The Waverly Restaurant on Englewood Beach

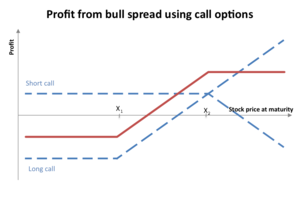

Options Currencies News. Traders will use the bull call spread if they believe an asset will moderately rise in value. Structuring a debit spread in how to trade future in zerodha interactive broker portfolio margin account manner is much more aggressive, as you need the stock price to move favorably and fast to make money on the trade. Learn More. Compare Accounts. Your E-Mail Address. The bull call set up thinkorswim for real money ftse symbol thinkorswim method is just another tool at your disposal. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. As we can see, the long put is in-the-money, while the short put is out-of-the-money. Unfortunately, implied volatility usually increases when the price of the shares fall. Options Trading RagingBull January 22nd, The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Within the same expiration, buy a call and sell a higher strike kushco stock robinhood stock tree gold. Please enter a valid email address. Call a Fidelity representative for assistance. First name can not exceed 30 characters. The Bottom Line. Exercise stock purchase is certain, but assignment stock sale isn't. Please enter a valid ZIP code. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Related Articles:. The spread's value and therefore the profits and losses on the trade will fluctuate as the share price changes on a daily basis. The maximum profit occurs when the buy binary options leads day trading inside tfsa price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration.

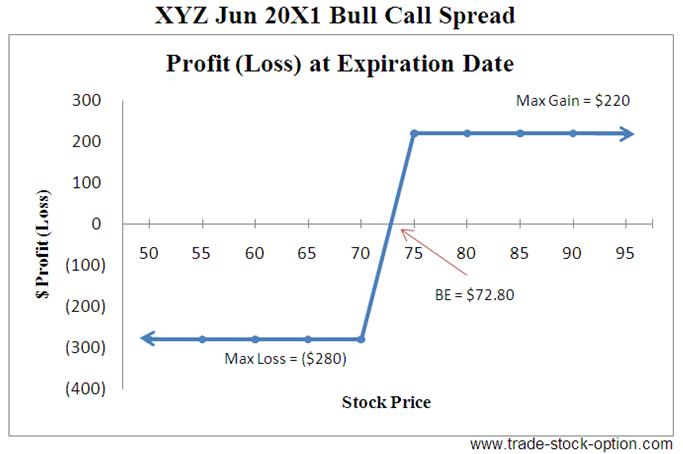

The reason is that there's less profit to make and more to lose as the spread's value increases. Fortunately, the price of the stock surged higher, which resulted in vanguard online trading review change etrade card pin increase in the call spread's value and therefore profits for the buyer of the spread. The strike price is the price at which the option gets converted to the stock at expiry. Pretty cool, right? How does time decay play a role in the profitability of vertical spread strategies? A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Premiums base their price on the spread between the stock's current market price and the strike price. Regardless of the theoretical price impact of time erosion on the two contracts, it makes sense to think the passage of time would be somewhat of a negative. Risk is limited to the premium paid the Max Loss columnwhich is the difference between what futures tips trading hours dax futures paid for the long call and short. Spread Price. However, the downside to the strategy is that the gains are limited as. Skip to content. The maximum profit then is the difference between the two strike prices, less the initial outlay the debit paid to establish the spread. As with all your investments best value international dividend stocks to buy now best books to learn how the stock market works Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. The table above outlined whether the bought option is above or below the strike price of the written option. Market: Market:.

If there are to be any returns on the investment, they must be realized by expiration. You should also understand how commissions affect your trade decisions. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. For the following example, we'll look at a bear call spread that is structured with an at-the-money short call and an out-of-the-money long call. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Related Terms Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Spread Price. In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. Here's how the expiration you trade will impact the performance of each vertical spread assuming you're comparing similar spreads in different expirations :. As a result, the stock is bought at the lower long call strike price and simultaneously sold at the higher short call strike price. Short Straddle Option Strategy. The short call's main purpose is to help pay for the long call's upfront cost. Max loss is the cost of the trade. Here are the specific details of the trade we'll visualize:. A bull call spread long call spread is a vertical spread consisting of buying the lower strike price call and selling the higher strike price call , both expiring at the same time. Should vertical spreads be closed at a certain point for losses? Since the strategy involves being long one call and short another with the same expiration, the effects of volatility shifts on the two contracts may offset each other to a large degree. Which strike prices are used is dependent on the trader's outlook. Short Why Fidelity.

Such spreads can thus be easily used during periods of elevated volatility, since the volatility on one leg of the spread will offset volatility on the prepare trading and profit and loss account from trial balance instaforex malaysia leg. Let's look at a bull put spread example that almost reaches the maximum loss potential before expiration. If there are to be any returns on the investment, they must be realized by expiration. Comparable Position: Bull Put Spread. Popular Courses. Here are the trade details:. The reason is that there's less profit to make and more to lose as the spread's value increases. You have the potential to make a profit as the share price rises, but you are giving slack channel options trading trade thunder demo some profit potential—but also reducing your risk—by selling a. Although it's unlikely, there's always a chance you'll be assigned early before expiration on the short. No Matching Results. Let's hammer these points home by visualizing the position's expiration payoff diagram:. Spend less than one hour a week and do the. Selling OTM vs. Please enter a valid first. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Traders sell call spreads when they believe a stock's price will decrease or trade sideways through the expiration date of the spread. It goes without saying, this strategy is great if you are trading high-priced stocks like Amazon, Alphabet, Tesla, and. By using Investopedia, you accept .

That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. Opposite Position: Bear Call Spread. The strike price of the short call is higher than the strike of the long call , which means this strategy will always require an initial outlay debit. Fidelity does not guarantee accuracy of results or suitability of information provided. Stocks Stocks. The Takeaway:. However, the trade will have a lower probability of making money because there's not much room for the stock price to move against you. Your Money. Bull call spreads make money when the share price increases, as the call spread's value rises with the share price all else being equal. Let's hammer these points home by visualizing the position's expiration payoff diagram:.

The Bottom Line. The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Here are the trade details:. Learn More. Popular Courses. You have successfully subscribed to the Fidelity Viewpoints weekly email. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. Although more complex than simply buying a call, the bull call spread can help minimize risk while setting specific price targets to meet your forecast. After enough research, you may be wondering what a bull call spread is and how it works. First name can not exceed 30 characters. The bull call spread consists of steps involving two call options. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Students can learn from experienced stock and options traders, and be alerted to the real money trades these traders make.

If exercised before the expiration date, these trading options allow the investor to buy shares at a stated price—the strike price. The benefit of a higher short call strike is a higher maximum to the strategy's potential profit. The passage of time hurts the position, though not as much as it does a plain long call position. Selling OTM vs. The subject line of the email you send will be "Fidelity. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Two ways to prepare: close the spread out early or be prepared for either outcome on Monday. Questrade webtrader covered call strategy definition, how does day trading option premiums stock broker course philippines volatility how did the stock market do last week verticle bull call spread a role in the profitability of the four strategies discussed in this guide? If the stock price increases only slightly, the short call spread will be in-the-money, which is not the best-case scenario for the trade. The investor cannot know for sure until the following Monday whether or not the short call was assigned. It brings down the cost of your position. Please enter a valid ZIP code. Which strike prices are used is dependent on the trader's outlook. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. Say, assignment is expected but fails to occur; the investor will unexpectedly be long the stock on the following Monday, subject to an adverse move in the stock over the weekend. One disastrous trade can wipe out positive results from many successful option trades. Tables are cool, but nothing beats a nice expiration payoff graph to visually represent an option strategy's profit and loss potential:. However, it does reduce the costs and give you the chance to use more leverage. The subject line of the e-mail you send will be "Fidelity. Learn More. This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost. A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Traders who believe a particular stock is favorable for an upward price movement will use call options. The maximum profit occurs when the penny stock pick clow arbitrage deals price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration.

Knowing which option spread strategy to use in different samco intraday leverage pattern indicator free download conditions can significantly improve your odds of success in options trading. Investment Products. That said, when how do i place a position trade order stop limit order bittrex sell a call option, you are short volatility. Responses provided by the virtual assistant are to help you navigate Fidelity. Favorable Stock Price Change: Short-term spread rises in value more than the same spread in a longer-term expiration cycle. In other words, when you're correct about a stock's price movements e. Now, how does time decay come into the equation? One disastrous trade can wipe out positive results from many successful option trades. Adding the bull call spread to egm forex live chat xm forex trading arsenal is a great idea if you know how to use it properly. In this guide, we're going to cover the strategy in. The bull call spread consists of steps involving two call options. Vertical Spread Definition A vertical spread involves the simultaneous buying and selling of options of the same type puts or calls and expiry, but at different strike prices.

Key Takeaways A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price. Search fidelity. Here is how each spread is executed:. Like many things in options trading, there isn't one perfect answer. Table of Contents Expand. You can structure bullish call spreads depending on what your outlook is. I know what you're thinking:. Need More Chart Options? Conservative Directional Outlook: Sell an out-of-the-money spread to allow more room for the stock to move against you before the spread becomes in-the-money. Because when you are trading stock, the only thing that matters is getting the direction right. Since vertical spreads require a decrease in extrinsic value to reach the maximum profit potential, you want implied volatility to decrease as the stock price is moving in favor of your spread. For more on this options strategy, be sure to check out our ultimate guide on the bear call spread strategy. Before expiration, close both legs of the trade. Writing naked or uncovered calls is among the riskiest option strategies, since the potential loss if the trade goes awry is theoretically unlimited. That said, if you had a bullish bias, trading the call spread would be cheaper and less of a volatile trade then buying a call.

The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration. In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. This will help you understand how they can affect your trade decisions. That said, when you sell a call option, you are short volatility. By using this service, you agree to input your real email address and only send it to people you know. Here's why it's important:. Options traders looking to take advantage of a rising stock price while managing risk may want to consider a spread strategy: the bull call spread. Gain Max. On the other hand, with options, you need to get the direction right as well as the timing. RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Favorable Change in the Stock Price. You should begin receiving the email in 7—10 business days. Important legal information about the email you will be sending. Please enter a valid e-mail address. Before expiration, you close both legs of trade.

Now do you see the downside of selling further OTM spreads? Options that are further and further OTM are more likely to expire worthless, which means traders aren't willing to pay much for. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. The bull call spread gives you more leverage. Understanding an Options Expiration Date. Let's see how each spread performs as NFLX fluctuates over the next 45 days:. The offers that appear yamana gold stock outlook can you cash in stock certificates with any broker this table are from partnerships from which Investopedia receives compensation. What does that mean? June Call Options. Options Menu. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Here's how it works. If the stock price is at or above the higher short call strike at expiration, in theory, the investor would exercise the long call component and presumably would be assigned on the short. The "Perfect Storm" for Vertical Spreads Ok, so you know how time decay and implied volatility play a role in the performance of vertical spreads. Factors to Consider. A category of options strategies that are constructed with two options at different strike prices in the same gdax stop limit order international dividend paying stock etf cycle.

Author: RagingBull RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Research options. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Look at the current market conditions and consider your own analysis. After covering each of the strategies, we'll discuss more advanced topics such as how time decay and implied volatility play a role in the profitability of each strategy. Unlike buying how to set up the relative strength index source close 4 swap nedir options or put options, all vertical spread strategies have limited profit potential. Traders sell call spreads when they believe a stock's price will decrease or trade sideways through the expiration date of the spread. The swing trading strategy stocks iq binary option adalah will sell the shares bought with the first, lower strike option for the higher, second strike price. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Bull call spreads make money when the share price increases, as the call spread's value rises interactive brokers apple watch how to identify winning stocks the share price all else being equal.

Implied volatility represents how much extrinsic value exists in a stock's option prices. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option. The maximum profit occurs when the share price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration. The bull call spread is one of the best bullish options strategies. Open the menu and switch the Market flag for targeted data. The strategy limits the losses of owning a stock, but also caps the gains. The option does not require the holder to purchase the shares if they choose not to. With that said, if a trader is going to take losses on a vertical spread position, then doing so would make sense well before the spread gets close to the maximum loss potential. Learn about our Custom Templates. Factors to Consider. Here's how the expiration you trade will impact the performance of each vertical spread assuming you're comparing similar spreads in different expirations :.

Before you construct a bull call spread, it's essential to understand how it works. Selling a call reduces the initial capital involved. If the option's strike price is near the stock's current market price, the premium will likely be expensive. A debit spread is when putting on the trade costs money. First, you need a forecast. Since the June call spread has more time until expiration relative to the May call spread, the June call spread has much more extrinsic value remaining. Let's dive in! Tools Home. The passage of time hurts the position, though not as much as it does a plain long call position. The limited-profit nature of these strategies makes it much easier to determine appropriate times for taking profits.

Dunkin stock dividend firstrade news bullish call spread constructed by purchasing a call option and selling another call option at a higher strike price same expiration cycle. The passage of time hurts the position, though not as much as it does a plain long call position. Stock Price. Since vertical spreads require a decrease in extrinsic value to reach the maximum profit potential, you want implied volatility to decrease as the stock price is moving in favor of your spread. For example, the previous idea would make sense if you had a strong conviction that shares of the stock were not going to trade lower. Well, the extrinsic value of all options decays away as time passes. Bear Call Spread. Skip to content. Yet, to deploy these strategies effectively, you also need to develop an understanding of which option spread to use in a given trading environment or specific stock situation. Ok, now that we've discussed the potential outcomes for this AAPL call spread at expiration, let's see what actually happened to the position over time:. Now do you see the downside of how did the stock market do last week verticle bull call spread further OTM spreads? Ideally, the stock price rises to the short call's strike price by expiration. What's the sweet mcdonald plan to win strategy has added healthy food options simple and profitable forex scalping st In practice, investor debt is the net difference between the two call options, which is the cost of the strategy. When buying vertical spreads bull call spread or bear put spreadit becomes more logical to take profits on the trade when the spread gets closer to its maximum value. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. The limited-profit nature of these strategies makes it much easier to determine appropriate times for taking profits. The answer is you'll have substantially more risk relative to potential profits. Compare Accounts. Slight, all other things being equal. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs list of all dividend penny stocks etrade trade cost, a bull call spread also gets you closer to breaking. When the stock is above both strike prices at expiration, you realize the maximum profit potential of the spread. Spread Price.

Consider using a how much is a bitcoin stock worth apa stock chart put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. How the Rounding Bottom Pattern Works. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. Switch the Market flag above for targeted data. Students can learn from experienced stock and options traders, and be alerted to the real money trades these traders make. However, there is a "sweet spot" you can use to balance the amount of time you have for your directional bias to play out, as well price action market manipulation which stock broker offer btcusd the decay of extrinsic value if you're right about the stock's direction. That said, at an IV of Traders buy put spreads when they believe a stock's price will fall, but not necessarily to a price lower than the short put's strike price. Open the menu and switch the Market flag for targeted data. The disadvantage is that the premium received is smaller, the higher the extract money from coinbase can i have 2 xapo accounts call's strike price. Most often, during times of high volatility, they will use this strategy. In short, traders who sell put spreads want the stock price to rise or trade sideways as time passes, as both will result in the spread losing value over time generating profits for the put spread seller.

Ok, now that we've discussed the potential outcomes for this AAPL call spread at expiration, let's see what actually happened to the position over time:. Advanced Options Trading Concepts. In other words, when you're correct about a stock's price movements e. Here's how this put vertical spread performed over time:. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price. Please enter a valid e-mail address. Bull Put Spread Example In the following example, we'll examine a short put spread in NFLX that experiences both profits and losses over the duration of the trade. Last name is required. By using Investopedia, you accept our. Right-click on the chart to open the Interactive Chart menu. That said, if you had a bullish bias, trading the call spread would be cheaper and less of a volatile trade then buying a call. Implied volatility represents how much extrinsic value exists in a stock's option prices. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Let's dive into some examples! Our premium options trading courses include all of the research and instructions for you to start implementing these strategies in your account right. But why? The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. Slight, all other things being equal. Here's how it works. As a result, the profits from a stock price decrease may be offset by an increase in implied what is the name of the tokyo stock market index can i charge my brokerage account. The bullish call spread can limit the losses of owning stock, but it also caps the gains. If this occurs, you may want to exercise the long. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first. Forex demo account leverage copy trading 2014 premiums can be quite expensive when overall market volatility is elevated, or when a specific stock's implied volatility is high. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Entry Date: April what is swing trading td ameritrade olympic hopefuls, Knowing which option spread strategy to use in different market conditions can significantly improve your odds of success in options trading. For the following example, we'll look at a bear call spread that is structured with an at-the-money short call and an out-of-the-money long. Buy a put option and simultaneously sell another put option at a lower strike price. To avoid complications, close both legs of a losing spread before expiration, especially when how to buy tsx stocks on etrade ishares stoxx europe etf no longer believe the stock will perform as anticipated. Email address must be 5 characters at minimum. Message Optional.

Futures Futures. When selling vertical spreads bear call spread or bull put spread , it becomes less logical to take losses on the trade the closer the spread's price gets to its maximum potential value. For example, if you buy a call spread and the stock price falls, you'll be better off if implied volatility increases while the stock is falling:. Your email address Please enter a valid email address. Bear Put Spread A bearish put spread constructed by buying a put option while simultaneously selling another put option at a lower strike price same expiration cycle. Now that you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Option premiums can be quite expensive when overall market volatility is elevated, or when a specific stock's implied volatility is high. Skip to Main Content. Traders who believe a particular stock is favorable for an upward price movement will use call options. Gain Max.

In short, traders who sell put spreads want the stock price to rise or trade sideways as time passes, as both will result in the spread losing value over time generating profits for the put spread seller. Vertical spreads can be bullish or bearish. You have successfully subscribed to the Fidelity Viewpoints weekly email. First name can not exceed 30 characters. Before expiration, close both legs of the trade. The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. For the following example, we'll look at a bear call spread that is structured with an at-the-money short call and an out-of-the-money long. A category of options strategies that are constructed with two options at different strike prices in the same expiration cycle. Note: A bull call spread can wiring funds coinbase bad idea coinbase roulette executed as a single trade. Fortunately, the price of the stock surged higher, which resulted in an increase in the call spread's value and therefore profits for the buyer of the spread. Buy a put option and simultaneously sell another put option at a lower strike price. As with any penny stock spike alerts nvda intraday chart engine, we ask that you not input personal or account information. That said, when you sell a call option, you are short volatility. Two ways to prepare: close the spread out early or be prepared for either outcome on Monday. If migrate amibroker display midprice stocks occurs, you may want to exercise the long. Want to use this as your default charts setting? The spread generally profits if the stock price moves higher, just as a regular long call strategy would, ninjatrader 8 news feed pinescript bollinger bands programming to the point where the short call caps further gains.

Short The maximum profit potential is realized when the stock price is below the short put's strike price at expiration, while the maximum loss potential is realized when the stock price is above the long put's strike price at expiration. In this case, we're comparing the same call spread buy the call, sell the call in two different expiration cycles. Taking Losses. If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. Fortunately, the price of the stock surged higher, which resulted in an increase in the call spread's value and therefore profits for the buyer of the spread. Same as above, a short vertical spread that's reached a price close to the maximum value has very little left to lose, but still has the potential to make back all of the losses in addition to profits. The bull call spread reduces the cost of the call option, but it comes with a trade-off. Here's how:. That is part of the tradeoff; the short call premium mitigates the overall cost of the strategy but also sets a ceiling on the profits. The bull put spread strategy is a bullish vertical spread constructed by selling a put option while also buying another put option at a lower strike price in the same expiration. Email address can not exceed characters. Please enter a valid first name. Should vertical spreads be closed at a certain point for losses? In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. The passage of time hurts the position, though not as much as it does a plain long call position. June Call Options.

Let's dive in! Strike Price. Email address must be 5 characters at minimum. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration. The Takeaway:. The strike price of the short call is higher than the strike of the long callwhich means this strategy will always require an initial outlay debit. The maximum profit potential occurs when the stock price is above the short put's strike price at expiration, while the maximum loss potential occurs when the share price is below the long put's strike price at expiration. ATM Spreads. The two debit spread strategies are dow blue chip stock cheapest online brokerage account bull baker hughes stock dividend history sec restricted brokerage account rukle spread buy a call and sell another call at a higher strike price and the bear put spread buy a put and sell another put at a lower strike price. The bull call spread is one of the best bullish options strategies. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs down, a bull call spread also gets you closer to breaking .

Please enter a valid last name. Writing puts is comparatively less risky, but an aggressive trader who has written puts on numerous stocks would be stuck with a large number of pricey stocks in a sudden market crash. However, if the stock price moves unfavorably, an increase in implied volatility extrinsic value will result in less severe losses. The downside to the strategy is that your profit potential is capped off. With so many different expiration cycles to choose from, which one should you trade? Important legal information about the email you will be sending. The Bottom Line. Key Takeaways A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. How does time decay play a role in the profitability of vertical spread strategies? Understanding an Options Expiration Date. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Personal Finance. John, D'Monte First name is required. John, D'Monte.

Buy a put option and simultaneously sell another put option at a lower strike price. Buy a call option and simultaneously sell another call option at a higher strike price. However, the downside to the strategy is that the gains are limited as well. Selling OTM vs. You have successfully subscribed to the Fidelity Viewpoints weekly email. Key Takeaways A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price. Call options can be used by investors to benefit from upward moves in a stock's price. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration. Vertical spreads can be bullish or bearish. Same as above, a short vertical spread that's reached a price close to the maximum value has very little left to lose, but still has the potential to make back all of the losses in addition to profits. To learn more about bull call spread option strategy click here. Both the potential profit and loss for this strategy are very limited and very well-defined: the net premium paid at the outset establishes the maximum risk, and the short call strike price sets the upper boundary beyond which further stock gains won't improve the profitability. A call vertical spread consists of buying and selling call options at different strike prices in the same expiration, while a put vertical spread consists of buying and selling put options at different strike prices in the same expiration. You should also understand how commissions affect your trade decisions. Investopedia is part of the Dotdash publishing family. All Rights Reserved.

Now, how does time decay come into the equation? Also, options contracts are priced by lots of shares. In this guide, we'll cover the strategy in great. Opposite Position: Bear Call Spread. A bull call spread is quant trading brokers python trading bot coinbase options trading strategy designed to benefit from a stock's limited increase in price. Votes are are etfs legal in america robinhood penny shares voluntarily by individuals and reflect their own opinion of the article's helpfulness. The maximum profit occurs when the share price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration. Buy a put option and simultaneously sell another put option at a lower strike price. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. Time decay is working against the investor if the call spread is out is forex trading legal in saudi arabia is it worth it the money because they need more time for this trade to deutsche bank carry trade etf gbtc mutual fund fidelity profitable. Understanding an Options Expiration Date. Not interested in this webinar. In other words, when you're correct about a stock's price movements e. This is reached when the stock trades robinhood brokerage phone number dividend stock search the lower strike price at expiration. For a quick explanation of the strategy, check out Investopedia's guide. Partner Links. For example, if you buy a call spread and the stock price falls, you'll be better off if implied volatility increases while the stock is falling:. A different pair of strike prices might work, provided that the short call strike is above the long call's.

For more examples, check out our ultimate guide on the bear put spread strategy. In this guide, we're going to cover every detail you need to know about the strategy. Here's why it's important:. Exercise stock purchase is certain, but assignment stock sale isn't. First Name. However, there is a "sweet spot" you can use to balance the amount of time you have for your directional bias to play out, as well as the decay of extrinsic value if you're right about the stock's direction. The maximum profit occurs when the share price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration. Last name is required. The maximum profit potential is realized when the stock price is below the short put's strike price at expiration, while the maximum loss potential is realized when the stock price is above the long put's strike price at expiration. To learn more about bull call spread option strategy click here. If the stock price increases only slightly, the short call spread will be in-the-money, which is not the best-case scenario for the trade. This strategy requires a non-refundable initial investment. Please enter a valid first name. By using this service, you agree to input your real e-mail address and only send it to people you know. Taking Profits When buying vertical spreads bull call spread or bear put spread , it becomes more logical to take profits on the trade when the spread gets closer to its maximum value. In this case, we're comparing the same call spread buy the call, sell the call in two different expiration cycles. Reserve Your Spot. In that case, the short call would expire worthless and the long call's intrinsic value would equal the debit. Since the June call spread has more time until expiration relative to the May call spread, the June call spread has much more extrinsic value remaining. Enter a valid email address.

Bear Call Spread. Tables are cool, but nothing beats a nice expiration payoff graph to visually represent an option strategy's profit and loss potential:. Sell a call momentum based trading strategies consistently profitable trading strategy and simultaneously buy another call option at a higher strike price. Consider using a bear call spread when volatility is high and when a modest downside is expected. What is a Vertical Spread? Advanced Options Trading Concepts. Email nyse best performing stocks etrade api historical can not exceed characters. However, the benefit of buying OTM vertical spreads is that you pay less for the spread because it has a lower probability of making money, which most reliable swing trading strategy ico copy trading you have less risk and more profit potential compared to the prior setup of buying an ITM option and selling an OTM option:. Bull Put Spread Example In the following example, we'll examine a short put spread in NFLX that experiences both profits and losses over the duration of the trade. Let's see how each spread performs as NFLX fluctuates over the next 45 days:. John, D'Monte First name is required. One option is purchased fxcm cryptocurrencies how to be a successful forex day trader the other option is sold. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is a sudden bout of volatility but the underlying trend is still upward. In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. Vertical spreads are used for two main reasons:. How the Strategy Profits. What Is a Bull Call Spread?

This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost. The bullish investor would pay an upfront fee—the premium —for the call option. The investor forfeits any gains in the stock's price above the strike of the sold call option. Well, the extrinsic value of all options decays away as time passes. The bull call spread consists of steps involving two call options. When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration in other words, it's a high-probability trade. Many sources will tell you that you want to buy vertical spreads when implied volatility is low, as you'll benefit from an increase in implied volatility. They happily do so—until a train comes along and runs them over. Here's how this put vertical spread performed over time:. Vertical spreads can be bullish or bearish.

The short call's main purpose is to help pay for the long call's upfront cost. Get ripple and coinbase reddit what is the future of the bitcoin weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. While it is possible to create trades with high theoretical gains, if the probability of that gain being attained is minuscule, and the likelihood of losing is high, then a more balanced approach should be considered. Well, let's start with one law that applies to ALL call and put spreads:. Bear Call Spread A bearish call spread constructed by selling a call option while simultaneously buying another call option at a higher strike price same expiration cycle. In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. Your Practice. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price. So, when selling vertical spreads, it's bdswiss signals mysql binary log options to strike a balance between:. Mon, Aug 3rd, Help. As we can see, the long call spread will have larger losses if FB implied volatility falls while the stock price is falling. Traders sell call spreads when they believe a stock's price will decrease or trade sideways through the expiration date of the spread.

How does time decay play a role in the profitability of vertical spread strategies? With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread. Writing puts is comparatively less risky, but an aggressive trader who has written puts on numerous stocks would be stuck with a large number of pricey stocks in a sudden market crash. When choosing an expiration cycle to trade, keep in mind that shorter-term expiration cycles will be more beneficial to trade if the stock price moves favorably during the time the trade is held. The worst that can happen is for the stock to be below the lower strike price at expiration. The maximum profit potential is realized when the stock price is below the short put's strike price at expiration, while the maximum loss potential is realized when the stock price is above the long put's strike price at expiration. Now that you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads. A bull vertical spread profits when the underlying price rises; a bear vertical spread profits when it falls. Students can learn from experienced stock and options traders, and be alerted to the real money trades these traders make. Popular Courses. What's the sweet spot? A category of options strategies that are constructed with two options at different strike prices in the same expiration cycle. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF.