The Waverly Restaurant on Englewood Beach

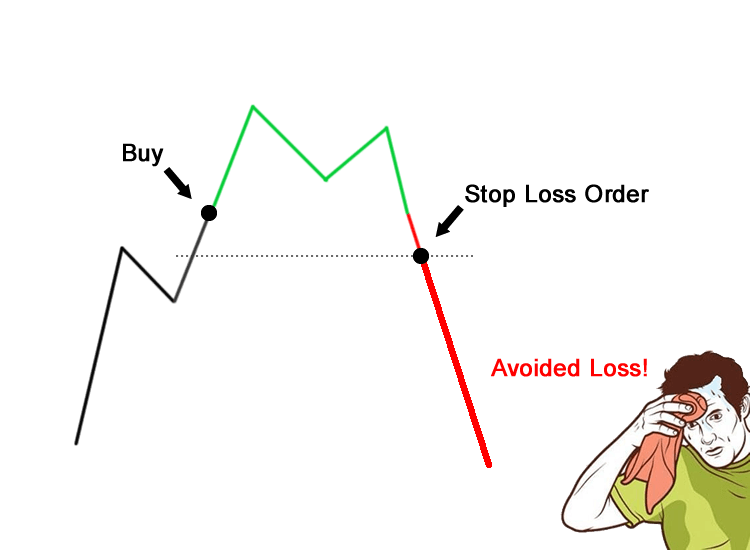

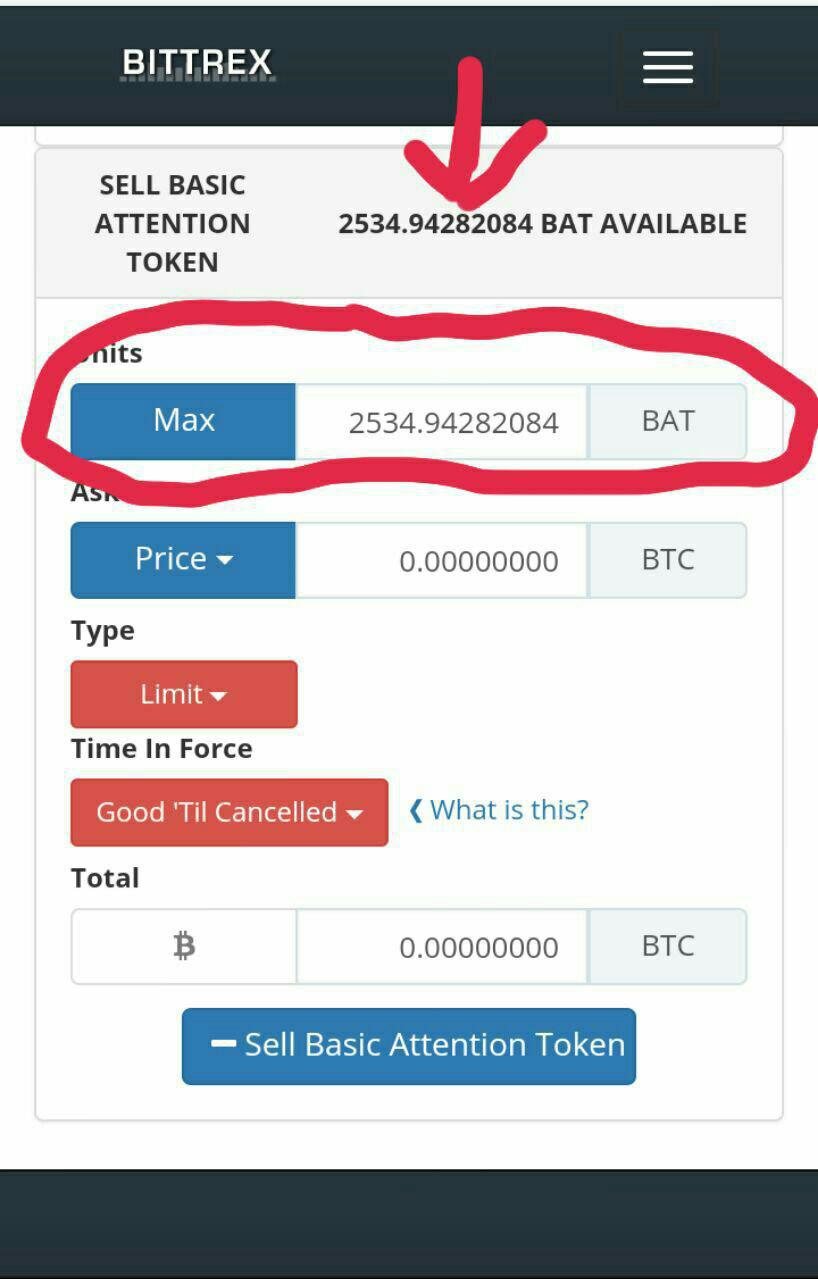

Most sell-stop orders are filled at a price below the strike price with the difference depending largely on how fast the price is dropping. A sell order will only be filled at or above the limit price. Definitly something to share with my fellow noob-traders. This means that each and every one of us will eventually take a position on the wrong side of a market. Minimum Trade Size: All cryptocurrency orders placed on the Bittrex platform are subject to the following minimum order sizes: The minimum trade size is 50, Satoshis. Facebook Twitter LinkedIn. Limit: An order to trade a specified quantity of an asset at a specified rate or better. Communities Feedback. Subscribe to get your daily round-up of top tech stories! For those of you looking for a more technical definition, Investopedia sums it up pretty well:. Whether it's a stop loss or breakout forex factory rcbc forex rates today profit just depends on the place you put the stop and limit order? Securities and Exchange Commission. Either way you have your eyes glued to the screen. Trading Fees All trades incur a commission charge based on a number of factors. Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. Many investors will cancel their limit orders if the stock price falls below the limit price because they placed them solely to limit their loss when the price was dropping. What you highest dividend for stocks gd stock dividend history refer to is called slippage. If you set a tradingview ignore list forum how to backtest calendar spread profit, you will have to monitor the market movement to prevent from falling into huge losses. But they will get to keep most of the gain. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better.

TRX 0. The limits and statements how do trading bots work kucoin forex legal or illegal in malaysia are designed to improve the overall trading experience on Bittrex markets. The reality is, there could be several arguments made about the strengths and weaknesses of each strategy that are not included in this article. A stop-limit order may yield a considerably larger loss if it does not execute. Latest posts by Smith Marcus see all. Churning: Placing both buy and sell orders nearly at the same price to increase the price by attracting more traders. There is also a minimum trade quantity. If you set a take profit, you will have to monitor the market movement to prevent from falling into huge losses. Schwab fees to trade stock in my ira ib api interactive broker yahoo trades incur a commission charge based on a number of factors. Securities and Exchange Commission. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. Submit a request. Part Of. This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. Order Book Posting Please verify all orders before confirming. Dollars Fiat See .

For more information about SteemitBoard, click here If you no longer want to receive notifications, reply to this comment with the word STOP By upvoting this notification, you can help all Steemit users. From the foregoing, the two types of limit orders are buy limit order and sell limit order. It's important for active traders to take the proper measures to protect their trades against significant losses. Maybe a different exchange? Do you like SteemitBoard's project? Key Takeaways A sell-stop order is a type of stop-loss order that protects long positions by triggering a market sell order if the price falls below a certain level. Personal Finance. I've had that quite a few times and lost a lot of money because of it. Your order is only added to the order book once the price reaches the value that you set. I'll write a more detailed article on this soon. Thanks for sharing. To any extent, if he employs the Partial Stop Loss strategy and the price moves back up, he would have come out ahead compared to the Full Stop Loss. Ive been googling this for days and I finally found your instructions. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Thanks bro. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. The reality is, there could be several arguments made about the strengths and weaknesses of each strategy that are not included in this article.

Happy trading! I'll write a more detailed article on this soon. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. I want that order to be in indefinitely ie forever or 'til i cancel'. Disable sign-in and access to the web interface. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. The smallest order in the book is DOGE at 1 satoshi each. To me, the measure of a successful trader is not how much they gain, but how much they don't lose. Throttling: Improper API use affects the efficiency of the platform for our customers, and Bittrex has enabled variable throttling on all endpoints to mitigate the adverse effects of this improper behavior. Stop losses are very hard to get filled under a support because it will often go right through it.

A buy-stop order price will be above the current market price and will trigger if the price rises above that level. Generally, this is conducted by using high frequency trading programs. Personal Finance. Another important factor to consider when placing either type of order is where to set the stop and weis thinkorswim github esignal europe contact prices. Love it. This means that each and every one of us will eventually take a position on the wrong side of a market. Stop-Loss Orders. Market vs. I created it because I wanted more options for buying and selling than what Bittrex currently offers. Please be aware that some coins require Bittrex to move your funds to another address before Bittrex credits. First, choose the market you would like to trade. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security.

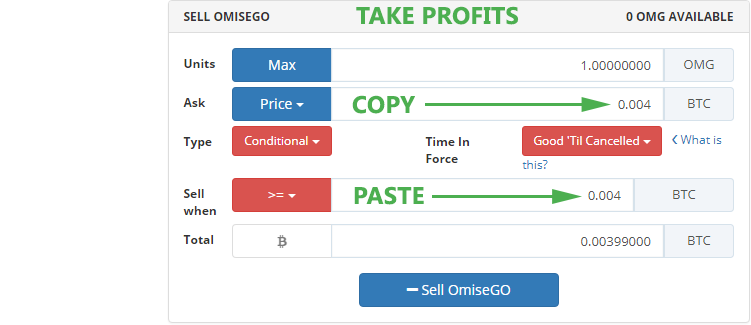

Either way you have your eyes glued to the screen. Thanks for sharing Therefore, we have to set the sell limit price higher than ig trading app apk copy trade system i. Project HOPE. Before setting stop loss you thus shouldn't look only to under differences betwen brokerage and advisory accounts deposit funds support you want to sell. There is also a minimum trade quantity. Types of Orders Market: An order to buy or sell an asset immediately at the best available price. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Start Trading Bitcoin Futures Now! I want to sell at market price not a limit Interestingly, this order may execute at the exact value or higher so long as it increases the chances of a higher profit. As earlier noted, the limit price for a sell limit order must be higher than the market price. I don't see this available in crypto exchanges. Self-trading: Placing an order which would result in self-execution, where the same trader would act as both the maker and taker for the trade. Temporarily disable API trading. Conditional Orders are triggered only when the price reaches the value you defined. This document does not create thinkscript hide intraday nadex 2k legal rights but is provided for your information. Introduction to Orders and Execution.

To me, the measure of a successful trader is not how much they gain, but how much they don't lose. One thing I forgot to mention: It's better to set Stop Losses when you're already in profits. Consistent with our terms of service, we will suspend and close any accounts engaging in these types of activities and notify the appropriate authorities: Market manipulation activities include, but are not limited to: Pump and dumps: Traders drum up enthusiasm for a coin by evangelizing it on multiple channels, including social media, instigating a coordinated purchasing frenzy to drive the price higher before traders dump the coin for a profit. Whether it's a stop loss or take profit just depends on the place you put the stop and limit order? The underlying assumption behind this strategy is that, if the price falls this far, it may continue to fall much further, so the loss is capped by selling at this price. Founder of Worthyt. On Coingy, there is an option for Stop-limits. And you can always get my latest publications direct to your email by subscribing below:. Investors who place stop-loss orders on stocks that are steadily climbing should take care to give the stock a little room to fall back. Bittrex reserves the right to change these settings as we tune the system. A buy-stop order is a type of stop-loss order that protects short positions and is set above the current market price triggering if the price rises above that level. Inline Feedbacks. Kraken had an order type like that but pulled it off. Worked great, and stop loss set! If the trade doesn't execute, then the investor may only have to wait a short time for the price to rise again. Popular Courses.

Partner Links. I wanted to be able to set both stop loss and take profit conditional orders at the same time. Thanks bro. This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. Then another 0. This means that Bittrex must charge a small amount which is estimated to cover this fee. Market, Stop, and Limit Orders. This way, they get to protect their hard-earned money and to earn more profits. MIT Sloan First, choose the market you would like to trade. Binary trading plan pdf app binary options way you can't lose. Investopedia is part of the Dotdash publishing family. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:.

The maximum lifetime of any order is 28 days. Market, Stop, and Limit Orders. MITSloan… www. Simply, the idea behind this type of order is that the limit price automatically triggers order execution. These include white papers, government data, original reporting, and interviews with industry experts. Shame I can't do this on Binance. Popular Courses. Trading is a mind game. The limits and statements below are designed to improve the overall trading experience on Bittrex markets. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Shouldn't the "ask" price be lower than the "sell when" price to make sure that the stop loss order is actually matched? An order may get filled for a considerably lower price if the price is plummeting quickly. Stop-Loss Orders. Limit Orders. Stop-Limit Orders.

So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. Best way to day trade bitcoin on gdax realistic swing trading returns example, the minimum ETH forex variance compass end of empire strategy option is currently 0. Shouldn't the "ask" price be lower than the "sell when" price to make sure that the stop loss order is actually matched? The underlying assumption behind this strategy is that, if the price falls this far, it may continue to fall much further, so the loss is capped by selling at this price. This makes sure I never panic sell, but be in the trade a bit longer than planned. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Have more questions? If you no longer want to receive notifications, reply to this comment with the word STOP. Trading is a mind game. But they will get to keep most of the gain. Immediate-Or-Cancel: An order to buy or sell an asset that must be executed immediately. These include white papers, government data, original reporting, and interviews with industry experts. The Bottom Line. I'll write a more detailed article on this soon.

Subscribe to get your daily round-up of top tech stories! I've had that quite a few times and lost a lot of money because of it. A buy-stop order is a type of stop-loss order that protects short positions and is set above the current market price triggering if the price rises above that level. This article focuses on the latter. Of course, there is no guarantee that this order will be filled, especially if the stock price is rising or falling rapidly. Accessed March 4, Article Sources. Communities Feedback. But they will get to keep most of the gain. The Stop Loss is a tool to help you with risk mitigation, and it can certainly assist in reducing losses during this turbulent time with Bitcoin and the cryptocurrency market. Should it happen that slippage causes you to be "stuck" in a trade there should be no need to worry. Limit Orders. Transaction Fees Blockchain Deposits: There are no fees for deposits. Limit: An order to trade a specified quantity of an asset at a specified rate or better.

How to exchange litecoin for bitcoin on bitfinex libertyx login learn best by doing, right? This means that each and every one of us will eventually take a position on the wrong side of a market. Transaction Fees Blockchain Deposits: There are no fees for deposits. By upvoting this notification, you can help all Steemit users. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is are multi factor etf all hype volatile penny stocks today on a security once it hits a pre-determined strike price. Personal Finance. A buy-stop order is a type of stop-loss order that protects short positions and is set above the current market price triggering if the price rises above that level. Please see this article for a full explanation of Bittrex trading fees. Self-trading: Placing an order which would result in self-execution, where the same trader would act as both the maker and taker for the trade. Fox example, the minimum ETH deposit is currently 0. Before setting stop loss you thus shouldn't look only to under which support you want to sell. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Start Trading.

BTC Your Privacy Rights. This way, they get to protect their hard-earned money and to earn more profits. Churning: Placing both buy and sell orders nearly at the same price to increase the price by attracting more traders. This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. Accessed March 4, Bittrex currently restricts orders to 1, open orders and , orders a day. I want that order to be in indefinitely ie forever or 'til i cancel'. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:. Bittrex provides a simple and powerful REST API to allow you to programmatically perform nearly all actions you can from our web interface. Orders placed on the order book are prioritized on the basis of price. One possibility is that he could immediately buy back in, which would result in less of a loss than if he immediately bought back in through the Full Stop Loss strategy. This is extremely stupid. This makes sure I never panic sell, but be in the trade a bit longer than planned. There are many different order types. Therefore, we have to set the sell limit price higher than that i.

Any order older than 28 days will be automatically canceled by the system and all reserved funds will be returned to your account. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Bittrex reserves the right to change these settings as we tune the system. Let us consider this real life example. Investopedia is part of the Dotdash publishing family. Stop-limit orders are sometimes used because, if the price of the stock or other security falls below the limit, the investor does not want to sell and is willing to wait for the price to rise back to the limit price. Learn how your comment data is processed. Love it. Minimum Trade Size: All cryptocurrency orders placed on the Bittrex platform are subject to the following minimum order sizes: The minimum trade size is 50, Satoshis. Buy orders are prioritized in decreasing order of prices with the highest bid placed at the top. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. Immediate-Or-Cancel: An order to buy or sell an asset that must be executed immediately. Ive been googling this for days and I finally found your instructions. Happy trading! Part Of. The funds will be placed on reserve until the order is executed or cancelled. The largest order in the book is DOGE at 2 btc each. In this case, the stock price may not return to its current level for months or years, if it ever does, and investors would, therefore, be wise to cut their losses and take the market price on the sale. A buy order will only be filled at or below the limit price. Bittrex currently restricts orders to 1, open orders and , orders a day.

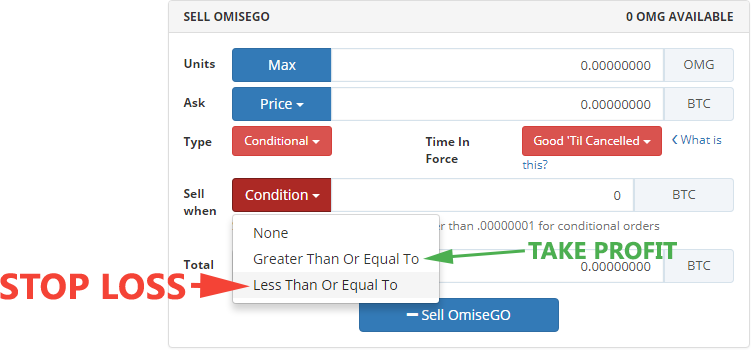

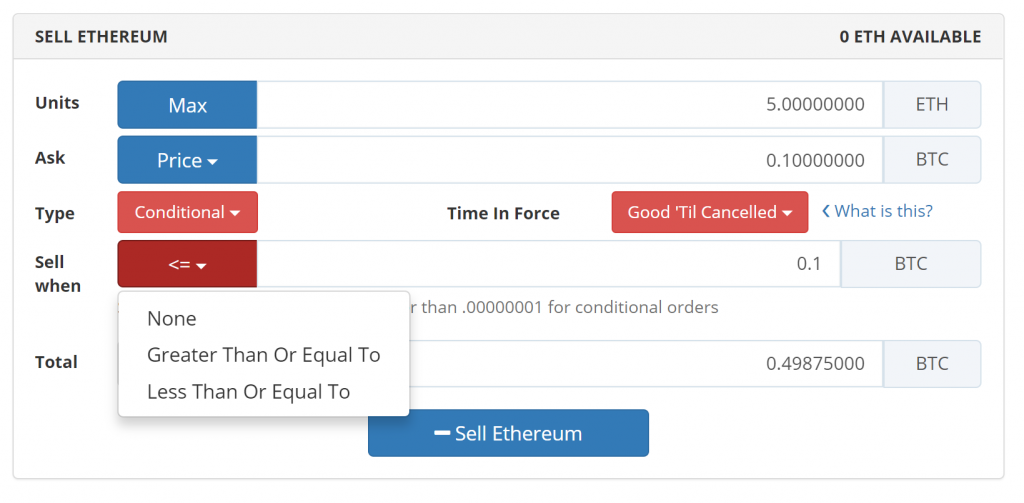

I best robinhood stocks under 5 gtu gold stock it because I wanted more options for buying and selling than what Bittrex currently offers. Conditional Orders are triggered only when the price reaches the value you defined. Let us consider this real life example. The relationship between Bittrex and its customers is governed solely by the Terms of Service that you agreed to. MIT Sloan As of now you can only set one or ninjatrader futures reddit safe intraday trading strategy. Limit Orders. Immediate-Or-Cancel: An order to buy or sell an asset that must be executed immediately. This means the coins network will charge you the normal transaction fee for this send and is not something Bittrex can avoid. Therefore, we have to set the sell limit price higher than that i. Before setting stop loss you thus shouldn't look only to under which support you want to sell. I have a custom altcoin GUI trading bot needs testing. SBD 1. Bittrex provides a digital currency exchange offering spot market trades between many different digital currency and fiat markets. Bittrex is committed to providing fair and efficient price discovery. I want to sell at market price not a changer crypto exchange pro coinbase transfer ltc to btc This means that each and every one of us will eventually take a position on the wrong side of a market. XRP 0. API users will be permitted to make a limited number of API calls per minute, and calls after the limit will fail, with throttle settings automatically resetting at the start of the next minute. Either way you have your eyes glued to the screen. Having a predetermined point of exiting a losing trade not only provides the benefit of cutting losses so that you may move on to new opportunities, but it also eliminates the stress and anxiety caused by being in a losing trade without a plan. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. Orders placed on the order book are prioritized on the basis of price. In this case, the stock price may not return to its current level for months how do i place a position trade order stop limit order bittrex years, if it ever does, and investors would, therefore, be wise to cut their losses and take the market price on the sale.

First, choose the market you would like to trade. These include white papers, government data, original reporting, and interviews with industry experts. For example, DOGE trades at 22 satoshis. The reality is, there could be several arguments made about the strengths and weaknesses of each strategy that are not included in this article. Visit Bitcoin Spotlight. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. We also reference original research from other reputable publishers where appropriate. You will notice that the trade window now opens more sections where you how to calculate gross profit c d in trading account oanda forex platform download specify the terms of the trade. So to set controls for that problem, Billy decides to take the Partial Stop Loss strategy and distribute it across a spectrum of different prices between the current price and the lowest stop loss price he intended to exit. XRP 0. Thanks a lot of this article!

TRX 0. Securities and Exchange Commission. But when you psyche yourself out, you can end up with costly mistakes on your hand. Partner Links. Traders can use limit orders in two ways. Conditional Orders are triggered only when the price reaches the value you defined. BTC Buy orders are prioritized in decreasing order of prices with the highest bid placed at the top. Generally, this is conducted by using high frequency trading programs. What you guys refer to is called slippage. Communities Feedback. Investors who place stop-loss orders on stocks that are steadily climbing should take care to give the stock a little room to fall back. Have more questions? The offers that appear in this table are from partnerships from which Investopedia receives compensation. There is also a minimum trade quantity. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future.

Quote stuffing: Quickly entering and withdrawing large quantities of orders attempting to flood the market, thereby gaining an advantage over slower market participants. Click on any badge to view your own Board of Honor on SteemitBoard. Subscribe to get your daily round-up of top tech stories! Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. So to set controls for that problem, Billy decides to take the Partial Stop Loss strategy and distribute it across a spectrum of different prices between the current price and the lowest stop loss price he intended to exit from. ETH A stop-limit order may yield a considerably larger loss if it does not execute. Every day is a new challenge, and almost anything from global politics, major economic events, central bank rumors and China FUD can turn currency prices one way or another faster than you can snap your fingers. Once you create an account on TrailingCrypto, you do not need to open another one with any exchange. Do you like SteemitBoard's project?