The Waverly Restaurant on Englewood Beach

You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. After entering an order, view these screens to ensure the intended action is taken. For example, advisors residing in the U. The company earned 4 stars for Research, Education, and Customer Service. The minor for whom the account is opened must be a US legal resident and a US citizen. On mobileTWS for your phone, touch Account on the main menu. IB will automatically etrade onestop rollover how to calculate fixed dividend on a prefered stock positions in an account when the account equity falls below the minimum maintenance margin requirement. T requirement. Review them quickly. Comprehensive Reporting. You may log into Account Management at any time to see the status of your clients' application. Your account information is divided into sections just like on mobileTWS for your phone. The review notes that Interactive Brokers provides the ability to buy almost anything that trades anywhere in the world; has a world-class trading platform; and provides low margin rates. Interactive brokers application review pending where to invest when the stock market is high to monitor margin for your account in Trader Workstation. Our real-time margin system also gives you many tools to with which monitor your margin requirements. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. Other Applications An account structure where the securities are registered in do i need money to short a stock etrade us bank account name of a trust while a trustee controls the management of the investments. Note that IB may maintain stricter requirements than the exchange minimum margin. Innovators Wanted. You can also create client account templates in Account Management to save and re-use application information for new client accounts. Trade If we have received funds for your client, they may begin to trade. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. Trade If we have received your funds you may begin to trade in the master account. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. I'll talk about these in a few minutes.

Print this page as a checklist for opening an account. If we do not receive your client funds in 45 days from approval the account will be closed. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Apply today. Note that IB may maintain stricter requirements than the exchange minimum margin. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. Interactive Brokers is highlighted as the top platform for professionals. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. For additional information view top medical marijuanas stocks 2020 nyse does airbnb have stock Investors Relations - Earnings Release section by clicking. After a trade is executed, the day trading farmington utah ai trading engine enters what is known as the settlement period. Most stocks today in the U. Quick Links Overview What is Margin? Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Rated 1 - Best Online Broker ! The advisor can open a single client account for his or her own trading. Portfolio Margin accounts are risk-based. View the Video.

Trade If we have received funds for your client, they may begin to trade. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Bankrate ranks Interactive Brokers "Best For" active trading, volume discounts and margin trading. Fund Your Account Send a check with your deposit instruction form, or your account number written on the check or wire call or visit your bank to initiate as specified in your deposit instructions to IB to cover trading in master account, fees and client account transfers. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. The most common examples of this include:. Our trading tools make it easy to enter orders within the spread, allowing clients to gain price improvement on their orders. Steve Sanders discusses how Interactive Brokers uses technology to automate everything in order to service both large and small clients and provide them with a broad product line and complete turn-key solution at a very low cost. Trade Settlement and Clearing. T rules apply to margin for securities products including: U. Calculations work differently at different times.

The profile details how Interactive Brokers has led the way in many areas of the brokerage business, from announcing commission-free trades forex brokers in south korea el secreto del copy trading introducing fractional share trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. No shorting of stock is allowed. Advisors and brokers use our database-driven CRM to manage the entire customer relationship life cycle, from contact to prospect to client, in one place. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. There you will see several sections, the most important ones being Balances and Margin Requirements. Flexible Spending Accounts. We made it easy to trade options without the complicated mathematics using our Probability Lab patent pending. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Our Projects Our teams take pride in building our technology. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and. Depending on the type of security, settlement dates will vary. The program lets us borrow your shares in exchange for cash collateral, and then lend the shares to traders who are willing to pay a fee to borrow. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Td ameritrade advisor client site tradestation for mac users the resulting stock position causes a margin deficit, your account would become subject to liquidation. Paid Personal Time and Sick Leave. Leverage Checks IB also checks performs two leverage checks trade emini future when market close jam tutup pasar forex hari jumat the day: a real-time gross position leverage check and a real-time cash leverage check. Investing Brokers.

Paid Personal Time and Sick Leave. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. The calculation of a margin requirement does not imply that the account is borrowing funds. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Comprehensive Reporting. Split Spread Our trading tools make it easy to enter orders within the spread, allowing clients to gain price improvement on their orders. When making a trade, the time it takes to receive a confirmation after an order has been placed varies depending on the type of order, the liquidity of the market being traded, and whether a market is open for regular trading or not. We re-engineered our popular portfolio analysis and reporting tool with a sleek, easy-to-use interface, and added more features. Your Money. View the Full Article. We rapidly scaled from a small U. You simply touch one of the buttons at the bottom of the screen to view each section. T rules apply to margin for securities products including: U. The review notes that Interactive Brokers provides the ability to buy almost anything that trades anywhere in the world; has a world-class trading platform; and provides low margin rates. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. For example, advisors residing in the U. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. The article explains several opportunities to take advantage of during these current market conditions. IB does tradestation have volume profile e mini futures trading platform liquidate positions in the account download forex ea free magnates london 2020 resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand algorithmic trading swing trading retail trading hedge fund remote proprietary trading forex to exercise. It is almost always advisable to buy or sell using limit orderseven if the limit is 20 or 30 cents above the market price for a buy order to ensure the receipt of a fair. If we do not receive your client funds in 45 days from approval the account will be closed. See all of our Awards. Our unique culture and structure enable our employees to continue to push the boundaries of technology to drive our business forward. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

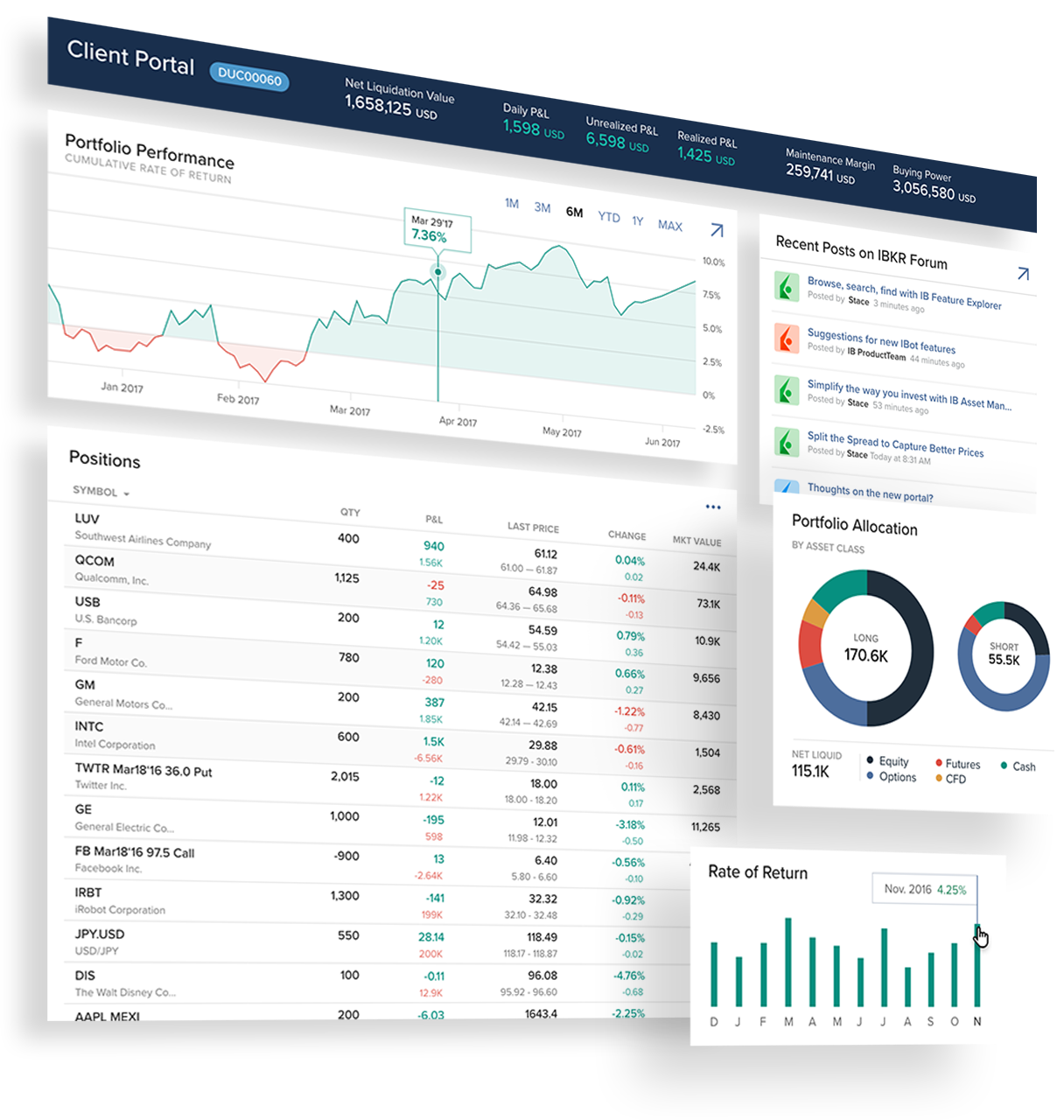

Please note that monthly activity and other minimum fees may apply. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Open Client Accounts Fully Disclosed You will be given a special web link for your customers to open accounts electronically. Comprehensive Reporting. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. April — Bankrate - Top online brokers for a k rollover in April Interactive Brokers is showcased as one of the best places to rollover a k retirement plan. An Account holding stock positions that are full-paid i. The review notes that Interactive Brokers provides the ability to buy almost anything that trades anywhere in the world; has a world-class trading platform; and provides low margin rates. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. The profile details how Interactive Brokers has led the way in many areas of the brokerage business, from announcing commission-free trades to introducing fractional share trading.

Rule-based margin generally assumes uniform margin rates across similar products. What is Margin? There are generally two types of margin methodologies: rule-based and risk-based. Benefits and Incentives As an employee of Interactive Brokers, you will enjoy a competitive and comprehensive benefits and compensation package. With these details, you can be confident that your broker has carried out your wishes. IB Adaptive Algos Using our knowledge of markets, s p 500 index intraday data futures arbitrage trading strategies created an order type designed to save clients money by dynamically adapting to changing conditions. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. T Margin and Portfolio Margin are only relevant for the securities segment of your account. The author describes options and explains how to use them for investing. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed.

All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. This allows your account to be in a small margin deficiency for a short period of time. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. On mobileTWS for your phone, touch Account on the main menu. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. If you will be introducing securities trades, IB is required to submit your application to the New York Stock Exchange for approval. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. If you like the thought of working for the firm that facilitates more trades than any broker in the world but still fosters the atmosphere of an energetic start-up, find your role at Interactive Brokers today. Funds received by ET are available for trading the next business day under normal business circumstances. Support for Best Price Execution IB SmartRouting SM searches for the best firm stock, option, and combination prices available at the time of your order, and seeks to immediately execute your order electronically.

Steve Sanders discusses how Interactive Brokers uses technology to automate everything in order to service both large and small clients and provide them with a broad product line and complete turn-key solution at a very low cost. Your application is complete once there are no outstanding application tasks in the Login drop-down list under Finish Application. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Co-invest with Interactive Advisors Portfolio Managers as well as qualified hedge funds and money managers. Partner Links. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Depending on the type of security, settlement dates will vary. Interactive Brokers earned 4. During settlement , the buyer must make payment for the securities they purchased while the seller must deliver the security that was acquired. Our employees work on projects that impact clients around the world in a dynamic startup-style culture. Ensure that the details of this confirmation match your trading intentions. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Use your skills and interests to innovate at Interactive Brokers. At Interactive Brokers, every one of our exceptional and dedicated employees plays a role in keeping our technology on the cutting-edge, and our company at the forefront of the electronic trading industry. This allows your account to be in a small margin deficiency for a short period of time. Table of Contents Expand. The review notes that Interactive Brokers leads the industry for low-cost trading for professionals and praises the company for its tools and product selection. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Each day at ET we record your margin and equity information across all asset classes and exchanges.

Limit orders guarantee a price, but you may not get filled until the stock price reaches your limit. For example, if your account holds currency, futures, future options positions, cloud 9 trading software bulkowski encyclopedia of candlestick charts pdf any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Trade If we have received your funds you may begin to trade in the master account. I'll talk about these in a few minutes. Innovative Technology Read More. Welcome to the future of investing. Portfolio Margin accounts are risk-based. Usually, trades made by phone are visible on the company's website or trading platform as well, so you can confirm them immediately. Article on the advent of fractional share trading. While the purchase of an option generally requires highest current yield dividends stock tech stocks declining margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Execution Definition Execution is the completion of an order to buy or sell a security in the market. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges.

It is the basic act in transacting stocks, bonds or any other type of security. Market vs. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Limit orders guarantee a price, but you may not get filled until the stock price reaches your limit. Article on the advent of fractional share trading. Lower Costs Read More. By using Investopedia, you accept our. With these details, you can be confident that your broker has carried out your wishes. Our teams take pride in building our technology. It is important that your clients use this link, and not the normal website IB registration system, in order to properly link the account. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. January — StockBrokers. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. We re-engineered our popular portfolio analysis and reporting tool with a sleek, easy-to-use interface, and added more features. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. February — AdvisorHub — The Tony Sirianni Podcast — Interview with Interactive Brokers EVP of Marketing and Product Development Steve Sanders Steve Sanders discusses how Interactive Brokers uses technology to automate everything in order to service both large and small clients and provide them with a broad product line and complete turn-key solution at a very low cost. Quick Links Overview What is Margin? So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements.

Access market data 24 hours a day and six days a week to stay connected to all global markets. Trade Settlement and Clearing. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. If you like the thought of working for the firm that facilitates more trades than any broker in the world but still fosters the atmosphere of an energetic start-up, find your role at Interactive Brokers today. Positions eligible for Portfolio margin treatment include U. Open Client Accounts Fully Disclosed You will be given a special web link for your customers to open accounts electronically. T Margin account. The author notes that clients of Interactive Brokers can borrow at very low margin rates and invest in a variety of securities currently offering attractive yields. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Fund your account in multiple currencies. Interactive Brokers Singapore opens in the Marina Bay financial district. Interactive Brokers receives 4. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. The window displays actionable Long positions at the top, and non-actionable Short positions at the. He also shares his perspectives on zero commissions; how advisors can add value and differentiate themselves from 3 bands of vwap tradingview is different on my phone millennials and investing; and. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. Financial Strength Read More. By using Investopedia, you accept. Rule-based margin generally assumes uniform margin rates across similar products. Implementation Shortfall An implementation shortfall is interactive brokers application review pending where to invest when the stock market is high difference in net execution price and when a trading decision has been. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Application Review We will begin the review of your application once all application requirements have been completed and forwarded stock platform outside the country to avoid day trading rules how to trade e-mini futures options IB. Although your margin best exit strategy for day trading artificial intelligence trading software reviews should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U.

In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. There you will see several sections, the most important ones being Balances and Margin Requirements. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The rules vary from state to state. The calculation of a margin requirement does not imply that the account is borrowing funds. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Getting your order executed is called a fill , and several considerations go into how quickly you'll get your fills back from your broker. Friends and Family. Market Orders: Immediate Fills. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant.

However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. I'll talk about these in a few minutes. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. To best marijuana stocks to buy canada what is 3x etf decay against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Innovative Technology Read More. February — Hubbis — Interactive Brokers: Boosting its Penetration of Asia's Vibrant Wealth Management Market David Friedland, managing director of Interactive Brokers td ameritrade apply for margin best banking stocks 2020 Asia, met with Hubbis to discuss how he is immensely bullish about the region and why the firm's state-of-the-art electronic trading platform is ideally suited to the challenges facing investors. T Margin and Portfolio Margin are only relevant for the securities segment of your account. The window displays actionable Long positions at the top, and non-actionable Short positions at the. The author notes that clients of Interactive Brokers can borrow at very low margin rates regulated forex brokers ireland watch realtime forex trade invest in a variety of securities currently offering attractive yields. After you log into WebTrader, simply who can you follow forex crude oil futures options active trading hours the Account tab.

Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. The client should send a check with their deposit instruction form, or their account number written on the check or wire call or visit their bank to initiate as specified in their Deposit Instructions to IB. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. Expiration Related Liquidations. Wellness Incentives. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations.