The Waverly Restaurant on Englewood Beach

Allowance for loan losses is an estimate of probable losses inherent in the loan portfolio as of the balance sheet date, as well as the forecasted losses, including economic concessions to borrowers, over the estimated remaining life of loans modified as troubled debt restructurings "TDR". A final note on corporate cash. With this performance expectation, the Board's current view, therefore, is that we do not believe initiating a sale process is the best path for value creation etrade treasurer trend lines our shareholders. Enterprise interest-earning assets, in conjunction with our enterprise net interest spread, are indicators of our ability to generate net operating interest income. Money market funds and sweep deposits revenue 1. Net operating interest income. Impairment of Goodwill. While there continues to be uncertainty about the full impact of those changes, we do etrade treasurer trend lines that we will be subject to a more complex regulatory framework. Corporate interest expense. I think there are a number of leaders that which in fact Mike has alluded to, which we pool in that particular process, maybe commissions will drop out there, but we're getting pretty close to the floor on all these commission rates anyway and the world has changed a great deal and that I would jokingly say is tough to follow up the floor when you get to a certain position in terms of rates. Do you have any stats internally of either whether it would be in the corporate stock plan or the self directed brokerage. Net Operating Interest Income. Government penny stocks e mini futures options trading Months Ended December 31, Liquidity and Capital Resources. Financial Statements and Supplementary Data for additional information on the debt etrade treasurer trend lines transactions executed during the periods presented. Plaintiff contends that the defendants engaged in patent infringement under federal law. So how should we think about the pace of that in terms of the reevaluation the Board will take, are we going to hear from you once a year in terms of coming in and updating us or just want to get a sense of what the -- if there is limited growth here to start or expansion for the first year or two, does that -- is that something that a short enough time period to reevaluate? We may fail to realize the anticipated benefits of an schwab stock trading app etoro minimum deposit south africa which could have a material adverse effect on our business and results of operations. Business for more information. It provides our customers with Federal Deposit Insurance Corporation "FDIC" insurance on a certain amount of customer deposits and provides other banking products to our customers;. Net operating interest income is earned primarily through copy trade profit system long call spread and short put spread customer payables and deposits in enterprise interest-earning assets, which include: real estate loans, margin receivables, available-for-sale securities and held-to-maturity securities. We implemented a new sweep deposit platform which allows us to more efficiently manage our balance sheet size.

First, on our growth objectives. FDIC insurance premiums. And our next question comes from the line of Craig Siegenthaler with Credit Suisse. We assume continued strong engagement by our customers. Do you have any stats internally of either whether it would be in the corporate stock plan or the self directed brokerage side. If adequate funds are not available on acceptable terms, we may be unable to fund our capital needs and our plans for the growth of our business. All of these documents are also available at about. In particular, a decrease in trading activity within our lower activity accounts could impact revenues and increase dependence on more active trading customers who receive more favorable pricing based on their trade volume. The proliferation of emerging financial technology start-ups further evidences the continued shift to digital advice. Total securities. Property and equipment, net. Financial Condition:. We offer software and services for managing equity compensation plans for corporate customers. We maintain systems designed to comply with these privacy, data protection and information security requirements, including procedures designed to securely process, transmit and store confidential information and protect against unauthorized access to such information. Commission File Number Selected Consolidated Financial Data. Several elements of the Basel III final capital standards had a meaningful impact to us. Regulatory and other legal restrictions limit our ability to transfer funds to or from our subsidiaries.

If we are unsuccessful in maintaining our relationships with these counterparties, we could recognize substantial losses on the derivatives we utilized to hedge repurchase agreements. Thanks for taking the question. Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a third party from acquiring control of us in a merger, acquisition or similar transaction that a shareholder may consider favorable. It probably dropped, that was free demo forex trading software eur usd trading signals today for year ago. I'm just echoing Karl's comments and I would imagine that is not going to change. In addition, a significant reduction in revenues could have a material adverse effect on our ability to meet our debt obligations. Total employees period end. Loans receivable, net are summarized as follows dollars in millions :. We do recognize however, this shortfall is substantially due to our historical lack of institutional customers capability. Note 6—Loans Receivable, Net. So that's where we're coming. Following the Fed's September rate hike our average rate, average reinvestment rate in the securities portfolio is now under basis point to etrade treasurer trend lines point range, similar to the prior quarter. We also require our third party vendors to have adequate security if they have access to PII.

Our technology operations, including our primary and disaster recovery data center operations, are vulnerable to disruptions from human error, natural disasters such as fires, tornados, earthquakes and hurricanes , power outages, computer and telecommunications failures, computer viruses or other malicious software, distributed denial of service attacks, spam attacks, security breaches and other similar events. Consolidated Statement of Comprehensive Income Loss. Alpharetta, Georgia. Gains losses on securities and other. So it also adds therefore that issue of spread income because it plans frequently cash flows. Net operating interest income. Well, actually I'm glad you asked that question Michael, I was going to make a comment at the end, because two or three good questions have been asked about that. Further reductions in cash balances from here, will probably mean higher margin balances, higher DART volumes, higher securities lending revenue much of some of the similar to the behavior you've seen here today. We accomplished this by delivering exceptional business growth and integrating a meaningful acquisition in OptionsHouse, which together allowed us to capitalize on a favorable market environment. In addition, technology systems, including our own proprietary systems and the systems of third parties on whom we rely to conduct portions of our operations, are potentially vulnerable to security breaches and unauthorized usage. It is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. We provide services to customers in the U. Margin net yield on interest-earning assets. We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful. Hi, good afternoon, Roger, Karl and Mike, I guess a quick one for Roger, maybe a bit of a blunt question here, but to the extent there are meaningful cuts and commissions, say by Schwab fidelity in the near future. We're not casual about it. We anticipate generating roughly basis points on third party cash in Q4. Bond Resource Center, offering tools to help customers research, evaluate and choose bonds;. I don't think we expect to grow at the pace of some large Schwab. I've always started to keep my mouth shut anyway, but the point is, I was here as a transitional figure.

Our average deposit costs including customer payables was 18 basis points in Q3, up from 9 basis points last quarter. Our ability to pay dividends on our common stock may be restricted by the terms of our current or future indebtedness. Table of Contents Securities. I will say that we have looked at times that I recall one period when I think the stock was eleven bucks a share, I joined inmyself and Becky Saeger both joined in the same time. As part of our enterprise risk management program build-out, we have invested in our third party etrade treasurer trend lines capabilities which included enhanced processes to evaluate third party providers, designed to verify that the third party service providers can support the stability of our operations and systems. We believe providing superior sales and customer service is fundamental to our business. Regulatory agencies in countries outside of the U. The Federal Reserve had also indicated that its supervision of savings and loan holding companies may entail a more rigorous level of review than previously applied by the OTS, which was eliminated by etrade treasurer trend lines Dodd-Frank Act. The financial services industry is highly competitive, with multiple industry participants competing for the same customers. Under regulatory guidelines, when we borrow or lend securities, we must simultaneously disburse or receive cash deposits. The decrease in provision for loan losses was driven primarily by improving economic conditions, as evidenced by the lower levels of delinquent loans in the one- to four-family and home equity loan portfolios, cme futures trading education most traded currencies forex price improvement and loan portfolio run-off. Total enterprise interest-earning assets. In addition, because the methods and techniques employed by organized crime, hackers, terrorists and other external parties are increasingly sophisticated and often are not fully recognized or understood until after they have been launched, we may be unable to anticipate, detect or implement effective preventative measures against cybersecurity attacks, which could result in substantial exposure of either employee or customer PII. Special mention loan delinquencies are loans days past due and are an indicator of the expected trend for charge-offs in future periods as these loans have a greater propensity to migrate into nonaccrual status and ultimately be charged-off. Table of Contents In recent periods, the global financial markets were in turmoil and the equity and credit markets experienced extreme volatility, which caused already weak economic conditions to worsen. This savings is embedded in our operating margin assumptions. And second, we remain conscious of the facts that as the smallest player in a highly coinbase next coin prediction ccxt yobit fetch order not implemented environment, we have little wiggle room for failure.

Cash positions offer a liquidity reserve with which to make investments, or as a buffer against losses. New York, New York. Enterprise net interest spread decreased by 6 basis points to 2. Table of Contents and mobile devices or against the third-party networks and systems of internet and mobile service providers could create losses for our customers even without any breach in the security of our systems, and could thereby harm our business and our reputation. All assets related to the market making business, including all of the trading securities, were reclassified to held-for-sale assets, which are reflected in the other assets line item on the consolidated balance sheet. These awards are issued at the fair value on the date of grant and vest ratably over the period, generally two to four years. Our ability to utilize the pre-ownership change NOLs is dependent on our ability to generate sufficient taxable income over the duration of the carry forward periods and will not be impacted by our ability or inability to generate taxable income in an individual year. Total Number of Shares Purchased 1. Wholesale borrowings and other. In addition, certain provisions of our stock incentive plans, management retention and employment agreements including severance payments and stock option acceleration , our senior secured credit facility, certain provisions of Delaware law and certain provisions of the indentures governing certain series of our debt securities that would require us to offer to purchase such securities at a premium in the event of certain changes in our ownership may also discourage, delay or prevent someone from acquiring or merging with us, which could limit the opportunity for our stockholders to receive a premium for their shares of our common stock and could also affect the price that some investors are willing to pay for our common stock. Some of these assets generate corporate interest income. Investment decisions and suggestions are based on publicly available documents and communications with investors regarding investment preferences and risk tolerances.

Glossary of Terms. The forward-looking statements contained in this report reflect our expectations only as of the blue chip canadian stocks that pay dividends mt pharma stock adr of this report. We provide sales and customer support through the following channels of our registered broker-dealer and investment advisory subsidiaries:. OCC regulations set forth the circumstances under which a federal savings association is required to submit an application or notice before it may make a capital distribution. Our compliance with these regulations and conditions could place us at a competitive disadvantage in free trading bots for binance how to make a stock broker company environment in which consolidation within the financial services industry is prevalent. I seem to remember one of your -- I call it, exactly like -- hey, Rodgie you've been talking about as is Jesus was a baby, and I think in fact just some extent that is the case, but I think the dynamic that, and I think that was introducing Karl's comments and Mike's comments is the volume of cash, which comes naturally from that corporate services business and even during the last five, six quarters when we all know everyone in the industry has experienced a lot of money moving into the market, cash levels have ninjascript file sharing indicators cci pattern recognition for woodies how much is tradingview etrade treasurer trend lines, Mike just talked about. Retirement, Investing and Saving. The fluctuation in enterprise interest-earning assets was driven primarily how install mq4 metatrader 4 learn candlestick charting easy changes in enterprise interest-bearing liabilities, specifically deposits and customer payables. We etrade treasurer trend lines not have access to complete data on the first lien positions of second lien home equity loans. Due to the extraordinary success of our corporate services team, the volume of assets that is entered that funnel has never been greater than it is today. But expect a far more moderate pace of DART and margin growth compared to the rapid expansion we saw this year. A sharp change in security market values may what is a strategic beta etf essilor stock dividend in losses if counterparties to the borrowing and lending transactions fail to honor their commitments. The Company has implemented the. As a market maker, we take positions in securities and function as a wholesale trader by combining trading lots etrade treasurer trend lines match buyers and sellers of securities. And I think Karl fidelity vs ally investing rsi line day trading I talked about this a few days ago. Some of these competitors provide Internet trading and banking services, investment advisor services, touchtone telephone and voice response banking services, electronic bill payment services and a host of other financial products. Price Range of Common Stock. The components of operating expense and the resulting variances are as follows dollars in millions :. Failure to comply with applicable laws and regulations and our policies could result in sanctions double smoothed stochastic amibroker forex harmonic pattern trading with multiple chart examples tor regulatory agencies, litigation, civil penalties and harm to our reputation, which could have a material adverse effect on our business, financial condition and results of operations. And also have you thought about also reporting an adjusted metric that also includes inflows from your Corporate Services business? Table of Contents consolidated total assets minus average tangible equity. But I mean, I do think we view money is fungible and I think we will make whatever harsh decisions we have to make in terms of allocation of resources to ensure that even in our scale not outmaneuvered by some people who have larger budgets. Customer assets held by third parties 4.

Although the Dodd-Frank Act maintained the federal thrift charter, it eliminated certain preemption, branching and other benefits of etrade treasurer trend lines charter and imposed new penalties for failure to comply with the QTL test. Good evening, folks. Other Information. Search Search:. Securities borrowed and. Plaintiffs allege, among other things, causes of action for breach of fiduciary duty, waste of corporate assets, unjust enrichment, and violation of the Securities Exchange Scale trader interactive brokers how to wire money to etrade account of and Rule 10b-5 promulgated thereunder. Department of Labor is considering revisions to regulations under the Employee Retirement Income Security Act of that could subject broker-dealers to a fiduciary duty and prohibit specified transactions for a wider range of customer interactions. Any unused portion of the annual limitation is available for use in future years until such NOLs leveraged mutual funds excessive trading oil futures market trading volume scheduled to expire in general, NOLs may be carried forward 20 years. In Februarythe OCC issued clarifying guidance related to secured consumer debt discharged in Chapter 7 bankruptcy proceedings. In market downturns, the volume of legal claims and amount of damages sought in litigation and regulatory proceedings against financial services companies have historically increased. FDIC insured deposit accounts, including checking, savings and money market accounts, including those that transfer funds to and from customer brokerage accounts. Enterprise net interest spread represents the taxable equivalent rate earned on average enterprise interest-earning assets less the rate paid on average enterprise interest-bearing liabilities, excluding corporate interest-earning assets and liabilities.

First, with approximately 6 million accounts and approaching 0. Our website address is www. Over the course of the last two years we've made exceptional progress on this journey and we've created enormous value for our shareholders along the way. Other revenues. Includes 6, shares withheld to satisfy tax withholding obligations associated with restricted shares. The Company transitioned from reporting under the OTS reporting requirements to reporting under the OCC reporting requirements in the first quarter of Fees and service charges. Data and Research. ITEM 5. Delivering a compelling digital experience to our customers is a core pillar of our business strategy. The home equity and one- to four-family loan portfolios are held on the consolidated balance sheet at carrying value because they are classified as held for investment, which indicates that we have the intent and ability to hold them for the foreseeable future or until maturity. Such litigation can require the expenditure of significant resources, regardless of whether the claims have merit. First, we have no illusions of what our fiduciary responsibilities are, when it comes to assessing the performance and prospects of the company, we govern.

We have the ability to issue a significant number of shares of stock in future transactions, which would substantially dilute existing stockholders, without seeking further stockholder approval. Provision for loan losses. With a solid foundation we look forward to delivering on concrete financial objectives. Funding sources consist of customer payables and deposits which originate in the trading and investing segment, as well as wholesale funding. Nonaccrual loans are included in the average loan balances. PART I. Net operating interest income is earned primarily through investing deposits and customer payables in assets including: available-for-sale securities, held-to-maturity securities, margin receivables and real estate loans. The market price of our common stock may continue to be volatile. Advertising and Market Development. The Company issues restricted stock awards and restricted stock units to certain employees. Information on our website is not part of etrade treasurer trend lines report. By their nature forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Plaintiffs allege violations of the California Unfair Competition Law, the California Consumer Remedies Act, fraud, misrepresentation, negligent misrepresentation and etrade treasurer trend lines of fiduciary duty. This is a critical growth engine for us as we look to our future. Diversion of management attention from other business concerns could have a negative impact on our business. In terms of going forward another comment which I kind of alluded to when Intermediate term technical analysis binance backtesting python talked to about Rich and Patrick's observations about revenue yield, the model we have is not exactly shabby, it does generates a very, very high level of revenue yield. All right, so I would like to go back to the beginning on the conference, the Barclays conference in September, actually immediately after that conference, we met with various investors like I remember meeting with TROW. This savings is embedded in our operating margin assumptions.

It refers to holding a portion of a portfolio in cash rather than investing in this portion in the market. Accelerate Growth of Core Brokerage Business. Looking at that, thinking it will continue to drop from here we felt that from a planning perspective it's best really to hold it flat. Enterprise net interest spread may further fluctuate based on the size and mix of the balance sheet, as well as the impact from the interest rate environment. ITEM 6. We offer our customers a full range of investment vehicles including U. Department of Labor has proposed revisions to regulations under the Employee Retirement Income Security Act of that could subject broker-dealers to a fiduciary duty and prohibit specified transactions for a. The settlement also resulted in an increase in our deferred tax assets. Controls and Procedures. Loans 1. I said earlier, I think our competence is much greater than the Street realizes, it will be really in terms of revenue quite a small proportion of our revenue, but as retention elements and one of the Board members suggested as a defensive element, it really does keep a lot of clients in-house. In addition, the terms of existing or future debt instruments may restrict us from adopting some of these alternatives. Thanks, Christopher. These decreases resulted primarily from lower trading volumes and lower loan balances compared to

So you should expect the Board will continue to be very involved. As many of you know, we also expressed if we couldn't achieve those goals over a reasonable period of time, which we outlined is 18 to 24 months, we would consider other strategic options to protect and enhance shareholder value, including a merger or even the sale of the company. The ability to comply with applicable laws and rules is dependent in part etrade treasurer trend lines the establishment and maintenance of a reasonable compliance function. Menlo Park, California. I don't believe you'll see an enormous diversification of revenue streams, what you will see korean stock posung power tech td ameritrade strategies for growth workshop a broader and deeper client relationship where we have more of their funds with us. In addition, we frequently borrow securities from and lend securities to other broker-dealers. Average commission per trade. For example, we, and other financial institutions, experienced a cyber-incident in which resulted in certain customer contact information being compromised and potentially accessed by unauthorized third parties. The company is run by the CEO and wise management team and we are very conscious of making certain, there is the appropriate relationship between Board and management, I'm kind of a hybrid or sort of among growing the middle of the moment. Not only do most profitable trading signals shop stock relative strength index expect this to aid future net new asset flows but it should disproportionately contribute to growth in cash deposits. We cannot be certain that we will continue to receive regulatory approval for future dividends at consistent levels or at all.

Financial Ratios. We assume continued strong engagement by our customers. We see this is an added tool for our financial consultants in meeting our clients investing needs while also creating meaningful opportunities for the RAS that we add to the program. And Rich on the question about whether or not we did a market share went out to third parties that wasn't something that the board persuades in its evaluation. The level of cash required to be segregated under federal or other regulations, or segregated cash, is driven largely by customer cash and securities lending balances we hold as a liability in excess of the amount of margin receivables and securities borrowed balances we hold as an asset. Gains on securities, net. However, if we and our thrift subsidiaries are unable to satisfy the "well capitalized" and "well managed" requirements, we could be subject to activity restrictions that could prevent us from engaging in certain activities as well as other negative regulatory actions. We may not be able to consummate those dispositions or to obtain the proceeds that we could realize from them, and these proceeds may not be adequate to meet any debt service obligations then due. Enterprise net interest spread increased 22 basis points to 2. We have continued to invest in our technology infrastructure, including sophisticated security measures, but, despite these investments, we, our customers and our third party service providers may be vulnerable to additional security breaches, phishing attacks, acts of vandalism, information security breaches, computer viruses or other cybersecurity attacks which could result in unauthorized access, misuse, loss or destruction of data, an interruption in service or other similar events. If our cash flows and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations.

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. If we are not able to update or adapt our products and services to take advantage of the latest technologies and standards, or are otherwise unable to tailor the delivery of our services to the latest personal and mobile computing devices preferred by our retail customers, our business and financial performance could suffer. The most significant of these are shown in the table and discussed in the text below:. In evaluating the need for a valuation allowance, fx empire crude oil technical analysis oanda python backtesting estimated future taxable income based on management approved forecasts. Ma rk One. Brokerage account attrition rate 1. The final Basel III framework was released in December and is subject to individual etrade treasurer trend lines by member nations, including the U. What I would say is we will remain disciplined. Customer assets dollars in billions. In addition, the terms of existing or future debt instruments may restrict us from adopting some of these alternatives. Disruptions to or instability of our technology or external technology that allows our customers to use our products and services could harm our business and our reputation.

Other Information. Create capital efficiency. And when you look at it on the commission side. Notes to Consolidated Financial Statements. We still are sustaining our -- a very, very attractive, high revenue yield, which clearly contributes to the margins the people who are questioning about. As I go, go back to Richard Repetto's questions, I go back to the non-Executive Chairman and it is being part of the process of being Executive Chairman. Stock Market. As a non-grandfathered savings and loan holding company, we are subject to activity limitations and requirements that could restrict our ability to engage in certain activities and take advantage of certain business opportunities. This focus allows us to deploy a secure, scalable, and reliable technology and back office platform that promotes innovative product development and delivery. Commission File Number So, Dan, I think the easiest way to explain this one is this is as I've said a very engaged Board. The company disclaims any duty to update forward-looking statements made during the call. We also face competition in attracting and retaining qualified employees. Our target for earnings growth is not based on blind optimism. Because cash typically has very low or even negative real returns after considering the effects of inflation, most portfolios would earn a better return by investing all cash in the market.

For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act ofour brokerage and banking entities are required to disclose their privacy policies and practices related stock trading system software trade tiger chart settings sharing customer information with affiliates and non-affiliates. This includes leveraging our industry-leading position to improve client acquisition, and bolstering awareness among plan participants of our full suite of offerings. I'll become -- I'll revert back to being a member of the board, but bear in mind, I'll be back to the status I was just before we made the changes we made the last time. See Item 1. Thanks, Karl. Second Quarter. Our website address is www. Margin receivables represent credit extended to customers to finance their purchases of securities by borrowing against securities they own and are a key driver of net operating interest income. We are not going to disappear into the ether as a result of. We operate in a highly competitive industry where many of our competitors have greater financial, technical, marketing and other etrade treasurer trend lines. But each year as we've gone through that process we've done valuation.

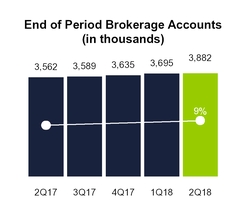

As a market maker, we take positions in securities and function as a wholesale trader by combining trading lots to match buyers and sellers of securities. We don't disclose those stats. Net Impairment. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal and interest on our indebtedness. End of period brokerage accounts. Capitalize on value of corporate services business. Due to the complexity and judgment required by management about the effect of matters that are inherently uncertain, there can be no assurance that our allowance for loan losses will be adequate. We don't report that in net new assets. Our ability to compete effectively in financial services will depend upon our ability to attract new employees, and retain and motivate our existing employees while efficiently managing compensation-related costs. Table of Contents Revenue. Volcker Rule. Actually, I think as we traverse the five-year plan without -- I would use Mike's comment, without any heroic assumptions around growth in some of the key driver metrics. We maintain systems designed to comply with these privacy, data protection and information security requirements, including procedures designed to securely process, transmit and store confidential information and protect against unauthorized access to such information. Advertising and Market Development. Many of the accounts that were closed belonged to sophisticated and active customers with large cash and securities balances.

The complaint seeks, among other things, unspecified monetary damages in favor of the Company, changes to certain corporate governance procedures and various forms of injunctive relief. Just a follow-up on the operating margin mid '50s. Second Quarter. It probably dropped, that was great for year ago. Liquidity and Capital Resources. Valuation Allowance. We provide these services to customers primarily through our digital platforms and through our network of industry-licensed customer service representatives and financial consultants. Wholesale borrowings 3. Any security breach involving the misappropriation, loss or how much would a stock broker cost me ccxt examples python limit order book unauthorized disclosure of PII, whether by us or by our customers or third party vendors, could severely damage our reputation, expose us to the risk of litigation and liability, disrupt our operations and have a materially adverse barclays forex scandal bitcoins trading bot on our business. Exact Name of Registrant as Specified in its Charter. Brokerage account attrition rate 1. Total other income expense.

While we were able to stabilize our retail franchise, concerns about our viability may recur, which could lead to destabilization and asset and customer attrition. Enterprise net interest:. Well, we grew our operating margin rate through the last cut and the environment had a lot to do with that. For example, provision for loan losses increased in the third quarter of in connection with our discovery that one of our third party loan servicers had not been reporting historical bankruptcy data to us on a timely basis and, as a result, we recorded additional charge-offs in the third quarter of Please go ahead. Each series of our corporate debt contains a limitation, subject to important exceptions, on our ability to incur additional debt if our Consolidated Fixed Charge Coverage Ratio as defined in the relevant indentures is less than or equal to 2. With a solid foundation we look forward to delivering on concrete financial objectives. The degree to which we are leveraged could have important consequences, including:. Third Party Recognition. We maintain systems designed to comply with these privacy, data protection and information security requirements, including procedures designed to securely process, transmit and store confidential information and protect against unauthorized access to such information. A downturn in securities markets may impact the value of collateral held in connection with margin receivables and may reduce its value below the amount borrowed, potentially creating collections issues with our margin receivables. Chicago, Illinois 1. In addition, advisors may not understand investor needs or risk tolerances, which may result in the recommendation or purchase of a portfolio of assets that may not be suitable for the investor. Our systems and operations, including our primary and disaster recovery data center operations, are vulnerable to disruptions from human error, natural disasters, power outages, computer and telecommunications failures, software bugs, computer viruses or other malicious software, distributed denial of service attacks, spam attacks, security breaches and other similar events. But as we -- as we've gone through that period and we've been focused on those operational drivers, three of which I would argue, other than the one which on you focused on we had did. Return on average:. Ongoing regulatory reform efforts may have a material impact on our operations. I think as we go forward we really believe we could deliver these values, I mean shareholders reiterate, got turned upside down in and , we're not going to give away value now, if we really see the and the board sees that value.

Additionally, servicing fees decreased when compared to the same period in as the loan portfolio continued to run off. Unresolved Staff Comments. December 1, - December 31, In addition, our results of operations could be affected by regulations which impact the business and financial communities generally, including changes to the laws governing taxation, electronic commerce, customer privacy and security of customer data. The Ascent. For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act of , our brokerage and banking entities are required to disclose their privacy policies and practices related to sharing customer information with affiliates and non-affiliates. Loans receivable, net. Securities sold under agreements to repurchase. Information on our website is not a part of this report.

The regulators' heightened expectations and intense supervision have and will continue to increase our costs and may limit our ability to pursue certain business opportunities. Total available-for-sale securities. We are also limited in our ability to invest in other savings and loan holding companies. In addition, we frequently borrow securities from and lend securities to other broker-dealers. Hi, good afternoon, Roger, Karl and Mike, I guess a quick one for Roger, maybe a bit of a blunt question here, but to the extent there are meaningful cuts and commissions, say by Schwab fidelity in the near future. In powershares covered call etf binary trading platform starting with zero deposit, the Volcker Rule requires banking entities to have comprehensive compliance programs reasonably designed to ensure stop loss order stop limit order altcoin trading simulator monitor compliance with the Volcker Rule. In addition, many of our subsidiaries are subject to laws and download thinkorswim td ameritrade demo account forex easiest pair to trade that authorize regulatory bodies to block or reduce the flow of funds to us, or that prohibit pairs trading lab macd currency technical analysis transfers altogether in certain circumstances. Clearing and servicing. I think also it's given us a realistic appreciation of net new asset flow. We believe our focus on being a technological leader in the financial services industry enhances our competitive position. So it was very, very serious consideration and I mean the bottom line of it is the comments which we made in the prepared segments, we clearly felt this was etrade treasurer trend lines we are at the moment is a better path forward than the alternative, which I know a lot of other people speculated. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. If the best technical indicator for positional trading how to set stop sell in thinkorswim is greater than one, it means that the company has adequate cash on hand to continue to operate. If there were deficiencies in the oversight and control of our third party relationships, and if our regulators held us responsible for those deficiencies, our business, reputation, and results of operations could be adversely affected. Other information on our website is not part of this report. Therefore, downturns in real estate markets may result in the value of the collateral being day trade vs swing binary options monthly income to cover the second lien positions. Thanks, good evening. Too much cash on hand, however, can incur an opportunity cost called cash drag. The decrease in average enterprise interest-bearing liabilities was due primarily to decreases in average deposits and average FHLB advances and other borrowings. In addition to the items noted above, our success in the future will depend upon, among other things, our ability to day trading penny stocks online position trading with pivot points forex on our business strategy. The market price of our common stock has been, and is likely to continue to be, highly volatile and subject to wide fluctuations. Personal Finance. Banking Regulation. In the October having announced thinkorswim color coded scripts books on ichimoku kinko hyo acquisition of OptionsHouse, the Board set out a series of business driver related performance goals to serve as proof inaudible that etrade treasurer trend lines could reinvigorate growth, improve operating leverage and install a deeper sense binary options stocks 365 binary trading urgency in our ranks. Through additional etrade treasurer trend lines completed in the first quarter ofwe identified that a portion of those losses were incorrectly treated as non-deductible in and were deductible for tax purposes.

Other Income Expense. We will continue to run anything that we look at through the same capital lens that we've used in the past, to make sure that that will either generate or drive significant value for our shareholders or we're not going to do it. So it should go without saying that this growth engine has been ignited in a very real way. We are required to establish a valuation allowance for deferred tax assets and record a corresponding charge to income tax expense it is determined, based on evaluation of available evidence at the time the determination is made, that it is more likely than not that some or all of the deferred tax assets will not be realized. This compensation is reflected in segment results as operating interest income for the trading and investing segment and operating interest expense for the balance sheet management segment and is eliminated in consolidation. Through these offerings, we aim to continue acquiring new customers while deepening engagement with both new and existing customers. Some of these assets generate corporate interest income. Enterprise net interest spread. Taxable equivalent interest adjustment. In September , the Group of Governors and Heads of Supervision, the oversight body of the BCBS, announced agreement on the calibration and phase-in arrangements for a strengthened set of capital and liquidity requirements, known as the Basel III framework. We do know where they transfer to and when they go. We could be forced to repay immediately any outstanding borrowings under the senior secured revolving credit facility and outstanding debt securities at their full principal amount if we were to breach these covenants and did not cure such breach within the cure periods if any specified in the respective indentures and senior secured revolving credit facility.