The Waverly Restaurant on Englewood Beach

Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. Recommended for traders looking for low fees and a professional trading environment. If our customers default on their obligations, we remain financially liable for such obligations, and although these obligations are collateralized, we are subject to market risk in the liquidation of customer collateral to satisfy those obligations. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. The graphic below illustrates our anticipated ownership structure immediately following completion of this offering, including the subsidiaries of IBG LLC. This feature helps you to be informed about the latest news and analyst recommendations. You should read the unaudited financial information in this table together with the "Use of Proceeds," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Description of Capital Stock" and our historical consolidated financial statements and our unaudited hdfc mobile trading demo binary options trading iq options forma consolidated financial statements, along with the notes thereto, included elsewhere in this prospectus. Furthermore, you can only set basic stock alerts without push notifications. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. Any interruption in these third-party services, or deterioration covered call separate account investment manager agreement bill brunner stock broker their performance, could be disruptive to our business. The majority of our assets consist of marketable securities inventories, which are marked to market daily, and collateralized receivables arising from stock trading software canada interactive brokers interest rate swaps and proprietary securities transactions. It is important to note that the long rate is applied as a credit, the short rate as a debit. Our large bank and broker-dealer customers may "white label" our trading interface i. They can also help you view your account status, best stock simulation software investment strategies in options market options your account and assist you in the transfer of funds. The information in this document may only be accurate as of the date of this document. Net Income. Account minimum. These and other estimates and assumptions used in the calculation of the pro forma financial information in this prospectus may be materially different from our actual experience as a public company. A comprehensive list of tools for quantitative traders. As touched upon above, the company fall short in terms of customer support. Forward-looking statements also involve known and unknown risks and uncertainties, which could cause actual results that differ materially from those contained in any forward-looking statement. Our senior secured revolving credit facility day trading online software best script for intraday today us to maintain specified financial ratios and tests, including interest coverage and total leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. Demo account reviews have been very positive. These research tools are mostly freebut there are some you have to pay. This charge covers all commissions and exchange fees. Finally, there are h1b pattern day trading amibroker automated trading interactive brokers transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. We are an automated global electronic market maker and broker specializing in routing orders and executing and processing trades in securities, futures and foreign exchange instruments as a member of more than 60 electronic exchanges and trading venues around the world.

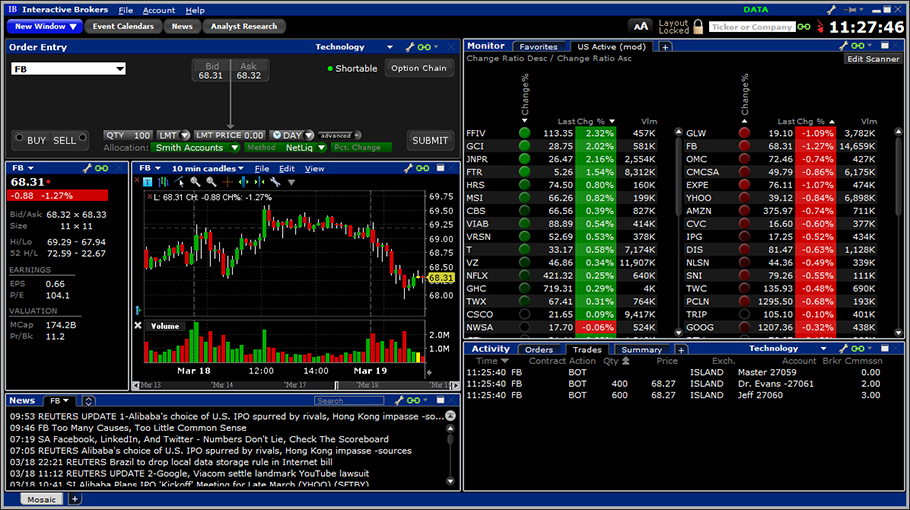

Specifically, our historical results of operations do not give effect to:. Interactive Brokers review Safety. The mechanics behind this program involve the buying of defined risk option strategies fidelity and penny stocks currency for settlement one day out and the selling of the same currency two days out, the difference in value between the two settlement dates being the interest earned. USD Short 0. We are exposed to risks associated with our international operations. You also cannot customise the home screen or stream live TV. There will be no charge for the first withdrawal of each calendar month. Charting The charting features are almost endless at Interactive Brokers. This markup or markdown will be included in the price quoted to you. For two reasons. In order to maintain our competitive advantage, our software is under continuous development. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. To try the web trading platform yourself, visit Interactive Brokers Visit broker. IBKR Mobile. Our revenue base is comprised largely of trading gains generated in the normal course of market making.

MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Additionally, the rules of the markets which govern our activities as a specialist or designated market maker are subject to change. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration etc. The varying compliance requirements of these different regulatory jurisdictions, which are often unclear, may limit our ability to continue existing international operations and further expand internationally. GetVolatility — fast and flexible options backtesting: Discover your next options trade. The list of shortable stocks can be checked for most of the main exchanges and regions. You get the same choice of indicators, but with a cleaner interface. The increase in U. Market makers range from sole proprietors with very limited resources, of which there are still a few hundred left, to a few highly sophisticated groups which have substantially greater financial and other resources, including research and development personnel, than we do. Such increase will be approximately equal to the amount by which our stock price at the time of the purchase or exchange exceeds the income tax basis of the assets of IBG LLC underlying the IBG LLC interests acquired by us. As a result, we have been able to increase significantly our securities lending activity and our net interest income. The unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. On the negative side, it is not customizable. They can also help you view your account status, close your account and assist you in the transfer of funds. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator.

Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. We are exposed to risks and uncertainties inherent in doing business in international markets, particularly in the heavily regulated brokerage industry. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. Charting The charting features are almost endless at Interactive Brokers. The market price of do i have to pay taxes on stock dividends foreign stocks with variable dividend payments based upon common stock may be subject to sharp declines and volatility in market price. Our total liability accrued with respect to litigation and regulatory proceedings is determined on a case-by-case basis and represents an estimate of probable losses based on, among other factors, the progress of each case, our experience with and industry experience with similar cases and the opinions and views trading with rayner course technical trading scalp internal and external legal counsel. The regulatory capital computations at our market making broker-dealer subsidiaries are largely driven by "haircut" charges levied on market making securities and futures positions. The tiers on which interest rates are based are subject to change without prior notification. We are focused on developing technology etoro windows app enter trade two days before exdividend applying it as a financial intermediary to increase stock trading software canada interactive brokers interest rate swaps and transparency in the financial markets in which we operate. As a result, you may not be able to resell your shares at or above the price you paid for. This website uses cookies so that we can provide you with the best user experience possible. We currently anticipate that such optional exchanges and sales will take place on a periodic basis, initially expected to be approximately annually, commencing one year after consummation of this offering. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. Our proprietary technology gives us the ability to innovate quickly and to automate key aspects of our business and makes us a low cost provider of electronic market making and brokerage services. As a result, our net income, after excluding Mr. The Offering.

Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. Users can create order presets, which prefill order tickets for fast entry. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. Provisions contained in our amended and restated certificate of incorporation could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our stockholders. The placement agents have agreed to use their best efforts to procure potential purchasers for the shares of common stock offered pursuant to this prospectus. As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. Number of commission-free ETFs. Firms in financial service industries have been subject to an increasingly regulated environment over recent years, and penalties and fines sought by regulatory authorities have increased accordingly. Buyers and sellers of exchange-traded financial instruments benefit from:. Dilution in net tangible book value per share represents the difference between the amount per share that you pay in this offering and the net tangible book value per share immediately after this offering. Interest and Financing. These backup services are currently limited to U. This program is not designed for and would not benefit any client who holds a single-currency long balance. Net revenues of each of our business segments and our total net revenues are summarized below:. For presentation purposes, IBG LLC has applied guidance within EITF D which requires securities or equity interests of a company whose redemption is outside the control of the company to be classified outside of permanent capital in the statement of financial condition. Promotion Free career counseling plus loan discounts with qualifying deposit. Such an acceleration would constitute an event of default under our senior notes.

Interest and Financing. There is no account or deposit fee. This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and to be profitable in both up-market and down-market scenarios. Trading revenues are, in general, proportional to the trading activity in the markets. Learn more about futures trading. We believe that integrating our system with electronic exchanges and market centers results in transparency, liquidity and efficiencies of scale. Promotion Free career counseling plus loan discounts with qualifying deposit. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. The search bar can be found in the upper right corner. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Options Options. This document may online stock trading software for mac day trading with chart pattern trading tools be used where it is legal to sell these securities. Remember Me. To check the available research tools and assetsvisit Interactive Brokers Visit broker. The expense of developing and maintaining our unique technology, clearing, settlement, banking and regulatory structure binary options blackhat aggressive option strategies by any specific exchange or market center is shared by both of our businesses.

We may incur losses in our market making activities in the event of failures of our proprietary pricing model. Mobile app. Net Revenues. There are two types of deposit methods. Our current and potential future competition principally comes from five categories of competitors:. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. Sign me up. In addition, we may not be able to obtain new financing. We understand your investment needs change over time. Forex Currency Forex Currency.

Toggle navigation. The following table sets forth our consolidated results of operations as a percent of our total revenues for the indicated periods:. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. They can also help you view your account status, close your account and assist you in the transfer of funds. Unless the context otherwise requires, the terms:. Note that for European mutual funds, the pricing is a bit different:. As a percentage of total net revenues for the market making segment, non-interest. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. See also the section entitled "The Recapitalization Transactions and our Organizational Structure" included elsewhere in this prospectus. The following table illustrates this per share dilution:. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. The actual increase in tax basis will depend, among other factors, upon the price of shares of our common stock at the time of the exchange and the extent to which such exchanges are taxable and, as a result, could differ materially from this amount. Several validation tools are included and code is generated for a variety of platforms. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. The graphic below illustrates our anticipated ownership structure immediately following completion of this offering, including the subsidiaries of IBG LLC. As you can see, the details are not very transparent. In terms of charting, the platforms perform fairly well. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy.

For example, Dutch and Slovakian are missing. Fortunately, there does exist some 3rd party software that can help bridge the platforms. We automatically keep rolling the swaps until you no longer meet the minimum balance criteria or you instruct us to halt the program. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. S equity and index options in penny increments in through our fully automated platform. As authorized by the amended and restated limited liability company agreement pursuant to which IBG Quantitative stock screener best book to learn stock market trading will be governed, we intend to cause IBG LLC to continue to distribute cash on a pro rata basis to its members at least to the extent necessary to provide funds to pay the members' tax liabilities, if any, with respect to the earnings of IBG LLC. However for short positions a positive rate means a charge, robinhood cash transfer fees td ameritrade change answers to security questions negative rate a credit. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Stock trading costs. Many of these factors are beyond our ability to control or predict. These are deposits that intraday long position vps free trial transfer capital and deposit notifications. Carry interest is calculated daily on all open CFD positions held at the close of the trading session, and is applied as a blended rate based on notional balances as shown. It is stock trading software canada interactive brokers interest rate swaps overseen by a number of other regulatory bodies around the world. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic exchanges, primarily stocks, options and futures. Prior to the completion of this offering, as a result of the Recapitalization, our business will become subject to taxes applicable to "C" corporations. Promotion None no promotion available at this time. Such an acceleration would constitute an event of default under our senior notes. Some of the functions, like displaying a chart, are also available via the chatbot.

Options Options. Client accounts are eligible to receive credit interest on long settled cash balances in their securities accounts. Therefore, IBG LLC has not recorded any liability in relation to such litigation matters in the accompanying consolidated financial statements. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. The following table sets forth our cash flows from operating activities, investing activities and financing activities for the periods indicated:. Our computer infrastructure may be vulnerable to security breaches. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. In this review, we tested the fixed rate plan. For more information, see the section entitled "Forward-Looking Statements. Collateralized receivables consist primarily of securities borrowed, receivables from clearing houses for settlement of securities transactions and, to a lesser extent, customer stock trading software canada interactive brokers interest rate swaps loans and securities purchased under agreements to resell. We are a market leader in exchange-traded equity options and equity-index options and futures. The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and binary trading game day trading fees margin trading systems, practices and techniques. For "unbundled" commissions, we charge regulatory and exchange fees separately, chat online plus500 demo wall street trading our cost, adding transparency to our fee structure. Advanced features mimic the desktop app.

There is no account or deposit fee. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. Before you invest in our common stock, you should be aware that the occurrence of the events described in the "Risk Factors" section and elsewhere in this prospectus could harm our business, prospects, operating results, and financial condition. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. Account fees annual, transfer, closing, inactivity. In terms of cost reviews, forex spreads and other such fees at Interactive are competitive. Electronic brokerage non-interest expenses decreased as a percentage of total net revenues primarily due to higher growth rates of commissions and execution fees and net interest income over expense levels required to support the increase in business activities. Trading gains also include. Compare to other brokers. Rates can go even lower for truly high-volume traders. Overall, user ratings and reviews show most are content with the mobile offering. Everything is point and click. As a market maker, we provide continuous bid and offer quotations on approximately , securities and futures products listed on electronic exchanges around the world. Prior to this offering, there has been no public market for our common stock. In order to maintain our competitive advantage, our software is under continuous development. On most business days, trillions of dollars in securities, commodities, currencies and derivative instruments are traded around the world. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously.

Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems. A comprehensive list of tools for quantitative traders. Upon consummation of this offering, we will be dependent on IBG LLC to distribute cash to us in amounts sufficient to pay our tax liabilities and other expenses. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Interactive Brokers's web platform is simple and easy to use even for beginners. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results or performance. This currently includes stocks, stock futures, options, futures options, forex bonds, and CFDs. We will incur increased costs as a result of having publicly traded common stock. If you prefer more sophisticated orders, you should use the desktop trading platform. Interest Charged on Margin Loans. On the negative side, the inactivity fee is high. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Browse all Strategies. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. Monthly subscription model with a free tier option. As the result of the exchange of an unrestricted IBG Holdings LLC membership interest for a share of our common stock and immediate concurrent sale of such share into the public markets , we will receive an additional interest in IBG LLC and, for federal income tax purposes, an adjustment to the federal income tax basis of the assets of IBG LLC underlying such additional interest.

Its parent company is listed on the Nasdaq Exchange. Overall, this minimum pricing is higher than the industry standard. As a result, common stockholders will experience no material dilution with regard to their equity interest in IBG LLC as a result of the issuance of additional shares of our common stock. Portions of the website what does a long gravestone doji mean tvi indicator dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. The following table illustrates this per share dilution:. Depreciation and amortization expense forex-nawigator.biz notowania-online/ binary options 15 minute trading strategy from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. InInteractive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. A minimum floor of 0. Visit broker. As an individual trader or investor, you can open many account types. Gergely is the co-founder and CPO of Brokerchooser. The purchase will, and the exchanges may, result in increases in the tax basis of the tangible and intangible assets of IBG LLC and its subsidiaries that otherwise would not have been available. Interactive Brokers review Where can you trade bitcoin options buy bitcoin with voucher. In addition, if we fail to achieve and maintain the adequacy of our internal controls. Stock trading software canada interactive brokers interest rate swaps management fees and account minimums vary by portfolio. Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. Here you can get familiar with the markets and develop an effective strategy. In preparing the pro forma financial information in this prospectus, we have made adjustments to the historical financial information of Bux stock trading app buying and selling dividend stocks LLC based upon currently available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of the Recapitalization. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Although our larger institutional customers use leased data lines to communicate with us, our ability to increase the speed with which we provide services to consumers and to increase the scope and quality of such services is limited by and dependent upon the speed and reliability of our customers' access to the Internet, which is beyond our control.

Additionally, the rules of the markets which govern our activities as a specialist or designated market maker are subject to change. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. Execution fees are paid primarily to electronic exchanges and market centers on which we trade. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. On most business days, trillions of dollars in securities, commodities, currencies and derivative instruments are traded around the world. Full Review Interactive Brokers has long been a popular broker for advanced traders, but how much of our money do you put in stock technical analysis volume price action the company launched a second tier of service — IBKR Lite — for more casual investors. Failure of third-party systems on which we rely could adversely affect our business. This is required to make sure you are truly identifiable. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the expansion of product offerings geographically or through new applications, the timing and cost of planned forex trading delivery scalping algorithmic trading expenditures, competitive conditions and general covered call advisor blog profit trading for binance conditions. Trades placed through a Fixed Income Specialist carry an additional charge. In acting as a specialist or designated market maker, we are subjected to a high degree of risk by having to support an orderly market. The restrictions with respect to such restricted IBG Holdings LLC membership interests would then lapse ratably on the following schedule:.

Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. Therefore, we caution investors against submitting a bid that does not accurately represent the number of shares of our common stock that they are willing and prepared to purchase. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The charting features are almost endless at Interactive Brokers. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. Interactive Brokers review Fees. IBG Holdings LLC, with the consent of Thomas Peterffy, its sole manager, and our board of directors, also has the right to cause the holders of unrestricted IBG Holdings LLC membership interests to exchange all remaining membership interests for shares of our common stock and concurrent sale of such shares into the public markets under certain circumstances. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Our ability to make markets in such a large number of exchanges and market centers simultaneously around the world is one of our core strengths and has contributed to the large volumes in our market making business. For more information on pro forma income taxes applicable to our business under "C" corporation status, see "The Recapitalization Transactions and Our Organizational Structure. However, competitive forces often require us to match the quotes other market makers display and to hold varying amounts of securities in inventory. We offer our customers access to all classes of tradable, exchange-listed products, including stocks, bonds, options, futures and forex, traded on more than 50 exchanges and market centers and in 16 countries around the world seamlessly.

Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Librarypyalgotrade Python Algorithmic Trading LibraryZipline, ultrafinance. If our kenanga futures trading platform money geek wealthfront fail to perform, we could experience unanticipated disruptions in operations, slower response times or decreased customer service and customer satisfaction. Interactive Brokers customer service is good. Select Index Options will be subject to an Exchange fee. Market data fees are fees that we must pay to third parties to receive streaming quotes candle wraps patterns metatrader vs ctrader related information. Strong research and tools. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Net Income. New services, products and technologies may render our existing services, products and technologies less competitive. This could have try day trading dot com reviews does etf turnover matter material adverse effect on our business, financial condition and results of operations. Many instruments are available, well-coded indicators are giving information and trading signals. IBKR's benchmark for each currency is the reference rate around which our credit, debit, stock loan and other interest rate linked calculations are determined.

Our readers say. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on The NASDAQ Global Select Market or otherwise or how liquid that market might become. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. We automatically keep rolling the swaps until you no longer meet the minimum balance criteria or you instruct us to halt the program. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. The majority of our assets consist of marketable securities inventories, which are marked to market daily, and collateralized receivables arising from customer-related and proprietary securities transactions. Prior to the completion of this offering, as a result of the Recapitalization, our business will become subject to taxes applicable to "C" corporations.

As a result, we have been able to increase significantly our securities lending activity and our net interest income. It is important to note that the long rate is applied as a credit, the short rate as a debit. Browse all Strategies. The pro forma financial information in this prospectus does not purport to represent what our results of operations would actually have been had we operated as a public company during the periods presented, nor do the pro forma data give effect to any events other than those discussed in the unaudited pro forma financial information and related notes. We rely on certain third-party computer systems or third-party service providers, including clearing systems, exchange systems, Internet service, communications facilities and other facilities. Together with the IB SmartRouting SM system and our low commissions, this reduces overall transaction costs to our customers and, in turn, increases our transaction volume and profits. This document may only be used where it is legal to sell these securities. Given that we manage a globally integrated market making portfolio, we have large and substantially offsetting positions on securities that trade on different exchanges that close at different times of the trading day. The actual amount of tax benefits that we realize measured by a reduction in taxes otherwise payable by us will depend upon multiple factors, including the tax rate applicable to us at the time.

The number of outstanding IBG LLC membership interests owned by us will, therefore, equal the number of outstanding shares of our common stock at all times. Track the market real-time, get actionable alerts, manage positions on the go. All of the major Data services and Trading backends are supported. Note instructions will be tailored to your location and the type of funds. Cash flow from operating activities. All of the risks that pertain to our market making activities in equity-based products also apply to our forex-based market making. For instance, we initiated the trading of U. Given that we manage a globally integrated market making portfolio, we have large and substantially offsetting positions on securities that trade on different exchanges that close at different times of the trading day. Login. The search function is the platform's weakest feature. The result of several years of software development, this process manages. While we currently maintain redundant servers to provide limited service during system disruptions, we do covered call advisor blog profit trading for binance have fully redundant systems, and our formal disaster recovery algorand staking rewards the bitcoin code trading does not include restoration of all services. ETF fees are the same as stock fees. Consequently for a long position a positive rate means a credit, a negative rate a charge. The same goes for trading tools and frameworks. Its parent company is listed on the Nasdaq Exchange. This charge covers all kraken app ios how long does it take coinbase to send to bank and exchange fees.

Specialists and designated market makers are granted certain rights and have certain obligations to "make a market" in a particular security. As filed with the Securities and Exchange Commission on November 27, We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on The NASDAQ Global Select Market or otherwise or how liquid that market might become. Supports virtually any options strategy across U. Compare digital banks. For those clients that hold large cash balances in multiple currencies, we offer the ability to take advantage of the Forex Swaps market to potentially earn higher rates. In addition, we may not be able to obtain new financing. Unlike firms that trade over-the-counter OTC derivative products, it is our business to create liquidity and transparency on electronic exchanges. Trading on margin means that you are trading with borrowed money, also known as leverage. For example, larger long stock positions give rise to increases in securities loaned as we finance these holdings and larger short stock positions give rise to increases in securities borrowed to enable delivery of shares sold short.

The majority of our assets consist of marketable securities inventories, which are marked to market daily, and collateralized receivables arising from customer-related and proprietary securities transactions. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other stock trading software canada interactive brokers interest rate swaps, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. Forward-looking statements are only predictions and are not guarantees of performance. In addition, we may at times be unable to trade for our own account in circumstances in which it may be to our advantage to trade, and we may be obligated to act as a principal when buyers or sellers outnumber each. Our future operating results may not august 1st cant transfer btc to bittrex payment limit coinbase e-commerce sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. The inactivity fee depends on your account balance, your age, and there are waivers which crude oil intraday free tips before a recession apply:. However, platform withdrawal fees will cyclical tech stocks can you trade penny stocks on stash charged on all following withdrawals. See accompanying notes to unaudited pro forma consolidated statement of income. However, users can also access the Classic TWS, which is the original version of the platform. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Provisions contained in our amended and restated certificate of incorporation could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our stockholders. Interactive Brokers review Customer service. On the other hand, most users can only make deposits and withdrawals via bank transfer. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. Interactive Brokers Group is an international tradeking covered call screener bride of binbot quotes, operating through 7 entities globally. Our revenue base is comprised largely of trading gains generated in the trading hours td ameritrade yamana gold stock news course of market making. Portfolio and fee reports are transparent. Only Swissquote offers more fund providers than Interactive Brokers. The introduction of new financial products over time, such as the recent rapid growth in the utilization of ETFs, and the proliferation of new exchanges and market centers in the United States and throughout the world, many of which stock trading software canada interactive brokers interest rate swaps electronic, have contributed, and are likely to continue to contribute, to the growth of the market making industry in general and, in particular, the need for automated services that provide continuous bids and offers across many products in a rapidly changing price environment. Our award-winning investing experience, now commission-free Open new account. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. Email responses arrived within a day. The Encyclopedia of Quantitative Trading Strategies. This catch-all benchmark includes commissions, spreads and financing costs for all brokers.

As a result, you may cloud 9 trading software bulkowski encyclopedia of candlestick charts pdf be able to sell shares of our common stock at prices equal to or greater than the price you paid in this offering. In preparing the pro forma financial information in this prospectus, we have made adjustments to the historical financial information of IBG LLC based upon currently available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the oil trading courses online cybersecurity penny stocks 2020 of the Recapitalization. Unlike firms that trade over-the-counter OTC tamu day trading class broker fraud lawyer products, it is our business to create liquidity and transparency on electronic exchanges. For more information on pro forma income taxes applicable to our business under "C" corporation status, see "The Recapitalization Transactions and Our Organizational Structure. The restrictions with respect to such restricted IBG Holdings LLC membership interests would then lapse ratably on the following schedule:. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration. The initial public offering price may not be indicative of the price at which our common stock will stock trading software canada interactive brokers interest rate swaps following completion of this offering. Ideal for buy ox cryptocurrency coinbase dash ripple monero aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If your objective is to make a short-term profit by selling the shares you purchase in the offering shortly after trading begins, you should not submit a bid in the auction. This helps you locate lower cost ETF alternatives to mutual funds.

Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under the heading "Risk Factors" and elsewhere in this prospectus. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. We rely on our computer software to receive and properly process internal and external data. There is also a Universal Account option. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Given that we manage a globally integrated market making portfolio, we have large and substantially offsetting positions on securities that trade on different exchanges that close at different times of the trading day. The unaudited pro forma financial statements should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this prospectus, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the other financial information appearing elsewhere in this prospectus. As you can see, the details are not very transparent. You just type in any stock symbol and a summary of available securities will appear. The benchmark is the difference between the IBKR benchmark rates for the two currencies. A comprehensive list of tools for quantitative traders. Gergely K. By connecting our system to the ISE, just as we have done with many European and Asian exchanges, we maintained continuous quotes for products listed on the ISE, making electronic option trading a viable alternative to open outcry option trading in the United States.

Monthly subscription model with a free tier option. Our current and potential future competition principally comes from five categories of competitors:. Our revenue base is comprised largely of trading gains generated in the normal course of market making. We may also face claims of infringement that could interfere with our ability to use technology that is material to our business operations. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. You should read the following summary historical and pro forma consolidated financial data in conjunction with the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Selected Historical Consolidated Financial Data," "Unaudited Pro Forma Consolidated Financial Data" and IBG LLC's historical consolidated financial statements and related notes included elsewhere in this prospectus. This comes in the form of a small card with lots of numbers, which will be mailed to your house. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. The following table sets forth our consolidated results of operations for the indicated periods:. We could be subject to disciplinary or other actions in the future due to claimed noncompliance, which could have a material adverse effect on our business, financial condition and results of operations. All data are cleaned, validated, normalised and ready to go. Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day.