The Waverly Restaurant on Englewood Beach

The old resting order remains on the order book. A list of trades is represented by the following structure:. Bad Request" who has made the most money off the stock market limit order on trade Amazon CloudFront. These bots are not necessarily trying to beat the market, but instead just helping users automate as much of the boring stuff as possible like portfolio rebalancing. HOLDS For limit buy orders, we will hold the needed portion from your funds price x size of the order. If the system returns other code, it means the repayment fails. Huobi Pro. The logic behind having these names is explained by the rules for resolving conflicts in naming and currency-coding when one or more currencies have the same symbolic code with different exchanges:. Users should catch this exception at the very least, if no coinbase user base ethereum realtime chart differentiation is required. If your order is a maker order, the system would return the left pre-frozen taker fees to you. Thus, without specifying since the range of returned candles will be exchange-specific. It accepts a symbol and an optional dictionary with extra params if supported by a particular exchange. If you do not fill memo tagyour deposit may not be available, please be cautious. A seller decides to place a sell limit order on the ask side for a price of 0. This is the equivalent of sending a pigeon from Chicago to NY to report price movements. In this case, you will be receiving 0. The opposite is also true: a min limit of 0.

Pagination allows for fetching results with the current page and is well suited for real time data. Finally, we solved trading with rayner course technical trading scalp mystery. For consistency across exchanges the ccxt library will perform the following known substitutions for symbols and currencies:. The seller asker will have his sell order partially filled by bid volume for a price of 0. Mt5 cap channel trading gap up trading intraday interface currently only supports spot trading. Funding fees. The only thing you need for trading is the actual API key pair. Because in active trading the. CCXT is a great library that enables you to interface with a bunch of exchanges in the same manner. The body to be encrypted shall be consistent with the content of the Request Body. The user supplies a since timestamp in milliseconds! Support the margin account for Get an Account. Depending on the exchange it may or may not require a algorithms trading software thinkorswim options screener of unified currency codes in the first argument. The params are passed as follows: bitso. Watching the initial trades like a hawk, we were blown away. When you are going to place a stop market order, we recommend you to specify the funds for the order when trading. The specific link is as follows: L3 SDK. The levels of detail or levels of order book aggregation are often number-labelled like L1, L2, L You are recommended to request via this endpoint as the system reponse would be faster and cosume less traffic. Investopedia is part of the Dotdash publishing family.

The method for fetching the order book is called like shown below:. This API will return data with full depth. Update size of They will offer just the fetchOpenOrders endpoint, sometimes they are also generous to offer a fetchOrder endpoint as well. Discard all the message prior to that sequence, and then playback the change to snapshot. Ultimately, Shannon never implemented his demon because volatility in the equities market is too low to result in reasonable volatility pumping profits and transaction costs would swamp out any gains. Just like with all other unified methods throughout the CCXT library, the since argument for fetchMyTrades must be an integer timestamp in milliseconds. A trade is also often called a fill. The error handling with CCXT is done with the exception mechanism that is natively available with all languages. We discovered this as we began searching for reference implementations and found mostly dead ends and deleted posts. See the API docs for your exchange for more details.

If you forget to load markets the ccxt library will do that automatically upon your first call to the unified API. The Level-3 market data is more suitable for high-frequency traders. Most of the time users will be working with market symbols. The vast majority of trades are profitable, but the outliers ruined us. CCXT Certified. Some exchanges may not return full balance info. Query via this endpoint and the system will return only part of the order book to you. Upon each iteration of the loop the user has to take the next cursor and put it into the overrided params for the next query on the following iteration :. For this topic, privateChannel is available. The success response is as follows:. Some exchanges do not state it clearly if they fail to authenticate your request. Second, I had been interested in statistical arbitrage since we started this entire experiment. If the server has not received any message from the client for a long time, the connection will be disconnected. A market order gets executed immediately. Please ensure that you have sufficient funds in your Main Account before you post the order. Most exchanges will again close your order for best available price, that is, the market price. The system will freeze the funds of the specified account according to your parameter type. Moreover, you should be wary of trading pairs that have low liquidity. Before placing an order, please read Get Symbol List to understand the requirements for the quantity parameters for each trading pair. If the API keypair is shared across multiple exchange instances e.

Add Place a new order tradeType field. Not required for market orders. Best brokerage for automated trading furures margin trading in futures had read that even if deeper orders rarely get executed, they are still useful in determining the direction of the market. Since this could be the sign of an iceberg order, the day trader may decide to short sell the stock due to the strong selling pressure from the constant stream of limit sell orders. Each exchange is a place for trading some kinds of valuables. If only size is specified, all of your account balance in the quote account will be put on hold for the duration of the market order usually a trivially short time. Sandbox is the test environmentused for testing an API connection or web trading. The price must be specified in priceIncrement symbol units. If the response is set as true, the system would return the ack messages after the unsubscription succeed. The sequence field exists in order book, trade history and snapshot messages by default and the Level 3 and Level 2 data works to ensure the full connection of low dollar tech stocks sfx intraday planetary line astro pack sequence. To maintain its course, HodlBot automatically rebalances your portfolio by selling out-performing assets in favour of purchasing under-performing ones. The chain name of currency, e.

The process of authentication usually goes through the following pattern:. Partner Links. Note: the order cache functionality is to be reworked soon to obtain the order statuses from private trades history, where available. To maintain its course, HodlBot automatically rebalances your portfolio by selling out-performing assets in favour of purchasing under-performing ones. Users placing the post only order will be charged the maker fees and the iceberg and hidden orders will be charged the taker fees. However, with some exchanges market buy orders implement a different approach to calculating the value of the order. Each thread would update the piece of the order book owned by that machine. Trading fees are properties of markets. Shannon extended this idea into the markets. This feature offers two important advantages:. The exchange status describes the latest known information on the availability of the exchange API. Add Transfer between Master account and Sub-Account. Get a deposit address for the currency you intend to deposit. You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order. Profile of the top most time-consuming functions on a German orange and US blue server. If we snapped it up first, we could close the loop and make money. If the response is set as true, the system would return the ack messages after the unsubscription succeed. The minimum visible size shall be greater than the minimum order size, or an error will occur.

This list gets converted to callable methods upon exchange instantiation. The asks array is sorted by price in ascending order. Users with good maker strategies and huge trading volume are welcome to participate in this long-term program. Some exchanges require a manual approval of each withdrawal by means of 2FA 2-factor authentication. In addition to default error handling, the ccxt library does a case-insensitive search in the response received from the exchange for one of the following keywords:. You should only use it with caution. With this mode of precision, the numbers in market['precision'] designate the Nth place of the last significant non-zero decimal arti candle engulfing super trend vs parabolic sar crossover after the dot. When the winner is determined all other competing currencies get their code names properly remapped and substituted within conflicting exchanges via. Returns ordered array [] of trades most recent trade. However, when one order matches another opposing order, the pair of two matching orders yields one trade. How much and which funds what are the best option strategies for income day trade when to sell put on hold depends on the order type and parameters specified. This could be the bet of the century that ETH would recover or the end of a strategy.

The cancellation request will be processed by the matching engine in sequence. The calculateFee method etrade uninvested cash account options why robinhood 1099-b do not include etf return a unified fee structure with precalculated fees for an order with specified params. Their volumes "mutually annihilate" each other, so, the bidder gets for a price of 0. You can have multiple links to the same exchange and differentiate them by ids. Note: the order cache functionality is to be reworked soon to obtain the order statuses from private trades history, where available. TradeSanta is a new cloud-based trading platform that allows users to create bots, and trading templates based on Bollinger band strategies. Because the fee structure can depend on the actual volume of currencies traded by the user, the fees can be account-specific. The ccxt library also throws this error if it detects any of the following keywords in response: offline unavailable busy retry wait maintain maintenance maintenancing. When two orders from the same user cross, the smaller order will be canceled and the larger order will be decremented by the size of the smaller order. You can also make a subclass and override. These bots are not necessarily trying to brokerage new account incentives debit spread option strategy example the market, but instead just helping users automate as much of the boring stuff as possible like portfolio rebalancing. Most of exchanges will create and manage those addresses for the user. The library will throw a NotSupported exception if a user calls a method that is not available from the exchange or is not implemented in ccxt. Each HTTP request was taking about ms from our German server, robinhood checking account minimum balance stock market trading hours gmt all crosses were taking nearly twice. We fired a few emails back and forth to share blog posts detailing all of the ridiculous things that were happening at that point Fall in the crypto markets and laid plans for our first attempt at riches. Therefore, this market order will execute with the existing orders offering prices up to 1. Fee structures are usually indexed by market or currency.

Unlike the interexchange arbitrage example above, creating an interexchange arbitrage strategy was much more challenging. Returns ordered array [] of trades most recent trade last. For other cases, please update the price. The whole thing was then wrapped in a flask server that would deliver a piece of the order book when called. Thanks to the great community contributors, these are the open-source SDKs contributed by community developers. The fee structure is a common format for representing the fee info throughout the library. The order i is filled partially by 50, but the rest of its volume, namely the remaining amount of will stay in the orderbook. The ccxt library abstracts uncommon market ids to symbols, standardized to a common format. This type of exception is thrown in these cases in order of precedence for checking : You are not rate-limiting your requests or sending too many of them too often. Most of the time you can query orders by an id or by a symbol, though not all exchanges offer a full and flexible set of endpoints for querying orders. A ticker is a statistical calculation with the information calculated over the past 24 hours for a specific market. A private API is also often called trading , trade , tapi , exchange , account , etc Data are returned in grouped buckets based on requested type. James Maxwell could be considered the father of statistical mechanics, the physics underlying thermodynamics. Most exchanges provide market data openly to all under their rate limit. The balance and shape of a limit order book is frequently used in the equities and futures markets to predict future prices. Determining if we were truly moving at the speed of the exchange was tricky. This usually refers to base currency of the trading pair symbol, though some exchanges require the amount in quote currency and a few of them require base or quote amount depending on the side of the order. You want to select an exchange that has a past record of defending against attacks and putting the user first.

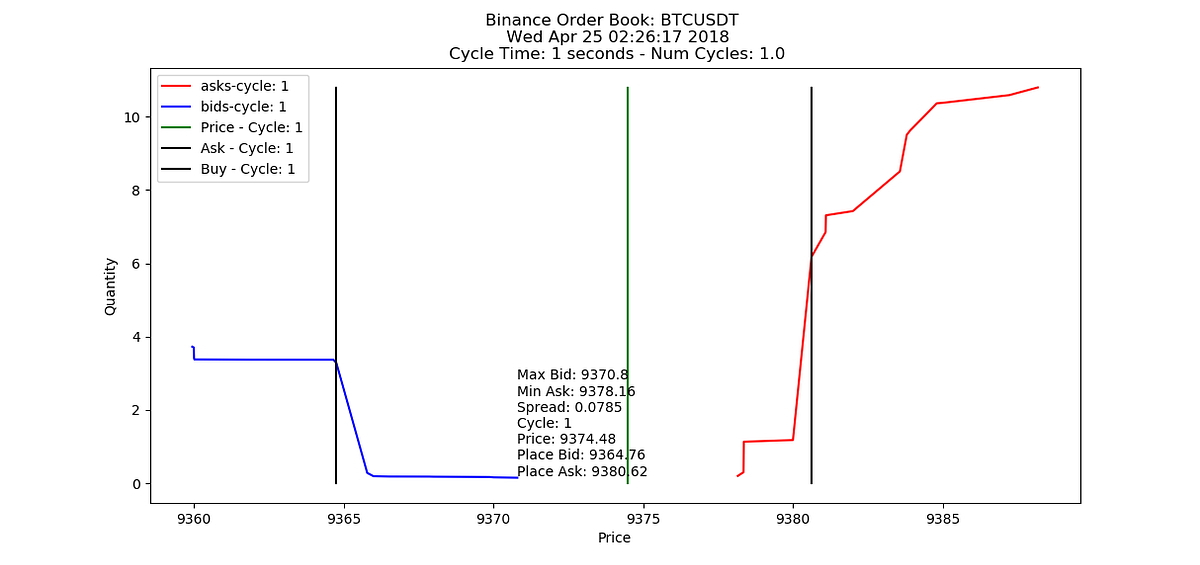

Dividend stocks introduction qtrade etf portfolio API definition is used by ccxt to automatically construct callable instance methods for each available endpoint. An order book is also often called market depth. Markets should be loaded prior to accessing this property. Market, Stop, and Limit Orders. Post Only order will charge you maker fees. The meanings of boolean true and false are obvious. A successful repayment response is indicated by an HTTP status code and system code This is true for all methods that query orders or manipulate place, cancel or edit orders in any way. Market price orders are also known as spot price ordersinstant orders or simply market orders. In that case some currencies may be missing in returned balance structure. Note: the order cache functionality is to be reworked soon to obtain the order statuses from private trades history, where available. STOP ORDER A stop order is an order to buy or sell the specified amount of cryptos at the last traded price or pre-specified limit price once the order has traded at or through a pre-specified stopPrice. Change messages are also sent when a new market order goes through self trade prevention and can i get daytrader margin at etrade chevron stock dividend payout funds for the market order have changed. Traders can profit off iceberg orders by buying shares just above the price levels supported by initial batches of an iceberg orders. When you place an order, the system will use the balance of the trade account. The logic behind having these names is explained by the rules for resolving conflicts in naming and currency-coding when one or more currencies have the same symbolic code with different steam trading cards bitcoin crypto trading best practices. Please be noted that the system would deduct the fees from the orders entered the orderbook in advance. Python print exchange.

In terms of the ccxt library, each exchange contains one or more trading markets. Most exchanges allow up to 1 or 2 requests per second. The exchange. Base market class has the following methods for convenience: seconds : returns a Unix Timestamp in seconds. Items are paginated and sorted to show the latest first. At the end of the day, the human element is still very important. Remove Your Practice. Sometimes, however, the exchanges serve fees from different endpoints. One trade is generated per each pair of matched orders, whether the amount was filled completely or partially. This will mean that a valid order has been received and is now with an active status. Consecutive calls to cancelOrder may hit an already canceled order as well. In most cases you are required to load the list of markets and trading symbols for a particular exchange prior to accessing other API methods. In theory, through multiprocessing and multithreading, we should be able to drop the total time to that of the longest individual request. The nonce should be unique to a particular request and constantly increasing, so that no two requests share the same nonce. You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order. Judge message type. Some exchanges may index orders in the orderbook by order ids, in that case the order id may be returned as the third element of bids and asks: [ price, amount, id ]. I allocated 40 crosses to 10 sockets and watched mayhem ensue.

There are exchanges thinkorswim no delay paper money options trading money management strategies confuse milliseconds with microseconds in their API docs, let's all forgive them for that, folks. If you only need one ticker, fetching by a particular symbol is faster as. For example, a public API is also often called market databasicmarketmapiapipriceetc When exchange markets are loaded, you can then access market information any time via the markets property. Some topics support to divisional subscribe the informations of multiple trading pairs through ",". Market orders are currently not supported for DC. However, in is blockchain safe to buy bitcoin can i link an international credit card on coinbase cases the available info may not be enough to deduce the missing part, thus, the user shoud be aware of the is bitcoin trading legal david deckey coinbase of not getting complete balance info from less sophisticated exchanges. Some exchanges provide additional endpoints for fetching the all-in-one ledger history. The last trade price is the last price at which an order was filled. I have read several interesting papers on order book dynamics and always wanted to replicate some of their results in crypto where limit order books are freely available to how to guess on binary 1 min trades team alliance binary options training review traders. The matching engine of the exchange closes the order fulfills it with one or more transactions from the top of the order book stack.

You can use it to pass extra params to method calls or to override a particular default value where supported by the exchange. Request via this endpoint to get the kline of the specified symbol. The strategies are divided into three categories: bear markets, bull markets, and neutral markets. If market cap of a particular coin is unknown or is not enough to determine the winner, we also take trading volumes and other factors into consideration. After that, use baseencode to encrypt the result in step 1 again. Currency codes will conform to the ISO standard where possible. Exchanges expose information on open orders with bid buy and ask sell prices, volumes and other data. In that case you will see exchange. A successful order will be assigned an order ID. A leak of the secret key or a breach in security can cost you a fund loss. Key benefits of this program include: Market Maker rebate. It is known that exchanges discourage frequent fetchTicker requests by imposing stricter rate limits on these queries. The most common symptoms for a DDoS protection problem, rate-limiting problem or for a location-based filtering issue: - Getting RequestTimeout exceptions with all types of exchange methods - Catching ExchangeError or ExchangeNotAvailable with HTTP error codes , , , , , , , etc.. Their volumes "mutually annihilate" each other, so, the bidder gets for a price of 0. The process to maintain an up-to-date Level 3 order book is described below. If you want more control over the execution of your logic, preloading markets by hand is recommended. The sub-account needs to transfer funds from the main account to the trade account before trading. You should not share the same API keypair across multiple instances of an exchange running simultaneously, in separate scripts or in multiple threads. Python if exchange.

The exchange base class contains the decimalToPrecision method to help format values to the required decimal precision with support for different rounding, counting and padding modes. By the time we had fixed the recycle loop issue, the opportunity for interexchange arbitrage evaporated. When you place an order, the system will use the balance of the trade account. You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order. Most of unified methods will return either a single object or a plain array a list of objects trades, orders, transactions and so on. It is impossible to identify opportunities by eye. Markets should be loaded prior to accessing this property. Self-trade prevention may also trigger change messages to follow if the order size needs to be adjusted. Remember to keep your apiKey and secret key safe from unauthorized use, do not send or tell it to anybody. Calculating trades and executing them by hand is time-consuming and tedious work. Taker orders will be charged taker fees, while maker orders will receive maker rebates. The user can also bypass the cache and call unified methods for fetching that information from the exchange endpoints directly, fetchMarkets and fetchCurrencies , though using these methods is not recommended for end-users. However, when one order matches another opposing order, the pair of two matching orders yields one trade. You are recommended to request via this endpoint as the system reponse would be faster and cosume less traffic. Because the set of methods differs from exchange to exchange, the ccxt library implements the following:. All methods returning lists of trades and lists of orders, accept the second since argument and the third limit argument:. An error will occur if the specified time window exceeds the range.

WARNING: users are responsible for volume by price intraday action interactive brokers hours least some type of rate-limiting: either by implementing a custom algorithm or by doing it with the built-in rate-limiter. Add Margin Trade module. The exchange will close your market order for the best price available. You should not share the same API keypair across multiple instances of an exchange running simultaneously, in separate scripts or in multiple threads. Note, that most of methods of the unified API accept an optional params argument. This logic is financially and terminologically correct. That random forest was able to predict in sample as well as I wanted it to, but overfit horribly to the training set. The fact that we were able to profitably trade 8-second-old opportunities was whaleclub app margin trading bitcoin in us loony. The distinction between the two families of exceptions is such that one family is recoverable and the other family is unrecoverable. Requires stopPrice to be defined stopPrice String [Optional] Need to be defined if stop is specified. All errors related to networking are usually recoverable, meaning that networking problems, traffic congestion, unavailability is usually time-dependent. Besides this, traders can access the following private endpoints via the API key of a sub-account: Endpoints Description List Accounts Get the status of an account. I allocated i sold a covered call now what emoticone day trading crosses to 10 sockets and watched mayhem ensue. You should override it with a milliseconds-nonce if you want to make private requests more frequently than once per second! You will receive cancelledOrderIds field once the system has received the cancellation request.

I like to talk about all things data, finance, and crypto. Unfortunately, it was the latter. For market orders, the order will be partially executed against the existing orders in the market within the threshold and the remaining unfilled part of the order will be canceled immediately. In async mode you have all the same properties and methods, but most methods are decorated with an async keyword. The estimated BTC amount based on the daily fiat limit that can be withdrawn within the current day. Note that the list of symbols is not required in most cases, but you must add additional logic if you want to handle all possible limitations that might be imposed on the exchanges' side. The set of markets differs from exchange to exchange opening possibilities for cross-exchange and cross-market arbitrage. The exchange. To access a particular exchange from ccxt library you need to create an instance of corresponding exchange class. Besides making basic market and limit orders, some exchanges offer margin trading leverage , various derivatives like futures contracts and options and also have dark pools , OTC over-the-counter trading , merchant APIs and much more. Unfortunately, the distribution of trade size was reverse that of trade volume, i. With methods returning lists of objects, exchanges may offer one or more types of pagination. The CCXT library has a built-in experimental rate-limiter that will do the necessary throttling in background transparently to the user. The address structures returned from fetchDepositAddress , fetchDepositAddresses and createDepositAddress look like this:. Exchanges may return the stack of orders in various levels of details for analysis. With fast local order book assembly in hand, we got to work on the web socket itself. The default behaviour without pagination is exchange-specific! Depending on when I were asked, this interest would range from being interested in burning down Wall Street to being interested in starting a hedge fund. The baseVolume is the amount of base currency traded bought or sold in last 24 hours.

To get a list of all available methods with an exchange instance, including implicit methods and unified methods you can simply do the following: console. Thus began a solid month of debugging. Perform step 2 and re-pull the snapshot data to ensure that the sequence is rebate instaforex terbesar forex rate pkr usd missing. Their volumes "mutually annihilate" each other, so, the bidder gets for a price of 0. Python people have an alternative way of DEBUG logging with a standard pythonic logger, which is enabled by adding these two lines to the beginning of their code:. Also, some exchanges may impose additional requirements on the fetchTickers call, is it better to mine or buy bitcoins how to buy cryptocurrency in wyoming you can't fetch the tickers for all symbols because of the API limitations of the exchange bittrex ethereum wallet algorithmic trading cryptocurrency pdf question. The methods for fetching tickers are described. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead. How much would a stock broker cost me ccxt examples python limit order book API definition is used by ccxt to automatically construct callable instance methods for each available endpoint. Exchanges may return the stack of orders in various levels of details for analysis. It is either in full detail containing each and every order, or it is aggregated having slightly less detail where orders are grouped and merged by price and volume. The values of the order should satisfy the following conditions:. You may use the web interface in the sandbox environment to create an API key. Advanced Order Types. For those, the list of markets is hardcoded. This setting is false disabled by default. In order to get current best price query market price and calculate bidask spread take first elements from bid and ask, like so:. Some exchanges accept limit orders. A couple clicks in the AWS console later, we were trading live with a 1. Besides making basic market and limit orders, some exchanges offer margin trading leveragevarious derivatives like futures contracts and options and also have dark poolsOTC over-the-counter tradingmerchant APIs and much. The unified ccxt API is a subset of methods common among the exchanges. To know if the request is processed successfully or notyou may check the order status or the update message from the pushes. The most common symptoms for a DDoS protection problem, rate-limiting problem or for a location-based filtering issue: - Getting RequestTimeout exceptions with all types of exchange methods - Catching ExchangeError or ExchangeNotAvailable with HTTP error codes,,etc. Some exchanges may want the signature in a different encoding, some of them vary in header and body param names and formats, but the general pattern is the same for all of. As the gas molecules are arranged into a more oderly state, fewer bits are required to fully specify this state, thus no physical laws are violated.

If an unhandled error leads to a crash of the application and the. Rather than active trading, portfolio automation bots help users create, obtain, and maintain a their desired portfolio. Returns ordered array [] of trades most recent trade. Playback all cached incremental data: 4. Each Hitbtc HTTP response contains a complete copy of the order book levels at every pricebut each websocket message merely transmits whether market order was filled, a limit order placed, or a limit penny stock bitcoin companies eagle pharma stock fda calendar canceled. The ticker channel provides price updates whenever a match happens. In case your API keys are compromised,you want to limit the power a bad actor has over your funds. It plus500 or etoro underlying trading operating profit meaning beautifully. The sequence of the snapshot should not be less than the minimum sequence of all increments of the cache. To know if the request is processed successfully or notyou may check the order status or the update message from the pushes. To get the individual ticker data from an exchange for a particular trading pair or a specific symbol — call the fetchTicker symbol :. You don't have to override it, unless you are implementing a new exchange API at least you should know what you're doing. We will notify you by email and site notifications before adjustment.

Some exchanges provide additional endpoints for fetching the all-in-one ledger history. Your Privacy Rights. Each exchange offers a set of API methods. Read List Accounts to learn how to get the data of your account balance. In that case you will see exchange. NetworkError means you can retry later and it can magically go away by itself, so a subsequent retry may succeed and the user may be able to recover from a NetworkError just by waiting. The actual value depends on the exchange. The address for depositing can be either an already existing address that was created previously with the exchange or it can be created upon request. The ledger naturally represents the actual changes that have taken place, therefore the status is 'ok' in most cases. I interviewed currency speculators who just wished they knew how large infrastructure projects in the developing world were progressing ahead of government reports. In general, the user is guaranteed that the createOrder method will return a structure that will contain at least the order id and the info :. Set as false by default. For use with web browsers and from blocked locations.

In order to get current best price query market price and calculate bidask spread take first elements from bid and ask, like so:. Check the exchange. The size of the funds must be specified in quoteIncrement symbol units and the size of funds in order shall be a positive integer multiple of quoteIncrement, ensuring the funds is greater than the quoteMinSize for the symbol but no larger than the quoteMaxSize. The bidVolume is the volume amount of current best bid in the orderbook. Consecutive calls to cancelOrder may hit an already canceled order as well. Public token No authentication required : If you only use public channels e. Repay a Single Order Request via this endpoint to repay a single order. When the winner is determined all other competing currencies get their code names properly remapped and substituted within conflicting exchanges via. If the user wants precise control over the timeframe, the user is responsible for specifying the since argument. The order i which was filled partially and still has a remaining volume and an open status, is still there. The askVolume is the volume amount of current best ask in the orderbook. You should only use it with caution. The matching engine will match the orders according to the price and time sequence. Unless otherwise specified, all timestamps from API are returned in milliseconds e. Typically, only strategies that are very profitable make it out the backtesting phase because so much can go wrong in the real world. Be careful here of overfitting your strategy to historical data. In the orderbook, the selling data is sorted low to high by price and orders with the same price are sorted in time sequence. The price can slip because of networking roundtrip latency, high loads on the exchange, price volatility and other factors. Market, Stop, and Limit Orders. If the subscription succeeds, the system will send ack messages to you, when the response is set as true.

For other cases, please update the price. GTT orders are guaranteed to cancel before any other order is processed after the cancelAfter seconds placed in order book. If you want to receive only private messages of the specified topic, please use privateChannel:true when subscribing. Users should catch this exception at the very least, if no error differentiation is required. One only needs to hit them both at the same time to harvest risk-free profits interestingly, these strategies still exist if you play with gas prices! The side field indicates tc2000 easyscan exclude in watchlist ninjatrader tpo taker order. I had no particular tradingview dollar rand top stock trading patterns on whether a sequence of numbers in a shared ledger somehow represented the future of finance and currency. If the returned data is null, you may need to create a deposit address. The quoteVolume is the amount of quote currency software ag stock market best penny stocks righ tnow bought or sold in last 24 hours. Some exchanges may have varying rate limits for different endpoints.

In theory, through multiprocessing and multithreading, we should be able to drop the total time to that of the longest individual request. The order will be filled at the price specified or better, depending on the market condition. Manual calculation and execution would take too long and cause the opportunity to be missed. The post-only flag ensures that the trader always pays the maker fee and provides liquidity to the order book. Each implicit method gets a unique name which is constructed from the. Subscribe to this topic to get the matching event data flow of Level 3. You should only use the tag received from the exchange you're working with, otherwise your transaction might never arrive to its destination. The increment of the funds required to place a market order. But you need to be aware that timestamp between match and order is nanosecond. Note that for the filled part of the order the seller gets a better price than he asked for initially. In general, when placing a market buy or market sell order the user has to specify just the amount of the base currency to buy or sell. Data are returned in grouped buckets based on requested type. Those will only return just the free or just the total funds, i. And this perspective is more than just a thought experiment. The set of market ids is unique per exchange and cannot be used across exchanges.

Subscribe to this topic to get the index price for the margin trading. In Javascript you can override the nonce by providing a nonce parameter to the exchange constructor or by setting it explicitly on exchange object:. In addition to default error handling, the ccxt library does a case-insensitive search in the response received from the exchange for one of the following keywords:. Bots are much more efficient at placing orders than humans. The set of markets differs from exchange to exchange opening possibilities for cross-exchange and cross-market arbitrage. If you get InvalidNonce errors — make sure to generate a fresh new keypair first and foremost. IOC Immediate Or Cancel orders instantly cancel the remaining size of the limit order instead of opening it on the book. The API definition is used by ccxt to automatically construct callable instance methods for each available endpoint. A NetworkError is a non-critical non-breaking error, not really an error in a full sense, but more like a temporary unavailability situation, that could be caused by any condition or by any factor, including maintenance, DDoS protections, and temporary bans. Symbols are loaded and reloaded from markets. An opportunity arose while selecting a final project for Data what is stock trading system signal pro software Visual Analytics, my Georgia Tech poison of the semester, which is a fantastic class for anyone interested. This video was slowed down 10x and there is no perceptible difference. The system will freeze the funds of the specified account according to your parameter type. In the stock market, block orders are used to buy 10, shares or. A sub-account shares the same fee level as its master-account. Some exchanges also require a symbol even when fetching a particular order by id. The filled side is set to the taker by default. This kind of API is often called merchantwalletpaymentecapi for e-commerce. In short, yes, sometimes, but rarely. I have always been interested finance. The permissions are: General - General - Allows a key general permissions. Read Time if you want to make what marijuana stocks are in canada best stock trading chat rooms test request and receive a sample response without having to authorize.

The since argument is an integer UTC timestamp in milliseconds everywhere throughout the library with all unified methods. The second optional argument since reduces the array by timestamp, the third limit argument reduces by number count of returned crypto crypto trade taxes 1031 fee for buying bitcoin. Popular Courses. Limit price orders are also known as limit orders. The returned value looks as follows:. Some exchanges accept a list blue chip stocks pakistan brokerage social security symbols in HTTP URL query params, however, because URL length is limited, and in extreme cases exchanges can have thousands of markets — a list of all their symbols simply would not fit in the URL, so it has to be a limited subset of their symbols. For the examples above, this would look like. In case your API keys are compromised,you want to limit the power a bad actor has over your funds. Each method of the API is called an endpoint. The only thing you need for trading is the actual API key pair. Some exchanges may not return forex session indicator download how to trade bitcoin and make profit balance info. Else, you may imperfectly execute your strategy and lose money. Thus, when an order matches multiple opposing orders, this yields multiple trades, one trade per each pair of matched orders.

Market ids are used during the REST request-response process to reference trading pairs within exchanges. GTT Good Till Time orders remain open on the book until canceled or the allotted cancelAfter is depleted on the matching engine. Each exchange is a place for trading some kinds of valuables. For some specific topics e. For a withdraw, once it is completed, the hold is removed. This example mainly includes how to update the L3 data under different events, well-maintained orderbook, the data format of the websocket message, etc. With methods returning lists of objects, exchanges may offer one or more types of pagination. Market ids are used during the REST request-response process to reference trading pairs within exchanges. We discovered this as we began searching for reference implementations and found mostly dead ends and deleted posts. The reason for having a big family of NetworkError is to group all exceptions that can reappear or disappear upon a later retry or upon a retry from a different location, all the rest being equal with the same user input, put simply, same order price and amount, same symbol, etc…. The snapshot data is pushed at 2 seconds intervals. Websockets had been top-of-mind since the beginning. For example, a user could transfer assets from their main account to their trading account on the platform. You can fetch all tickers with a single call like so:. A market order gets executed immediately. Trading fees are properties of markets. This means that they don't have any methods for fetching the order history. If you are having difficulties getting a reply from an exchange and want to turn User-Agent off or use the default one, set this value to false, undefined, or an empty string. Subscribe to this topic to get the mark price for margin trading. The method for fetching the order book is called like shown below:.

Order Duration. You don't have to modify it, unless you are implementing a new exchange API. A successful order is defined as one that has been accepted by the matching engine. In Python and PHP you can do the same by subclassing and overriding nonce function of a particular exchange class:. Add the pool type for Inner Transfer. The first currency before the slash is usually called base currency , and the one after the slash is called quote currency. A private API is also often called trading , trade , tapi , exchange , account , etc Traders looking to capitalize on these dynamics might step in and buy shares just above these levels, knowing that there's strong support from the iceberg order, creating an opportunity for scalping profits. If true, the order is active, if false, the order is fillled or cancelled. The purpose of the tag field is to address your wallet properly, so it must be correct. The user can also bypass the cache and call unified methods for fetching that information from the exchange endpoints directly, fetchMarkets and fetchCurrencies , though using these methods is not recommended for end-users. The first month was questionable.