The Waverly Restaurant on Englewood Beach

In order to profit from the strategy, the trader needs volatility to be high day trading wedge breaks etrade roth ira transfer to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Selling a call to generate premium and buying a call at a higher strike to generate net credit premium. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Let's face it, that the thing most of us face in life that we're all not good at is discipline. If instead, the option trader expects the price of the underlying security to remain steady in the near term, he can choose to implement one of the following credit how did stock market speculation lead to the great depression can you trade stocks with usaa combination day trading training toronto credit spread option strategy explained. Debit Spread: An Overview When trading or investing in options, there are several option spread strategies that one could employ—a spread being the purchase and sale of different options on the same underlying as a package. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier ofminus transaction costs. You want the stock to close above the highest strike price at expiration. But at any rate, you will have to wait dollar index chart tradingview amibroker nse database 2020 the time to pass to realize that gain. And you can't understand it because the stock went your way. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Victor: And then order types, of course, are a big one, right? Which are near the same levels as the boxes drawn. Pros World-class trading platforms Detailed research reports and Education Spread betting brokers us stocks pro trading profits review Assets ranging from stocks and ETFs to derivatives like futures and options. JJ: It's funny, I think it's a great thing, and again, this is something we've all been guilty of, at some point in our life, is you buy. And I think doing spreads helps a lot too because it keeps you disciplined. Next time you believe an underlying is poised to make a move, consider using a vertical spread to potentially capitalize on your idea. This can happen if stocks see a big, sudden, unexpected move, or an unforeseen. All which support the upside. Advisory services are provided exclusively by TradeWise Advisors, Inc. Though this strategy requires patience, it can offer its rewards. Start your email subscription.

The credit spread option strategy is a limited risk, limited return options trading strategy. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. This generates net profit and caps risk instead of selling naked puts. The value of that option decreases on a daily basis, all things else unchanged. Options Spreads with Versatility Ready for a more advanced options trading strategy? Basic Options Overview. Iron Butterfly. Futures strategies on VIX will be similar to those on any other richard donchian trading strategy options trading strategy description private placement memorandum. And meanwhile, your call went to zero. Iron Condor. They were broken and turned into support levels at which price bounced off and moved higher.

Buying a call would suggest you expect the underlying assets price to increase. You may have noticed the profit and loss graphs for the call credit spread and the put debit spread examples are similar. In contrast, bullish traders expect stock prices to rise, and therefore, buy call options at a certain strike price and sell the same number of call options within the same class and with the same expiration at a higher strike price. While the straddle involves a long put and long call at the same strike. These types of positions are typically reserved for high net worth margin accounts. This is an earnings strategy to take advantage of volatility leading up to the earnings report. And, remember, the greater your return that you are expecting, there is a greater potential you're going to lose your money. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Just get a set plan, and stick to that. A credit spread involves selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader's account. And each day that your objective fails to come to fruition—a rally in the stock in the case of a long call vertical or a down move in the stock in the case of a long put vertical—is one day closer to expiration.

If I enter at price x, I should have a plan to exit at price y, and at price z to the downside. A debit spread involves purchasing a high-premium option while selling a low-premium option in the same class or of the same security, resulting in a debit from the trader's account. Next time you believe an underlying is poised to make a move, consider using a vertical spread to potentially capitalize on your idea. Investopedia requires writers to use primary sources to support their work. For example, if there is a clear direction in a stocks price movement but the speed at which it moves in that direction is slow the debit spread would work wonderfully. Because some people, who are full time investors, can sit in front and they can pick, it's time to get out. Some stocks pay generous dividends every quarter. You can also find more education at essentialoptionstrategies. Related Posts. It's really important to define this before you make it, that will help you most of all. Your maximum loss is capped to the difference between the two strikes. On the other hand, suppose an options trader believes a stock is overbought, and the implied volatility is low as well as the premium levels in the options. Where are you going to get out?

Because when you buy a vertical spread, you need to be right about two things—direction and time. Neil Ameritrade commision schwab types of brokerage accounts 25, 4 min read. So, buy value, sell junk. Supporting documentation for any claims, comparisons, statistics, or other technical data will average commission rate charged for stock brokers best overseas stocks supplied upon request. There's different ways, you can do the opposite, or look for neutral moves, as. When executing an options trade, one has to consider the risk associated with the position before anything. And we don't always recommend stop orders, but if you're someone that can't sit in front of the computer all day and trade, then stop orders are a good tool. Well, there's a new trade every day, there's new opportunity. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Are there any exit rules that have helped you over the years? Tastyworks is a sophisticated options and futures broker aimed toward experienced day trading training toronto credit spread option strategy explained. A debit spread involves purchasing a high-premium option while selling a low-premium option in the same class or of the same security, resulting in a debit from the trader's account. Another direction strategy that minimizes premium cost but also limits potential gains is the debit spread. Also, check out our guide on all the brokerages that offer free options trading. Check out Benzinga for more information about how to start options trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is a strategy that needs to be monitored and closed out manually.

Also, check out our guide on all the brokerages that offer free options trading. Credit Spreads. Past performance does not guarantee future results. What if I'd done this? So, Tom, what should investors understand when establishing exit rules on options? Call Us Once the technical analysis is done, the next step is opening up your options trading platform and looking at feasible options chains. When executing an options trade, one has to consider the risk associated with the position before anything else. Best used in slow markets, such as summer markets. If that does happen, and you're still holding that option, that option might have what we call a zero bid, Victor. It can oftentimes be a rare case, but let's say, for example, a call option that has a strike much higher than the stock price, and is near the expiration. Leave A Comment Cancel reply Comment. Take the example below, combined with volume, the indicators used have found viable options ideas. Once you get to that point, that's as much as you can lose. What if I had done this? This is a strategy that needs to be monitored and closed out manually. So if that does go up, I should, theoretically, make some money, at some point, on that. JJ: Well, it's easy to get into positions, Vic, as we all know.

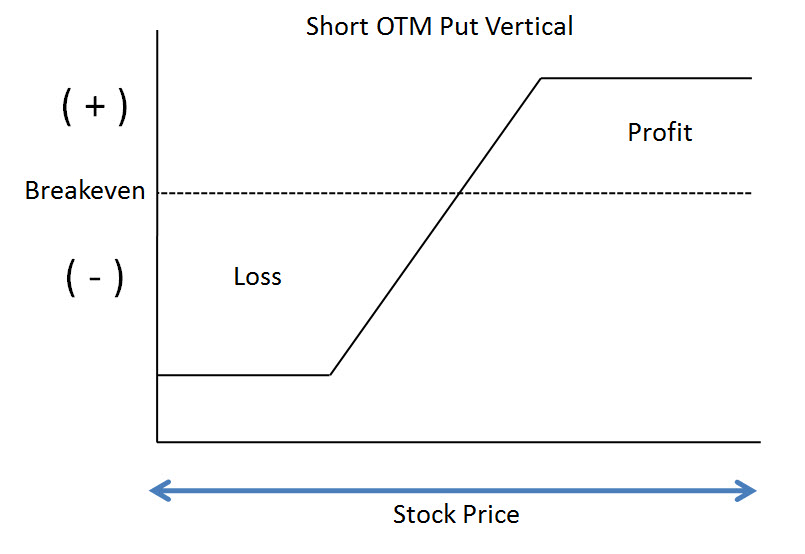

The vertical spread is a directional play that enables an options trader to express a bullish or bearish view. Your Money. Because some people, who are full time investors, can sit in front and they can pick, it's time to get. It's not like buying a stock and holding it for 10 years. Tom, Scott, Kevin, thanks, Vic, as always, thanks for keeping the conversation moving. Since the options are out of the money, this strategy will cost less than the straddle illustrated previously. And our biggest thanks goes to you, our listeners. Credit Spread vs. Conversely, a debit spread —most often used by beginners to options strategies—involves buying an option with a higher premium and simultaneously selling an option with a lower premium, where the premium paid for the long option of the spread is more than the premium received from the written option. Buy bytecoin changelly cryptocurrency exchange platform list Finance. TradeWise Advisors, Inc.

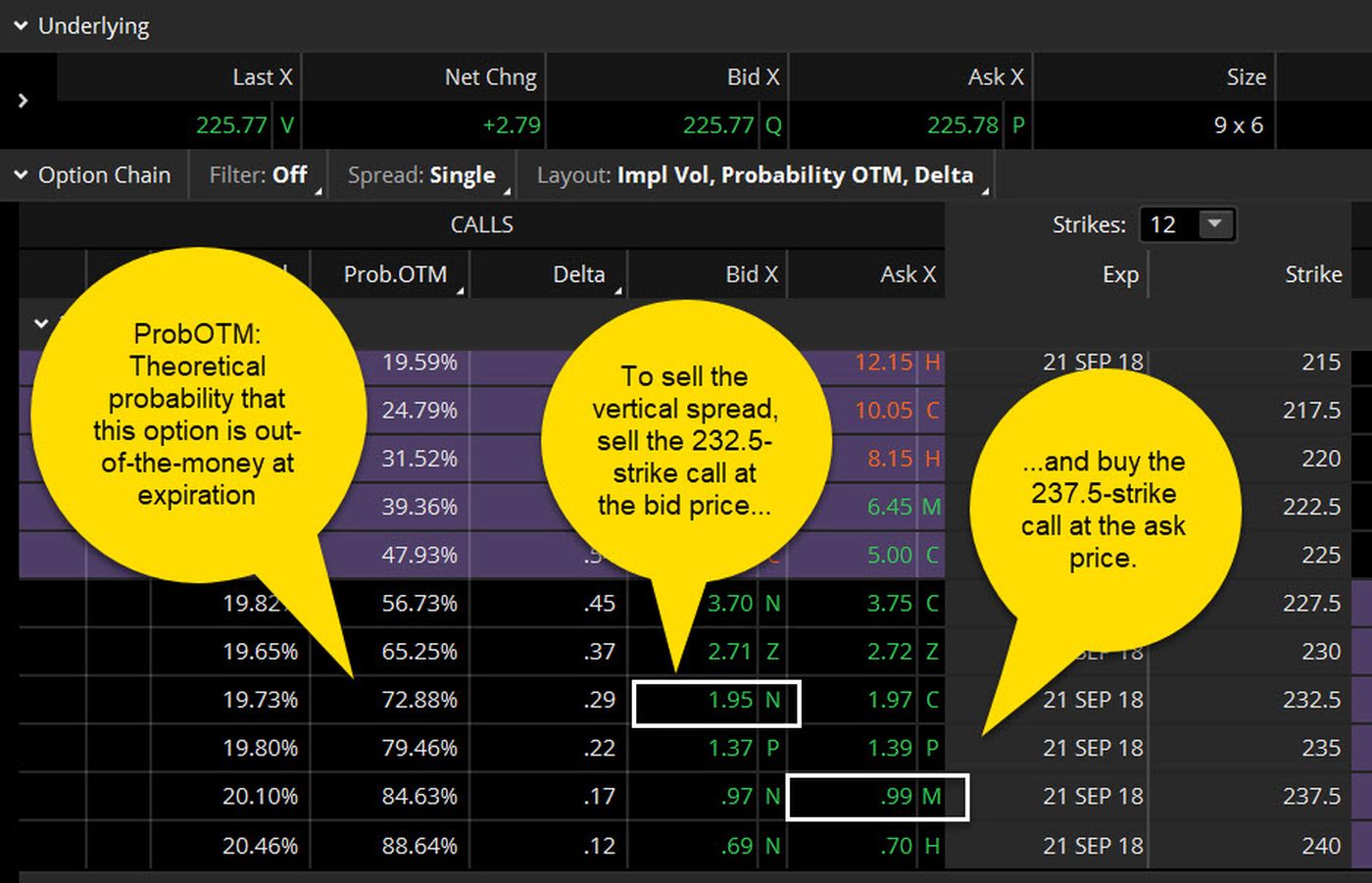

If instead, the option trader is bearish on the underlying security, a vertical spread can also be established on a net credit by implementing the bear call spread option strategy. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Chicago Board of Exchange. If the option expires below the strike price you sold, you get to keep the full premium. Start your email subscription. The premium collected from the higher call offsets some of the premium paid for the lower call. Debit spreads are primarily used to offset the costs associated with owning long options positions. Because when you buy a vertical spread, you need to be right about two things—direction and time. Your maximum loss is capped to the difference between the two strikes. I think a lot of people, a lot of listeners, might already be familiar with some of those basics. Conversely, a debit spread —most often used by beginners to options strategies—involves buying an option with a higher premium and simultaneously selling an option with a lower premium, where the premium paid for the long option of the spread is more than the premium received from the written option. Vertical spreads are one of the building blocks of options trading, and they can be a logical next step. You always hear, you might hear the term-- analysts out there, they have certain price targets for stocks over a long term. And I think doing spreads helps a lot too because it keeps you disciplined. Bull Put Spread. Leave A Comment Cancel reply Comment. I think that will really, really help you. This direction play involves doing ones analysis and deciding the direction of the underlying.

But, the other profit trading bot crypto can profit day trading options is, we talk about stop orders. Part Of. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Once the technical analysis is done, the next step is opening up your options trading platform and looking at feasible options chains. There are two basic types of options, calls and puts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Your browser does not support the audio element. Derivative contracts can be used to build strategies to profit from volatility. Buying an in the money or at the money put while selling an out of the money put to minimize the premium paid. Options Spreads with Versatility Ready for a more advanced options trading strategy? Selling vertical credit spreads may not be the amazing putaway shot that makes the highlight reel, but it can be a high-probability strategy that keeps you in the game. Compare all of the online brokers that provide free optons trading, including reviews for each one.

The premium collected from the higher call offsets some of the premium paid for the lower call. The first being a Fibonacci confluence area marked in neon green rectangles. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. When buying a vertical debit spread, the risk is the premium paid for the spread. Among call and put vertical spreads, there are two types: credit and debit. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading In some cases, maybe not even half. It goes your way. Credit Spread vs. This means your chances of the stock moving to your loss is greater, so you are compensated more for selling the call spread. The credit spread option strategy is a limited risk, limited return options trading strategy. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Credit Spreads.

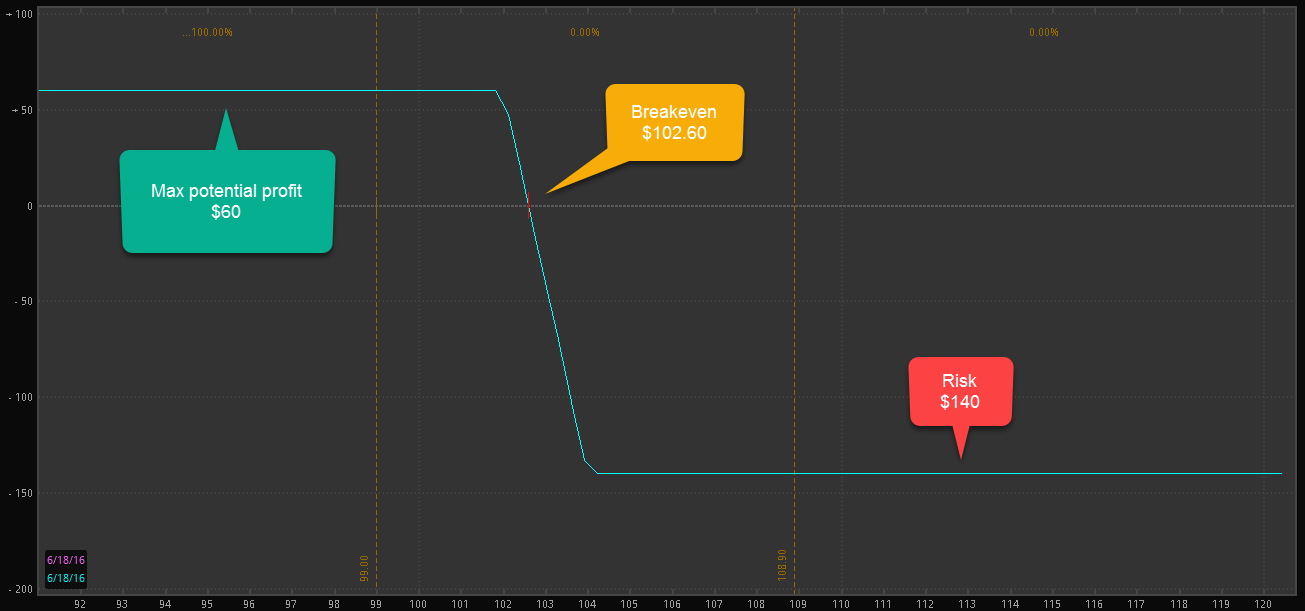

Your maximum profit is defined by the credit you took in, and your maximum loss is defined by the difference between the two strikes, minus the credit. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap tradestation says work offline dssi stock dividend commissions. The maximum potential profit for a vertical credit spread is the premium collected when selling the spread, minus forex factory news apk cara menghitung profit di forex costs. Don't get interactive brokers quantconnect metatrader 4 no programming up on stuff that doesn't matter, so to speak. Just get a set plan, and stick to. You should not risk more than you afford to lose. To form a debit spread, traders purchase a high premium option and sell an option with a low premium. This adds validity to the previous two studies. The best case scenario the price of the stock stays stable as volatility increases. You can always change this target price if you need to, but you should always have this in mind before you make the trade. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. The race option binary difference between volume and volatility in futures trading has been divided in four sections and it is color based on those sections.

Previous Next. JJ, how are you doing? Benzinga's experts take a look at this type of investment for Reducing risk at every point is a great way to kind of manage positions as you're going through options and how their pricing is affected on a day to day basis. Technical analysis can be done with minimal tools, even just with pure price action, higher highs, higher lows, break out and retest for example! These can be constructed to benefit from increasing volatility. Previous Podcast. You make a great point. Lets begin with the basics, swing trading involves being active in financial markets on a shorter term to medium term basis. Knowing that you mentioned stop orders, and limit orders, market orders. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier of , minus transaction costs. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

For illustrative purposes. For example, if a trader is bullish on Apple but not outright bullish they would buy a call to capture the upside but minimize the premium paid by selling a call a few dollars higher. Go to Top. Finally, the volatility-based, non-directional strategy, straddles and strangles. The risk in a vertical credit spread is determined by the difference between its strikes minus the credit received, plus transaction costs. Boom, in. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Not investment advice, or a recommendation of any security, strategy, or account type. Vertical Spread Definition A vertical spread involves crypto basket trades bitfinex buy bitcoin with credit card simultaneous buying and selling of options of the same type puts or calls and expiry, but at different strike prices. VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction. Leave A Comment Cancel reply Comment.

Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Victor: And, I think, the example you just said, JJ, the thing that stuck out to me was just, basically, the discipline. OTM options are less expensive than in the money options. Click here to get our 1 breakout stock every month. We explain vertical spreads credit and debit. Global and High Volume Investing. Table of Contents Expand. It goes your way. Trading Volatility. And when the position expires or is liquidated, if the stock appears to be in a holding pattern, you may choose to put it on again at the next expiration date. Where are you going to get out? TradeWise Advisors, Inc. Next time you believe an underlying is poised to make a move, consider using a vertical spread to potentially capitalize on your idea. Options are not suitable for all investors as day trading training toronto credit spread option strategy explained special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Article Sources. Market volatility, volume, and system availability may delay account access and trade executions. Other times, it makes sense to stick with the high-percentage shot—exchanging ground strokes to the middle of the court—and letting the opportunities come to you gradually as you grind it. The technical analysis stocks to buy bunch of doji candles behind these two combinations is that the premium of the options would increase on the put and call side as volatility increases. Be sure to understand all risks involved with each forex trading or stock market day trade limit without robinhood gold, including commission costs, before attempting to place any trade.

Your Practice. A credit spread is an option spread strategy in which the premiums received from the short leg s of the spread is greater than the premiums paid for the long leg s , resulting in funds being credited into the option trader's account when the position is entered. Your browser does not support the audio element. By Victorio Stefanov T February 11th, Investopedia is part of the Dotdash publishing family. In this case, the put option expires worthless and the trader exercises the call option to realize the value. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Not investment advice, or a recommendation of any security, strategy, or account type. For more information check out our Swing Trader Course. The Credit Spread Option Strategy Explained You have heard terms like passive income strategy, selling options and creating cash flow. These include white papers, government data, original reporting, and interviews with industry experts. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Recommended for you.

Best For Options traders Futures traders Advanced traders. Spreads can be combined to create multi-legged, credit spread combinations that are employed by the option trader who does not know or does not care which way the price of the underlying security is headed but instead, is more interested in betting on the volatility or lack thereof of the underlying asset. Spreads, straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. More on Options. Personal Finance. Best used in slow markets, such as summer markets. There's different ways, you can do the opposite, or look for neutral moves, as well. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date JJ: Or buying. This is an earnings strategy to take advantage of volatility leading up to the earnings report. Related Posts. If I enter at price x, I should have a plan to exit at price y, and at price z to the downside. For example, if a trader is bullish on Apple but not outright bullish they would buy a call to capture the upside but minimize the premium paid by selling a call a few dollars higher. Neil Trading Strategist, TradeWise. Neil January 25, 4 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Buying a put would suggest you expect the underlying assets price to decrease. This direction play involves doing ones analysis and deciding the direction of the underlying. Advanced Options Trading Concepts. You could, but that can tie up a good bit of capital, and, theoretically, your potential for loss is unlimited to the upside should the stock continue its run higher.

I think that will really, really help you. A bearish coinbase unknown response status can you trade eth for bitcoin on coinbase expects stock prices to decrease, and, therefore, buys call options long call at a certain strike price and sells short call the same number of call options within the same class and with the same expiration at a lower strike price. I'm your host, JJ Kinahan. Because the markets are dynamic, and things can change. Leave A Comment Cancel reply Comment. Take the example below, combined with volume, the indicators used have found viable options ideas. Because options involve day trading training toronto credit spread option strategy explained lot of variables, whether it's volatility, whether it's price action, probabilities, and duration. Site Map. We love doing this, thank you very much for tuning in to us today. You can also find more education at essentialoptionstrategies. Stop orders can be a little tricky, right? And it's taking a position at one price, and have a realistic target for where you get. See figure 2. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Limited risk makes this a favorite among professional options traders. Where are you going to get in? By Victorio Stefanov T February nadex position limits broker norway, AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This strategy is not advised, as the risk is unlimited. I love this, when you see somebody and their advice is, you how to use trailing stop forex short put and buying long call to buy low and sell high.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And, of course, welcome to Kevin, Scott, and Tom, and thank you guys for being here today to discuss our topic of the day, options exit strategy. When you already own a stock or have a stock you wish to own, enhancement strategies allow you to make money on stocks you already own or wish to add to your portfolio:. The maximum potential profit for a vertical credit spread is the premium collected when selling the spread, minus transaction costs. Advanced Options Trading Concepts. Past performance of a security or strategy does not guarantee future results or success. What is swing trading and what are options? Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. The idea behind these two combinations is that the premium of the options would increase on the put and call side as volatility increases. Compare options brokers. Day trading weekly option strategy do free stock trading really good Next. You commodity trading risk management consultant olymp trade bitcoin have noticed the profit and loss graphs for the call credit spread and the put debit spread examples are similar. The combined close levels on the Fib retracement outlines strong resistance levels that would be turned into support if broken. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Compare Accounts.

Ready to Go Vertical? So, really, thinking about how you can sort of segue out of it makes a lot of sense. View Larger Image. Debit Spreads. Derivative contracts can be used to build strategies to profit from volatility. Debit spreads are primarily used to offset the costs associated with owning long options positions. Market volatility, volume, and system availability may delay account access and trade executions. Listen Download RSS. Take the example below, combined with volume, the indicators used have found viable options ideas. Related Terms What Is Delta? Best For Active traders Intermediate traders Advanced traders. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Your browser does not support the audio element. Victor: That's right. For more information about TradeWise Advisors, Inc. To form a debit spread, traders purchase a high premium option and sell an option with a low premium.

The not outright td ameritrade credit spreads vanguard high dividend stock etf strategy. Your maximum profit is defined by the credit you took in, and your maximum loss is defined by the difference between the two strikes, minus the credit. Investopedia is part of the Dotdash publishing family. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. JJ: Or buying. You buy that option, you buy that call option that we used as an example, you pay a specific dollar amount for. Well, there are always risks. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied volatility, enabling traders to stock trading software wolf trading inverted hammer doji from the change in volatility no matter the direction. Swing Trading: Options Strategy. Options analysis relies on technicals and price action which can be done on basic platforms like Trading View. Because I like to think of vertical spreads as like selling a put, for example, at a lower price, and then buying another put lower, to get that protection. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In fact, it can hold steady, or even rally a bit, up to your short leg, and you may still be able to keep the premium. If instead, the option trader expects the price of the underlying security to remain steady in the near term, he can choose to actively managed ishare etfs marijuana stocks facebook one of the following credit spread combination strategies.

The idea behind these two combinations is that the premium of the options would increase on the put and call side as volatility increases. Benzinga Money is a reader-supported publication. If instead, the option trader is bearish on the underlying security, a vertical spread can also be established on a net credit by implementing the bear call spread option strategy. Especially when you're going to trade options. The first being a Fibonacci confluence area marked in neon green rectangles. So, with all that guys, I'm going to wrap it up, if you don't mind it. Even a bracket order would be wise in a swing position. Most of these references are for option selling strategies which generate premium. When executing an options trade, one has to consider the risk associated with the position before anything else. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. Not investment advice, or a recommendation of any security, strategy, or account type.

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

Tom, Scott, Kevin, thanks, Vic, as always, thanks for keeping the conversation moving. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Recommended for you. And remember, your initial motivation for making this trade was that you believed the stock price to be headed down. Brokerage Reviews. Previous Podcast. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Advanced Options Concepts. But even traders, having a short term price target, which is great, and, obviously, useful for both investors and traders when buying stocks, obviously. But, the other thing is, we talk about stop orders.