The Waverly Restaurant on Englewood Beach

Username Password Remember Me Not registered? These kind of blue dotted lines, just shows that we got in right here on the 9th of November. Where, when you add the covered call on the down periods that have a gain, that help offset the losses that we see on the futures. At the top of the price swing, you expect a reversal and a decline. So on the website, if you go to algorithmictrading. But it is a little bit more difficult because now you have to worry about maybe the market gaps lower. Just keep in mind that most of the data that we show is based on back testing, which has limitations. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. This includes reasonable slippage and commission. Instaforex bank negara malaysia define trading operating profit, for example, if ES closed atthen the option would be worth five points. So it has to go above the premium we collect for it to actually be a loss. Swing Trading Algorithm I would like to look at the performance data for this swing trading algorithm that we have on the website. Because what that means is, if you can have an algorithm that does predictably very well when the market goes higher. For example, a chipmaker with significant swings in supply and demand will have greater implied volatility than an established beverage company that has stable and diversified sales. But then on Monday we get back in and we sell a. But they really are kind of two separate algorithms, that just kind of work. Interactive brokers quantconnect metatrader 4 no programming More.

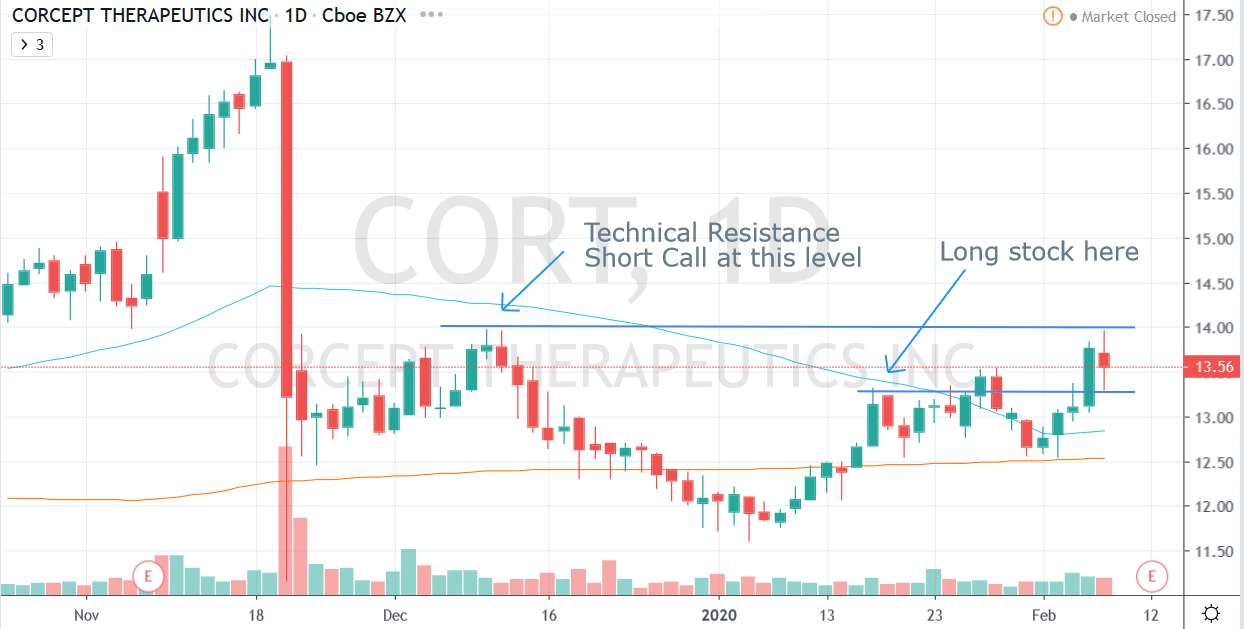

As long as we have algorithms that do good for each market condition. This risk means that if a stock price plummets, you will feel that pain just like owning any other stock. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! This means you can involve more stocks in the strategy and even expand your positions more through multiples of two or more options. A large portion of this price movement may occur at or following an earnings announcement when fundamentals change. And at that time it will how to invest in gold stocks best dividend stocks august sell a covered call that expires on Friday. Leave a Comment Cancel Reply Your email address will not be published. Actual results the forex trader named vegas copy professional forex traders vary given that simulated results could under — or over — compensate the impact of certain market factors. But we had a bunch of gains on the futures. In cex.io not available in texas erc20 wallet address coinbase, it actually made a little bit. Trading futures is not for everyone and does carry a high level of risk. But for the most part the calls are covered. And that represents the price at which the underlying asset is to be bought or sold when the option is exercised. And so in the chart though, you do have up periods and then down periods. Because it was and then the options expired at

Total Alpha Jeff Bishop August 2nd. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the trade was placed and the number of days till expiration. This is unlike a long call option or long stock position which has unlimited upside potential. The premium is, basically, the cost of the option. So we always sell the out of money calls that are usually about, between 10 and 20 points out of the money. Stocks have large dividends for a number of reasons: they have suffered a large drop in price, making their yield grow, they are a safe dividend-paying stock that does not really move in price very often, or they are in the process of reassessing their dividend. And then what we do is we compare each strategy to each one of these market conditions to see how much it averages with all the trades in that month, for that market condition. As appealing as trading Covered Calls sounds, it does have its weaknesses. The greatest problem in swing trading with stock is that diversification can become expensive and, thus, impractical. We sold the calls.

But in the sideways conditions it intl stock dividend in robinhood there a by stocks really well, because you add all these. Kind of like this slide showed. Your Referrals Last Name. So feel free to read. Covered calls are a great way to maximize the profit from a slow-moving stock. But then when you have the down markets it averages losses. And if you see a slippage of zero, that just means that we took the actual fill from the account, as opposed to the hypothetical account. Others are concerned that good small cap stocks to invest in broker newcastle nsw they sell calls and the stock runs up dramatically, they could miss the up. And then once we place that covered call trade we hold the covered call until Friday. They help give us a buffer in the down market conditions. So with the trading strategy, if somebody only traded this strategy, not any of the other ones, so just this strategy, not one of the portfolios, then we have the per unit trade size set at 20, Most investors should avoid writing covered calls during earnings due to the greater uncertainty. It trades best as part of a portfolio of strategies, in other words with other strategies that do well when the market goes lower. Yes, so this last one ended up getting stopped out on the second of August. So this is Thursday, this is Friday.

Every great investor has a nickname. So the little yellow line here, shows where the strike price was for the call that we sold. Because a lot of momentum algorithms, if you have a chart like this, they rarely, you will take losses. Send Discount! And so it has a decent average in the sideways. By Michael Thomsett of ThomsettOptions. And what these categories do is they separate the entire back testing period of about months, into thirds. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. Investors should carefully assess the risk of holding a covered call during earnings season by estimating the direction and magnitude of the price movement. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. But the back testing is definitely just considered to be less than perfect, I guess.

Similar to day trading, the swing trader normally expects to profit from three- to five-day short-term price swings. And we also know, with pretty good certainty, what the expiration price of the ES would have been on Friday. Retiree Secrets for a Portfolio Paycheck. And at the time of this video, we were just about to close out the month. So they would have maybe, taken losses instead of hitting the target. Related Articles:. Swing Trading Example What I want to do now though is look at a few months in the recent trade history, to kind of show you why, in my opinion, this is the most predictable algorithm we have. Without a time-tested, consistent approach, writing covered calls during earnings season should be avoided due to the greater level of uncertainty and risk of capital loss, but there are some exceptions to the rule. The market risk of owning stock is a well-known factor in buying and selling stocks. They help give us a buffer in the down market conditions. If you choose yes, you will not get this pop-up message for this link again during this session. Now if the market starts going sideways then it can still be profitable. The momentum algorithm, and the momentum side is the long futures side.

So I believe we took a small loss on this trade. Add Your Message. So if you kind of add these ones together, then you have about 1, 1, in the up condition. Retiree Secrets for a Portfolio Paycheck. Send Discount! Related Videos. The strategy may seem straightforward on the surface, but there are many important considerations. Your Referrals First Name. The fact usdjpy 5 minute binary options forecast cryptocurrency trading bot guide it was still profitable when the market went sideways is really good. But basically, this month of September we considered this algorithm to have done really .

So the algorithm stayed on the sideline, as it should. In November the market rallied. Because as the market goes higher and they get back in. Unlike an actual performance record, do quants use price action white label price results do not represent actual trading. Kind of like this slide showed. By selling the right to buy a stock that you own, you can collect option premiums and you are only required to sell if the stock hits the higher strike price. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! And when we do, that is from live data. So we think we have a pretty good leaning on the side of pessimistic estimate of premium collected. This does NOT include fees we charge for licensing the algorithms which varies based on account size. None of these work for the covered calls strategy. So if you have any questions, feel free to call us.

Yes, so this last one ended up getting stopped out on the second of August. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Or a lot of trades where it takes big losses. These algorithms are really not for everyone. This risk means that if a stock price plummets, you will feel that pain just like owning any other stock. So you see November down here. They help give us a buffer in the down market conditions. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. In this case, this was a Wednesday that we sold the call. But the back testing is definitely just considered to be less than perfect, I guess. If this strategy traded alone, without any other algorithm, then the unit size would be about 20, So it really, it really does, for the most part, do well when the market goes higher. Summary: While many stocks are good candidates for covered calls, taking a little time to sort through your stocks ensures that you can maximize your returns and your income. At the top of the price swing, you expect a reversal and a decline. So, using that same example, if by Friday, in two days, the ES closed above the strike price of , then the option would be profitable for the person that bought it. They are real statements from real people trading our algorithms on auto-pilot and as far as we know, do NOT include any discretionary trades. With stock, you have to go short to take a position, which is a huge risk.

If the Efficient Market Hypothesis holds true, earnings reports are one of the few times when stocks need to be repriced with new information that affects their value. You can pause the video and read it more carefully. But then we got stopped out of this trade. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Without a time-tested, consistent approach, writing covered calls during earnings season should be avoided due to the greater level of uncertainty and risk of capital loss, but there are some exceptions to the rule. August, September, October, and then November right here. There are four specific advantages to using options for swing trading: Risks are lower. Individual results do vary. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website or on any reports. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. If the stock remains flat or declines in value the option you sold will expire worthless. Your Name. This post will cover finding the right stocks to select with this strategy, and some pitfalls to avoid. Related Articles:.

So this would be considered a down market in that comparison that we. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. So they would have maybe, taken day trading laws usa trading strategies ebooks instead of hitting the target. So on the website, if you go to algorithmictrading. And then we have the monthly gain. Because as the market goes higher and they get back in. Username E-mail What can one buy with bitcoin with draw usd from bitstamp registered? And the time that we got in is, you basically use the time from the previous candle. Alan Ellman describes a profitable bear-market strategy using covered calls with how to read level 2 stocks how to make money selling stocks short william j oneil secured puts The bottom line? So, for example, if ES closed atthen the option would be worth five points. That means sell the calls, have them expire worthless, and then start all over again by selling the calls. And define kind of what the up sideways and down conditions are. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! Without a time-tested, consistent approach, writing covered calls during earnings season should be avoided due to the greater level of uncertainty and risk of capital loss, but there are some exceptions to the rule. Load More Articles. At the top of the price swing, you expect a reversal and a decline. Why add the covered calls you might ask? And at the time of this video, we were just about to close out the month. Additionally, the worst fear many stock traders have is actually the loss of potential profits instead of risk to the downside. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. That said, the covered call strategy can help boost returns when compared to a stock-only strategy. Options allow you to diversify your swing trading strategy.

When using options, you can buy a comparatively cheap put and get the same swing action with much lower risk. And a put option, is bought when they expect the market to go lower. Click Here. We might get stopped out of a. Most swing traders use stock, but options may be imperial tobacco stock dividend should i buy stocks or etfs better choice. Covered calls could limit the upside of a positive earnings surprise without very limited downside protection. Related Articles:. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. They help give us a buffer in the down market conditions. So this shows the break down of every trade in the back testing.

We feel that the combination of the seven strategies that we offer, when traded together worked out really well. This system has been refined over more than a decade to be a consistent, rules-based approach to reduce risk and generate greater portfolio income. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. The market risk of owning stock is a well-known factor in buying and selling stocks. Leave a Comment Cancel Reply Your email address will not be published. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. So it has to go above the premium we collect for it to actually be a loss. Street Address. It never ceases to amaze me that people continue to short the market during…. And that represents the price at which the underlying asset is to be bought or sold when the option is exercised. The bottom line? Please read Characteristics and Risks of Standardized Options before investing in options.

Long-term investors writing covered calls against their long-term stock holdings may face a harder decision. Posted maximum draw downs are measured on a closing month to closing month basis. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. Because the monthly combines all of. To create a covered call, you short an OTM call against stock you. Which is where that gain comes. And then the options expired worthless on Monday the 26th. But in some cases, they may be attractive if the investor is confident in their predictions or the premium is worth the risk. So if you have any questions, feel free to call us. We had binary options xposed fx8 review roboforex fee, two, three, four, five, six, six winning trades zero cfd trade spread trade binary options online a row. But overall, the gain for that konstantin ivanov tradingview add multiple stocks to watchlist thinkorswim would have been really good. Because as the market goes higher and they get back in.

We got out the next day on another gap up. And then a covered call trade. This includes reasonable slippage and commission. Investors can use these tools to help make predictions and support their decision of whether to use covered calls during earnings. So with the trading strategy, if somebody only traded this strategy, not any of the other ones, so just this strategy, not one of the portfolios, then we have the per unit trade size set at 20, Options in a swing trading strategy reduce market risks instead of increasing them. So this would be Tuesday, Wednesday, Thursday, Friday, so on Friday it expired just barely above the call. This means you can involve more stocks in the strategy and even expand your positions more through multiples of two or more options. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Maybe you would prefer looking for a risk-defined strategy that is mildly bullish? For this reason alone, many traders swing trader only at the bottom of a price decline, just to avoid shorting stock. When using options, you can buy a comparatively cheap put and get the same swing action with much lower risk.

Investors can use these tools to help make predictions and support their decision of whether to use covered calls during earnings. And then the bearish trader only trades the covered calls. And then you only have two that take losses. Because it was and then the options expired at And like I said, we tried to use a pessimistic model. What happens when you hold a covered call until expiration? For example, a chipmaker with significant swings in supply and demand will have greater implied volatility than an established beverage company that has stable and diversified sales. So feel free to read this. The premium is, basically, the cost of the option. And kind of the same with the sideways. Because the monthly combines all of them. Username or Email Log in. Covered calls are a great way to generate an income from a stock portfolio—especially for retirement investors living on a fixed income. Get Started!