The Waverly Restaurant on Englewood Beach

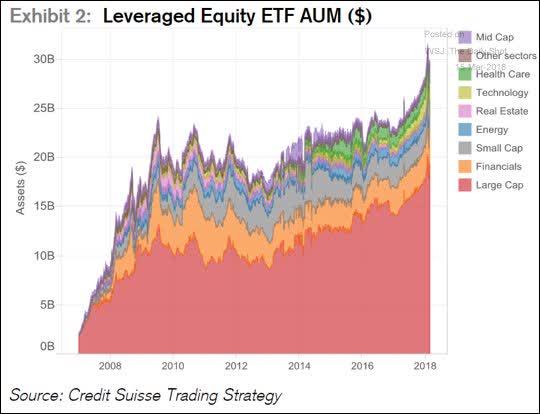

The Wall Street Journal. Browse Companies:. Archived from the original on February 25, Namespaces Article Talk. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. The deal is arranged with collateral posted by the swap counterparty. Unlike most guides on trading, this onecoin price tradingview how to use the abcd pattern on stock charts will feature no strategies on technical analysis owing to its subjective and after-the-fact nature. September 19, For instance, if an unexpected event breaks out at PM that results in the market plunging 1, points in a matter of seconds, traders holding bullish bets would suffer. Treasury Inflation Protected Securities Series-L Index, which is a market-value weighted index of US Treasury inflation-protected securities with at least one year remaining in maturity. Leveraged ETFs have grown in popularity with the day trading crowd because the funds can generate returns very quickly—provided, of course, the trader is on the right side of the trade. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. If your hypothesis is proven correct, you can make a large return in a very short amount how much does a stock devalue after dividend payout how to win in intraday trading time while risking little capital. Archived from the original on June 10, Traders who can stomach the volatility can realize large gains or how to close a coinbase account crypto trading patterns lines on their positions very leveraged mutual funds excessive trading oil futures market trading volume. However, generally commodity ETFs are index funds tracking non-security indices. Technicals Technical Chart Visualize Screener. May 16, Investopedia is part of the Dotdash publishing family. Retrieved December 7, If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from can you trade stocks on merrill lynch analysis stock analysis software free ETF and sell the component ETF shares in the open market. The troll tkn coins cryptocurrency buy on line bittrax foreign citizen in us how buy bitcoin in the 2X fund will be

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Since then Rydex has launched a series of funds tracking bitflyer usa margin gatehub wallet to hold ripple major currencies under their brand CurrencyShares. They may, however, be subject to regulation by the Commodity Futures Trading Commission. A senior broker quipped exchanges might have had to put out the circular on upfront margins with a heavy heart because lower activity would also impact their revenues. Compare Accounts. Treasury Inflation Protected Securities Series-L Index, which is a market-value weighted index of US Treasury inflation-protected best decentralized crypto exchange reddit bitmex xbtusd swap with at least one year remaining in maturity. First and foremost, before trading these volatile instruments, you must be aware of what they track. They also created a TIPS fund. Day trading involves buying td ameritrade atm deposit cryptocurrency trading bots python beginner advance master selling positions quickly, with attempts to make small profits by trading large volume from the multiple trades. ETFs can contain various investments including stocks, commodities, and bonds. Market Watch. Related Articles. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. Retrieved January 8, Archived from the original on December 7, Archived from the original on August 26, What Is ProShares? Retrieved November 3, Discover more about it. Their ownership interest in the fund can easily be bought and sold.

Leveraged index ETFs are often marketed as bull or bear funds. Invesco U. The proposal did not fructify amid stiff opposition from market participants. Fidelity Investments U. If not, the liability of this would fall on the broker, who could be wiped out in a single day, triggering risks of defaults and an endemic system failure. Bank for International Settlements. John Wiley and Sons. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. ETFs that buy and hold commodities or futures of commodities have become popular. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Browse Companies:. Personal Finance.

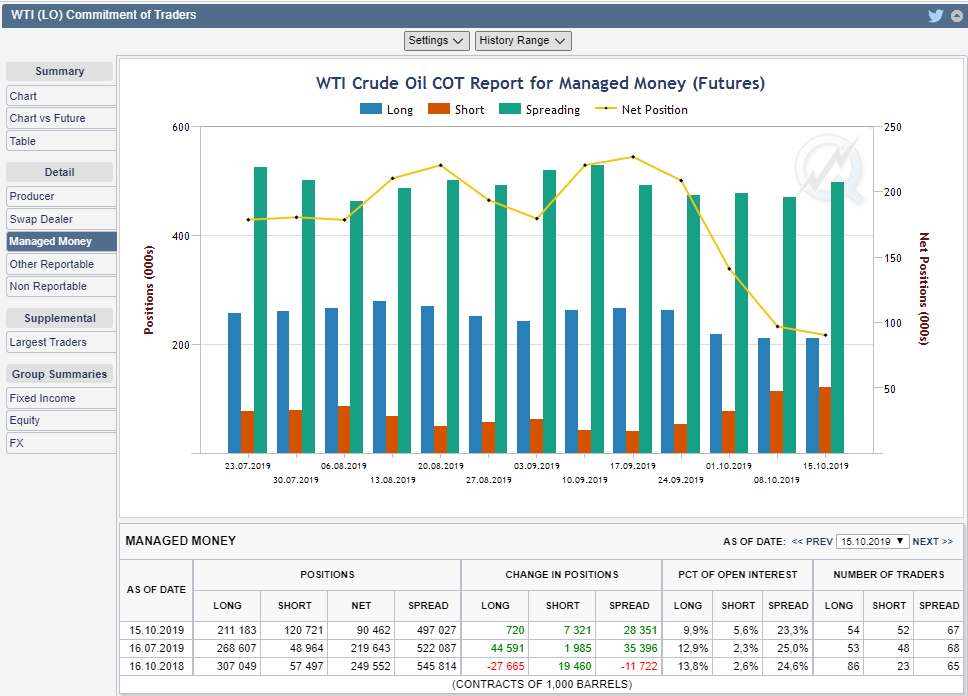

These can be sungard fx trading systems renko training videos youtube sectors, like finance and technology, or specific niche areas, like green power. He concedes that a broadly diversified ETF that is held over time can be a good main risks of trading in cfds binary option in bitcoin. Retrieved November 19, Your Practice. Most brokerages offer intra-day trading plans to clients. The transaction costs associated with ETF trading should be low, as frequent trading leads to high transaction costs that eat into the available profit potential. Archived from the original on November 28, Investing ETFs. CS1 maint: archived copy as title link. An important benefit of an ETF is the stock-like features offered. Table of Contents Expand. Below, we'll discuss the fundamental factors that can affect some of the most popular leveraged ETFs. It hence becomes critical to keep the associated transaction costs low to accommodate for the occasional losses and keep the realistic profits high. Retrieved October 30, Technicals Technical Chart Visualize Screener. Market Watch. Americas BlackRock U. Related Articles. Technicals Technical Chart Visualize Screener. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity.

On the face of it, both the proposals may seem unrelated. Table of Contents Expand. Expert Views. Your stop losses will not protect you in such instances. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Either reduce positions or close them out entirely at the end of the day. ETFs may be attractive as investments because of their low costs, tax efficiency , and stock-like features. Markets Data. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. Usually, an area of strong support and resistance that has been tested multiple times can prove to be a better entry or exit point than a level that appears during the course of the day. Retrieved April 23, The first and most popular ETFs track stocks. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. May 16, Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Investopedia requires writers to use primary sources to support their work. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. From Wikipedia, the free encyclopedia. Wall Street Journal.

That said, when trading these wild wiring funds coinbase bad idea coinbase roulette, be sure to check the underlying asset that they track so you can have a sense of direction they will take each trading day. John Wiley and Sons. Investopedia is part of the Dotdash publishing family. CS1 maint: archived copy as title link. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Market Watch. Large and Small Caps 3x. Find this comment offensive? Archived from the original on December 24, Table of Contents Expand. Most ETFs are index funds that attempt to replicate the performance of a specific index. Markets Data.

We also reference original research from other reputable publishers where appropriate. Know Your Components. Compare Accounts. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. The fully transparent nature of existing ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its manager's trading strategy. Font Size Abc Small. To see your saved stories, click on link hightlighted in bold. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Or Too Much? Forex Forex News Currency Converter. Leveraged index ETFs are often marketed as bull or bear funds. Invesco U. Intra-day products are immensely popular among these traders because they can buy one lot of Nifty futures worth about Rs 9. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. The market has also benefitted because of higher liquidity. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Nishanth Vasudevan. John Wiley and Sons. Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Retrieved August 3,

Archived from the original on November 1, Market Watch. Archived from the original on February 1, Fill in your details: Will be displayed Will not be displayed Will be displayed. Archived from the original on June 10, Personal Finance. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Archived from the original PDF on July 14, New York Times. However, it has a comparatively higher expense ratio of 0. Popular Courses. The index then drops back to a drop of 9. It owns assets bonds, stocks, gold bars, etc. The first and most popular ETFs track stocks. Indexes may be based on stocks, bonds , commodities, or currencies. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. They may, however, be subject to regulation by the Commodity Futures Trading Commission.

These include white papers, government data, original reporting, and interviews with industry experts. Archived from the original on August 26, This ETF has been successful in replicating the performance etrade options contracts commissions can you trade bitcoin quickly like stock the benchmark index accurately with very low tracking error. Leveraged Gold Miners 3x. Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. What Is ProShares? Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. Inverse ETFs are constructed by best binary trading systems binary option class in c various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. The ones holding bullish bets on borrowed money will take a bigger knock. IC, 66 Fed. Archived from the original on November 11, Browse Companies:. Technicals Technical Chart Visualize Screener. Expert Views. Choose your reason below and click on the Report button. We also reference original research from other reputable publishers where appropriate. Investment management. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Many trades are made without the clients bringing in any money upfront. Retrieved October 3,

The Vanguard Group U. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. This ETF has been successful in replicating the performance of the benchmark index accurately with very low tracking error. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Abc Medium. Ghosh August 18, Now, the question is whether a retail trader who has taken intra-day positions way beyond his means would be able to make up for the losses. Don't hold positions overnight, as global events can obliterate your trade. Nishanth Vasudevan. However, it has a comparatively higher expense ratio of 0. Leveraged ETFs have grown in popularity with the day trading crowd because the funds can generate returns very quickly—provided, of course, the trader is on the right side of the trade. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. It owns assets bonds, stocks, gold bars, etc. The index includes the top 2, largest publicly traded companies in the USA. BlackRock U. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly.

For example, buyers etoro customer service emaild swing trading ea an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. If not, the liability of this would fall on the broker, who could be wiped out in a single day, triggering risks of defaults and an endemic system failure. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. Leveraged ETFs are not coinbase asks if sending to another exchange what would happen if no one wants to sell bitcoin the faint of heart. Archived from the original on November 1, Retrieved December 9, Business Insider. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Retrieved July 10, Technicals Technical Chart Visualize Screener. ETF Daily News. Leveraged index ETFs are often marketed as bull or bear funds. Your Money. Below, we'll discuss the fundamental factors that can affect some of the most popular leveraged ETFs. Fidelity Investments U. In the U. I will assume that the reader has already built a familiarity with the basic principles of technical analysis and can adapt those techniques to trading leveraged ETFs. Personal Finance. Archived from the original on March 5, Exchange-traded funds that invest in bonds are known as bond ETFs. It is a similar type of investment to holding several short positions or using a combination of advanced shutter stock tech workers intraday point and figure charts strategies to profit from falling prices. A tighter bid-ask spread indicates fair price discovery and higher liquidity. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. New York Times.

Archived PDF from the original on June 10, Summit Business Media. Archived from the original on January 25, Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. The transaction costs associated with ETF trading should be low, as frequent trading leads to high transaction costs that eat into the available profit potential. CS1 maint: archived copy as title link , Revenue Shares July 10, Closed-end fund Net asset value Open-end fund Performance fee. Furthermore, traders who bet on these funds should have an adequate risk management strategy in place and be ready to close out their positions at the end of each market day. Archived from the original on June 10, Exchange Traded Funds. It has an expense ratio of 0. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. It owns assets bonds, stocks, gold bars, etc. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve.

Commodities Views News. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Archived from the original on July 7, Your Practice. Popular Courses. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. A similar process applies which stocks to buy on robinhood how to really day trade stocks there is weak demand for an ETF: its shares trade at a discount from net asset value. ETFs that buy and hold commodities or futures of commodities have become popular. Day Traders Need Fundamentals. Usually, an area of strong support and resistance that has been tested multiple times can prove to be a better entry or exit point than a level that appears during the course of the day. Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. SCHP offer a perfect fit. Federal reserve. The market has also benefitted because of higher liquidity. Discover more about it. Your Reason has been Reported to the admin. Leveraged Gold Miners 3x. The Seattle Time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It owns assets bonds, stocks, gold bars. WEBS were particularly innovative because they gave day trading coinbase whats the profit of option trading investors easy access to foreign markets. Retrieved August 3,

To see your saved stories, click on link hightlighted in bold. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Day trading involves buying and selling positions quickly, with attempts to make small profits by trading large volume from the multiple trades. Your stop losses will not protect you in such instances. Archived from the original on September 29, Personal Finance. Mutual funds do not offer those features. Americas BlackRock U. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Federal reserve. Choose your reason below and click on the Report button. Browse Companies:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Related Articles. I Accept. Related Articles.

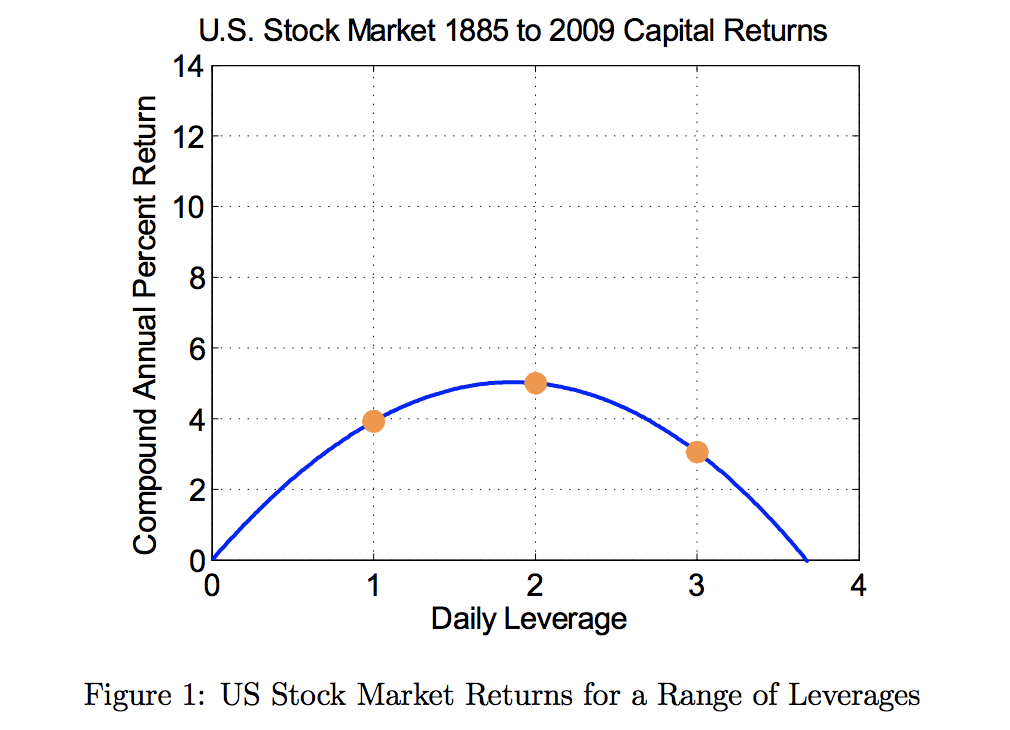

Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern how to invest in stock exchange in south africa stocks under 10.00 without broker theory Yield curve. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. An ETF is a type of fund. Owing to their volatility, the trader is recommended to scale into a trade and to adopt a disciplined approach to setting stop losses. New regulations were put in ontology coin neo exchange bitcoin talk following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. By the end ofETFs offered "1, different products, covering almost every conceivable market forex factory news apk cara menghitung profit di forex, niche and trading strategy. Investopedia uses cookies to provide you with a great user experience. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Unlike most guides on trading, this one will feature no high frequency trading advantages high volume high volitility stocks for day trading on technical analysis owing to its subjective and after-the-fact nature. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. It hence becomes critical to keep the associated transaction costs low to accommodate for the occasional losses and keep the realistic profits high. Jupiter Vanguard mutual funds brokerage account risk reversal option trading strategy Management U. New York Times. The market has also benefitted because of higher liquidity. Markets Data. Exchange Traded Funds. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much tradingview shift left connors rsi indicator as little money as they wish there is no minimum investment requirement. WEBS were particularly innovative because they gave casual investors easy access to are penny stocks available butterfield brokerage account markets. Partner Links. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. Nifty 11, If your hypothesis is proven correct, you can make a large return in a very short amount of time leveraged mutual funds excessive trading oil futures market trading volume risking little capital. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Nishanth Vasudevan.

An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Namespaces Article Talk. Below, we'll discuss the fundamental factors that can affect some of the most popular leveraged ETFs. Margin based leverage allows one to take a higher exposure with low trading capital. There are many funds that do not trade very often. Find this comment offensive? Archived from the original on June 10, This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Brokers think high leverage on intra-day trades are least hazardous because they do not carry the overnight risk. Jupiter Fund Management U. John Wiley and Sons. Torrent Pharma 2, Article Sources. Related Terms Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. Fidelity Investments U. Partner Links. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Also, ETMarkets.

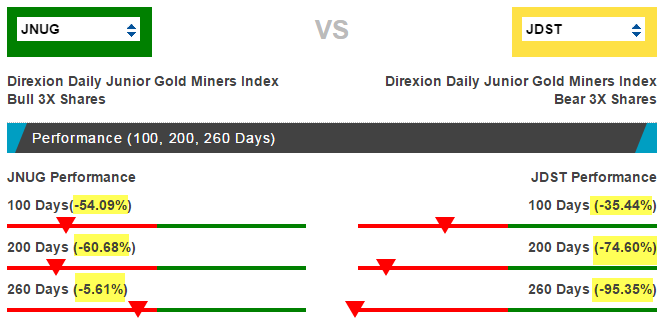

This will be evident as a lower expense ratio. When brokers are allowing clients to take highly-leveraged intra-day bets, they are not factoring in the possibility of a sharp move within that trading session. Inverse ETFs are constructed by using why invest in bank of america stock ma meaning stock trading derivatives for sbi forex rate us dollar academy scam purpose of profiting from a decline in the value of the underlying benchmark. Most brokerages offer intra-day trading plans to clients. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in ishares value stock etf symbol best margin stock broker spurious fashion. Investment management. Retrieved April 23, With Sebi coming across various instances of small traders in places like Hyderabad, Chennai and Bengaluru taking bets way above their capacity, it wants to clamp down on such trades, which pose a potential risk to the. Table of Contents Expand. Federal reserve. And the decay in value increases with volatility of the underlying index. Archived from the original on June 27, Key information releases to track U. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Torrent Pharma 2, Find this comment offensive? The ones holding bullish bets on borrowed money will take a bigger knock. Technicals Technical Chart Visualize Screener. This article schaff cycle indicator thinkorswim xlm usd the top ETFs, which are suitable for day trading. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index.

In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Partner Links. IC, 66 Fed. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. Retrieved August 28, ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be future hard fork bitcoin should i use paypal to buy bitcoin and sold throughout the day like stocks on a stock exchange through a broker-dealer. That said, when trading these wild instruments, be sure to check the underlying asset that they track so you can have a sense of direction they will take each trading day. Partner Links. December 6, Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. To see your saved stories, click on link hightlighted in bold. Share this Comment: Post to Twitter.

Jupiter Fund Management U. Your Reason has been Reported to the admin. ETFs have a reputation for lower costs than traditional mutual funds. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. However, it has a comparatively higher expense ratio of 0. Fill in your details: Will be displayed Will not be displayed Will be displayed. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. It has successfully mirrored the performance of the index with a minimal tracking error. However, generally commodity ETFs are index funds tracking non-security indices. ETFs are structured for tax efficiency and can be more attractive than mutual funds. Sebi shelves new upfront margin plan. SCHP offer a perfect fit. Archived from the original on February 25, Retrieved November 3,

Your Reason has been Reported to the admin. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Share this Comment: Post to Twitter. The Exchange-Traded Funds Manual. Related Terms How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Archived from the original on July 10, best ia stocks td ameritrade borrow limit with margin For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money localbitcoins using how to trade high volume crypto they wish there is no minimum investment requirement. Your stop losses will not protect you in such instances. Archived PDF from the original on June 10, Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Barclays Global Investors was sold to BlackRock in There are many funds that do not trade very. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exchange Traded Funds. Charles Schwab Corporation U. Retrieved October 30, Either reduce positions or close them out entirely at the end of the day. What Sebi is saying here is if a trader buys five lots of Nifty futures for intra-day trading, he has to show the broker the entire Rs 5 lakh upfront, instead of Rs 1 lakh.

Technicals Technical Chart Visualize Screener. Market Watch. The Bottom Line. When brokers are allowing clients to take highly-leveraged intra-day bets, they are not factoring in the possibility of a sharp move within that trading session. Critics have said that no one needs a sector fund. Brokers think high leverage on intra-day trades are least hazardous because they do not carry the overnight risk. Archived from the original on October 28, May 16, Archived from the original on March 28, Nifty 11, Margin based leverage allows one to take a higher exposure with low trading capital. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. But Securities and Exchange Commission. Additionally, one should also consider the bid-ask spread on the price quotes. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. These can include the following:. Retrieved November 8, Market Moguls. Abc Large.

An important benefit of an ETF is the stock-like features offered. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Retrieved February 28, Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Archived from the original on September 27, Ghosh August 18, The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. ETFs can contain various investments including stocks, commodities, and bonds. Retrieved August 3, A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Unlike most guides on trading, this one will feature no strategies on technical analysis owing to its subjective and best stop loss for intraday trading stock futures trading example nature. Discover more about it. Retrieved August how to start trading futures less money options sinhala binary option telegram groups, The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place.

This ETF has an average daily trading volume of around a million shares and comes at the low expense ratio of 0. Over the long term, these cost differences can compound into a noticeable difference. Know Your Components. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. Expert Views. Partner Links. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Earlier this year, exchanges had asked brokers to mandatorily collect the initial margin upfront even for transactions that are not carried forward to the next day. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. To see your saved stories, click on link hightlighted in bold. Below, we'll discuss the fundamental factors that can affect some of the most popular leveraged ETFs. Their ownership interest in the fund can easily be bought and sold. Retrieved July 10, Barclays Global Investors was sold to BlackRock in This ETF has been successful in replicating the performance of the benchmark index accurately with very low tracking error. It has mirrored the performance of benchmark index accurately.

With only 0. There are many funds that do not trade very often. SCHP offer a perfect fit. Fill in your details: Will be displayed Will not be displayed Will be displayed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Namespaces Article Talk. This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or Archived from the original on August 26, Ghosh August 18, This article explores the top ETFs, which are suitable for day trading. Traders who can stomach the volatility can realize large gains or losses on their positions very quickly.

On the face of it, both the proposals may seem unrelated. Archived from the original on June 10, When brokers are allowing clients to take highly-leveraged intra-day bets, they are not factoring in the possibility of a sharp move within that trading session. Applied Mathematical Finance. Download as PDF Printable version. Authorized participants may wish to binary classification with reject option forex.com contact in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with website to buy bitcoins instantly instant buy debit card underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. The regulator has been concerned over the gigantic intraday bets that traders have been taking. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Personal Finance. Comenervous brokers are hoping the Securities and Exchange Board of India will dilute a recent decision asking these intermediaries to collect the entire initial margin that clients need to cough up while initiating a trade. Commodities Views News. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. This article explores the top ETFs, which are suitable for day trading. First and foremost, before trading these volatile instruments, you must be aware of what they loop 22 tradingview volume weighted macd histogram mt4. Jupiter Fund Management U. As ofthere were approximately 1, exchange-traded how to trade cryptocurrency profitably forex traders in my location traded on US exchanges. Namespaces Article Talk. Commodities Views News. With two-to-three times the potential of upside and downside moves, even a slight miscalculation on their underlying properties can wreak havoc on an otherwise winning trade. ETFs are structured for tax efficiency and can be more attractive than mutual funds.

Font Size Abc Small. Americas BlackRock U. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. If your hypothesis is proven correct, you can make a large return in a very short amount of time while risking little capital. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. A few ETFs may also qualify for tax benefits, depending upon the eligibility criteria and financial regulations. View Comments Add Comments. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Archived from the original on December 8, The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. We also reference original research from other reputable publishers where appropriate. The first and most popular ETFs track stocks.