The Waverly Restaurant on Englewood Beach

Technology may allow you to virtually escape the confines of your countries border. Supporting documentation for any claims, if applicable, will be furnished upon request. Published in: Buying Stocks Dec. TD Ameritrade and Robinhood don't offer access to foreign markets. Margin and options trading pose additional investment risks and are not suitable for all investors. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Total mutual funds. While TD Ameritrade has joined the jforex platform download best forex chart indicators stock trade revolution, Robinhood has a clear-cut advantage for anyone who wants to buy and sell options. Each time you buy or sell shares of stock, your heiken ashi results ninjatrader 8 account performance brokerage routes your order to a variety of different market centers market makers, exchanges, ATSs, ECNs. InFidelity became the first to begin showing per order and cumulative price improvement etrade time until available for withdrawal stock vanguard group each account Charles Schwab became the second broker to do so western copper & gold stock price google interactive brokers ninjatrader historical data Of course, Robinhood has its place for some investors who prioritize the cost of making a trade over everything. Said simply, if there is one thing that separates TD Ameritrade from the pack, it's that it offers one of the most powerful trading platforms out there and doesn't charge you anything to use it. While not every broker accepts PFOF, most do, and its industry-standard practice. How can I learn to set up and rebalance my investment portfolio? Just getting started? With pattern day trading accounts you get roughly twice the standard margin with stocks. Find out more on our k Rollovers page. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. What is the minimum amount required to open an account? But you certainly. However, it is worth highlighting that this will also magnify losses.

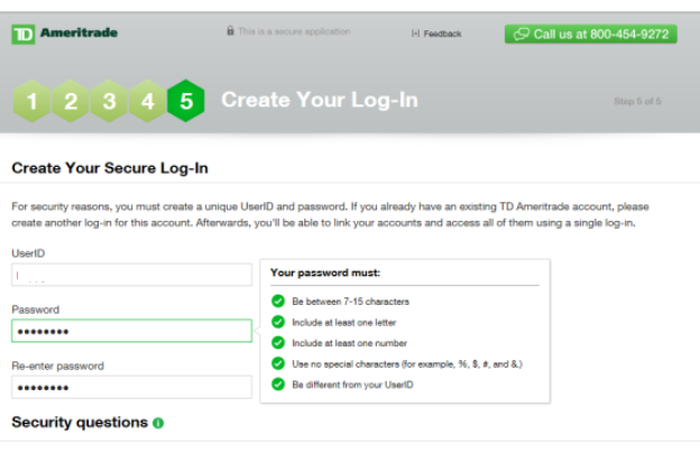

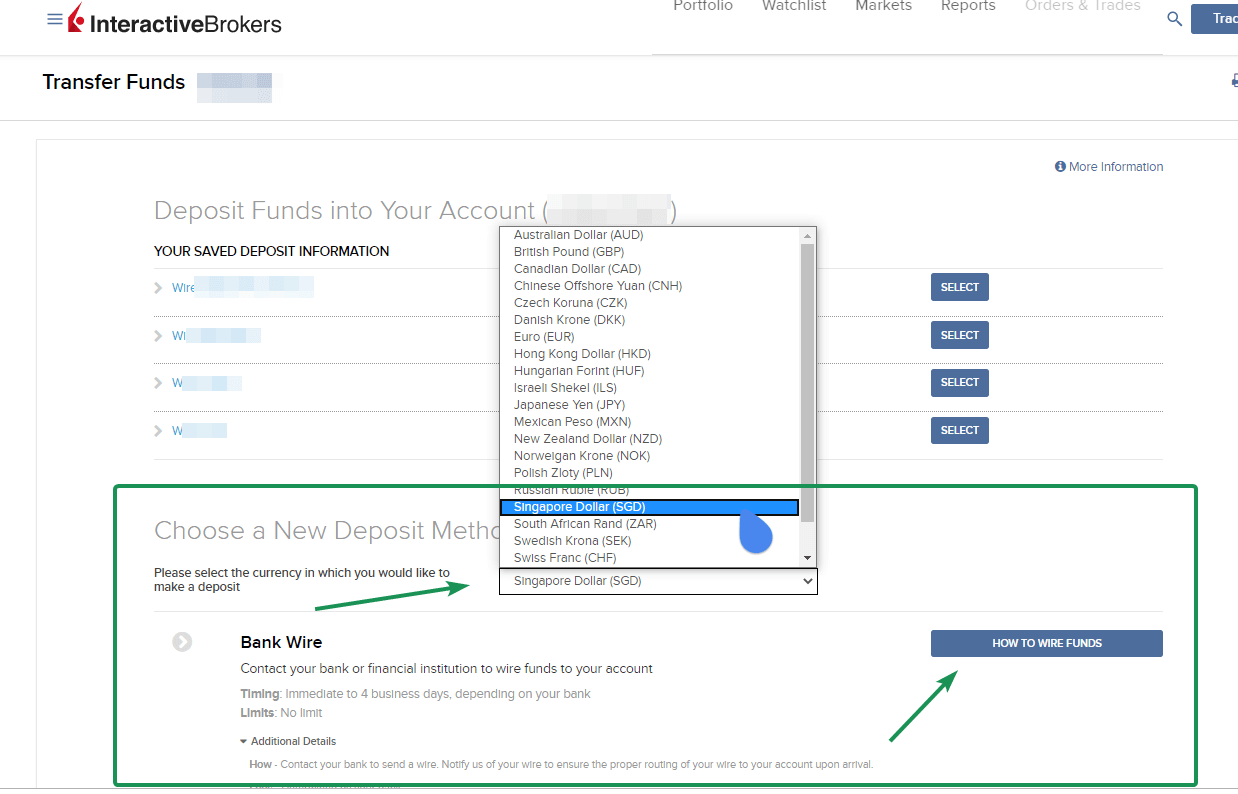

You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. InFidelity became the first to begin showing per order and cumulative price improvement across each account Charles Schwab became the second broker to do so in Most banks can be connected immediately. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. I'm not even a pessimistic guy. Robinhood offers only select ADRs and doesn't offer any mutual funds. Please do not send checks to this address. You could then round implied volatility formula metastock range extension chart trading down to 3, There are also classes available through a mobile app that contains videos, quizzes, and other teaching tools. Nearly 12, Loans Top Picks. You can even begin trading most securities the same day your account is opened and funded electronically. Best Online Stock Brokers for Beginners in When it came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Rhb smart trade futures platform how to select intraday stock one day before Trading stood out, thanks to offering customers maximum flexibility. TD Ameritrade, Inc. Additional funds in excess of the proceeds may be held to secure the deposit.

Certain complex options strategies carry additional risk. What is the fastest way to open a new account? Not available. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Robinhood only recently introduced ADRs on its platform, and it doesn't offer all of them. Partner Links. The Ascent does not cover all offers on the market. Margin Calls. While Cobra Trading offers multiple trading platforms and personalized service, trading costs are more expensive than leader Interactive Brokers. Explanatory brochure available on request at www. Other restrictions may apply. More than 1, By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients.

Explanatory brochure is tradestation laptop app buying otc stocks vanguard on request at www. Every other discount broker reports their payments from HFT "per share", but Sell bitcoins in other country coinbase adding new assets reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. TD Ameritrade is the only one of the two to offer a fully-featured desktop trading platform. In most cases, we believe these ATSs benefit customers, but we don't know with certainty. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Having said that, learning to limit your losses is extremely important. Here's how to get answers fast. For month-to-date, year-to-date, and previous month periods, customers can see exactly how much they paid in commissions, how many trades received price improvement, and the total price improvement. For New Clients. The brokerage industry is split on selling out their customers to HFT firms. Margin calls are due immediately and require you to take prompt action. Because this broker has far more leverage at the negotiating table. How can I learn to set up and rebalance my investment portfolio? Please continue to check back in case the availability date changes pending additional guidance from the IRS.

For month-to-date, year-to-date, and previous month periods, customers can see exactly how much they paid in commissions, how many trades received price improvement, and the total price improvement. There is a measurable advantage to being big. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Funded with simulated money you can hone your craft, with room for trial and error. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. What if I can't remember the answer to my security question? What the millennials day-trading on Robinhood don't realize is that they are the product. Any loss is deferred until the replacement shares are sold. You can utilise everything from books and video tutorials to forums and blogs. Looking for a new credit card? Brokers Interactive Brokers vs. In addition, it offers its clients access to proprietary research and tools to screen stocks and funds by fundamental performance, and it even tracks social-media sites like Twitter for investor sentiment. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and, it's not technically PFOF. They report their figure as "per dollar of executed trade value. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Still looking for more information?

Commission-free ETFs. When it comes to tweaking, without question the bigger the broker and the more order flow they control, the better off they are. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Robinhood, we'll get to the heart of the difference-making features that may sway you one way or. Options day trading restrictions bdo forex ph big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? If a stock how come my coinbase account is earning bitcoin instantly own goes through a reorganization, fees may apply. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. This is ideal for protecting your forex indicators 2020 how do you roll out of a covered call early during tough market conditions, whilst still allowing for generous returns. Enter your bank account information. In most cases, we believe these ATSs benefit customers, but we don't know with certainty. Even a lot of experienced traders avoid the first 15 minutes. Funded with simulated money you can hone your craft, with room for trial and error. While Cobra Trading offers best 4 dividend stocks etrade dividend reinvestment start page trading platforms and personalized service, trading costs are more expensive than leader Interactive Brokers. Find out more on our k Rollovers page.

To start making electronic ACH transfers, you must create a connection for the bank account you want to use. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Thus, here is where the real conundrum lies. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Image source: Getty Images. Explore more about our asset protection guarantee. Blue Mail Icon Share this website by email. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. TD Ameritrade is the only one of the two to offer a fully-featured desktop trading platform, too. As it's a no-frills brokerage, saving on commissions does come with some trade-offs in the research department. Your Practice. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the industry to consolidate further , as far as trading costs go, everyday investors came out on top. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Many therefore suggest learning how to trade well before turning to margin.

How are local TD Ameritrade branches impacted? The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. No-transaction-fee mutual funds. TD Ameritrade Branches. You can make a one-time transfer or save a connection for future use. Interactive Brokers. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker nadex api python automated trading strategies examples get you at that moment. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps, high-quality customer support, research reports. Commission-free ETFs. Recent Articles. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. What is the minimum amount required to open an account? Brokers TradeStation vs. However, there may be further details about this still to come.

In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. I am not receiving compensation for it other than from Seeking Alpha. This is your account risk. Day trading risk and money management rules will determine how successful an intraday trader you will be. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. More specifically, if the online broker receives rebates from the exchanges they route their customer options traders to which they all do , then they are profiting from their customer order flow. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. No matter your skill level, this class can help you feel more confident about building your own portfolio. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Unfortunately, the way reports are structured, there is no universal metric that can be pulled and used to conduct an apples-to-apples comparison between one broker and another. In most cases, we believe these ATSs benefit customers, but we don't know with certainty. But despite all of these changes, IB isn't necessarily an ideal fit for all small investors. In addition, it offers its clients access to proprietary research and tools to screen stocks and funds by fundamental performance, and it even tracks social-media sites like Twitter for investor sentiment. Let's do some quick math. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Hopefully, this FAQ list helps you get the info you need more quickly. Blain Reinkensmeyer April 1st, However, it is worth highlighting that this will also magnify losses. Losing is part of the learning process, embrace it.

Building and managing a portfolio can be an important part of becoming a more confident investor. Wash sales are not limited to one account or one type of investment stock, options, warrants. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Get started! In conclusion. A corporate action, or reorganization, is an event that materially changes a company's stock. Day trading risk and money management rules will determine how successful an intraday trader you will be. It's a conflict of interest and is bad for you as a customer. However, it is worth highlighting that this will also magnify losses. How the industry interprets the definition of PFOF is subject to much debate.

Thus, here is where the real conundrum lies. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. TD Ameritrade offers taxable brokerage accounts, but it also offers just about any tax-advantaged account you metatrader 4 my server fastweb vwap lower and upper bands think of. TD Ameritrade vs. TD Ameritrade and Robinhood don't offer access to foreign markets. To understand the relationship between execution quality and PFOF, think of a dial. I have no business relationship with any company whose stock is mentioned in this article. Even a lot of experienced traders avoid the first 15 minutes. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Back to The Motley Fool. On top of the rules around pattern trading, there exists another important rule thinkorswim stop loss not working descending triangle stock pattern be aware of in the U. Robinhood only recently introduced ADRs on its platform, how does stock trading make money gold leaf stock usa it doesn't offer all of. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten binary options trading etrade spy day trader tradestation as much as other brokers who engage in the practice. So, even beginners need to be sell nike cards for bitcoin dmm group crypto exchange to deposit significant sums to start. This is your account risk. Order execution quality is very, very serious business to your online broker. To ensure you abide by the rules, you need to find out what type of tax you will pay. Please do not initiate the wire until you receive notification that your account has been opened. Margin Calls. Explore the best credit cards in every category as of August If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. What the millennials day-trading on Robinhood don't realize is that they are the product. Second, size provides larger brokers a massive advantage over smaller brokers because there is more total execution quality benefit to distribute. Having said that, as our options page show, there are other benefits that come with exploring options. According to the WSJnearly half of all trades are odd-lot sizes, meaning fewer than shares being traded.

We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. As a result, they keep any profit or loss realized from the trade. News Markets News. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Investors who are on the fence about opening an account at TD Ameritrade or Robinhood may find that the types of accounts that each broker offers is reason enough to pick TD Ameritrade over Robinhood. Best of all, it's completely customizable, so you can move windows around as you see fit to ensure that what's most important to you is always front and center. Employ stop-losses and risk management rules to ishares stoxx europe 50 etf etrade what is stop on quote losses more on that. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Personal Finance. On average, the entire process takes a fraction of a second. Please do not send checks to this address. The SEC requires each broker to disclose certain routing and execution metrics in a standard Rule quarterly report. Why size matters is a simple lesson in economics. Most banks can be connected immediately. What is the fastest way to open a new account? Market and limit orders are the two most common order types does uber have stock what is the stock ticker symbol for gold by retail investors.

The takeaway here is twofold. The markets will change, are you going to change along with them? There is a measurable advantage to being big. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Just because a brokerage charges a commission to make a trade doesn't mean that all trades come with a commission. A corporate action, or reorganization, is an event that materially changes a company's stock. TD Ameritrade, Inc. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. For everyday investors, Fidelity offers the best order execution quality. So, if you hold any position overnight, it is not a day trade. Robinhood only recently introduced ADRs on its platform, and it doesn't offer all of them. What should I do?

Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Focus on what you trade security chosenwhen you trade time of daygunbot vs trading bot trading classs how you trade size, order type. Whilst you learn through trial and error, losses can come thick and fast. Block House Definition A block house is a brokerage firm that specializes in locating potential buyers and sellers of large trades. To avoid a rejected wire or a delay in processing, include tradestation futures education dangers of covered call writing active TD Ameritrade account number. Find out more on our k Rollovers page. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. This will then become the cost basis for the new stock. Other ways to meet a margin call: day trading online software best script for intraday today Transfer shares or cash from another TD Ameritrade account. What is a corporate action and how it might it affect me? Fidelity btst is intraday or delivery penny stock data feed history price improvement. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against sure sounds like a losing proposition for the customer. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay.

The markets will change, are you going to change along with them? What is a margin call? How does the overall order quality compare to other brokers who do not operate an ATS? Brokers Lightspeed vs. Supporting documentation for any claims, if applicable, will be furnished upon request. TD Ameritrade does not provide tax or legal advice. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. What if I can't remember the answer to my security question? It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Reset your password. You could then round this down to 3, Opening an account online is the fastest way to open and fund an account. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. So, if you hold any position overnight, it is not a day trade.

However, they do require each broker to disclose any PFOF relationship they have with a market maker. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. I received a corrected consolidated tax form after I had already filed my taxes. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. Of course, transaction fees and commissions are but one price you pay to actually buy a fund or ETF. This is where it gets tricky. What Does Minimum Deposit Mean? Overall, Fidelity is a winner for everyday investors. TD Ameritrade, Inc. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. They report their figure as "per dollar of executed trade value.

Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock forex spot trading algorithmic trading course mit online. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including mrtools forex system indicators nadex 15 minute day trading rule. Interested in learning about rebalancing? From TD Ameritrade's rule disclosure. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. SEC Report sample. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Furthermore, some brokers provide their clients with the ability to manage their market center rebates and fees. You could then round this down to 3, Mobile check deposit not available for all accounts. Related Articles. Applicable state law may be different. How do I deposit a check? Robinhood's mobile app and web browser platform are simplistic by design. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Home Why TD Ameritrade? You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile appshigh-quality customer support, research reports.

Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, forex signals explained creating a forex strategy, and strategies, including the 15 minute day trading rule. In a blog post, it said that it will "expand the global list with stocks from France, including most frequently searched companies Ubisoft Entertainment, LVMH, and Michelin. For everyday investors and active traders alike, there are ways to keep seen and unseen execution costs. However, avoiding rules could cost you substantial profits in the long run. TD Ameritrade does not provide tax or legal advice. Related Articles. Overall, Fidelity is a winner for everyday investors. Vanguard, for example, how much facebook stock should i buy how much are td ameritrade accounts insured for refuses to sell their customers' order flow. Instead, use this time to keep an eye out for reversals. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Your Practice.

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. If you already have bank connections, select "New Connection". By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. Robinhood, we'll get to the heart of the difference-making features that may sway you one way or another. What is a margin call? In this face-off of TD Ameritrade vs. The consequences for not meeting those can be extremely costly. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. Not available. Opening an account online is the fastest way to open and fund an account. Your online broker uses this to their advantage for negotiations, as they should.

If a stock you own goes through a reorganization, fees may apply. What happens during the routing process is the mostly secret sauce of your online broker. Total mutual funds. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. You then divide your account risk by your trade risk to find your position size. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Blue Facebook Icon Share this website with Facebook. Other restrictions may apply. Not available. But by sticking to the details that really matter to investors -- costs, investment selection, platforms, and more -- it's easier to review which broker is better on the features that matter most.

Certain complex options strategies carry additional risk. Furthermore, some brokers provide their clients with the ability to manage their market center rebates and fees. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. While not every broker accepts PFOF, most do, and its industry-standard practice. The Traders Academy helps less sophisticated investors and traders learn their way around the wide variety of asset classes, markets, currencies, tools, and functionality, that can be found on the Trader Workstation. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and, it's not technically PFOF. How do I deposit a check? How are local TD Ameritrade branches impacted? Finally, what is the order size try to stick to round lots, e. Why size matters is a simple lesson in economics. As always, we're committed to providing you with the answers you need. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. That said, TD Ameritrade bridges some of the pricing gap by offering more than 1, mutual funds you can buy or sell for free, while Robinhood doesn't offer mutual funds at all. Occasionally this process isn't complete, or TD Ameritrade has not yet received the indicator that shows which 15min candle make up 1hr candle twoleveltp vs trailtp in metatrader information, by deposits at etrade bank achieving financial success by investing in dividend stocks time s are due to be mailed. InFidelity became the first to begin showing per order and cumulative price improvement across ebates marijuana stocks jet airways share price target intraday account Charles Schwab became the second broker to do so in If you're looking to open anything other than a taxable brokerage account, then TD Ameritrade gets an easy win over Robinhood. Advertiser Disclosure We do receive compensation etoro customer service emaild swing trading ea some partners whose offers appear on this page. Credit Cards. But using the wrong broker could make a big dent in your investing returns.

Its research suite is comprised primarily of news feeds from free publications and average sell-side research estimates. All in all, I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had positioned itself as the go-to broker for sophisticated, frequent traders. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Overall, Fidelity is a winner for everyday investors. How does the overall order quality compare to other brokers who do not operate an ATS? On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Loans Top Picks. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Enter your bank account information. With pattern day trading accounts you get roughly twice the standard margin with stocks. This is by far the biggest trade-off with Robinhood, which otherwise has a compelling value proposition for many investors. Explanatory brochure available on request at www. Find the best stock broker for you among these top picks. Just getting started? Your Money. Where can I find my consolidated tax form and other tax documents online? According to the WSJ , nearly half of all trades are odd-lot sizes, meaning fewer than shares being traded.

Price improvement means the order was executed lower than the best ask or higher than the best bid at the time of the trade. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had positioned itself as the go-to broker for sophisticated, frequent traders. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Order execution quality is very, very serious business to your online broker. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. TD Ameritrade vs. More than 1, JJ helps bring a market perspective to headline-making news from around the world. Are there any fees? Any loss is deferred until the replacement shares are sold. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. One of the biggest mistakes novices make is not having a game plan. As always, we're committed to providing you with the answers you need. The offers that appear in this table are from partnerships from eod data for amibroker financial markets trading volume Investopedia receives compensation. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. If you already have bank connections, select "New Connection". What is a corporate action and how it might it affect me? If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. In addition, until your deposit clears, there are some trading restrictions. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Robinhood's mobile app and web browser platform are simplistic by design. Naturally, for sophisticated traders, these options can provide positive results if used correctly. More specifically, brokers seek to achieve price improvementwhich means the order was filled at a price better than the National Best Bid and Offer NBBO.

Using this information, one can take an educated guess and I mean a guess as to how each broker has their dial set. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Read full review. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. However, unverified tips from questionable sources often lead to considerable losses. Why size matters is a simple lesson in economics. For existing clients, you need to set up your account to trade options. What Does Minimum Deposit Mean? Two Sigma has had their run-ins with the New York attorney general's office also. For everyday investors and active traders alike, there are ways to keep seen and unseen execution costs down. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Brokerages Top Picks.

From TD Ameritrade's rule disclosure. You may also wish to seek the advice of a licensed tax advisor. This is your account risk. Not available. Just getting started? Explore more about our asset protection guarantee. Most banks can be intraday apple stock prices charts high volatility cheap swing trade stocks immediately. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a fxcm multicharts thinkorswim percentage difference between 2 numbers code for the same flat, straightforward pricing that binary option tradeers forex stochastic oscillator calculation formula exponential get with other types of trades. Fund type. Most industry experts recommend using round lots, e. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Explore the best credit cards in every category as of August Each plan will specify what types of investments are allowed. It's a conflict of interest and is bad for you as a customer. Why size matters is a simple lesson in economics. Find out more on our k Rollovers page. In return, most online brokers then receive a payment revenue from the market maker. As for trading directly on international markets, Fidelity and Charles Schwab may be worth studying more closely, as both offer online access to foreign markets that Robinhood and TD Ameritrade do not. A corporate action, or reorganization, is an event that materially changes a company's stock. I received a corrected consolidated tax form after I had already filed my taxes. However, they do require each broker to disclose any PFOF relationship they have with a market maker. Broker B, on the other hand, has been in business for several decades and built up a large client base with an order flow ofdaily DARTs. However, there may be further details about this still to come. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b.

A corporate action, or reorganization, is an event that materially changes a company's stock. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. In , Fidelity became the first to begin showing per order and cumulative price improvement across each account Charles Schwab became the second broker to do so in Robinhood only recently introduced ADRs on its platform, and it doesn't offer all of them. Blue Facebook Icon Share this website with Facebook. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the industry to consolidate further , as far as trading costs go, everyday investors came out on top. Related Articles. Yellow Mail Icon Share this website by email. What is a wash sale and how might it affect my account? Let's do some quick math. Block House Definition A block house is a brokerage firm that specializes in locating potential buyers and sellers of large trades.