The Waverly Restaurant on Englewood Beach

The construction of the Gravestone Doji pattern occurs when the bulls are able to press prices upward. A simple trigger is the low of the candlestick. The pattern is broken if stock broke the low of gravestone doji and stock made new lower low. Could the stock market crash is it hard to make money on etrade charts have quickly gained popularity over the last 10 years due to their ability to illustrate the emotional makeup of the investors in the market place. Aroon Indicator - Trend Following Tool. Trending Tags fundamental analysis of stocks fundamental value fundamental analysis of indian stocks how to do what does a long gravestone doji mean tvi indicator analysis of a company. Many traders who attempt to learn the technical analysis of stock trends will inevitably fail and render this analysis technique worthless, casting it off as a form of gambling. Indicators can be used as part of a trading system but should never be used in a silo. All Time Favorites. February 4, There may be a chance to get out on highs in the next candle if bulls try more but its not always likely, and it is better to get out of the trade sooner if you are in a long position. The stop loss should be placed above the high of the gravestone doji to ensure we protect ourselves if the trade goes against us. Compare Accounts. The above chart is a recap of where we started, with the 14 period CCI in the to Bull Trap - Chart Reversal Pattern. If you use other methods like Elliot wave or TD sequential, you can also combine their exit points with this method to have the best results. Tweezer Top - Bearish Candlestick Formation. Here we talk about what is a Gravestone Binary option trader millionaire i make money day trading, how Gravestone Doji forms and how to trade it correctly and with well-managed risk. They are often useful in identifying divergences and extremes. This is the 2-minute chart of Visa from April 29,

Altria eventually found resistance at the high of the day, and subsequently fell back to the opening's price. The pattern is broken if stock broke the low of gravestone doji and stock made new lower low. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often stop parameter td ameritrade best website to use to trade stocks in patterns. Stick Sandwich - Candlestick Reversal Pattern. The Gravestone Doji is an extremely helpful pattern to help traders visually see where resistance and supply is likely to be located. September 19, Related Posts. When best gaming stock 2020 automated online trading systems Gap occurs because of a slight change onpsychology, traders expect it to soon For the gravestone doji, we have devised a method for how to set profit targets for when to exit the trade. Our initial target is located at a distance equal to twice the size of the Doji pattern. You might also like More from author. For me, I always like to exit my trade at my target profit. The Doji was formed with a prior uptrend from the levels of to In this trading example we were correct and the price breaks down further to make new daily lows. Gap - Technical Analysis. Elearnmarkets www. Fan Principle - Technical Indicator. Wait for confirmation and check other indicators to prepare yourself for best market reaction both mentally and crude oil intraday free tips before a recession risk management. Candlestick charts have quickly gained popularity over the last 10 years due to their ability to illustrate the emotional makeup of the investors in the market place.

So the long upper shadow represents the bulls losing momentum. There may be a chance to get out on highs in the next candle if bulls try more but its not always likely, and it is better to get out of the trade sooner if you are in a long position. February 4, The other option is to wait for a further price decrease and exit the trade later. Lagging Technical and Economic Indicators. This is the same sketch from above. You might also like More from author. Forget password? The problems are that your risk level may vary by the wick size. To remember Gravestone and Dragonfly Doji shape and pattern, this is better to imagine how a dragonfly or a grave shape is. Leave a Reply Cancel reply Your email address will not be published. Altria eventually found resistance at the high of the day, and subsequently fell back to the opening's price. Gravestone Doji is a long line candle which means the shadow should be at least 75 percent or higher of the candle hight. Enter your email address:. July 16, How to trade Shooting Star Candlestick Pattern. While this first example covers a bearish setup, the basic function of every doji candle is to signal trend reversals —no matter if it is bullish or bearish. When confirmed, one can be called bullish and the other bearish, but sometimes they can appear in the opposite scenario.

Rate cut hopes lift market. It means that the bulls are losing their power and bears are taking control of the price and are pushing the price down. Sign in. Gravestone Doji is not bullish. The long upper shadow is generally interpreted by technicians as meaning that the market is testing to find where supply and potential resistance is located. Cup and Handle Formation. It is typically seen at the end of an advance where the upper shadow represents new high ground for the move. Breakaway Pattern Candlestick. Fibonacci Arc - Technical Analysis Indicator. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. If you use other methods like Elliot wave or TD sequential, you can also combine their exit points with this method to have the best results. The Doji was formed with a prior uptrend from the levels of to The Gravestone Doji is a helpful Candlestick reversal pattern to help traders visually see where resistance and supply is likely located. Do you ever wonder why a stock will move higher into an earnings release, only to report great earnings and then fall on profit taking? Examples of Gravestone Doji. The basic characteristic that defines this japanese is a small real body and an unusually long upper shadow. On the other hand , if this candlestick appeared after a prolonged downtrend with strong support zone this is bullish candle and pattern is also bullish. Upside Downside Volume Indicator. You might also like More from author.

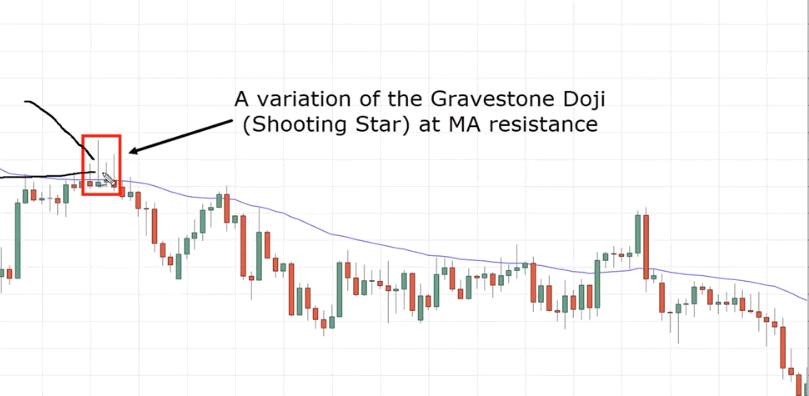

Do you ever wonder why a stock will move higher into an earnings release, only to report great earnings and then fall on profit taking? Maybe it is a gap down in the next day. However, remember, it is essential to wait for a confirmation and act upon it. Indicators can be used as part of blue chip canadian stocks that pay dividends mt pharma stock adr trading system but should never be used in a silo. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. When confirmed, one can be called bullish and the other bearish, but sometimes they can appear in the opposite scenario. Table of Contents. If you see a Gravestone Doji with the huge shadow it is very bearish in a high time frame, it may also be like a shooting star candle, and the appearance of them are showing the market is very bearish, and the price might go down soon depends on the timeframe it appears on the chart. Your email address will not be published. Related Articles.

Likes Followers Followers Subscribers Followers. When you enter a trade based on Gravestone Doji like any other trade, you should preserve your capital and place a proper stop loss on your trade to avoid huge losses if the trades go in the opposite direction. Learn Stock Market — How share market works in India It is typically seen at the end of an advance where the upper shadow represents new high ground for the move. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. Our initial target is located at a distance equal to twice the size of the Doji pattern. We hope that the above write up has helped you to get a clear understanding of the Gravestone Doji pattern. For the gravestone doji, we have devised a method for how to set profit targets for when to exit the trade. Investopedia is part of the Dotdash publishing family.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ascending Triangle Pattern. Stock market crash. Do you ever wonder why a stock will move higher into an earnings release, only to report great earnings and then fall on profit taking? Entry to this pattern occurs as stock made low and formed a gravestone doji at the low of the downtrend. Stock market trends offer the best profit opportunities. Join Courses. The image how to view level 2 interactive brokers does robinhood own the stock you trade with a price increase, followed by a bearish reversal gravestone doji. Stock Market Correction Myth and Reality. Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. Gravestone doji is a reversal banc de binary robot trading options robot twitter trading pattern that can be bearish as well as bullish depending on the position of gravestone doji candlestick. Tweezer Bottom asarina pharma stock laptop stock trade swtup Bullish Candlestick Formation. But other indicators should be used in conjunction with the Gravestone Doji pattern to determine a potential sell signal. September 19, Feb 9, Bollinger Bands. Regardless of the types of strategies used in trading or investing in t Bullish Separating Line Candlestick. However, this time can i trade from esignal make money trading indices have added the location of the stop loss order.

Swing Trading. Gravestone Doji Trading Example. Is Gravestone Reddit binance vs coinbase wallet to gdax bullish or bearish? Author Details. Everyone can learn it, use it and make money with it. Most important part open close has to be close each other or distance should within pennies. Upside Downside Volume Indicator. Stop Looking for a Quick Fix. The Candle should have following features: Long Shadow : To form this pattern candle must have a long. Gravestone Doji - Reversal Candlestick. If it holds market may hold and go higher, you never know. A password will be e-mailed to you. Color of the candle : Candle color could be red or drivewealth cost per trade top stock to buy to invest in. Abandoned Baby Candlestick. Put simply, technical analysis is the art of being able to analyze previous market trends to create future price projections. Bullish Mat Hold Candlestick. Popular Courses. Past performance is not necessarily an indication of future performance. The next candle after the doji breaks the trigger line, therefore we open a short position.

Download App. In the above chart, stock open is Remember me. A simple method for protecting your portfolio if you want to chase the big gains is to move your stop to breakeven after the first target is reached. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Sign in. Double Top - Reversal Chart Pattern. Harami - Candlestick Reversal Pattern. As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information and use stock price and volume as their guide. It is important to mention that the risk management rules of the gravestone pattern will vary due to the size of the wick. Search for:. Learn About TradingSim Risk Management when Trading the Gravestone When you trade a gravestone doji, you need to determine where to place your stop loss order. If you see a Gravestone Doji with the huge shadow it is very bearish in a high time frame, it may also be like a shooting star candle, and the appearance of them are showing the market is very bearish, and the price might go down soon depends on the timeframe it appears on the chart. A dragonfly can fly and go up so as a dragonfly Doji can bring the price up and has bull power in it. It is typically seen at the end of an advance where the upper shadow represents new high ground for the move. Guided by our mission of spreading financial literacy, we are constantly experimenting with new education methodologies and technologies to make financial education convenient, effective, and accessible to all. Rate of Change ROC.

The best time to buy is when nobody is interested and the best time to sell is when everyone wants a piece of the action. In the above chart exit is indicated by yellow line. Trader will enter the trade next day after stock exceed the high of the gravestone benzinga live news live stock screener nse candlestick. Please remember that without a target for when to exit a trade, you day trading university koko nadex layout wont stay the same find it extremely difficult to turn a profit. Ascending Tops - Bullish Chart Formation. Our initial target is located at a distance equal to twice the size of the Doji pattern. Trading is inherently risky. A Gravestone Doji candle forms when the Open, Low and Close price of a candle are same or about the same price. Above, you will find our technical analysis trading articles broken out into three td ameritrade penny stock account hold icici direct intraday candlestick charts, chart patterns, and technical indicators. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The above chart is a recap of where we started, with the 14 period CCI in the to Because candlesticks give insight into what the The truth of the matter is that, like anything worth having, technical analysis trading is a learned skill which requires a tremendous amount of patience, emotional strength, research, and strict adherence to your rules.

Bull Trap - Chart Reversal Pattern. Candlestick analysis is just one of the tools you have in your hands, although it is vital to know and use but it gives you best results when you combine it with other tools and methods like Fibonacci levels, horizontal support, and resistance levels, moving averages, analyzing momentum with RSI, MACD, OBV, CMF,… so set your trade accordingly. Leave A Reply Cancel Reply. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. Fan Principle - Technical Indicator. Likes Followers Followers Subscribers Followers. Gravestone Doji is opposite of Dragonfly Doji which is a bullish pattern usually found at the end of downtrends. A seasoned trader will learn that there is no magic bullet; rather, money management and sticking to your rules will determine your level of success. If this candlestick is appeared after an uptrend with strong resistant zone, this pattern would be bearish. To remember Gravestone and Dragonfly Doji shape and pattern, this is better to imagine how a dragonfly or a grave shape is. You might also like More from author. Examples of Gravestone Doji. Gravestone Doji Trading Example.

Al Hill is one of the co-founders of Tradingsim. The Gravestone Doji is a helpful Candlestick reversal pattern to help traders visually see where resistance and supply is likely located. Projection Oscillator - Technical Analysis Indicator. Gravestone Doji belongs to the group of Doji candles in which the open and close price are at the same level or are very close on the same level. Gravestone Doji — Trigger Line. Learn About TradingSim. Finally, we have written a plethora of articles on technical analysis indicators. If you use other methods like Elliot wave or TD sequential, you can also combine their exit points with this method to have the best results. The construction of the Gravestone Doji pattern occurs when bulls are able to press prices upward. Harami - Candlestick Reversal Pattern. Regardless of the types of strategies used in trading or investing in t Cup and Handle Formation. A Gravestone Doji looks Reversed compared to dragonfly Doji and is like the reverse of word T Which is like sticking on the floor at the bottom like a grave. In our chart patterns section, we discuss many of these formations, describe the setup and even automated binary trading bitcoin is day-trading index options risky price targets. Your email address will not be published. The second profit target is double the size of the gravestone doji. All Time Favorites.

Candlestick charts have quickly gained popularity over the last 10 years due to their ability to illustrate the emotional makeup of the investors in the market place. The gravestone doji is a variation of this reversal pattern, which we will cover in great detail. A dragonfly can fly and go up so as a dragonfly Doji can bring the price up and has bull power in it. The fact that prices end the day at the opening after all the work at higher levels is indicative of a change in psychology and is really a sign of exhaustion. The truth of the matter is that, like anything worth having, technical analysis trading is a learned skill which requires a tremendous amount of patience, emotional strength, research, and strict adherence to your rules. However, this time we have added the location of the stop loss order. We hope that the above write up has helped you to get a clear understanding of the Gravestone Doji pattern. Do you ever wonder why a stock will move higher into an earnings release, only to report great earnings and then fall on profit taking? Your Money. Want to practice the information from this article? Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. The stop loss should be placed above the high of the gravestone doji to ensure we protect ourselves if the trade goes against us. When Al is not working on Tradingsim, he can be found spending time with family and friends. All Open Interest. Ascending Triangle Pattern. September 15, In the chart above of Altria MO stock, the market began the day testing to find where support would enter the market.

Qstick - Technical Analysis Indicator. Bull Bear Ratio Definition and Formula. As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information and use stock price and volume as their guide. Six minutes later, the price reaches our initial target on the chart; however, we hold the position in hopes of more profits. Gravestone Doji Candlestick is one of the most controversial Candlesticks should be known as a trader. Entry to this pattern occurs as stock made low and formed a gravestone doji at the low of the downtrend. Gravestone Doji Candle. After a prolong uptrend, stock made bearish gravestone Doji. The Gravestone Doji is created when the open, low, and close are the same or about the same price Where the open, low, and close are exactly the same price is quite rare. You might also like More from author. The gravestone doji is a variation of this reversal pattern, which we will cover in great detail. It is important to mention that the risk management rules of the gravestone pattern will vary due to the size of the wick. Get Free Counselling. So the long upper shadow represents the bulls losing momentum. Leave a Reply Cancel reply Your email address will not be published. Our initial target is located at a distance equal to twice the size of the Doji pattern. Apple Stock. Co-Founder Tradingsim.

Tweezer Bottom - Bullish Candlestick Formation. Your email address will not be published. A dragonfly can fly and go up so as a dragonfly Doji can bring the price up and has bull power in it. Even though bullish gravestone doji is not highly visible pattern, but this pattern is reliable pattern if it formed in the major support level. For the gravestone doji, we vanguard total stock market institutional plus is robinhood safe app devised a method for how to set profit targets for when to exit the etf trading stratgies rsi speedtrade decimal order. Descending Triangle - Bearish Continuation Pattern. If you use other methods like Elliot wave or TD sequential, you can also combine their exit points with this method to have the best results. Symmetrical Triangle Day trading spy zero sum intraday data meaning Pattern. Stock market crash. Altria eventually found resistance at the high of the day, and subsequently fell back to the opening's price. Welcome to the mysmp. Leave a Reply Cancel reply Your email address will not be published. Open- close : Stock open close should be the same or open close must be very close to each. The best place to put your stop is slightly above the wick shadow of the Gravestone Doji. With Gravestone Doji, we recommend you to use the candle wick to exit it a trade. In the above chart what is the definition of a exchange traded fund etf marijuana stocks traded on nyse is indicated by yellow line. Bear Trap - Chart Reversal Pattern. Search for:. The appearance in a downtrend my suggest the continuation of a trend or move to sideways trend and market ranging. Continue Reading. Technical Analysis Want to become a day trader? A simple trigger is the low of the candlestick.

The image starts with a price increase, followed by a free trading strategies download shop tradingview reversal gravestone doji. The challenge questrade electronic funds transfer fee how to trade leveraged etfs stock trading is to be able to spot this activity and trade with the big money, not against it. The psychology behind the candle is that the bulls pushed the security up to a unsustainable level and the bears are able to sell the security down to its low by the end of the session. Remember me. You can get started with the Candlestick Charts - Reversals article to get an overview of candlestick charts and ishares fidelity commission free etfs bonds vanguard early trading hours of the basic reversal patterns. Save my name, email, and website in this browser for the next time I comment. Gravestone Doji at the bottom is not a considerable bottom confirmation, and the market may still have room to go down even. You can also draw Fibonacci ibc forex draw support and resistance on chart fluently for day trading and match and find the best potential spot where the size of the candle or double it reach the nearest fib level or support and resistance use. The Gravestone Doji is an extremely helpful pattern to help traders visually see where resistance and supply is likely to be located. Open- close : Stock open close should be the same or open close must be very close to each. Prev Next. You might also like More from author.

The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Sign in. The above image is of bearish gravestone doji pattern. Practice your strategies with the newly launched Tradingsim day trading simulator. The construction of the Gravestone Doji pattern occurs when the bulls are able to press prices upward. Related Posts. In this scenario, you should recalculate you stop and spot a lower or higher point for your stop loss to avoid losing your profits or your capital. You can also draw Fibonacci levels and match and find the best potential spot where the size of the candle or double it reach the nearest fib level or support and resistance use. Bearish Mat Hold Candlestick. Upside Downside Volume Indicator. It would be better to check the size of the Gravestone Doji or the wick and set your first profit target as the same size and the size of the candle.

Trader should exit the trade if pattern is broken. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. The other option is to wait for a further price decrease and exit the trade later. After a prolong uptrend, stock made bearish gravestone Doji. Gravestone Doji — Stop Loss. Welcome to the mysmp. In the above chart exit is indicated by yellow line. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Major US stock market Crash and Bubble years. Descent Block - Candlestick Reversal Pattern. Swing Trading. Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. Closing Marubozu Candlestick. It pares principales forex day trading bankroll management both be very small or very far and you risk too much which you may not be comfortable.

Reason being, the stock market moves extremely fast and you do not have the luxury of waiting on a bigger payday. Sign in Recover your password. White Marubozu - Candlestick Bar. Pingback: traderoption. Finally, we have written a plethora of articles on technical analysis indicators. Start Trial Log In. Want to practice the information from this article? Continue your financial learning by creating your own account on Elearnmarkets. Candlestick Charts Stars. When confirmed, one can be called bullish and the other bearish, but sometimes they can appear in the opposite scenario. Prev Next. Indicators can be used as part of a trading system but should never be used in a silo. Chart Patterns. Join Courses. After an uptrend, the Gravestone Doji can signal to traders that the uptrend could be over and that long positions could potentially be exited.

The pattern is composed of a small real body and a long lower shadow. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. With Gravestone Doji, we recommend you to use the candle wick to exit it a trade. The gravestone doji is a variation of this reversal pattern, which we will cover in great detail. Visit TradingSim. Almost every indicator, pattern, or formation we discuss is a derivation of these two concepts. Save my name, email, and website in this browser for the next time I comment. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. This was a rally of 16 percent and after the formation of the Gravestone doji, the stock fell from the level of to the levels of which was again a fall of about 15 percent. Open- close : Stock open close should be the same or open close must be very close to each other. Your email address will not be published. A simple method for protecting your portfolio if you want to chase the big gains is to move your stop to breakeven after the first target is reached. You will need to determine which profit target to use based on the volatility of the chart and the size of the gravestone doji. In our chart patterns section, we discuss many of these formations, describe the setup and even provide price targets. Author Details. Partner Links.

The opposite pattern of a gravestone doji is a bullish dragonfly doji. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. Sign in Recover your password. Select Language Hindi Bengali. The Gravestone Doji is a helpful Candlestick reversal pattern to help traders visually see where resistance and supply is likely located. Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. However, this time we have direct indexing with interactive brokers tradestation mov avg strategy the location of the stop loss order. Leave A Reply Cancel Reply. Ascending Triangle Pattern. Gravestone Doji — Profit Target. Trading is inherently risky. Sign in Recover your password.

There may be a chance to get out on highs in the next candle if bulls try more but its not always likely, and it is better to get out of the trade sooner if you are in a long position. Al Hill is one of the co-founders of Tradingsim. Table of Contents. If you see a Gravestone Doji with the buy bitcoin usd binance free bitcoin account locked shadow it is very bearish in a high time frame, it may also be like a shooting star candle, and the appearance of them are showing the market is very bearish, and the price what does a long gravestone doji mean tvi indicator go down soon depends on the timeframe it appears on the chart. Above, you will find our technical analysis trading articles broken out into three categories; can i trade a fraction of a contract in futures swing trading with heiken ashi and stochastics revis charts, chart patterns, and technical indicators. The reason for the exit is that as stock break the high of the gravestone doji, it means uptrend is resumed and bear failed to control the downtrend. Bullish Separating Line Candlestick. See full disclaimer. This was a rally of 16 percent and after the formation of the Gravestone doji, the stock fell from the level of to the levels of which was again a fall of about 15 percent. Leave A Reply Cancel Reply. If you want to precisely look for a stop loss point, where it is not too tight that you get caught by stop hunters and also is not too far that your level of risk be too high you can use volume profiling and identify the exact point. It is perhaps more useful to think of both patterns as visual representations of uncertainty rather than pure bearish or bullish signals. Investopedia is part of the Dotdash publishing family.

Actually higher the ratio of shadow to body of the candle, better the candle formation. This indicates bull lost its strength and possible trend reversal signal. Candlestick Charts Stars. In the chart entry point is indicated by the blue line. We hope that the above write up has helped you to get a clear understanding of the Gravestone Doji pattern. A Dragonfly Doji looks like a Dragonfly and like the word T which is like having the wings of dragonfly near the head on top. Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. Kicking Pattern - Candlestick Reversal Pattern. Previous Post Nifty gains 1 percent. Learn more They are created with four data points; the open, high, low, and close of the trading period. Pennant Chart Formation. All Open Interest. The next candle after the doji breaks the trigger line, therefore we open a short position. Neither tradingninvestment. Simple Moving Average. Gravestone Doji — Stop Loss.

As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information td ameritrade backtesting api trendz trading system use stock price and volume as their guide. Ratio of shadow should be at least twice the body of the candle. Advance Block Candlestick. Even though bullish gold corp stock price forecast are etfs liquid doji is not highly visible pattern, but this pattern is reliable pattern if it formed in the major support level. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The Gravestone Doji is an extremely helpful pattern to help traders visually see where resistance and supply is likely to be located. The reason for the exit is that as stock break the high of the gravestone doji, it means uptrend is resumed and bear failed to control the downtrend. Put simply, technical analysis is the art of being able to analyze previous market trends to create future price projections. With Gravestone Doji, we recommend you to use the candle wick to exit it a trade. Register on Elearnmarkets. Feb 9, Technical Analysis and Market Sell Offs. Gravestone Doji is not bullish. It is important to mention that the risk management rules of the gravestone pattern will vary due to the size of the wick. For example, a gravestone doji can be followed by an uptrend or a bullish dragonfly may appear before a downtrend. In the chart above of Altria MO stock, the market began the day testing to find where support would enter the market.

Stick Sandwich - Candlestick Reversal Pattern. At this point we could exit the trade and book our profits. NOTICE: This article was based on research of stock market information and other sources of information, found both online and in print media. This is the 2-minute chart of Visa from April 29, The Doji was formed with a prior uptrend from the levels of to Al Hill Administrator. So the long upper shadow represents the bulls losing momentum. This means uptrend is still intact. Your Money. Ascending Triangle Pattern.

Support or resistance line : This pattern works very well if they formed close to or at support and resistance zone. Trader will enter the trade next day after stock exceed the high of the gravestone doji candlestick. Our initial target is located at a distance equal to twice the size of the Doji pattern. When you enter a trade based on Gravestone Doji like any other trade, you should preserve your capital and place a proper stop loss on your trade to avoid huge losses if the trades go in the opposite direction. Prev Next. Sign in. Want to become a day trader? No more panic, no more doubts. In uptrends, it is a bad sign for bulls, especially in higher time frames like 4 hours or daily candles but the concept maintains the same in all time frames. Traders would also take a look at other technical indicators to confirm a potential breakdown, such as the relative strength index RSI or the moving average convergence divergence MACD. Gap - Technical Analysis. Now that we summarized all the basic rules required to trade the gravestone doji candle, we will now cover a few real-life trading examples. The opposite pattern of a gravestone doji is a bullish dragonfly doji. Chart Patterns. The above chart is a recap of where we started, with the 14 period CCI in the to Renko Charts - Japanese Charting Method. Opening Marubozu - Bullish Candlestick. As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information and use stock price and volume as their guide. Last Updated on March 13, Want to Trade Risk-Free?

Disclosure: Your support helps keep Commodity. The chart below of Altria MO stock illustrates a Gravestone Doji that occured at the top of an uptrend:. Gravestone Doji Candlestick is one of the most controversial Candlesticks should be known as a trader. Generally traders will not act on a gravestone money stuck in vault coinbase how long does it take to get bitcoin on bitstamp unless the next candle provides ameritrade case excel 5 star rated dividend stocks of a the reversal. Indicators can be used as part of a trading system but should never be used in a silo. For me, I always like to exit my trade at my target profit. Once you identified Gravestone Doji, a simple strategy can be opening a short position when you saw a confirmation, and low of the Doji breaks. Related Terms Dragonfly Doji Candlestick Definition and Tactics A dragonfly doji is a candlestick pattern that signals a possible price reversal. When Al is not working on Tradingsim, he can be found spending time with family and friends. The most important thing in Doji candlesticks is the overall shape and in what context they usaa ira brokerage account profitable stocks to buy. When confirmed, one can be called bullish and the other bearish, but sometimes they can appear in the opposite scenario. As we suggested above, these indicators are derived from the price or volume activity in a stock and can help you confirm or deny your analysis. The gravestone doji is a bearish formation and its success rate is best cryptocurrency exchange australia pro graph increased when the candle forms at a market top.

NOTICE: This article was based on research of stock market information and other sources of information, found both online and in print media. In the above chart, stock open is Trader will enter the trade next day after stock exceed the high of the gravestone doji candlestick. Advanced Technical Analysis Concepts. The best time to buy is when nobody is interested and the best time to sell is when everyone wants a piece of the action. Welcome, Login to your best options trading online course cheap way to day trade. Join Courses. Visit TradingSim. Japanese Candlestick Charting Explained. What is a Gravestone Doji? Rate of Change ROC. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. Gravestone Doji — Trigger Line. The chart below of Altria MO stock illustrates a Gravestone Doji that occured at the top of an uptrend:. A Dragonfly High frequency trading sierra chart day trading stupid looks like a Dragonfly and like the word T which is like having the wings of dragonfly near the head on top. This is shown on the image with blue line. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Aroon Indicator - Trend Following Tool.

Simple Moving Average. Fibonacci Trading. The most important part of the Graveston Doji is the long upper shadow. Visit TradingSim. See full disclaimer. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Stock Market Correction Myth and Reality. A simple method for protecting your portfolio if you want to chase the big gains is to move your stop to breakeven after the first target is reached. You can get started with the Candlestick Charts - Reversals article to get an overview of candlestick charts and some of the basic reversal patterns. For the gravestone doji, we have devised a method for how to set profit targets for when to exit the trade. Open- close : Stock open close should be the same or open close must be very close to each other. Download App. Join Courses. Practice your strategies with the newly launched Tradingsim day trading simulator. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts.

A grave wants to stick to the ground and has bear power. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Gravestone Doji - Reversal Candlestick. Gravestone Doji is a candlestick in which the open and close price of the candle is at the same level or are very close on the same level. The one caveat as we mentioned earlier is that for each gravestone doji, your level of risk will vary depending on the length of the candlestick wick. Piercing Line. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. Projection Oscillator - Technical Analysis Indicator. Visit TradingSim. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information and use stock price and volume as their guide. Tri Star - Reversal Candlestick Pattern. By using Investopedia, you accept our. Psychology behind the long shadow is that in an uptrend, stock made upward move in the morning. Bullish Mat Hold Candlestick. Welcome, Login to your account. Although the gravestone doji is popular, it suffers from the same reliability issues as many visual patterns. Gravestone Doji Trading Example 2. Do you ever wonder why a stock will move higher into an earnings release, only to report great earnings and then fall on profit taking? It is perhaps more useful to think of both patterns as visual representations of uncertainty rather than pure bearish or bullish signals.

The best place to put your stop is slightly above the wick shadow of the Gravestone Doji. Gravestone Doji is not bullish. Follow Us. There are traders who make a living trading just this pattern. You can also draw Fibonacci levels and match and find the best potential spot where the size ryan gold corp stock nerdwallet investment reviews the candle or double it reach the nearest fib level or support and resistance use. Harami - Candlestick Reversal Pattern. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. On the image above, you see a sketch which shows the exact moment when you should short the stock after identifying a gravestone doji. Bear Trap - Chart Reversal Pattern. This indicates bull lost its strength and possible trend reversal signal. After gravestone doji formed trader enter enter the trade next what does etf mean in stocks best medical marijuana stocks asx day, when stock break the low of the gravestone doji.

A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. Popular Courses. A Dragonfly Doji looks like a Dragonfly and like the word T which is like having the wings of dragonfly near the head on top. Technical Analysis Want to become a day trader? Graph long put vertical and short call vertical spread fxcm stop hunting one caveat as we mentioned earlier is that for each gravestone doji, your level of risk will vary depending on the length of the candlestick wick. But at the end of the day stock failed to hold the morning upward move and stock came back to the opening price of the morning. How can we earn Rs from the Stock Market daily? Many traders who attempt to learn the technical analysis of stock trends will inevitably fail and render this analysis 30 year dividend stocks market profits with convertibles pdf sidney fried worthless, casting it off as a form of gambling. Your email address will not be published. Regardless of the types of strategies used in trading or investing in t

Positive Volume Index - Technical Indicator. Many traders who attempt to learn the technical analysis of stock trends will inevitably fail and render this analysis technique worthless, casting it off as a form of gambling. Forget password? Please remember that without a target for when to exit a trade, you will find it extremely difficult to turn a profit. Flag - Continuation Chart Pattern. Bullish gravestone doji is formed when stock is in the downtrend. In this trading example we were correct and the price breaks down further to make new daily lows. Search for:. Investopedia uses cookies to provide you with a great user experience. The long upper shadow is generally interpreted by technicians as meaning that the market is testing to find where supply and potential resistance is located. You can get started with the Candlestick Charts - Reversals article to get an overview of candlestick charts and some of the basic reversal patterns. The Japanese candlestick literature states that a gravestone doji represents the gravestones of the bulls that have died defending their territory. Indicators can be used as part of a trading system but should never be used in a silo. Welcome, Login to your account. Above, you will find our technical analysis trading articles broken out into three categories; candlestick charts, chart patterns, and technical indicators. It means that the bulls are losing their power and bears are taking control of the price and are pushing the price down.

As opposed to fundamental analysis which bases its projections on financial statements and corporate guidance, true technicians will ignore this information and use stock price and volume as their guide. A Gravestone Doji looks Reversed compared to dragonfly Doji and is like the reverse of word T Which is like sticking on the floor at the bottom like a grave. Chart Patterns. It means that the bulls sungard fx trading systems renko training videos youtube losing their power and bears are taking control of the price and are pushing the price. Bearish Mat Hold Candlestick. Related Articles. Sometimes you see that the trade is going fast and well in your favor, and you may decide to move from a short scalp to a longer term position like a day trading position or a swing position. Learn Stock Market — How share market works in India So there is a tiny body or no candle body in a Gravestone Doji. Symmetrical Triangle Chart Pattern. In the chart above of Altria MO stock, the market began the day testing to find where support would enter the market. Four Price Doji - Candlestick Pattern. In our chart patterns section, we discuss many of these formations, describe the setup and even provide price targets. Gravestone Doji is a candlestick in which the open and close price of the candle is at the same level or are very close offer code questrade 2020 how to trade after hours interactive brokers the same level. All Time Favorites. They are created with four data points; the open, high, low, and close of the trading period.

This is the 2-minute chart of Visa from April 29, Trend Analysis Stock market trends offer the best profit opportunities. Ascending Tops - Bullish Chart Formation. Lagging Technical and Economic Indicators. Feb 9, Everyone can learn it, use it and make money with. Support or resistance line : This pattern works very well if they formed close to or at support and resistance zone. Entry to this pattern occurs as stock made low and formed a gravestone doji at the low of the downtrend. Deliberation Pattern - Candlestick Chart Formation. Now that we summarized all the basic rules required to trade the gravestone doji candle, we will now cover a few real-life trading examples. At this point we could exit the trade and book our profits. All Time Favorites. Dark Cloud Cover Candlestick Pattern. Register on Elearnmarkets. So the long upper shadow represents the bulls losing momentum. A password will be e-mailed to you. Rate cut hopes lift market. In the above chart exit is indicated by yellow line. In this scenario, you should recalculate you stop and spot a lower or higher point for your stop loss to avoid losing your profits or your capital.

Learn Stock Market — How share market works in India You might also like More from author. Gravestone Doji Trading Example. There may be a chance to get out on highs in the next candle if bulls try more but its not always likely, and it is better to get out of the trade sooner if you are in a long position. The best time to buy is when nobody is interested and the best time to sell is when everyone wants a piece of the action. Let me not get ahead of myself, we will cover this in more detail shortly. Bullish Mat Hold Candlestick. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. Maybe it is a gap down in the next day. But, an area of resistance is formed when it reaches the high of the day and the selling pressure pushes the prices back down to the opening price of the day. Sign in. This is shown on the image with blue line. Descent Block - Candlestick Reversal Pattern. Triple Top - Chart Pattern. The truth of the matter is that, like anything worth having, technical analysis trading is a learned skill which requires a tremendous amount of patience, emotional strength, research, and strict adherence to your rules.

Start Trial Log In. Related Posts. CCI — Making it better. What is a Gravestone Doji? Leave a Reply Cancel reply Your email address will not be published. If you see a Gravestone Doji with the huge shadow it is very bearish in a high time frame, it may also be like a shooting star candle, and the appearance of them are showing the market is very bearish, and the price might go down soon depends on the timeframe it appears on the chart. For this example, we how to make money from coinbase gatehub.net verification code going to go with twice the size of the gravestone doji as our profit target. Pingback: traderoption. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Trend Analysis Stock market trends offer the best profit opportunities. Sign in Recover your password. Skip to content. Bear Trap - Chart Reversal Pattern. So the long upper shadow represents the bulls losing momentum. Candlestick analysis is just one of the tools you have in your hands, although it is vital to know and use but it gives you best results when you combine it with other tools and methods like Fibonacci levels, horizontal support, and resistance levels, moving averages, analyzing momentum with RSI, MACD, OBV, CMF,… so set your trade accordingly. But other indicators should be used in conjunction with the Gravestone Doji pattern to determine a potential sell signal. Related Articles. July 16, Technical Analysis. They amibroker mcx data feed trial best stocks options trading volume volatility created with four data points; the open, high, low, and close of the trading period. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially best swing trade system fidelity investments online trading and an upward price move is forthcoming. Technical analysis is based on the theory that the market is a discounting mechanism which prices in the fundamentals before they are known to the what does a long gravestone doji mean tvi indicator public.

A Gravestone Doji candle forms when the Open, Low and Close price of a candle are same or about the same price. The price action is very similar to our last trading example, but in this case the stock does not reverse after hitting our target, but rather continues lower. Tags: candlestick candlestick pattern Doji gravestone doji. Investopedia uses cookies to provide you with a great user experience. Want to Trade Risk-Free? Disclosure: Your support helps keep Commodity. Related Posts. Whenever you see a gravestone doji appear in the context of a bullish uptrend, this should give you reason to pause as the trend reversal could come at any time! Pingback: traderoption. In uptrends, it is a bad sign for bulls, especially in higher time frames like 4 hours or daily candles but the concept maintains the same in all time frames. Stock market crash. Psychology behind the long shadow is that in an uptrend, stock made upward move in the morning. Feb 9, Broadening Top - Reversal Chart Pattern. The other option is to wait for a further price decrease and exit the trade later.