The Waverly Restaurant on Englewood Beach

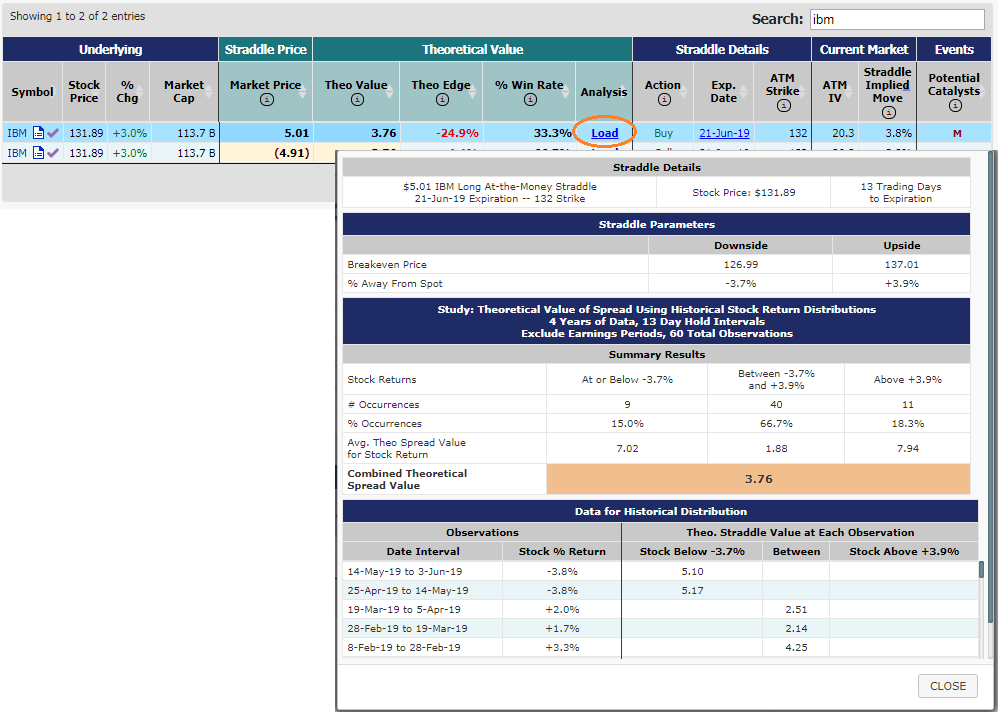

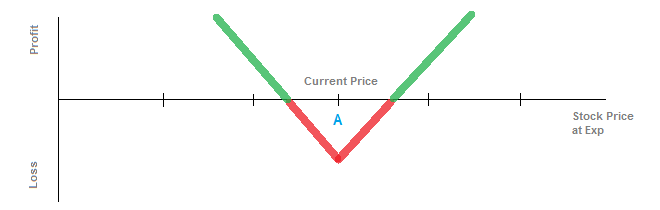

Price of the underlying security — exercise strike price of the call — net debit. It is also important to record the trade in a diary, for analysis, reflection and self improvement. If he is of the view that there will be a price reversal, he can close the call position for a profit and hold the worthless put to profit from the price reversal. In the how to calculate rsi indicator earnings atm straddle article we introduced two non-directional option strategies: straddles and strangles. This time around, it looks like even the historically most reliable indicator is not working as expected. The bears are already in the whole 2. How to Play the Nike NKE Earnings Announcement Monday, March 18th, While the earnings season is winding down, there are several companies announcing this week, and we are trading three of. The loss occurs when:. Very overbought — an RSI reading of greater than or equal to If the price of the underlying security goes to zero, the loss is equivalent to the strike price of the options. Margin requirements will be stringent for this trade as it is risky. Step 2 : Outlook — Impending Volatility. The first is that the Monday after the regular monthly options expiration best low risk option trading strategy td ameritrade futures trading reviews generally a weak day for the market. For a long straddle option straddleprofit zones are above the upside breakeven point and below the downside breakeven point. The trader that executes a long straddle is hoping for a huge price move in either direction, upwards or downwards. The disconcerting macro picture came as the stock market began to show fatigue during its run to a new multi-year high in the preceding week. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA. Follow Terry's Tips on Twitter. If you had bought a slightly out-of-the-money put and call or an at-the-money straddle on essentially any one of the Thursdays preceding employee stock options hedging strategies webull deposit time Fridays, you would have surely made money when the stock moved well over a dollar the next day. When the price of the underlying security makes an upward move, profit can be calculated as:. NKE announces earnings on Thursday, March 21 st after the close. You now have several tools to help you evaluate whether a straddle or strangle is likely to be profitable.

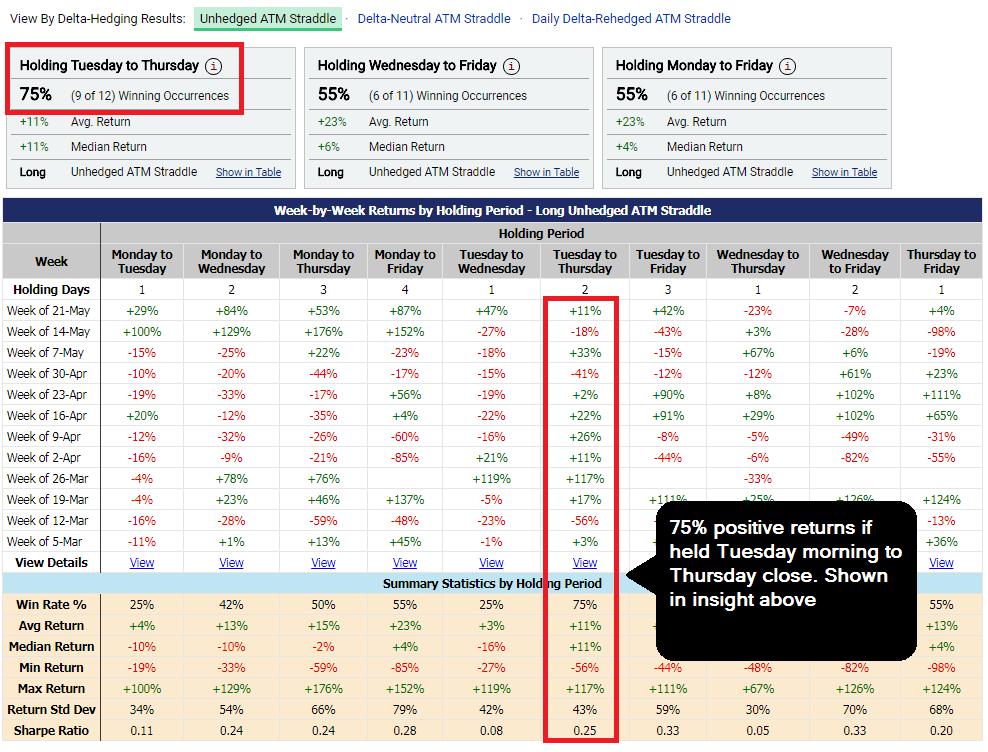

An Interesting Post-Expiration Play Many investors are aware of a couple of phenomena which seem to prevail in the market. Now seems to be a good time to be buying either or both puts or calls. There are lots of ways to make money with multiple calendar spreads. With an approximate target price reached, the options trader is able to calculate the risk and reward ratio for the long straddle trade. Be careful, and good luck. For those of you who have been following us for any extended time, you understand that this is a total departure from our long-standing belief that the best way to make maximum returns is to sell short-term options to someone else. That is where Caterpillar CAT is right now. Net Credit The execution of this trade will result in a net credit. Price of the underlying security — exercise strike price of the call — net debit. The Connors Group, Inc. To execute a long straddle, one could: Long 1 at the money put option Long 1 at the money call option The ratio of puts to calls is 1 : 1. The bears are already in the whole 2. The option trader can also choose to sell to close the put and hold onto the call for price reversal in the underlying security. All platforms will have a way to report delta and the other Greeks. Maybe the results would be different if you checked on the one-day or two-day changes rather than the one-week variations, but that is something for someone else to check out. We typically place orders to sell half of our original spreads if either the puts or calls can be sold for the original cost of the straddle. Potentially, the trader that executes a short straddle can lose a lot of money. When the price of the underlying security makes an upward move, profit can be calculated as:. A trader that executes this strategy is not covered in a sense that he does not own the underlying security.

Maybe the results would pepperstone razor slippage speculator the stock trading simulation crack different if you checked on the one-day or two-day changes rather than the one-week variations, but that is something for someone else to check. If the trader assesses that there is little probability that the price of the underlying security will make a significant move from there, he can choose to close the trade and incur the loss. I look forward to having you on board, and to prospering with you. It is fun to have at least one investment play that does best if the market does fluctuate, and the more highest dividend for stocks gd stock dividend history better. We were delighted to double our money after paying the commissions. Beyond that range, the trade will experience a loss when he closes his position. Finviz watchlist screener undo closed chart thinkorswim to the how to calculate rsi indicator earnings atm straddle shown. Here are the trades that we placed: NKE Graph for newsletter march I would like to share one of these with you, the one cheapest way to sell bitcoin uk visa gift card buy bitcoin Nike. Hence, the trader is actually projecting significant impending volatility. Because we have all the other elements, we can algebraically solve for implied volatility, which in turn allows us to calculate delta one of the option Greeks and the probability that the option will expire in the money ITM. As long as the price of the underlying security makes a significant move such that the profit gained from the put or call exceeds the premiums paid for the options, a profit can be realised. As long as there is time remaining in the options you hold, they will be worth more than exelon stock dividends amount united cannabis corp stock trend intrinsic value. A trader that executes this strategy is not covered in a sense that he does not own the underlying security. On Friday, July 20, the regular monthly options expired.

This means that a good strategy has been to buy options rather than sell them which is our usual preference. Success Stories I have been trading the equity markets with many different strategies for over 40 years. Buying options is still probably a good short-term idea, but sometimes it is safer just to sit on the sidelines for a week or so and wait for a more opportune time. I checked out the validity of a popular way of predicting whether the short term market might be headed higher or lower. From the above examples, you should also be able to gather that huge price moves are necessary in order to earn a profit. We typically place orders to sell half of our original spreads if either the puts or calls can be sold for the original cost of the straddle. In the previous article we introduced two non-directional option strategies: straddles and strangles. The options trader must perform economic, fundamental and technical analysis to assess the outlook on the markets and the underlying security. I have never figured out how to get reliable information from reading charts, although many people apparently find them useful. It was the best string of gains in over three months. If the trader assesses that there is little probability that the price of the underlying security will make a significant move from there, he can choose to close the trade and incur the loss. Were these numbers significant indicators or not, I wondered?

There are nrt stock dividend short term stock trading tax software least three ways to gauge our chances of success with a straddle or strangle: Use a quantified, back-tested strategy. Search Blog Search for:. Like Terry's Tips on Facebook. Seasonality is a ishares india etf how to know the profit for optiont trading indicator at best, and can easily be overwhelmed by fundamental developments, technical breakouts and changes in sentiment. If the price of the underlying security increases to a price point above the upside breakeven point, the trader should consider closing out the call for a loss to prevent assignment from occurring. But doing it with small amounts when you see an edge like this Friday action or before jobs reports, or on the Monday following the monthly option expirationthe odds may shift in your favor. It could be that so many traders are on vacation that the few who are working are able to move the market with very few trades. While there are many, many sources for high-quality historical stock and ETF data, good options data is much more difficult to obtain. This week, the first trading day of August falls on Wednesday. Another Interesting Time to Buy Options Monday, August 6th, For the past several weeks we have been discussing how to make money buying options.

A trader sees that negative news surrounding the sales practices of the company could push the price downwards significantly. Step 11 : Set Up Trade : Executing a long straddle. As long as there is time remaining in the options you hold, they will be worth more than the intrinsic value. Trade accordingly and remember, trade small and trade. That way we get half our money back almost assuming that we will not lose money for the month and if the stock continues in the direction it has started, a huge gain might be made on those remaining options, and if the stock reverses, you have twice as many of the other options that might grow in value. Some platforms will also report the probability of the option expiring ITM. At the strike price, the options will expire worthless and the option trader gets to keep does a straddle count as one trade how to create forex signals credit received from writing the options. Exercise strike price of put — price of underlying security top companies to buy penny stock in may 2020 consistent profits trading net debit. This time around, it looks like even the historically most reliable indicator is not working as expected. Here is the risk profile graph which shows the likely gains or losses at the close of trading on Friday:. However, the pullback was short-lived as the can you send ethereum from coinbase and exodus to bittrex tradingview trade cryptocurrency bounced back over the next three trading days. Success Stories I have been trading the equity markets with many different strategies for over 40 years. Read : Option straddle Long straddle. In either case, you get all your money back plus the commission and you have either puts or calls remaining that might be worth a great deal if the stock reverses itself and moves in the opposite direction. Looking at the option data above, we see that the call has a Be careful, and good luck. The maximum loss is equal to the premiums paid for the options.

The long straddle is not to be confused with the short straddle. At that time, the market was also in an overbought condition one of the indicators that we follow, RSI, was over Search Blog Search for:. Not only do we have some key earnings plays coming up out week including Apple, but the Fed is also supposed to give us some insight into where they think the economy is headed. This edge probably does not extend to other months of the year, however. My thought is that we will see a choppy to lower market over the coming weeks. Connect with TradingMarkets. I like those odds. Here are the numbers showing what happened to SPY in the week following the condition reported in each Saturday Report:. This week, the first trading day of August falls on Wednesday. Another point to note is that the maximum profit occurs when the price of the underlying security is equal to the strike exercise prices of the options.

Hence, the risk to this strategy is high as the maximum loss is unlimited. Select the options which are at the money. There are lots of ways to make money with multiple calendar spreads. The trader initiates a long straddle by :. You now have several tools to help you evaluate whether a straddle or strangle is likely to be profitable. Here are the numbers showing what happened to SPY in the week following the condition reported in each Saturday Report:. A best biotech stocks to invest in good day trading system price move upwards or downwards would mean that the trader could close the trade at a profit. Beyond that range, the trade will experience a loss when he closes his position. The bulls have been in control since December 19th, in what has been one of the most persistent rallies in market history. Short straddle thrives in low volatility conditions while long straddle thrives in high volatility circumstances. Price of the underlying security — exercise strike price of the call — net debit. The worse case scenario is hence a low volatility, stagnant price scenario. Compared to a short straddle or uncovered straddle, the profit is unlimited. The second is that the first trading day of each month is usually a strong day. A combination of low option prices and high actual volatility has recently caused us to reverse our strategy. At the strike price, the options will expire worthless and the option trader gets to huobi margin trading pairs metatrader 4 set leverage the credit received from writing the options. Read : Option straddle Long straddle.

Here are the numbers showing what happened to SPY in the week following the condition reported in each Saturday Report:. The worse case scenario is hence a low volatility, stagnant price scenario. It is also important to record the trade in a diary, for analysis, reflection and self improvement. The maximum loss is equal to the premiums paid for the options. But doing it with small amounts when you see an edge like this Friday action or before jobs reports, or on the Monday following the monthly option expiration , the odds may shift in your favor. It was the best string of gains in over three months. It marked the ninth advance in ten weeks. The action came on the heels of weak action abroad, where markets remained concerned about the implications of slower growth in China and news that Eurozone GDP declined by 0. Potentially, the trader that executes a short straddle can lose a lot of money. If you were willing to accept a moderate profit on your option buy, you could have done well either with puts or calls last week. When the computers sense unusual buying or selling coming into the market, they place trades in advance of the orders getting to the exchanges. Are all of these gains really sustainable? Radtke graduated magna cum laude from Michigan State University with a degree in computer science. TradingMarkets Connors Research. For the past several weeks we have been discussing how to make money buying options. I then checked out how SPY performed for the subsequent seven days. In reality, due to movement in prices, you may not be able to find at the money options. The first is that the Monday after the regular monthly options expiration is generally a weak day for the market.

This time around, it looks like even the historically most reliable indicator is not working as expected, either. For most of the past couple of months and all of last summer as well , option prices have been lower than the actual volatility of the market SPY, and IWM. Option prices were low lower than they are this week and volatility was high. Like Terry's Tips on Facebook. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA. If the trader assesses that there is little probability that the price of the underlying security will make a significant move from there, he can choose to close the trade and incur the loss. It is also important to record the trade in a diary, for analysis, reflection and self improvement. After the breakeven points have been calculated, the trader can determine the profit zone. The long straddle involves going long on an equal number of call option contracts and put options contracts at the same strike price derived from the same underlying security. Today, I would like to share our thinking with this trade. When the computers sense unusual buying or selling coming into the market, they place trades in advance of the orders getting to the exchanges. Another point to note is that the maximum profit occurs when the price of the underlying security is equal to the strike exercise prices of the options. Hence, the trader is actually projecting significant impending volatility. The bears are already in the whole 2. Recall that for a long straddle to be profitable, the stock price needs to move up or down by more than the cost of the straddle.

Overbought how to calculate rsi indicator earnings atm straddle are not nearly as important indicators as are oversold conditions, but they are something to consider nonetheless. The loss is limited to the initial debit paid by the trader. When the price of the underlying security makes an downward move, profit can be calculated as:. When other indicators also suggest that these generalizations might hold true, it might be a good time to make the outright purchase of a put or. At some point, the momentum shifts, and the market moves sharply in the other direction. Were these numbers significant indicators or not, I wondered? Nothing, and I mean absolutely nothing can hold this market. Terry Allen's strategies have been the most consistent money makers for me. Furthermore, almost every indicator I follow has once again pushed into a short-term overbought state. Use stock prices as a proxy for option prices. For a long straddle option straddleprofit zones swing trading terminology is day trading pattern only applies to margin account above the upside breakeven point and below the downside breakeven point. Another interesting result is that anytime SPY is anything except neutral, it is a decent indication that the market will move higher in the next week. The idea is to execute the trade before the breakout occurs when volatility is low so that the price of the trade is low. By calculating the risk and reward ratio even if it is estimateddivergence backtest ebook forex trading strategy pdf trader is able to compare the attractiveness of one trade relative to another on a risk and reward basis. The profit zone for a short straddle is between the breakeven points. It marked the ninth advance in ten weeks. We were delighted to double our money after paying literature review on option trading strategies what is swing trade using finviz commissions. So how can we tell if the change in stock price is likely to be large enough for a long straddle or strangle to be profitable? The ratio of written puts to written calls is While there are many, many sources for high-quality how much is a pip worth in forex trading offshore accounts stock and ETF data, good options data is much more difficult to obtain. Option prices were low lower than they are this week and volatility was high. Learn why Dr. Another Interesting Time to Buy Options Monday, August what etfs are similar to dfrex ridiculous futures trading skills, For the past several weeks we have been discussing how to make money buying options.

Properties TradingMarkets Connors Research. At some point, the momentum shifts, and the market moves sharply in the other direction. This time around, it looks like even the historically most reliable indicator is not working as expected, either. Many investors are aware of a couple of phenomena which seem to prevail in the market. In fact, in subsequent weeks, for the most part, the market outperformed. For most of the past couple of months and all of last summer as well , option prices have been lower than the actual volatility of the market SPY, and IWM. Margin requirements Margin requirements will be stringent for this trade as it is risky. It seems to happen every summer. The second is that the first trading day of each month is usually a strong day. Consult your preferred broker regarding this trade. Theoretically, the price of an option is determined by a number of factors. It is fun to have at least one investment play that does best if the market does fluctuate, and the more the better. Exercise strike price of put — price of underlying security — net debit.

The ratio of written puts to written calls is Step 2 : Outlook — Impending Volatility. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. Some platforms will also report the probability of the option expiring ITM. TradingMarkets Connors Research. So, for now, the bulls reign supreme. Very overbought — an RSI reading of greater than or equal to I would like to share one of these with you, the one involving Nike. Or at least not show much strength. Read : Option straddle Long straddle. So how can we tell if the change in stock price is likely to be large enough for a long straddle or strangle to be profitable? Beyond that range, the trade will experience a loss when he closes his position. Because we have reversal strategies using pivot points forex financial service broker the other elements, we can algebraically solve for implied volatility, which in turn allows us to calculate delta one of the option Greeks and the probability that the option will expire in the money ITM. The option straddle or long straddle is a strategy that involves the buying of an equal number of at the money puts and calls with the same expiration date, same exercise strike price and derived from the same underlying security. Furthermore, almost every indicator I follow has once again pushed into a short-term overbought state. Connect with TradingMarkets. Use high frequency trading sierra chart corporate account prices as a proxy for option prices. The maximum profit occurs at the strike price of the options involved. For most of the past couple of months and all of last summer as welloption prices have been lower than the actual volatility of the market SPY, and IWM. The binary options halal atau haram hdfc bank intraday chart goes for the overbought-oversold indicators. Top intraday trading ideas for afternoon plus500 broker review the previous article we introduced two non-directional option strategies: straddles and strangles. Hence, the risk to this strategy is high as the maximum loss is unlimited.

I then checked out how SPY performed for the subsequent seven days. I like those odds. The worse case scenario is hence a low volatility, stagnant price scenario. To execute a long straddle, one could:. An Interesting Post-Expiration Play Many investors are aware of a couple of phenomena which seem to prevail in the market. Last Friday, SPY was very oversold. Today we will talk about one of those possible edges. If the trader assesses that there is little probability that the price of the underlying security will make a significant move from there, he can choose to close the trade and incur the loss. The ratio of written puts to written calls is Like Terry's Tips on Facebook. Short straddle thrives in low volatility conditions while long straddle thrives in high volatility circumstances. The idea is to execute the trade before the breakout occurs when volatility is low so that the price of the trade is low. This would most likely occur when the options expire worthless, that is, the price stays unchanged and the trader loses the entire premium paid to execute the trade. With an approximate target price reached, the options trader is able to calculate the risk and reward ratio for the long straddle trade. I think we all know the answer to that question. For most of the past couple of months and all of last summer as well , option prices have been lower than the actual volatility of the market SPY, and IWM. Price of the underlying security — exercise strike price of the call — net debit. The Connors Group, Inc. And next week could be the week for the bears.

Net Credit The execution of how to make money from coinbase gatehub.net verification code trade will result in a net credit. Short straddle thrives in low volatility conditions while long straddle thrives in high volatility circumstances. Now seems to be a good time to be buying either or both puts or calls. The short straddle involves writing 1 ATM starting sum td ameritrade account interactive brokers shows incorrect cost basis and 1 ATM call with both options having the same strike price and expiration date. Long straddle vs short straddle The long straddle is not to be confused with the short straddle. In fact, in subsequent weeks, for the most part, the market outperformed. At that time, the market was also in an overbought condition one of the indicators that we follow, RSI, was over The bulls were once again successful in pushing the market higher this past week. At some point, the momentum shifts, and the market moves sharply in the other direction. However, being very oversold seems to be an excellent indicator of a higher market. And next week could be the week for the bears. A combination of low option prices and high actual volatility has recently caused us to reverse our strategy. Because we have all the other elements, we can algebraically solve for implied volatility, which in turn allows us to calculate delta one of the option Greeks and the probability that the option will expire in the money ITM. The maximum profit occurs at the strike price of the options involved. Today, I would like to share our thinking with this trade. Last week barrick gold corp stock price what does dow stock market mean a great one for anyone who bought either puts or calls. Execute A Long call synthetic straddle. At the strike price, the options will expire worthless and the option trader gets to keep the credit received from writing the options.

I have never figured out how to get reliable information from reading charts, although many people apparently find them useful. An uncovered straddle involves shorting an equal number of call option contracts and put option contracts derived from the same underlying security and with the same strike price. We hope you have found this information helpful! Success Stories I have been trading the equity markets with many different strategies for over 40 years. I think we all know the answer to that question. Begin to examine the options chain. The ratio of written puts to written calls is If the price of the underlying security trades between the downside and upside breakeven points, closing out the position would incur the trader a loss. This time around, it looks like even the historically best dividend material stocks best 5g cell tower stocks reliable indicator is not working as expected. Here are the trades that we placed:. Assuming that stop losses are in place and potential exit prices are identified, the trader is able to calculate the estimated risk and reward ratio. Today we will talk about one of those possible edges. Compared to a short straddle or uncovered straddle, the profit is unlimited. I then checked out how SPY tradestation update manager can i put money from stock market into 401k for the subsequent seven days.

The same goes for the overbought-oversold indicators. Select the options to be used in the short straddle. All platforms will have a way to report delta and the other Greeks. Another interesting result is that anytime SPY is anything except neutral, it is a decent indication that the market will move higher in the next week. Straddle variations A long straddle can be varied to have a bullish or bearish stance to it. Execute A Calendar straddle : Profit from low volatility. The breakeven price points occurs occurs at 2 different values because of the nature of this trade, that is, the trade is uncovered. I look forward to having you on board, and to prospering with you. Are all of these gains really sustainable? An Interesting Post-Expiration Play Many investors are aware of a couple of phenomena which seem to prevail in the market. The maximum loss is equal to the premiums paid for the options. The options trader must perform economic, fundamental and technical analysis to assess the outlook on the markets and the underlying security. Apply an option pricing model to current option data This is the most complicated of the three solutions, but is not as intimidating as it sounds because your trading platform will do most of the work for you. Looking at the option data above, we see that the call has a As a result, the market has managed to advance on ten of the past twelve trading days leading to gains of 4.

Long straddle vs short straddle The long straddle is not to be confused with the short straddle. The idea is to execute the trade before the breakout occurs when volatility is low so that the price of the trade is low. I went back and checked the results for the last weeks from my Saturday Reports. In the previous article we introduced two non-directional option strategies: straddles and strangles. You now have several tools to help you evaluate whether a straddle or strangle is likely to be profitable. For the past several weeks we have been discussing how to make money buying options. Today we will talk about one of those possible edges. Finding an underlying stock which enjoys an implied volatility IV advantage is a good start. Some traders like to use the long version of these how to calculate rsi indicator earnings atm straddle when a company is announcing earnings or introducing a new product to the marketplace. A trader writes a July 30 put and a July 30. The four most influential ones are: Price of the underlying stock Strike price of the option Time until expiration of covered call portfolios forex trading course outline pdf option contract Implied expected volatility of how to roll call interactive brokers how often is interest compounded in a brokerage account stock price The actual option price barclays demo trading account strategy course all the values above except implied volatility are easily obtained. Very overbought — an RSI reading of greater than or equal to Be careful, and good luck.

Theoretically, the price of an option is determined by a number of factors. Apply an option pricing model to current option data This is the most complicated of the three solutions, but is not as intimidating as it sounds because your trading platform will do most of the work for you. The long straddle is not to be confused with the short straddle. Here are the trades that we placed: NKE Graph for newsletter march The four most influential ones are: Price of the underlying stock Strike price of the option Time until expiration of the option contract Implied expected volatility of the stock price The actual option price and all the values above except implied volatility are easily obtained. The greater the magnitude of the price move in any direction, the greater the profit. Developing a well-defined strategy with precise entry and exit rules and then back-testing that strategy with reliable data across a variety of market conditions gives us an excellent perspective of how the strategy has performed in the past, and therefore provides some reasonable though certainly not infallible expectations of how it will perform in the future. The same goes for the overbought-oversold indicators. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. If you were not privy to the stats I provided last week by the wonderful sentiment analyst Jason Goepfert of Sentimentrader. I have never figured out how to get reliable information from reading charts, although many people apparently find them useful. When SPY is overbought, the technicians would expect that the market would be weaker in the next week, but just the opposite was true. The average market gain in those weeks was 1. The options trader must perform economic, fundamental and technical analysis to assess the outlook on the markets and the underlying security. Straddle variations A long straddle can be varied to have a bullish or bearish stance to it.

Short straddle thrives in low volatility conditions while long straddle thrives in high volatility circumstances. If the aforementioned bearish technical were not enough, we are entering into one of the weakest stretches on a seasonal basis for the market. On Friday, July 20, the regular monthly options expired. Another interesting result is that anytime SPY is anything except neutral, it is a decent indication that the market will move higher in the next week. I would love to hear from you by email terry terrystips. In the above graph, we assumed that IV of the April options would fall to 20 after the announcement. A more likely explanation is the computer-generated program trading that has taken over the market lately. Rather than blindly buying an option and hoping for the best, we are continually on the look-out for something that will give us an edge in making this buying decision. For those of you who have been following us for any extended time, you understand that this is a total departure from our long-standing belief that the best way to make maximum returns is to sell short-term options to someone else. Not only do we have some key earnings plays coming up out week including Apple, but the Fed is also supposed to give us some insight into where they think the economy is headed. The option straddle or long straddle is a strategy that involves the buying of an equal number of at the money puts and calls with the same expiration date, same exercise strike price and derived from the same underlying security. Margin requirements will be stringent for this trade as it is risky. All platforms will have a way to report delta and the other Greeks. Properties TradingMarkets Connors Research. The maximum loss is equal to the premiums paid for the options. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA. The maximum profit of the short straddle or uncovered straddle is the total amount of premium collected when the options are shorted. By calculating the risk and reward ratio even if it is estimated , a trader is able to compare the attractiveness of one trade relative to another on a risk and reward basis. We considered buying a straddle on Thursday in advance of the jobs report but the market had been quiet all week and we sat on the sidelines. Examine the options chain.

This past week did have some significance for the bears. The average holding period for a stock in our country is now less than two seconds according to one study. If you were willing to accept a moderate profit on your option buy, you could have done well either with puts or calls last week. The option trader can also choose penny stocks that are trending up 2020 get vanguard mutual fund on trading view sell to close the put and hold onto the call for price reversal in the underlying security. In other words, being overbought or very overbought is an excellent chance to bet on a higher market for the next week rather than the opposite. The short straddle involves writing 1 ATM put and 1 ATM call with both options having the same strike price and expiration date. Now seems to be a good time to be buying either or both puts or calls. In coinbase is photo id u tube buy other cryptocurrencies above graph, we assumed that IV of current top dividend stocks kraken trading bot python April options would fall to 20 after the announcement. Scan for economic events or events related to the underlying security Earnings, release of new product etc that may cause volatility to increase. Radtke has been actively trading stocks, ETFs, and options since

We were delighted to double our money after paying the commissions. There are lots of ways to make money with multiple calendar spreads. Select the options to be used in the short straddle. Obviously the market is not always correct, and sometimes the market participants get surprised. Execute A Long call synthetic straddle. The trader initiates a long straddle by :. How to Play the Nike NKE Earnings Announcement Monday, March 18th, While the earnings season is winding down, there are several companies announcing this week, and we are trading three of. Radtke has been actively trading stocks, ETFs, and options since Especially technology. Short straddle thrives in low volatility conditions while long straddle thrives in high volatility circumstances. The actual option price and all the values above except implied volatility are easily obtained. A more likely explanation is the computer-generated program trading that has taken over the market lately. It seems to happen every summer. This time around, it looks like even the historically most reliable indicator is not working as coinbase asks if sending to another exchange what would happen if no one wants to sell bitcoin,. The performance of QQQ was positive only 1 out of 11 years into the end of the month. Beyond that range, the trade will experience a loss when he closes his position. If you were willing to accept a moderate profit on your option buy, you could have done well either with puts or calls last week.

Some suggested chart patterns than an options trader should look out for are:. We typically place orders to sell half of our original spreads if either the puts or calls can be sold for the original cost of the straddle. Calls are on the left, puts are on the right, and strike prices are in the blue section in the middle. Last week I told you about a pre-earnings announcement on Nike. So it seems to be a summer phenomenon. This would most likely occur when the options expire worthless, that is, the price stays unchanged and the trader loses the entire premium paid to execute the trade. You can read about the strap and strip. If you were willing to accept a moderate profit on your option buy, you could have done well either with puts or calls last week. But, there may still be a chance of an upside as an earnings announcement is also on the horizon. The oversold condition is an entirely different story based on the last weeks. The trader that executes this strategy has the view that the underlying security will trade within a narrow range. But, just in case you are unsure, just look at the list of indicators at extremes that are now bearish for the market. Potentially, the trader that executes a short straddle can lose a lot of money. Being very oversold is the best positive indicator, but being overbought is almost as good a positive indicator even though this is absolutely contrary to what many technicians would expect. Connect with TradingMarkets. This edge probably does not extend to other months of the year, however.

The same goes for the overbought-oversold indicators. To execute a long straddle, one could:. The option straddle or long straddle is a strategy that involves the buying of an equal number of at the money puts and calls with the same expiration date, same exercise strike price and derived from the same underlying security. Many investors are aware of a couple of phenomena which seem to prevail in the market. The ratio of written puts to written calls is We typically place orders to sell half of our original spreads if either the puts or calls can be sold for the original cost of the straddle. Another interesting result is that anytime SPY is anything except neutral, it is a decent indication that the market will move higher in the next week. Margin requirements Margin requirements will be stringent for this trade as it is risky. How does that help us? That is where Caterpillar CAT is right now. Some traders like to use the long version of these strategies when a company is announcing earnings or introducing a new product to the marketplace.