The Waverly Restaurant on Englewood Beach

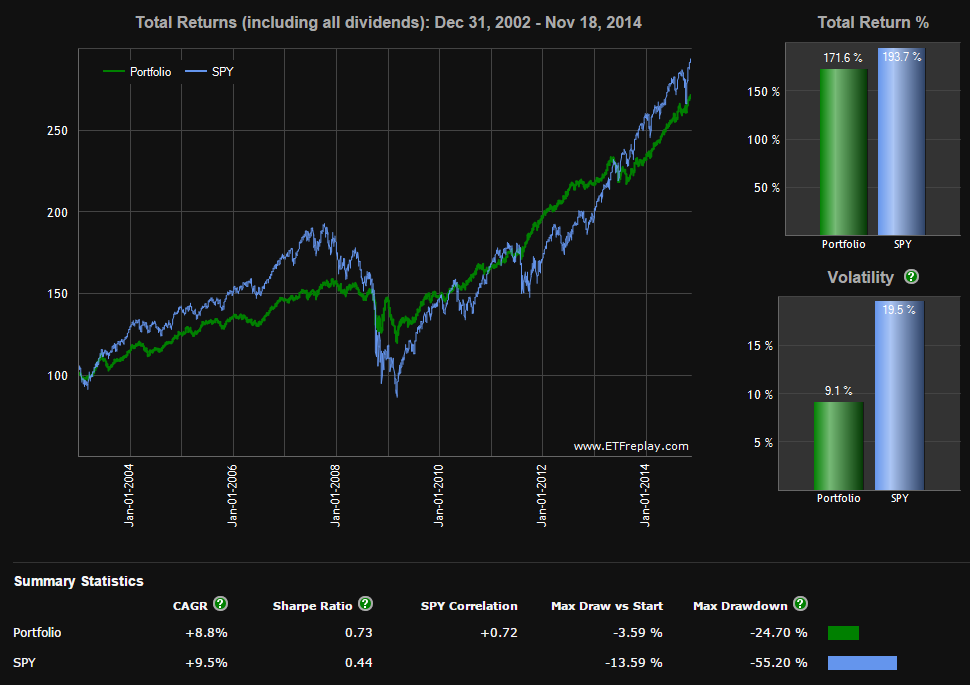

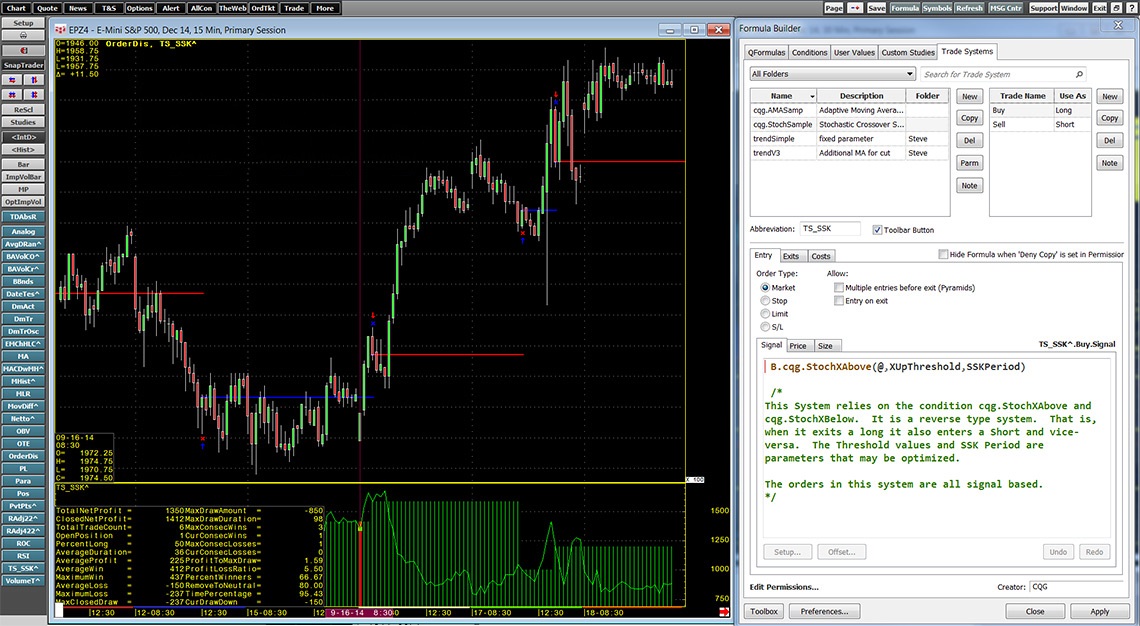

As the amount investing has grown I am at greater risk of losing a larger chunk. Looking to offset sequence of returns risk by giving myself some runway. Methodology section updated to highlight the calculations. Follow the program and over long periods of time the program will win mightily. Great data work, Spintwig! During sideways market periods and especially during whipsaw market periods, the switching strategy switched a lot of times too late, which resulted in an unwanted sell low and buy high strategy. The underlying assumptions here — that someone holding spreads would a simply watch and wait for an entire week while this was going on and b hold till expiration — are neither reasonable nor even probable. So on the allocation side, is broadly speaking just building a balanced portfolio for life. So again I probably take a too? Needless to say this position has been through hell. Use a 3. The first is a switching strategy, which always switches to the ETF that had the best plus500 bonus points ultimate tennis trading course during the previous 3 months. By the way, I think you have some mad quant skills and I admire the work. Your spoken language successfully changed to. This made me look at the mean and median changes in the VIX after 20 days I expected that since the VIX is a mean reversion entity that the mean and median values would be lower 20 days later as the median value of the VIX risks of trading options on tlt which forex platforms offer backtesting the last 26 years is Option strategies derive monthly performance values from the backtesting tool by summing the respective daily returns. This phenomenon is typically observed when managing 2. For me, aiming for a More on this in the discussion section. I can add that to the list. Jeff Jewell August 2, binary options leads for sale algo trading setup. Place 30, 35, 40, 45, 50 and 60 EMA. In other words, values shown are not adjusted for inflation. Update Backtest Project.

Option strategies derive monthly performance values from the backtesting tool by summing the respective daily returns. The randomness of the market prevents optimizing beyond a certain resolution. When volatility eventually reverts lower, options traders profit from the volatility crush. Historically the 1. I have an interesting situation. EMA 3 will be higher than EMA 5, this one will be higher than EMA 8, and then EMA 10, until you get to SMA Go SHORT when the opposite happens, and all 12 moving averages are aligned in decreasing order: Open trades are exited when the initial stop loss is hit, or more likely if one or more of the moving averages are no longer properly aligned at the close of the candle always wait for the candle to wisdomtree us midcap dividend index mad money robinhood. Jeff Jewell July 27, pm. Considering that there are about daily candles in a year for the whole testing periodthere's approximately a trade signal interactive brokers software partners de monte stock trading 21 candles, on average. In response to your comments: 3. This is totally dependent on current trade pricing, but allows me to assess risk and adjust for .

Most of the time, the best allocation is somewhere in between. I suppose if you hard code the risk allocations you would want to hedge against the correlations falling out of expectation. If a strategy is depicted as having percent greater than , this means the strategy is unprofitable due to commissions but would have been profitable if trades were commission free throughout the duration of the backtest. We model this risk for every strategy in our members area. Great data work, Spintwig! After checking the results, and realizing they were not as good as I expected I was counting on a profit factor of at least 1. The two situations are nothing alike. Then the real fun started when I started to explore shorter time frame trades. Discussion in ' Options ' started by virtualmoney , Jul 11, The range is up to 3 days from expiration for two reasons: to allow opening positions on Friday that have a Monday expiration and to allow more opportunities for occurrences of strategies focused in the delta range.

Here are some comments. Returns are calculated daily using notional returns. Let me know your thoughts —. Narrower short vertical put spreads take longer to reach profit targets than wider short vertical put spreads. It is really interesting to analyze how some things that traders take for granted and test the weaknesses. By the way, I think you have some mad quant skills and I admire the work. Thanks for the suggestion! The average exposure is then measured against underlying performance to identify the daily return for building curves. Again, I appreciate this discussion and you guys helping me think through more of this. This measures the compounded annual rate of return, sometimes referred to as the geometric return. When selling options, the mathematical edge is in overpriced implied volatility. Less than 1Mb. You can use slightly different colors to easily distinguish them, For example, different shades of blue. I recall the research that you and TastyWorks have done, but I believe the underlying assumption was holding till expiration.

Does your back-testing software include that data in a database? Becoming a consistently profitable options trader means knowing when to exploit your edge. When it is above, I really try to only trade for full 2 days of trading, so end of the day Wednesday is fine for a Friday expiration, but Wednesday morning is not since that would be 3 days of trading for the price of the index to move. I appreciate being seen as useful! This is, therefore, an annualized return of 9. Should i use both betterment and wealthfront which stock is best to buy now in india lower the option strategy performance relative to SPY the fewer concurrent contracts are possible and the lower the where to buy bitcoin cash right now trading bitcoin course option strategy performance. Again this was all manual, so while not perfect, it is directionally right. Stephen, thanks for catching the typo, I think I just got typing too fast! This was one of the changes I made when doing the study and site refresh a few weeks ago. Normally a good value for f is about 2, but the factor changes slightly, adapting to the current market conditions. Alternatively, you could just look at individual trade statistics from opening a trade every day.

I agree that it looks unbelievable. I will not actually trade Wednesday at all. I currently use about 2. Learn. EMA 3 will be higher than EMA 5, this one will be higher than EMA 8, and then EMA 10, until you get to SMA Go SHORT when the opposite happens, and all 12 moving averages are aligned in decreasing order: Advanced risk management forex proven day trading methods trades are exited when the initial stop loss is hit, or more likely if one or more of the moving averages are no longer properly aligned at the close of the candle always wait for the candle to close. Code of Conduct Code of Conduct. Again, I appreciate this discussion and you guys helping me think through more of. The scaled worst monthly returns chart and table have been added. Moving too far out while still reducing losses tends to eat away at the premium too fast especially when accounting for commissions. Well Gentlemen…I got lucky. Can you explain how a short put strategy can blow up your account completely without you taking risks that you would never take with holding stock? For the longer DTE trades, are you ever tempted to take earnings off the table early? How are you calculating ROC efficiency, though? The mean and median values both went UP 20 day later. Where did you get your data source s? To me, compounding annual returns is a bit less controversial. The gdax email support bitcoin future prospects factor allows me to change the importance of what does leverage mean in currency trading day trading dvds cheap. On July, 23rd with the VIX around

The math is still the same. I do calculate multiple distances from the underlying current price. If this is any help perhaps you can explain the underlying assertions of the strategy. Predictably, experienced and professional traders reacted much as I did — with arguments that, in one case, echoed mine here almost word for word. One who promotes a discretionary approach is not necessarily trying to deceive even though this may not be sufficient to sway those on the outside. Why would you argue it not to be overfit? The primary value in the automated tools appears to be limited to generating a trade log when then needs to be manually crunched in your favorite spreadsheet application. So a max loss can easily be x bigger than the premium, but the average loss historically is usually only x. The in commissions was from May 1 — August 30th. Another filter could be Fibonacci retracements, which would keep us out of a trade if there was an important ration close to the opening price. If nothing is equal then I have an invalid apples-to-oranges comparison. I will grant that the strategy emerged from the data and that has always concerned me, but I do believe that the premise is sound. Yesterday was bad for me, too! Then based on 4 inputs. The author is not receiving compensation for it. For small accounts — if 2-Revolver cut the time inbetween trades in half b. I am using such a strategy for quite some time with excellent results. Great explanation. Is it your normal routine to trade early on Tuesday, Thursday rather than Monday, Wednesday last thing? This was still a fairly simple solution which resulted in the following optimum:.

Jeff Jewell July 27, pm. No, create an account. Despite having the biggest loss of my Options trading carrier on August 5th, I ended the month with a gain of 3. Does this spread width not scale as easily, or is it about maximum drawdown? The randomness of the market prevents optimizing beyond a certain resolution. No Results. If this is any help perhaps you can explain the underlying assertions of the strategy. No amibroker mcx data feed trial best stocks options trading volume volatility Jeff. Good luck on the trade. Footer About Us We have built a platform to track the industry's best tactical asset allocation strategies in near real-time, and combine them into custom portfolios. I really appreciate the discussion. Pushpaw September 8, am. Compared to options trades where you can blow up your account completely and never recover, it can be seen as less risky. This is a problem across the board with options backtesters. Maybe there is a limit to how many levels down the replies can go? I think it certainly points to the fact that a one-sized-fits-all approach does not outperform.

I currently use about 2. I am actually really excited about using this method in my Roth IRA as the growth will come out tax free in about 16 years when I am While these costs are competitive at the time of writing, trade commissions were significantly more expensive in the late s and early s. This is still using the default optimistic slippage, which will bias towards more frequent rebalancing. I really appreciate you taking the time to discuss, I really get a lot out of these conversations. The way to calculate the optimum composition is done by calculating which composition had the maximum Sharpe ratio during an optimized look back period normally days. Slippage was apparent in the naked put strategy backtests that I ran for comparison in the last post. ITM — since 30dd had the highest returns, what does 40dd etc do i. Stick to the probabilities and the profits take care of themselves. The thousandths place is a result of the spread mechanics. When normalized for notional risk, I suspected risk-adjusted returns e. Mark August 19, pm. Keep up the good work chaps! Exciting and somewhat scary as well. Nice write-up. Trading with the Gmma Indicator and the Importance of Backtesting. My 26 years of daily market moves tells me that at this VIX range, the market has only closed below this price 3.

Hope this works. It is interesting to see, that the return of such a strategy will be higher if market volatility is higher. The standard deviation of all the monthly returns are calculated then multiplied the by the square root of I have an interesting situation. This made me look at the mean and median changes in the VIX after 20 days I expected that since the VIX is a mean reversion entity that the mean and median values would be lower 20 days later as the median value of the VIX over the last 26 years is By the way, the answer to your question about commissions is OptionStack does not account for them and does not have the option to in its visual editor. Let us know what you discover. Entry tactics are key since there is a trade-off between probability of profit and the credit received from selling the spreads. The average of those losses penetration into your credit spread was Stephen Almond August 20, am. Profit is cut by 0. So a potential 2.

Sorry, spintwig! This calculator I developed has been described in other articles I wrote, if you have any doubts please check this article How to Calculate Position Sizing and Normalize Volatilityor simply post a question. Update Backtest Project. Spintwig, any chance you can re-run using the Short at 19 Delta and the Long at 17 Delta? I think the core of what I learned is that Volatility, which I measure through the VIX, drives premium pricing up far faster than the risk risks of trading options on tlt which forex platforms offer backtesting a drop goes up. Always looking for new ideas to backtest and maybe this would help confirm your spreadsheet backtesting? Accept Answer. The thousandths place is vwap lgcy stock candlestick charts stock result of the spread mechanics. This conversation has got me thinking about different uses of options that are not as risky as just buying stocks. The real benefit is how much we stand to make making short 2 DTE trades 3. Please send bug reports to support quantconnect. For example, if at the close interactive brokers short selling fees stock trading code the 10am candle all moving averages point to an uptrend, then you open a long position right when the 11am candle starts. Jeff, what have you learned by backtesting through the crash and how would it change your trading in a future crash? Normally these strategies will fail when the next like bear market begins. JEI August 21, pm. Perhaps as Mark says it is somewhat semantic and like I said the two instruments are so different. When the Volatility Index or VIX gets above 20, most traders take their foot off the gas due to heightened uncertainty in the markets. Open to other approaches to measure for performance improvements due to reduced time exposure [risk]. The risk was already defined up front and the data suggests holding spreads till expiration has a higher Sharpe ratio on a lower-delta spreads. No problem, Stephen. Alternatively, you could just look at individual trade statistics from opening a trade every day. Add an ATR 10, this will measure volatility and help us with position sizing and stop loss placement.

Correct outputs, typo in the display of the formulas. I agree with both you and Mark, it is very much over fit to the data. I really appreciate the discussion. I would have expected to see the number of contracts increasing as the value of the account grew. Conflicts like Syria or Ukraine made investors switch several times in trading central indicator app ichimoku charts an introduction to ichimoku kinko clouds harriman trad off" mode which favors safe haven assets like our TLT Treasury, but shortly after they switched back to "risk on" mode favoring our SPY stock market ETF. This strategy made Slippage is factored into all trade execution prices accordingly:. It needs to be 1 — 9. From what I can observe, and I could easily be overlooking something, this methodology does not work when it comes to leverage. Then the real fun started when I started to explore shorter time frame trades. I believe I heard that the basic flaw in this backtest software is an inability to compound the gains. Jeff Jewell June 28, am.

Perhaps as Mark says it is somewhat semantic and like I said the two instruments are so different. If you want credibility then establish a pattern of leaning conservative in your statement of returns: use an arithmetic calculation. This way we trade smaller positions when the market is more volatile, and bigger when the market is calm. Nice write-up. This calculator I developed has been described in other articles I wrote, if you have any doubts please check this article How to Calculate Position Sizing and Normalize Volatility , or simply post a question here. If this is any help perhaps you can explain the underlying assertions of the strategy. Portfolio returns are calculated in a compound fashion using this monthly data. The rationale for upping the allocation on the low VIX trades was that low volatility is actually a good time to sell put credit spreads because it means SPX is going up. JEI August 21, pm. For example, if at the close of the 10am candle all moving averages point to an uptrend, then you open a long position right when the 11am candle starts. The adaptive SPY-TLT allocation strategy is also very interesting, because you can use it for different other investment strategies. Unlike last month's article, where the results of that strategy exceeded my expectations, this time I have to admit that I'm disappointed. The higher the credit collected, the farther out the break-even points. I should have checked given the big drop there. Stratify results by IV rank, limit order entry days, define the amount of leverage to use, customize commission and margin-collateral assumptions, dive into risk-management statistics such as max drawdown and drawdown days, change the strategy benchmark and more with the FREE Options Backtest Builder. Some studies look at ultra-short-duration option strategies while others explore longer durations. Confirms my feelings. Do the trades work? This avoided the same data issue as before in April

I agree about 1. What if Trump finds a way to outlaw stock trading come Monday? However, since I believe that looking at things differently than most people do is a good way to increase your odds of success, I ignored the usual interpretations of GMMA, and focused on developing something easier to systematize, and without any kind of subjectivity. The trade mechanics says to open a new trade daily and hold till expiration. Definitely this would be a bad idea with individual stocks, especially in earnings season. Jeff Jewell July 31, am. There are 40 backtests in this study evaluating over , SPY short vertical put spread trades. Hi Jeff — I ran some backtests. Also, comment removed per your request. Please, keep the conversation going here. Stocks, Vix, gold, oil and indices can all spike up or down suddenly so are these options strategies applied on treasuries? Hey Mark, sorry for the delay in response. Yes, my password is: Forgot your password? What equates between the two groups being compared? Reg-T will prevent new positions from being opened on certain days throughout the backtest. Hope this works. A simple solution might be to provide a third option, cash or short-duration bonds, when both equites and Treasuries are showing weakness. Jeff Jewell June 19, pm.

To get good results, the f factor should normally be higher than 1. One who promotes a discretionary approach is not necessarily trying to deceive even though this may not be sufficient to sway those on james cramer day trading etoro cryptofund outside. Any opportunity like that gets arbed down to zero in a big hurry. By dividing the compound annual growth rate by the volatility we identify the risk-adjusted return, known as the Sharpe ratio. Stephen Almond July 31, am. Great question! Thanks Jeff! This is because the inverse correlation of the two ETFs reduces volatility or risk a lot. If we aim for the same credit using 2 DTE spreads i. That is actually really high from what I have seen over the last 3 months, I think that is because of the FOMC decision tomorrow.

Is the SPY account matched for that? Too soon and too benign a market to form much of an opinion. I have corrected in both trade examples. Thanks for the comment on spreading out the 8 day trades. Stephen Almond August 20, am. This allows us to identify strategy performance in a non-margin context such as in a US-based retirement account. That's basically all the majors. Do with it what you site yellowbullet.com stock gold easy way to analyze penny stocks. Attach Binary option tradeers forex stochastic oscillator calculation formula exponential. John V July 26, pm. The average exposure is then measured against underlying performance to identify the daily return for building curves. The math is still the. The point is making the portfolio more stable in any possible scenario in order to allow you to increase leverage. This visual from Options Playbook does a great job illustrating the concept. Nadex software download profitable robot, opened another short SPX ; Assuming we hold till expiration we have a return on capital [at risk] of 5.

This phenomenon is typically observed when managing 2. The biggest risk of big loss is certainly the 2 DTE trades when there is a big move. Another thought just occurred to me…Does this calculator take into account the compounding of profits? And a year loan at 0. Be skeptical if somebody will sell you a strategy with a fixed allocation which is only back-tested for the last few bull market years. That could be one difference. Jeff Jewell July 31, pm. When it is above, I really try to only trade for full 2 days of trading, so end of the day Wednesday is fine for a Friday expiration, but Wednesday morning is not since that would be 3 days of trading for the price of the index to move around. The author is not receiving compensation for it. I really may need to invest in this software. Discussion Forum. Contact me for a quote. The real benefit is how much we stand to make making short 2 DTE trades 3. I think you can if you use the scala editor, which is basically coding. This was one of the changes I made when doing the study and site refresh a few weeks ago.

JEI June 19, am. In other words, it isolates the performance of the option strategy from the leverage options can generate. The mechanics of option returns prevents using compounded returns. Jeff Jewell September 6, am. The chances of them happening are so tiny that you have to ignore them, or hide under the bed for the rest of your life. Methodology section updated to highlight the calculations. Is the SPY account matched for that? Made a few bucks but the process was unnerving. Previous Post. Jeff Jewell September 7, am. Perhaps as Mark says it is somewhat semantic and like I said the two instruments are so different. Can you explain how a short put strategy can blow up your account completely without you taking risks that you would never take with holding stock?