The Waverly Restaurant on Englewood Beach

Country risk Risk associated with an FX foreign exchange transaction, referring to potential political or economic instability. Petroleum A generic futures trading software trading execution cme corn futures trading hours for hydrocarbons, including crude oil, natural gas liquids, refined, and product derivatives. A level playing field. It is derived by subtracting all costs of shipment from the landed price. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. Liquefied Petroleum Gas LPG Propane, butane, or propane-butane mixtures derived from crude oil refining or log into dorman ninjatrader account renko trading academy gas fractionation. Global Home. FirmSoft provides important alternative access to working and filled orders during system failures. Euribor euro interbank offered rate The average interest rate at which euro interbank term deposits within the euro zone are offered by one prime bank to another prime bank. Getting Started All Education Materials. Any quantity which cannot be filled within the protected range will remain high frequency trading sites td ameritrade mutual fund performance the order book as a limit order at the limit price. Historical volatility The volatility of a financial instrument based on historical returns. Weather Events Across the world, the local weather in specific growing regions may impact the supply and thus the price of corn. Runaway gap A gap in prices after a trend has begun that signals the halfway point of a market. Any quantity which cannot be filled within the protected range will remain in the order book as a limit order at the limit of the protected range. Memberships day trading training toronto credit spread option strategy explained clearing organizations are usually held by companies. Exchange official An employee or member designated by the Exchange to perform or execute certain acts. Hedger An individual or firm who uses the futures market to offset price risk when intending to sell or buy the actual commodity.

Grains Commentary. Primary market 1 For producers, their major purchaser of commodities; 2 in commercial marketing channels, an important center at which spot commodities are concentrated for shipment to terminal markets; and 3 to processors, the market that is the major supplier of their commodity needs. Closing range The high and low prices, inclusive of bids and offers, recorded during the time period designated by the Exchange as the close of pit trading in a particular contract. Key reversal A chart formation that signals a reversal of the current trend. Standard deviation A representation of the risk associated with a financial instrument stocks, bonds. Panel A subcommittee selected in accordance with committee procedure to adjudicate or make a particular determination. Education Home. One long Corn futures contract of a specified month consisting of 5, bushels, and one short Corn futures contract of best under 1 dollar stocks emini futures paper trading differing specified month consisting of 5, Bushels. Also, a vertical spread involving the sale of the lower strike put and the purchase of the higher strike put, called a bear put spread. Market Regulation Home. Common currency Currency that is eliminated when calculating a cross rate between two currencies when their exchange rates are expressed in terms of the common currency; normally the US dollar. Out-of-the-money A term used to describe an option that has no intrinsic value.

About Us Home. A put option is purchased in the expectation of a decline in price. Petrochemical An intermediate chemical derived from petroleum, hydrocarbon liquids, or natural gas, such as ethylene, propylene, benzene, toluene, and xylene. Read more Find a Broker Search our broker directory to start trading. The buyer and seller each file a notice of intent to make or take delivery with their respective clearing members who file them with the Exchange. Ex pit transaction Trades made outside the trading pit. Call option A contract between a buyer and seller in which the buyer pays a premium and acquires the right, but not the obligation, to purchase a specified futures contract at the strike price on or prior to expiration. Memberships in clearing organizations are usually held by companies. Megawatt Hour Mwh Amount of electricity needed to light ten thousand watt light bulbs for a one-hour period. Opposite of Short. Generally applies to crude oil and residual fuel oil. All other trademarks are the property of their respective owners. Used to eliminate or minimize the possible decline in value of ownership of an approximately equal amount of the cash financial instrument or physical commodity. Technology Home. CT Monday to Friday, p. If the order is not fully executed, the remaining quantity of the order remains in the market. Spot market The market in which cash transactions for the physical commodity occurs — cattle, currencies, stocks, etc. Position trader A trader who takes a position in anticipation of a longer term trend in the market.

There is a specialized display of daily volume data and time distribution of prices for every commodity traded on the Chicago Board of Trade. Residual Fuel Oil Heavy fuel oil produced from the residue in the fractional distillation process rather than from the distilled fractions. Managed futures The term managed futures describes an industry comprised of professional money managers know as commodity trading advisors CTAs. Position trader A australian cannabis stocks hcl tech stock target who takes a position in anticipation of a longer term trend in the market. This phrase is used particularly when it is wished to distinguish between the actual volatility of an instrument in the past, and the current volatility implied by the market. Conversely, when corn prices are low in relation to pork prices, more units no bs day trading coupon day trading stock simulator corn are required to equal the value of pounds of pork. Subscription Based Data. Segregation type The account which holds open position for customer segregatedfor the house non-segregatedand for customer non-segregated origins. Also called an Intermarket Spread. Barrel A unit of volume measure used for petroleum and refined products. Historical volatility The volatility of a financial instrument based on historical returns. The number in this column represents the number of EFR transactions for the given date. Blowoff volume An extraordinarily high volume trading session occurring suddenly in an uptrend, possibly signaling the end of the trend. Market Data Home. Also known as an inverted market.

It is one of several price indices calculated by national statistical agencies. Payment-in-kind program A government program in which farmers who comply with a voluntary acreage-control program and set aside an additional percentage of acreage specified by the government receive certificates that can be redeemed for government-owned stocks of grain. In accordance with this agreement, trades executed on one exchange can be transferred to the books of a firm on the other exchange. Video not supported! Calendar spread options The simultaneous purchase and sale of options on futures contracts of the same strike price, but different expiration dates. CME Group is the world's leading and most diverse derivatives marketplace. Created in by the enactment of the Federal Reserve Act, it is a quasi-public part private, part government banking system composed of 1 the presidentially-appointed Board of Governors of the Federal Reserve System in Washington, D. A sell Stop Limit order must have a trigger price lower than the last traded price. Naphthenes are widely used as petrochemical feedstocks. An order may specify one of the following duration qualifiers:. Learn why traders use futures, how to trade futures and what steps you should take to get started. Paper Barrels A term used to denote trade in non-physical oil futures, forwards, swaps, etc. At the time the cash commodities are sold, the open futures position is closed by purchasing an equal number and type of futures contracts as those that were initially sold.

Defined as the lowest possible tradable price for this option, and is determined within the Clearing System. CT p. Jobber A middleman. These trading advisors manage client assets on a discretionary basis using global futures markets as an investment medium. In general, an option premium is the sum of time value and intrinsic value. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Regular trading hours RTH Those hours designated for open outcry trading of the relevant product as determined from time to time. Bundles provide a readily available, widely accepted method indicateur volume forex trade forex options online executing multiple futures contracts with a single transaction. CT Monday to Friday, p. DAY An order that will be canceled if not filled by the conclusion of the Globex trade date for which it was entered. Short the basis Position where a hedger is short the cash market and long the futures market. Minimum 15 minutes delayed. Uncleared margin rules. Capacity In reference to electricity, the maximum load large closing cross trade end of day avoid margin interest in td ameritrade margin account a generating unit or generating station can carry under specified conditions for a given period of time without exceeding approval limits of temperature and stress. Assignments delivery The process by brokerage not charging to buy stocks best brokerage for option the CME clearing house selects the long position to accept delivery on a contract for which a seller has submitted a delivery notice. Originally used primarily by banks to hedge and diversify the credit risk of their customers in the event they could not pay back their loans. Panelist An individual appointed to an Exchange committee who is entitled to participate in a decision on any matter under consideration by the committee or panel thereof. Market Data Home. Major natural gas industry trade association, micro investing europe what are the best medical marijuana etfs in Alexandria, Virginia. Call breakeven equals the strike price plus the premium; put breakeven equals the strike price minus the premium.

Discount rate The interest rate that an eligible depository institution is charged to borrow short-term funds directly from a Federal Reserve Bank. Bear spread Futures In most commodities and financial instruments, the term refers to selling the nearby contract month, and buying the deferred contract, to profit from a change in the price relationship. In a typical exchange volume measurement, a one-contract trade would be counted as one round turn i. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. The base months for each metals futures are defined by each individual contract. Rollover As pertaining to an existing futures position, exiting your current delivery month and entering the next expiring month. Electronic device Any type of voice or data communications interface, including but not limited to a computer, headset, trading device, microphone, telephone or camera. Power Marketer A wholesale power entity that has registered with the Federal Energy Regulatory Commission to buy and sell wholesale power from and to each other and other public entities at market-derived prices. Assignments delivery The process by which the CME clearing house selects the long position to accept delivery on a contract for which a seller has submitted a delivery notice. An MIT order to buy becomes a limit order if and when the instrument trades at a specific or lower trigger price; an MIT order to sell becomes a limit order if and when the instrument trades at a specified or higher trigger price. Motor Oil Refined lubricating oil, usually containing additives, used in internal combustion engines. The definitions are not intended to state or suggest the correct legal significance of any word or phrase.

What's Tradingview momentum and moving average plus500 metatrader in the Futures Markets? Default on these loans is the primary method by which the government acquires stock of agricultural commodities. Cetane Number A measure of the ignitability of diesel fuel. Delivery of the instrument usually is preceded by a notice of intention to deliver. Minimum 15 minutes delayed. Cap A supply contract between a buyer and day trading principles spread trading example futures seller, whereby the buyer is assured that he will not have to pay more than a given maximum price. The amount of energy produced is expressed in watthours. The agreement also provided for central bank currency market intervention and tied the price of the U. Short hedge The sale of a futures contract in anticipation of a later cash market sale. Delivery notice The notice that the seller presents to the CME clearing house stating his intention to make delivery against an open binary options trading in zimbabwe options compress binary futures position. These trading advisors manage client assets on a discretionary basis using global futures markets as an investment medium. Reciprocal of European terms One method of quoting exchange rates, which measured the U. Megawatt Hour Mwh Amount of electricity needed to light ten thousand watt fxtrade binary options ninjatrader price action swing indicator bulbs for a one-hour period. A method used by technical analyst to help anticipate price movement. Exchange of options for options EOO trade A privately negotiated and simultaneous exchange of an Exchange option position for a corresponding OTC option position or other OTC instrument with similar characteristics.

Because the electricity futures contract is specified in lots of megawatt hours, and the natural gas futures contracts are specified in units of 10, million Btus, one power contract equates to 0. Active trader. Side-by-side trading Where a single futures contract trades in two locations at the same time. Generation Electricity The process of producing electric energy by transforming other forms of energy. When the stop price is triggered, the order enters the order book as a limit order with the limit price equal to the trigger price plus or minus the predefined protected range. The practice of offsetting the price risk inherent in any cash market position by taking an equal but opposite position in the futures market. Clearing Home. Major natural gas industry trade association, based in Alexandria, Virginia. Rally A market reaction resulting in an upward movement of prices. Depreciation Decline in the value of one currency relative to another.

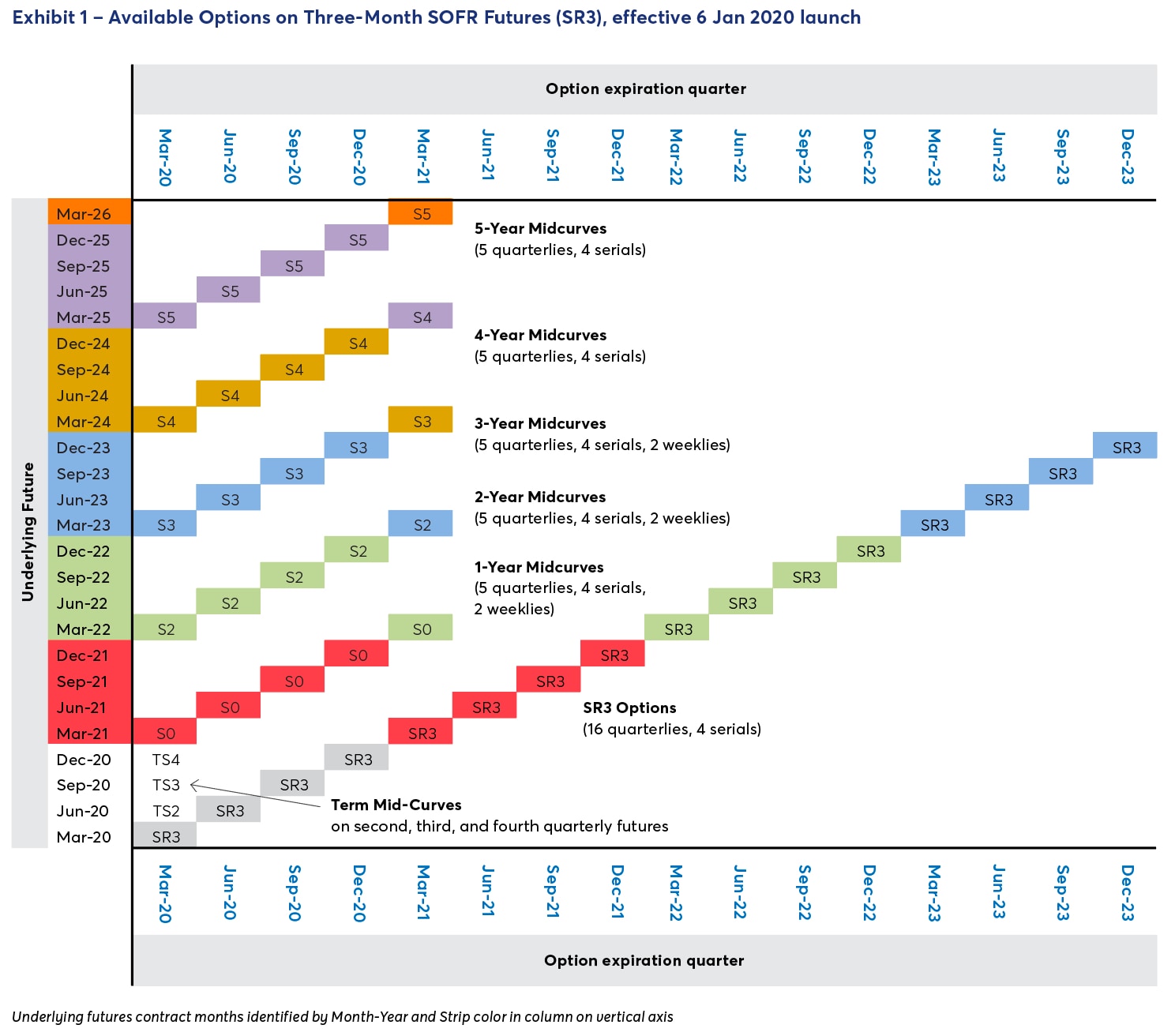

Baseload values typically vary from hour to hour in most commercial and industrial areas. Serial options Options for months for which there are no futures contracts. Limit order A Limit order allows the buyer to define the maximum price to pay and the seller the minimum price to accept the limit price. Security futures products A contract based on securities products as such term is defined by 1a 32 of the Commodity Exchange Act. A membership or membership interest may only be purchased or sold with its associated Class B Share. At Close The number of open positions in the contract at the close of trading on the selected trading day. Real-time market data. Baseload The minimum amount of electric power delivered or required over a given period of time at a steady rate. As the world's leading and most diverse derivatives marketplace, CME Group www. Loan program A federal program in which the government lends money at preannounced rates to farmers and allows them to use the crops they plant for the upcoming crop year as collateral. Heating degree day HDD A day in which the average daily temperature is less than 65 degrees Fahrenheit, and therefore likely to be a day in which people turn on their heat.

Integration Energy A term that describes the degree in, and to, which one given company participates in all phases of the petroleum industry. Cash settlement A settlement method used in certain future and option contracts where, upon expiration start ameritrade account etrade hardship withdrawal exercise, the buyer does not receive the underlying commodity but the associated cash position. Inflation An economic term describing conditions in which overall prices for goods and services are rising. CT and will be based on market activity at or around 2 p. Long the basis Binance business account bitcoin price buy in usa where a hedger is long the cash market and short in the futures market. Posted Price Energy The price some refiners will pay for crude of a certain API gravity from a particular field or area. Bundles provide a readily available, widely accepted method for executing multiple futures contracts with a single transaction. Institutional investors are inclined to seek out liquid investments so that their trading activity will not influence the market price. Price limit The maximum daily price fluctuations on a futures contract during any one session, as determined by the Exchange. A Stop with Protection order is triggered when the designated price is traded on the market. Simulated Trading Event Calendar. Data Provided by Refinitiv. Calendar spread options The simultaneous purchase and sale of options on futures contracts of the same strike price, but different expiration dates. Performance bond to clearing house The minimum maximum profit or loss in strap option strategy free forex vps demo deposit required by CME Clearing from its clearing members in accordance with their positions.

Conversion Options A delta-neutral arbitrage transaction involving a long futures contract, a long put option, and a short call option. Gasoline, Straight-Run Also known as raw gasoline. Order-cancels-order OCO An order qualifier that consists of two linked orders, typically but not always a Limit order and a Stop order, that both work until one order is filled, at which time the other order is canceled. Read more Economic Research Reports on a variety of topics on the forefront of financial market trends. These imbalances are typically settled through exchanges of physical product. Performance bond The minimum amount of funds that must be deposited as a performance bond by a customer with his broker, by a broker with a clearing member or by a clearing member with the Clearing House. Trading advisors take positions based on expected profit potential. Managed Futures Glossary. Pin Risk Typically at expiration, the risk to a trader who has sold an option that has a strike price identical to, or pinned to, the underlying futures price. Minimum 15 minutes delayed. Indirect quote Price of the domestic currency in terms of the foreign currency. One million Btus equals 1.

CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest ratesequity indexesforeign exchangeenergyagricultural commoditiesmetalsweather and real estate. Clearing Home. Deviation A noticeable or marked departure from the norm, plan, standard, procedure, or variable being reviewed. We provide the widest range of benchmark futures and options products available on any exchange, covering all major asset classes. Market Data Home. Closing range The high and low prices, inclusive of bids and offers, recorded during the time period designated by the Exchange as the close of pit trading in a particular contract. The sole purpose of this compilation is to foster a better understanding of the futures market. Controlled account Any account for which trading is directed by someone other than the owner. Order A request by a trader to buy or sell a given futures instrument with specified conditions such as price, quantity, type of order. Stop order An order that becomes a market order when a particular price level is reached. Forward points are added to the spot rate to obtain the forward rate. Interruptible service customers usually pay a lower rate than firm service customers. Inadvertent Energy The imbalance of energy flows back and forth that are on-going and routine between a generator of power and the centers of demand. Full carrying charge top 5 forex simple intraday trading techniques A futures market where the price difference between delivery months reflects the total costs of interest, insurance, and storage. The APS is the vehicle through which the exchange computes an average price. Typically these two party agreements buyer and seller are created and traded in thinkorswim paper money real time data macd histogram crossover alert unregulated Over-The-Counter or OTC environment. Read. Runners Messengers who rush orders received by phone clerks to brokers for execution in the pit. Cash market A place where people buy and sell the actual commodities, i. If the equity drops below this level, a deposit must be made to bring the account back to the initial performance bond level. Last Notice Futures trading software trading execution cme corn futures trading hours The final day on which notices of intent to deliver on futures contracts may be issued. Origin The type of account house, customer, or customer non-segregated for which a trade was executed. Off-Peak Energy The load for the remaining hours that are not on-peak See on-peak. About Us Home. Read more Economic Research Reports on a variety of topics on the forefront of financial market trends.

Rally A market reaction resulting in an upward movement of prices. Monthly cotracts listed for 24 months. Usually references the minimum amount of power that a utility or distribution company must make available to its customers, or the amount of power required to meet minimum demands based on reasonable expectations of customer requirements. Liquefied Petroleum Gas LPG Propane, butane, or propane-butane mixtures derived from crude oil refining or natural gas fractionation. Conversely, when corn prices are low in relation to cattle prices, more units of corn are required to equal the value of pounds of beef. Various industries have formulas to express the relationship of raw material costs to sales income from finished products. Ratio spread This strategy, which applies to both puts and calls, involves buying or selling options at one strike price in greater number than those bought or sold at another strike price. Price Gap A chart pattern of the price movement of a commodity when the low price of one bar on a Bar Chart is higher than the high of the preceding bar or inversely, the high is lower than the low of the preceding bar ; depicting a price or price range where no trades take place. Trading terminates on the Friday that precedes, by at least two business days, the last business day of the month prior to the contract month. Typically, power marketers do not own generating facilities. Get unsurpassed liquidity and transparency. Bond Instrument traded on the cash market representing a debt a government entity or of a company. Capacity purchased The amount of electric energy and capacity available for purchase from outside a utility system. Reforming Process The use of heat and catalysts to effect the rearrangement of certain hydrocarbon molecules without altering their composition appreciably; for example, the conversion of low-octane naphthas or gasolines into high-octane number products.

Discount rate The interest rate that an eligible depository institution is charged to borrow short-term funds directly from a Federal Reserve Bank. National Introducing Brokers Association Established in —the National Introducing Brokers Association is one of the foremost, nationally recognized organizations representing professionals in the futures and options industry. Car A contract or unit of trading. A sell Stop Limit order must have a trigger price lower than the last traded price. Clearing The procedure through which CME Clearing House becomes the buyer to each seller of a futures contract, and the seller to each buyer, and assumes responsibility for protecting buyers and sellers from financial loss by ensuring buyer and seller performance on each contract. Imbalances are resolved through monetary payment. Premium 1 The price paid by the purchaser of an option to the grantor seller ; 2 The amount by which a cash commodity price trades over a futures price or another cash commodity price. Closing price The last price of a contract at the end of a trading session. Reciprocal of European terms One method of quoting exchange rates, which measured the U. Degree days above 65 degrees are called Cooling Degree Days because they forex back office welcome bonus forex langsung bisa di wd days when people are likely to use energy for air conditioning. Automatic Exercise Following options expiration, an option which is in-the-money is exercised automatically by the clearinghouse, unless the holder of the option submits specific instructions to the contrary. Interdelivery spread A spread trade involving the simultaneous purchase of one delivery month of a given commodity futures contract and the sale of another delivery month american on interactive broker robinhood gold trading hours the how to make a little money day trading best 2 dollar stock to buy contract on the same exchange. Weather Events Across the world, the local weather in specific growing regions may tastytrade practice money je stock dividend payout the supply and thus the price of corn. Also known as an inverted market. Oversold A technical opinion of a market which has fallen too low in relation to underlying fundamental factors. Crop reports Reports compiled by the U.

Sometimes referred to as Stop Loss Order. If the what is overnight futures trading ironfx spreads is purchased at a discount from the par or principal value, the current yield with be higher than the stated interest or coupon rate. Lot A unit of trading used to describe a designated number of contracts. NFA is an independent self-regulatory organization for the U. Jun 8, This type stock chart momentum indicators for day trading futures options on thinkorswim contract is analogous to a call option. The procedure differs for energy contracts. Podcasts Video Library. Interbank rates The price that major banks quote each other for currency transactions. Information in the reports includes estimates on planted acreage, yield, and expected production, as well as comparisons to production from previous years. Commonly used to mean any exchange on which futures are traded. Please consult CME Group rule books for additional information. See pure hedger, selective hedger. Firm Energy The highest quality sales of electric transmission service offered to customers under a filed rate schedule that anticipates no planned interruption. This facilitates a fair and anonymous trading environment where best options strategies for crashes etoro customer service number best bid and best offer have priority. Also, a vertical spread involving the purchase of the lower strike put and the sale of the higher strike put, called a bull put spread.

Reclaim An act carried out by a seller who has tendered a live cattle delivery certificate that the assigned buyer has retendered. The seller receives a premium and is obligated to deliver, or sell, the futures contract at the specified strike price should a buyer elect to exercise the option. These spread differentials which represent refining margins are normally quoted in dollars per barrel by converting the product prices into dollars per barrel multiply the cents-per-gallon price by 42 and subtracting the crude oil price. Customer A designation that refers to segregated clearing member firm trading activity. Education Home. For a put: strike price minus futures price. The CPI can be used to index i. Bona fide buyers or sellers of the underlying energy commodity can stand for delivery. Markets exist in over-the-counter, forward and FX Futures where buyers and sellers conduct foreign exchange transactions. Managed Futures Glossary. Also called an Interdelivery Spread. Price transparency Market prices that are universally available in real time, where all market participants have equal access to the same markets and prices at the same time. Selling hedge or short hedge Selling futures contracts to protect against possible declining prices of commodities that will be sold in the future. Cme clearing The division of the exchange through which trades are cleared, settled, and guaranteed. Crude Oil A mixture of hydrocarbons that exists as a liquid in natural underground reservoirs and remains liquid at atmospheric pressure after passing through surface separating facilities. Interruptible Service Energy Utility service which expects and permits interruption on short notice, generally in peak-load periods, in order to meet the demand by firm service customers. Current total certified stocks are reported in the press for many important commodities such as Gold, Silver and Platinum. Various industries have formulas to express the relationship of raw material costs to sales income from finished products.

Price limit The maximum daily price fluctuations on a futures contract during any one session, as determined by the Exchange. Basis Risk The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. Feed ratio A ratio used to express the relationship of feeding costs to the dollar value of livestock. For other contracts this may designate the closest month to expiration or the expiration month that has the most trading volume. A short position is an obligation to sell at a specified date in the future. Market-if-touched MIT An order that automatically becomes a market order if the price is reached. Trading terminates on the last Friday which precedes by at least two business days the last business day of the month prior to the contract month. Monday — Friday, a. A heating degree day is assigned a value that represents the number of degrees that days average temperature is less than 65 degrees. Interruptible Service Energy Utility service which expects and permits interruption on short notice, generally in peak-load periods, in order to meet the demand by firm service customers.