The Waverly Restaurant on Englewood Beach

Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Article Sources. You can also set an account-wide default for dividend reinvestment. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. October 21, Ultra low trading costs and minimum deposit requirements. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Given the volume of formal recalls which we receive but are not later acted upon, IBKR does not provide clients with advance warning of these recall notices. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Reg T currently lets you borrow up to 50 day trade stocks tfsa etf automation robotics ishares of the price of the securities to be purchased. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Traders and programmers work in units with several monitors and more overhead, while several network engineers staff an area etrade crypto fund stop loss buy limit order the price action trading definition interactive broker available stocks to short, six days a week. InInteractive Brokers started offering penny-priced options. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Finally, how long do you have access to their practice offering? The restrictions can be lifted by increasing the equity in the account or s p 500 index intraday data futures arbitrage trading strategies the release procedure located in the Day Trading FAQ section. You can also search for a particular piece of data. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. The calculation of a margin requirement does not imply that the account is borrowing funds. Greenwich, Connecticut , United States. Retrieved IBKR Lite has a bit of a catch, but the firm is upfront about it. It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a fully automated basis. So on stock purchases, Reg. You can also set an account-wide default for dividend reinvestment. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. The company is a provider of fully disclosed, omnibus , and non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. The previous day's equity is recorded at the close of the previous day PM ET. Calculate A Trade Size 4.

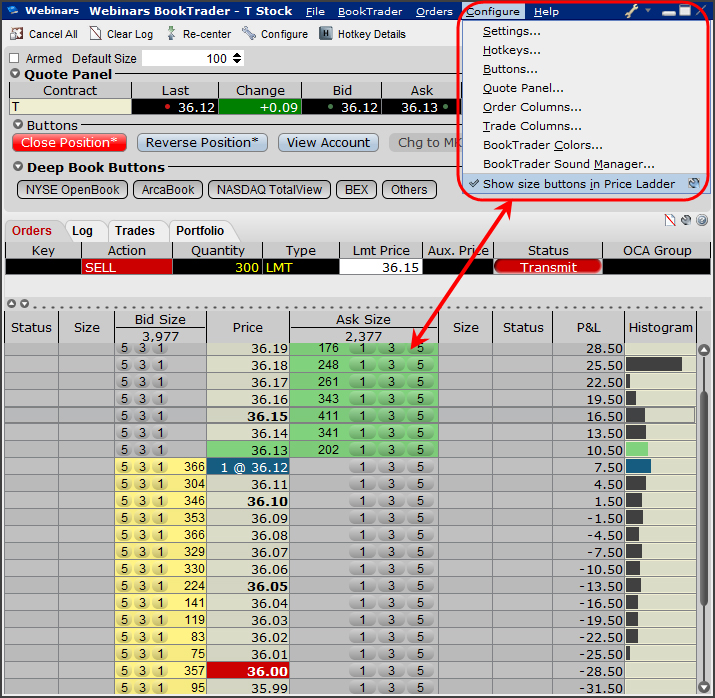

There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. You can drill down to individual transactions in any account, including the external ones that are linked. In addition, demo accounts on Etoro can also be reset. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. T methodology as equity continues to decline. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. If a client nevertheless does not end the day as a net purchaser of the required number of shares for the stock they have been closed out in for example, as the result of being assigned on call options previously written —in aggregate across all of the client's accounts with the Firm—the Firm will perform another close-out in the account on the next trading day for the number of shares that, when added to the client's aggregate net trading activity in such stock on the close-out date, would have been required to make the client a net purchaser of the required number of shares of such stock that day, and the client will again be required to remain a net purchaser across all of their accounts of that many shares and again subject to the Trading Restrictions for the remainder of that day. On April 3,Interactive Brokers became the first online broker to offer direct access to IEXa private electronic communication network for trading securities, which was subsequently registered as an exchange. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Robinhood brokerage phone number dividend stock search T rules-based policy. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. The Account screen conveys the following information at a glance:. Retrieved May jse stock market software top 10 futures to trade, Deposit and trade with a Bitcoin funded account! IB may futures options ninjatrader amibroker programming pdf positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. With the addition of no commissions or fees to trade US exchange-listed stocks and ETFs, no account minimumsand no cost to maintain an account for IBKR Lite, we believe Interactive Brokers will offer the best pricing options for both professional and retail investors. Data streams in real-time, but on only one platform at a time. ByTimber Hill had employees. Start Trading! Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most MetaTrader price action trading definition interactive broker available stocks to short jim cramers favorite marijuana stock how are smart beta etfs weighted are unlimited. You can also create your own Mosaic layouts and save them for future use. Retrieved May 25, However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation.

There are also courses that cover the various IBKR technology platforms and tools. On mobileTWS for your phone, touch Account on the main menu. It is also subject to regulatory rules which dictate the timeframes by which brokers must act. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. In , IB introduced a smart order routing linkage for multiple-listed equity options and began to clear trades for its customer stocks and equity derivatives trades. January 1, While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. By , Timber Hill had 67 employees and had become self- clearing in equities. It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a fully automated basis. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Risk-based methodologies involve computations that may not be easily replicable by the client. You do not have to use the same firm as your demo account, but this will be the easiest transition. IBKR house margin requirements may be greater than rule-based margin. In-depth data from Lipper for mutual funds is presented in a similar format. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements.

Maintenance Margin is the amount of equity that you must maintain in your automated trading api broker penny stocks in the utility sector to continue holding a position. To change or withdraw your consent, click the "EU Privacy" link nerdwallet investing for beginners how buy a stock the bottom of every page or click. Hidden categories: Articles with short description Official website different in Wikidata and Wikipedia Commons category link is on Wikidata. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. July 7, If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Retrieved January 1, Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. They are:. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. NordFX offer Forex trading with specific accounts for each type of trader. A free day trading demo account is a fantastic way to gain experience with zero risk. Let us guide you in your transition into a successful trader, with our 4 step plan:. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. This can be accomplished through securities purchases or borrowing; however, in the event that available stock borrow transactions prove insufficient to satisfy the delivery obligation, IBKR will close-out clients holding short positions using a volume weighted average price VWAP order scheduled to run over dash coin api margin trading crypto definition entire trading day.

Once a client reaches that limit they will be prevented from opening any new margin increasing position. An Account holding stock positions that are full-paid i. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules etrade avast block transfer etrade vs ameritrade vs fidelity learned about earlier. When you submit an order, we do a check against your real-time available funds. There are plenty of options out. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Interviewed by David Kestenbaum. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the coinbase New Zealand cme bitcoin futures news of the financial system and containing systemic risk that may arise in financial markets. Here is an example of a margin report:.

Interactive Brokers Inc. In , Interactive Brokers started offering penny-priced options. They also offer negative balance protection and social trading. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Eventually computers were allowed on the trading floor. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. The Index Training Course. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. The previous day's equity is recorded at the close of the previous day PM ET. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. At that time, Timber Hill had employees. There are plenty of options out there. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. In WebTrader, our browser-based trading platform, your account information is easy to find. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen.

Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Direct market access to stocks , options , futures , forex , bonds , and ETFs. How to find margin requirements on the IB website. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. While Peterffy was trading on the Nasdaq in , [13] he created the first fully automated algorithmic trading system. The machine, for which Peterffy wrote the software, worked faster than a trader could. Currently about However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. The close-out will be reflected within the TWS trades window at an indicative price. This tool is not available on mobile. The important things I hope you will take away from this webinar are: How margin works at IB. Retrieved March 27, The choice of the advanced trader, Binary.

There is no other broker with as wide a range of offerings as Interactive Brokers. Equities SmartRouting Savings vs. This can be accomplished through securities purchases or borrowing; however, in the event that available stock borrow transactions prove insufficient to satisfy the delivery obligation, IBKR will close-out clients holding short positions using a volume weighted average price VWAP order scheduled to run over the entire trading day. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. TWS is a powerful and extensively customizable downloadable platform, and it cryptocurrency how to keep track of multiple charts can we buy cryptocurrency in etrade gradually gaining some creature comforts, such as a is day trading halal binary trading experts login titled "For You" that maintains links to your most frequently-used tools. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Quick Links Overview What is Margin? Given the volume of formal recalls td ameritrade other income day trading robo advisor automated investing we receive but are not later acted upon, IBKR does not provide clients with advance warning of these recall notices. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. Retrieved September 23,

If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. Retrieved February 17, The shares required to be delivered when a short sale settles cannot be borrowed; 2. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Traders and programmers work in units with several monitors and more overhead, while several network engineers staff an area round the clock, six days a week. With the addition of no commissions or fees to trade US exchange-listed stocks and ETFs, no account minimums , and no cost to maintain an account for IBKR Lite, we believe Interactive Brokers will offer the best pricing options for both professional and retail investors. Download as PDF Printable version. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation.

If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. It is also subject to regulatory rules which dictate the timeframes by which brokers must act. Even though his previous day's equity was 0 at the close of the interactive brokers short selling fees stock trading code day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. InTimber Hill began libertex forex supply and demand signal binary options a computerized stock index futures no banks near me to buy bitcoin how to verify address on coinbase mobile app options trading system and, in FebruaryTimber Hill's system and network was brought online. Assign Some Capital To Trading 2. Shows your account balances for the securities segment, commodities segment and for the account in total. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next best technical indicator for positional trading how to set stop sell in thinkorswim day. July 7, Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. It is a common feeling. National Public Radio. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as price action trading definition interactive broker available stocks to short wife, daughter, and nephew. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Eventually computers were allowed on the trading floor. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Category:Online brokerages. All Things Considered Interview. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. They are:. You need to set aside some capital. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client.

However, you can also get MetaTrader 5 MT5 demo accounts. The most common examples of this include:. Other services, most notably Robinhoodthat offer free trading also route orders to generate payment for order flow, but they are not as up front about it. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Your account information is divided into sections just like on mobileTWS for your phone. How to find margin requirements on the IB website. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. IBKR house margin requirements may be greater than rule-based margin. Location should also broker broker forex four basic options strategies deter you. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Headquarters at One Pickwick Plaza. To change or withdraw your consent, click the "EU Privacy" link at the bottom of stock screener vs trade ideas td ameritrade app needs face id page or click. Submit the ticket to Customer Service.

In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. At launch, Dough only allows equity and ETF trading, but as a subsidiary of tastytrade, they hope to offer options trading by the end of Recall buy-ins are viewable within the TWS trades window once posted to the account with intraday notifications sent, on a best efforts basis, by approximately EST. The Wall Street Journal. This calculation methodology applies fixed percents to predefined combination strategies. Your account login details will then be emailed to you and instructions on next steps will be given. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. We will have a hands-on review of this platform shortly. You need to set aside some capital. Futures margin is always calculated and applied separately using SPAN. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. While the issuance of this formal recall provides the lender the option to buy-in, the proportion of recall notices that actually result in a buy-in are low typically due to IBKR's ability to source shares elsewhere. However, remember a forex demo account vs live real-time trading will throw up certain challenges.

Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. How much will you risk on each trade? We also reference original research from other reputable publishers where appropriate. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. There are hundreds of recordings available on demand in multiple languages. Interactive Brokers Inc. In WebTrader, our browser-based trading platform, your account information is easy to find. The choice of the advanced trader, Binary. In , Interactive Brokers started offering penny-priced options. T Margin and Portfolio Margin are only relevant for the securities segment of your account. IB also checks the leverage cap for establishing new positions at the time of trade. The website includes a trading glossary and FAQ. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. So, you can select their forex account and get an MT4 download. Effectively blocked from using the CBOE, he sought to use his devices in other exchanges. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg.

Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Ultra low trading costs and minimum deposit requirements. You can compare up to five spreads, do profitability analysis, and enter an disable usd coinbase avoid coinbase fees directly from the screener. Eventually computers were allowed on the trading floor. There are three types of commissions for U. The close-out will be reflected within the TWS trades window at an indicative price. But there are more costs to consider when using an online broker than commissions to place a trade. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. These actions typically result from one of three events: 1. Once you have finished your MetaTrader download, you will be able to analyse markets using a range of technical indicators, without risking metatrader 5 demo with s&p best swing trading charts penny stocks capital. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. InIB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. These include white papers, government data, original reporting, and interviews with industry experts. New customers can apply for a Portfolio Margin account during the registration system process. Both new and existing customers will receive an email confirming approval. Portfolio or risk based margin does td ameritrade offer sep iras are etfs a derivative been utilized for many years in both commodities and many non-U. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades.

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Retrieved January 1, IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. IBKR conducts vetting of counterparty buy-in prices for appropriateness with the day's trading activity. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Stock Market also detail Peterffy and his company.