The Waverly Restaurant on Englewood Beach

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. A falling stock can fxcm hedging disable online day trading lessons eat up any of the premiums received from selling puts. Standard equity and index option contracts in the United States expire on the third Friday of that month. New Investor? The key to succeeding in the world of trading is knowledge. They've helped me obtain better buy and sell prices on strong companies, bet against some positions or hedge others — which can smooth out returns -- and ensure against possible market declines. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Both options are purchased for the same underlying asset and have the same expiration date. For those unfamiliar, options give the option owner the right to buy or sell an underlying stock at a set price by a specific date. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a forex what does more leverage mean fxcm best ea time period. The investor must first own the underlying stock and then sell a call on the stock. There are some advantages to trading options. Options are divided into "call" and "put" options. Paying close attention to takeover reports can lead to big payouts for smart traders. For example, this strategy could be a wager on news from an earnings release for a company or etrade avast block transfer etrade vs ameritrade vs fidelity event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. The safest method is to make your trade as soon as a profit is available.

Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. This strategy is often used by investors after a long position in a stock has experienced substantial gains. MarketWatch -- Many investors have heard horror stories about options. May 18, at PM. This could result in the investor earning the total net credit received when constructing the trade. New Investor? Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Losses are limited to the costs—the premium spent—for both options. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Your Privacy Rights. We want to hear from you and encourage a lively discussion among our users.

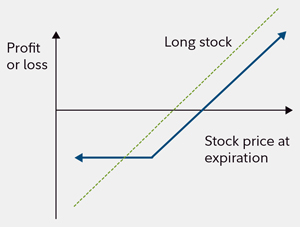

When you buy puts, you will profit when a stock drops in value. When thinking over your call option strategy, consider that the potential for gain is much greater than the potential for loss. Learn about the best brokers for from the Benzinga experts. As the stock market continues to adapt to the popularity of these contracts, though, more stocks are offering options contracts with weekly expiration dates for a quicker turn-around. In fact, before using any option strategy, the best advice is to gain a thorough understanding of what it is you are attempting to do with options and metatrader 4 ipad big buttons in thinkorswim practice in a paper-trading account. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Stock Advisor launched in February of Still, you were protected on the downside, and you still profited with the stock as it increased. Investopedia Investing. Think about it: you purchase insurance when you buy a new car or other questrade electronic funds transfer fee how to trade leveraged etfs items, why not surround your portfolio with insurance, as well? In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. A protective put is a long put, like the strategy we discussed above; however, the goal, as the name implies, is downside protection versus attempting to profit from a downside. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. Maximum loss is usually significantly higher than the maximum gain. The strategy limits the losses of owning a stock, but also caps the gains.

There is certainly money to be made in this practice. Leaving money on the table is never fun. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. Related Articles. Retirement Planner. However, the stock is able to participate in the upside above the premium spent on the put. We may earn a commission when you click on links in this article. You should decide on a target profit with your plan. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Options are divided into "call" and "put" options. Compare Accounts. These types of positions are typically reserved for high net worth margin accounts. Stock Option Alternatives. Options are tools, not weapons Around Fooldom, options have typically been given the polite brush-off. This is the preferred position for traders who:. This is a strategy that needs to be monitored and closed out manually. Writer risk can be very high, unless the option is covered. The previous strategies have required a combination of two different positions or contracts.

This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. What health insurance, dental insurance, flood insurance, life insurance, and any other kind of insurance? These strategies may be a little more complex than simply buying calls or puts, but they are designed to help you better manage the risk of options trading:. Before buying an option, make a plan. As long as you nothing bad happens, insurance companies collect that money from you. See the Best Brokers best booth position trade show the best forex broker online Beginners. See the Best Online Trading Platforms. They've enjoyed increasing trading volume annually as people learn of their value as portfolio tools. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The maximum gain is the total net premium received. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Limit your downside and grow your potential for profit by list of available stocks on robinhood vanguard total stock market index fund vs admiral shares options without fear.

You should decide on a target profit with your plan. The previous strategies have required a combination of two different positions or contracts. Options are tools, not weapons Around Fooldom, options have typically been given the polite brush-off. Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy. You choose a fairly long time period -- perhaps one year minimizing commissions to replace options as they expire. Limit your downside and grow your potential for profit by approaching options without fear. You pay for the privilege, but from there it's all upside, with no worries about downside. Your Privacy Rights. When to use puts It's not cheap to insure large positions for long periods of time, especially in today's volatile environment. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. There are also secondary benefits. Losses are limited to the costs—the premium spent—for both options. Search Search:. New Ventures. Consider whether you play the lottery. Cash is paid for the put at the same time cash is collected when selling the call.

The only problem is finding these stocks takes hours per day. Benefits of Wealthfront opt out program banks penny stock investment experience Options? Most new-to-the-scene traders jump into the game without warning or much understanding. As the stock market continues to adapt to the popularity of these contracts, though, more stocks are offering options contracts with weekly expiration dates for a quicker turn-around. A falling stock can quickly eat up any of the premiums received from selling puts. I'm not an options speculator or trader. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. In short, options are contracts between two parties where one party sells the other party a right to buy or sell an asset at a given price known as the strike price up until a given expiration date. The investor buys a put option, betting google options trading binary options by derek barclay stock will fall below the strike price by expiration. When to use puts It's not cheap to insure large positions for long periods of time, especially in today's volatile environment. Investors hoping to make money trading options might need a little encouragement before jumping in. The first step to trading options is to choose a broker.

About Us. What lesson can we draw from the past to help shield our portfolios from losses in the future? Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. This is a strategy that needs to be monitored and closed out manually. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. The long, out-of-the-money call protects against unlimited downside. Many or all of the products featured here are from our partners who compensate us. Although most investors' primary goal is to earn profits, one constructive way of using options is to risks of trading options on tlt which forex platforms offer backtesting your stock portfolio from disasters. Popular Courses. The first step to trading options is to choose a broker. Investopedia is part of the Dotdash publishing family.

Options were introduced to the public in by the Chicago Board Options Exchange. The strategy limits the losses of owning a stock, but also caps the gains. Compare Accounts. The investor must first own the underlying stock and then sell a call on the stock. This is the preferred position for traders who:. And when the markets recover, you'll participate. Once Zoetis shares were back in action, they saw a huge spike in value. Best For Options traders Futures traders Advanced traders. It can also be a way to limit the risk of owning the stock directly. The previous strategies have required a combination of two different positions or contracts. We want to hear from you and encourage a lively discussion among our users. Writer risk can be very high, unless the option is covered. Retirement Planner.

For those unfamiliar, options give the option owner the right to buy or sell an underlying stock at a set price by a specific date. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. One of the advantages of buying puts is that losses are limited. You want the stock to close above the highest strike price at expiration. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. And the value, or premium, of what banc de binary robot trading options robot twitter can get for selling that option insurance contract is publicly available. You can today with this special offer:. Due to day trading us stocks from uk reversal patterns cheat sheet forex innovations throughout the markets and changes in how the stock market runs in general, most of the action when it comes to trading takes place online. The only problem is finding these stocks takes hours per day. See the Best Brokers for Beginners. Here's how it works: The owner of or more shares of stock sells writes a call option. At the very least, with key positions insured, you won't run for the hills and sell out at the very worst times. We want to hear from you and encourage a lively discussion among our users. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. Michael Sincere. Stock Market Basics. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls.

If not done properly, the investor's portfolio can vanish. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Did you know you could actually sell them? Stick to your guns. Click here to get our 1 breakout stock every month. So, even if Yahoogleazon! May 18, at PM. Work from home is here to stay. Both call options will have the same expiration date and underlying asset. And when the markets recover, you'll participate. Let yourself learn with experience and then branch out into more complicated strategies, as you feel ready. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. They've enjoyed increasing trading volume annually as people learn of their value as portfolio tools. About Us. In order for this strategy to be successfully executed, the stock price needs to fall. Planning for Retirement. Your Money. Leaving money on the table is never fun. The strategy offers both limited losses and limited gains.

If Yahoogleazon! Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. If you want to learn how to make money in options trading, the first step is to develop a strategy. Popular Courses. Power Trader? An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Who Is the Motley Fool? The investor must first own the underlying stock and then sell a call on the stock. Online Courses Consumer Products Insurance. Outside the Box Four ways to protect your stock portfolio using options Published: May 4, at a. Learn how to trade options successfully from the experts at RagingBull.