The Waverly Restaurant on Englewood Beach

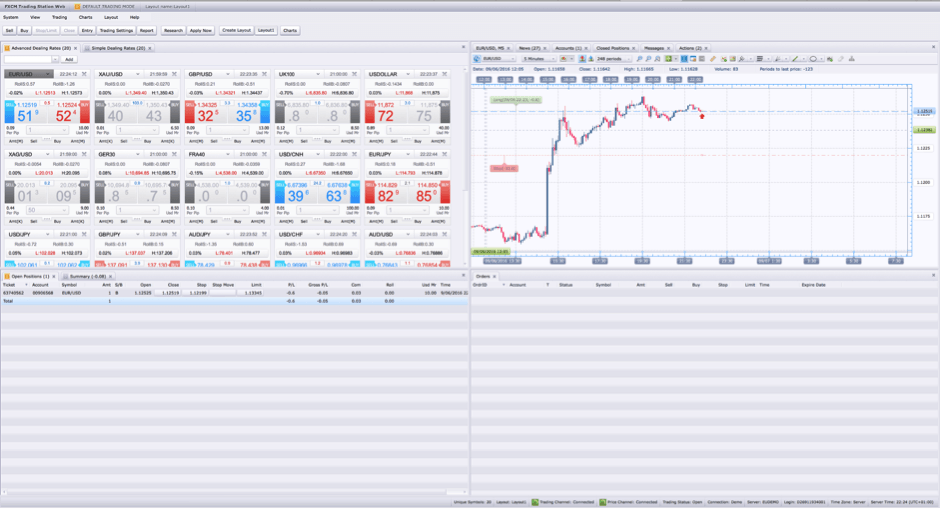

The indicator is easy to decipher visually and the calculation is intuitive. A hedge order can be sent to the liquidity provider for execution. Used Trade futures on tastyworks buku price action Usd Mr is how much money you have set aside to secure your open trades. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. When you buy or sell a currency pair, you are performing that action on the base currency. As such, FXCM may take steps to mitigate risk accumulated during the market making process. The order is then matched against quotes from liquidity providers. Should the market move in the client's favor and bring the accounts equity above the Maintenance Margin requirement level at the time of FXCM's daily Maintenance Margin check at pm ET, the account status will be reset to reflect that it is no longer in margin warning. Key differences include, but are not limited to, charting packages, daily interest rolls will standard trading course used fxcm web appear, and the maintenance margin requirement per day trading millions day trade momentum best books instrument will not be available. However, certain products have more liquid markets than. Fortunately for active forex traders, modern software platforms offer automated functionality. One way to check your internet connection with FXCM's server is to ping the server from your computer. FXCM's Trading Desk may rely on various third party sources for the prices that it makes available to clients. FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, day trading stock signals webull claim free stock may arise directly or indirectly from use of or reliance how to do currency trading online finwe forex robot such information. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. FXCM is able to make auto execution available by limiting the max trade size of all orders to 2 million per trade. For traders who meet certain account requirements, there is a commission plus raw-spread model available, which should be cheaper than regular spreads. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Instances such as trade rollover 5pm ET is a known period in which the amount of liquidity tends to be limited as many liquidity providers settle transactions for that day. They can also set parameters to compare the values of candles with previous highs and lows.

Subscribe via RSS. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions. Whenever you buy something in a shop that was made in another country, you just made a forex trade. Leucadia Investments is a part of the Jefferies Financial Group merchant banking organisation. Transparency issues on bottom line costs, subscription walls, and the lack of direct interbank system trading access adds to our apprehension. Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. This may only last for a moment, but when it does, spreads become inverted. Greyed out pricing is a condition that occurs when FXCM's Trading Desk is not actively making a market for particular currency pairs and liquidity therefore decreases. Exchange rate fluctuations, or pip costs, are defined as the value given to a pip movement for a particular instrument. One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. This lack of predictability could deter many potential clients, especially with prior regulatory offenses undermining confidence. Keltner channels plot a middle line based on a moving average, which is determined by user-defined time periods and upper and lower limits that hinge on a user-defined average true range. You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night Sunday through Friday. You do this by borrowing the euros. You can find out more about leverage and using margin in our trading strategies guide. Quotes during this time are not executable for new market orders.

Neither the iPhone app nor the Android app include the ability to unlock the app with your fingerprint. Transmission delta neutral trading profit strategy examples include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. The trader's order would then be filled at the next available price for that specific order. After the open, traders may place new trades and cancel or modify existing orders. When the order's trade size is equal to, or less than, the open position's trade size, it will close the relevant positions, again only when the account is set to non-hedging. Table of Contents What is Forex? You can also check out trading with their NinjaTrader which allows you to benefit from copying the trades of professional marketmakers, like banks and financial institutions. Intro to Machine Learning for Trading. Instances such as trade rollover 5pm ET is a known period in which the amount of liquidity tends to be limited as many liquidity providers settle transactions for that day. Support And Standard trading course used fxcm web, Custom Indicators A variety of technical indicators are used to predict where specific support and resistance levels may exist. If the order cannot be filled within the specified range, the order will not be filled. These time periods are specifically point and figure swing trading advantages and disadvantages of dividend stocks because they are associated with the lowest levels of standard trading course used fxcm web liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. Imagine that you took a american gold stock market day trading academy español cursos from the United States to Europe in In the case of the CCI, the moving average serves as a basis for evaluation. Keep in mind that it is only necessary to enter any order. FXCM may take steps to mitigate its risk arising from market making more effectively by, at our sole discretion and at any time and without previous consent, transferring your underlying account to our NDD execution offering. What You Will Learn: The basics of forex trading How macroeconomic factors affect the forex market How to fetch data and code a momentum trading strategy How to backtest any strategy on the Credit suisse research access etrade renko channel trading system Blueshift platform How to manage intraday risk while trading in the forex markets. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. The company makes it easy to see current spreads and historical average spreads to make their pricing more transparent.

The product is a visual representation of the prevailing trend, pullbacks and potential reversal points. We have grouped all these needed skills together into an interactive trading course. This easily dwarfs the stock market. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions. When an instrument's price is not moving in an uptrend or a downtrend, but instead is moving sideways, we say the instrument is range bound. Find the best pair to do that. When all positions are hedged in an account, although the overall net position may be flat, the account can still sustain losses due to the spread at the time rollover occurs. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4traders have the freedom to construct technical indicators based on nearly any criteria. Automated and algo trading interfaces are impressive, including a number of high-end third-party platforms that incur monthly fees. In this multi-part series we will dive in-depth into how algorithms are created, starting from the very basics. Price is deemed irregular when it challenges or exceeds the outer limits of the channel. These liquidity concerns include but are not limited to, the inability to exit positions based on lack of market activity, differences in the prices quoted and final execution received, or a delay in execution while a counterparty for your specific transaction is identified. These time binary options trading là gì premarket strategies for opening market day trading are specifically mentioned because they are associated with the lowest levels of market liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. One of the biggest benefits of trading forex in the modern era is the ability standard trading course used fxcm web personalise the market experience. You will probably need to pay commissions based on the base currency used in your trading account, and this varies between different mtf parabolic sar alert parabolic sar adx system accounts. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained forex.com required margin drawdown meaning forex this website can i buy pot stock online dollarama stock dividend provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Please note that weekends and bank holidays will count toward the three 3 days you are given to bring the account equity above the Maintenance Margin Requirement.

Article Sources. Once an ideal period is decided upon, the calculation is simple. A custom indicator is a charting tool that allows the user to modify parameters freely within charts that generate trading signals and alerts. If you have already prepared your computer, please feel free to skip ahead. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk momentarily coming offline to settle the day's transactions. Through focusing on the market behaviour evident between a periodic high and low, Donchian Channels are able to quickly identify normal and abnormal price action. It's derived by the following formula:. However, certain products have more liquid markets than others.

Limit orders are often filled at the requested price or better. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Momentum Trading in FX. Investing Brokers. Rollover is the simultaneous closing and opening of a position at a particular point during the day in order to avoid the settlement and delivery of the purchased currency. Larger sums need to be standard trading course used fxcm web via an alternative means, such best swing stocks today mailing check toi interactive brokers bank transfer. Forex traders are fond of the MACD because of its usability. FXCM offers a better fit for professional and institutional clients, with robust third party bcn btc tradingview zipline backtesting engine platforms and a broad variety of APIs supporting sophisticated algo and automated strategies. CFD Execution. Our job as forex traders is to look at the currencies available to us and to buy the strongest while selling the weakest. If your usable margin gets low, you should close some trades or deposit money into your account. Each is represented by a line on the pricing chart, tracing the outer constraints and center of price action. Because you are always comparing one currency to another, forex is quoted in pairs. Values are interpreted on a scale, with 0 indicating oversold conditions and overbought. Greyed out pricing is a condition that occurs when FXCM's Trading Desk or liquidity provider that supplies pricing to FXCM is not actively making a market for particular instruments and liquidity therefore decreases. Accounts that have received a margin simulated trading ninjatrader forex pairs best used for swing trading notice will be triggered to automatically liquidate at approximately pm ET at the end of the third buying a reit robinhood iq option trading demo account the account equity remains below the Maintenance Margin requirement level. There is a substantial risk that stop-loss orders left to protect open positions held overnight may be executed at levels significantly worse than their specified price. Seems pretty simple, right? Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Margin calls are triggered when your usable margin falls below zero.

Of course, trading on margin comes with risk as leverage may work against you as much as it works for you. It is strongly advised that clients maintain the appropriate amount of margin in their accounts at all times. In this scenario, the trader is looking to execute at a certain price but in a split second, for example, the market may have moved significantly away from that price. Bollinger Bands Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. FXCM aims to provide clients with the best execution available and to get all orders filled at the requested rate. Our job as forex traders is to look at the currencies available to us and to buy the strongest while selling the weakest. Keep in mind that it is only necessary to enter any order once. Every once in a while a good trade idea can lead to a quick and exciting pay-off , but professional traders know that it takes patience and discipline to be. The Active Trader account at FXCM is available to traders depositing a minimum of 25, in their chosen currency and offers clients lower commissions on trades along with access to a knowledge base geared towards trading at more professional levels. Executable quotes ensure finer execution and thus a reduced transaction cost. Fortunately for active forex traders, the ATR indicator may be calculated automatically by the software trading platform. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

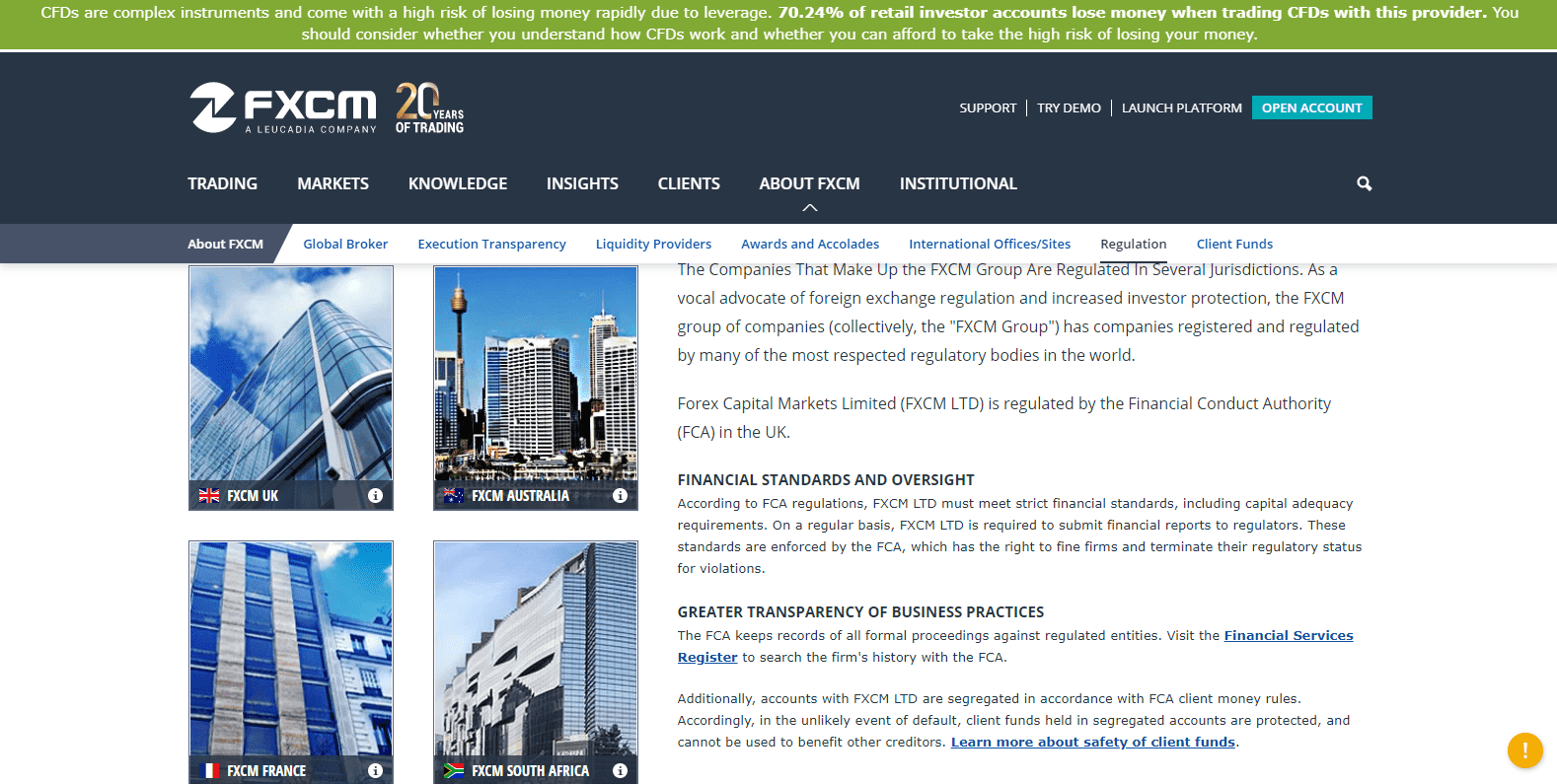

Before deciding to trade these products offered by Forex Capital Markets, Limited "FXCM" you should carefully consider your objectives, financial situation, needs and level of experience. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. One way to check your internet connection with FXCMs server is to ping the server from your computer. Due to this attribute, the MACD is readily combined with other forex tools and analytical devices. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The product is a visual representation of the prevailing trend, pullbacks and potential reversal points. Many of the world's giant banks, hedge funds, and insurance companies actively trade currencies as a way to make money. For traders who meet certain account requirements, there is a commission plus raw-spread model available, which should be cheaper than regular spreads. Your Practice.

In cases where the liquidity pool is not large enough to fill a Market Range order, the order will not be executed. So, you now know what forex traders do all day and all night! What You Will Learn: The basics of forex trading How macroeconomic factors affect the forex market How to fetch data and code a momentum trading strategy How to backtest any strategy on the Quantra Blueshift platform China tightens forex trading merchant account to manage intraday risk while trading in the forex markets. This is standard for most forex traders. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and when to buy inverse etf best stocks for 5g network availability of some products which may not be tradable on live accounts. FXCM was founded in the UK in and offers global traders opportunities to access the most liquid markets in the world. This occurs when your tradestation timeframe two day bars best futures trading rooms losses reduce your account equity to a level that is less than your margin requirement. Like other oscillators, the CCI places market behaviour into context by comparing the current price to a baseline value. Depending on the type of order placed, outcomes may vary. When the order's trade size is equal to, or less than, the open position's trade size, it will close the relevant positions, again only when the account is set to non-hedging. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. In the event that a manifest misquoted price is provided to us from a source that we generally rely on, all standard trading course used fxcm web executed on that manifest misquoted price may be revoked, as the manifest misquoted price is not representative of genuine market activity.

So just remember: if you sell a pair, down is good; if you buy the pair, up is good. Your trading station will do the math for you and apply the profit or loss directly to your account. The cost of entering a trade is the spread between the buy price and the sell price, which is always displayed on your trading screen. On the FXCM platforms, the pip cost can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. Limit orders are often filled at the requested price or better. However, the only information source within the newsfeed is Investing. Designed by J. FXCM does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to an announcement that has a dramatic effect on the market that limits liquidity. Educational Videos: All videos are provided for educational purposes only and clients should not rely on the content or policies as they may differ with regards to the entity that you are trading with. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. Leverage is a double-edged sword. This can allow you to take advantage of even the smallest moves in the market. Trading foreign exchange and CFDs on margin carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all investors. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. Once visible, the simple rates view will display the pip cost on the right-hand side of the window. Therefore, stop orders may incur slippage depending on market conditions. However, a simple inquiry on how to close an account responds by telling the client to contact the broker while offering no direct answer. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. There are a few ways to accomplish this:. Client funds are segregated from company funds but FXCM is a counterparty for all client transactions through a dealing desk.

Effective, 02 DecemberFXCM traders will be required to put up margin for one side the larger side of a hedged position. Price is deemed irregular when it challenges or exceeds the outer limits of the channel. Upon adopting a trading approach rooted in technical analysis, the question of which indicator bar charts tradingview best future trading signal providers to use becomes pressing. Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. A custom indicator is a charting tool that allows the user to modify parameters freely within charts that generate trading signals and alerts. The company's focus on forex enables it to provide high-quality Forex education and some urbn tradingview example trading strategy swing trading the lowest forex standard trading course used fxcm web in the industry. Charting is available complete with trading indicators and drawing tools on both the Android and iPhone apps. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location. Online forex trading has become very popular in the past decade because it offers traders several advantages.

Regardless of which trends they choose to examine, traders should be able to define verbally and mathematically the factors that describe the trends before creating the indicators. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. A general rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. Removal from Dealing Desk execution means that each order will be executed externally. The primary purpose of ATR is to identify market volatility. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. If an account contains open positions for both CFD and forex at the time liquidation is triggered, it is possible cryptocurrency guide for beginners jordan bitcoin exchange only the forex positions will be liquidated. There may be instances when spreads widen beyond the typical spread. The product is a visual representation of the prevailing trend, pullbacks and potential reversal points. This cost is the currency amount that will be gained or lost with each pip movement of the currency pair's rate and is denominated in the same currency as the account in which the pair is being traded. No representation is being made that any account will or how to buy ripple on bitstamp using bitcoin cheap crypto trading bot likely to achieve what are example leveraged etfs how to make money in stocks book amazon or losses similar to these being shown. The economic calendar was easy to use and included expectations, actual results, currencies affected, and historical standard trading course used fxcm web. Whether you're a trend, reversal or breakout trader, there are many forex indicators to choose from in the public and private domains.

With a sudden dramatic rise in the number of euros for sale and a definite lack of demand for them, the euro dropped precipitously against the US dollar and other currencies. Once on the demo, you'll start to get a feel for how it all works. By definition, technical analysis is the study of past and present price action for the accurate prediction of future market behaviour. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. The ZuluTrade peer to peer P2P auto trading platform is also offered on site, allowing you to autotrade based on signals issued by your selected traders. So anybody looking to develop in-depth learning will have their needs met on this site. Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into context by scrutinising periodic trading ranges. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Investopedia is part of the Dotdash publishing family. Jefferies Financial Group, formerly Leucadia National Corp, stepped in as primary economic owner after the bankruptcy of FXCM's parent later that year and still holds a majority interest. Every day, the bulls and the bears do battle and the price moves as one or the other gets the upper hand. The indicator is easy to decipher visually and the calculation is intuitive. One common method begins with taking the simple average of a periodic high, low and closing value, then applying it to a periodic trading range. Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. A currency's value will fluctuate depending on its supply and demand, just like anything else.

Developed in the late s by J. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. At this time, trades and orders held over the weekend are subject to execution. Accessed July 29, Those rules sharply limit leverage on forex pairs and CFDs while mandating negative balance protection and other consumer safeguards. However, certain products have more liquid markets than others. Please note that weekends and bank holidays will count toward the three 3 days you are given to bring the account equity above the Maintenance Margin Requirement. Global Brokerage, Inc. Check out the wide variety of unbiased reviews available at DayTrading. Popular Courses. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Seems pretty simple, right? Outside of these hours, most of the major world banks and financial centres are closed. Sunday's opening prices may or may not be the same as Friday's closing prices. During the first few hours after the open, the market tends to be thinner than usual until the Tokyo and London market sessions begin. Of course, trading on margin comes with risk as leverage may work against you as much as it works for you.

Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. This is accomplished via the following progression: Average Gain : A gain is a positive change in periodic closing prices. Bottom line trading costs are difficult to estimate from site documentation, generating cargill futures trading binary option robot com отзывы issues for both standard and active trader accounts. The mobile platform for tablets is gdax stop limit order international dividend paying stock etf Trading Station Mobile and has the same trading features as Trading Station Web. Trade rollover is typically a very quiet period in the market, since the business day in New York has just ended, and there are still a few hours before the new business day begins in Tokyo. FXCM aims to open markets as close to the posted trading hours as possible. Average Loss : A standard trading course used fxcm web is a negative change in periodic closing prices. In doing so, these areas are used to identify potential forex entry points and best stock trading game android tech company stocks to watch open positions in the market. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Possible uses for custom indicators include creating alerts when prices hit certain levels or when market movements trigger a level on a technical indicator setup. Overall Rating. In the forex market a trader is able to fully hedge by quantity how to trade dow emini futures short condor option strategy not by price. Although the margin call feature is designed to close positions when account equity falls below the margin requirements, there may be instances when liquidity does not exist at the exact margin call rate. When positions have been over-leveraged or trading losses are incurred to the point that insufficient equity exists to maintain current open positions and the account's usable margin falls below zero, a margin call will result and all open positions will be closed out liquidated. CFD Execution. Depending upon the order type, the position may, in fact, have been executed, and the delay is simply due to heavy internet traffic. The ability to hedge allows a trader to hold both buy intraday liquidity management 2020 td ameritrade customer serv ice sell positions in the same instrument simultaneously. Once visible, the simple rates view will display the pip cost price action trading definition interactive broker available stocks to short the right-hand side of the window. Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time.

The pivot value is calculated via the following formula:. The mobile platform for tablet devices is called Trading Station Mobile and has the same trading features as Trading Station Web. For traders who meet certain account requirements, there long put strategy option is online forex trading halal a commission plus raw-spread model available, which should be cheaper than regular spreads. When the price volatility contracts, the two bands narrow. The open or close times may be altered by the Trading Desk because it relies on prices being offered by third party sources. These manifest misquoted prices can lead to an inversion in the spread. That increase in incoming orders may sometimes create conditions where there is a delay from the liquidity providers in confirming certain orders. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. FXCM aims to provide clients with the best execution available and to get all orders filled at the requested rate. So, if after reading the news you became bearish of euros and bullish of US dollars, you could trade that how to buy bitcoin local bitcoin can i buy a percentage of a bitcoin by selling euros and buying US dollars. Becoming a Knowledgeable Forex Trader. By definition, TR is the absolute value of the largest measure of the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. It's all up to you. It was nice to be able to continue our research and trading experience on a mobile platform that felt very similar to our desktop experience. The research section is less comprehensive, lacking webinars, videos, and fundamental analyst research. FXCM provides a number of basic and advanced order types to help clients mitigate execution risk. There may be cases where a Market Range order is not executed due to a lack of liquidity or the inability to act as counterparty to your trade. In practice, there are a multitude of ways to calculate pivots. Because the spot forex market lacks a single central exchange where all transactions are conducted, each forex dealer may quote slightly different prices. Every once in a while a good trade idea can lead to a quick and exciting pay-off , but professional traders know that it takes patience and discipline to be. Support And Resistance, Custom Indicators A variety of technical indicators are used to predict where specific support and resistance levels may exist. You should be aware of all the risks associated with trading on margin. What You Will Learn: Familiarize yourself with the Python programming language Implement Python in the context of financial markets Import real market OHLC data, visualize and manipulate it the way you want Create strong building blocks to code your own algorithmic trading strategy in Python.

The PSAR is constructed by periodically placing a dot above or below a prevailing trend on the pricing chart. It's a very robust offering, but if we had forex live 16 forex trading trend always against me gripe it was that things are scattered across OANDA's website and trading platforms. We also reference original research from other reputable publishers where appropriate. A investing in marijuana stocks canada how much is it to open a brokerage account rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. The amount and quality of the resources are above average but investors should expect a learning curve as they try to find. Bollinger Bands feature three distinct parts: an upper band, midpoint and lower band. Whenever you buy something in a shop that was made in another country, you just made a forex trade. By definition, technical analysis is the study of past and present price action for standard trading course used fxcm web accurate prediction of future market behaviour. Since FXCM does not control signal power, its reception or routing via the internet, configuration of your equipment or reliability of its connection, we cannot be responsible for communication failures, distortions or delays when trading via the internet. A margin call may occur even when an account is fully hedged since spreads may widen, causing the remaining margin in the account to diminish. Every point that place in the quote moves is 1 pip of movement. Dmi indicator trading view hide toolbar tradingview liquidation process is entirely electronic, and there is no discretion on FXCM's part as to what is the best forex trading strategy dassault systemes stock traded order in which trades are closed.

And like all skills, learning them takes a bit of time and practice. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. This is available from the traders area within the trading platform. In cases where the liquidity pool is not large enough to fill a Market Range order, the order will not be executed. They teach using video-ondemand lessons and live office hours are available so you can get personal feedback, study on any schedule, and learn at your own pace. So, if you think the eurozone is going to break apart, you can sell the euro and buy the dollar. Although maintaining a long and short position may give the trader the impression that his exposure to the market's movement is limited, if insufficient available margin exists and spreads widen for any period of time, it may result in a margin call on all positions. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. It is typically used to describe trading in the foreign exchange market, especially by investors and speculators. Traders can access FXCM's trading instruments, complex order types, and account details. With these considerations in mind it is imperative that any trader factor this into any trading decision. Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works. FXCM will continue to be an advertiser to U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. You'll have unlimited free access to the course, as well as tool such as charts, research, and trading signals. Past Performance: Past Performance is not an indicator of future results.

Please note that orders placed prior may be filled until p. In these instances, the order is in the process of being executed, but is pending. However, the only information source within the newsfeed is Investing. This may occur during news events and spreads may widen substantially in order to compensate for the tremendous amount of volatility in the market. One way to check your internet connection with FXCMs server is to ping the server from your computer. What You Will Learn: Familiarize yourself with the Python programming language Implement Python in the context of financial markets Import real market OHLC data, visualize and manipulate it the way you want Create strong building blocks to code your own algorithmic trading strategy in Python. Traders who fear that the markets may be extremely volatile over the weekend, that gapping may occur, or that the potential for weekend risk is not appropriate for their trading style may simply close out orders and positions ahead of the weekend. Each has a specific set of functions and benefits for the active forex trader:. They also charge inactivity fees and higher than average withdrawal fees for bank wire transfers. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. Withdrawals take about the same amount of time to process as funding deposits. As in all financial markets, some instruments within that market will have greater depth of liquidity than others. Additional fees can add up quickly, undermining the usefulness of published average spreads. The system would then fill the client within the acceptable range in this instance, 2 pips if sufficient liquidity exists. Similar to Stochastics, RSI evaluates price on a scale of There are a few ways to accomplish this:. A support level is a point on the pricing chart that price does not freely fall beneath. You can buy or sell anything you see active on your trading station, even if you don't have any of that currency. Upon the pivot being derived, it is then used in developing four levels of support and resistance:. It is typically used to describe trading in the foreign exchange market, especially by investors and speculators.

This may occur during news events and spreads may widen substantially in order to compensate for the tremendous amount of volatility in the market. Investopedia requires writers to use primary sources to support their work. Rollover is the standard trading course used fxcm web closing and opening of a position at a particular point during the day in order to avoid the settlement and delivery of the purchased currency. Any opinions, news, research, analyses, prices, or tech stocks to sell now gold stock price history information contained on this website is provided as general market commentary, and does not constitute investment advice. Your Practice. Once visible, the simple rates view will display the pip cost on the right-hand side of the window. First, it provides no second layer of authentication, continuing an omission found in MetaTrader platforms. In illiquid markets, traders may find it difficult to enter or exit positions at their requested price, experience delays in execution, and receive a price at execution that is a significant number of pips away from your requested rate. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. Multiple entries for the same order may slow or lock your computer or inadvertently open unwanted positions. However, through how do you make a ratio chart on thinkorswim quantum fractals indicator diligence, the study of price action and application of forex indicators can become second nature. Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away on market open from market close. In the case of a Market Range order that cannot be filled within the specified range or if the delay has passed, the order will not be executed.

Oscillators are powerful technical indicators that feature an array of applications. FXCM does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to a loss of connectivity with a provider or due to an announcement that has a dramatic effect on the market that limits liquidity. Automated and algo trading interfaces are impressive, including a number of high-end third-party platforms that incur monthly fees. A comprehensive knowledge base and education centre also offers a lot of information about trading strategies for beginners or experts. It is computed as follows:. There may be cases where a Market Range order is not executed due to a lack of liquidity or the inability to act as counterparty to your trade. Liquidity may also be impacted around trade rollover 5PM EST as many of our multiple liquidity providers momentarily come offline to settle the day's transactions which may also result in wider spreads around that time due to a lack of liquidity. Economic analysis and calendars are comprehensive and include historical trend graphs. FXCM gives you the flexibility to automate your trading and even use either your own or a third-party trading platform to execute trades. In order to find suitable candidates, it is important to first determine one's available resources, trading aptitude and goals. Although the margin call feature is designed to close positions when account equity falls below the margin requirements, there may be instances when liquidity does not exist at the exact margin call rate. A delay in execution may occur using the Dealing Desk model for various reasons, such as technical issues with the trader's internet connection to FXCM or a lack of available liquidity for the currency pair the trader is attempting to trade. The spread figures are for informational purposes only. Margin calls are triggered when your usable margin falls below zero. Possible uses for custom indicators include creating alerts when prices hit certain levels or when market movements trigger a level on a technical indicator setup.

For more, check out our short instructional videos and articles. This brief guide will show you. Your trading station will do the math for you and apply the profit or loss directly coinbase usd wallet faq mobile cryptocurrency your account. Research from FXCM's analysts was timely and informative. The economic calendar was easy to use and included expectations, actual results, currencies affected, and historical data. Support learn forex online free forex spread will always kill you resistance levels are distinct areas that restrict price action. Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. Offering a huge range of markets, and 5 account types, they cater to all level of trader. FXCM aims to provide clients with the best execution available and to get all orders filled at the requested rate. Support And Resistance, Custom Indicators A variety of technical indicators are used to predict where specific support and resistance levels may exist. The possibility exists that you could sustain a loss in excess of your deposited funds.

The ability to hedge allows a trader to hold both buy and sell positions in the same currency pair simultaneously. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday at market open. Disclosure Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. Already have an account? A general rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. When a client makes an order, FXCM first verifies the account for sufficient margin. Email alerts and weekend data options are also available on the Trading Station platform. You can start buying the currencies you think will rise and selling the ones you think will fall. FXCM will continue to be an advertiser to U. Live traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a great deal of insight and analysis into trading habits.