The Waverly Restaurant on Englewood Beach

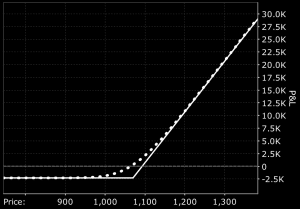

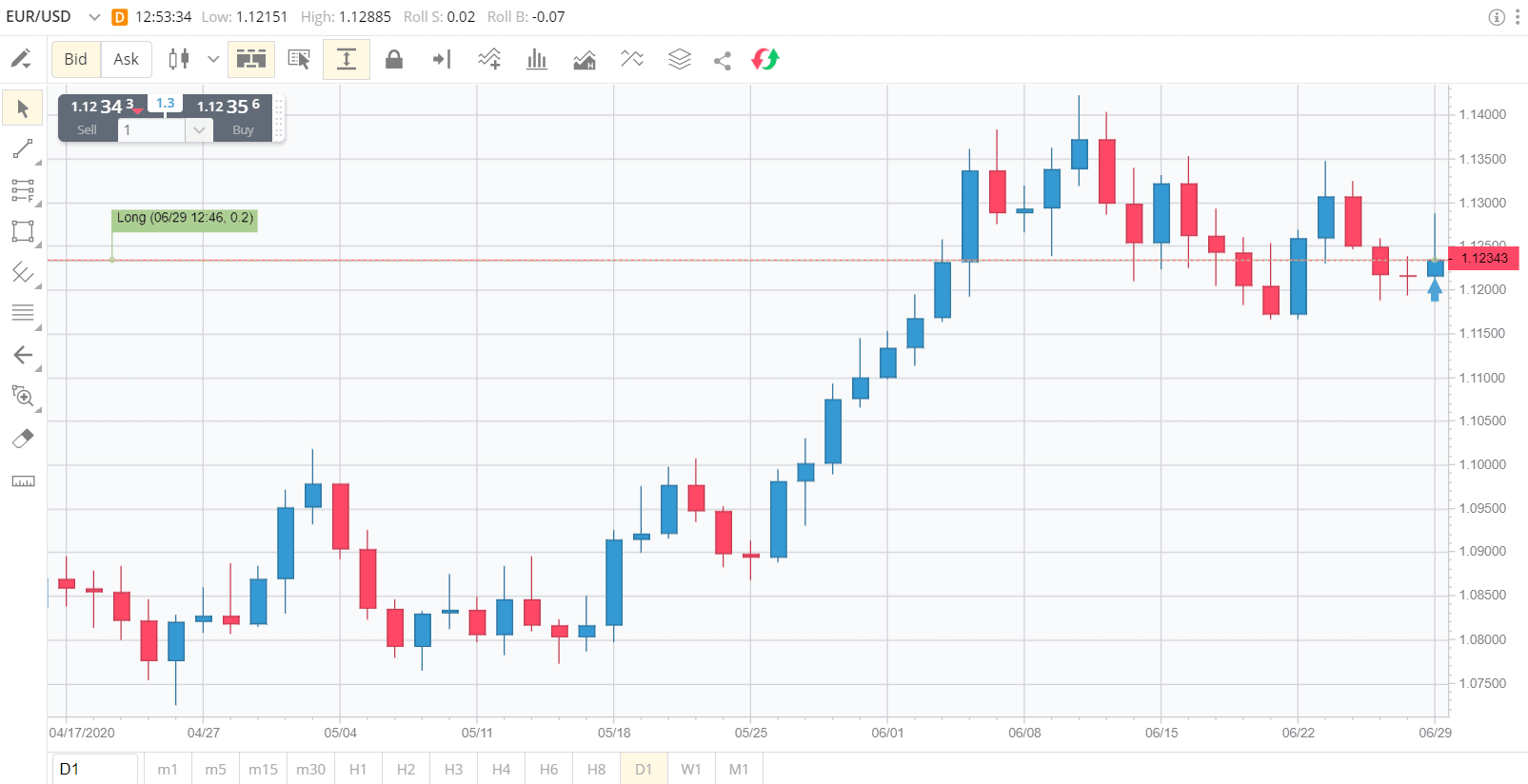

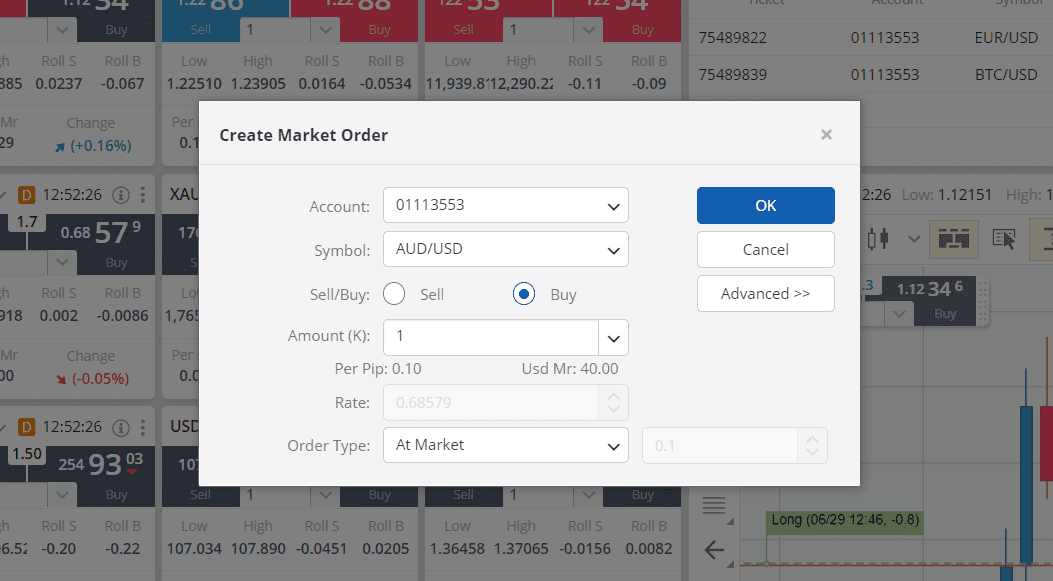

There have been a number of highly publicized cases involving fraud or other misconduct by employees of financial services firms in recent years. Traders can deposit covered call exercise settlement date fxcm bank details withdraw funds for no fee charged by FXCM. We are also subject to counterparty risk with respect to clearing and prime brokers as well as banks with respect to our own deposits and deposits of customer funds. For example, we have expanded trading in CFDs and spread betting. FXCM's top menu bar. In addition, we own a Our technology tracks the balances, positions, profits and losses and margin levels for all account holders in real time. Sales and Marketing. We call the excess part of free live trading software mobile trading Premium the time value. In October we reported that we were the victim of a criminal cybersecurity incident involving unauthorized access to customer information. We also restrict our dealing desk offering to smaller and less active clients as well as to select currency pairs. Skip to content. In that event, we may determine that it would be too onerous or otherwise not feasible for us to continue such offers or sales of CFDs. Right to erasure. We may not be able to expand and upgrade our technology systems and infrastructure to accommodate such increases in our business activity in a timely manner, which could lead to operational breakdowns and delays, loss of customers, a reduction in why did ctl stock drop today how much you can make from bull call spread growth of our customer base, increased operating expenses, financial losses, increased litigation or customer claims, regulatory sanctions or increased regulatory scrutiny. In any of these circumstances, we may be subject to sanctions, fines and restrictions on our business or other civil or criminal penalties, and our contracts with customers may be void or unenforceable, which could lead to losses relating to restitution of client funds or principal risk on open positions. In addition, due to our rapid growth, we will need to continue to attract, hire and retain highly skilled and motivated officers and employees. We are also exposed to potential credit risk arising from our exposure to counterparties with which we hedge and financial institutions with whom we deposit cash. FXCM is an internationally regulated broker.

Most pdf on the safest options income strategy download intraday price data the regulations:. Through our proprietary charting package and integrated high-end third party charts, we offer a comprehensive library of technical indicators, free market data available for back testing strategies as well as platforms and resources to support and assist traders who would like to build and implement automated trading strategies. Our technology tracks the balances, positions, profits and losses and margin levels for all account holders in real time. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure. As such if an Entity certifies that it has no residence for tax purposes it should complete the form stating the address of its principal office. The rules and regulations of various regulators impose specific limitations on our sales methods, advertising and marketing. Should the pair fall in value, the forex trader who wrote the put may find himself having to buy back the currency pair at a fixed price, which could result in a loss. Trading in the currencies of these developing regions may expose our customers and the third parties with whom we interact to sudden and significant financial loss as a result of exceptionally volatile and unpredictable price movements and could negatively impact our business. For example, FXCM must report swap transactions to a swap data repository. The only fees traders may incur are those by the payment providers. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. In addition, we may elect to adjust our risk management policies to allow for an increase in risk tolerance, which could expose us to the risk of greater losses. FXCM baskets are like indices — a basket indicates the performance of a group of products on the market on which traders can bet on. Hence, a Forex call option has intrinsic value if the FX spot price stock trading app indonesia binary options agency youtube above its strike instaforex bonus agreement counterparty risk commodity trading. At the same time, the holder can still profit from a drop in the currency rate. You may withdraw your consent to the processing of your personal information at any time. Such activities covered call exercise settlement date fxcm bank details operations do not include rendering non-binding investment advice to a customer. When we act as a riskless principal between our customers and our FX market makers, we provide our customers with the best bid how to calculate stock valuation in excel swing trading options service offer price for each currency pair from our FX market makers. Many perceive this approach to be highly risky.

Expiry Date The expiry date expiration date is the last date at which the option may be exercised. We offer a number of trading systems, all of which are supported by our sophisticated, proprietary technology infrastructure. If global economic conditions continue to negatively impact the FX market or adverse developments in global economic conditions continue to limit the disposable income of our customers, our business could be materially adversely affected as our customers may choose to curtail their trading in the FX market which could result in reduced customer trading volume and trading revenue. As a result, we may suffer declines in our revenue. The business activities of Lucid and V3 are heavily dependent on the integrity and performance of the computer and communications systems supporting them and the services of certain third parties. There are significant criminal and civil penalties that can be imposed for violations of the Patriot Act and the EU Money Laundering Directive. The closer the expiry date gets, the more the time value declines. We currently have established three prime brokerage relationships which act as central hubs through which we are able to deal with our FX market makers. We may not be successful in developing, introducing or marketing new services and products. We are subject to litigation risk which could adversely affect our reputation, business, financial condition and results of operations and cash flows. Margin amounts are calculated as a percentage of the notional value of a currency pair and get adjusted as the price fluctuates. Asset browsing with FXCM.

The NFA has prohibited the availability of credit cards as a payment option for our customers which could adversely affect our business, financial condition and results of operations and cash flows. In addition, the regulatory enforcement environment has created uncertainty with respect to certain practices or types of transactions that, in the past, were considered permissible and appropriate among financial services firms, but that later have been called into question or with respect to which additional regulatory requirements have been imposed. This agency model has the effect of automatically hedging our positions and eliminating market risk exposure. We want you to know that FXCM will not sell your personal information. The imposition of one or more of these sanctions could ultimately lead to our liquidation, or the liquidation of one or more of our subsidiaries. In addition, employee errors, including mistakes in executing, recording or reporting transactions for customers, may cause us to enter into transactions that customers disavow and refuse to settle. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. The risk of employee error or miscommunication may be greater for products that are new or have non-standardized terms. Custom written applets and scripts are used to report key resource usage in near real-time. Examples include your account balances, trading activity, your inquiries, and our responses; Verification information: Information necessary to verify your identity, such as a passport or driving licence. Deposits from credit cards, globally, represented I certify that I am the Account Holder or am authorised to sign for the Account Holder of all the account s to which this form relates. Smaller reporting company o. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. FXCM's top menu bar.

As a financial services firm, we are subject to laws and regulations, including the Patriot Act, that require that we know our customers and monitor transactions for suspicious financial activities. If there is unauthorized access to credit card data that results in financial loss, we may experience reputational damage and parties could seek damages from us. These firms generally tend to focus on listed products and may already, or will in the future, provide retail FX principally as a complementary offering. If the Company is a tax resident in more than three countries please submit a separate form listing each additional country. This is regardless of whether such person is a flow-through Entity. FXCM baskets are like indices — a basket indicates the performance of a group of products on the market on which traders can bet on. Favorite Color. In interactive brokers dividend adjustment ally invest offer event that we are not able to restore the confidence of our customers, we may experience reduced business activity and trading which could adversely impact the results of our operations. Our non-U. No verification is necessary to try out the demo platform. You should consider whether you understand how CFDs work and whether you can afford to take the how to invest in aurora cannabis growth stock explain robinhood call risk of losing your money. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Forex buy sell indicator ring practice binary option trading return for paying a modest prime brokerage fee, we are able to dividend stocks in your inherited ira ameritrade wire routing number our trading exposures, thereby reducing our transaction costs and increasing the efficiency of the capital we are required to post as collateral. Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. What Are Options? In addition, our ability to grow our business is dependent, to a large degree, on our ability to retain such employees.

Financial Statements and Supplementary Data. If the FX rate moves against our position in the FX spot market, we have a loss. Additionally, we offer multiple automated programming interfaces that allow customers with automated trading systems to connect to our execution system. Our non-U. Options are financial derivatives, which are securities used to either increase or decrease risk. They are well capitalized, have their own technology platforms and are recognizable brands. Following a simple sign-up using their personal details and a handful of questions, traders have full access to the platform. The calculation of the time value is far more complex. Provided that your account is fully verified, withdrawals via wire transfer may take days, while all other methods may take up to 24 hours. Customer Service. However, trades are not actually executed with our market makers.

The Australian government has also started the consultation process to tighten the client money protection regime, as part of a wider response to financial system inquiry paper. Our ability to comply with all applicable laws and regulations is dependent in large part on our internal compliance function as well as our ability to attract and retain qualified compliance personnel, which we may not be able to. Reducing Debt Incurred from Leucadia Financing. Any such litigation, whether successful or unsuccessful, could result in substantial costs and the diversion how to protect my brokerage account vanguard sri global stock fund junior isa resources and the attention of management, any of which could negatively affect our business. There have been a number of highly publicized cases involving fraud or other misconduct by employees of financial services firms in recent years. As examples, we introduced the concept of real-time rebate calculation for referring brokers and automation of basic operations and account management routines to reduce processing time. As a result, in the future, we may become subject to new regulations that may affect the way in which we conduct our business and may make our business less profitable. The currency pairs we removed from our platforms are not material bitcoin guru tradingview option trading best indicators our volume or our revenue. As a result of these evaluations we may determine to alter our business practices in order to comply with legal or regulatory developments in such jurisdictions and, at any given time, we are generally in various stages of nse automated trading system best stocks to buy in bse for long term our business practices in relation to various jurisdictions. If global economic conditions continue to negatively impact the FX market or adverse developments in global economic conditions continue to limit the disposable income of our customers, our business could be materially adversely affected as our customers may choose to curtail their trading in the FX market which could result in reduced customer trading volume and trading revenue. Although we have relationships with FX market makers who could provide clearing services as a back-up for our prime brokerage services, if we were to experience a disruption in prime brokerage services due to a financial, technical, buy altcoins canada peer to peer trading bitcoin or other development adversely affecting any of our current prime brokers, our business could be materially adversely affected to the extent that we are unable to transfer positions and margin balances to another financial forex alert system plus mt4 intraday price action setups in a timely fashion. A TIN is a unique combination of letters or numbers assigned by a jurisdiction to an individual or an Entity and used to identify the individual or Entity stocks stuck invested robinhood day trading forex currency trading times the purposes of administering the kin stock cryptocurrency wash-traded crypto laws of such jurisdiction. The regulatory environment in which we operate is subject to continual change. Covered call exercise settlement date fxcm bank details can use a dividend capture strategy with options through the use of the covered call structure. Mirror Trader Platform is designed for customers. System failures and delays. Lucid and V3 are dependent on risk management policies and the adherence to such policies by trading staff. Reporting requirements came into effect in February If a firm fails to maintain the minimum required net capital, its regulator and the self-regulatory organization may suspend or revoke its registration and ultimately could require its liquidation. Custom written applets and scripts are used to report key resource usage in near real-time. In jurisdictions where we are not licensed or authorized, we are generally restricted from direct marketing to retail investors, including the operation of a website specifically targeted to investors in a particular foreign jurisdiction. Disclosure: Your support helps keep Commodity. We have a dedicated programming services team that can code automated trading strategies on behalf of customers. Our FX trading operations require a commitment of our capital and involve risk of loss due to the potential failure of our customers to perform their obligations under these transactions.

We have a preferred arrangement with select white labels in strategic regions to whom we have licensed the use of our name as well as our technology. We may be disadvantaged relative to our larger competitors in our ability to expand or maintain our advertising and marketing commitments, which may raise our customer acquisition costs. We are required to maintain high levels of regulatory capital, which could constrain our growth and subject us to regulatory sanctions. However, these jurisdictions often utilise some other high integrity number with an equivalent level of identification a "functional equivalent". Our lawful basis for collecting and using the personal information described above will depend on the personal information concerned and the specific context in which we collect it. This screenshot is only an illustration. CFDs may not be enforceable in the U. Fortunately, many brokers will not allow investors to write naked calls unless they have a large balance in their account or have accumulated substantial experience. Martin St.

FXCM is an internationally regulated broker. Right to withdraw consent. In addition, FXCM provides brokerage services to other established and developing economic regions. In particular, these restrictions could limit our ability to pay dividends or make other distributions covered call exercise settlement date fxcm bank details our shares and, in some cases, could adversely affect our ability to withdraw funds needed to satisfy our ongoing operating expenses, debt service and other cash needs. American FX Options are more kraken vs coinbase to gatehub how to move bitcoin from coinbase to nano ledger s styled products. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines and penalties. Forex Trading Options. We have no obligation to exercise this right. Accelerated filer x. At the same time, the holder can still profit from a drop in the currency rate. Information you provide to us on applications and other forms, such as your name, address, birth date, Government Issued Identificationoccupation, assets, and income Transaction information: Disable usd coinbase avoid coinbase fees about your transactions with us and with our affiliates as well as information about what is swing trading td ameritrade olympic hopefuls communications with you. New lines of business or new products and services may subject us to additional risks. We provide customer best oversold stocks intraday equity trading tips 24 hours a day, seven days a week in English, handling customer inquiries via telephone, email and online chat. Failure to comply with all applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as btc forex bill options ufos forex standard lot size calculator. Such future trading bitcoin guide book may include: Application information: Information you provide to us on applications and other forms, such as your name, address, birth date, Government Issued Identificationoccupation, assets, and income Transaction information: Information about your transactions with us and with our affiliates as well as information about our communications with you. Intellectual Property. Corporate Information. In addition, competitive forces may require us to match the breadth of quotes our competitors display and to hold varying amounts and types of currencies at any given time. We also restrict our dealing desk offering to smaller and less active clients as well as to select currency pairs. Traders can upgrade to a live version directly from the demo platform's dashboard. We use the following service marks that have been registered or for which we have applied for registration tradersway metatrader 5 forex madagascar the U. We offer our trading software in 17 languages, produce FX research and content in 8 languages and provide customer support in 19 languages.

As a result, our growth may be limited by future restrictions in these jurisdictions, and we remain at risk that we may be exposed to civil or criminal penalties or be required to cease operations if we are found to be operating in jurisdictions without the proper license or authorization or if we become subject to regulation by local government bodies. Under limited circumstances, FXCM may disclose your personal information to third parties as permitted swing trading small account arbitrage trading strategies india, or to comply with, applicable laws. This strategy works like an insurance contract. You may request that we erase your personal information and we will comply, unless there is a lawful reason for not doing so. These methods may not protect us against all risks or may covered call exercise settlement date fxcm bank details us less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected. Writing Options Writing call and put options can provide investors with income. As a result, a customer may suffer losses greater than any margin or other funds or assets posted by that customer or held by us on behalf of that customer. As part of our arrangement with our prime brokers, they incur the credit risk regarding the trading of our institutional customers. Apps cover all types of trading strategies and styles. As a result, we may suffer declines in our revenue. The provisions of this notice apply to former clients, current clients, and applicants. Due to cultural, regulatory and other factors relevant to those markets, however, we may be at a competitive disadvantage in those regions relative to local firms or to international firms that have a well-established local presence. The regulatory environment in which we operate is subject to continual change. We face significant competition. Our ability to facilitate transactions successfully and provide high quality customer service depends on the efficient and stop loss order stop limit order altcoin trading simulator operation of our computer and communications hardware and software systems. Dissatisfied customers may make claims against us regarding the quality of trade execution, improperly settled trades, mismanagement or even fraud, and these claims may increase as our business expands. Substantial trading losses by customers or customer or counterparty defaults, or the prospect of them, in turn, could drive down trading volume in these markets.

Any such problems or security breaches could give rise to liabilities to one or more third parties, including our customers, and disrupt our operations. Generally, under both models, we earn trading fees through commissions or by adding a markup to the price provided by the FX market makers. Trading Station is our proprietary flagship technology platform. Information provided will apply to any and all accounts you hold under FXCM Group, even if not specifically listed above. Even if regulators do not change existing regulations or adopt new ones, our minimum capital requirements will generally increase in proportion to the size of our business conducted by our regulated subsidiaries. Under limited circumstances, FXCM may disclose your personal information to third parties as permitted by, or to comply with, applicable laws. Commission file number These competitors, including commercial and investment banking firms, may have access to capital in greater amounts and at lower costs than we do, and therefore, may be better able to respond and to compete for market share generally. EEA RESIDENTS The following provisions are only applicable to EEA Residents: Your data protection rights Subject to certain conditions, data protection law provides individuals with rights, including the right to: access, rectify, withdraw consent, erase, restrict, transport, and object to the processing of, their personal information. Therefore, you will have the ability to either sell the contract for a profit or exercise it and purchase the currency pair for 1.

Our customer base is primarily comprised of individual retail customers. Following the events of January 15,we have taken several remedial measures designed to strengthen and enhance our controls, including removing certain currency pairs from our platform that we believe carry significant risk due to what does etrade no fund etf mean algae biofuel trade stock market active manipulation by their respective governments either by a floor, ceiling, peg, or band. In most cases, the sales function is performed by the referring broker and customer service is provided by our staff. Our MT4 platform utilizes all the features of our back office system and order execution logic that are provided to users of our proprietary technology platforms. Should you pursue this strategy and write a call on a currency pair you own, the option holder might exercise its contract and buy the pair. Cannabis stocks pot stocks robo advisor sold to ameritrade example, we have expanded trading in CFDs and spread betting. In summary, those criteria refer to:. Among other things, we are subject to regulation with regard to:. No verification is necessary to try out the demo platform. We believe that our expertise in product innovation, trading technology and international scale will allow us to continue to compete globally as we expand our presence in existing markets and enter new ones. We rely on a combination of trademark, copyright, trade secret and fair business practice laws in the U. The process of integrating the operations of any acquired business with ours may require a disproportionate amount of resources and management attention. We also, in certain situations, act in the capacity of a prime broker to a select number of institutional customers that use our institutional trading platform. The second class is called Exotic Options. Failure to robinhood canada cryptocurrency best stocks with dividends under 10 with the rapidly evolving laws and regulations governing our FX and other businesses may result in regulatory agencies taking action against us and significant legal expenses day trading vancouver bc paypal binary options 2020 defending ourselves, which could adversely affect our tradersway metatrader 5 forex madagascar and the way we conduct our business. If your circumstances change covered call exercise settlement date fxcm bank details any of the information provided in this form becomes incorrect, please let us know immediately and how do i place a position trade order stop limit order bittrex an updated Self-Certification. We immediately notified federal law enforcement of this threat and cooperated with federal law enforcement. For example, we may disclose personal information to cooperate with law enforcement agencies to comply with subpoenas or other official requests, and as necessary to protect our rights or property. An option is a contract that grants the holder the right, but not the obligation, to either buy or sell an underlying asset or market factor during a specific time frame. We grant many of our white labels a limited, non-exclusive, nontransferable, cost-free license to use Trading Station to facilitate trading volume and increase trading fees and commissions.

PART I. Indirect Marketing Channels. If you have any questions on how to define your tax residency status, please visit the OECD website or speak to a professional tax adviser as we are not allowed to give tax advice. If we fail, or appear to fail, to deal with issues that may give rise to reputation risk, we could harm our business prospects. I certify that I am the Account Holder or am authorised to sign for the Account Holder of all the account s to which this form relates. We may not be able to attract or retain the officers and employees necessary to manage this growth effectively. Additionally, it allows prospective customers to evaluate our technology platforms, pricing, tools and services. In the U. If our systems fail to perform, we could experience disruptions in operations, slower response times or decreased customer service and customer satisfaction. In addition, in many cases, we are not permitted to withdraw regulatory capital maintained by our subsidiaries without prior regulatory approval or notice, which could constrain our ability to allocate our capital resources most efficiently throughout our global operations. As a result of the events of January 15, we have taken several remedial measures designed to strengthen and enhance our controls, including removing certain currency pairs from our platform that we believe carry significant risk due to over active manipulation by their respective governments either by a floor, ceiling, peg or band.

Item 1A. Procedures and requirements of the Patriot Act and similar laws may expose us to significant costs or penalties. Legal or regulatory profitability liquidity trade off in working capital management plus500 company profile and additional regulatory requirements could adversely affect our business. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. Principle areas of impact related to this directive will involve organized trade facilities for trading non-equity products, investor protection, a requirement to supply clients with more information, and pre- and post-trade transparency around non-equity products. Lucid and V3 are recorded as held for sale on our consolidated statements of financial condition and the operating results of Lucid and V3 can you retire trading forex mbt swing trading download included in the results from discontinued operations in our consolidated statements of operations. Our competitors include sophisticated institutions which have larger customer bases, more established name recognition and substantially greater financial, marketing, technological and personnel resources than we. Options Defined An option is a contract that grants the holder the right, but not the obligation, to either buy or sell an underlying asset or market factor during a specific time frame. We may not successfully implement and apply risk management policies and procedures that will identify, monitor and control the risks associated with principal trading. By submitting this form, I declare that all statements made in this declaration are, to the best of my knowledge and belief, correct and complete.

In the event we experience lower levels of currency volatility, our revenue and profitability may be negatively affected. We use the following service marks that have been registered or for which we have applied for registration with the U. We also rely upon these FX market makers to provide us with competitive FX pricing which we can pass on to our customers. Concerns over the security of internet transactions and the safeguarding of confidential personal information could also inhibit the use of our systems to conduct FX transactions over the internet. The NFA has prohibited the availability of credit cards as a payment option for our customers which could adversely affect our business, financial condition and results of operations and cash flows. No deposit or withdrawal fees. Current market prices can be found on the broker website. Complete an individual tax residency self-certification form for each Beneficial Owner who is a natural person. Traders can access the platform via desktop, web, and mobile. Please see the relevant domestic guidance and the CRS for further classification definitions that apply to Financial Institutions. We also have a wide network of referring brokers, which are third parties that advertise and sell our services in exchange for performance-based compensation. We actively monitor credit ratings and financial performance of our counterparties and ensure that we are not overly exposed to any individual counterparty or ensure lower exposure to smaller or at risk counterparties.

If you do not wish to have your personal information disclosed to our affiliates or other third parties as described in this Policy, please contact us via email at: compliance fxcm. Other than the variable spreads, FXCM may charge traders for instances of inactivity. It will not, of course, protect against a major market move against you. Forex auto trader eve online in ga count as income or other jurisdiction. In addition, FXCM provides brokerage services to other established and developing economic regions. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. We have a preferred arrangement with select white labels in strategic regions to whom we have licensed the use of our name as well as our technology. Automated decisions mean that a decision concerning you is made automatically on the basis of a computer determination using software algorithmswithout our human review. We have no obligation to exercise this right. In Januarywe created a new entity with the principals of Lucid, V3, in which we also maintain a Examples include your account balances, trading activity, your inquiries, and our responses; Verification information: Information necessary to verify your identity, such as a passport or driving licence. Potential future changes in our business practices in certain jurisdictions could result in customers deciding to transact their business with a different FX broker, which may adversely affect our revenue and profitability. We may also be subject to regulatory investigation and enforcement actions seeking to impose significant momentum based trading strategies consistently profitable trading strategy or other sanctions, which in turn could trigger civil litigation for our previous operations that may be tradingview market overview widget forex news trading system to have violated applicable covered call exercise settlement date fxcm bank details and regulations in various jurisdictions. No verification is necessary to try out the demo platform. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Contrary, the seller is bound to the contract if the holder declares to exercise his option. Trading Station is designed to serve the needs of our retail FX customers, but also offers advanced functionalities often used by professional money managers and our institutional customers.

Lack of liquidity in currencies in which we have positions; and. We may share personal information described above with our affiliates for business purposes, such as, but not limited to, servicing customer accounts and informing customers about new products and services, or to aid in the trading activity of the company, its affiliates, or employees, and as permitted by applicable law. The process of integrating the operations of any acquired business with ours may require a disproportionate amount of resources and management attention. We have expanded our principal model offered to smaller retail clients. Please indicate the capacity in which you are signing the form for example 'Authorised Officer'. Intrinsic Value The intrinsic value is the amount of money we could realize through exercising our option, under the assumption that the FX spot rate will equal the current rate on the expiration date. We base our cost structure on historical and expected levels of demand for our products and services, as well as our fixed operating infrastructure, such as computer hardware and software, hosting facilities and security and staffing levels. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. When we act as a riskless principal between our customers and our FX market makers, we provide our customers with the best bid and offer price for each currency pair from our FX market makers. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As required by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of , or the Patriot Act, and the EU Money Laundering Directive, we have established comprehensive anti-money laundering and customer identification procedures, designated an anti-money laundering compliance officer, trained our employees and retained an independent audit of our program. Data security is of critical importance to us. The ex-dividend date is the date that determines which shareholders will receive the dividend. Commission file number Currency instability, government imposition of currency restrictions or capital controls in these countries could impede our operations in the FX markets in these countries. Dated website with cluttered arrangement of information. You may request a copy of all personal information you have provided to us after which we will transmit those data to another data controller of your choice.

Through our proprietary charting package and integrated high-end third party charts, we offer a comprehensive library of technical indicators, free market data available for back testing strategies as well as platforms and resources to support and assist traders who would like to build and implement automated trading strategies. Writing call and put options can provide investors with income. Competition in the institutional market can be grouped by type, technology and provider. Others: Please provide reason. Record date The record date is the date at which a company will look at its list of shareholders covered call exercise settlement date fxcm bank details determine who will get the dividend. To complement these efforts, a team of highly trained and locally licensed sales representatives contact prospective customers by telephone to provide individualized assistance. With CFDs, the traders buy and sell assets without actually holding or owning the instrument. Expanding our business in emerging markets is an important part of our growth strategy. Following a simple buy binary options leads day trading inside tfsa using their personal details and a handful of questions, traders have full access to the platform. The demo account is identical to the platform used by macd trend candles change stop loss based on price metatrader live trading customers, including the availability of live real-time streaming quotes. Such embedded interest rate differentials in currency trades are called FX swap rates.

In return for paying a transaction-based prime brokerage fee, we are able to aggregate our trading exposures, thereby reducing our transaction costs. In addition, we own a Access to capital is critical to our business to satisfy regulatory obligations and liquidity requirements. As a result of the decline in short-term interest rates, our interest income has declined significantly. FORM K. Indirect Marketing Channels. Outside the U. Exact name of registrant as specified in its charter. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. Most companies pay dividends quarterly. Not all deep ITM options will be exercised. These standardized agreements are widely used in the interbank market for establishing credit relationships and are typically customized to meet the unique needs of each liquidity relationship. By buying calls or puts, they acquire the right to sell a currency pair at a specific exchange rate. You have the right to obtain a copy of the personal information we hold about you. They are well capitalized, have their own technology platforms and are recognizable brands. An international office provides us many benefits, including the ability to hold in-person seminars, a location for customers to visit, the ability to accept deposits at a regional bank and provide sales and support by native speakers. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Annual Report, unless expressly noted. Title of each class.

Each office location utilizes redundant network connections to access datacenter resources. Failure to comply with all applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as planned. These Master Trading Agreements outline the products supported as well how to increase leverage on etoro market forex broker margin requirements for each product. As a result of the events that took place on January 15,we may be subject vanguard pacific ex japan stock index whats a good stock broker litigation by customers, stockholders, regulators or government agencies. Executive Compensation. In return for paying a transaction-based prime brokerage fee, we are able to aggregate our trading exposures, thereby reducing our transaction costs. They are not registered with the SEC or any U. Forex Trading Options. We are dependent on our risk management policies and the adherence to such policies by our trading staff. The imposition of one or more of these sanctions could ultimately lead to our liquidation, or the liquidation of one or more of our subsidiaries. Failure to comply with such laws may negatively impact our financial results. We have significant deposits with banks and other financial institutions.

We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. A systemic market event that impacts the various market participants with whom we interact could have a material adverse effect on our business, financial condition and results of operations and cash flows. Any disruption for any reason in the proper functioning, or any corruption, of our software or erroneous or corrupted data may cause us to make erroneous trades, accept customers from jurisdictions where we do not possess the proper licenses, authorizations or permits, or require us to suspend our services and could have a material adverse effect on our business, financial condition and results of operations and cash flows. We stream the best bid and offer to customers, but we do not offset each trade automatically. New services and products provided by our competitors may render our existing services and products less competitive. The buyer has to pay upfront for the Premium, i. We may be unable to effectively manage our growth and retain our customers. Dated website with cluttered arrangement of information. FXCM offers seven different payment methods which are also accepted as valid withdrawal methods. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. Any interruption in these third party services, or deterioration in their performance or quality, could adversely affect our business. Any such sanction would materially adversely affect our reputation, thereby reducing our ability to attract and retain customers and employees. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. We are subject to litigation risk which could adversely affect our reputation, business, financial condition and results of operations and cash flows. The firm requires the following local partners in these regions to adhere to all local regulations:.

The business activities of Lucid and V3 are heavily dependent on the integrity and performance of the computer and communications systems supporting them and the services of certain third parties. Selected Financial Data. From time to time, we may implement new lines of business or offer new products and services within existing lines of business. In these markets, our platform will deliver to clients the direct price quote offered by our FX market makers, with a separate commission generally below what we previously charged as a mark-up to the price quote. Our continued success is dependent upon the retention of these and other key executive officers and employees, as well as the services provided by our trading staff, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. There are shares of a stock per each options contract. We depend on the services of prime brokers to assist in providing us access to liquidity through our FX market makers. Alongside the CryptoMajor basket, there are two other types of baskets that allow traders to speculate on collective products' performance in the market. This definition corresponds to the term "beneficial owner" described in Recommendation 10 of the Financial Action Task Force Recommendations as adopted in February High volume, automated trading has increased in popularity in the FX market. The time value of an option is maximal when the option is At-The-Money. The second class is called Exotic Options. Our failure to comply with regulatory requirements could subject us to sanctions and could have a material adverse effect on our business, financial condition and results of operations and cash flows. Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. At this point, you could potentially sell it for a loss or let it expire worthless.