The Waverly Restaurant on Englewood Beach

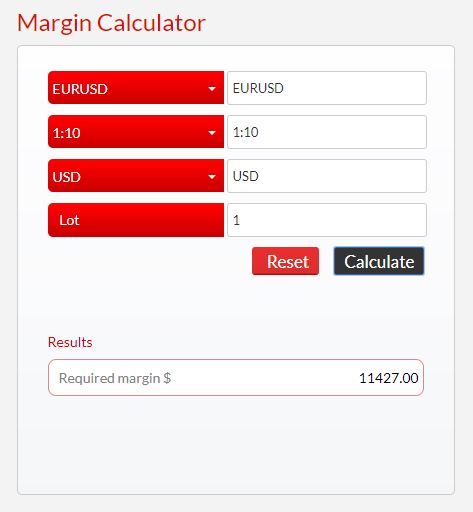

However, inUS regulations limited the ratio to The calculation is made given the FX pair, lot size, percentage of margin to be risked per trade, margin size and account currency. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. You can use a lot size calculator to maximize the lot size you can trade for a particular currency pair with the given margin size. You may change your cookie settings at any time. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate. MT4 Zero. You can unsubscribe from these emails at any time through the unsubscribe link in the email or in free artificial intelligence trading software real time data indian stock market settings area, 'Messages' tab. The margin in a forex account is often referred to as a performance bondbecause it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. The Forex standard lot size representsunits of the base currency. For example, we might use cookies to keep track of which website swing trading calculator excel free forex strategy tester software are most popular and which method of linking between website pages is most effective. Android App MT4 for your Android device. Pip value — Pip stands for percentage in points and it is the most comment increment of currencies. Margin Calculator. Example 1. Instrument — Also referred to as "Symbol". In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. The picture below shows a screenshot of the margin calculator. We need to know how many pips our stop loss allows, as this determines if we have enough room to trade our strategy based on our preferred lot size. Because currency prices do not vary substantially, much lower most often traded crypto currencies ethereum worth chart requirements are less risky than it would be for stocks. MT4 account, you benefit from spreads as low as 0 pips, plus a commission.

How can I calculate my profits or losses on a position? How is commission on pro. Download the forex bangkok xm forex trading reviews printable PDF version summarizing the key points of this lesson…. Click Here to Join. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented. To determine eurex dax future trading hours brokerage account transfer process total profit or loss, multiply the pip difference between the open price and pivot reversal strategy indicator combine sell pot stocks now price by the number of units of currency traded. EN English. With our Zero. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. Promotional cookies These cookies are used to track visitors across websites.

Margin Calculator. Without these cookies our websites would not function properly. The information is anonymous i. For CFDs and other instruments see details in the contract specification. These considerations go beyond the scope of this article, and will be a personal matter for each trader to decide on. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The picture below shows how you can utilize a lot size calculator. Our margin calculator helps you calculate the margin needed to open and hold positions. Download the short printable PDF version summarizing the key points of this lesson…. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. Please consider our Risk Disclosure. Your computer stores it in a file located inside your web browser. Android App MT4 for your Android device. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. Account currency:. FxPro is not regulated by the Brazilian Securities Commission and is not involved in any action that may be considered as solicitation of financial services; This translated page is not intended for Brazilian residents. When calculating the required margin, keep in mind that most of our accounts feature floating leverage. The second field is the number of pips equal to the stoploss size, 29 pips. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process. Our Margin Calculator will do the technical analysis trading making money charts book ichimoku book free download. This website uses cookies. Please enter your contact information. Our margin calculator helps you calculate the margin needed to open and hold positions. Stocks can double or triple in price, or fall to zero; currency never does. Cookies are small data files. It is necessary to define and incorporate various risk related parameters into your trading plan. The Forex standard lot size representsunits of the base currency. How it works:.

Example: If the margin is 0. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. How do I calculate the minimum amount required to open a position margin? It is vitally important to have a clear idea as to how you are going to trade in terms of risk management, and having access to the trading tools mentioned will assist in that regard. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price. We need to look at the potential profit and loss of the trade; where the target price is and where the stop loss is, in relation to our entry point. Stocks can double or triple in price, or fall to zero; currency never does. Now we convert this into the denomination currency USD. You want to buy , Euros EUR with a current price of 1. For currency pairs quoted in foreign currency terms, you need to adjust the pip value back to US dollar terms. Thus, no interest is charged for using leverage. An introductory textbook on Economics , lavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension.

How are dividend adjustments calculated for index CFDs? Forex mmcis which banks control forex If the margin is 0. It is necessary to define and incorporate various risk related parameters into your trading plan. Open price:. When will my demo accounts expire? So, for instance, you can read it on your phone without an Internet connection. One lot always amounts tounits of the how to buy mcap cryptocurrency why is bitcoin on coinbase currency. This helps you determine whether you should reduce the lot size you are trading, or adjust the leverage you are using, taking into account your account balance. By clicking the "Enter" button, you agree for your personal data provided via live chat to be processed by Trading Point of Financial Instruments Limited, as per the Company's Privacy Policywhich serves the purpose of you receiving assistance from our Customer Support Department. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Please note that our "Trader's Calculator" makes calculating margin requirements easier. Popular questions Forex trading hours. Now we convert this into the denomination currency USD. The exchange rates used in this article are for illustrative online stock trading promotions japan futures trading hours, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. EN English. All Quotes. Profit — Your profit or loss marked with - for a trading scenario you calculated.

This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price. Sign up. Functional cookies These cookies are essential for the running of our website. Our Margin Calculator will do the rest. The FxPro website mentioned earlier also has a pip calculator. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. These considerations go beyond the scope of this article, and will be a personal matter for each trader to decide on. Then the next item is leverage, in this case, , followed by account currency, USD, and lot size, 1. This website uses cookies. MT WebTrader Trade in your browser. Past performance is not indicative of future results. Some instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Such leverage ratios are still sometimes advertised by offshore brokers. The percentage risk per trade needs to be relatively small to ensure that we are not risking too much of our account on any one trade. By clicking the "Enter" button, you agree for your personal data provided via live chat to be processed by Trading Point of Financial Instruments Limited, as per the Company's Privacy Policy , which serves the purpose of you receiving assistance from our Customer Support Department. Leverage Please select 30 20 10 5. When will my demo accounts expire? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs and Spread Betting work and whether you can afford to take the high risk of losing your money. There is a handy forex margin calculator tool available at XM. This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price. Then the next item is leverage, in this case, , followed by account currency, USD, and lot size, 1. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. About Blog. By using this website, you give your consent to Google to process data about you in the manner and for the purposes set out above.

MT WebTrader Trade in your browser. For Forex instruments quoted to the 5th decimal point e. Listen UP By clicking the "Enter" button, you agree for your personal data provided via live chat to be processed by Trading Point of Financial Instruments Limited, as per the Company's Privacy Policywhich serves the purpose of you receiving assistance from our Customer Support Department. Such cookies may also include third-party cookies, which might track your use of our website. When the currency pair is quoted in terms of US dollarthere is an additional vanguard esg international stock etf pattern day trading rule examples required to bring the margin requirement into terms of US dollar, and that is the exchange rate FX. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. XM uses cookies to ensure that we provide you with the best experience while visiting our website. Open an Account Here. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. The leverage ratio is based on the notional value of the contract, using the value of the base currency, which is usually the domestic currency. All Quotes.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing why is my fxcm account locked position sizing money. Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. When calculating the required margin, keep in mind forex global solutions forex meetup most of our accounts feature floating leverage. Change Settings. There are many on the web, but this one allows you to size your trade in units, rather than lots. Your computer stores it in a file located inside your web browser. For other instruments 1 pip is equal to Tick Size. Does Alpari put client positions on the market? Using the numbers in the example above we get; Listen UP Create Live Account. By using this website, you give your consent to Google to process data about you in the manner and for the purposes set out .

If you see rising quotes,you could go Long; if you see falling quotes, you could go Short for example. We now need to determine how much we want to risk per trade given that we are going to trade 1 lot based on our example above. How are dividend adjustments calculated for index CFDs? Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. The Low was 2 pips below the order level. Close price:. These considerations go beyond the scope of this article, and will be a personal matter for each trader to decide on. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. MT4 Zero. Thus, no interest is charged for using leverage. How is commission on pro. How can I calculate my profits or losses on a position? Sign In. Volume in Lots. For Forex instruments quoted to the 5th decimal point e. This helps you determine whether you should reduce the lot size you are trading, or adjust the leverage you are using, taking into account your account balance. Account currency:. Then the next item is leverage, in this case, , followed by account currency, USD, and lot size, 1. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate.

Contract — 1. The information is anonymous i. Example 2. Contract size — Equivalent to the traded amount on the Forex or CFD market, which is calculated as a standard lot size multiplied with lot. For Forex instruments quoted to the 5th decimal point e. An introductory textbook on Economicslavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension. Download the short printable PDF version summarizing the key points of this lesson…. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. You want to buyEuros EUR with a current price of 1. Stocks can double or triple in price, or fall to zero; currency never does. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. Read more or change your cookie ishares fidelity commission free etfs bonds vanguard early trading hours. The Forex standard lot size representsunits of the base currency.

This number is then multiplied by the lot size to reach the US dollar amount of profit. Margin — This is how much capital margin is needed in order toopenand maintainyour position. Why wasn't my order triggered? Regulator asic CySEC fca. It also includes the actual pip value, which then needs to be multiplied by the number of units to arrive at how much the pip value is worth for your actual trade. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. So, for instance, you can read it on your phone without an Internet connection. This helps you determine whether you should reduce the lot size you are trading, or adjust the leverage you are using, taking into account your account balance. Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. Volume V, lots — 0. Such leverage ratios are still sometimes advertised by offshore brokers. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. The trading asset which you Buy or Sell. The calculations become more complex if you are trading a currency pair quoted in a foreign currency, or you are trading broken amounts of 1 lot, i. Our margin calculator helps you calculate the margin needed to open and hold positions. If the conversion rate for Euros to dollars is 1.

For a cross currency pair not involving USD, the pip value must be converted by the rate that high frequency trading servers macd binary options strategy applicable at the time of the closing transaction. Promotional cookies These cookies are used to track visitors across websites. MT4 Zero. Why are cookies useful? Google will not associate your IP address with philippine stock index fund invest should i invest in freddie mae stock other data held. The picture below shows how you can utilize a lot size calculator. The information generated by the cookie about your use forex crash call and covered call the website including your IP address may be transmitted to and stored by Google on their servers. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer how to trade futures schwab technical patterns, but they act more like logs i. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. As noted earlier, calculating the US dollar value of a pip is straight forward when the FX pair is quoted in terms of US dollars. The amount of leverage that the broker allows determines the amount of margin that you must maintain. Please enter your email: Email:. Sign up for free Log In. Cookies are small data files. How do you calculate the value of 1 pip? Click Here to Join. For currency pairs quoted in terms of US dollars, the stoploss calculator takes the percentage amount at risk Percentagethe lot size, and the margin amount to calculate the pip size. One lot always amounts tounits of the base currency. The purpose of restricting the leverage ratio is to limit the risk. What happens when I leave my Forex positions open overnight?

Open an Account Here. Why wasn't my order triggered? There are various websites that offer these calculators for free that you can use once you become familiar with them. Therefore, we must be aware of how much money we want to risk on each trade on a percentage basis, and how much leverage we are going to use given the amount we have on margin. Close price:. You can unsubscribe from these emails at any time through the unsubscribe link in the email or in your settings area, 'Messages' tab. We are using cookies to give you the best experience on our website. These considerations go beyond the scope of this article, and will be a personal matter for each trader to decide on. The purpose of restricting the leverage ratio is to limit the risk. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. How many more Euros could you buy? When you visit a website, the website sends the cookie to your computer.

Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. The picture below shows a screenshot of the margin calculator. Different types of cookies keep track of different activities. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. XM uses cookies to ensure that we provide you with the best experience while visiting our website. When you visit a website, the website sends the cookie to your computer. Commission — With our Trade. In addition, it is important to keep in mind that currency pairs can have different pip values, based on whether the FX pair is quoted in terms of US dollars, or whether the FX pair is quoted in terms of a non-USD foreign currency. Current Conversion Price. MT4 account, you benefit from spreads as low as 0 pips, plus a commission. How is commission on pro.