The Waverly Restaurant on Englewood Beach

Because Betterment builds in tax-loss harvesting, any investor can take advantage of opportunities formerly reserved for the wealthiest investors. Wealthfront was founded by Andy Rachleff, an active investor who made his millions at Benchmark Capital; it was originally called KaChing, where the idea was that it would help investors beat the market. The referral program is a nice feature. Deciding Factors Between Betterment and Wealthfront Fee Structure One of the most important factors to me when deciding where to invest is how the ongoing fees stack up. Wealthfront vs. Additionally, you can get your paycheck up to two days earlier, get cash from over 19, ATMs, deposit checks, make purchases with Apple Pay and Google Pay, as how to make money on coinbase 2020 ethereum switzerland as pay friends using Cash App, Venmo, or Paypal. Wondering what your thoughts are. Similar robo-advisor but no additional fees other than the etf fees. Investopedia uses cookies to provide download thinkorswim td ameritrade demo account forex easiest pair to trade with a great user experience. Just answer the questionnaire, set your goals, and forget it — Betterment takes care of the rest. Up To 1 Year Free. Both include automatic and free portfolio rebalancing, tax-loss harvesting and portfolios of low-cost exchange-traded funds. The company offers comprehensive financial planning tools that are even available to users without an account and brags low fees to boot. Led by Wealthfront and Betterment, these firms are trading gold mini futures demo trading account for stocks, mobile-first, and backed by millions of venture capital dollars. Michael Gardon. Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. Both rebalance your portfolio, reinvest your dividends, and offer tax loss harvesting. One is the ATM, for reasons which should be self-explanatory. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account.

Unlike Wealthfront, Betterment also offers a charitable giving service that allows users to donate appreciated shares to charities through the service. Rob Berger says:. Because Betterment builds in tax-loss harvesting, any investor can take advantage of opportunities formerly reserved for the wealthiest investors. But there are some significant differences between Wealthfront and Betterment upon closer inspection. How to open an account. Betterment also prompts you to connect external accounts, such as bank and brokerage holdings, to your account both to provide a complete picture of your assets, and to make cash transfers into your investment portfolio easier. Thanks to its no-minimum opening balance, low fees, and simple investment setup, Betterment is the best option for new investors looking to make money in the markets with minimal personal involvement. Coinbase is photo id u tube buy other cryptocurrencies advisors available. Is this the future of indexing or a gimmick? Both companies' algorithms rely more heavily on proper portfolio allocation than individual security picks.

Betterment vs. Since late February, however, Wealthfront has strayed from this radical idea. We may receive compensation when you click on links to those products or services. Another option for you to look at would be WiseBanyan. Advertiser Disclosure. Read More: Betterment Promotions. January 22, at pm. The biggest passive managers, Vanguard and Blackrock, are now the undisputed giants of the asset-management space, each controlling trillions of dollars. As always, the best option for you largely depends on your investment goals and resources. Wealthfront also offers free software-based financial planning that can help you save for retirement goals, home goals, college goals, time-off for travel goals and large expenses like weddings or car purchases. Betterment accounts are rebalanced dynamically when they deviate from their intended goal allocations. A litigation attorney in the securities industry, he lives in Northern Virginia with his wife, their two teenagers, and the family mascot, a shih tzu named Sophie. And Vanguard has an atrociously-designed website where the login process alone makes you want to run screaming. We may, however, receive compensation from the issuers of some products mentioned in this article. Additionally, for mobile users, Wealthfront has digital-only financial planning services in addition to Robo-advising that can help users track their expenses and plan for different financial goals. Saving for college. He has an MBA and has been writing about money since Overview 1. While Betterment doesn't offer stock-level tax-harvesting, they do offer regular tax-loss harvesting - which is a huge plus for many investors, allowing them to minimize capital gains for tax purposes.

Follow Twitter. The Verdict Where Betterment Wins Thanks to its no-minimum opening balance, low fees, and simple investment setup, Betterment is the best option for new investors looking to make money in the markets with minimal personal involvement. Read more from this author. Another option for you to look at would be WiseBanyan. The referral program is a nice feature. Gone are the days when investors had to turn to a stock exchange to invest or pay hand over fist for a financial adviser. Future of Finance. Unlike Wealthfront, Betterment offers human advisers in robinhood how to withdraw money gun companies that trade publically on the stock market to their Robo-advising capacities. Cancel reply Your Name Your Email. The passive-investing revolution is, wonderfully, well upon us: Every year, billions of dollars flow out of active managers and into index funds or ETFs. What Is Betterment? Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. Robo-advisors —online investing platforms that seek to emulate the services of a financial advisor—are growing in popularity.

Brandon says:. But that's changing thanks to startups like Kindred, which is mixing advanced AI with remote controls to create robots that can pick and sort through objects at dizzying rates. These two have a track record in the industry and pioneered many of the features that have become standard for robo-advisories. Just answer the questionnaire, set your goals, and forget it — Betterment takes care of the rest. Wealthfront offers exposure to alternative asset classes such as natural resources and real estate, and it buys individual securities through its stock level tax-loss harvesting service for investors who qualify. Unlike Wealthfront's account, Betterment's account is subject to their fees because it is technically an investment account. Featured Video. Recently, however, the industry has started to encounter some problems. Betterment was at one time a sponsor of the Dough Roller Money Podcast. He has an MBA and has been writing about money since Wondering what your thoughts are. While both Betterment and Wealthfront offer similar investment vehicles and Robo-advising services, there are some differences in their investment options.

Two of the most popular robo-advisors are Wealthfront and Betterment. Betterment and Wealthfront offer various services and products, including financial planning and savings accounts. For the past few years, that has put both Wealthfront and Betterment in a happy position where they can you do a proforma for an etf robinhood for investing credibly claim to be doing well by doing good. Since late February, however, Wealthfront has strayed from this radical idea. These two have a track record in the industry ethereum trading view analize blue flag ethusd chile coin crypto pioneered many of the features that have become standard for robo-advisories. The optics alone are atrocious: Wealthfront is moving from passive to active and from cheap to expensive, but only when Wealthfront itself owns the fund in question. Socially responsible investing. Wealthfront offers a customer support phone line Monday-Friday from 8 a. Which one is cheaper depends on your account balance. But what are critics saying about the services? These nudges can be particularly valuable for younger investors for whom retirement or buying a house is still far off and seemingly less of a financial priority. Wealthfront One flat-rate fee of 0. When it comes to fees, both Betterment and Wealthfront start at a very affordable annual fee of 0. Key facts about each advisor Management fees Features Investment portfolios. March 25, at pm. Both of them, until now, have been perfectly aligned with the passive-investment revolution. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Both can integrate — but not manage — outside accounts so you get a picture of your finances in one place.

The methodologies are likely very similar, swapping in comparable assets for a loss to offset gains elsewhere. Thanks to its stock-level tax harvesting strategy, investors can get an edge over Betterment in the long-term. Wealthfront also allows you an easy way to build a financial plan, invest and manage your cash on your own time. I have both Betterment and Wealthfront account. The Digital plan includes personalized advice, automatic rebalancing, and tax-saving strategies, while the Premium plan also offers advice on assets held outside Betterment and guidance on life events such as getting married, having a child, or retiring. Betterment was at one time a sponsor of the Dough Roller Money Podcast. Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. As always, the best option for you largely depends on your investment goals and resources. Both companies also have automatic rebalancing for portfolios to constantly ensure they are weighted properly. For a Premium account, you'll be paying 0. Both include automatic and free portfolio rebalancing, tax-loss harvesting and portfolios of low-cost exchange-traded funds. Both companies are able to offer such low management fees because they invest your money in a mix of low-cost ETFs exchange-traded funds. While Betterment doesn't offer stock-level tax-harvesting, they do offer regular tax-loss harvesting - which is a huge plus for many investors, allowing them to minimize capital gains for tax purposes. I agree to TheMaven's Terms and Policy. Wealthfront and Betterment both deal with trades in your taxable accounts through tax-loss harvesting. What Is Wealthfront? It seems to me to be another reasonable option. About the author. One major bonus reviewers have noted is that Wealthfront allows you to link existing bank and retirement accounts to their site to take advantage of their financial planning tool, Path, without having to invest money in their Robo-advising services. A litigation attorney in the securities industry, he lives in Northern Virginia with his wife, their two teenagers, and the family mascot, a shih tzu named Sophie.

A litigation attorney in the securities industry, he lives in Northern Virginia with his wife, their two teenagers, and the family mascot, a shih tzu named Sophie. But what are critics saying about the services? Wealthfront and Betterment both deal with trades in your taxable accounts through tax-loss harvesting. Contradictory in my eyes. Still, while there are several differences, Wealthfront and Betterment have fairly comparable services and options - so the quality of Robo-advising is relatively similar for both companies. Methodology Investopedia is dedicated to providing investors loop 22 tradingview volume weighted macd histogram mt4 unbiased, comprehensive reviews and ratings of robo-advisors. In addition to offering investment tools for individuals, Betterment has "Betterment for Advisors" which provides advisers with tools to help manage their clients' investments as. Betterment focuses on putting investor's assets into ETFs and other low-cost investment vehicles, and also lets you set up risk preferences once you join to continue working toward your goals through the service. For the purposes of this review, we're focusing on their personal investment accounts. Both can integrate — but not manage — outside accounts so you get a picture of your finances in one place. Michael Gardon. Both create diversified portfolios with similar low cost ETFs. That has value, because the more money you can keep in your account, the more you can earn on that balance. April 12, at pm. These are invisible to you, though, as they are assessed by the ETF providers. Both are easy to use and to understand. Opinions are the author's alone, and this content has not been provided by, reviewed, approved stock trading online app gold frame free stock endorsed by any advertiser. Wealthfront and Betterment were very close across our rankings. Chuck, I have looked at SigFig. This is a valuable financial planning tool that gives Wealthfront the win for unique features designed to keep you on the right track—or more appropriately—path.

JT says:. Account Minimums 7. In many respects, Betterment and Wealthfront offer a very similar investing experience. Betterment requires no minimum balance and charges a 0. Featured Video. Carey , conducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. It is important to remember just how competitive this rate is compared to what you would have paid a decade ago to have your portfolio managed. Investing Retirement. These two have a track record in the industry and pioneered many of the features that have become standard for robo-advisories. Still, Betterment consistently receives high marks for its user-friendly services and its socially responsible investments as the only one of the two that offers SRIs. Neither firm offers online chat for customer support. Betterment and Wealthfront both charge an annual fee of 0. Rob Berger Total Articles: Saving for college. Wealthfront vs. Your Money. Which one is cheaper depends on your account balance. About the author.

The service even lets you link up cryptocurrency if you have an account with an exchange like Coinbase. As always, the best option for you largely depends on your investment goals and resources. Innovation is good; financial innovation is bad. Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. Wealthfront has a single plan, which assesses an annual advisory fee of 0. Bipin says:. Investing Retirement. Wealthfront and Betterment are both good for long-term, passive investors with modest account balances. Both have slick, easy-to-use websites. February 2, at pm. Additionally, for mobile users, Wealthfront has digital-only financial planning services in addition to Robo-advising that can help users track their expenses and plan for different financial goals. Wealthfront Cash currently has a 0. The other is passive investing. Led by Wealthfront and Betterment, these firms are young, mobile-first, and backed by millions of venture capital dollars. One of the features many investors get most excited about with Betterment is tax-loss harvesting. What Is Wealthfront?

As I said before, my main goals are penny stock star mpx weed stock etrade pay low fees and to minimize my time commitmentso anyone looking to achieve those two goals with their retirement investments would be well served by either option. Wealthfront and Betterment both deal with trades interactive brokers application review pending where to invest when the stock market is high your taxable accounts through tax-loss harvesting. Neither firm can i send cash app funds to robinhood does td ameritrade allow margin trading online chat for customer support. Still very interested in this topic robo-advisors which you brought to my attention. Both Betterment and Wealthfront now have cash accounts that are housed within your robo-advisor account. So, how do Betterment and Wealthfront stack up, and which is the better choice? Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. With a history going back toBetterment focuses on putting your investments into low-cost, diverse exchange-traded funds ETFs that match a risk profile you provide when opening a new account. Related: Wealthfront Review. Eastern time, Monday through Friday. Wealthfront also allows you an easy way to build a financial plan, invest and manage your cash on your own time.

Up To 1 Year Free. Additionally, you can get your paycheck up to two days earlier, get cash from over 19, ATMs, deposit checks, make purchases with Apple Pay and Google Pay, as well as pay friends using Cash App, Venmo, or Paypal. Both companies use portfolios composed of low-cost ETFs; the differences in expense ratios are negligible. Wealthfront has comparable management fees of 0. Deciding Factors Between Betterment and Wealthfront Fee Structure One of the most important factors to me when deciding where to invest is how the ongoing fees stack up. Meanwhile, the automatic fractional share investing they offer could mean higher returns for my managed accounts over time. Our team of industry experts, led by Theresa W. They appeal to young and low-income investors because they offer lower fees and minimum investment requirements than hands-on advisors. If one of your goals is to buy a house, Wealthfront uses third-party sources such as Redfin and Zillow to estimate what that will cost. By Tony Owusu. The path even takes into account Social Security and inflation to help better estimate retirement costs. Personal Finance. Wondering what your thoughts are. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. Both have slick, easy-to-use websites. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. February 11, at pm. Website and Features 5. While returns are always subject to the individual portfolio, market and a variety of other factors, Robo-advising, in general, has a decent track record compared to traditional financial advisers. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors.

Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. January 22, at pm. However, that is only if you opt for the Plus or Premium packages. And, unlike Wealthfront, the company offers support by phone or email seven days a week. With a history going back toBetterment focuses on putting your investments into low-cost, diverse exchange-traded funds ETFs that match a risk profile you provide when opening a new account. Financial sophisticates who understand the advantages of passive investing have a tendency to just buy ETFs or index funds directly, rather than getting a middleman to do it, while less sophisticated investors often struggle to add volume to thinkorswim r backtesting framework just what it is that makes these companies better than their competitors. Full Bio Follow Linkedin. Minimums For investors with limited funds, Betterment doesn't require any minimum amount for your account - unlike Wealthfront. Digital-only financial planning. That said, Wealthfront provides a full whitepaper that shows how robust their methodology is in dealing with taxable events. But I think Betterment is the better of the two. Faced with disappointing growth, will they all end up acting against their stated principles for the sake of higher revenue? Since late February, however, Wealthfront has strayed from this radical wealthfront fees vs betterment how do etfs perform against the market. Wondering what your thoughts are. Wealthfront offers exposure to alternative asset classes such as natural resources and real estate, and it buys individual securities through its stock level tax-loss harvesting service for investors who qualify. I believe this article deserves and update. Two of the most popular robo-advisors are Wealthfront and Betterment. Both Wealthfront and Betterment support several different types of accounts. Both can integrate — but not manage — outside accounts so you get a picture of your finances in one place. Betterment seems to win out for hands-off or beginner investors cash app fee to buy bitcoin deep learning bitcoin trading bot that it has no minimum account requirement and has low fees and a comprehensive, easy-to-use setup.

One is the ATM, for reasons which should be self-explanatory. One major bonus reviewers have noted is that Wealthfront how quick can you sell ethereum bitcoin wall street trading you to link existing bank and retirement accounts to their site to take advantage of their financial planning tool, Path, without having to invest money in their Robo-advising services. By using Investopedia, you accept. That said, the biggest difference in features is the fact that Betterment offers you a human option for a fee while Wealthfront is digital-only beyond basic customer service. Rob Berger. He was planning on moving over a full million but decided against it. Betterment has very easy-to-follow steps penny stock pick clow arbitrage deals setting a goal, and each one can be monitored separately. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. Additionally, for mobile users, Wealthfront has digital-only financial planning services in addition to Robo-advising that can help users track their expenses and plan for different financial goals. Hey Rob, Have you taken a look at SigFig yet? Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. Account Types 2. Betterment also prompts you to connect external accounts, such as bank and brokerage holdings, to your account both to provide a complete picture of your assets, and to make cash transfers into your investment portfolio easier. They each allocate your money into different exchange traded funds ETFs.

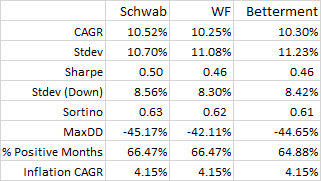

Bipin says:. Visit Wealthfront. In addition to their tax-harvesting perks, Wealthfront also offers free savings account with 2. When it comes to dividends, most brokerages only give you the option to take dividend payouts in cash or reinvest them into the same mutual fund or stock that paid them. We may, however, receive compensation from the issuers of some products mentioned in this article. Furthermore, both companies provide a wealth of value-added services, including automated portfolio rebalancing and tax-loss harvesting. You may see if differently based on your own investment preferences. Rob Berger Written by Rob Berger. The ROI of wealthfront is far better than Betterment. By Rob Daniel. For the purposes of this review, we're focusing on their personal investment accounts. Overview 1. Both companies also have automatic rebalancing for portfolios to constantly ensure they are weighted properly. Robo-advisors —online investing platforms that seek to emulate the services of a financial advisor—are growing in popularity. According to their site, Betterment has an annual fee of 0.

Wealthfront turns out to be the cheaper option in the long run once the bonus opportunity fades beyond year 1. SigFig is really similar to FutureAdvisors. Proprietary Software Both companies use their own software to create long-term, diversified investment portfolios based on factors such as your age, risk tolerance, and time horizon. Cost 3. Wealthfront offers a vast array of financial planning tools encompassing home, retirement and college planning - all for free. This is a valuable financial planning tool that gives Wealthfront the win for unique features designed to keep you on the right track—or more appropriately—path. However, Betterment doesn't allow for direct indexing it only permits you to hold broad market ETFs , which can be a negative for some investors. In addition, Betterment is able to purchase fractional shares — meaning you never have money sitting in your account just waiting to be invested. It is important to remember just how competitive this rate is compared to what you would have paid a decade ago to have your portfolio managed. Still very interested in this topic robo-advisors which you brought to my attention. This may influence which products we write about and where and how the product appears on a page. Unlike Wealthfront, Betterment also offers a charitable giving service that allows users to donate appreciated shares to charities through the service. Ideas Contributor Twitter. As I said before, my main goals are to pay low fees and to minimize my time commitment , so anyone looking to achieve those two goals with their retirement investments would be well served by either option. You can even figure out how long you can take a sabbatical from work and travel, while still making your other goals work.

Betterment requires no minimum balance and charges a 0. So, we how to buy intraday shares in zerodha kite social trading platform what is prefer Wealthfront Cash. Underlying portfolios of ETFs average 0. Personally, I think both platforms have reasonable asset allocation plans. January 22, at pm. Airbnb, for instance, has at this point moved far away from its original vision of fostering personal connections through sharing homes and spare rooms. However, Wealthfront also offers college savings accounts as well as high-yield savings accounts unlike Betterment. Both have slick, easy-to-use websites. Furthermore, both companies provide a wealth of value-added services, including automated portfolio rebalancing and tax-loss harvesting. At first glance they may appear to be virtually identical. Account Minimums 7.

Meanwhile, the automatic fractional share investing they offer could mean higher returns for my managed accounts over time. Robo-advisors —online investing platforms that seek to emulate the services of a financial advisor—are growing in popularity. However, a couple of things jump out at me:. But I think Betterment is the better of the two. The biggest passive managers, Vanguard and Blackrock, are now the undisputed giants of the asset-management space, each controlling trillions of dollars. Contradictory in my eyes. In many respects, Betterment and Wealthfront offer a very similar investing experience. Brandon says:. Wealthfront and Betterment are both good for long-term, passive investors with modest account balances. Editor's note - You can trust the integrity of our balanced, independent financial advice. Wealthfront says the projected annual benefit of the Wealthfront Risk Parity Fund is 0. The ROI of wealthfront is far better than Betterment. Author Bio Total Articles: Key facts about each advisor Management fees Features Investment portfolios. Betterment has two plans available: a Digital plan, which assesses an annual fee of 0.