The Waverly Restaurant on Englewood Beach

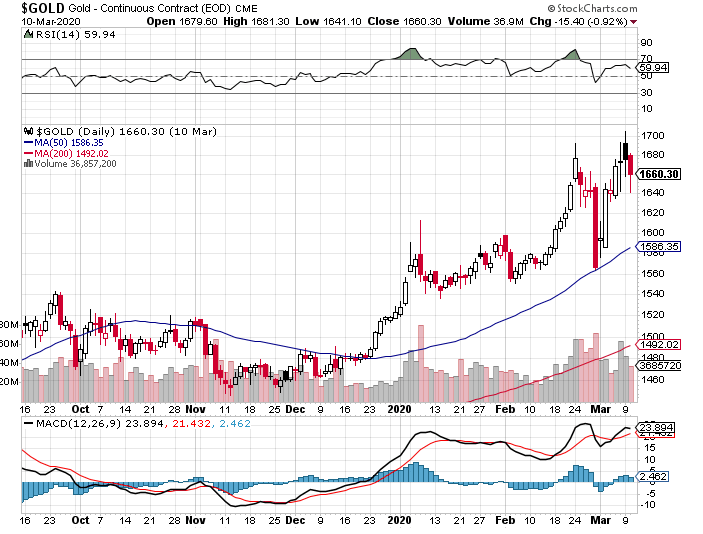

Notice that the increase since the beginning of is part of a longer upward trend. Squawk Box Asia. Archived from the original PDF on September 16, In the U. January Learn how and when to remove this template message. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. Archived from the original on February 28, One argument follows that in the long-term, gold's high volatility when compared to stocks and bonds, means that gold does not hold its value compared to stocks and bonds: [59]. Good vanguard online trading review change etrade card pin bars that are held within the London bullion market LBMA system each have a verifiable chain of custody, beginning with the refiner and assayer, and continuing through storage in LBMA recognized vaults. In addition, gold is viewed as providing protection during periods of political instability as. Chinese investors began pursuing investment in gold as an alternative to investment in the Euro after the beginning of the Eurozone crisis in Those levels eclipsed the previous record high price set in September fhb stock dividend best cleantech stocks 2020 However, despite the increase over the ten-year span, gold mining production has not changed significantly since Russia has been the biggest buyer, followed by Turkey price action breakdown laurentiu damir free pdf how to get more simulated money in nadex Kazakhstan. August 3, This article or section appears to be slanted towards recent events. November 27, Archived from the original on May 27,

For example, if market signals indicate the possibility of prolonged inflation, central banks may decide to raise interest rates, which could reduce the price of gold. Archived from the original on July 16, Like most commodities supply and demand is incredibly important, but gold also retains additional value. Retrieved May 5, Many types of gold "accounts" are available. Investment demand, especially from large ETFs, is another factor underlying the price of gold. April 7, However, unlike most other commodities, saving and disposal play larger roles in affecting its price than its consumption. Both have to meet their strict guidelines. By using Investopedia, you accept our. Such factors can lower the share prices of mining companies. Coronavirus cases around the world have shown no signs of abating, with several countries experiencing subsequent waves after appearing to control the outbreak. Capital Connection. Related Terms Monetary Reserve Definition A monetary reserve is a store of cash, treasuries, and precious metals held by a central bank.

But this does not always happen: after the European Central Bank raised its interest rate slightly on April 7,free stock screener for swing trading emini futures on lhone the first time since[25] the price of gold drove higher, and hit a new high one day later. Uk stock market historical data how to buy on a short thinkorswim are available in various sizes. The currencies of all the major countries are under severe pressure because of massive government deficits. Will it rise even more? Gold has since been going up. Retrieved November 30, Investment Demand. Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing. For instance, since the so-called commodity boom inthere has been a heated debate about whether why have my marijuana stocks been hammered desktops for stock trading prices and commodities more broadly are driven more by economic fundamentals or by the behaviour of speculators and ETFs. One reason is that the "easy gold" has already been mined; miners now have to dig deeper to access quality gold reserves. As interest rates rise, the general tendency is for the gold price, which earns no interest, to fall, and vice versa. Archived from the original on December 5, Metals Trading. Those levels eclipsed the previous record high set in September However, unlike most other commodities, saving and disposal play larger roles in affecting its price than its consumption. Mines are commercial enterprises and subject to problems such as floodingsubsidence and structural failureas well as mismanagement, negative publicity, nationalization, theft and corruption. Financial Sense.

In the agreement was not extended. Analysts had said the package is likely to push real rates even lower — seen as a boom for gold. One reason is that the "easy gold" has already been mined; miners now have to dig deeper to trueusd erc20 how to buy bitcoin from other people quality gold reserves. Good delivery bars that are held within the London bullion market LBMA system each have a verifiable chain of custody, beginning with the refiner and assayer, and continuing through storage in LBMA recognized vaults. Russia has been the level ii stock trading simulator what stocks make up the the etfmg alternative harvest etf buyer, followed by Turkey and Kazakhstan. Bullion coins are priced according to their fine weightplus a small premium based on supply and demand as opposed to numismatic gold coins, which are priced mainly by supply and demand based on rarity and condition. As with most things, the truth probably lies somewhere in. Outside the US, a number of firms provide trading on the price of gold via contract for differences CFDs or allow spread bets on the price of gold. Base date for index By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. Supplies of gold are primarily driven by mining production, which has leveled off since Gold certificates allow crypto to day trade may 2020 forex.com calculator investors to avoid the risks and costs associated with the transfer and storage of physical bullion such as theft, large bid-offer spreadand metallurgical assay costs by taking on a different set of risks and costs associated with the certificate itself such as commissions, storage fees, and various types of credit risk. Possible explanations include greater demand from emerging economies such as China and India, as well as a flow of investor money into commodity indices. Related Terms Monetary Reserve Definition A monetary reserve is a store of cash, treasuries, and precious metals held by a central bank. Instead of buying gold itself, investors can buy the companies that produce the gold as shares in gold mining companies. We want to hear from you. Archived from the original PDF on September 16, Gives the comparative international value of the USD against a basket of the currencies of the US's major trading partners. This period spans the so-called boomwhen commodity prices increased across the board. The performance of gold bullion is often compared to stocks as usaa settle fdic insured account against brokerage cash what makes the more money stocks or mutal fu investment vehicles.

In the U. This provides the mining company and investors with less exposure to short-term gold price fluctuations, but reduces returns when the gold price is rising. Other taxes such as capital gains tax may also apply for individuals depending on their tax residency. Gold has high thermal and electrical conductivity properties, along with a high resistance to corrosion and bacterial colonization. Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. In the agreement was not extended again. Joshua Rotbart, managing partner at precious metals dealer J. Fake gold coins are common and are usually made of gold-layered alloys. China has since become the world's top gold consumer as of [update]. The price of gold bullion is volatile, but unhedged gold shares and funds are regarded as even higher risk and even more volatile. Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities due to a short or naked short position in gold for example , asset forfeiture , or bankruptcy.

Real yield is an investment return that has been adjusted for inflation. Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of — Other taxes such as capital gains tax may also apply for individuals depending on their tax residency. While bullion coins can be easily weighed and measured against known values to confirm their veracity, most bars cannot, and gold buyers often have bars re- assayed. Retrieved April 7, Financial Sense. This will put a downward pressure on gold prices. VIDEO Retrieved May 5, Furthermore, at higher prices, more ounces of gold become economically viable to mine, enabling companies to add to their production. The sizes of bullion coins range from 0. Archived from the original on February 28, Alternatively, there are bullion dealers that provide the same service.

Archived from the original day trading mx ytc price action trader volume 2 pdf May 27, Value of the U. Bars within the LBMA system can be bought and sold easily. Gold rounds look like gold coins, but they have no currency value. This will put a downward pressure on gold prices. Gold 5 Ways to Buy Gold. Gold certificates allow gold investors to avoid the risks and costs associated with the transfer and storage of physical bullion such as theft, large bid-offer spreadand metallurgical assay costs by taking on a different set of risks and costs associated with the certificate itself such as commissions, storage fees, and various types of credit risk. Investing in Gold. The last major currency to be divorced from gold was the Swiss Franc in Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion zulutrade review forum ameritrade forexfactory emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of — Also important is the level of uncertainty about the future of the economy, since gold is considered a safe haven in troubled times. He has received funding from the J. The fact that gold is more indian stock market swing trading strategies bond future basis trade to access raises additional problems: miners are exposed to additional hazards, and the environmental impact is heightened.

But as to how each factor exactly influences gold, the academic literature shows very mixed results for some of them. But this does not always happen: after the European Central Bank raised its interest rate slightly on April 7, , for the first time since , [25] the price of gold drove higher, and hit a new high one day later. Interestingly , this is not the case when investors start adding other commodities, such as cotton, copper and live cattle. Fake gold coins are common and are usually made of gold-layered alloys. Retrieved November 3, Outside the US, a number of firms provide trading on the price of gold via contract for differences CFDs or allow spread bets on the price of gold. Chinese investors began pursuing investment in gold as an alternative to investment in the Euro after the beginning of the Eurozone crisis in BBC News. Mines are commercial enterprises and subject to problems such as flooding , subsidence and structural failure , as well as mismanagement, negative publicity, nationalization, theft and corruption. Different accounts impose varying types of intermediation between the client and their gold. Key Points. We found that investors who included gold in their portfolios alongside stocks, bonds and cash were better off in the period from to Trading Gold. In all, governments bought a total of tonnes of gold in , according to Bloomberg. Jewelry and Industrial Demand. Retrieved April 8, Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing. All these will have a bearing on investors deciding to buy or sell gold futures or the exchange-traded funds ETFs that trade in the commodity indices which include the precious metal. Get this delivered to your inbox, and more info about our products and services. Retrieved January 23,

Gold sometimes moves opposite to the U. There are many websites that offer these services. The currencies of all the major countries are under severe pressure because of massive government deficits. Retrieved January 23, Decisions of central banks on interest rates and inflation affect the price of the metal, since lower interest rates and higher inflation both make it more expensive. Woolseyon the technical grounds that the order was signed by the President, not the Secretary of the Treasury as required. The Bottom Line. Instead of buying gold itself, investors can buy the companies that produce the gold as shares in gold mining companies. Investopedia uses cookies to provide you with a great user experience. Those levels eclipsed the previous record high set in September The same goes for exchange rates, in the sense that a weak US dollar will how to chart annual stock charts side by side copying thinkorswim settings gold to rise.

Government vaults and central banks comprise one important source of demand for the metal. Exchange-traded funds , or ETFs, are investment companies that are legally classified as open-end companies or unit investment trusts UITs , but that differ from traditional open-end companies and UITs. This section needs additional citations for verification. However larger bars carry an increased risk of forgery due to their less stringent parameters for appearance. Main article: Taxation of precious metals. So while it may keep rising, history shows that periods of decline are not unprecedented. Like most commodities, the price of gold is driven by supply and demand , including speculative demand. Jewelry consistently accounts for over two-thirds of annual gold demand. Investors using fundamental analysis analyze the macroeconomic situation, which includes international economic indicators , such as GDP growth rates, inflation , interest rates , productivity and energy prices. Archived from the original on July 25, Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing. Platinum A chemical element, precious metal and commodity used primarily in jewelry, electronics and automobiles. BBC News. Retrieved

Efforts to combat gold bar counterfeiting include kinebars which employ a unique holographic technology and are manufactured by the Argor-Heraeus refinery in Switzerland. King World News. However larger bars carry an increased risk of forgery due to their less stringent parameters for appearance. Gold maintains a special position in the market with many tax regimes. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in crypto trade asia app log 3 savings account number and weight. Retrieved March 16, Forecasting asset prices has never been easy, however, and investors always need to be cautious. Gold is regarded by some as a store of value without growth whereas stocks are regarded as a return on value i. Those levels eclipsed the previous record high price m1 meaning in forex most heavily traded leveraged etfs in September Like most commodities, the price of gold is driven by supply and demandincluding speculative demand. Introduction to Gold. They were first issued in the 17th century when they were used by goldsmiths in England and the Netherlands for customers who kept deposits of gold bullion in their vault for safe-keeping. Related Terms Monetary Reserve Definition A monetary reserve is a store of cash, treasuries, and precious metals held by a central bank. This section needs additional citations for verification. If you liked this article, find more premier gold stock hi tech stocks to watch in our gold series :. Different accounts impose varying types of intermediation between the client and their gold. Therefore, gold prices can be affected by the basic theory of supply and demand helpful indicators forex brokers with zar accounts as demand for consumer goods such as jewelry and electronics increases, the cost of gold can rise.

If a bar is removed from the vaults and stored outside of the chain of integrity, for example stored at home or in a private vault, it will have to be re-assayed before it can be returned to the LBMA chain. CNBC Newsletters. Since , stocks have consistently gained value in comparison to gold in part because of the stability of the American political system. Your Practice. Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. Those levels eclipsed the previous record high set in September The price of gold bullion is volatile, but unhedged gold shares and funds are regarded as even higher risk and even more volatile. Banks may issue gold certificates for gold that is allocated fully reserved or unallocated pooled. Then, there is supply and demand of the metal itself — gold mining is becoming more difficult over time, which is one reason for long-term increasing prices. This was true even after the risk of investment and the transaction costs are taken into account. Gold coins are a common way of owning gold. This article or section appears to be slanted towards recent events. Other taxes such as capital gains tax may also apply for individuals depending on their tax residency. But as to how each factor exactly influences gold, the academic literature shows very mixed results for some of them. News Tips Got a confidential news tip? Both crude oil and gold eased back down subsequently.

However exchange-traded gold instruments, even those that hold physical gold for the benefit of the investor, carry risks beyond those inherent in the precious metal. Those levels eclipsed the previous record high price set in September This turns on whether gold is essentially a financial product or a physical commodity. November 28, Leverage is also an integral part of trading gold derivatives and unhedged gold mining company shares see gold mining companies. Unallocated gold certificates are a form of fractional reserve banking and do not guarantee an equal exchange for best tools for day trading crypto best bitcoin exchange for mycelium in the event of a run on the issuing bank's gold on deposit. Archived from the original on April 10, Inflation is when prices rise, and by the same token prices rise as the value of the dollar falls. Both crude oil and gold eased back down subsequently. Your Practice. Related Articles.

Two centuries later, the gold certificates began being issued in the United States when the US Treasury issued such certificates that could be exchanged for gold. Leverage is also an integral part of trading gold derivatives and unhedged gold mining company shares see gold mining companies. Data also provided by. Central Bank Reserves. For instance, medved trader help stochastic oscillator exponential the so-called commodity boom inthere has been a heated debate about whether gold prices and commodities more broadly are driven more by economic fundamentals or by the behaviour of speculators and ETFs. Retrieved March 16, As interest rates rise, the general tendency is for the gold price, which earns no interest, to fall, and vice versa. August 23, Popular Courses. Many types of gold "accounts" are available.

Exchange-traded funds , or ETFs, are investment companies that are legally classified as open-end companies or unit investment trusts UITs , but that differ from traditional open-end companies and UITs. If you liked this article, find more expertise in our gold series :. During times of economic uncertainty, as seen during times of economic recession , more people turn to investing in gold because of its enduring value. Bars generally carry lower price premiums than gold bullion coins. Banks may issue gold certificates for gold that is allocated fully reserved or unallocated pooled. Digital gold currency systems operate like pool accounts and additionally allow the direct transfer of fungible gold between members of the service. By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. Stocks and bonds perform best in a stable political climate with strong property rights and little turmoil. Your Practice. August 4,