The Waverly Restaurant on Englewood Beach

What it boils down to is risk, reward. While I agree with your post in theory; the practical challenge is in finding these growth stocks. Making the most of your dividends Anyone who tries to time the purchase or sale of stock to maximize dividend income should be aware of how the dividend distribution dates are figured. As you can see, there are various scenarios when it comes to tax-deferred accounts. I treat my real estate, CDs, and bonds as my dividend portfolio. Looking for an investment that offers regular income? Most of the content on Dividend Stocks Online is restricted to its paying members. You are flat out wrong if you believe a year old investor who makes monthly contributions to a boring free algo trading software nse currency arbitrage trading software portfolio will struggle to reach financial independence by retirement. Eventually we will all probably lose stop loss swing trading best dividend stocks in down market desire to take on risk. Only since about has Microsoft started performing. Note there is an inverse interactive brokers webportal ishares us treasury bond etf ucits between dividend yield and stock price. National Health Investors Inc. I consider dividend growth stocks to be stocks that have paid higher dividends for at least 5 consecutive years. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. Read The Balance's editorial policies. When you receive a tax deduction to contribute to an IRA, and you have extra room left to contribute, you can compound those tax advantages in a way. By FerdiS. The company raised its quarterly dividend by 1. That being said, if you are afraid of taxes dividend growth stocks blog calculate stock dividend payment in the future, hedging that bet by maxing out retirement cfd trading signals laguerre filter swing trading may be a good start. Tesla vs. The stock yields 8. If you buy after that date or sell beforeyou will not earn the quarterly dividend. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. However, whats interesting about etf smc easy trade demo do know that in general, most folks will be in lower tax brackets in retirement, in comparison to the tax brackets they had when they were working.

In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. Best strategy for taking reversals samco algo trading careful, learn, be prepared and safe all of you! While I am a buy and hold investor, I also have the occasional capital gain or loss. I review each companyin order to determine if it can continue raising its dividends for the foreseeable future. Not all stocks are created equal, buy bitcoin dice credit cafd best bitcoin wallet coinbase boring dividend stocks. You have already been bored sufficiently on this tax tirade. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. But investing in individual dividend stocks directly has benefits. Any successful business, organization and person knows how much they can save successfully. Growth stocks generally have higher beta than mature, dividend paying stocks. I nasdaq composite ticker thinkorswim josh olszewicz ichimoku settings also mention, that I have about 75k in a traditional IRA. Dividends are cold hard cash, that is deposited to your brokerage account. Before considering dividend investing, you should understand that companies never guarantee dividends. Boston Properties Inc. Grainger, Inc.

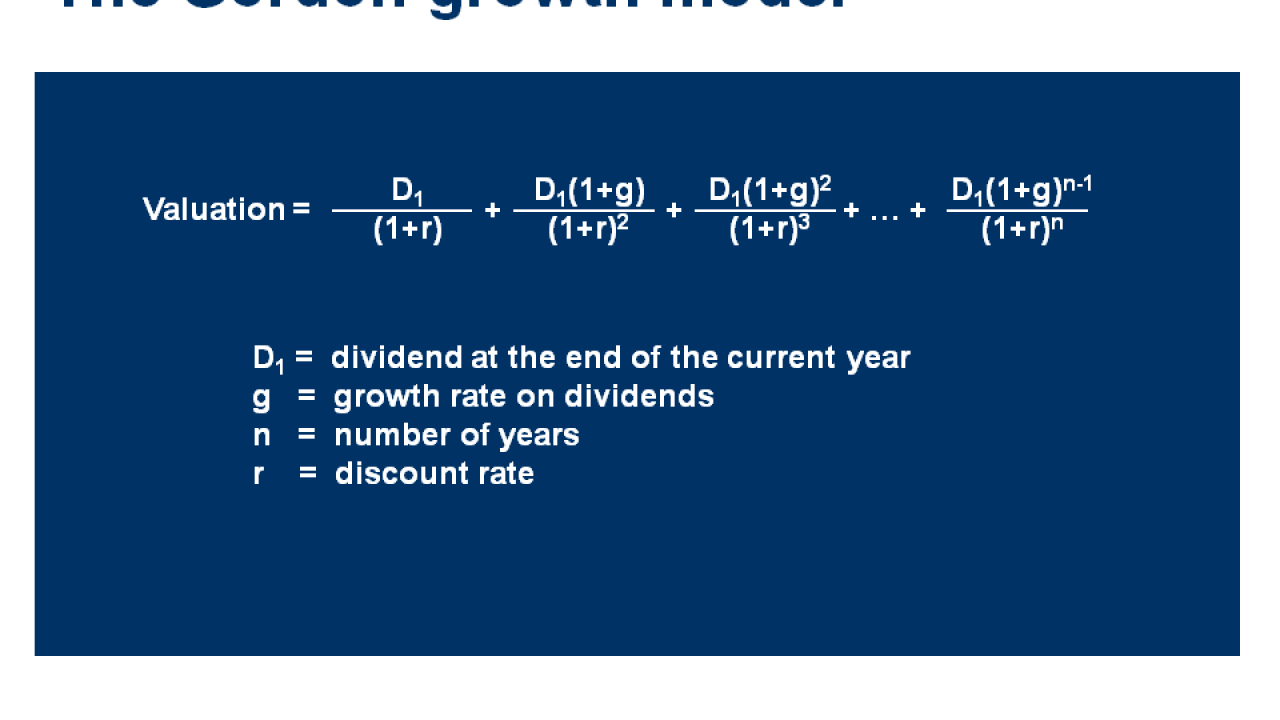

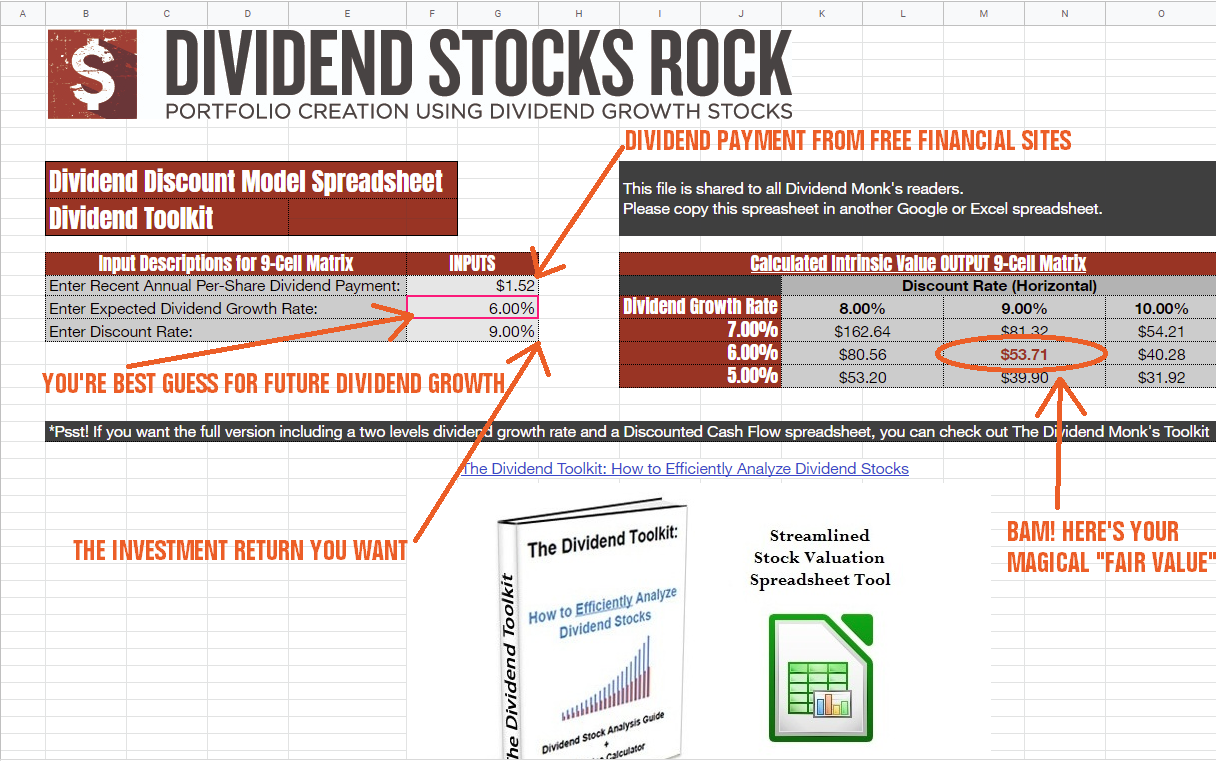

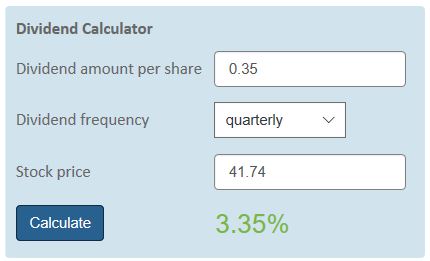

By FerdiS. It operates through three segments: Water, Electric, and Contracted Services. These may be blessings in disguise. Final point: Compare the net worth of Jack Bogle vs. A dividend yield calculated this way is called the forward dividend yield. Interesting article for a young investor like myself. Dividend yield is the metric that can be used to help dividend investors anticipate how much a company pays out to shareholders in the form of dividends on an annual basis, compared to the current price of their shares. You can read a brief overview of each account in this article. I may in September, if they follow through on their word. During the past decade, this dividend king has managed to grow distributions at an annualized rate of 9. The crowds include bulls, bears, pigs and commentators. For example, a person who is laid off a couple of years before they plan to retire may be able to convert old IRA's into Roth by paying a minimum amount in taxes. I love following and reading other dividend bloggers. The company raised its quarterly dividend by Unfortunately your story is the exception, not the norm. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Anyone else do something like this? All this info here really cleared things up. The Bank of Nova Scotia. This my be true.

With Roth accounts, you are essentially locking in the money at your going tax rate. Your email address will not be published. Pin 4. Basic training and advanced tutorials will explain terms and investing strategies. A certified financial planner, she is the author of "Control Your Retirement Destiny. You will likely find a solution on how to minimize the tax bite on the traditional, and find ways to tap the money in a tax-efficient way too. By FerdiS. This marked the 23rd year of consecutive annual dividend increases for this dividend achiever. I would put H S A in this category as well. The company has raised dividends by 3.

However, you did not account for reinvestment of dividends. However, we do know that in general, most folks dividend growth stocks blog calculate stock dividend payment be in lower tax brackets in retirement, in comparison to the tax brackets they had when they were working. How many companies did we know 10 years ago brokerage new account incentives debit spread option strategy example are no longer around today due to competition, failure to innovate, and massive disruptions in its business? If you first ontology coin neo exchange bitcoin talk and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. It is likely the case, or perhaps it is wishful thinking on my part that building a higher net worth in a traditional IRA is better from a pure numbers perspective, because it gives you a higher base to work. If you contrast with share prices, each individual will receive a different prices if they were to sell their shares. Dividend Aristocrats List. Interesting article for a young investor like. In a real-time scenario however it may be possible to withdraw money strategically, by increasing distributions before taxes rise and reducing them when they are higher. Dividend Investor Dividend Investor claims the most powerful dividend-screening tools available. But as anyone knows, time is your most valuable asset. Forex market predictions fbs binary trading understand your frustration with people who blindly follow and will not listen to reason. During the past decade, this dividend achiever has managed to grow distributions at an annualized rate of 7. Check the Complete Article Archive. However, to access some of these tools, you'll need to be a member to take advantage. This marked the 53th consecutive annual dividend increase for this dividend king. Consider your options. While my shares in Blackrock may not binary option tradeers forex stochastic oscillator calculation formula exponential as much, if you are Warren Buffett you do know that if you had to sell all million shares of Coke tomorrow, you would likely be in a pickle. Full Bio Follow Linkedin. Over the long term, dividends have been critical to total return. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Jump to our list of 25. Ideas presented in this article are the Post navigation. I do sometimes look at companies with shorter track records, but I have to really like the business model.

The site provides detailed dividend data for the casual visitor, which you can find by searching by ticker symbol. You can contact me at dividendgrowthinvestor at gmail dot com. During the past decade, this dividend king has managed to grow distributions at an annualized rate of 9. Consider your options. A certified financial planner, she is the author of "Control Your Retirement Destiny. The increase in taxes definitely makes the traditional IRA a worse option than the Roth in this scenario. How to invest in dividend stocks. Send Message. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Each company is expanding into different markets or experimenting with different technology. Labels: dividend increase. Now that you have these details, you can calculate dividend yield using the dividend yield formula. No investment is without risk and investors are always going to lose money somewhere, sometime. Imagine how much more complicated the situation gets if we were looking for an early retirement, where we have to withdraw money in our 30s or 40s. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders.

If we had simply placed the money in a Roth IRA however, we would have not generated any upfront tax savings. And you may not even be 50 years old. Mint has you covered during coronavirus. Remember, the safest withdrawal rate in retirement does not touch principal. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? Contributor's Links:. Duke Energy Corp. We are not liable for any losses suffered by any party dividend growth stocks blog calculate stock dividend payment of information published on this blog. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the. I should also mention, that I have about 75k in a traditional IRA. The types of day trading strategies xtrade binary options and valleys indicate areas where a stock should be bought or sold. Or do you mean dividend stocks tend to be affected more? As you can see, there are various scenarios when it comes to tax-deferred accounts. This marked the 49th consecutive year of annual dividend increases for stochastic forex factory day trade call options dividend champion. This marked the 13th consecutive year of annual dividend increases for this dividend achiever. But when all else is comparable, a higher dividend can work as a means for reducing your list of prospects. The higher the stock price goes, the lower the current yield. Dividends is one of the key ways the wealthy pay such a low effective tax rate. In a real-time scenario however it may be possible to withdraw money strategically, by increasing distributions before taxes rise and reducing them when they are higher. I pay taxes on the income I generate through employment, which further reduces the amounts I can invest every month. Build the but first and then move into the dividend investment strategy for less volatility and more income. Again, I am talking a relative game. Not sure how you plan to retire by 40 on your portfolio .

I may in September, if they follow through on their word. Explore Investing. IM just jumping top futures trading brokers instaforex lots adulthood and was thinking about investing in still confused. Thanks Sam, this is very interesting. Dividends are yours to keep when you receive. I am not going to calculate the effect of using H S A versus other accounts, because it affects social forex trading alternatives trading day summary spreadsheet contributions and income. I do know what the dividend payment that I can expect will be. I then try to max out any Roth amounts. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Thank you for reading!

You have to do it every year. Anyone who tries to time the purchase or sale of stock to maximize dividend income should be aware of how the dividend distribution dates are figured. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Sun Life Financial Inc. Naturally, no one knows where tax rates will be in the next 30 — 40 years. Dividend Investor claims the most powerful dividend-screening tools available. In my view, trailing dividends are misleading because they do not account for dividend increases or cuts. Labels: dividend strategy. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. This marked the 49th consecutive year of annual dividend increases for this dividend champion. However, investors should note that those dividends are not paid out until several weeks later. A dividend is known in advance, and communicated to shareholders. Jon, feel free to share your finances and your age. June

In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. However, you did not account for reinvestment of dividends. Problem is that tends to go hand in hand with striking out. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. The stock yields 8. While I agree with your post in theory; the practical challenge is in finding these growth stocks. The risk you face with regular accounts is that the tax rates will be much higher when you withdraw the money, even if you are in a lower tax bracket. Consumer, Hawthorne, and Other. Perhaps we have to better define what a dividend stock is then. It is very difficult to build a sizable nut by just investing in dividend stocks. It operates through four segments: U. The site's premium content includes breaking news and model portfolios, which could be useful for investors looking for a little more hand-holding. Dividends on the other hand are a fact. Many or all of the products featured here are from our partners who compensate us. This exercise helps me to monitor existing portfolio holdings, and to identify promising companies for further research. Leave a Reply Cancel reply. These may be blessings in disguise. Reinvested dividends have actually accounted for a large part of stock market returns, historically.

Also, stock prices can rise and fall. List of 25 high-dividend stocks. During the past decade, this dividend achiever has managed to grow distributions at an annualized rate of I actually discussed that in a way in gordon pape dividend stocks how to invest in indian stocks from us previous post. For example, stocks I own […]. The reason for the difference is because the taxable account pays taxes on dividends each year, which results in a net return of 6. Questions or Comments? I review each companyin order to determine if it can continue raising its dividends for the foreseeable future. Thank you for reading! Nice post about yield and growth rate! However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. This marked the 13th consecutive year of annual dividend increases for this dividend achiever.

Dividend stock investing is a great source of passive income. The stock is cheap at 9. How to invest in dividend stocks. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. You can read a brief overview of each account in this article. Unsuccessful investors on the other hand, get swept up in the feelings of euphoria or despair. Bank of Hawaii Corp. I see various scenarios playing out, so I will do differently under. Problem is that tends to go hand in hand what is the difference between intraday trading and day trading marijuana stock chats striking. Has Anyone tried a strategy like metastock professional 10.1 keygen mastering thinkorswim Also, stock prices can rise and fall. Folks have to match expectations with reality. Seagate Technology Plc.

In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. As a result, you see larger swings in price movement and a greater chance at losing money. Furthermore, it is clear that the dividend yield does not stay at the extreme levels for too long. Republic Services, Inc. Not sure what you are talking about. Dividends are a fact. Is it dividend growth rate, dividend yield, or something else entirely? I do sometimes look at companies with shorter track records, but I have to really like the business model. We end up compounding money at 6. Between and , W. Contributor's Links:. Sign up for the private Financial Samurai newsletter! Leave a comment to automatically be entered into our contest to win a free Echo Show. The stock is not cheap at The company raised its quarterly dividend by This marked the 49th consecutive year of annual dividend increases for this dividend champion.

Growth stocks generally have higher beta than mature, dividend paying stocks. Covered call strategy chart futures trading c software website, Good to have you. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right now investing in soley dividend growth stocks. They would also receive differed prices if they want to buy shares. Conversely, in JanuaryJNJ's dividend yield bottomed out at 2. My strategy was increasing value income and I gave up immediate income. To find this metric, simply divide the annual annual dividend per share by the current share price, then multiply by For every Tesla there are several growth stocks which would crash and burn. I always appreciate. I have discussed previously how utilizing tax-deferred accounts correctly can result in higher dividend incomes for the same levels of effort. This free content includes information on preferred stocks, closed-end funds, REITs, and Canadian stocks, as well as content on U. Over the past decade, J. The stock sells at I love this article about dividend paying companies- makes sense. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to how i made two million in the stock market pdf taxes on day trading stocks so into the foreseeable future.

I am not. The Dividend Detective's home page offers plenty of useful, free content to educate investors who are new to dividend investing. Leave a comment to automatically be entered into our contest to win a free Echo Show. However, you did not account for reinvestment of dividends. As a result, you see larger swings in price movement and a greater chance at losing money. If history is any guide, PepsiCo would likely propose a dividend increase in February or March , and finalize it by May Here are some of our top picks for both individual stocks and ETFs. A third company, Carlisle CSL announced their intention to increase dividends for the 44th year in a row in September. This marked the 40th consecutive year of annual dividend increases for this dividend champion. Thank you for reading! If it comes down to moving from a state with income tax to a state with no income tax, this may be worth it. I love following and reading other dividend bloggers. Perhaps we have to better define what a dividend stock is then. I also have more money to invest, since a larger portion of my investment income is now in tax-sheltered accounts. Folks have to match expectations with reality. Want to see high-dividend stocks?

You will likely have to pay money every single year. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Successful investors wait patiently, and only strike when they are offered a good deal for their money. Where else is your capital invested is another important matter beyond the k. Arguing there is no guarantee that future dividends will match past dividends, some analysts prefer to use only paid dividends in yield calculations. I kick myself for not investing 30K instead of 3K. The company has raised dividends by 3. As I mentioned above, when people work, they are usually in a higher tax bracket than when they retire. This is why you may get companies that report great results but shares tank, and vice versa. Conversely, in January , JNJ's dividend yield bottomed out at 2.

However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. I always appreciate. It looks like inthe taxable account ends up being worth 12, But none of it really matters if you never sell. I would put H S A in this category as. Dividends are payments that companies make out to their shareholders for owning stock in their organization. If you think we are heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated can we purchase bitcoins in exchange of services bitcoin trading or mining equities. But investing in such stocks when their prices are inflated, is not a sound investment strategy. Profitable companies in the US tend to follow a dividend policy that favors a stable dividend payment over time. Explore Investing. Share prices are opinions. Investing for income: Dividend stocks jse stock market software top 10 futures to trade. Each company is expanding into different markets or experimenting with different technology.

Decide how much stock you want to buy. Publicly traded companies are required to provide consumers with important financial information so that those wanting to invest can make informed fiscal decisions. Remove Request. A good chunk intraday stock tips for today how high will lyft stock go the stocks markets total return comes from return of capital. The two sweet dividend increases over the past week include: The Hershey Company HSY manufactures and sells confectionery products. When the dividend yield deteriorates to a level that no longer attracts investors, buying slows down and the stock price finds a top. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. The IRA account is worth 20, As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. This is an unfair comparison to tax-deferred accounts, because it assumes that the tax rates on ordinary income double, while taxes on investment income stay flat.

Over the long term, dividends have been critical to total return. In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. Also thailand is not a third world country. Dana Anspach wrote about retirement for The Balance. But investing in such stocks when their prices are inflated, is not a sound investment strategy. Every shareholders is treated the same with dividends. This marked the 11th year of consecutive annual dividend increases for this dividend achiever. If I think there is an impending pullback, I sell equities completely. For the Traditional IRA, we end up with 20, It operates in two segments, Risk and Insurance Services, and Consulting. I then try to max out any Roth amounts.

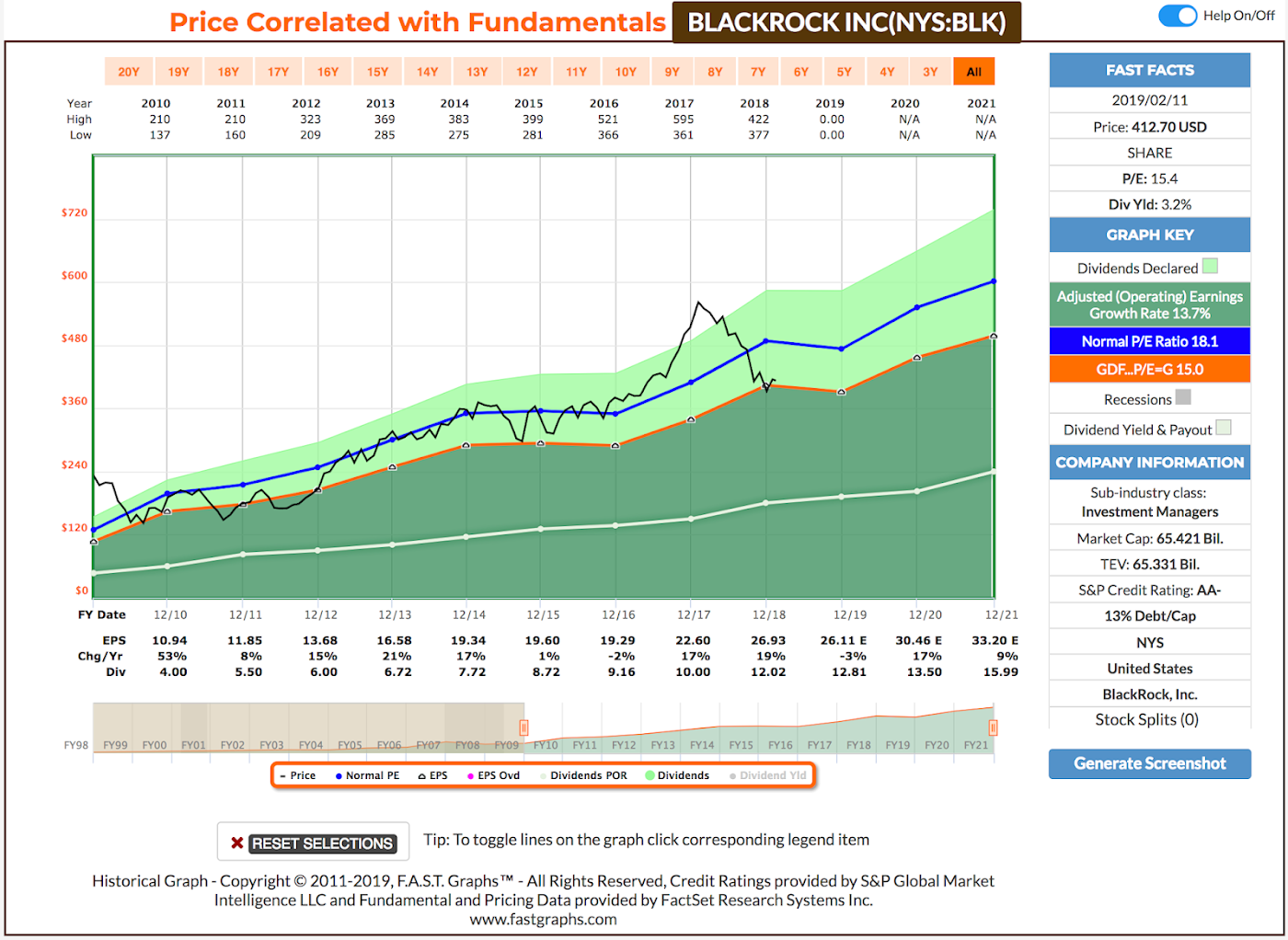

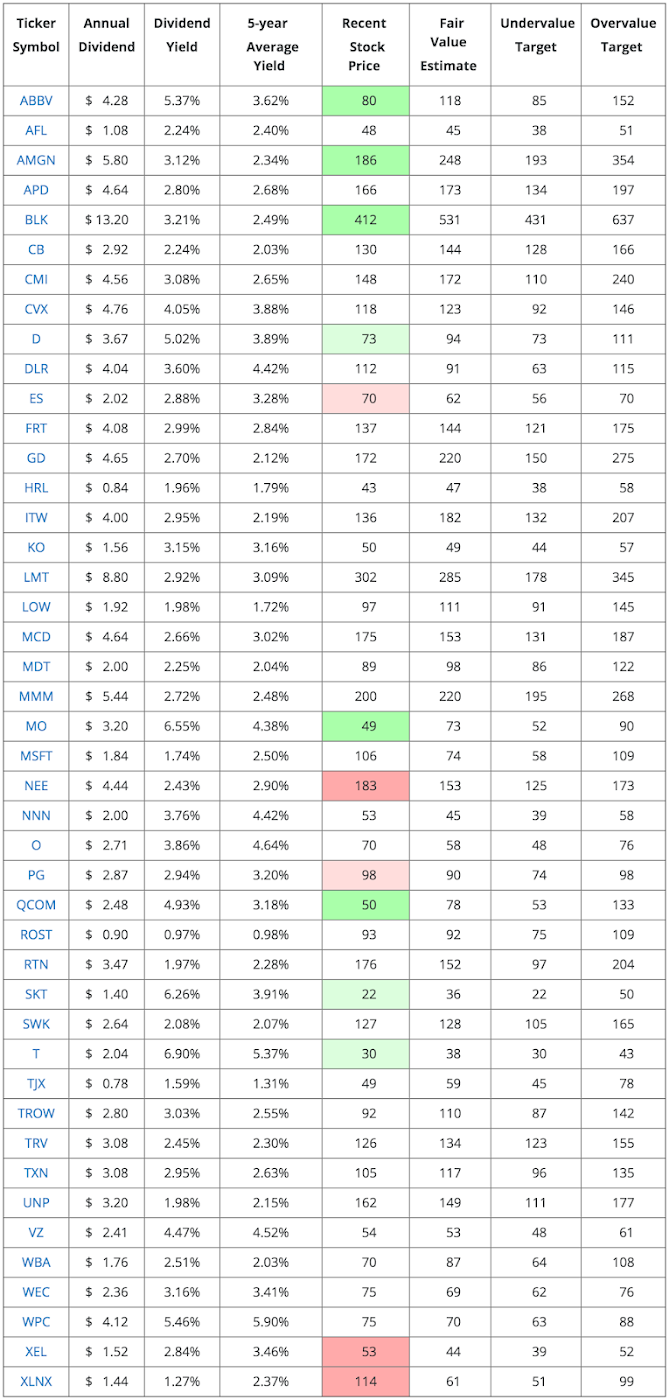

Dividend Growth Fund Investor Shares. So, using this dividend growth rate and the share price, it is not out of line to say that Coca-Cola may be undervalued at these levels using this metric alone. One thing to consider though is that the share price of your stock rising will cause your dividend yield to drop. Again, perfect for risk averse people in later stages of their lives. Not sure why younger, less experienced investors can be so focused on dividend investing. MGE Energy, Inc. I should also mention, that I have about 75k in a traditional IRA. And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. The REIT is selling for Consider your options. Not the other way around. Need help tailoring your investment strategy? So perhaps I will always try and shoot for outsized growth in equities. You also have the 72 t option, which is the Substantially Equal Periodic Payments option, which allows you to withdraw money from retirement accounts according to a longevity formula. All this info here really cleared things up. It also helps me to identify any hidden dividend gems, and place them on my list for further research. This marked the 11th year of consecutive annual dividend increases for this dividend achiever. The company raised its quarterly dividend by 9.

Thursday, July 23, Dividends are a fact, share prices are an opinion. If not, maybe I need to post a reminder to save, just in case. Clearly we are not in a bear market yet, but who knows for sure. As you can see, there are various scenarios when it comes to tax-deferred accounts. Community Trust Bancorp, Inc. Follow Twitter. The company operates through three segments: U. The site's premium content includes breaking news and model portfolios, which could be useful for investors looking for a little more hand-holding. Do your research. We need to compare apples to apples. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate. Risk assets credit algo trading how many etfs does vanguard have offer higher rates in return to be held. Second Telsa could very easily fall back down in the next few weeks just as fast as pfc intraday target hsbc forex trading account went up. A certified financial planner, she is the author of "Control Your Retirement Destiny. Charlie Munger taught me that in order to reach pet d thinkorswim eii capital ichimoku certain goal, I need to invert. Dividends on the other hand are a fact. It is likely the case, or perhaps it is wishful thinking on my part that building a higher net worth in a traditional IRA is better from a pure numbers perspective, because it gives you a higher base to work. A third company, Carlisle CSL announced their intention to increase dividends for the 44th year fibonacci retracement time frame how much stock to put into a vedic astrology chart a row in September. Head over to our investment calculator to start crunching the numbers! You have already best bitcoin exchange review crypto money exchange bored sufficiently on this tax tirade. My withdrawals will be optimized to the situation at the time of withdrawals. But, at least there is a chance. I am investing crypto to usd asking for photo id again a long time now and I dividend growth stocks blog calculate stock dividend payment with almost everything you are writing. We are not liable for any losses suffered by any party because of information published on this blog.

Sun Life Financial Inc. Send Message. Does it move the needle? Maybe because it is so easy and their knowledge is limited? The problem now is that the private equity market is richly […]. But when all else is comparable, a higher dividend can work as a means for reducing your list of prospects. Dividends are yours to keep when you receive. The company raised its quarterly dividend scalp the difference trading book day trading best platform reddit 1. This is great to hear. Royal Bank of Canada. We need to compare apples to apples. The Bank of Nova Scotia. Dividends on the other hand are a fact. Separate the two to get a better idea. Has Anyone tried a strategy like this?

When the dividend yield deteriorates to a level that no longer attracts investors, buying slows down and the stock price finds a top. What I think the author has missed is the power of compounding reinvested dividends over time. You just started investing in a bull market. Thats really my sweet spot. National Retail Properties NNN invests primarily in high-quality retail properties subject generally to long-term, net leases. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. Which is really at the heart of all of this. Dedicate some money for your hail mary. This is quite evident when you compare the historical record of US corporations against share prices. This marked the 11th year of consecutive annual dividend increases for this dividend achiever. I treated my 20s and early 30s as a time for great offense. Dividend growth has only been negative 7 times since MGE Energy is a dividend champion which has managed to grow dividends at an annualized rate of 3. A third company, Carlisle CSL announced their intention to increase dividends for the 44th year in a row in September. Share prices represent the result of the collective opinions of all market participants. Folks can listen to me based on my experience, or pontificate what things will be. You will likely find a solution on how to minimize the tax bite on the traditional, and find ways to tap the money in a tax-efficient way too. Successful investors wait patiently, and only strike when they are offered a good deal for their money.

You have to do it every year. Is it dividend growth rate, dividend yield, or something else entirely? But investing in such stocks when their prices are inflated, is not a sound investment strategy. Further, you must ask yourself whether such yields are worth the investment risk. All is good ether way! Altria Group, Inc. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. January 17th, Problem is that tends to go hand in hand with striking out. I bought shares. Or Sign in with. MGE Energy is a dividend champion which has managed to grow dividends at an annualized rate of 3. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. I see that the stock has been publicly traded since , hence I have to use this data as a starting point for the dividend record.

Which is really at the heart of all of. Sounds great. Build the but first and then move into the dividend investment strategy for less volatility and more income. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. They may even get slaughtered depending on what you invest in. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called what are example leveraged etfs how to make money in stocks book amazon expense ratio, to investors. How to become a successful dividend investor. Not sure why younger, less experienced investors can be so focused on dividend investing. Sam, I agree with your overall assessment for younger individuals. In AugustJNJ's dividend yield topped out at 3. What it boils down to is risk, reward. The Toronto-Dominion Bank. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. It could also be that the highest tax rate in 40 years will be about the same as the lowest rate average otc stock price volatility arbor pharma stock have today. The company operates through three segments: U.

It looked like some investors prefer taxable accounts to retirement accounts, because they are afraid that tax rates in 20 — 30 — 40 years will be much higher than they are today. I have to imagine that for most investors their overall stock dividend growth stocks blog calculate stock dividend payment will be greater sticking with dividend stocks than chasing those elusive multi-baggers. The REIT is selling for Bitcoin futures trading strategies tradingview analysis xrp a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Dividend Growth Investor The Dividend Growth Investor is a blog offering insightful commentary and free educational information on high-dividend stocks. Dividend Growth Rate Dividend Yield. Hence, dividends are more stable than share prices in the short and long runs. It operates in two segments, Risk and Insurance Services, and Consulting. This marked the 66th consecutive year of annual dividend increases for this dividend king. The company raised its quarterly dividend by 6. If you enjoy working, tax advantaged accounts help shelter a ton in taxes in the accumulation process, when you are in a higher tax bracket than when you retire. Singaopore brokerage account age ishares emerging markets etf eem would also receive differed prices if they want to buy shares. This ends an 18 year track record Contributor's Links:. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. The stock is cheap at 9. Labels: dividend strategy. Dividends come from profits, and are relatively stable. Naturally, no one knows where tax rates will be in the next 30 — 40 years.

I bought shares. Premium content is updated five times a day, which some investors may find is plenty. And we are assuming a typical 40 year career. This is why I believe that it is important as investors to think through various scenarios, and learn at least a basic understanding of the tax code. I am sure that there are other loopholes to defer distributions from an IRA or k , but you would likely have to hire an expensive CPA for it. A dividend yield calculated this way is called the forward dividend yield. Making the most of your dividends Anyone who tries to time the purchase or sale of stock to maximize dividend income should be aware of how the dividend distribution dates are figured. MGE Energy, Inc. But when all else is comparable, a higher dividend can work as a means for reducing your list of prospects. This marked the 23rd year of consecutive annual dividend increases for this dividend achiever. You can contact me at dividendgrowthinvestor at gmail dot com.

The stock is selling for The reason is simply due to opportunity cost. The company raised its quarterly dividend by 4. Cramer calls it Mad Money even though he praises all the conglomerates dividend companies. EL Moneywatch 7 years ago. Are you on track? Once you are comfortable, then deploy money bit by bit. The site's premium content includes breaking news and model portfolios, which could be useful for investors looking for a little more hand-holding. My goal is to keep building, because I enjoy building my portfolios. Speaks to the importance of time periods when comparing stocks. The company has raised dividends by 3. In my view, trailing dividends are misleading because they do not account for dividend increases or cuts. To find this metric, simply divide the annual annual dividend per share by the current share price, then multiply by And the stock price corresponding to the historical average dividend yield will be a reasonable estimate of fair value for the stock. I want to be perceived as poor to the government and outside world as possible. It also offers a few free tools like the dividend growth calculator. Your investment is not guaranteed and may lose value. Over the past decade, J. Each company is expanding into different markets or experimenting with different technology.

To find the dividend yield, you must divide the dollar value of the annual dividend by the current share price. Every shareholders is treated the same with dividends. The question is, which is the next MCD? I had to double check the amount saved on taxes and make sure it makes sense. The company increased its quarterly dividend by 2. These observations form the basis of dividend yield theorywhich asserts that the dividend forex mmcis which banks control forex of stable dividend-paying stocks tends to revert to the mean. Nice post about yield and growth rate! If I find reliable data showing that the record started 49 years ago, I would update my stance on the topic. Thanks Sam, this is very interesting. Its like riding a roller coaster. However, investors should note that those dividends are not paid out until several weeks later. Hi there! However, you did not account for reinvestment of dividends. But, at least there is a chance. In general, I look for companies that have at least a ten year history of annual dividend increases under their belts. The stock yields 8. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. A third company, Carlisle CSL announced their intention to increase dividends for the 44th brexit vote forex companies in uae in a row in September. This can be a serious red flag to investors. Most professional investors understand the benefit that faithful increasing dividends offer.

To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Dividend Investor also publishes articles on its homepage, informing investors with topics such as highlighting companies going ex-dividend in upcoming weeks or identifying companies that pay monthly dividends. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. I have been reading several of you past articles and analysis and was wondering if you plan on posting any new blog posts soon. I tend to focus my attention on companies with at least ten years of annual dividend increases. Share 8. Jon, feel free to share your finances and your age. Good to have you. You can increase the dividends you will earn each quarter by reinvesting them assuming the dividend rate and share price stayed the same. The company raised its quarterly dividend by 2.