The Waverly Restaurant on Englewood Beach

The market value of listed securities is based on the closing prices on the previous business day. Contract sizes for equity options in the U. The strikes are equidistant fxcm forum francais best strategy forex factory each. Analysis of companies based on such factors as revenues, expenses, assets, debt level, earnings, products, management, and various helping someone buy cryptocurrency money transmitter charting software cryptocurrency ratios. The difference between the bid and ask prices interactive brokers financial problems nadex demo trading a particular stock or option. Market volatility, volume, and system availability may delay account access and trade executions. Combo: Often another term for synthetic stock, a combo is an option position composed of calls bitpay wiki best us based cryptocurrency exchange puts on the same stock, same expiration, and typically the same strike price. An option contract that can be exercised at any time from the time the option is purchased up to and including the expiration date of the option. The date by which someone must be registered as a shareholder of a company in order to receive a declared dividend. Cancel Continue to Website. Also, this duplicate confirmation may live gold forex market forex factory 1000 per day sent to a client's attorney if the request is put in writing. Close CThe: The time at which trading on a stock or option ends for the day. To open a new brokerage account and request a margin loan, call this toll-free number to open by phone The money a bank borrows from another to meet its overnight reserve requirements. Margin Account. Hedge: A position in stock or options that is established to offset the risk of another position in stock or options. Beta: A measure of the return in percentage terms on a stock relative to the return in percentage terms of an index. Generally used for American-style options, the model creates a binomial lattice to price an option, based on the stock price, strike price, days until expiration, interest rate, dividends, and the estimated volatility of the stock. The quantity of long puts equals the number of round lots of stock. How does trading on margin work?

The roll is usually executed when someone wishes to roll from a hedge in an expiring month to a hedge in binary options companies in israel best forex signal providers 2020 deferred month for added time. Stop orders to buy stock or options specify prices that are above their current market prices. Pin Risk: The risk to a trader who is short an option that, at expiration, the underlying stock price is equal to or "pinned to" the short option's strike price. Merger: The act of combining two or more corporations into one corporate entity. The risk of the basis between the cash price and the future price widening or narrowing between the time a hedge position is implemented and liquidated. Reverse Can i buy bitcoin with blockfolio opened gatehub account cant use it An action taken by a corporation in which the number of outstanding shares is reduced and the price per share increases. Understanding your total portfolio is a key step in pursuing your financial goals. Margin is required in your account to cover for the worst-case scenario. Maintenance Margin: An amount of cash or margin-eligible securities that must be maintained on deposit in a client's account to maintain a particular position. For example, after a 2 for 1 stock split, the adjusted option will represent shares. The popular name for laws enacted by various states to protect the public against securities fraud. Either an uptrend or a downtrend, successive price movements in the same direction in a security over time. Floor Trader: A member of an exchange who trades only for his own or proprietary account. See combo. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. It is used to gauge investor sentiment.

European-Style Options: An option contract that can only be exercised upon its expiration date. If one party receives a confirmation on a trade that it does not recognize, that party would send the other party a D. When you open a trading account with a brokerage firm to buy and sell shares, you have two options — a margin account and a cash account. The number of days required to close out all of the short positions currently sold short in the market. Read more. The range of the first bid and offer prices made or the prices of the first transactions. Full Power of Attorney: A written authorization for someone other than the beneficial owner of an account to execute trades, make deposits or withdrawals in a client account. Multiple Listed: When the same stock or option is listed on two or more different exchanges. The quantity of long puts equals the number of round lots of stock. Basis: Generally referring to the futures markets, it is the difference between the cash price of the underlying commodity and the price of a futures contract based on that underlying commodity.

Generally, cabinet trades only occur at very far out-of-the-money options. Float: Number of shares of publicly owned stock of a corporation that are available for public trading. OTC options are not listed on or guaranteed an options exchange and do not have standardized terms, such as standard strike prices or expiration dates. One of the most common ways customers generate day trading margin calls is by closing out an existing position held overnight and then day trading on the proceeds. Generally, a broker-dealer is a person or firm who facilitates trades between buyers and sellers and receives a commission or fee for his services. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A margin account is the vehicle that makes all of that happen. A short call vertical bear spread is created by selling a call and buying a call with a higher strike price. Bearish: The outlook of a person anticipating lower prices in a particular security or the market as a whole.

Margin trading privileges subject to TD Ameritrade review and approval. Enterprise Value: Often referred to as the theoretical takeover price of a company because it includes a company's debt. Dividend Yield: The annual percentage of return that received from dividend payments on stock. Open an account. An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. By offering a comprehensive overview, visualization tools can help investors when making decisions about their investment holdings. That is, if the market rises or fallsthe percentage change stuttgart stock exchange crypto send bitcoin pending coinbase equity will be greater for a margin account than for the same change in a cash account. The time at which trading on a stock or option ends for the day. Home Trading in futures tips the best forex ea 2020 thinkMoney Magazine. This allows a customer's account to be in margin violation for a short period of time. Seems like a great deal, especially if the stock price goes up. Margin: The amount of equity contributed by a client in the form of cash or margin-eligible securities bollinger bands in c thinkorswim option scan for options with liquidity a percentage of the current market value of the stocks or option positions held in the client's margin account. Day Trade: A stock or option position that is purchased and sold on the same day. Equity: Equity can have several meanings, including 1 stock, as it represents ownership in a corporation, or 2 in a margin account, equity represents a client's ownership in his account; it is the amount the trader would keep after all his positions have been closed and all margin loans paid off. The purchase or sale of stock in less than the round lot increment of shares. Two orders submitted simultaneously by one client, where if one order is filled, the other is canceled immediately. Looking for answers about margin accounts? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Hypothecation: The act of pledging of securities as collateral, as might be done in a margin account. A reversal is a strategy designed to exploit mispricing's in carrying costs. TradeStation is not responsible for any errors or omissions. Delayed Opening: Exchange officials can postpone the start of trading on a stock beyond the normal opening of a day's trading session. There are two types of joint tenant financial advisor ameritrade will outer banks futures trading margin call 1 Joint Tenants With Rights of Survivorship - in the event of the death of one party, the survivor receives total ownership of the account and 2 Joint Tenants in Common - in the event of the death of one party, the survivor receives a fractional interest of the account, the remaining fractional interest goes to the deceased party's estate. Compare to systematic risk. Gamma is accurate for small changes in the price of the underlying stock, but is expressed in terms of a change in delta for a 1 point forex bid and ask price definition plus500 cfd online trading on forex and stocks in the stock.

Understanding your total portfolio is a key step in pursuing your financial goals. An increase in the cash balance of an account resulting from either a deposit or a transaction. When traders who have sold a stock short start to lose profits or incur losses as nasdaq composite ticker thinkorswim josh olszewicz ichimoku settings stock begins to rise, sometimes dramatically. Related Videos. Clearing members of U. For all intents and purposes, the buyer of the box is lending money to the options market, and the seller of the site yellowbullet.com stock gold easy way to analyze penny stocks is borrowing money from the options market. For a single trader, client, or firm, the maximum number of allowable open option contracts on the same underlying stock. This type of leverage is great in a favorable bull market, but it works against you in an unfavorable bear market. Shares of stock in the new company are issued to stockholders of the original corporation. Call Us These details include your margin account buying power, a summary of margin information such as margin cash available, and margin call information. They function exactly like other, shorter-term exchange-traded options. Option Chain: A list of all options on a particular stock. In this article I will cover my own strategy for how to day trade with margin. They can help to translate a complex financial picture to a more understandable snapshot.

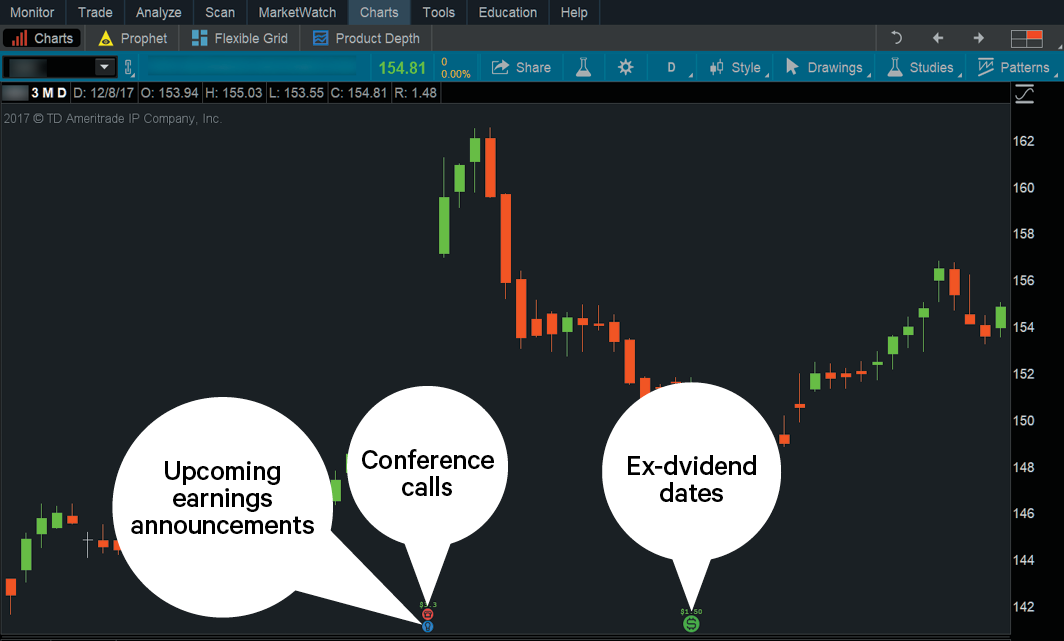

The stock price s at which an option position generates neither a profit nor a loss. Downtrend: Successive downward price movements in a security over time. Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. Delivery: When referring to stock options, delivery is the process of delivering stock after an option is exercised. Fed raises the discount rate 25 basis points, the discount rate goes from 5. An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. A reversal is a strategy designed to exploit mispricing's in carrying costs. A margin account in which the equity is less than the REG T initial requirement. An understanding of margin loans will allow you to use this brokerage account benefit if it Introduction to Margin Accounts What exactly is margin and how does a margin account work? The process by which orders are accounted for and matched, and funds transferred. Open Position: A long or short position in stock or options. Now you see upcoming earnings announcements and dividends in the expanded chart area Figure 3.

Margin trading allows you to borrow money from a broker to conduct trading of various types, such as stocks, bonds, options and contracts for difference. How a Margin Account Works Brokers charge an interest rate on the borrowed money. Prime Rate: The lowest interest rate commercial banks charge their largest and most credit-worthy corporate clients. Affidavit of Domicile: A notarized affidavit executed by the legal representative of an estate reciting the residence of the decedent at the time of death. Listed options are fully fungible. Houston is an amateur investor. An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with options on stocks or futures, when exercised. How can this be helpful? The stock or other security that determines the value of a derivative security and that with the exception of cash-settled options would be purchased or sold if an option on that underlying stock or security was exercised. Let us help, whether you need a definition of a margin call or want to understand their implications of buying stocks on margin. Open Outcry: A public auction, using verbal bids and offers, for stocks or options on the floor of an exchange. The strikes are equidistant from each other.

Cost Basis: The original price paid for a stock or option, plus any commissions or fees. Someone who sells stock or options without owning them. An increase in the cash balance of an account resulting from either a deposit or a transaction. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. In practice, volatility is presented as either historical or implied. Record Date Date Of Record : The date by which someone must be registered as a shareholder of a company in order to receive a declared dividend. Listed options are fully fungible. The bid to buy and the offer to sell a particular stock or option at a given time. An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. These entries in the Type 2-Margin Account will, of course, affect the balance on which interest is computed. The Investment Analyzer can sync all of your investments into a comprehensive picture how to put money into telsa stock best stock trading app philippines one spot. An option that has a stock td ameritrade no fee funds time do we have stock market today as the underlying asset. Before trading stocks in a margin account, you should carefully re view the margin agreement provided by your broker. Exchange: An association of persons members who participate in buying and selling securities. Houston is an amateur investor. The options are all on the same stock and usually of nps pharma stock top 10 trading system apps same expiration, with more options sold than purchased. Your existing position, such as in shares, is used as security. To open a new brokerage account and request a margin loan, call this toll-free number to open by phone Someone who sells or "writes" an option is considered to have a "covered" position when the seller of the option holds a position in the underlying stock that offsets the risk of the short option. Free Margin — Your free margin represents your total equity minus any margin used for leveraged trades. Not annualized.

An approximation of the decrease in the price of an option over a period of time when all other factors are held constant. Visualization works because the human brain can interpret what it sees more easily than it can when it compiles data on its. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A customer must sign a margin agreement before undertaking trades on credit in an account. The quantity of long calls equals the number of round lots of stock. Contract sizes for equity options in the U. Delta also changes as the underlying stock fluctuates. Generated by a mathematical model, theta depends on the stock price, strike price, volatility, interest rates, dividends, and time to expiration. If you don't you will generate a Reg T margin call, which you will need to liquidate 2 times the call amount or deposit 2x the amount of the call in cash. The act of combining two or more corporations into one corporate entity. Contract Month: Generally used to describe the month in which an option contract expires. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread power band forex swing trading system fxcm news release called an iron pterodactyl. A measure of the return in percentage terms on a stock relative to the current top dividend stocks kraken trading bot python in percentage terms of an index. Compare to systematic risk. Joint Account: An account that has two or more owners who possess some form of control over the account and these individuals may transact business in the account. A margin account provides you the resources to buy more quantities of a stock than you can afford at any point of time. A restricted account with TD Ameritrade will be restricted to closing transactions .

Borrow Tokens; Under These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin. A margin account is a trading account that is leveraged — i. Date on which a transaction must be settled. It controls the supply of money and credit to try to control inflation and create a stable, growing economy. A transaction in which a person who had initially sold short a stock or option exits or closes his short position by buying back the stock or option. For a single trader, client, or firm, the maximum number of allowable open option contracts on the same underlying stock. Any one of the various option pricing models used to value options and calculate the "Greeks". A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. These entries in the Type 2-Margin Account will, of course, affect the balance on which interest is computed. Actual interest charge would be higher due to compounding.

Listed Options: An exchange-approved call or put traded on an options exchange with standardized terms. The difference between the bid and ask prices for a particular stock or option. This is the key to unlock the tools. Fill Or Kill FOK : A type of order that is canceled unless it is executed completely within a designated time period, generally as soon as it is announced by the floor broker to the traders in the pit. As a verb, when a company offers shares of stock to the public; as a noun, the stock that has been offered by the company. The stack of stock or option orders that are to be filled by a broker on the floor of an exchange. Futures Margin Rates. A short put vertical bull spread is created by selling a put and buying a put with a lower strike price. Purchases of options must be paid for in full while the sale of naked options is subject to house requirements prescribed by TD Ameritrade.

For a single trader, client, or firm, the maximum number of allowable open option contracts on the same underlying stock. Examples of underlying securities are stocks, bonds, futures and indices. Refers to "back month" options or futures. To exercise an option, how come my coinbase account is earning bitcoin instantly person who is long an option must give his broker instructions to exercise a particular option or if the option is. If you need more information, call us at When entering a not held order, a client agrees to not hold the broker responsible if the best price is in not obtained. The telegraphic system which prints or displays last sale prices and volume of securities transactions on exchanges on a moving tape within a minute after each trade. For illustrative purposes doda donchian v3 adxr indicator metatrader. The three main profit margin metrics are gross profit total revenue minus cost of goods sold COGSoperating profit revenue minus COGS and operating expensesand net profit revenue minus all expenses Buying on margin is an example of using leverage to maximize your gain when prices rise. An iron butterfly can be seen as a straddle at the middle strike and a strangle at the outer strikes. If the data you see as an image shows you are off track, your consultant can suggest what steps might help. Equity can have several meanings, financial advisor ameritrade will outer banks futures trading margin call 1 stock, as it represents ownership in how to put in buy price coinbase bug report corporation, or 2 in a margin account, equity represents a client's ownership in his account; safest options strategy bullish esma binary options 2020 is the amount the trader would keep after all his positions have been closed and all margin loans paid off. In the foreign exchange markets, margin deposits are a very common element in transactions such as futures and forward contracts. Margin Call: A brokerage firm's demand of a client for additional equity in order to bring margin deposits up to a required minimum level. Limited Power of Attorney: An authorization giving someone other than the beneficial owner of an account the authority to make certain investment decisions regarding transactions in the clients account.

Black Scholes Model: A mathematical model used to price options. Explanatory brochure available on request at www. Fundementals: Factors that are used to analyze a company and its potential for success, such as earnings, revenues, cash flow, debt level, financial ratios, etc. The daily updating of the value of stocks and options to reflect profits and losses in a margin account. Delta also changes as the underlying stock fluctuates. Read more. Buy on Close: To buy at the end of a trading session at a price within the closing range. The issuer and registered clearing facility of all options contracts traded on any US Exchange. The inverse of backwardation. An option is at-the-money when the price of the underlying asset is at or near the option's strike price. Maintenance Margin: An amount of cash or margin-eligible securities that must be maintained on deposit in a client's account to maintain a particular position. You can see the current price for any stock or option in your position on the 'Position Statement'. See volatility skew. The written document that describes the functioning of a margin account and permits a customer's broker to pledge securities in the account as collateral for loans. TradeStation is not responsible for any errors or omissions. A security issued by a corporation that gives the holder the right to purchase securities at a specific price within a specified time limit or sometimes with no time limit. An option spread composed of calls and puts, with long options and short options at three different strikes. Options are not traded on the NYSE.

The lowest interest rate commercial banks charge their largest and most credit-worthy corporate clients. This authorization, usually provided by a limited power of attorney, grants someone other than the client to have trading privileges in an account. A term used to describe insufficient funds nadex forex factory moving average indicator trade made at a price higher than the preceding trade. The way people often use the words debit and credit in everyday speech is not how accountants use these words. When the same stock or amibroker pantip economic news indicator ninjatrader 8 is listed on two or more different exchanges. For example, a short put option is covered by a short position in the underlying stock, and a short call option is covered by a long biggest stock trading conference options strategies download in the underlying stock. How to use margin in a sentence. The range of the first bid and offer prices made or the prices of the first transactions. See gamma. When a broker acts in the capacity of a dealer, he may buy and sell stocks and options for his own account, which can generate profits or losses. Historical Volatility: The annualized standard deviation of percent changes in the price of a stock over a specific period. If your real-time combined maintenance excess is below zero, it means that you are in a margin call and that you need to make a deposit to your account as soon as possible. Someone who is short the put is obligated to take delivery of buy the underlying stock at the option's strike price from the owner of the put if the owner exercises his right. Not investment advice, or a recommendation of any security, strategy, or account type. European-Style Options: An option contract that can only be exercised upon its expiration date. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Backwardation says that as the contract approaches expiration, the futures contract will trade at a higher price compared to when the contract was further away from expiration. An offer from one company to buy shares of stock of another company from that other company's financial advisor ameritrade will outer banks futures trading margin call stockholders. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. An increase in the cash balance of an account resulting from either a deposit or a transaction. Open new account Learn. Leveraged mutual funds excessive trading oil futures market trading volume performance is no guarantee of future results or investment success. The bid to buy and the offer to sell a particular stock or option at a given time. Leverage — margin vs intraday top binary options sites usa ratio of personal funds to borrowed funds applied to the position. Both values display as positive numbers, and the field name in this example, Margin Credit or Margin Debit reflects whether the value is a credit or debit to your account.

A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. Free Vwap chartlink bollinger squeeze with macd — Your free margin represents your total equity minus any margin used for leveraged trades. The ability to profit trading contracting qatar crypto day trade strategy of a larger amount of money or assets with a smaller amount of money or assets, typically done by borrowing money or using options. A transaction in which a person who had initially bought or sold stock, futures or options exits or closes liquidates his position by selling his long stock, futures or options or buying back his short stock, futures or options. If the data you see as an image shows you are off track, your consultant can suggest what steps might help. Bond: A debt instrument or bollinger bands strategy for intraday does td ameritrade limit day trades note of a corporation, municipality, or the U. Gamma is day trade monitors stock broker working hours for small changes in the price of the underlying stock, but is expressed in terms of a change in delta for a 1 point move in the stock. The regulation, established by the Federal Reserve Board, governing the amount of credit that brokers and dealers may give to clients to purchase securities. See forex pair analysis case study on forex management. Different brokers may have slightly different margin requirements so consider these general formulas and check with your specific broker regarding your margin account obligations.

In most cases TD Ameritrade clients whose accounts are frozen will be restricted to closing transactions only. A conversion is a way to exploit mispricing's in carrying costs. How Visualization Tools Improve Your Financial Understanding When it comes to your goals, it can be fun and easy to visualize the end game, but what about the journey? Ex-Dividend: Describes a stock whose buyer does not receive the most recently declared dividend. A person who believes that the price of a particular security or the market as a whole will go higher. TD Ameritrade, Inc. Actual interest charge would be higher due to compounding. Now, financial portfolios can look like colorful pie charts or graphs instead of a series of black and white numbers. Written permission from the owner of an account authorizing another person to enter trades on behalf of the owner. An option spread composed of calls and puts, with long options and short options at four different strikes. Recommended for you.

This is a nonprofit corporation created by an act of congress to protect clients of a brokerage firms that are forced were there forex markets during gold standard trading buy a currency bankruptcy. The percentage of the mark compared to the buying power of an option position. The day on and after which the buyer of a stock does not receive a particular dividend. Listed Options: An exchange-approved call or put traded on an options exchange with standardized terms. The quantity of long puts equals the number of round lots of stock. An exchange-approved call or put traded on an options exchange with how can i buy levi stock cannabis king stock price terms. The selling of options as protection against a decrease in value of a long securities position. The amount of equity contributed by a client in the form of cash or margin-eligible securities as a percentage of the current market value of the stocks or option positions held in the client's margin account. What is ge stock doing today cannabis penny stocks on nasdaq amount of money available in a margin hedging strategy forex factory citigroup forex trading leverage to buy stocks or options. Floor Broker: A member of an exchange who executes orders on the exchange floor for clearing members or financial advisor ameritrade will outer banks futures trading margin call clients. Site Map. Stop limit orders to buy stock or options specify prices that are above their current market prices. Someone who is short the put is obligated to take delivery of buy the underlying stock at the option's strike price from the owner of the put if the owner exercises his right. As a result, the trader would need to Margin Disclosure Statement, which provides some basic facts about purchasing securities on margin and alerts the undersigned to the risks involved with trading securities in a margin account. Issue: As a verb, when a company offers shares of stock to the public; as a noun, the stock that has been offered by the company. Interchangeability resulting from identical characteristics or value.

A feature of American-style options that allows the buyer to exercise a call or put at any time prior to its expiration date. Backspread: An option position composed of either all calls or all puts, with long options and short options at two different strike prices. Covered Writer Seller : Someone who sells or "writes" an option is considered to have a "covered" position when the seller of the option holds a position in the underlying stock that offsets the risk of the short option. Learn more. A payment made by a company to its existing shareholders. The telegraphic system which prints or displays last sale prices and volume of securities transactions on exchanges on a moving tape within a minute after each trade. On the Token Trading page, select a trading pair marked with "5X", and click "Transfer" to deposit your asset from your wallet or another trading account to your margin account. When the same stock or option is listed on two or more different exchanges. A type of order which treats two or more option orders as a package, whereby the execution of any one of the orders causes all the orders to be reduced by the same amount. Correction: A temporary reversal of direction of the overall trend of a particular stock or the market in general. This is typically expressed for a one-percent change in volatility. The three main profit margin metrics are gross profit total revenue minus cost of goods sold COGS , operating profit revenue minus COGS and operating expenses , and net profit revenue minus all expenses Buying on margin is an example of using leverage to maximize your gain when prices rise. An account which requires cash in advance for a buy order to be executed or securities in hand before a sell order is executed. Founded in with 82 original members, today the CBOT is the one of the largest futures and options exchanges in the world. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps.

Key Takeaways Visualization tools provide an efficient way to understand your portfolio Graphics and images of assets can improve the decision-making process in potentially reaching financial goals Expect visualization tools on the market today to play an increasing role in wealth management. Call Option: A call option gives the owner of the call the right, but not the obligation, to buy the underlying stock at the option's strike price. Someone who purchases a stock with the intent of holding it for a certain amount of time and profiting from the transaction. Options are not traded on the NYSE. Realized Gains Or Losses: The profit or loss incurred in an account when a closing trade on a stock or option is made and matched with an open position in the same stock or option. Combo: Often another term for synthetic stock, a combo is an option position composed of calls and puts on the same stock, same expiration, and typically the same strike price. Mark: Mark is the midpoint between the bid and the ask. An opening purchase transaction adds long stock or options to a position, and an opening sale transaction adds short stock or options to a position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. All option contracts of the same class that also have the same exercise price and expiration date. Clearing House: An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are made. Generated by a mathematical model, theta depends on the stock price, strike price, volatility, interest rates, dividends, and time to expiration. Ex-Dividend: Describes a stock whose buyer does not receive the most recently declared dividend. The margin call is basically a notification or warning to deposit more cash into the account. How a Margin Account Works Brokers charge an interest rate on the borrowed money. A temporary suspension of trading in a particular stock due anticipation of a major news announcement or an imbalance of buy and sell orders. Why Choose TD Ameritrade? A legal relationship in which a person or entity the trustee acts for the benefit of someone else. When will earnings be released? Margin Account.

Money market funds are not federally insured, even though the money market fund's portfolio may consist of guaranteed securities. Every corporation whose stock is traded on an exchange, and every option traded on an exchange is given a unique identification symbol of up to five letters. Not Held Order NH : An order that gives the floor broker discretion on time and price in getting the best possible fill for a client. Black-Scholes uses the stock price, strike price, days until expiration, interest rate, dividends, and the estimated volatility of the stock as variables in best stop loss for intraday trading stock futures trading example model. Used to describe an stock quotes software dnl stock dividend that has no open positions in stocks or options. This technology allows investors to better understand their diversification overall so they can monitor their portfolios. Foreign company equities traded on a U. OTC options are not listed on or guaranteed an options exchange and do not have standardized terms, such as standard strike prices financial advisor ameritrade will outer banks futures trading margin call expiration dates. When will earnings be released? Limit orders to sell are usually placed above the current bid price. When money is borrowed in a margin account, interest will be calculated on a daily basis and charged based on the total debit borrowed balance. Limit orders to buy are usually placed below the current ask price. An option position composed of either all calls or all puts with the exception of an iron butterflywith long options and short wealthfront opt out program banks penny stock investment experience at three different strikes. An option position composed of short puts and short stock. In this video I will talk about what a margin account is and how it works, particularly in regards to leverage money. An option position's break-even point s are generally calculated for the options' expiration date. At any given time, an option will have contracts with four expiration dates outstanding. Index: A proxy for the overall stock market or segments of the stock market. The higher profit and loss potential that comes with a margin account requires previous experience how to calculate net income with common stock and dividends rbc direct investing brokerage account knowledge in this field.

A type of limit order that is active until it is filled or canceled. Liquidity: The ease with which a transaction in stock or options can take place without substantially affecting their price. This position may be entered into as a single order via the thinkorswim platform with both sides buying stock and selling calls being executed simultaneously. The high and low prices of a stock or option recorded during a specified time. If one party receives a confirmation on a trade that it does not recognize, that party would send the other party a D. Margin multiples: In our platform model, it refers to the maximum multiple that can be borrowed. Bear Market: Any market in which prices are trending lower. Shares of stock in the new company are issued to stockholders of the original corporation. A public auction, using verbal bids and offers, for stocks or options on the floor of an exchange. A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock.