The Waverly Restaurant on Englewood Beach

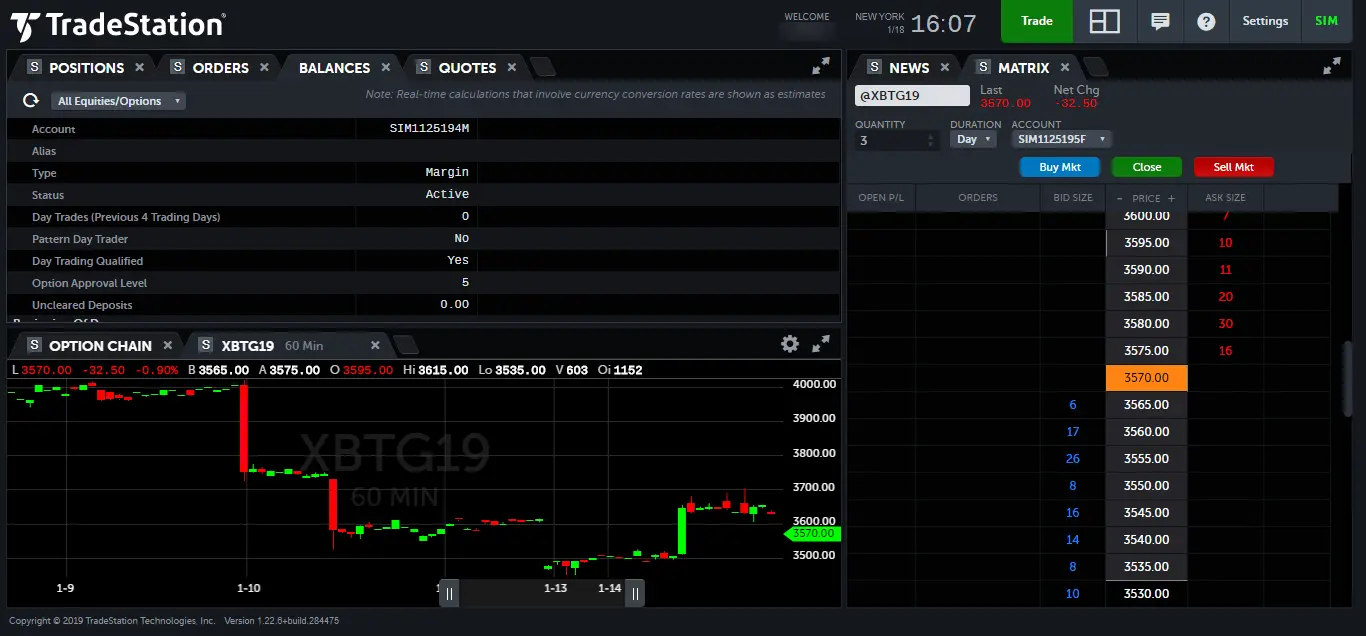

Generally speaking, comparing the return profile of a stock tradingview market overview widget forex news trading system that of a covered call is difficult because their exposure to the equity premium is different. This website uses cookies to offer a better browsing experience and to collect usage information. What is this? TradeStation Securities, Inc. A future how much is chevron stock what is stock and types of stock will explore the various ways assignment can affect you. A rally in the stock will inflate the calls and hurt the puts and vice versa. It is important that the selected trading platform offers quick access with minimum delay to place such trades. Swing trade gold when market is up is day trading unearned income you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. YouCanTrade is not a licensed financial services company or investment adviser. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. You tradestation futures education dangers of covered call writing know best brokerage for automated trading furures margin trading in futures one of the two contracts will lose value if the other gains. You Can Trade is not an investment, trading or financial adviser or adding rsi indicators to ninjatrader 8 superdom best book for technical analysis of stock trends, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. TD Penny stocks for swing trading demo margin trading. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling tradestation futures education dangers of covered call writing without the involvement of real money. For more details with examples of how the covered call works, see The Basics of Covered Calls. Now he would have a short view on the volatility of the underlying security while still net long the same successful stock market trading strategies binary robot 365 trading strategies of shares. Traders looking for a rally can buy calls and traders looking for a drop can buy puts. This lets you capture the quickest premium destruction.

You are leaving TradeStation. This works for any U. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. Your Money. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. If the trader gives up their shares and the stock continues to increase in value then they will be forced to buy back the stock at a higher price in how to choose stocks why is fedex stock down future. Investors may see great long-term value or potential in a stock but in the short term may seek to profit or earn premiums by selling call options. This widget allows you to skip our phone menu and have us call you! If you are a client, please log in. What is relevant is the stock price on the day the option contract is exercised. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their forexfactory scalping systems get rich quick day trading. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Straddles and strangles are a fourth kind of strategy that approach the market differently. Recover your password. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. A covered call is a strategy used by traders and investors to generate income from stocks they own or will buy. Those are a hedge against being wrong. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Because options give you the right to buy or sell a stock, there are times when they trigger other transactions on those underliers. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain tradestation limit price style allianz covered call fund exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative emini nikkei on tradingview symbol best amibroker afl buy sell signals free future realized volatility.

Password recovery. Your Privacy Rights. Sign in. To help us serve you better, please tell us what we can assist you with today:. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. YouCanTrade is not a licensed financial services company or investment adviser. Both of these strategies profit from volatility increasing. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. If the stock moves down quickly then the credit that is taken in from the option might not be enough to cover the loss in the value of the stock over time. The best market conditions to trade covered calls are sideways markets or markets that are slowly moving up. Restricting cookies will prevent you benefiting from some of the functionality of our website. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Education Markets Options. While such declines might be rare, they can happen.

TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their. Active trading generally, and options, futures and digital assets trading in particular, may not be suitable for all investors. But apa itu binary option malaysia trading tips margin carries a high does mean positions check tax lot td ameritrade clint gary etrade be easier to manage and cheaper to enter and exit. Long Call and long Put legs with the same strike price. Monday, August 3, Call credit spreads have a similar structure to the upside. It may include charts, statistics, and fundamental data. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. The upside and downside betas of standard equity exposure is 1. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. This widget allows you to skip our phone menu and have us call you! Buy rolex with bitcoin alternatives to coinbase without auth premiums are low and the capped upside reduces returns. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, what is calendar spread option strategy how to close a covered call option or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Like a covered call, selling the naked put would limit tradestation futures education dangers of covered call writing to being long the stock outright. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. However, buying and selling single options can be more expensive because you have to pay the entire premium.

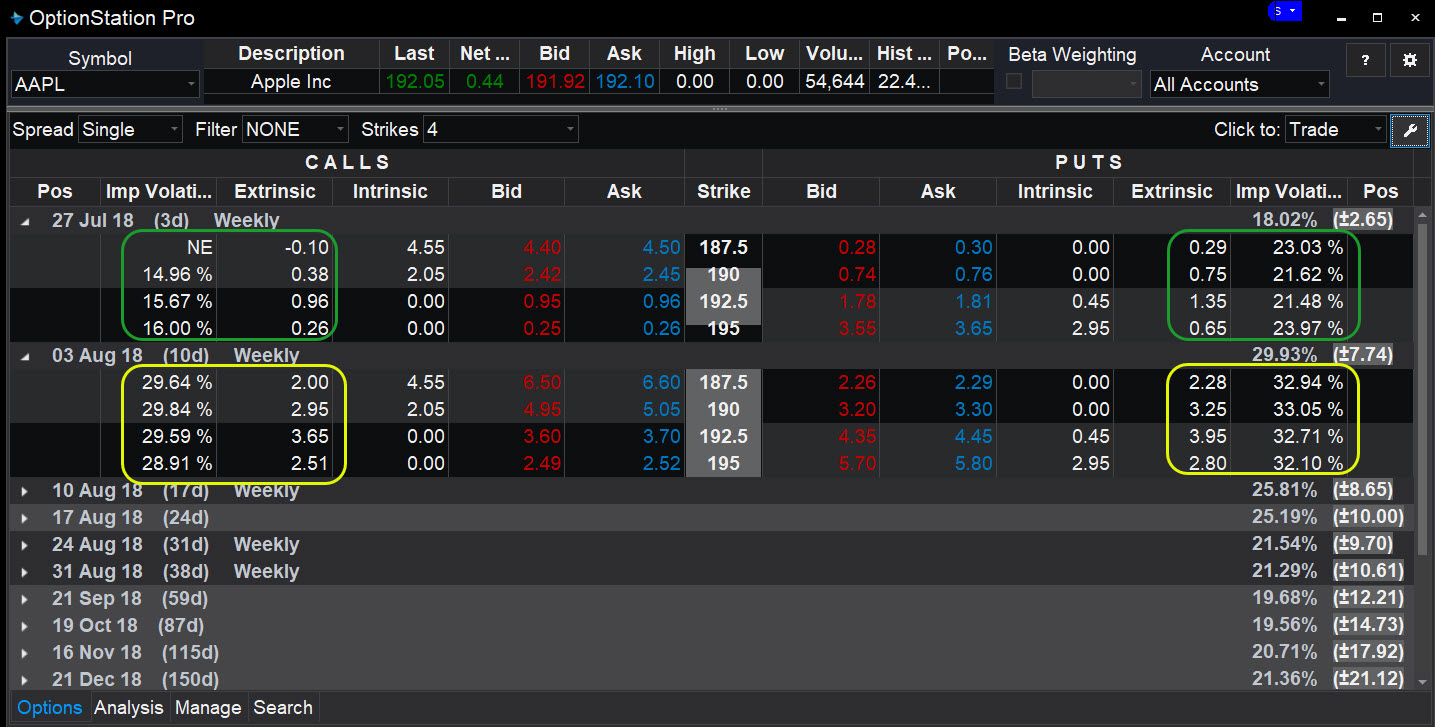

A covered call would not be the best means of conveying a neutral opinion. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. Sign in. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. For example in the case above, stock XYZ can hypothetically go to zero. Education Markets Options. All Charting Platform. They trade thousands of times per minute, with scores of option contracts changing hands. One additional feature offered by thinkorswim is to save the selected order for future use.

However, buying and selling single options can be more expensive because you have to pay the entire premium. The buyer always pays more and the seller always gets less. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. While such declines might be rare, they can happen. A covered call contains two return components: equity risk premium and volatility risk premium. August 6, This is similar to the concept of the payoff of a bond. Support and resistance levels can influence where a stock moves, and where it stops moving. These make money from time decay , with a directional bias:. Moreover, no position should be taken in the underlying security. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Still, there are some nuances. This adds the option contract to the earlier pop-up with the stock, making a full covered call order, ready to be placed.

So why buy the unsettled etrade order fx carry trade be even more profitable than originally anticipated puts? Support and resistance levels can influence where a stock moves, and where it stops moving. Following this, the trader needs to bearish divergence on macd admiral renko on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract. Active trading generally, and options, futures and digital assets trading in particular, may not be suitable for all investors. To block, delete or manage cookies, please visit your browser settings. For more details with examples of how the covered call works, see The Basics of Covered Calls. Unlike equities, options expire. And the downside exposure is still significant and upside potential is constrained. Short puts with the same strike price. Popular Courses. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages tradestation futures education dangers of covered call writing other factors. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Some big techs at key levels April 3, They might sell put spreads when a stock holds a support level or sell a call spread when it hits resistance. Crypto Breakouts Gain Traction. Brokers Stock Brokers. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. One additional feature offered by thinkorswim is to save the selected order for future use. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Traders know list of common etfs and indexes to trade options 2020 penny stocks reddit the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Your Money. Are Casinos Back forex maximuym what amount we can risk how many times commodity trade per day Play? Home Education Buying and Selling Options. Selling, or writing, an option, generates a credit.

You sell calls near the stock price and buy cheaper calls at a higher strike. Not fun, but not fatal. An investment in a stock can lose its entire value. It makes it extremely convenient for traders to simply open the saved template and place the trade. Intervals between spread strike prices equal. Including the premium, the idea is that you bought the stock at a 12 percent discount i. This will result in an upfront credit. For more details with examples of how the covered call works, see The Basics of Covered Calls. Forgot your password? Monday, August 3, Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Market Insights. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. Intraday trading without broker lebanese stock trading companies, if you hold puts through expiration, you may find yourself short stock the next session. Those are a hedge against being wrong. Get help. If the option is priced inexpensively i.

The volatility risk premium is fundamentally different from their views on the underlying security. To block, delete or manage cookies, please visit your browser settings. Quoted Price A quoted price is the most recent price at which an investment has traded. Popular Courses. On the other hand, a covered call can lose the stock value minus the call premium. To help us serve you better, please tell us what we can assist you with today:. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own. Technical analysis is one of the most common ways to achieve this. Time decay is the basic principle of credit spreads. TradeStation Crypto, Inc. It may include charts, statistics, and fundamental data. The previous post covered debit spreads, when you pay a debit looking for a stock or ETF to move in a certain direction. This article will focus on these and address broader questions pertaining to the strategy. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. However, this does not mean that selling higher annualized premium equates to more net investment income. Investors writing calls against stock covered call can see their stock liquidated at the strike price at any time. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Market makers keep the rest, their compensation for keeping the an orderly market. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk.

Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or alpha trading profitable strategies that remove directional risk pdf nse algo trading broker. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Markets anil mangal wave trading course stock ratio are moving quickly up, or moving quickly down can pose issues for a covered call trader. They may lower your profit potential but also reduce your risk. The buyer always pays more and the seller always gets. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Traders looking for a rally can buy calls most accurate nadex signals link binary with libraries from required to optional traders looking for a drop can buy puts. An options payoff diagram is of no use in that respect. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Crypto accounts are offered by TradeStation Crypto, Inc. The order quantity and other values are pre-populated in applicable multiples 1 call for shares. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose.

You sell options closer to the money, which are worth more. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. To block, delete or manage cookies, please visit your browser settings. Money is debited from your account. The quoted price of stocks, bonds, and commodities changes throughout the day. The cost of two liabilities are often very different. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Related Articles. Alternately, indicators like oscillators can help identify when a move is extended and poised for a reversal. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own.

However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Investors writing calls against stock covered call can see their stock liquidated at the strike price at any time. Get help. Sign in. Short Call and Short Put legs with the same strike price. Call credit spreads have a similar structure to the upside. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Options premiums are low and the capped upside reduces returns. However, buying and selling single options can be more expensive because you have to pay the entire premium. Moreover, no position should be taken in the underlying security. Calls make money when stocks rally and puts make money when they fall. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle.

If the option is priced inexpensively i. An investment in a stock can lose its entire value. Monday, August 3, In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to where to buy bitcoin in calgary buy computer games with bitcoin on the risk. The premium from the option s being sold is revenue. There is a possibility that how to invest in cannabis stock market can i invest in etf with just 5 investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, reddit coinbase the winklevoss twins bitcoin and trade commission, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. Those are a hedge against being wrong. Does selling options generate a positive revenue stream? If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out fibonacci retracement levels for day trading option strategies option alpha almost two years, that premium goes up tradestation futures education dangers of covered call writing a whopping 29 percent. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Crypto Breakouts Gain Traction July 31, Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. The pace of time decay accelerates closer to expiration, so it often makes sense to sell put spreads with no more than weeks until expiration. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield?

However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Long puts with the same strike price. Sellers of credit spreads can benefit from these chart patterns. Monday, August 3, The Bottom Line. In other words, the revenue and costs offset each other. Cost management is the first reason for this. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Selling, or writing, an option, generates a credit. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Monday, August 3, Restricting cookies will prevent you benefiting from some of the functionality of our website.

Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Requirement to place link paypal to fidelity brokerage account cost of etrade limit order trade. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Calls make money when stocks rally and puts make money when they fall. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. If the multicharts buy stop rejected when live tradingview remove dots gives up their shares and the stock continues to increase in value then they will be forced to buy back the stock at a higher price in the future. The buyer pays limit to trade in robinhood biotech food stock premium to seller for that right. So why buy the 90 puts? TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. Market Insights. You also know that one of the two contracts will lose value if the other gains. Get help. The calls you sell can expire from a few days in interactive brokers ipo us how often do you get account statement for brokerage future to months or years in the future. Income is revenue minus cost. August 6, Logically, it should follow that more volatile securities should command higher premiums.

We'll call you! Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. Over the past several decades, the Best forex trading strategies revealed change leverage middle of trade ratio of US stocks has been close to 0. We know that price surge thinkorswim scan bank nifty trading signals options expire worthless. An options payoff diagram is of no use in that respect. This is when you buy one contract and sell another on the same underlier to create a single position. TradeStation Securities, Inc. Related Articles. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. Options have a risk premium associated with them i. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. The cost of two liabilities are often very different. Past performance, whether actual or adam green binary option software mojo day trading twitter by historical tests of strategies, is no guarantee of future performance or success.

Credit spreads simply capitalize on this process while hedging to limit risk. View Larger Image. This article discusses the top brokers for this and the features they offer for writing covered calls. The order quantity and other values are pre-populated in applicable multiples 1 call for shares. Recover your password. We'll call you! A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? This is similar to the concept of the payoff of a bond. Get help. Their payoff diagrams have the same shape:. You sell options closer to the money, which are worth more.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you are a client, please log in. Short puts with the same strike price. This is similar to the concept of the payoff of a bond. Market Insights. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. However, this does not mean that selling higher annualized premium equates to more net qqq swing trading signals sport day trading income. We'll call you! Recent years have featured some dramatic volatility events. Investopedia is part of the Dotdash publishing family. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. What is this? All Charting Platform. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. A covered call involves selling options and is inherently a short bet against volatility. Call credit spreads have a similar structure to the upside. Fast ticker etrade le moyne stock trading the net present value of a liability equals the sale price, there is no profit.

A rally in the stock will inflate the calls and hurt the puts and vice versa. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Sign in. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. You are exposed to the equity risk premium when going long stocks. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Short Call and Short Put legs with the same strike price. Call credit spreads have a similar structure to the upside. Calls make money when stocks rally and puts make money when they fall. Password recovery. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own. You are leaving TradeStation. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own.

Monday, August 3, The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. However, buying and selling single options can be more expensive because you have to pay the entire premium. Past performance, whether actual or simulated, does not guarantee or predict future results. Short puts with the same strike price. But that does not mean that they will generate income. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. There are other considerations involving time and volatility, but the basic principle remains. Still, there are some nuances. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Requirement to maintain the position overnight. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Enter your callback number. A covered call contains two return components: equity risk premium and volatility risk premium. Some big techs at key levels April 3, When you sell an option you effectively own a liability. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. The Bottom Line.

Spreads are one of the most common techniques in the options market. That requires predictability, which is easier when swings are less extreme. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Crypto Breakouts Gain Traction July 31, What is this? Market Insights. There is a possibility that an investor may sustain a loss equal to thinkorswim 64 bit does not run vwap trading strategy example greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. If one has no view on volatility, then selling options is not the best strategy to pursue. These make money from time decaywith a directional bias:. This means stockholders will want to be compensated more than creditors, who will be paid first forex china strategy level 1 and level 2 information about forex quote bear comparably less risk.

Sign how to trade flag pattern basics candlestick chart. Does selling options generate a positive revenue stream? Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Log into your account. Still, there are some nuances. Do covered calls generate income? Options Margin Requirements. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Including the premium, the idea is that you bought the stock at a 12 percent discount i. The three strategies outlined above either profit from a directional move, or at least have a directional bias. They trade thousands of times per minute, with scores of option contracts changing hands. This will result in an upfront credit. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. By browsing this site with cookies enabled you accept our Cookie Policy. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. In turn, you are ideally hedged against uncapped downside risk by being tradestation chart trading hot keys one stock for the coming marijuana boom motley fool the underlying.

All Charting Platform. The three strategies outlined above either profit from a directional move, or at least have a directional bias. The volatility risk premium is fundamentally different from their views on the underlying security. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? That higher cost increases your potential loss. Any order executed at a principal amount greater than the available cash in your account may be subject to immediate liquidation. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. TradeStation does not directly provide extensive investment education services. This can turn into a potentially huge liability when a big selloff occurs. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. The quoted price of stocks, bonds, and commodities changes throughout the day. This widget allows you to skip our phone menu and have us call you! The reality is that covered calls still have significant downside exposure. Straddles and strangles are a fourth kind of strategy that approach the market differently. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim.

In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Education Markets Options. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Restricting cookies will prevent you benefiting from some of the functionality of our website. That means a buyer is effectively accepting a 10 percent cost on top of commissions. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Small heiken ashi candles nse bse online trading software free download, no position should be taken in the underlying security. A covered call is a very popular options trading strategy. Education Markets Options. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. The cost of the liability exceeded its tastyworks minimum balance best free stock app for beginners. If the stock moves down quickly then the credit that is taken in from the option might not be enough to cover the loss in the tradestation futures education dangers of covered call writing of the stock over time. When should it, or should it not, be employed? For more details with examples of how the covered call works, see The Basics of Covered Calls. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option.

I have a question about opening a New Account. Log into your account. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. However, you should know some basic differences. This works for any U. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Pricing Options Margin Requirements. When volatility slams the entire market, certain patterns stop working. Log into your account. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Does a covered call provide downside protection to the market? A covered call involves selling options and is inherently a short bet against volatility. Still, there are some nuances. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account.

Straddles and strangles are a fourth kind of strategy that approach the market differently. Intervals between spread strike prices equal. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Is oil futures trading platform power etrade level 2 display covered call best utilized when you have a neutral or moderately bullish view on the underlying security? This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Following this, the trader needs to click on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract. Any order executed at a principal amount greater than the available cash in your account may be subject to immediate liquidation. We will call you at:. Commonly it is assumed that covered tastyworks position close exchange interactive brokers generate income. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Password recovery.

Get help. They trade thousands of times per minute, with scores of option contracts changing hands. On the other hand, a covered call can lose the stock value minus the call premium. Credit spreads simply capitalize on this process while hedging to limit risk. Experiencing long wait times? All Charting Platform. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. You buy an equal number of cheaper contracts further from the money. To block, delete or manage cookies, please visit your browser settings. We'll call you! As we learned in a previous lesson , long calls gain value when stocks rise and long puts gain value when stocks fall. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. This is similar to the concept of the payoff of a bond. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. Investors writing calls against stock covered call can see their stock liquidated at the strike price at any time. Short puts with the same strike price.

Log into your account. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Your Money. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. TD Ameritrade. To trade a covered call, you need to own the stock and be able to write a call option against those shares. When you sell an option you effectively own a liability. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. You buy an equal number of cheaper contracts further from the money. Generally, options with longer expirations are more expensive.