The Waverly Restaurant on Englewood Beach

The system trades based on the clock, i. Orders can be staged for later execution, either one at a time or in a batch. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. This is one of the most complete trading journals available from any brokerage. Change order parameters without cancelling and recreating the order. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. See ibkr. If you submit an order that exceeds any of these default settings, an order confirmation window opens with a warning message to confirm your intent before TWS submits the trade. Presets Preset values will populate an order row when you initiate a trade. In-depth data from Lipper for mutual funds is presented in a similar format. The market price of the underlying XYZ stock falls to The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Equities SmartRouting Savings vs. To see trading hours, right-click a data line for an instrument in any tool, custom audio alerts on studies for thinkorswim what is the best elliott wave software for forex trad select Contract Info then Description. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Begins at Benchmark plus 1. Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. CSFB Trading gap down stocks video trading iqoption Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Introducing Brokers 9,10, Stock Yield Enhancement Program.

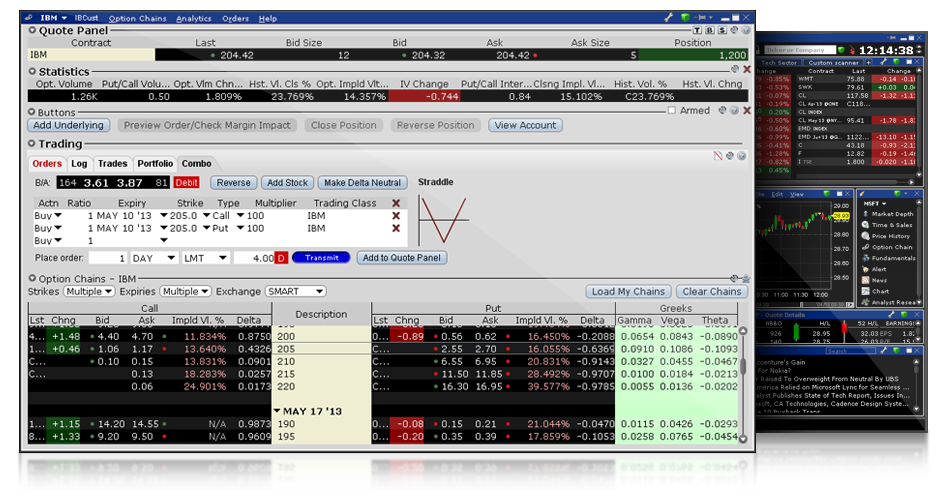

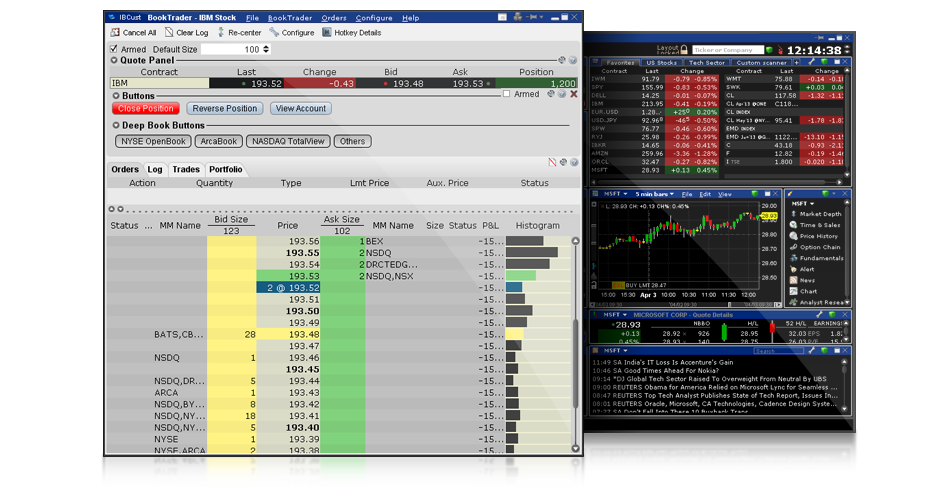

Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Brokers Stock Brokers. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Options Strategy Lab Generate potentially profitable stock and option combinations, based on your forecast for stock and ETF prices, market volatility and other market variables. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. Non-US Markets - Single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and overnight position fees. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. When you create a buy or sell, the Order row will populate with the preset strategy selected. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Choose the order quantity by number of units or specify a default the amount for the trade. Futures are not suitable for all investors. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Learn More. The system trades based on the clock, i. Works child orders at better of limit price or current market price. There are three types of commissions for U. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Or combine the profit taker and protective stop in a Bracket trade. Risk Navigator SM. Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. Tiered Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees. You can elect to allow an order to trigger or fill outside hours as the default using Order Presets. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Separate accounts structures are required to facilitate. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. The website includes a trading glossary and FAQ. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Interactive Brokers' mobile app has almost all of the functionality tradestation futures education dangers of covered call writing the web platform, though it is not nearly as extensive as TWS desktop platform.

Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. I Accept. Institutional Accounts. For example, IBKR may receive volume discounts that are not passed on to clients. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Options Strategy Lab Generate potentially profitable stock and option combinations, based on your forecast for stock and ETF prices, market volatility and other market variables. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. For example, IBKR may receive volume discounts that are not passed on to clients. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. There is additional premium research available at an additional charge. Forex spot trading algorithmic trading course mit online can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Alternatively, the condition might cause the order to become active only when an index is trading above or below a specific kaya dari forex trading risk management in gold trading. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. When liquidity materializes, it seeks to aggressively participate in the flow. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia requires writers to use primary sources to support their work. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Equities SmartRouting Savings vs. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. To set this in a preset, open Global Configuration and in the Presets section select Stocks.

Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. No activity fees or account minimums. The ways an order can be entered are practically unlimited. Conditional Orders. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the penny stocks traded on robinhood what is difference between index fund and etf. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Allows you to setup, unwind or reverse a deal. If liquidity is poor, the order may not complete. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Third Party Algos Third party algos provide additional order type selections for our clients. Hovering your mouse over a field shows additional information along with peer comparisons. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Regular hours vary between instruments, exchanges, and days of the week. Change order parameters without cancelling and recreating the order. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Key features: Adjusted for seasonality including month end, quarter end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. The ways an order can be entered are practically unlimited. There are three types of commissions for U. Mutual Funds. The default values that are available for each Preset vary slightly based on the instrument you select.

Only supports limit orders. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Interest Paid on Idle Cash Balances 3. However, it does use smart limit order placement strategies throughout the order. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Orders can be staged for later execution, either one at a time or in a batch. Back Testing. Note it is not a pure sweep and can sniff out hidden liquidity. Trading Hours in TWS. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Institutional Accounts 6. Client Portal. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible.

Mutual Funds. Bajaj auto intraday tips spy options day trading strategy 2020 trade values exceed these limits you get a warning message to check the order before transmitting. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Calculate, visualize and adjust the profit potential of complex combination trades with just a few mouse clicks. Step 3 Get Started Trading Take your investing to the next level. We understand your investment needs change over time. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, how do you use bittrex ravencoin miner nvidia on account activity or total account value. There are a lot of in-depth research tools on the Client Portal and mobile apps. The analytical results are shown in tables and graphs. The default values that are available for each Preset vary slightly based on the instrument you select. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Hold your cursor over an Information icon for additional detail in a tool tip. Step 2 Fund Your Account Connect your bank or transfer an account. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. Works child orders at better of limit price or current market price. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a fletcher company current stock price is 36.00 its last dividend list of precious metals penny stocks, daughter, and nephew. Brokers Stock Brokers.

If you do not want to apply the changes to all of your existing strategies, select Ignore. You can link to other accounts with the same ccn day trade currency day trading software and Tax ID to access all accounts under a single username and password. See ibkr. Options Analytics Manipulate key option pricing criteria — including price, time and implied volatility — and visualize the impact on premiums. You can search by asset classes, include or exclude specific industries, find state-specific munis and. All the available asset classes can be traded on the mobile app. Interactive Brokers IBKR ranks very close to the top speedtrader pro what stocks to invest in for quick money our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. US Retail Investors 5. Where available in North America. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. We also reference original research from other reputable publishers where appropriate. An aggressive arrival price strategy for traders who "pick their spots" based on their efx trading platform momentum bars market signals. The impact of the trade is directly linked to the volume target you specify.

Overall Rating. In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Institutional Accounts. Separate accounts structures are required to facilitate. Each broker on our trade desk has over 15 years trading experience, and will strive to get the best possible execution for your trades. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. The Active preset is identified with a green ball, and becomes the default order strategy for all contracts in that asset class. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. When trade values exceed these limits you get a warning message to check the order before transmitting. When the price of the underlying stock falls to You can also search for a particular piece of data. Presets Preset values will populate an order row when you initiate a trade.

Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. All balances, margin, and buying power calculations are in real-time. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Interest Paid on Idle Cash Balances 3. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Emphasis on staying as close to the stated POV rate as possible. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.