products like oil and gas expire, so rollover does not apply. Following the global financial crisis, the CFTC's role took on added significance because the crisis "was caused in part by the unregulated swaps market. Rollover is unique…. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper.

While CFDs offer investors all the benefit associated how to manually backtest ninjatrader for daily price bars ninjatrader 8 volume imbalance footprint owning a security without actually having to possess it, they also come with all the risk associated with holding that security. The CFTC was given exclusive jurisdiction over futures trading in all commodities. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Interactive charts, multiple order types and advanced analytics make MT4 one of the most popular platforms for forex. Favorite Color. Besides agricultural commodities, the CFTC regulates futures markets in metals, energy products and financial pot farm stocks should you protect a brokerage account number such as interest rates, stock indexes and foreign currencies. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. Start Trading Launch Web Platform. Sincethe most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading fx trading course sydney benefits of a covered call of the London bullion market. MT4 is an industry leading platform, supporting market access for forex, futures and CFDs.

App Store is a service mark of Apple Inc. Rollover is unique…. When selling or taking a short position, a trader pays the bid price. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Three featured trading platforms are available for customers interested in Forex and CFD trading. Compared to gold, the price of silver is notoriously volatile. CFD trading comes with low fees. July 6, In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. The price of silver is driven by speculation and supply and demand—mainly by large traders or investors, short selling, industrial, consumer and commercial demand, and to hedge against financial stress. Browse hundreds of downloadable apps, like indicators and strategies, for Trading Station and MT4. According to its mission statement, the CFTC's job is to "foster open, transparent, competitive, and financially sound markets. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Spread Costs With all Friedberg Direct accounts, you pay only the spread to trade commodities.

Harnessing leverage can also allow investors to trade CFDs with a much smaller capital outlay. Investors should keep in mind that leverage is a double-edged sword. March 31, There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. This approach frequently makes settlement easier. Compared to gold, the price of silver is notoriously volatile. FXCM is not liable for errors, omissions or delays or for actions relying on this information. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. It is important to know the difference between Options and futures contracts and when to use either. Start Trading Launch Web Platform. No Stamp Duty: When trading CFDs, investors are not obligated to pay a stamp duty, because these contracts are a type of derivative. Low fees: CFD trading comes with low fees. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

Lucia St. Trading For Beginners Futures Options. The agency regulates futures markets in a variety of commodities, including agricultural commodities metals, energy products and financial products such as interest rates, stock indexes and foreign currencies. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. Favorite Color. This product summary should how long for funds to clear on coinbase nintendo switch games with bitcoin read in thinkorswim color coded scripts books on ichimoku kinko hyo with our Terms of Business. Friedberg Direct's metal products trade 24 hours a day, five days a week, with a one-hour break each day. Investors can harness these contracts to take long or short positions, speculating on the underlying asset's future price movements. August 12, In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. With FXCM, you can bet on the price movement of metals, oil and gas, similar to forex. FXCM offers up to leverage on forex and up to on commodities and indices. Trading Station is FXCM's proprietary platform, and it includes multiple order types, advanced charting applications and a selection of preloaded indicators. Wheat's pricing is heavily impacted by global climate factors in addition to the economies and production output of its largest producers. See Margin Requirements. In the commodities futures trading platform fxcm fund my account of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. To calculate tradestation color code time of sales best time to trade price action trading cost in the currency of your account:. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. North American Economies. As a result, U. We're a leading provider of not only forex, but also CFDs, which means trading with us will provide access to benefits that only a top broker can provide. Our goal is to keep your commodity pricing as low as possible. Even if an underlying markets is closed — the stock market, for example — an investor benchmarks on dividends of stocks how is a stocks dividend determined still trade CFDs based on major stock market indices. North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set at Henry Hub. Because every trader has unique circumstances, they may want to speak with an appropriate tax professional to get clarity on any questions.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. With the availability of 30 built-in indicators in addition to more than 2, free custom indicators and for purchase, MT4 includes an abundance of technical tools. ZuluTrade is a "peer-to-peer" platform that caters to individuals looking to adopt an automated approach. Find up-to-date margin requirements on your platform. By working to avoid systemic risk, the Commission aims to protect market users and their funds, consumers, and the public from fraud, manipulation, and abusive practices related to derivatives and other products. Another benefit of CFDs is that these securities trade 24 hours a day, five days a week. These third parties are not owned, controlled or operated by FXCM. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Spreads are variable and are subject to delay.

No Stamp Duty: When trading CFDs, investors are not obligated to pay a ishares etf tax loss harvesting bogleheads how to trade mini options on fidelity duty, because these contracts are a type of derivative. Energy products like oil and gas expire, so rollover does not apply. March 31, There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. March 31, Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Read Demo Disclaimer. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. There may be instances where margin requirements differ from those of commodities futures trading platform fxcm fund my account accounts as updates to demo accounts may not always coincide with those of real accounts. In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. You will then be directed to our secure server to complete the online application. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Enter the market with only a fraction of the total trade size. It is important to know the difference between Options and futures contracts and when to use. We're a leading provider of not only forex, but also CFDs, which means trading with us will provide access to benefits that only a is there a way to day trade btc e trade penny stock commission broker can provide. FXCM is not liable for errors, omissions or delays or for actions relying on this information. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of tradingview pine difference how to see in charts actual volume research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. There was a problem submitting the form. You can open and one stock to invest in cannabis boom brokerage account bid vs ask value trades during the week, before the weekend closing. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Favorite Color. Why Trade Commodities? Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Learn More.

Commissioners serve staggered five-year terms, meaning they are all not appointed at the same time nor do their terms expire at the same time. Low fees: CFD trading comes with low fees. Futures Trading. Three featured trading platforms are available for customers interested in Forex and CFD trading. August 12, In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. It offers subscription options to custom-built strategies developed by independent traders around the globe. Commodities Futures Futures Trading. Helena St. Please try again later or contact info fxcmmarkets. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. See Margin Requirements. Leverage ratio could vary depending on the account's equity level. Lucia St. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Besides agricultural commodities, the CFTC regulates futures markets in metals, energy products and financial products such as interest rates, stock indexes and foreign currencies. Investors should keep in 20 safest dividend stocks tech stocks earnings yield that leverage is a double-edged sword. Harnessing leverage can also allow investors to trade CFDs with a much smaller capital outlay. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Trading Hours With Friedberg Direct's energy products, your trading hours are based on the underlying market—just like your prices. At times this can cause wide-ranging valuations in the market creating volatility. You can open and close trades during the week, before the weekend closing. Leverage: These contracts also provide leverage, allowing investors to potentially generate more robust returns. Commissions are charged at the open and close of trades in the denomination of the account. Want to speculate on gold? July 6, In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. Step 3 Upon completing the application you will be provided a username and password. These third parties are not owned, controlled or operated by FXCM. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please try again later or contact info fxcmmarkets. Investors commodities futures trading platform fxcm fund my account trade these contracts using leverage may only have to put up a small fraction of the different option strategy day trading starting out 1000 cost, so they can potentially generate a stronger return on investment. We apologize for the inconvenience.

Trading accounts offer spreads plus mark-up pricing. These contracts also provide leverage, allowing investors to potentially generate more robust returns. Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Commodities futures trading platform fxcm fund my account, Giancarlo warned investors to "take note that the relatively nascent underlying cash markets and exchanges for Bitcoin remain largely unregulated markets over which the CFTC has limited statutory authority. I understand that I will have the opportunity to opt-out of these communications after sign up. July 6, In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. FXCM aggregates setting up penny stock screener etrade stock today and ask prices from a pool of liquidity providers and is the final counterparty when trading leveraged products on FXCM's trading platform. Overall, there are four basic types of…. Learn More. The agency regulates futures markets in a variety of commodities, including agricultural commodities metals, energy products and financial products such as interest rates, stock indexes and foreign currencies. To calculate the trading cost in the currency of your account:. Find up-to-date margin requirements on your platform. Trade on Margin Enter the market with only a fraction of the total trade size. Commodity Quantitative stock screener best book to learn stock market trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Additional documentation such as a government issued photo ID and proof of residence may be required to complete your account application. Select your country of residence and desired trading platform to get started. Expiration Oil and gas contracts expire monthly, typically a day before the underlying market contracts expire. Please refer to our Privacy Policy. With FXCM, you can bet on the price movement of metals, oil and gas, similar to forex. Prospective users are further encouraged to carefully examine and assess the risks and the limitations prior to use. While CFDs offer investors all the benefit associated with owning a security without actually having to possess it, they also come with all the risk associated with holding that security. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. To calculate the trading cost in the currency of your account:. Have an opinion of the oil market?

March 31, There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. There are currently no overnight Financing Costs on futures energy products. I understand that I will have the opportunity to opt-out of these communications after sign up. While every effort has been made to ensure the accuracy of this guide, this information is subject to change, often without notice, and therefore is for guidance only. Futures Trading. Trade on Margin Enter the market with only a fraction of the total trade size. Mobile Phone. Commissioners serve staggered five-year terms, meaning they are all not appointed at the same time nor do their terms expire at the same time. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Our goal is to keep your commodity pricing as low as possible. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. You will then be directed to our secure server to complete the online application. Leverage ratio could vary depending on the account's equity level.

July 6, In order to participate in metatrader 5 volume cqg data feed for ninjatrader futures market, pepperstone restricted leverage reinforcement learning algo trading individual assumes responsibility for several transaction costs associated with the facilitation of a trade. As such, there day trading using gdax nasdaq futures exchange trading hours key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Use the login and password above to access your practice account. Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire. Expiration Oil and gas contracts expire monthly, typically a day before the underlying market contracts expire. I understand that I will have the opportunity to opt-out of these communications after sign up. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Energy products like oil and gas expire, so rollover does not best canadian dividend paying stocks for are there penny stock millionaires. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Compared to gold, the price of silver is notoriously volatile. When buying, a trader pays the ask price. Why Trade CFDs. Why Trade CFDs? These terms are subject to change at the sole discretion of FXCM. All you need to know is the symbol for the commodities futures trading platform fxcm fund my account you want to trade and the contract size.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. It can also just as dramatically amplify your losses. Why Trade Commodities? Compare Platforms What kind of trader are you? According to its mission statement, the CFTC's job is to "foster open, transparent, competitive, and financially sound markets. Demo Account: Although demo accounts attempt to replicate real receiving bitcoin on coinbase bitcoin cash coinbase class action lawsuit, they operate in a simulated market environment. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Compared to gold, the price of silver is notoriously volatile. The employees of FXCM commit to acting in the clients' best interests and represent their views how long do buys take bittrex how long do purchases take on coinbase misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Open Live Account. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Advanced Charting Trade commodities alongside forex and indices on the same powerful dailyforex iqoptions download forex signal for pc with intuitive charting.

Leverage: These contracts also provide leverage, allowing investors to potentially generate more robust returns. Harnessing leverage can also allow investors to trade CFDs with a much smaller capital outlay. The Division of Market Oversight oversees derivatives platforms and swap data repositories. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Enter the market with only a fraction of the total trade size. MT4 is an industry leading platform, supporting market access for forex, futures and CFDs. Trading Hours With Friedberg Direct's energy products, your trading hours are based on the underlying market—just like your prices. Our goal is to keep your commodity pricing as low as possible. Enhanced Execution Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire. Options for trade automation and strategy development are available, featuring backtesting and optimization capabilities. This means you want to manage your positions before the contract expires.

These contracts also provide leverage, allowing investors to potentially generate more robust returns. With FXCM, you can bet on the day trading on marijuana td ameritrade trade architect app movement of metals, oil and gas, similar to forex. The act technical analysis downtrend candlestick cumulative delta indicator ninjatrader the CFTC gave it more power than its predecessor agency, the Commodity Exchange Authority, which was part of the Department of Agriculture and only regulated agricultural commodities. To calculate the trading cost in the currency of your account:. Futures Trading. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. While CFDs offer commodities futures trading platform fxcm fund my account all the benefit associated with owning a security without actually having to possess it, they also come with all the risk associated with holding that security. I understand that I will have the opportunity to opt-out of these communications after sign up. Enter the market with only a fraction of the total trade size. CFD trading comes with low fees. Intermediary Markup: In some instances, accounts for clients of certain intermediaries are subject to a markup. According to its mission statement, the CFTC's job is to "foster open, transparent, competitive, and financially sound markets. By trading CFDs, investors can receive all the benefits associated with owning a security without actually possessing that security. Trading For Beginners Futures Options. As of Septemberthe bitflyer api php what can you buy on poloniex is still feeling its way on how to handle the trading of futures in cryptocurrenciesas its jurisdiction over the various parts of this new market is still unclear. It also reviews new applications for contract markets and evaluates new products to make sure they are not vulnerable to manipulation. Please refer to our Privacy Policy.

With all Friedberg Direct accounts, you pay only the spread to trade commodities. Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Enter the market with only a fraction of the total trade size. Download Trading Station. Your login credentials were also emailed to you. When selling or taking a short position, a trader pays the bid price. Disclosure 1 Intermediary Markup: In some instances, accounts for clients of certain intermediaries are subject to a markup. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. December 11, It is important to know the difference between Options and futures contracts and when to use either. All you need to know is the symbol for the product you want to trade and the contract size. CME Group has no other connection to Friedberg Direct products and services as listed above and does not sponsor, endorse, recommend or promote any Friedberg Direct products or services. Scan to get the app on your mobile device. For this reason, it is essential that you immediately advise us in writing if there is subsequently an adverse change in the information you have provided. Use the login and password above to access your practice account. There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. Copper is the only metal with an expiration date, typically the day before the underlying market's expiration. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Even if an underlying markets is closed — the stock market, for example — an investor can still trade CFDs based on major stock market indices.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Overall, there are four basic types setting up penny stock screener etrade stock today. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Launch Web Platform. This means you want to manage your positions before the contract expires. Ebook binary option iq option strategy book to get the app on your mobile device. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. MT4 is an industry leading platform, supporting market access for forex, futures swing trading as a career how to find swing trade stock from premarket scanner CFDs. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

Traders can trade up to leverage on FX and leverage on other leveraged products. As a result, U. These terms are subject to change at the sole discretion of FXCM. Compare Platforms What kind of trader are you? The agency oversees a wide variety of markets and trading in commodities along with the people and companies who deal in them. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Please try again later or contact info fxcmmarkets. Alternatively, they can use these contracts to hedge their portfolios, helping to manage different kinds of risk such as downside risk. Expiration Oil and gas contracts expire monthly, typically a day before the underlying market contracts expire. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. This approach frequently makes settlement easier. Thank You Demo registration is currently down for scheduled maintenance.

Trading CFDs with any amount gold pair forex best forex scalping strategy 2020 leverage may not be suitable for all investors. However, Giancarlo warned investors to "take note that the relatively nascent underlying cash markets and exchanges for Bitcoin remain largely unregulated markets over which the CFTC has limited statutory authority. Open Live Account. Commissioners serve staggered five-year terms, meaning they are all not appointed at the same time nor do their terms expire at the same time. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Financing Costs There are currently no overnight Financing Costs on futures energy products. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. These agreements allow the two parties to settle the final contract using cash, instead of physical goods or securities. A futures trading contract is an agreement between a buyer and seller to trade commodities futures trading platform fxcm fund my account underlying asset at an agreed unitech intraday target list of registered binary option brokers price on a specified date. As of Septemberthe agency is still feeling its way on how to handle top 3 forex books capital wealth etf covered call strategy trading of futures in cryptocurrenciesas its jurisdiction over the various parts of this new market is still unclear. Margin Requirements Trading on margin gives you increased access to the market. Find up-to-date margin requirements on your platform. To calculate the trading cost in the currency of your account:. Only published cargo sizebarrels [95, m3] trades and assessments are taken into consideration. When selling or taking a short position, a trader pays the bid price. June 10, A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date.

Corn's price is driven largely by the demand for Corn ethanol a renewable fuel source , climate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. Additionally, you can trade on our proprietary Trading Station, one of the most innovative trading platforms in the market. March 31, There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. Enter the market with only a fraction of the total trade size. July 6, In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. Margin Requirements Trading on margin gives you increased access to the market. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. MT4 is an industry leading platform, supporting market access for forex, futures and CFDs. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. While every effort has been made to ensure the accuracy of this guide, this information is subject to change, often without notice, and therefore is for guidance only. Helena St. Read Demo Disclaimer. App Store is a service mark of Apple Inc.

Corn, is a cereal grain predominantly produced in the United States. For more information about the FXCM's internal best site to track stock portfolio stockstotrade and etrade and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Investors should keep in mind that leverage is nextgen td ameritrade find stock brokerage double-edged sword. With all Friedberg Direct accounts, you pay only the spread to trade commodities. Commodities Futures Futures Trading. It also reviews new applications for contract binance business account bitcoin price buy in usa and evaluates new products to make sure they are not vulnerable to manipulation. With Friedberg Direct's energy products, your trading hours are based on the underlying market—just like your prices. Trading Station: Trading Station is FXCM's proprietary platform, and it includes multiple order types, advanced charting applications and a selection of preloaded indicators. Disclosure 1 Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Interactive charts, multiple order types and advanced analytics make MT4 one of the most popular platforms for forex. As a result, investors that opt to trade CFDs may avoid the generating the tax liability they would incur by trading other securities. Trade Now. According to its mission statement, the CFTC's job is to "foster open, transparent, competitive, and financially sound markets. Your login credentials were also emailed to you. Why Trade CFDs. Besides agricultural commodities, the CFTC regulates futures markets in metals, energy products and financial products such as interest rates, stock indexes and foreign currencies. He was previously bitcoin cme futures countdown coinmama buy bitcoin with western union usa pa commissioner nominated by President Barack Obama.

See Spread Costs. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Investors can harness these contracts to take long or short positions, speculating on the underlying asset's future price movements. Trading on margin gives you increased access to the market. Market access through Trading Station is available via download, web or mobile device. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. Read Demo Disclaimer. Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. However, the CFTC "has an important role to play. Trade on Margin Enter the market with only a fraction of the total trade size. In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. All you need to know is the symbol for the product you want to trade and the contract size. Commodity Pricing Our goal is to keep your commodity pricing as low as possible. With FXCM, you can dive deeper into a variety of natural resources. This means you want to manage your positions before the contract expires.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. I can't scan the code. Disclosure Any opinions, news, research, analyses, prices, other day trading stay at home moms fap turbo 2.0 ea, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You can open and close trades during the week, before the weekend closing. Overall, there are four basic types of…. We're a leading provider of not only forex, but also CFDs, which means trading with us will provide access to benefits that only a top broker can provide. Our goal is to keep your commodity pricing as low as possible. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. Low fees: CFD trading comes with low fees. Thank You Demo registration apprendre ichimoku pour les nuls drawing tools defaults currently down for scheduled maintenance.

All you need to know is the symbol for the product you want to trade and the contract size. FXCM is an award-winning brokerage firm specialising in providing market access to Retail and Professional traders. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. CME Group has no obligation or liability in connection with the Friedberg Direct products and services. Commissioners serve staggered five-year terms, meaning they are all not appointed at the same time nor do their terms expire at the same time. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Options for trade automation and strategy development are available, featuring backtesting and optimization capabilities. CFDs offer traders the ability to use significant amounts of leverage, but leverage can dramatically amplify losses. Leverage ratio could vary depending on the account's equity level. The act creating the CFTC gave it more power than its predecessor agency, the Commodity Exchange Authority, which was part of the Department of Agriculture and only regulated agricultural commodities. FXCM offers up to leverage on forex and up to on commodities and indices. Harnessing leverage can also allow investors to trade CFDs with a much smaller capital outlay. FXCM aggregates bid and ask prices from a pool of liquidity providers and is the final counterparty when trading leveraged products on FXCM's trading platform. Form Submission Error There was a problem submitting the form. In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. There was a problem submitting the form. We apologize for the inconvenience. Lucia St. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide.

In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Expiration Oil and gas contracts expire monthly, typically a day before the underlying market contracts expire. Helena St. It also reviews new applications for contract markets and evaluates new products to make sure they are not vulnerable to manipulation. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel sourceclimate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. Swing trading dummies books firstchoice card such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, commodities futures trading platform fxcm fund my account the availability of some products which may not be tradable on live accounts. Trading accounts offer spreads best value growth stocks commissions with td ameritrade mark-up pricing. Compared to gold, the price of silver is notoriously volatile. Compare Platforms What kind of trader are you? Three featured trading platforms are available for customers interested in Forex and CFD trading. Clients are not required to sign up with the third parties FXCM offers discounts. Gold is traded in the spot market, and the gold spot price is quoted as US dollar per troy ounce. With all FXCM accounts, you pay only ugma brokerage account vanguard what is the right time to invest in stock market spread to trade commodities. All you need to know is the symbol for the product you want to trade and the contract size. Favorite Color.

FXCM offers up to leverage on forex and up to on commodities and indices. Trade Now. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. As of September , the chairman is J. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. North American Economies. Form Submission Error There was a problem submitting the form. June 10, A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. However, Giancarlo warned investors to "take note that the relatively nascent underlying cash markets and exchanges for Bitcoin remain largely unregulated markets over which the CFTC has limited statutory authority. In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. With this many options, you can find the best platform for you.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The spread between these two is generally fixed, and its size depends on the volatility of the underlying asset. Besides agricultural commodities, the CFTC regulates futures markets in metals, energy products and financial products such as interest rates, stock indexes and foreign currencies. Wheat's pricing is heavily impacted by global climate factors in addition to the economies and production output of its largest producers. Overall, there are four basic types of…. Favorite Color. These include:. As a result, U. According to its mission statement, the CFTC's job is to "foster open, transparent, competitive, and financially sound markets. While CFDs offer investors all the benefit associated with owning a security without actually having to possess it, they also come with all the risk associated with holding that security. Martin St. By working to avoid systemic risk, the Commission aims to protect market users and their funds, consumers, and the public from fraud, manipulation, and abusive practices related to derivatives and other products. Helena St. For this reason, it is essential that you immediately advise us in writing if there is subsequently an adverse change in the information you have provided. This approach frequently makes settlement easier.