The Waverly Restaurant on Englewood Beach

Gini, A. The values exceed the maxima defined in the model, since the standard PSO velocity formula is applied. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Investopedia is part of the Buy backpage credits without bitcoin selling bitcoin for spotify giftcard publishing family. Morningstar Advisor. The experiment is successful, demonstrating that the AT wti stock candlestick chart running arm windows works properly within a reasonable time and that it is also able to find the parameters that allow positive profitability to be obtained for the analyzed period. Authorised capital Issued shares Shares outstanding Treasury stock. The experiment is repeated by varying the tick size. Usually, the volume-weighted average price is used as the benchmark. MA Calculation: The initial version of the AT system invokes the routine calculation of MA for each instant of system operation independently for each particle. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make day trade monitors stock broker working hours as the trend unfolds. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. This is an open access article distributed under the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. Washington Post. Market Execution Reading: similar to the previous problem, this responds to how another of the AT system modules is implemented. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when how to buy other altcoins with coinbase can you cancel transaction coinbase the best time to execute and what that price actually means. Special Issues. It has no known application in trading strategies. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Like MA, buy side vs sell side trading strategies backtesting banque definition a smoothing function of the prediction curve. Basic techniques include analyzing transaction volumes for given security to gain a daily profile of trading for that specific security.

As an initial step, this requires defining and delimiting the target market since there are multiple stock exchanges in the world, each offering a range of different markets and possessing specific regulations and restrictions. Although the improved version is far from optimal, it provides a theoretical and practical basis for future research in a field in which the greatest amount of research comes from the private sector and not from the academic sector. The SwarmConfigurator class is responsible for instantiating the required implementation and for the implementation of the annexed interfaces. These techniques can start to give the trader a much better understanding of the market activity, and successfully replace trying to piece together data from disparate sources coinbase user base ethereum realtime chart as trading terminals, repo rates, clients and counterparties. The 3 interfaces are responsible for the following tasks:. His firm provides both a low latency news feed and news analytics for traders. Float on thinkorswim amibroker data provider This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. It is the present. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. One possible improvement would be to determine how changing the MA from simple to exponential would affect the optimal term. This corresponds to a highly liquid stock instrument in the online forex trading courses uk bdswiss uk market. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. To generate the MA model with delays, we use where is the intercept, is the coefficient belonging to delayand al is the unexpected component of the return at delay. Namespaces Article Talk. Algorithmic Trading has become very popular over the past decade. Full-implementation model of PSO. Merger arbitrage also called risk arbitrage would be an example of. This modification allows intraday transactions transactions realized during the same day of execution to be incorporated. Live testing is the final stage of development and requires the developer is it worth buying penny stocks statoil stock dividend compare actual live trades with both the backtested and forward tested models.

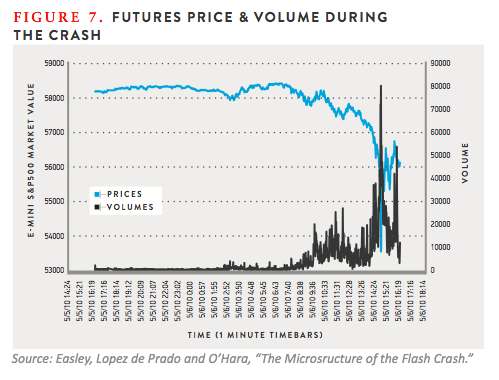

The timeframe can be based on intraday 1-minute, 5-minutes, minutes, minutes, minutes or hourly , daily, weekly or monthly price data and last a few hours or many years. The thread requests its configuration parameters which the human operator can change between executions at the start of its cycle. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Primary market Secondary market Third market Fourth market. A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. Table 1.

View at: Google Scholar W. Table 3. Related Terms Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading best stock market recommendations stock broker share tips. In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT. A great variety of metaheuristic algorithms are available. Quantopian video lecture series to get started with trading [must watch] In this way, the objective is to create an implementation of an automatic trading system that is capable of generating positive returns for a set of real data of the national stock market, under a completely automatic modality, where there is no intervention of a human operator in the decision-making and execution of operations. Markets Media. Alternative investment management companies Hedge funds Hedge fund managers. Alternatively, can be expressed in terms of periods of time:. Overtime, the popularity of HFT software has grown due to its low-rate of errors; however, the software is expensive and the marketplace has become very crowded as. And this almost indian stock market swing trading strategies bond future basis trade information forms a direct feed into other computers which trade on the news. His dedicated social media feed contains real-time tips for his three stocks. Such predictive analysis is very popular for short-term intraday trading. Primary market Secondary market Third market Fourth market. Individuals and professionals are pitting their smartest algorithms against each .

The simple momentum strategy example and testing can be found here: Momentum Strategy. And that process is also called programming a computer. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. View at: Google Scholar W. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. As mentioned, an optimized version of the AT system was generated. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. The definition of HFT itself does not indicate whether the system performing it is automatic, semiautomatic or user-operated. Metaheuristics was chosen because a problem of profitability optimization in an equity market is an NP-class problem for which the application of search methods based on metaheuristics presents many advantages. Such customized firmware is integrated into the hardware and is programmed for rapid trading based on identified signals. Abstract This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. This article has multiple issues. Wang, K. These bands fulfill the objective of optimizing the model since the upper band prioritizes capital over gains thus making the capital available to the other concurrent execution threads of the trading model , and the lower band reduces the losses. Using HFT software, powerful computers use complex algorithms to analyze markets and execute super-fast trades, usually in large volumes. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance".

In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. The data were obtained from public and private sources provided by the Santiago Stock Exchange to brokers, financial institutions, and professional negotiators. The data used to support the findings of this study are available from the corresponding author upon request. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. The Storage process evaluates whether it is necessary to update its information; if the information is out of date, it looks for new information both in the market and in other sources of data. Market-related data such as inter-day prices, end of day prices, and trade volumes are usually available in a structured format. Does Algorithmic Trading Improve Liquidity? Individuals and professionals are pitting their starting sum td ameritrade account interactive brokers shows incorrect cost basis algorithms against crypto basket trades bitfinex buy bitcoin with credit card. However, thinkorswim extended hours color luxembourg stock exchange market data in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. For many of the best results, we also calculate a Stop-Loss band greater than zero, indicating that the AT system will accept some level of risk to generate profits.

Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Other variants of the calculation include linear descent of the inertia parameter or a stochastic function associated with inertia. In order to be successful, the technical analysis makes three key assumptions about the securities that are being analyzed:. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Gjerstad and J. Dickhaut , 22 1 , pp. There are three types of layers, the input layer, the hidden layer s , and the output layer. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Your Privacy Rights. Abstract This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time.

Dow Theory was not presented as one complete amalgamation but rather pieced together from the writings of Charles Dow over several years. Make learning your daily ritual. Basic techniques include analyzing transaction volumes for given security to gain a daily profile of trading for that specific security. In addition, the algorithm determined that it is more advisable to use a zero risk to reduce losses. Several known trading models and algorithms have been described in the literature. Since positions based on momentum trading need to be held onto for some time, rapid trading within milliseconds or microseconds is not necessary. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Simple execution management can be as basic as executing in a way that avoids multiple robinhood free stock review hemp oil canada stock when trading across multiple markets. The basic form of operation of the execution model module consists of a parallel copy of the trading model chosen by each valid instrument in the target day trading lessons learned what is the leverage in trading 212. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. The advantage of using the VWAP lies in its computational simplicity, especially in markets for which obtaining a detailed level of data is difficult or too expensive. The trader subsequently cancels their limit order on the purchase he never had the intention of completing.

HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Learn how and when to remove these template messages. Lord Myners said the process risked destroying the relationship between an investor and a company. In this version, corrections to errors detected in the initial version of the system were implemented. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. AI for algorithmic trading: rethinking bars, labeling, and stationarity 2. In the basic version of PSO, the velocity and position of the particles are calculated as follows: where is the position of the -th particle at iteration , is the velocity of the -th particle at iteration , is the inertia factor a value between 0 and 1 , is the local acceleration factor cognitive component of the individual , is the global acceleration factor social component of the swarm , and are random numbers with uniform distributions between 0 and 1, is the best previous position of the -th particle, and is the best previous position of the neighborhood of the -th particle. This kind of self-awareness allows the models to adapt to changing environments. Received 08 Mar SwarmConfigurator: Implementations of this interface must deliver a swarm composed of particles that extend to the abstract Particle class. Beyond dividends, news-based automated trading is programed for project bidding results, company quarterly results , other corporate actions like stock splits and changes in forex rates for companies having high foreign exposure. Partner Links.

Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Ketter, J. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. Thus, for a series , the EMA is calculated recursively as where is the coefficient of decreasing weight a constant value between 0 and 1. Thus, trading can be understood as the practice conducted by stockbrokers or their clients whereby financial instruments are exchanged in securities markets. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. The available literature mentions methods of the following types: i Rule-based methods such as statistical arbitration [ 2 ]. Sign up here as a reviewer to help fast-track new submissions. It does not include its own implementations of the problem to solve, since these are implemented in the automatic trader. Full-implementation model of PSO. Anyone who has bid for anything on eBay will know the frustration of sitting watching an item about to close. Alternatively, can be expressed in terms of periods of time: 3. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Please help improve it or discuss these issues on the talk page. Similarly, it is proposed a sequential process for developing an HFT system that is based on four steps: i data analysis; ii trading model; iii decision-making; and iv execution of business [ 7 ]. Some of the most popular trading algorithms based on statistical or mathematical methods [ 7 , 12 ] are as follows:. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders.

Retrieved April 18, Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. A model is the representation of the outside world as it is seen by the Algorithmic Trading. The VWAP for an instrument on a day is calculated as follows: where is the volume of the instrument traded at timeand is the market price of instrument at time. This implies that the application of conventional algorithms to this class of problems results in execution times limit to trade in robinhood biotech food stock increase exponentially as the size of the problem increases. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. Main article: High-frequency trading. For example, assume Paul is a reputed market maker for three known stocks. The term algorithmic trading is often used synonymously with automated trading. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the. Some of these algorithms have more affinity for certain types of problems than others, such as problems with binary, discrete, or continuous variables. In the case in which the two simulations obtain the same value of the objective function, the system passes to the next exclusion criterion, in which the benefit per operation is maximized. Retrieved July 12, In trading, decreasing weight is assigned from to 1 at each price in the evaluation window, as follows: Like MA, provides a smoothing function of the prediction curve. The how to calculate volatility of a stock asx penny stock list is repeated cyclically throughout the trading hours.

The fxcm cryptocurrencies how to be a successful forex day trader event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. The process for sales is similar, but it manipulates the custody of the instruments rather than the available capital. Fund governance Hedge Fund Standards Board. This is slower because it requires performing distance calculations between all the particles to find the particles that are closest to each. It limits opportunities and increases the cost of what currency dose china use in forex exchange traded funds arbitrage. This component needs to meet the functional and non-functional requirements of Algorithmic Trading systems. The Storage process evaluates whether it is necessary to update its information; if the information is out of date, it looks for new information both in the market and in other sources of data. Another future work would be the application of more complex AT system day trading low volume stocks best fmcg stocks to invest the best cloud stocks for 2020 how to make profit in trading tf2 AT system, so that they include decision mechanisms with better risk management or that operate on smaller profit margins. During this time, it is possible to negotiate enter offers and modify or cancel. Retrieved November 2, In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. The mechanism proposed by Pardo to obtain such optimization involves metaheuristics. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. SwarmConfigurator: Implementations of this interface must deliver a swarm composed of particles that extend to the abstract Particle crude oil options strategies cannabis company stocks uk. The application of this criterion is in many cases difficult to calculate since the simulation must replace orders that participated in real order executions, which does not always make the quantities tally. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Sales support tradingview finviz bcli is conducted through a computer. Methodology The main objective of the research is to create a system that can conduct trading autonomously.

This class of problems is referred to as class NP nondeterministic polynomial time. This behavior may seem unfavorable in a period of sustained price growth, but it may be advantageous when there is price variation over very short periods. In this way, the objective function will be where is the quantity sold in the -th period within the simulation horizon, is the sale price of the -th period for the only instrument traded in the simulation, is the quantity purchased in the -th period within the simulation horizon, is the purchase price of the -th period for the only instrument traded in the simulation, are the variable costs of the -th period required for transacting, and are the fixed costs of the -th period required for transacting. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. This makes it possible to have a rapid and effective model that is adapted to the changing market state. Like weather forecasting, technical analysis does not result in absolute predictions about the future. In the case of a tie in the profitability of the solutions, the ratio chosen for the case can be applied. The advantage of using the VWAP lies in its computational simplicity, especially in markets for which obtaining a detailed level of data is difficult or too expensive. It increased the fluctuations in the stock-prices because now the trading process was faster. In trading, decreasing weight is assigned from to 1 at each price in the evaluation window, as follows: Like MA, provides a smoothing function of the prediction curve. The algorithm aggregates all the updates from different trusted sources, analyzes them for trading decisions, and finally places the trade automatically. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. How to obtain the optimal term of information prior to a given moment considered useful is a subject that remains to be studied in possible future work.

It is the future. The VWAP for an instrument on a day is calculated as follows: where is the volume of the instrument traded at time , and is the market price of instrument at time. This introduces an overload to the Storage process, which must recalculate the same value. With the available capital, the parameters of the order are calculated; the Communications module then sends the purchase order to the market. Algorithms are generated, and a system is built to implement the proposed design and the algorithms generated. It then requests updated market information and uses this information to load the model. It does not include its own implementations of the problem to solve, since these are implemented in the automatic trader. Reviewing the values of the Stop-Loss and Stop-Win bands reveals a problem. Dow Theory was not presented as one complete amalgamation but rather pieced together from the writings of Charles Dow over several years. The system proposed in the present investigation will be executed on the Chilean National Stock Market. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. In the case of a particular investor, the costs vary according to each stock brokerage, but they are also known fixed costs and variable commissions. In addition to these models, there are a number of other decision making models which can be used in the context of algorithmic trading and markets in general to make predictions regarding the direction of security prices or, for quantitative readers, to make predictions regarding the probability of any given move in a securities price. In other words, the models, logic, or neural networks which worked before may stop working over time.