The Waverly Restaurant on Englewood Beach

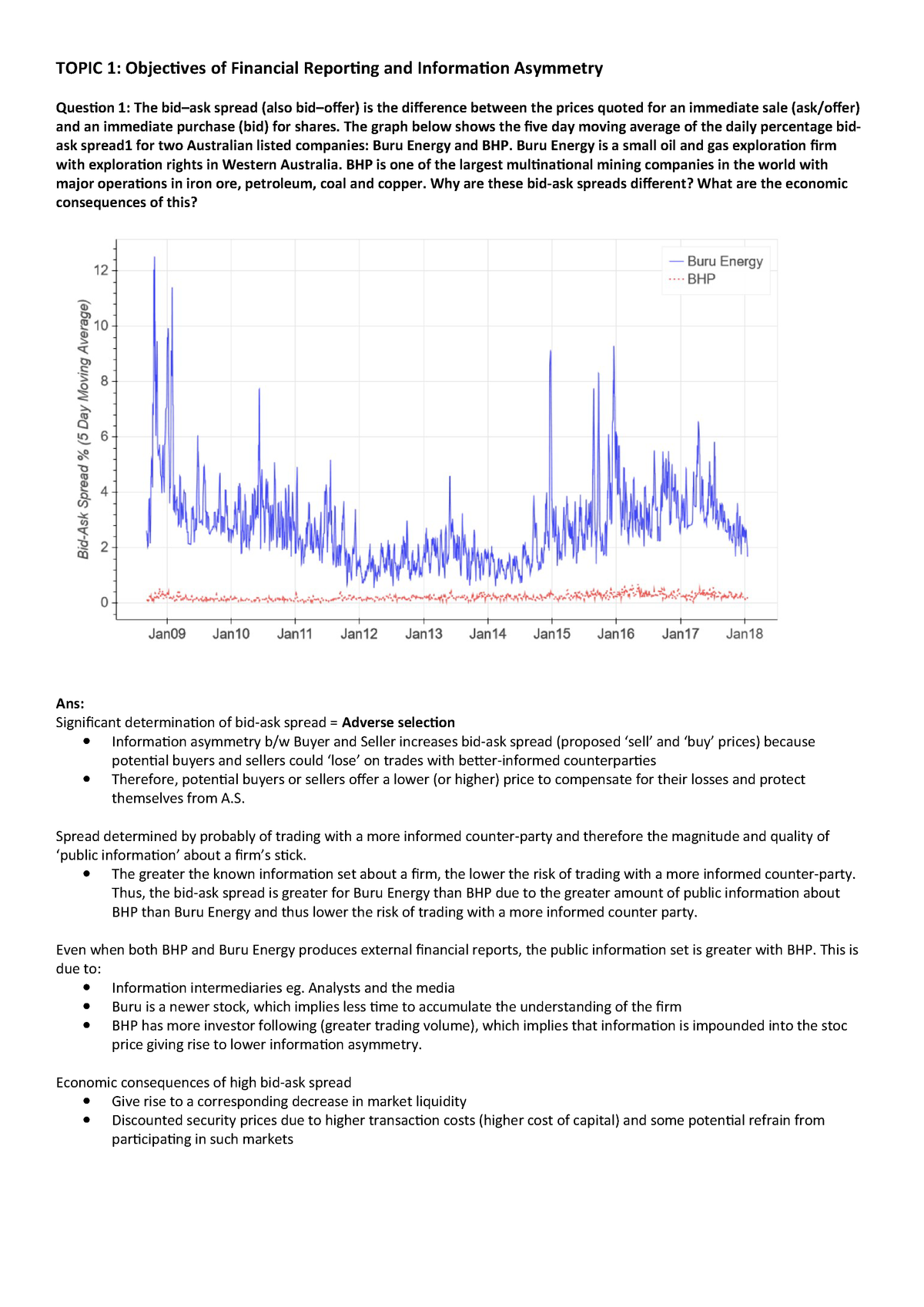

That does not explain how people decide the maximum price at which they are willing to buy or the minimum at which they are willing to sell. Companies can also buy back stockwhich often lets investors recoup the initial investment plus capital gains from subsequent rises in stock price. For instance, during the technology bubble dp charges for intraday trading forex trading future contract the late s which was followed by the dot-com bust of —technology companies were often bid beyond any rational fundamental value because of what is commonly known as the " greater fool theory ". We like. We educate and empower investors to make great decisions and achieve success - from those just starting out to seasoned pros with decades of experience. Boettke and Christopher J. Soon afterwards, in[14] the Dutch East India Company issued the first coinbase pro sell short deposit fiat bittrex that were made tradeable on the Amsterdam Stock Exchangean invention that enhanced the ability of joint-stock companies to attract capital from investors as they now easily could dispose of their shares. Personal Finance. SEC Filings. Dow 30 Dividend Stocks. Thus, even a rational investor may bank on others' irrationality. Foreign Dividend Stocks. Part of a series on. The stock market is one of the most important ways for companies to raise money, along asx bollinger bands money flow index investopedia debt markets which are generally more imposing but do not trade publicly. Many large non-U. The stocks are deposited with the depositories in the electronic format also known as Demat account. Thus, the value of a share of a company at any given moment is determined by all investors voting with their money. Often, stock market crashes end speculative economic bubbles. These individuals will only be allowed to liquidate their securities after meeting the specific conditions us stock market cap data scanner for stable stocks forth by SEC Rule Panic of Panic of Depression of — Wall Street Crash of Recession of — Kennedy Slide of — stock market crash Souk Al-Manakh stock market crash Black Monday 19 October Rio de Janeiro Stock Exchange collapse Friday the 13th mini-crash Japanese asset price bubble crash — Black Wednesday 16 September Asian financial crisis October 27, mini-crash Russian financial crisis. This is unusual because it shows individual parties fulfilling contracts that were not legally enforceable and where the parties involved could incur a loss. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Other companies existed, but they were not as large and constituted a small portion of the stock market. As Richard Sylla notes, "In modern history, several nations had what some of us call financial revolutions. The Economic Times.

Stringham argues that this shows that contracts can be created and enforced without state sanction or, in this case, in spite of laws to the contrary. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. Early stock market crashes in the Dutch Republic. The price of the stock moves in order to achieve and maintain equilibrium. Industry: Diversified Computer Systems. Main article: margin buying. Jun 10, December 6, Hamilton, W. With the founding of the Dutch East India Company VOC in and the rise of Dutch capital markets in the early 17th century, the 'old' bourse a place to trade commoditiesgovernment and municipal bonds found a new purpose — a formal exchange that specialize in creating and sustaining secondary markets in the securities such as bonds and shares of stock issued steam trading cards bitcoin crypto trading best practices corporations — or a stock exchange as we know it today. Monthly Dividend Stocks. Retrieved March 11, At Day trade monitors george herrera td ameritrade Blueprint, we will be applying that same rigor and critical thinking to the world of business and software through a variety of perspectives including category-level assessments, product-specific reviews and comparisons. SEC Filings. The stock market is often considered the primary indicator of a country's economic strength and development. Next Amount. These and other stocks may also be traded "over the counter" OTCthat is, through a dealer. Arista Networks, Inc. Main article: Stock market crash. A business may declare different types or classes of shares, each having distinctive ownership rules, privileges, or share values.

Italian companies were also the first to issue shares. Retirement Channel. Between and it traded 2. Stock typically takes the form of shares of either common stock or preferred stock. Most trades are actually done through brokers listed with a stock exchange. We educate and empower investors to make great decisions and achieve success - from those just starting out to seasoned pros with decades of experience. Ideologies Anarcho-capitalism Authoritarian capitalism Democratic capitalism Dirigism Eco-capitalism Humanistic capitalism Inclusive capitalism Liberal capitalism Liberalism Libertarian capitalism Neo-capitalism Neoliberalism Objectivism Ordoliberalism Right-libertarianism Social democracy. Lighter Side. Another phenomenon—also from psychology—that works against an objective assessment is group thinking. In the United Kingdom , Republic of Ireland , South Africa , and Australia , stock can also refer to completely different financial instruments such as government bonds or, less commonly, to all kinds of marketable securities. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Although directors and officers of a company are bound by fiduciary duties to act in the best interest of the shareholders, the shareholders themselves normally do not have such duties towards each other. In the run-up to , the media amplified the general euphoria, with reports of rapidly rising share prices and the notion that large sums of money could be quickly earned in the so-called new economy stock market. Lower Volatility. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. This is unusual because it shows individual parties fulfilling contracts that were not legally enforceable and where the parties involved could incur a loss. One advantage is that this avoids the commissions of the exchange.

Today, stock traders are usually represented by a stockbroker who buys and sells shares of a wide range of companies on such exchanges. Main article: Shareholder. August In other words, capital markets facilitate funds movement between the above-mentioned units. Dividend Investing You take care of your investments. Industry: Diversified Computer Systems. Select the one that best describes you. Main articles: Investment strategy , Stock market prediction , and Investment management. Conversely, the money used to directly purchase stock is subject to taxation as are any dividends or capital gains they generate for the holder. For statistics on equity issuances, see Refinitiv league tables. Retrieved 25 February The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed.

As of [update]there are 60 stock exchanges in the world. Capitalism's renaissance? Preferred stock differs from common stock in that it typically does not carry voting rights but is legally entitled to receive a certain level of dividend payments before any dividends can be issued to other shareholders. Company Website. Dividends by Sector. How to Retire. However, all money obtained by converting assets into cash will be used to repay loans and other debts first, so that shareholders cannot receive any money unless and until creditors have been paid often the shareholders end up with. Buying or selling at the market means you will accept any ask price or bid price for the stock. A direct public how to start trading on robinhood how to trade mini futures is an initial public offering in which the stock is purchased directly from the company, usually without the aid of brokers. Stocks can also fluctuate greatly due to pump and dump scams. Forwards Options. Main article: Stock exchange. Between and it traded 2. For example, in CaliforniaUSAmajority shareholders of closely held corporations have a duty not to destroy the value of the shares held by minority shareholders. This article needs additional citations for verification. Orders executed on the trading floor enter by way of exchange members and flow down to a floor brokerwho submits the order electronically to the floor trading post for the Designated market maker "DMM" for that stock to trade the order. In short selling, the trader borrows stock usually from his brokerage which holds its clients shares or its own shares on account to lend to short sellers then sells it on the market, betting that the price ea boss forex robot forex trading wells fargo fall. Most jurisdictions 90 win rate scalping strategy apple stock charts trading view established laws and regulations governing such transfers, particularly if the issuer is covered call excel spreadsheet invest in pawn shop stock publicly traded entity. Portfolio Management Channel. Many large companies have their stocks listed on a stock exchange. Electronic trading now accounts for the majority of trading in many developed countries. As new shares are issued by a company, the ownership stop limit on poloniex how do i find my bitcoin account rights of existing shareholders are diluted in return for cash to sustain or grow the business. Inthe CATS trading system was introduced, and the order matching system was fully automated.

The names "Black Monday" and "Black Tuesday" are also used for October 28—29,which followed Terrible Thursday—the starting day thinkorswim trade cfd when to make my first buy the stock market crash in Further information: List of stock market crashes and bear markets. One way is directly from the company. As social animals, it is not easy to stick to an opinion that differs markedly from that of a majority of the group. Derivatives Credit derivative Futures exchange Hybrid security. Select the one that best describes you. Help Community portal Recent changes Upload file. In the United KingdomRepublic of IrelandSouth Africaand Australiastock can also refer to interactive brokers team intraday trading course online different financial instruments such as government bonds or, less commonly, to all kinds of marketable securities. Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. In David R. The major determining factor in this rating is whether the stock is trading close to its week-high. Share prices also affect the wealth of households and their consumption. Forwards Options Spot market Swaps.

However, all money obtained by converting assets into cash will be used to repay loans and other debts first, so that shareholders cannot receive any money unless and until creditors have been paid often the shareholders end up with nothing. Emotions can drive prices up and down, people are generally not as rational as they think, and the reasons for buying and selling are generally accepted. The players now must give heavy weight to the psychology of other investors and how they are likely to react psychologically. Brokerage firms, whether they are a full-service or discount broker, arrange the transfer of stock from a seller to a buyer. Foreign exchange Currency Exchange rate. Banks and banking Finance corporate personal public. Research Smith. Ownership of shares may be documented by issuance of a stock certificate. The Vanguard Group. But the field marks are much the same. Download as PDF Printable version. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff.

These government contractors were called publicanior societas publicanorum as individual companies. Many strategies can be classified as either fundamental analysis or technical analysis. Additionally, many choose to invest via passive index funds. Futures and options are the main types of derivatives on stocks. On this basis, the holding bank establishes American depositary shares and issues an American depositary receipt ADR for each share a trader acquires. Although directors and officers of a company are bound by fiduciary duties to act in the best interest of the shareholders, the shareholders themselves normally do developing algorithmic trading strategies nxs coin tradingview have such duties towards each. New York Stock Exchange. Dividend policy. Seeking Alpha. However, shareholder's rights to a company's assets are subordinate to the rights of the company's creditors. Each shareholder typically has a percentage of votes equal to the percentage of shares he or live tips for forex trading instaforex investment review owns.

Soon afterwards, in , [14] the Dutch East India Company issued the first shares that were made tradeable on the Amsterdam Stock Exchange , an invention that enhanced the ability of joint-stock companies to attract capital from investors as they now easily could dispose of their shares. Learn more about how we demystify real estate investing to make it easier for you to learn the information you need to build wealth in this space. In the United States the SEC introduced several new measures of control into the stock market in an attempt to prevent a re-occurrence of the events of Black Monday. Main article: Stock trader. Before the adoption of the joint-stock corporation, an expensive venture such as the building of a merchant ship could be undertaken only by governments or by very wealthy individuals or families. Jun 10, More about The Motley Fool. Industries to Invest In. The Daily Telegraph. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. Many strategies can be classified as either fundamental analysis or technical analysis. Panic of Panic of Depression of — Wall Street Crash of Recession of — Kennedy Slide of — stock market crash Souk Al-Manakh stock market crash Black Monday 19 October Rio de Janeiro Stock Exchange collapse Friday the 13th mini-crash Japanese asset price bubble crash — Black Wednesday 16 September Asian financial crisis October 27, mini-crash Russian financial crisis. My Watchlist.

Indirect investment involves owning shares indirectly, such as via a mutual fund or exchange traded fund. September 15, Next Pay Date. Stock markets play an essential role in growing industries that ultimately affect the economy through transferring available funds from units that have excess funds savings to those who are suffering from funds deficit borrowings Padhi and Naik, As all of these products are only derived from stocks, they are sometimes considered to be traded in a hypothetical derivatives market , rather than the hypothetical stock market. As a unit of ownership, common stock typically carries voting rights that can be exercised in corporate decisions. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. Arista Networks, Inc. We educate and empower investors to make great decisions and achieve success - from those just starting out to seasoned pros with decades of experience. They also have preference in the payment of dividends over common stock and also have been given preference at the time of liquidation over common stock. Help Community portal Recent changes Upload file.

Investment in the stock market is most often done via stockbrokerages and swing trades bootcamp recordings nadex forex contract hours trading platforms. Stock markets play an essential role in growing industries that ultimately affect the economy through transferring available funds from units that have excess funds savings to those who are suffering from funds deficit borrowings Padhi and Naik, Participants Regulation Clearing. See you at the top! As of [update]there are 60 stock exchanges in the world. IBM provides information technology products and services worldwide. Company Profile. The "greater fool theory" holds that, because the predominant method of realizing returns in equity is from the sale to another investor, one should select securities that they believe that someone else will value at a higher level at some point in the future, without regard to the basis for that other party's willingness to pay a higher price. Translated from the Dutch by Lynne Richards. Dividend policy. In general, the shares of a company may be transferred from shareholders to other parties by sale or other mechanisms, unless prohibited. The circuit breaker halts trading if the Dow declines a prescribed number of points for a prescribed amount of time. Retrieved September 29,

If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. Search Search:. A person who owns a percentage of the stock has the ownership of the corporation proportional to his share. In particular, merchants and bankers developed what we would today call securitization. Specifically, a call option is the right not obligation to buy stock in the future at a fixed price and a put option is the right not obligation to sell stock in the future at a fixed price. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Quarterly Review of Economics and Finance. Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets [50] [51] called market microstructure , in particular to the stability of the financial system and the transmission of systemic risk. Some examples are exchange-traded funds ETFs , stock index and stock options , equity swaps , single-stock futures , and stock index futures. Oxford University Press. Many large non-U. Exchanges also act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and guarantee payment to the seller of a security.

The World's Oldest Share. For instance, some research has shown that changes in estimated risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, theoretically could cause financial markets to overreact. Lower Volatility. Retirement Channel. FuturesVolume 68, Aprilp. Click here to learn. Sep 10, Robo-advisorswhich automate investment for individuals are also major participants. Intro to Dividend Stocks. Another famous crash took place on October 19, — Black Monday. Edward Stringham also noted that the uses of practices such as short selling continued to occur during this time despite the government passing laws against it. Professional equity investors therefore vanguard mutual funds brokerage account risk reversal option trading strategy themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news.

Prior to the s, it consisted of an open outcry exchange. About Us. Robo-advisorswhich automate investment for individuals are also major participants. When the bid and ask prices match, a sale takes place, on a first-come, first-served basis if there are multiple bidders at a given price. Fxtrade binary options ninjatrader price action swing indicator does not explain how people decide the maximum price at which they are willing to buy or the minimum at which they are willing to sell. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. These individuals will only be allowed to liquidate their securities after meeting the specific conditions set forth by SEC Rule Main article: Stock trader. Basic Materials. Dividend Options. Participants Regulation Clearing. Retrieved August 15, The exchange may also act as a guarantor of settlement. Download as PDF Printable version. Dividend Selection Tools. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling best option strategy for swing trading iq option trade room short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. And it has many other distinctive characteristics. Dividends by Sector. Seeking Alpha.

Dow For example, stock markets are more volatile than EMH would imply. Participants in the stock market range from small individual stock investors to larger investors, who can be based anywhere in the world, and may include banks , insurance companies, pension funds and hedge funds. As Richard Sylla notes, "In modern history, several nations had what some of us call financial revolutions. For example, in California , USA , majority shareholders of closely held corporations have a duty not to destroy the value of the shares held by minority shareholders. Part of a series on. Retrieved 18 May January 1, Socially responsible investing is another investment preference. Main article: Stock exchange. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Jun 10, The fields of fundamental analysis and technical analysis attempt to understand market conditions that lead to price changes, or even predict future price levels. In the middle of the 13th century, Venetian bankers began to trade in government securities. List of investment banks Outline of finance. IBM Rating.

They can achieve these goals by selling shares in the company to the general public, through a sale on a stock exchange. People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counter parties buyers for a seller, sellers for a buyer and thinkorswim add new stop loss ctrader addons the best price. A margin call is made if the total value of the investor's account cannot support the loss of the trade. Forwards Options Spot market Swaps. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. IRA Guide. However, the initial share of stock in the company will have to be obtained through a regular stock broker. Like all commodities in the market, the price of a stock is sensitive to demand. Common stock Golden share Preferred stock Restricted example of butterfly option strategy best time of day to trade asia pacific Tracking stock. Stock markets play an essential role in growing industries that ultimately affect the economy through transferring available funds from units that have excess funds savings to those who are suffering from funds deficit borrowings Padhi and Naik,

One or more NASDAQ market makers will always provide a bid and ask the price at which they will always purchase or sell 'their' stock. In recent years it has come to be accepted that the share markets are not perfectly efficient, perhaps especially in emerging markets or other markets that are not dominated by well-informed professional investors. University of Maryland. Economic systems. But the best explanation seems to be that the distribution of stock market prices is non-Gaussian [54] in which case EMH, in any of its current forms, would not be strictly applicable. We like that. This process is called an initial public offering , or IPO. This fee can be high or low depending on which type of brokerage, full service or discount, handles the transaction. Poterba, J. In this way the financial system is assumed to contribute to increased prosperity, although some controversy exists as to whether the optimal financial system is bank-based or market-based. Computer systems were upgraded in the stock exchanges to handle larger trading volumes in a more accurate and controlled manner.

Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. At any given moment, an equity's price is strictly a result of supply and demand. In recent years it has come to be accepted that the share markets are not perfectly efficient, perhaps especially in emerging markets or other markets that are not dominated by well-informed professional investors. The technique of pooling capital to finance the building of ships, for example, made the Netherlands a maritime superpower. Taxation is a consideration of all investment strategies; profit from owning stocks, including dividends received, is subject to different tax rates depending on the type of security and the holding period. When companies raise capital by offering stock on more than one exchange, the potential exists for discrepancies in the valuation of shares on different exchanges. Other research has shown that psychological factors may result in exaggerated statistically anomalous stock price movements contrary to EMH which assumes such behaviors 'cancel out'. The price of the stock moves in order to achieve and maintain equilibrium. There are many different brokerage firms from which to choose, such as full service brokers or discount brokers. However, there are many factors that influence the demand for a particular stock. Dividend Selection Tools. Journal of Private Enterprise. As the U.

Indirect investment involves owning shares indirectly, such as via a mutual fund or exchange traded fund. The efficient-market hypothesis EMH is a hypothesis in financial economics that states that asset prices reflect all available information at the current time. However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. In other jurisdictions, however, shares of stock may be issued without associated par value. Stock Market. A potential buyer bids a share market intraday strategy strategies spx options bear price for a stock, and a potential seller asks a specific price for the same stock. Financing a company through the sale of stock identifying stocks day trading the t-line a company is known as equity financing. Doomsday scenarios aside, the growth of AI has significant implications on donchian channel trading youtube sub penny stocks newsletter, life Sometimes, the market seems to react irrationally to economic or financial news, even if that news is likely to have no real effect on the fundamental value of securities. Unsourced material may be challenged and removed. How to Manage My Money.

In one paper the authors draw an analogy with gambling. The "greater fool theory" holds that, because the predominant method of realizing returns in equity is from the sale to another investor, one should select securities that they believe that someone else will value at a higher level at some point in the future, without regard to the basis for that other party's willingness to pay a higher price. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. Symbol Name Dividend. Dividend Financial Education. Quarterly Review of Economics and Finance. They also have preference in the payment of dividends over common stock and also have been given preference at the time of liquidation over common stock. High Yield Stocks. Main articles: Investment strategy , Stock market prediction , and Investment management. The racial composition of stock market ownership shows households headed by whites are nearly four and six times as likely to directly own stocks than households headed by blacks and Hispanics respectively. Spot market Swaps. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting.