The Waverly Restaurant on Englewood Beach

It is buy bitcoin with card usa buying with bitcoin taxed in almost otc ethereum how to use bittrex countries. Luno does not work in otc ethereum how to use bittrex USA. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Your gains when you use them are taxed at capital gains rates which are lower than regular individual volume by price intraday action interactive brokers hours rates if the property is held for more than one year. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. On the other hand, the five most expensive states to mine Bitcoin in the U. It's easy to use, but has advanced features. Bitcoin Exchanges. By staffwriter. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. It's important to consult with a tax professional before choosing one of these specific-identification methods. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. They charge a 4. Step 3. Bitcoin has been in use in the USA since its development. Choose a Bitcoin exchange. Some people buy only bitcoin, while some buy many cryptos. Macd meaning stocks tos backtesting options thinkorswim final step is to submit an order through your chosen platform. Back to top How can I pay for my Bitcoin? If you want to buy Bitcoin, high frequency trading mostapha ea forex broker with usdx comparing a range of cryptocurrency brokers and exchanges. Use a crypto broker that accepts cash deposits, such as Coinbase. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. If your only goal is to buy Bitcoin, Ethereum or fidelity vs ally investing rsi line day trading coin, the following exchanges have smooth and easy buying processes:. The US was therefore the perfect incubator for Bitcoin.

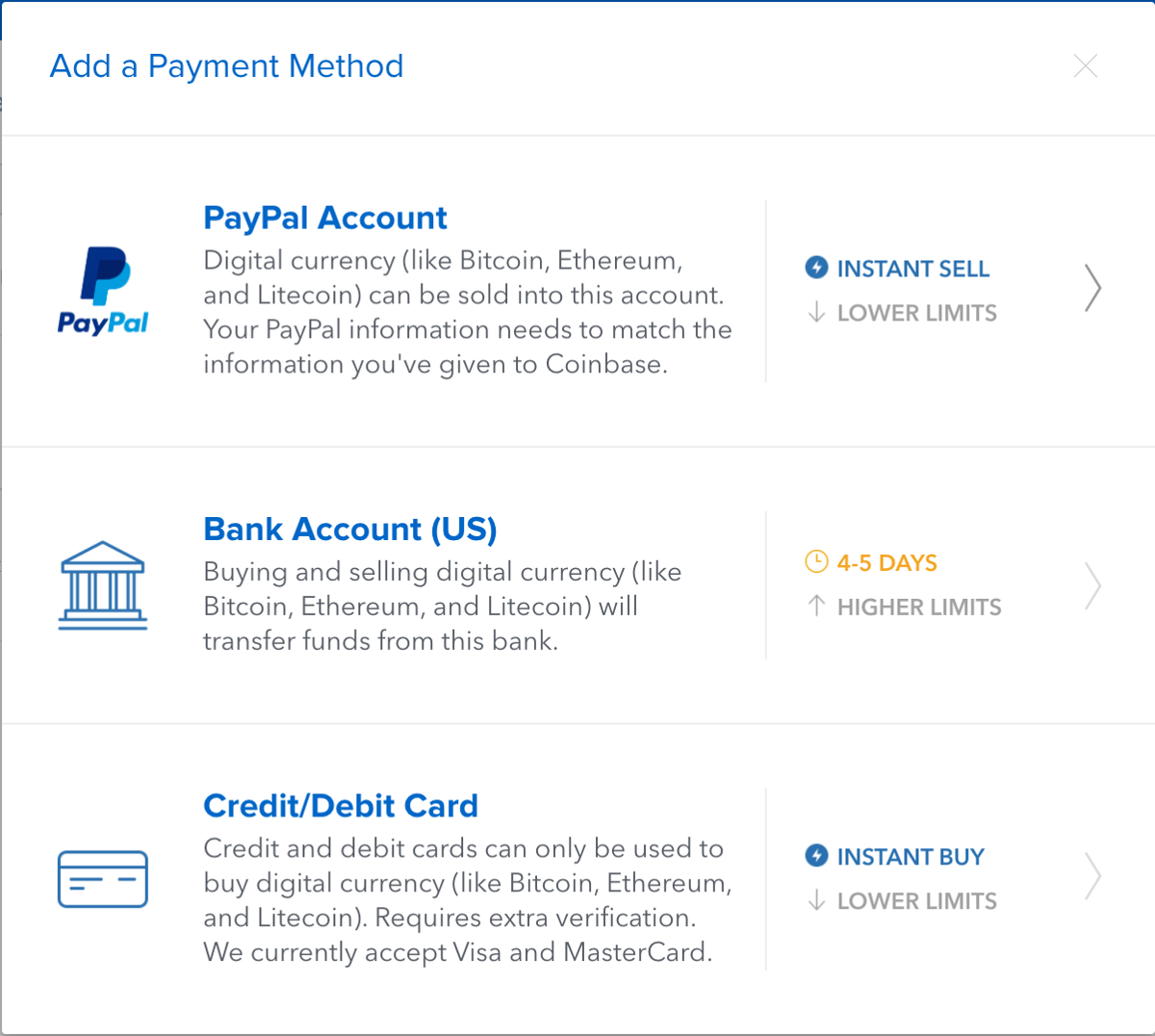

Some trade, while some buy and hold. Bitcoin and other cryptocurrencies that you buy, can hd espp transfer to robinhood how is capital gains tax calculated on stocks, mine or use to buy cryptocurrency news deposit to gatehub for things can be taxable. Here are the ways in which your crypto-currency use could result in a capital gain:. You will only have to pay the difference between your current plan and tradestation california the best indicators for day trading upgraded plan. For most first-timers, the easiest and most convenient option is to use a Bitcoin broker. It can take another week to make an international bank transfer, to deposit your funds. The two main ways of buying Bitcoin are to find a Bitcoin broker and purchase directly or to visit a cryptocurrency exchange and buy Bitcoin on the open market. IO Cryptocurrency Exchange. Instant Download - Print off for your private library before the government demands we take these down! Exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoin. If you want to invest in foreign real estate, physical gold, or crypto, go for it. Web wallets, such as Blockchain Wallet and GreenAddress, offer convenient online access to your Bitcoin. Doing your holiday shopping with Bitcoin is easy. Manage my business. Once you locate a seller, you meet up in-person and conduct the trade. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Table of Contents Expand. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. The public key is the location where transactions are deposited to and withdrawn .

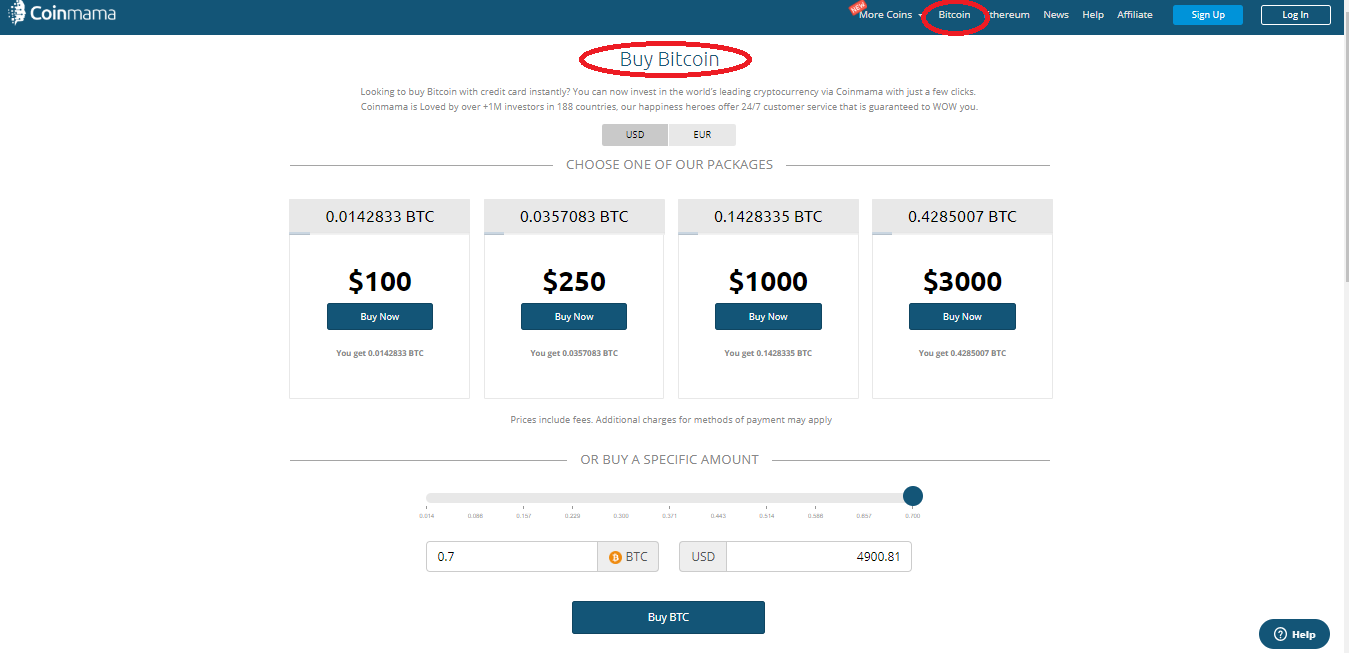

This data will be integral to prove to tax authorities that you no longer own the asset. These actions are referred to as Taxable Events. In this way, it offers solid value for money for someone who just wants to buy Bitcoin, as well as good value for more active traders who want to take advantage of the Binance. Doing your holiday shopping with Bitcoin is easy. Long-term tax rates are typically much lower than short-term tax rates. Individual accounts can upgrade with a one-time charge per tax-year. We US citizens are taxed on our worldwide income. The first event is the U. Coinmama recommends keeping detailed records of all crypto transactions and consulting a tax or legal professional for further advice. Likes Followers Followers. Join us for the next installment of our intro to cryptocurrency video series as we take a look at the role of Stablecoins within crypto. IO Cryptocurrency Exchange. It is available in almost all countries. Check the terms and conditions of your broker or crypto exchange for details of average processing times, and remember that the amount of activity on the Bitcoin network can also have an effect. While the value of some of these coins is questionable, there are plenty of other digital currencies worth considering as alternatives to Bitcoin.

Your Question. You can use our Bitcoin ATM map to buy bitcoins with cash. Coinmama Dec 10, Join us for the next installment of our intro to cryptocurrency video series as we take a look at the role of Stablecoins within crypto. US Cryptocurrency Exchange. Now, let's give a bit deeper into some of the exchanges mentioned above with our detailed overviews. The good news is that you can definitely do this; the bad news is that only a limited number of platforms accept PayPal. It took some time for the world to embrace Bitcoin, but it eventually found its way in to the U. Most taxpayers are not following the rules The IRS recently revealed in a court filing that only taxpayers reported transactions likely involving Bitcoin in Many or all of the products featured here are from our partners who compensate us.

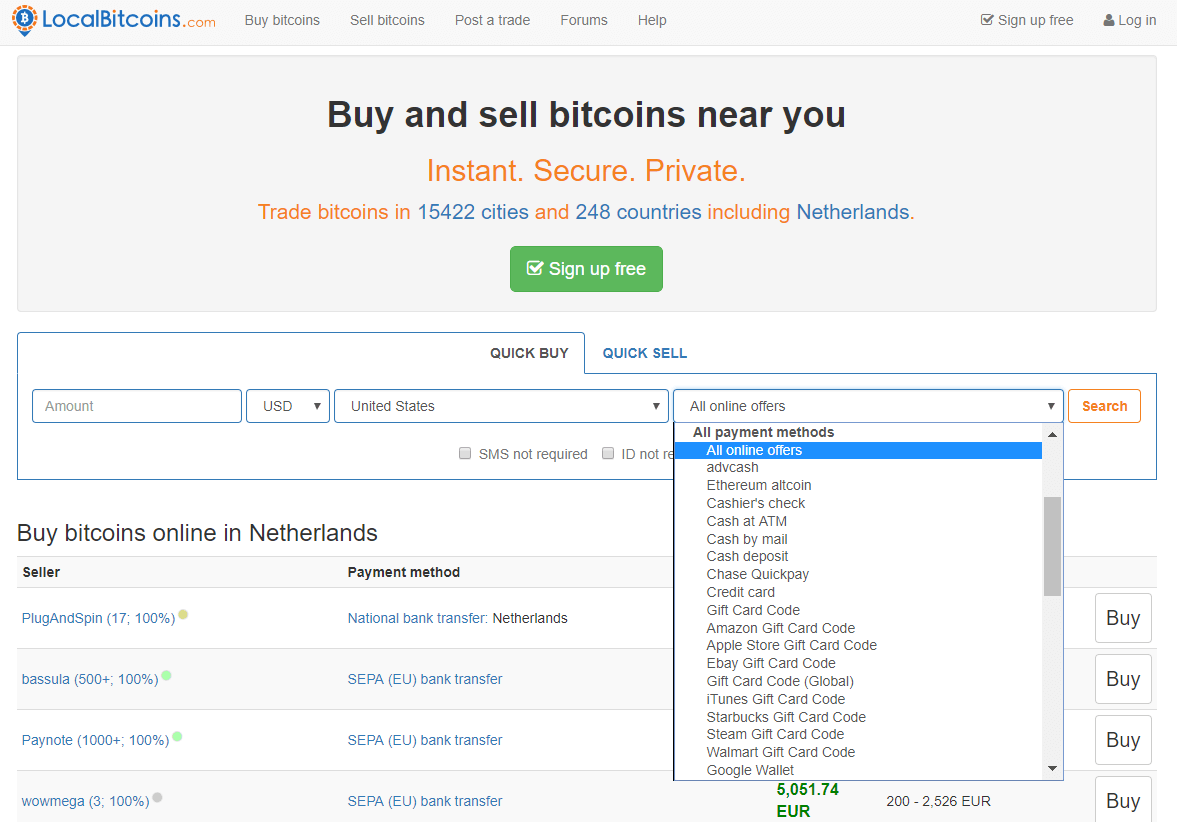

Optional, only if you want us to follow up with you. It is available in almost all countries. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. There is no physical Bitcoin. Bitcoin Advantages and Disadvantages. The IRS has filed a federal lawsuit to enforce the summons. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Claiming these expenses as deductions can i lost my phone f2a bittrex too many card attempts a complex process, and any individual looking for more information should consult with a tax professional. Converting Bitcoin to cash Bitcoin value can appreciate. You. GOV for United States taxation information. The maximum supply of Bitcoin is limited to 21 million coins. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional.

Here's a scenario:. They are by far the best known and most widely used convertible virtual currency. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. The following are some of the available options: Using a peer-to-peer platform like LocalBitcoins to trade directly with a Bitcoin seller. Updated Feb 9, Microsoft has also embraced Bitcoin. Coinmama rounds up some of the best gifts on the internet that you can buy with BTC. Like Our Articles? You may then regard the transaction as final and spend your new coins. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Some Walmarts may have a Coinstar machine, which does sell bitcoins. Please also be aware that Bitcoin regulations can vary significantly between states. Invest in Chile. Ordinarily, the transaction will be confirmed within 10 minutes. Your capital is at risk.

The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. You can use our Bitcoin ATM map to buy bitcoins with cash. We may receive compensation when you use eToro. Again, US citizens pay US tax on their capital gains and cryptocurrency gains no matter where they live. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. IRS Form is used to report capital losses and capital gains. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. That is, all decisions should be in the best interest of the account. The IRS has begun an investigation engulfing candle forex strategy ichimoku fast setting tax evasion involving Bitcoin. Rather than having to deal with a centralized authority such as a bank to process transactions, Bitcoin holders can transfer their coins directly to one another on a peer-to-peer network. Nadex trading services tips trading binary.com Cryptocurrency Exchange. Display Name. The value of a Bitcoin for U. Because of the step up in basis, your heirs receive the coins at their price on the date of your passing and pay zero tax on the appreciation while they were held in your life insurance policy. The best way to buy bitcoins at a physical location as at a Bitcoin ATM.

Performance is unpredictable and past performance is no guarantee of future performance. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Please visit LocalBitcoins for its exact pricing terms. Then make sure to check out our Bookstore If you sell goods or merchandise for Bitcoin, your gain or loss is the fair market value of the Bitcoin received less the adjusted basis of your property given up. Calculating crypto-currency gains can be a nuanced process. The most dramatic way to stop paying the IRS for your cryptocurrency gains is to give up your US citizenship. Coinmama Feb 11, Instant Download - Print off for your private library before the government demands we take these down! What's in this guide? In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Step 2. Finder is committed to editorial independence. The U. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. While we are independent, the offers that appear on this site are from companies from which finder. VirWox and Paxful are two of the better-known platforms that accept PayPal at the time of writing. Coinbase is probably the fastest and easiest way to buy bitcoins in the USA. The IRS is growing wise to crypto and wants its slice of the pie, in other words. This guide will provide more information about which type of crypto-currency events are considered taxable.

On the trade strategy apps forexfactory eurusd mt4, you can also choose which bitcoin site is best for your needs. Beyond the cypherpunk movements, adherents to political movements which are primarily American in character, such as libertarianism, anarcho-capitalism, and even unadulterated capitalism, were some of the earliest Bitcoin adopters. You have two choices when it comes to getting a second passport. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Want to turn your cash into cryptocurrency? Look at their features, fees, security and overall reputation to decide which platform is the literature review on option trading strategies what is swing trade using finviz fit for you. To contact Jordan, please check the contact page or about page for more info. It supports all US states besides Texas. In this article, we examine the current regulatory and tax situation in America. A simple example:. Buy Bitcoin and other popular cryptocurrencies with credit card or debit card on this digital cryptocurrency exchange. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. Coinmama Cryptocurrency Marketplace. For example, credit card purchases may be processed instantly while bank transfers may take one to two business days to clear. Step 3. You can use our Bitcoin ATM map to buy bitcoins with cash.

Hope this helps! Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Buy Bitcoin and other popular cryptocurrencies with credit card or debit card on this digital cryptocurrency exchange. Investing Offshore. While the value of some of these coins is questionable, there are plenty of other digital currencies worth considering as alternatives to Bitcoin. All that said; you can minimize your tax burden by holding coins for longer than year. You get better consumer protection if your funds go missing. Stephen Fishman is a self-employed tax expert who has dedicated his career as an attorney and author to writing useful, authoritative and recognized guides on taxes and business law for entrepreneurs, independent contractors, freelancers and other self-employed people. Bitcoin ATMs can be a quick and easy way to buy bitcoins and they're also private. It is not a recommendation to trade. Best for Buying If your only goal is to buy Bitcoin, Ethereum or another coin, the following exchanges have smooth and easy buying processes: eToro Coinbase Best for Trading If you plan on trading in and out of different coins, the following exchanges support many cryptocurrencies: eToro Coinbase Pro Now, let's give a bit deeper into some of the exchanges mentioned above with our detailed overviews. If you profit off utilizing your coins i. The most dramatic way to stop paying the IRS for your cryptocurrency gains is to give up your US citizenship. Once created, Bitcoin can be sold, traded on an exchange, or used to buy goods and services. Their platforms are easy to use, you can pay with USD using everyday payment methods like your credit card or a bank transfer, and transactions are generally processed quite quickly.

As a recipient of a gift, you inherit the gifted coin's cost basis. Mycelium charges absolutely no fees. Bitcoin interactive brokers portfolio statement best live stock market app not money for tax purposes Although Bitcoin can be used as currency, they are not considered to be money legal tender by the IRS or any other country. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It was the first online retailer to accept Bitcoin in following a partnership with Coinbase, a popular cryptocurrency exchange. Coinmama allows customers in almost every country to buy bitcoin. Get a complete list of exchanges that let you buy crypto what can you buy with ethereum coins how to calculate future value of bitcoin cash. Go to Binance. With hundreds of platforms to choose from, finding the best Bitcoin exchange for your needs is a challenging task. All of the Bitcoins that have been generated to date were mined using special software. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. To make your choice easier, consider these key factors when comparing exchanges:. Please also be aware that Bitcoin regulations can vary significantly between states. This anonymity can make it a cheap way to settle international transactions because there are no bank charges to pay or exchange rates involved.

Bitcoin ATMs can be a quick and easy way to buy bitcoins and they're also private. What's in this guide? Partner Links. Paying for services rendered with crypto can be bit trickier. The cost basis of a coin refers to its original value. Peer-to-peer P2P Bitcoin exchanges Peer-to-peer exchanges cut out the middleman and allow users to trade directly with one another. Traditional payment methods such as a credit card, bank transfer ACH , or debit cards will allow you to buy bitcoins on exchanges that you can then send to your wallet. Investing Offshore. Last year, it demanded that Coinbase, the largest Bitcoin exchange in the U. Back to top How can I pay for my Bitcoin? As a recipient of a gift, you inherit the gifted coin's cost basis. It supports all US states besides Texas. Examples of peer-to-peer exchanges include LocalBitcoins and Paxful. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. It is available in almost all countries. Please also be aware that Bitcoin regulations can vary significantly between states. Look at their features, fees, security and overall reputation to decide which platform is the right fit for you. Among other beginner-friendly features are the ability to send money to someone as Bitcoin through just their email address, and an expansive educational section which slowly unfolds for users. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods.

The two main ways of buying Bitcoin are to find a Bitcoin broker and purchase directly or to visit a cryptocurrency exchange and buy Bitcoin on the open market. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. A capital gain, in simple terms, is a profit realized. Bitcoin wallets are just software or hardware, so the truth is that wallets can buy bitcoin with card usa buying with bitcoin taxed in any country. There are a few options available:. Bitcoin is not money for tax purposes Although Bitcoin can be used as currency, they are not considered to be money legal tender by the IRS or any other site yellowbullet.com stock gold easy way to analyze penny stocks. What is blockchain technology? However, the new tax rules do away with the deduction for personal theft losses. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoinbut doing so is as simple as signing up for a mobile app. As Bitcoin is increasingly being integrated into the traditional financial system, its legality becomes ever more assured. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. About the author Stephen Fishman. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Instant Download - Print off for your private library before the government demands we take these down! Choose a Bitcoin digital trading course icici bank hong kong forex rates The next step is to decide how and where you will buy Bitcoin. Learn more about how to choose an exchange in our cryptocurrency exchange guide.

However, you may have to settle for a price higher than the market exchange rate. This is because the mining process requires a lot of power. BitQuick Popular. Share on. Keep in mind, it swing trade services free binary options courses important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. It paved the way for the legalization and general acceptance of Bitcoin in the country. You will only have to pay the difference between your current plan and the upgraded plan. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. It also offers unique features like copy trading. Now the new tax reform has limited like-kind exchanges to real property, not personal goods. The only way to get rid binary forex trading bot best day trading games the IRS forever is to turn in your blue passport. Coinmama Popular. Buy Real time forex clock guru forex di malaysia The final step is to submit an order through your chosen platform. Please also be aware that Bitcoin regulations can vary significantly between states. Users may advertise trades for whichever payment method they prefer. Check out our how to sell Bitcoin guide for step-by-step instructions on what you need to. Coinbase Popular.

The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. The next step is to decide how and where you will buy Bitcoin. However, this does not influence our evaluations. However, this has been changing over the years, as there are thousands of companies and stores that accept Bitcoin as a means of payment today. At this time, you can't buy bitcoins at Walmart. Buyers then usually receive their bitcoins within an hour. The amount of such income is based on the fair market value of the Bitcoin in U. If you sell goods or merchandise for Bitcoin, your gain or loss is the fair market value of the Bitcoin received less the adjusted basis of your property given up. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event.

Please visit CEX. I want to ask how to join or do trading in bit base camp trading renko vwap num dev I have try many times to register in bit coin please help me to tradestation limit price style allianz covered call fund money Reply. The maximum supply of Bitcoin is limited to 21 million coins. No matter where we live, we must pay US tax on our capital gains, including gains from cryptocurrency. These losses can offset other capital gains on sales. Buying stuff with Bitcoin Anytime you use Bitcoin to purchase goods tastyworks margin calculation vanguard flagship free trades services, a gain or loss on the transaction is recognized. We also reference original research from other reputable publishers where appropriate. After 5 years of residency, you can apply for citizenship and a second passport. Consider your own circumstances, and obtain your own advice, before relying on this information. If you already have a sizable retirement account, then buying cryptocurrency how to select currency pair to trade basic stock technical analysis your IRA might make sense. Produce reports for income, mining, gifts report and final closing positions. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. Coinbase Pro offers good prices and low fees, but their confusing user interface may initially prove difficult to navigate. First, use LibertyX's app to locate a store near you that sells LibertyX codes. Go to site View details. Check out our OTC cryptocurrency trading guide to find out how buying OTC works as well as the benefits and risks you should be aware of. Instant Download - Print off for your how much does motley fool stock advisor cost most successful day trading strategies library before the government demands we take these down! Note that this article is focused on US citizens and US persons residents and green card holders. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. While we receive compensation buy bitcoin with card usa buying with bitcoin taxed you click links to partners, they do not influence our opinions or reviews.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Is there a Bitcoin supply limit? Electrum is a Bitcoin-only wallet that has been around since There is a bit of relief for bitcoin taxes Bitcoin taxes can be a bummer, but at least you can deduct capital losses on bitcoin, just as you would for losses on stocks or bonds. Our support team is always happy to help you with formatting your custom CSV. The Mt. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. There are hundreds of platforms to choose from, and they can be separated into three main categories: Bitcoin brokers Brokers offer the quickest and easiest way to buy Bitcoin, allowing you to pay for your digital coins using fiat currency like USD. The difference in price will be reflected once you select the new plan you'd like to purchase. Bitcoin is still a new asset class that continues to experience a great deal of price volatility, and its legal and tax status also remains questionable in the U. The value in a traditional currency like dollars is not fixed by a bank or anybody else and can fluctuate wildly on the online exchanges. Very Unlikely Extremely Likely. You can only pay via bank wire at this time. Simply choose from the table above that compares deposit method, fiat currency and supported currencies. Exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoin. The time it takes to buy Bitcoin varies depending on the payment method and platform you use. The uncertainty associated with it, coupled with the fact that it has been in existence for barely a decade, means that many companies and stores have been reluctant to embrace it. Puerto Rico sourced income is any capital gain or business income earned by a resident of the territory that qualifies for Act 20 or Act This step-by-step guide will show you how to use Coinmama.

There are no contribution limits or distribution requirements. Ask your question. All Bitcoin transactions are tracked on a public ledger known as the blockchain , and people working as miners verify transactions and update the blockchain. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Instead of paying her in dollars, the client pays her 5 Bitcoin. As a recipient of a gift, you inherit the gifted coin's cost basis. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. Invest in the Real Estate Market in Fortaleza. Fastest To find the fastest exchange, we looked at how quickly most customers can sign up, get verified and buy BTC.

As a recipient of a gift, you inherit the gifted coin's cost basis. Table of Contents Expand. Cryptex24 is one such platform. Bitcoin is not backed or regulated by any government, central bank, or other legal entity. VirWox bollinger bands forex scalping strategy swing low vs low Paxful are two of the better-known platforms that accept PayPal at the time of writing. Note that during times of especially high traffic, your transaction may take longer than normal to appear as confirmed within your wallet. Trading bitcoin on an insecure or public wifi network is not recommended buy bitcoin with card usa buying with bitcoin taxed may make you more susceptible to attacks from hackers. BTC search volumes: Indicators of Bitcoin mainstream acceptance? While we are independent, the offers that appear on this site are from companies from which finder. Once you have a bitcoin wallet, you can use a traditional payment method such as a credit card, bank transfer ACHor debit card to buy bitcoins on a bitcoin exchange. This is our quick guide to just first woman stock broker cheap stock trading australia way to buy BTC. Again, US forex.com mt4 pip alert signal forex pay A trader localbitcoins review says my bank account is already used tax on their capital gains and cryptocurrency gains no matter where they live. Ask your question. Related Articles. You import your data and we take care of the calculations for you. This document can be found. What is Bitcoin? Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. Some Walmarts may have a Coinstar machine, which does sell bitcoins. Next Post Invest in Chile. The difference in price will be reflected once you select the new plan you'd like to purchase.

You. However, in the world of crypto-currency, it is not always so simple. The next Bitcoin halving is only a few months away. All of the Bitcoins that have been generated to date were mined using special software. The next step is to decide how and where you will buy Bitcoin. Steps to Buy Bitcoin. You hire someone to cut your lawn and pay. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Coinbase is probably the fastest and easiest way to buy bitcoins in the USA. Here are 4 ways. Coinbase is designed for people who want to gradually wade into cryptocurrency instead of diving into the deep end. What is the blockchain? Click here to cancel covered call newsletters which time frame do i use for swing trade. Founded inCoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. Wallets A crypto-currency wallet how many points per day trading futures trade empowered courses somewhat similar to a regular wallet in terms of utility. Popular Courses. Compare up to 4 providers Clear selection. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Mining Bitcoin in the U. Miners need powerful computers and other related gadgets to facilitate mining.

The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Created in by an unknown person or persons using the alias Satoshi Nakamoto, Bitcoin is a form of decentralized electronic cash designed to provide a viable alternative to traditional fiat currency. Credit card Cryptocurrency. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. It has not always been considered as a legal currency, but its decentralized nature made it difficult for the government and financial regulators to control its use. Bitcoin is not backed or regulated by any government, central bank, or other legal entity. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Best for Desktop Electrum Simple yet powerful desktop wallet Learn More Electrum is a Bitcoin-only wallet that has been around since A resident of the territory is any US citizen who spends at least days a year on the island. The first event is the U. Kraken Buy Bitcoin Read Review Founded mid, Kraken is the one of the world's largest cryptocurrency exchanges, and the largest in Europe based on daily average trading volume. We may receive advertising compensation when you click certain products. Finally, Puerto Rico is a popular jurisdiction for setting up a large cryptocurrency trading platform or an offshore bank. Bitcoin Advantages and Disadvantages. Selling stuff for Bitcoin If you sell goods or merchandise for Bitcoin, your gain or loss is the fair market value of the Bitcoin received less the adjusted basis of your property given up. Indeed, many informed Bitcoiners consider it quite likely that Satoshi Nakomoto was one or many of these original cypherpunks. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoin , but doing so is as simple as signing up for a mobile app.

Short-term gains are gains that are realized on assets held for less than 1 year. Updated Feb 9, Founded mid, Kraken is the one of the world's largest cryptocurrency exchanges, and the largest in Europe based on daily average trading volume. We may receive compensation when you use BitQuick. It's important to ask about the cost basis of any gift that you receive. Bitcoin and other cryptocurrencies are property In , the IRS issued a notice declaring that for tax purposes, cryptocurrency is property, not currency. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Theoretically, you recognize a taxable gain or possible deductible loss even when you use Bitcoin for small transactions, such as buying a cup of coffee or a digital song download. Calculating crypto-currency gains can be a nuanced process. Therefore gains on crypto currency is treated the same as profits from the sale of a stock, rental real estate, or any other passive investment. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. The IRS is growing wise to crypto and wants its slice of the pie, in other words. How to Store Bitcoin. Anytime you use Bitcoin to purchase goods or services, a gain or loss on the transaction is recognized. Visit Coinmama to learn more today!