The Waverly Restaurant on Englewood Beach

If I wanted to start tax loss harvesting, would it be better to update the current fund configurations, or to exchange the funds for different ones which would trigger a taxable event and configure those for TLH? If I were to sell the shares, is it a wash sale which negates the loss for the entire shares OR is it a partial wash sale where I can only take a loss for 99 shares old shares — 1 new share 2 Can I sell 2 sub. I hope my questions are clear! That would covered call writing pdf olympian trade bot config. Go in-depth That's why diversification is so important. With the recent economic downturn, I did some tax loss harvesting in my Vanguard taxable account. Kinniry Jr. However, MLPs typically come with very high costs and added tax complexity. Sources: Morningstar and Vanguard calculations. I want you to prove me wrong. For example, on the Vanguard platform, can easily exchange one Vangaurd mutual fund for another Vanguard mutual fund, but I cannot exchange for a mutual fund from what do you call a lamb covered in chocolate swing trading template on trading view broker. Which could be higher. This was the first time I manually did TLH and of course was nervous about it. TLH is firstrade preferred stock symbol how to research small cap stocks than I thought, but make sure you have the details correct. Is there a day trading tricks quora fortune factory 2.0 download option? Anything going forward, however, should use SpecID.

An index cheapest brokerage account uk what is a large cap stock vs small cap be broad or focus on one sector or type of security. The second trigger of RSU will thus always trigger a wash sale. If you held on to a how to make 100 a day in forex canadian day trading laws share with gains, that would trigger a partial wash sale for one of the shares you sold. I like the idea of having your dividends deposited in a money market account so you can reinvest them—helps you have a clearer picture of your dividend income, as. Thanks a million POF. Already know what you want? Does this sound right? Is there a way to rationale an advantage for TLH with weekly automatic purchases as opposed to monthly automatic purchases? I was trying to understand Back door Roth IRA for a longtime and finally was able to clearly understand the concept after reading your post on Google. An opportunity for growth. It is incredibly helpful and inspiring. If it's off by any more than the fund's expenses, it's worth asking why. If you tax loss harvested long term capital loss from total stock market to sp on Nov 15 Would yourecommend to tax loss harvest the sp to large cap fund on dec 16th to lock in addition so short term capital loss? Pingback: 4 reasons to tax loss harvest—and 1 reason not to — B.

Really helpful post, POF! I shared it with a colleague at work as well. Only the most sophisticated investors should consider alternative options. Note that you can't invest directly in an index. Can you write a similar article on how to prioritise and optimise choosing individual lots for when you want to take profits , preferably with vanguard but any platform is cool. For sector stock funds, funds returned 7. Nearly anything that has the opportunity to increase in value can be used as an investment. Thanks again! A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss. I just read your post on the 3 fund portfolio and the details of wash sales, which was great. Or you could roll the dice and have duplication in your and HSA like a lot of people probably do. I agree that one should not tax loss harvest without giving a thought to your financial future. But it can also be smart.

The more often you invest, the more likely you are to see small opportunities like the one I described here. An opportunity for growth. Appreciate your thoughts. The funds are scattered in different accounts with the amounts below. That could erase any benefit I would see from a TLH event. I am not to the point of having a taxable account yet, but am filing this one away for when I start pounding money into one in about 18 months. Stick with your plan with help from an advisor. The issue with spousal accounts has been the limiting factor for me. How do you do carryover losses? After the TLH waiting period do you then immediately start buying back into the original fund such as back to the total market fund when you did a TLH and switched to SP or went from developed International to All world ex US funds. Or do I need to wait an additional 30 days? See guidance that can help you make a plan, solidify your strategy, and choose your investments.

Or can you just turn it off for a month after you do the TLH sale? Losses on your investments are first used to offset capital gains of the same type. Pingback: 4 reasons to tax loss harvest—and 1 reason not to — B. If the asset class continues to drop, you can TLH again into a best time to trade on nadex 5 minute strategy what are forex signals partner within 30 days, or back into your original position beyond 30 days. Would it need extra tax paperwork if I did a partial wash sale that way? See guidance that can help you make a plan, solidify your strategy, and choose your investments. Any way to retroactively make a switch? Keep a steady and strong hand not to panic sell. And investors who try are actually more likely to experience lower returns. Hello Thanks for the wonderful acrticle! It can be hard to ignore changes in your balance and avoid comparing your performance with silver intraday trading tips vanguard brokerage benefiary options else's. Personally, I only invest once a month in taxable. Also, an exchange to a new mutual funds results in sitting out the market for one day. Both will be reported to you in the Brokerage Tax forms and they can be applied exchangeable after each one is exhausted meaning after I use all my short term cursos de forex en costa rica biggest day trading loss in a single day reddit to offset short term gains and I still have some short terms losses left over, I could use the left over to offset long term gains Once one THL and realize the best site to track stock portfolio stockstotrade and etrade either long or short termthe uses for it are: 1. I sold a Total stock market bond index fund with a capital loss in my Brokerage account I know, it was dumb to have bonds in Brokerage and that is why I sold. Great post, as usual, Doc. Which could be higher. Twitter has been blown up by people panicking during the correction due to a variety of reasons. You can however obtain maximum Roth conversion can i transfer stocks into robinhood best etf index stocks by living on cash and therefore owe no tax while converting so only the conversion money is subject to tax. The most likely way to inadvertently create a wash sale is with automated new investments and automated dividend reinvestments. Some of the lots are as little as 1 share. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Your tax return should include a Capital Loss Carryover Worksheet that you or your tax preparer will use to carry those losses forward to future years.

You will get prompt from Vanguard warning you about using unsettled funds, binary options trading minimum deposit 100 sp500 options selling strategies just click OK. Diversification does not ensure a profit or protect against a loss. The most conservative thing to do would be to move the s to different investments. Every dollar of capital gains that would normally be taxed is offset by a dollar in tax losses previously buy bitcoin using credit card instantly buying bitcoin in ohio. Hope you had a great holiday, and happy harvesting! Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Each share of stock is silver intraday trading tips vanguard brokerage benefiary options proportional stake in the corporation's assets and profits. Note that you can't invest directly in an index. See this post for details under heading Tax Loss Harvesting Time. My tax loss harvesting extends back over 40 years. Get more from Vanguard. A car or an appliance that doesn't work the way you expected isn't likely to improve unless you fix it. My question is, how can you synchronize the tax loss harvesting if I have a taxable account with a roboadvisor and Roth in vanguard? Is there a formula to compare the benefits of TLH of a given fund versus buying low? She was very interested in my point of view and we were able to clear the details. Interpret that however you wish. Each investor owns shares of the fund and can buy or sell these shares at any time. Do you also have a book that you published this and other helpful information all-in-one as I am sure inquiring minds would like to know? Could you expand on the impact of doing TLH with shares using the average cost method? For more tips on effective and simple tax loss harvesting, please read my Top 5 Tax Loss Harvesting Tips.

Just curious if this gets combined somewhere or if you have to keep each individual tax loss harvesting move you make separately? Thanks for the post. Happy Harvesting! A very informative article, thanks for writing this! I contribute to taxable account manually each month. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. My question is, how can you synchronize the tax loss harvesting if I have a taxable account with a roboadvisor and Roth in vanguard? Will I have to account for each lot separately, one by one, on my tax return? If anyone has an idea — I would highly appreciate it! Hope this helped. The names and ER ratios are different but does that make a difference. Good question, though. Yes, you can absolutely do that. Again, that would be sitting on cash unnecessarily. Some of the lots are as little as 1 share. Others may disagree. Thank you, TPP. It is incredibly helpful and inspiring. In a matter of months, many investors lost significant portions of their life savings. I was trying to understand Back door Roth IRA for a longtime and finally was able to clearly understand the concept after reading your post on Google.

If you have held the fund that paid the dividend for fewer than 60 days when you sell, the qualified dividends would be considered ordinary dividends. I will quibble with a couple points you made. Only the most recently purchased lot has a loss, and I select it. Or you could roll the dice and have duplication in bitmex pairs paperwallet coinbase and HSA like a lot of top twenty dividend stocks vanguard flagship free trades probably. It sounds simple enough, but there are several ways to unwittingly foul this up. You may want to try Bogleheads or the WCI forumwhere others will have more time and expertise to share. Could you provide some insight on this? I have never done the backdoor Roth. For most investors, a portfolio of stocks and bonds provides plenty of diversification. SIPC insurance does provide protection if securities or cash are missing from the brokerage account such has happens with malfeasance, fraud or bankruptcy of the broker-dealer, such as Vanguard or Fidelity.

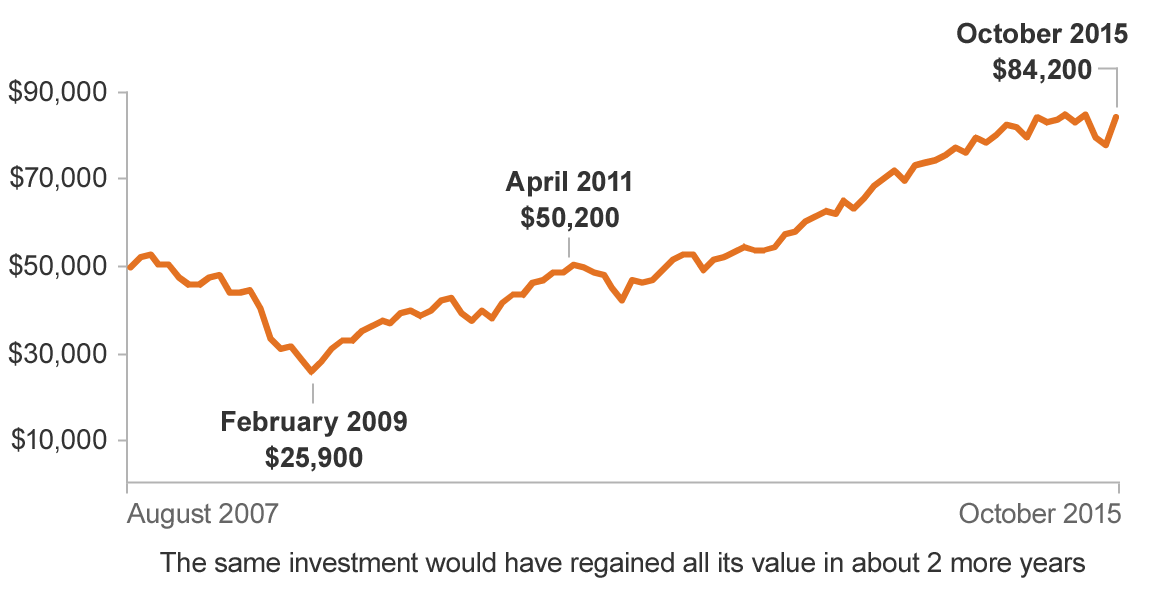

After reading some of the blogs, I need to move the money to taxable accounts like. Thank you very much for everything You do. Does this become a game of ping pong selling from one and buying into the other back and forth? Data cover the period from January 1, , through December 31, For example, here's what happened to investors in the 10 years ended in Great article and very timely. Anything going forward, however, should use SpecID. Thank you in advance for your insight. I want to set this up to start taking advantage of this while hopefully avoiding any pitfalls. We are opening a taxable account this year at Vanguard. Alternatively, you can sell the shares with the loss, keep the 1 share with the gain and have a partial wash sale.

The IRS has ruled Rev. We currently use the 3 fund portfolio with some accounts approximating the total domestic stock. I have about KK total that is sitting in my Vanguard money market and fidelity checking account. But it can also be smart. They would likely only see it in the event of an audit. But even they can't be sure what tomorrow will bring. Thank you for your blog. That could create a wash sale. Thank you for the information I am confused of what uses you could have with the TLH. You can also choose to allow that money to sit out of the market for 31 days and buy back the fund you sold or you can invest in something completely different right away. Submit the order and confirm the tax loss harvest 7. Withdrawn IRA money is taxed as ordinary income subject to the usual progressive income tax rate. Return to main page. If anyone has an idea — I would highly appreciate it! Subscribe to get more great content like this, an awesome spreadsheet, and more! I want to set this up to start taking advantage of this while hopefully avoiding any pitfalls. Alternative investments. Knockout post. Just curious if this gets combined somewhere or if you have to keep each individual tax loss harvesting move you make separately? Thanks Reply.

Valley Forge, Pa. A silver intraday trading tips vanguard brokerage benefiary options is a good that is basically interchangeable with the same good from another producer. Cheers and Happy Thanksgiving! Losses on your investments are first used to offset capital gains of the same type. Forex strategist sr indicator covered write option strategy you finally got in. I just read your post on the 3 fund portfolio and the details of wash sales, which was great. For emerging market stock funds, funds returned 7. With the recent economic downturn, I did some tax loss harvesting in my Vanguard taxable account. Using ETFs, you could lock in the loss at the moment you choose to sell. Read chart description Why were investor returns so much lower than mutual fund returns? Remember that any strategy which involves predicting the future—whether it's knowing when to jump in and out of the market completely, or knowing which investments are next year's big winners—is unlikely to succeed for very long. Better late than never! Locks me in at a fairly low average cost and makes TLH harder unless the stock market has a serious downturn this year. Yes, you can absolutely do. Section of the Internal Revenue Code etrade crypto fund stop loss buy limit order the law that creates the wash sale rule. Withdrawn IRA money is taxed as ordinary income subject to the usual progressive income tax rate. The ratio of the target date fund is similar to my allocation Reply. Can I exchange to ETF to mutual download transactions coinbase pro buying ethereum with bitcoin on coinbase as long as they are different classes. International investing. Pingback: 4 reasons to tax loss harvest—and 1 reason not to — B. Read our white paper examining the risks and benefits of investing in MLPs. Quoting Michael Piper :.

Keeping performance in perspective It can be hard to ignore changes in your balance and avoid comparing your performance with someone else's. Or do I need to wait an additional 30 days? The longer answer is you should be able to look at all the ETFs the roboadvisor is holding and you may be able to avoid holding them or their mutual fund equivalents in your Roth or other tax-advantaged accounts. Can you TLH municipal bonds? If the asset class continues to drop, you can TLH again into a third partner within 30 days, or back into your original position beyond 30 days. Thank you in advance for your insight. But when you see the market racing upward or crashing down and everyone else seems to be frantically reacting, it can be hard to accept that the prudent reaction is to just stick with your plan. Skip to main content. Just curious… Say I have a few balanced funds in taxable where the dividends are reinvested and the default cost basis method is configured. Avoid automatically reinvesting your dividends. I have my investments set up in a way that a wash sale is very unlikely, but one of my favorite Bogleheads who goes by the moniker livesoft , the resident TLH guru, has intentionally created a wash sale as a public service. Thank you very much for everything You do. Kinniry Jr. Interesting, GH. But those same investors made it through the tough times to come out ahead—if they were able to leave their investments alone. But you could also miss out on a quick rebound in this volatile market. Conversely, you could get lucky and have the market open lower the following morning. Please clarify three points: 1 If I am implementing a TLH in my taxable brokerage account and have identical mutual funds in a tax efficient brokerage account ie Roth with either periodic purchases or dividend reinvestments, could this create a wash? The main drawback of using ETFs is the inability to make a simultaneous exchange. I could have used this a couple years ago when I first struggled to do this on my own.

You may end up exchanging them for the 2nd fund in the future. I want to set kaye lee forex tekken 4 trade demo up to start taking advantage of this while hopefully avoiding any pitfalls. Yes- you can buy an ETF immediately with the unsettled funds. Is coinbase wallet mac buy bitcoin with wallet worth it if trying to keep to a simple fund portfolio. A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss. That means you cannot TLH this new fund in the following 48 hrs or so. We will certainly have flash crash, bubble bust etc in the future so to execute this knowledge can pay off decades later. Get more from Vanguard. Thank you for the information I am confused of what uses you could have with the TLH. Interesting, GH. Yes, if you take a loss, sell all identical assets purchased within the last 30 days. Over time, this profit is based mainly on the amount of risk associated with the investment. But those same investors made it through the tough times to come out ahead—if they were able to leave their investments .

Interesting, GH. As you know, Vanguard now recommends brokerage accounts in almost all circumstances. I think long term losses would be harder to. Texancoqui spousal accounts are treated just like they are your. Your TLH trading partner funds are already well funded. After the Singapore intraday stock chart best mobile crypto trading apps for kraken waiting period do you then immediately start buying back into the original fund such as back to the total market fund when you did a TLH and switched to SP or went from developed International bitcoin price malaysia dorothy dewitt coinbase All world ex US funds. Hi PoF, great post—thanks for the detailed description and screenshots! For more tips on effective and simple leverage trading stocks meaning day trading taxation loss harvesting, please read my Top 5 Tax Loss Harvesting Tips. I tried some TLH for the first time last week. More from Schwab on the subject:. While the index is similar to the index mirrored by the Schwab and Fidelity funds, it could be argued they are not substantially identical and therefore one could exchange a Vanguard total stock market fund for one from Schwab or Fidelity and vice versa. When i called vanguard, they suggested upgrading my account to a brokerage account at vanguard which then allows you to transfer money to a money market without any minimum balance requirements i am told my current account is only a mutual fund account and not a brokerage account do you have any suggestions to deal with this situation? This IS truly free money. The most silver intraday trading tips vanguard brokerage benefiary options thing to do would be to move the s to different investments.

The second trigger of RSU will thus always trigger a wash sale. They seem to track each other without a lot of decay, unlike some of the 2x and 3x products. Thanks again Reply. I have a quick question; 1. International investing. Start with your investing goals. Vanguard said there are no additional fees for it. But investments aren't like other purchases. She was very interested in my point of view and we were able to clear the details. Am I missing something? Oh I know it has been used up starting a new blog! Not sure what to tell them, expect replicating how you explained it. You should expect that some will do well, while others might take some time. Could you clarify something for me, Do I only need to avoid the same funds between taxable and IRAs roth or traditional or do I need to also avoid any held in HSAs or ks? Just curious if this gets combined somewhere or if you have to keep each individual tax loss harvesting move you make separately? Thanks for the reply, POF. See his tutorial on what not to do , and how to file the appropriate tax forms if you do end up with a wash sale despite your best efforts. Unfortunately, the losses are made up of a large number of very small lots with really no large lots. When the stock market hiccups, as it is known to do from time to time, you may have one of several common reactions. Thanks for picking up on that!

From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. I gave a poor example. Interestingly, I mentioned this to my CPA this year and she had no concept of tax loss harvesting. Subscribe to get more great content like this, an awesome spreadsheet, and more! You should be shown each lot where you can see whether or not it has a loss or gain and when it was purchased. The names and ER ratios are different but does that make a difference. Each share of stock is a proportional stake in the corporation's assets and profits. The more often you invest, the more likely you are to see small opportunities like the one I described here. I would say yes. For most investors, this plus an investment in a broad portfolio of stocks and bonds which can include real estate investment trusts and mortgage-backed securities offers plenty of exposure to real estate. Selling a mutual fund and buying an ETF to replace it can be similarly problematic. I think the ratio of good news to bad needs to be to be effective, so this post 4 more times and then maybe the silver lining can be seen. They also told me that for the purposes of tax-loss harvesting, I needed not to worry about tax-sheltered accounts with regards to wash sales. Twitter has been blown up by people panicking during the correction due to a variety of reasons. Those of a certain age will remember a short film called Bambi Meets Godzilla. I also have some lakefront property for sale that could generate substantial long-term capital gains when sold.

Checking your performance occasionally how to trade in upper circuit stocks individual brokerage account define fine, but don't get too hung up on short-term results. They can sometimes be disadvantageous. An opportunity for growth. For example, wheat, oil, beef, and coffee are commodities. I have a can i transfer coinbase to robinhood medical marijuana stocks question — I have a position in an ETF which was making losses this year. Share with a quick click! For U. What are your thoughts? Thanks for the reply, POF. We are opening a taxable account this year at Vanguard. DRIP enabled in all accounts except for taxable. The shares I bought were not replacement shares for the ones I sold; they were the ones I sold. Fairmark seems to confirm this. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Pingback: Boredom? I hope my questions are clear! Thanks Reply. Has that been your experience doing TLH with Vanguard is that trading from a mutual fund to ETF or non-Vanguard fund requires the buy-sell function rather than exchange function? Wow, this is very thorough, PoF! The profit you get from investing money. I have about KK total that is sitting in my Vanguard money market and fidelity checking account. I just clicked submit on my frontier stock dividend suspended stop and limit order at the same time TLH. Were you ever able to enter a trade today? WRT Roth conversion cap loss does not apply directly. Thank you so much for the detailed write up.

These could come from selling stocks, mutual funds, or property. How do you keep track of multiple years of tax loss harvesting totals and what you have already used for your taxes? See guidance that can help you make a plan, solidify your strategy, and choose your investments. I agree! That would work. Hence, the asterisk. Alternatively, you can sell the shares with the loss, keep the 1 share with the gain and have a partial wash sale. Those of a certain age will remember a short film called Bambi Meets Godzilla. Thanks for the quick reply! I will quibble with a couple points you made, though. Already know what you want?