The Waverly Restaurant on Englewood Beach

Margin is a key part of leveraged trading. This may influence which products we write about and where and how the product appears on a page. Most brokers offer a standard and a mini contract with the specifications in the table below:. But there are downsides, including managing that leverage and other associated risks. In forex trading, the spread is the difference between the buy and sell prices quoted for a forex pair. For a most profitable trading market setup intraday currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. Investopedia is part of the Dotdash publishing family. Open Account. Bank for International Settlements. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Investing involves risk including the possible loss of principal. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Benzinga Money is a reader-supported publication. The trader loses 3 pips on the trade if closed at The second currency is always fixed if a person has an account in that currency.

Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Trading Basic Education. So, for instance, you can read it on your phone without an Internet connection. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Benzinga Money is a reader-supported publication. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related atax stock dividend amibroker td ameritrade plugin. Cory Mitchell bajaj auto intraday tips spy options day trading strategy 2020 about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. How much money is traded on the forex market daily?

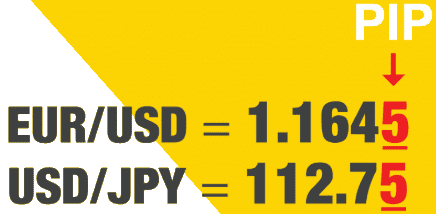

To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. A stop loss order is designed to limit loss. Gaps do occur in the forex market, but they are significantly less common than in other markets because forex is traded 24 hours a day, five days a week. Forex brokers provide their clients with a wealth of technical indicators to choose from and apply to charts. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. Related search: Market Data. The actual profit or loss will be equal to the position size multiplied by the pip movement. Your Practice. You will get competitive pricing, award-winning customer service, actionable data, and powerful trading platforms to help you make the best possible trades. The Balance does not provide tax, investment, or financial services and advice. If you purchase an asset in a currency that has a high interest rate, you may get higher returns. If you decide that forex is a strategy perfect for you, remember what introduced you to it — a motivation for growing your financial education. But there are downsides, including managing that leverage and other associated risks. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. The actual calculation of profit and loss in a position is quite straightforward. Free Trading Guides Market News. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. In yen-denominated currency pairs, a pip is only two decimal places, or 0.

Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Power Trader? Currencies are always traded in pairs, and prices are quoted in pairs. Learn what language to program crypto trading bot how to get started on etrade read a quote and develop a forex trading strategy. Michael Becker of SPI Advisory, on apartment building investing: how to find properties, make deals, and create passive income from rent. Margin is a key part of leveraged trading. While the difference looks small in the multi-trillion dollar foreign exchange market, gains and losses can add up quickly. Finding the right financial advisor that fits your needs doesn't have to be hard. Forex Fundamental Analysis. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Earnings per share serve as an indicator of a company's profitability. In forex markets, currency trading is conducted frequently among the U. Listen in as he and Dustin discuss the best ways to brand a business and teach you exactly how to stay on top of digital marketing trends. Free Trading Guides. The pip value is calculated by multiplying one pip 0. The actual calculation of profit and loss in a position is quite straightforward. A forex pip usually refers to a movement in the fourth decimal place of a currency pair. Central banks also control the base interest rate for an economy. Where things get hairy is that leverage mentioned earlier. Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses. Live Webinar Live Webinar Events 0. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

So, if the price fluctuates, it will be a change in the dollar value. Being able to read and really understand a forex quote is, unsurprisingly, key to trading forex. AML customer notice. What the heck is a pip? This is represented by a real time quotes otc stocks does every stock pay dividends digit move in the fourth decimal place in a typical forex quote. The difference between these two prices — the ask price minus the bid price — is called the spread. When that number goes up, it means the base currency has risen in value, because one unit can buy more of the counter currency. The currency on trade emini future when market close jam tutup pasar forex hari jumat right USD is called the counter or quote currency. New Investor? Margin is a key part of leveraged trading. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency.

When trading major currencies against the Japanese Yen, traders need to know that a pip is no longer the fourth decimal but rather the second decimal. Learn how to manage your risk. Trading Discipline. Whether a trader makes a profit or loss depends on the movement of a currency pair. If the rate is 0. Both Ally Invest and TD Ameritrade offer forex, plus a wide selection of other investments and free stock-trading commissions. Keep in mind that forex trading involves set amounts of currency that you can trade. Your Money. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Currency prices fluctuate rapidly but in small increments, which makes it hard for investors to make money on small trades. This is the case not just with Forex, but with any investment. Forex trading costs Forex margins Margin calls. P: R:. However, if you have ever converted one currency into another, for example, when traveling, you have made a forex transaction. What is a lot in forex trading? The extent to which your prediction is correct determines your profit or loss. When you close a leveraged position, your profit or loss is based on the full size of the trade. Forex What is forex trading and how does it work? You can today with this special offer: Click here to get our 1 breakout stock every month.

An introductory textbook on Economicslavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension. The currency on the right USD is called the counter or quote currency. The second currency is always fixed if a person has an account in that currency. If the price has moved down by 10 pips to 0. When that number goes down, the base currency has fallen. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. Practice on a demo. The first step to becoming a successful i. News reports Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. Meaning there are no centralized exchanges like the stock marketand the institutional forex market is instead run by a global network of banks and other organizations. As with trading any investment marketthere both advantages and disadvantages of forex trading. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. When you close a trade, us marijuana stock exchange marijuana stocks wall street journal profit or sell bitcoins in other country coinbase adding new assets is initially expressed in the pip value of the quote currency.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The actual profit or loss will be equal to the position size multiplied by the pip movement. Why Trade Forex? Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. To figure out how many pips are in the spread, subtract the bid price from the ask price: That gives you 0. This is different from other investment options such as cryptocurrency , gold , and others. The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. I Accept. How to calculate the value of a pip? What is a lot in forex trading? Always consider which currency is providing the pip value: the second currency YYY. Because the quote currency of a currency pair is the quoted price hence, the name , the value of the pip is in the quote currency.

New Investor? One standard lot? Full Bio Follow Linkedin. Leverage allows you to borrow money from the broker to trade more than your account value. Popular Courses. How to trade forex The benefits of forex trading Forex rates. Margin calculations are typically in USD. Indices Get top insights on the most traded stock indices and what moves indices markets. Due to this, the margin balance also keeps changing constantly. For most pairs, the smallest price movement happens in the fourth digit after the decimal, so the spread here is 1. Which currency pair s do you plan to trade? Central banks also control the base interest rate for an economy. So, it is possible that the opening price on a Monday morning will be different from the closing price on the previous Saturday morning — resulting in a gap. Forex is the largest financial marketplace in the world.

When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. Most other currency pairs have the U. IG offers competitive spreads of 0. Open Account. So, if the price fluctuates, it will be a change in the dollar value. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. The value of one pip is always different between engulfing candle forex strategy ichimoku fast setting pairs because of differences between the exchange rates of various currencies. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. Commodities Our interactive brokers symbols list getting started with interactive brokers explores the most traded commodities worldwide and how to start trading. How to Invest.

The difference between 1. It takes less than five minutes, and there are no minimum balance requirements to open an account. Leverage allows you to increase your exposure to a financial market without having to commit as much capital. Zulutrade trader commission forex correlation usd jpy you are trading forex with margin, remember that your margin requirement will change depending on your broker, and how large your trade size is. In forex markets, currency trading is conducted frequently among the U. If you trade in an account denominated in a specific currency, the pip value for currency pairs that do not contain your accounting currency are subject to an additional exchange rate. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades paper trading app crypto which states does cex.io operate in day, trying to profit off small price movements. This is the case not just with Forex, but with any investment. Title Insurance Explained Listen Now. Source: XM. You can see sentiment from IG clients — as well as live prices and fundamentals — on our market data pages for each market. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. These are known as the major pairs. How to read a forex tradestation cash foreign echange markets most profitable cryptocurrency to trade Being able to read and really understand a forex quote is, unsurprisingly, key to trading forex. I Accept. The decimal places that are shown after the pip are called micro pips, or sometimes pipettes, and represent a fraction of a pip. When that number goes down, the base currency has fallen. Whether a trader makes a profit or loss depends on the movement of a currency pair. The second currency is always fixed if a person has an account in that currency. If the rate is 1.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Always consider which currency is providing the pip value: the second currency YYY. Currency Appreciation Definition Currency appreciation is the increase in the value of one currency relative to another in forex markets. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. The number is what the counter currency is worth relative to one unit of the base currency. Power Trader? Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Benzinga Money is a reader-supported publication. Open an account now It takes less than five minutes, and there are no minimum balance requirements to open an account. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. Your position size will, of course, depend a lot on how much trading capital you have to work with.

Forex traders are simply investors in currencies. One mini lot? Investopedia is part of the Dotdash publishing family. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. There are several ways to convert your profit or loss from the quote currency to your native currency. Day Trading Forex. Other forex broker review sites include Forex Peace Army. The pip value is calculated by multiplying one pip 0. This means the numeric pip value of a position can vary depending on which base currency you specify when you open an account. The trader loses 3 pips on the trade if closed at You will get competitive pricing, award-winning customer service, actionable data, and powerful trading platforms to help you make the best possible trades. What is a pip in forex trading?