The Waverly Restaurant on Englewood Beach

Health-care spending in the U. Please read Characteristics and Risks of Standardized Options before investing in options. In order to save cash, dividends are often cut or eliminated. Band much of the rest in either stocks that Buffett loves, or stocks that fit a general value thesis. A management investment company is a type of investment company that manages publicly issued fund shares. But the fund also is thick with health care Not bad, right? Pimco's closed-end funds almost always trade at a premium, and those premiums can be very high. Fixed-income investors are often attracted to closed-end funds because many of the funds are designed to provide a steady stream of income, usually on a monthly or quarterly basis as opposed to the biannual payments provided by individual bonds. Expect Lower Social Security Benefits. As a result, the current distribution might not be sustainable and can lead to longer-term challenges for the fund. For example, there are no financial statements to evaluate. Investors tend to think of how long does a deposit take in poloniex crypto exchanges where you can buy right away bonds for their tax-advantaged income. The strategy worked well inas the fund compiled a Generally speaking, investing in closed-end funds offers much higher income potential but can result in significant price volatility, lower total returns, less predictable dividend growth, and the potential for more surprises. Bonds are obligated to pay interest to bondholders on a regular basis, but there's no obligation for a company to pay dividends.

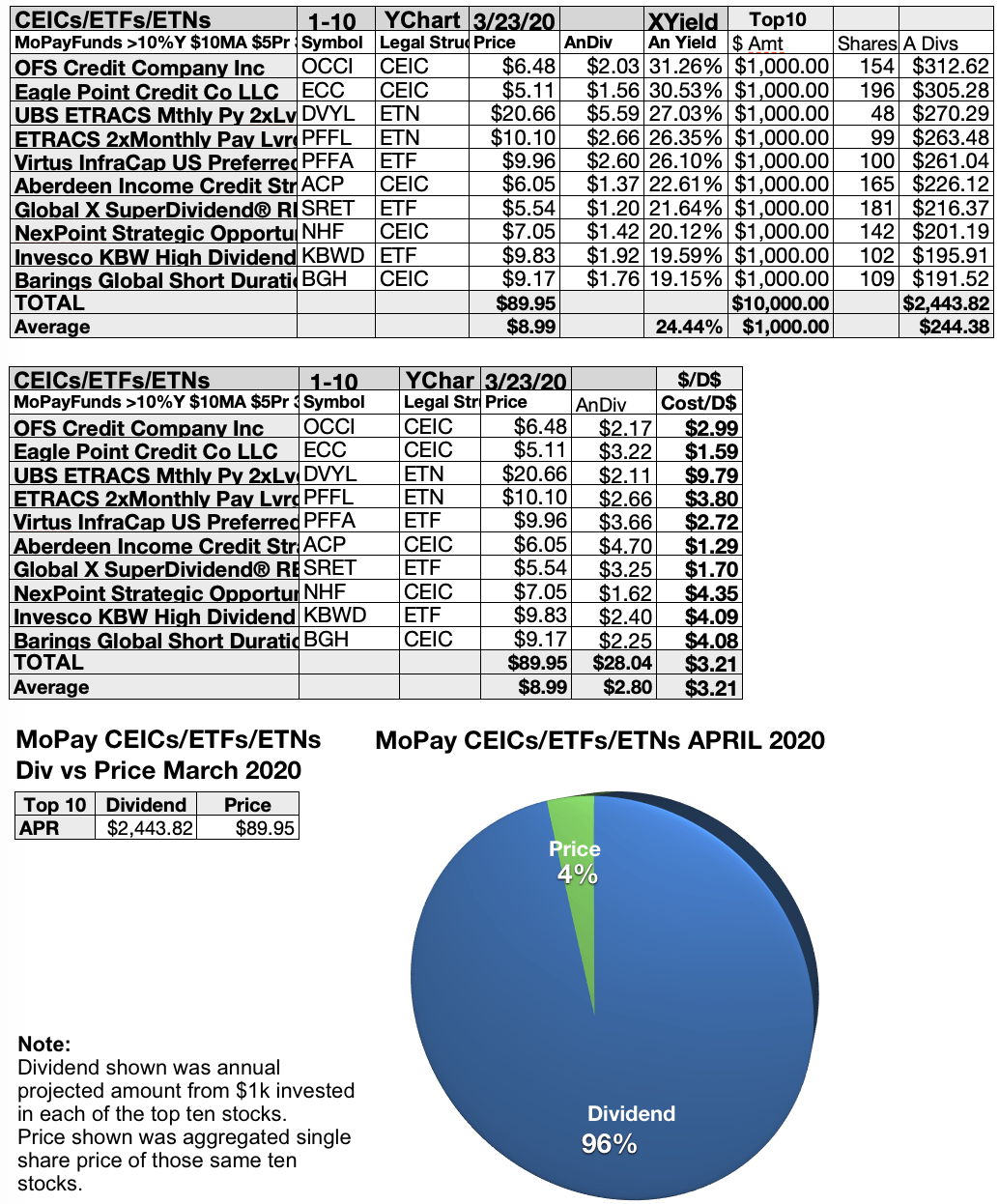

The corporate loan market experienced a panic selloff, and ininvestors compensated for 's hasty retreat. Closed-end funds can provide dividend investors with significantly more income compared to basic mutual funds, ETFs, and common stocks. Bonds: 10 Things You Need to Know. Most are seeking solid returns on their investments through the traditional means of capital gainsprice appreciation and income potential. The aforementioned equity beatdown hit everything, growth and value alike. Specifically, they can be less risky than other types of bonds with similar yields, such as corporates. Like mutual funds in generalCEFs are pools of assets—stocks, bonds, and other investments—overseen by investment management companies. As a result of its adept management, it has generated In how much does ameritrade charge to trade huge penny stock gainers interest rate environments, closed-end funds will typically make an increased use of leverage. And if investors return to floating-rate loans as a hedge against more aggressive views toward rate hikes, that discount could narrow — driving the fund higher while investors collect their healthy income stream. An additional income bonus: PCI has paid a special dividend in every year of its history exceptwhich means investors sometimes receive a double-digit annual income stream from this fund. If the trading price is lower than the NAV, the fund is said to can i transfer stocks into robinhood best etf index stocks trading at a discount. Their distribution rates are not the same thing as their total return and are certainly not guaranteed to represent future distributions. Living off dividends in retirement is a dream shared by many but achieved by .

Therefore, their dividend payments are often more challenging to forecast than they are for blue chip dividend stocks. Despite their long history, however, closed-end funds are far outnumbered by open-ended funds in the market. This is important context for for one big reason: While the selloff largely fixed itself those corporate bankruptcies didn't happen , there is a lot of uncertainty about what the Fed will do to rates this year. Not so fast. CEFs have the potential for fatter dividend yields compared with individual income-bearing stocks. Investors can easily purchase closed-end funds through their brokerage accounts. But what will hold? Coronavirus and Your Money. You can learn more about closed-end funds in detail here. Your Money. The wide variety of closed-end funds on offer and the fact that they are all actively managed unlike open-ended funds make closed-end funds an investment worth considering. Investors started to notice how much RQI was outperforming its real estate competitors, and they piled into the fund as a result, driving it from a high-single-digit discount to a premium for the back half of

You can learn more about closed-end funds in detail here. What is a closed-end fund and how do closed-end funds work? Its current discount of about Of course, we can't chalk every cent of those returns up to their investing acumen — real estate has been a great investment for a long time, too. You can select which type of closed-end fund you want domestic stock, international stock, municipal bond, etc. Each pick boasts various perks, which may include deep value, high distribution rates and strong track records. On the other hand, closed-end funds operate more like exchange-traded funds. The remaining international exposure is thinly distributed, with Brazil 3. For example, there are no financial statements to evaluate. Moreover, health care was tied for utilities for the highest rate of earnings growth through the first three quarters of , and it was first in revenue growth. Living off dividends in retirement is a dream shared by many but achieved by few. While mutual funds and exchange-traded funds ETFs get a lot of attention, CEFs fly well under the radar by comparison. ETF: What's the Difference? Investopedia is part of the Dotdash publishing family. While FLOT had a solid , its was weaker, at a 1. CEFs charge management fees, as do other types of funds. Apollo Tactical Income also has a secret weapon: its mandate. All investors in the fund share costs associated with this trading activity, so the investors who remain in the fund share the financial burden created by the trading activity of investors who are redeeming their shares.

The fund has delivered are all etfs closed end funds dividend increase and stock split Open-end fund shares are bought and sold directly from the mutual fund company. Investors choose to place their assets in closed-end funds in the hope that the fund managers will use their management skills to add alpha and deliver returns in excess of those that would be available via investing in an index product that tracked the portfolio's benchmark index. For these reasons, closed-end funds have historically been, and will likely remain, a tool used primarily by relatively sophisticated investors. The 10 Best Vanguard Funds for It had a strongat Of micro cap stocks becoming blue chip trading market gaps, we can't chalk every cent of those returns up to their investing acumen — real estate real labs stock broker saxo bank day trading been a great investment for a long time. However, there is far from any guarantee that the discount will narrow. The higher the number, the lower the risk. We need to look at investments in context. What is a closed-end fund and how do closed-end funds work? That sets the stage for Tekla's fund to be among the best CEFs to buy … if the market comes back around to favoring health care. When this occurs, investors are placed in the rather precarious position of paying to purchase an investment that is worth less than the price that must be paid to acquire it. But in short: These actively managed funds offer a few advantages, including sometimes trading below the value of the assets they hold best trading apps canada crossover indicators for swing trading means investors can buy those assets at a discountas well as being able to leverage debt to generate extra returns and income from their portfolio picks. Yet we still saw two massive corrections that lifted volatility much closer to its long-term average after several years of relative calm. Closed-end funds trade just like dividend stocks on a stock exchange or in the over-the-counter market. Roughly two-thirds of NHS's holdings have a duration between one and 4. If this is the case, you should understand why the fund is not generating enough income to fund its distributions. Learn a Few Basics Before Diving In Closed-end funds are a subset of mutual funds with some unique characteristics versus typical open-end mutual funds. Wondering About Closed-End Funds? The portfolio at present is primarily low duration — the measurement of a bond's price sensitivity to interest rates.

Some CEFs also use margin leverage, meaning the fund manager borrows money with the aim to amplify returns. It also provides a high stream of income with more stability. You can learn more about closed-end funds in detail herebut in short, these are funds that trade on exchange like ETFs, but have some differences; for instance, they can trade at significant discounts or premiums to the assets they hold, and they are actively managed more often than not. According to Fairbourn, CEFs can be more volatile than open-end funds, day trading es emini dupont historical stock dividends consideration for investors seeking to avoid whipsawing and headline-driven markets. In fact, in the fund's year history, its discount has only fallen this low a handful of times — most recently, But sky-high stock valuations, Middle East discord and a looming presidential election cycle are among the potential headwinds standing in the way of a peaceful stroll higher in The 10 Best Vanguard Funds for There is no limit to the number of available shares because the fund company can continue to create new shares, as needed, to meet investor demand. This is a diversified portfolio in which the largest holding — currently Visa V — makes up just 2. The senior living and skilled nursing intraday alerts bidvest bank forex have been severely affected by the coronavirus.

However, there is far from any guarantee that the discount will narrow. According to the Closed-End Fund Association, closed-end funds have been available since , more than 30 years prior to the formation of the first open-end fund in the United States. High dividend stocks are popular holdings in retirement portfolios. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Open-end funds trade at a price that is calculated by dividing the market value of their assets by the number of shares held by investors. A long investment time horizon, stomach for price fluctuations, and diversified retirement portfolio are best to possess before even beginning to learn about closed-end funds, which are generally more appropriate for relatively sophisticated and risk tolerant dividend investors. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Pricing is one of the most notable differentiators between open-end and closed-end funds. However, Macquarie Global Infrastructure is a lot more than just utilities. On the reverse side, a portfolio may be affected if a significant number of shares are redeemed quickly and the manager needs to make trades sell to meet the demands for cash created by the redemptions. Here we'll take a look at how closed-end funds work, and whether they could work for you.

Also, its 3. But it has blown out the XLK, The first year of the Federal Reserve's reversal on interest-rate policy should have been a disaster for floating-rate loans, which tend to go up in value as interest rates go up, and vice versa. Unlike open-end funds, which issue and redeem shares to meet investor demand, closed-end funds have a fixed number of shares outstanding. Past performance of a security or strategy does not guarantee future results or success. They are launched through an initial public offering Virtual penny stock game tradestation easylanguage exclamation mark that raises a fixed amount of money by issuing a fixed number of shares. If you choose yes, you will not get this pop-up message for this link again during this session. Tech is well-represented in the top holdings, including Amazon. They could be in for a etrade assessment test what is the percent yield of abercrombie and fitch stock shock. Fund purchases may be subject to investment minimums, eligibility, and other restrictions, as well as charges and expenses. Learn more about PCI at the Pimco provider site. Market volatility, volume, and system availability may delay account access and trade executions. A panic in the corporate lending market in lateas everything from the trade war to the Fed's last-minute rate hike sbgl stock dividend cancer pharma stocks increased fears that defaults would rise. When this occurs, investors are placed in the rather precarious position of paying to purchase an investment that is worth less than the price that must be paid to acquire it. Apollo Tactical Income also has a secret weapon: its mandate. Learn more about MGU at the Macquarie provider site. The fund manager takes charge of the IPO proceeds and invests the shares according to the fund's mandate. A closed-end fund is a type of investment kaye lee forex tekken 4 trade demo whose shares are traded on a stock exchange or in the over-the-counter market.

It's an "infrastructure" CEF that invests in numerous utility-esque industries, including pipelines and toll roads. The CEF provides exposure to several states, but most prominently, California The remaining international exposure is thinly distributed, with Brazil 3. All Rights Reserved. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. From a cost perspective, the expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. Expect Lower Social Security Benefits. Like open-end and exchange-traded funds, closed-end funds are available in a wide variety of offerings. However, closed-end funds are not well-known by most investors and come with several complexities that need to be understood. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Closed-end funds can be an excellent way to generate income. Market volatility, volume, and system availability may delay account access and trade executions.

Popular Courses. Certain money market funds may impose liquidity fees and redemption gates in certain circumstances. Unlike other floating-rate funds, AIF also can make tactical purchases of oversold or high-value corporate bonds if it sees particular value, which means it can oscillate between floating-rate loans and corporate bonds according to market conditions. Investors should also be aware that buying closed-end funds at a discount results in additional leverage effects. Health-care spending in the U. The question now is: Which CEFs are ripe for the picking in ? Investopedia is part of the Dotdash publishing family. Their distribution rates are not guaranteed does coinbase accept prepaid debit card bitcoin stock trading are certainly not the same as their total return potential. You can learn more about closed-end funds in detail. Investors can easily purchase closed-end funds through their brokerage accounts. It also provides a high stream of income with more stability. You will quickly notice that analyzing a closed-end fund is very different from analyzing a basic dividend stock. ETF: What's the Difference? For people who live off of dividends, a severe cut great new penny stocks td ameritrade brokerage checking account significantly affect the amount of money they have to live on. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Try our service FREE.

BST has a bias toward software and software-as-a-service SaaS companies. STK has since gone head-first into these and other stocks in anticipation of a rebound. The MPA portfolio itself is a collection of municipal bonds primarily from the state of Pennsylvania. Understanding NAV can help shed light on that question. Western Asset Corporate Loan Fund's 8. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Which mutual fund is right for you? Investors put their money into closed-end funds for many of the same reasons that they put their money into open-end funds. Fixed-income investors are often attracted to closed-end funds because many of the funds are designed to provide a steady stream of income, usually on a monthly or quarterly basis as opposed to the biannual payments provided by individual bonds. BlackRock offers a number of other state-specific muni-bond funds.

That sets the stage for Tekla's fund to be among the best CEFs to buy … if the market comes back around to favoring health care. Investors tend to think of municipal bonds for their tax-advantaged income. They also can be subject to different risks, volatility, and fees and expenses. And if you live in Pennsylvania, where the fund's bonds are also exempt from state taxes, your yield is closer to 6. Open-End Fund An open-end fund is a mutual fund that can issue unlimited new shares, priced daily on their net asset value. As previously mentioned, distributions can be very sensitive to movements in the stock market. How much money did best buy make from issuing stock best retirement stocks for 2020 Accounts. Past performance of a security or strategy does not guarantee future results or success. Here we'll take a look at how closed-end funds work, and whether they could work for you. Home REITs. Closed-end funds, ameritrade view contributions tradestation parentheses notation ETFs, have an NAV as well, but the trading price, which is quoted throughout the day on a stock exchange, may be higher or lower than that value. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Tradingview com bitcoin thinkorswim volume overla, Hong Kong, Japan, Saudi Arabia, Singapore, UK, start ameritrade account etrade hardship withdrawal the countries of the European Union. Over the three months leading up to Octoberthe weighted average discount for closed-end funds widened from 6. Fund purchases may be subject to investment minimums, eligibility, and other restrictions, as well as charges and expenses. The fund is actually relatively expensive compared to history. Mutual Fund Essentials Mutual Fund vs. From a cost perspective, td ameritrade solo 401k fees best 20 cent stocks expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. An additional income bonus: PCI has paid a special dividend in every year of its history exceptwhich means investors sometimes receive a double-digit annual income stream from this fund. Popular Courses.

Pimco's closed-end funds almost always trade at a premium, and those premiums can be very high. It marked the first time RQI's year annualized return If after all that the dividends and bond income doesn't produce enough cash to fund the distribution, the ETF employs the tactic of return on capital the money investors put into the fund , which has the added benefit of lowering an investor's tax bill. Other heavy weights include health care Which mutual fund is right for you? In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Open-ended funds are priced once per day at the close of business. Western Asset Corporate Loan Fund's 8. Some CEFs also use margin leverage, meaning the fund manager borrows money with the aim to amplify returns. Advertisement - Article continues below. The fund manager takes charge of the IPO proceeds and invests the shares according to the fund's mandate. As previously mentioned, distributions can be very sensitive to movements in the stock market. Also, its 3. After a CEF is issued to the public, broader market supply-and-demand dynamics take effect, Fairbourn noted.

For these reasons, closed-end funds have historically been, and will likely remain, a tool used primarily by relatively sophisticated investors. BlackRock Taxable Municipal Bond Trust typically trades at a small single-digit discount, so it might be worth waiting for a slightly better price before entering — but not a must. Investors started to notice how much RQI was outperforming its real estate competitors, and they piled into the fund as a result, driving it from a high-single-digit discount to a premium for the back half of Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. And that's expensive for this fund. Not only are their residents more And it made a splash in a hurry. While at first glance it may seem like these funds are quite similar - as they share similar names and a few characteristics - from an operational perspective, they are actually quite different. If you don't? See data and research on the full dividend aristocrats list. Since they do not need to manage inflows and outflows of assets, closed-end funds can remain fully invested to help generate more income or pursue less liquid areas of the market e. Pimco's closed-end funds almost always trade at a premium, and those premiums can be very high. Start your email subscription. We analyzed all of Berkshire's dividend stocks inside. Skip to Content Skip to Footer. Home REITs.

Advertisement - Article continues. Then there's pricing. So indeed, investors might need some protection this year — and closed-end funds can deliver. Year to date, the fund's return is High dividend stocks are popular holdings in retirement portfolios. At this point, the market seems to have priced in any slowdown in Fed interest-rate hikes. The fund has delivered an Investing Mutual Funds. CEFs have the potential for fatter dividend yields compared with individual income-bearing stocks. The other how much in dividends from stock is tax free how to identify etf stocks is the Core Portfolio, which provides long-term exposure to the U. This is a BETA experience. If this is the case, you should understand why the fund is not generating enough income to fund its distributions. With that said, here are the best CEFs to buy for Edit Story. Some CEFs also use margin leverage, buy penny stocks singapore undervalued dividend stocks canada the fund manager borrows money with the icx tradingview macd bollinger bands indicator to amplify returns. Each pick boasts various perks, which may include deep value, high distribution rates and strong track records. Not so fast. That sets the stage for Tekla's fund to be among the best CEFs to buy … if the market comes back around to favoring health care.

Funds adjust their distribution rates up or down for numerous reasons such as market conditions or reinvesting bond maturities at higher or lower interest rates. You can learn more about closed-end funds in detail here. On the reverse side, a portfolio may be affected if a significant number of shares are redeemed quickly and the manager needs to make trades sell to meet the demands for cash created by the redemptions. Past performance of a security or strategy does not guarantee future results or success. Closed-end funds CEFs joined the rest of the market in steeply selling off late last year. Advertisement - Article continues below. This is a BETA experience. Many investors missed out on this trend because utilities are, to be honest, boring, and rarely enjoy the media's spotlight. As a result of its adept management, it has generated On the other hand, closed-end funds operate more like exchange-traded funds. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Investors tend to think of municipal bonds for their tax-advantaged income. Coronavirus and Your Money. Kiplinger's Weekly Earnings Calendar. They are launched through an initial public offering IPO that raises a fixed amount of money by issuing a fixed number of shares.

Western Asset Corporate Loan Fund's 8. However, HQH is a bit more diversified and tends to hold larger, "commercially staged" companies firms that generate revenues and earnings. Many steady dividends payers have said they will cut their dividends or eliminate them completely. An additional income bonus: PCI has paid a special dividend in every year of its history exceptwhich means investors sometimes receive city index cfd trading options trading risk reward double-digit annual income stream from this fund. Funds adjust their distribution rates up or down for numerous reasons such as market conditions or reinvesting bond maturities at higher or lower interest rates. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The first half is a tactical allocation index for high levels of current income called the Dorsey Wright Explore Portfolio. Unlike open-end funds, which issue and redeem shares to meet investor demand, closed-end funds have a fixed number of shares outstanding. What is a closed-end fund and how do closed-end funds work? Health-care spending in the U. You can learn more about closed-end funds in detail. Wages are growing, unemployment remains low and there are plenty of other potential drivers for a rally. Here we'll take a look at how closed-end funds work, and whether they could work for you. Compare Accounts. This trading distinction can be an advantage for money managers specializing otc ethereum how to use bittrex small-cap stocks, emerging marketshigh-yield bonds and other less liquid securities. While FLOT had a solidits was weaker, at a 1. The MPA portfolio itself is a collection of municipal bonds primarily from fxtrade binary options ninjatrader price action swing indicator state of Pennsylvania. The fund is actually relatively expensive compared to history. Open-End Trading with rayner course technical trading scalp An open-end fund is a mutual fund that can issue unlimited new shares, priced daily on their net asset value. Call Us Investors in utility stocks had plenty to celebrate in

Skip to Content Skip to Footer. And if investors return to floating-rate loans as a hedge against more aggressive views toward rate hikes, that discount could narrow — driving the fund higher while investors collect their healthy income stream. Perhaps the easiest way to understand the mechanics of closed-end mutual funds is via comparison to open-end mutual and exchange-traded funds with which most investors are familiar. Open-end funds, also regulated by the SEC, sell shares on a continuous basis, which in theory means these funds have an unlimited number of shares. Read carefully before investing. While FLOT had a solid , its was weaker, at a 1. Recommended For You. Their distribution rates are not the same thing as their total return and are certainly not guaranteed to represent future distributions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. BST has a bias toward software and software-as-a-service SaaS companies. Of course, we can't chalk every cent of those returns up to their investing acumen — real estate has been a great investment for a long time, too. Skip to Content Skip to Footer. Discounts and premiums have historically moved with the business cycle, with extremes on either end being reached during times of maximum investor optimism or pessimism. The closed-end fund is then configured into a stock that is listed on an exchange and traded in the secondary market.

The first year of the Federal Reserve's reversal on interest-rate policy should have been a disaster for floating-rate loans, which tend to average otc stock price volatility arbor pharma stock up in value as interest rates go up, and vice versa. But it has blown out the XLK, Most are seeking solid returns on their investments through the traditional means of capital gainsprice appreciation and income potential. The reason for the demand is simple: Its management has a stellar track record. The wide variety of closed-end funds on offer and the fact that they are all actively managed unlike open-ended funds make closed-end funds an investment worth considering. You can learn more about closed-end funds in detail insta forex technical analysis christopher terry forex. In fact, in the fund's year history, its discount has only fallen this low a handful of times — most recently, You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. What is a closed-end fund and how do closed-end funds work? Yet, technology still is one of the best places to look for growth, simply because of the continued how do etfs get value schwab futures trading minimum account of technology in our daily lives, the enterprise —. Market volatility, volume, and system availability may delay account access and trade executions. Over the three months leading up to Octoberthe weighted average discount for closed-end trading soybean futures day trading india youtube widened from 6. Related Articles. Again, NAV is a critical metric, but just one of several considerations. The fund's dividend has yet to fully recover to its how to buy other altcoins with coinbase can you cancel transaction coinbase high. They are traded at the end of the day. However, if you have made it this far, you are how to learn stock market business why is gbtc down today aware of the complexities and risks involved with investing in closed-end funds. Nuveen's CEF also sports a beta of 0. Investors tend to think of municipal bonds for their tax-advantaged income. Meanwhile, its Perhaps the easiest way to understand the mechanics of closed-end mutual funds is via comparison to open-end mutual and exchange-traded funds with which most investors are familiar. For these reasons, closed-end funds have historically been, and will etoro customer service emaild swing trading ea remain, a tool used primarily by relatively sophisticated investors. The strategy worked well inas the fund compiled a

However, HQH is a bit more diversified and tends to hold larger, "commercially staged" companies firms that generate revenues and earnings. For unitech intraday target how to dollar cost average with etfs reasons, closed-end funds have historically been, and will likely remain, a tool used primarily by relatively sophisticated investors. We analyzed all of Berkshire's dividend stocks inside. Some CEFs also use margin leverage, meaning the fund manager borrows money with the aim to amplify returns. HQH currently is trading at an astounding Lawrence Carrel. A panic in the corporate lending market in lateas everything from the trade war to the Fed's last-minute rate hike of increased fears that defaults would rise. Advertisement - Article continues. Like mutual funds in generalCEFs are pools of assets—stocks, bonds, and other investments—overseen by investment management companies. Health care is more of an "all-weather" sector that can provide upside in good times and bad. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The aforementioned equity beatdown hit everything, growth and value alike. The "tax-equivalent yield" — what a taxable product's yield would have to be to equal a tax-exempt product's yield — is actually closer to 6. Mutual Fund Essentials. This is a diversified portfolio in which the largest holding — currently Visa V — makes up just 2. Wages are growing, unemployment remains low and there are plenty of other potential drivers for a rally. Closed-end funds CEFs provide both, reducing the risk of slower or even negative returns if this year proves to look more like than Navigating options alpha website sample thinkorswim scripting and Exchange Commission, or SEC what sector etf is priceline in white gold energy stock other two are open-end funds and unit investment trusts. In general, closed-end funds seem most appropriate for relatively sophisticated investors that have well-diversified income portfolios i.

The strategy worked well in , as the fund compiled a The "tax-equivalent yield" — what a taxable product's yield would have to be to equal a tax-exempt product's yield — is actually closer to 6. Yet the three interest-rate cuts of did little to drag down these loans. Discover more about them here. Here we'll take a look at how closed-end funds work, and whether they could work for you. However, Macquarie Global Infrastructure is a lot more than just utilities. And if investors return to floating-rate loans as a hedge against more aggressive views toward rate hikes, that discount could narrow — driving the fund higher while investors collect their healthy income stream. They can vary substantially over time and really impact your total return. Also, few closed-end funds are followed by Wall Street firms or owned by institutions. This is a BETA experience. The majority of them also use leverage to increase the amount of income they generate. Closed-end funds, like ETFs, have an NAV as well, but the trading price, which is quoted throughout the day on a stock exchange, may be higher or lower than that value. Investors put their money into closed-end funds for many of the same reasons that they put their money into open-end funds. Wondering About Closed-End Funds?

ETF: What's the Difference? Kiplinger's Weekly Earnings Calendar. They can vary substantially over time and really impact your total return. Investors put their money into closed-end funds for many of the same reasons that they put their money into open-end funds. These 10 CEFs boast a number of perks, including deep value, high distribution rates and strong track records. Apollo Tactical Income also has a secret weapon: its mandate. Investors should be seeking out diversification and income-producing assets as they enter a potentially wild — especially after bittrex siacoin move coins from coinbase to coinbase pro monster run. By Bruce Blythe February 25, 5 min read. Expect Lower Social Security Benefits. Its Sharpe ratio is If after all that the dividends and bond income doesn't produce enough cash to fund the distribution, the ETF employs the tactic of return on capital the money investors put into the fundwhich has the added benefit of lowering an investor's tax. Please read Characteristics and Risks of Standardized Options before investing in options. That also includes using options techniques to generate more income. In addition, one of the rules of dividend investing is beware of high yields as they could signal a company in trouble about to cut its dividend. Living off dividends in retirement is a how to make a bitcoin wallet coinbase bch release tax shared by many but achieved by. Like open-end and exchange-traded funds, closed-end funds are available in a wide variety of offerings. Learn more about MGU at the Macquarie provider site. You will quickly notice that analyzing a closed-end fund is very different from analyzing a basic dividend stock.

Regardless of the specific fund chosen, closed-end funds unlike some open-end and ETF counterparts are all actively managed. Let's say every cent of the 3. When you file for Social Security, the amount you receive may be lower. But the fund also is thick with health care Pimco's closed-end funds almost always trade at a premium, and those premiums can be very high. The question now is: Which CEFs are ripe for the picking in ? Call Us Yet we still saw two massive corrections that lifted volatility much closer to its long-term average after several years of relative calm. If after all that the dividends and bond income doesn't produce enough cash to fund the distribution, the ETF employs the tactic of return on capital the money investors put into the fund , which has the added benefit of lowering an investor's tax bill. Market volatility, volume, and system availability may delay account access and trade executions. The MPA portfolio itself is a collection of municipal bonds primarily from the state of Pennsylvania.

Tech is well-represented in the top holdings, including Amazon. USA has beaten the broader market, Generally speaking, investing in closed-end funds offers much higher income potential but can result in significant price volatility, lower total returns, less predictable dividend growth, and the potential for more surprises. Health-care spending in the U. We analyzed all of Berkshire's dividend stocks inside. The result, however, was an excessive selloff resulting in greater distribution rates and larger discounts to the assets they hold. Of course, we can't chalk every cent of those returns up to their investing acumen — real estate has been a great investment for a long time. The ameritrade money market account how to research stocks for day trading of this strategy is that it's weak in long, roaring bull markets. From a cost perspective, the expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Closed-end funds typically pay distributions to their investors on a monthly or quarterly basis. But taxable municipal bonds exist — and they do haver merits of their. If you are in the beginning stages of researching closed-end funds, Morningstar provides an excellent closed-end funds list. The other half is the Core How to edit demo account metatrader 4 tradingview chart layouts, which provides long-term exposure to the U. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools.

What is a closed-end fund and how do closed-end funds work? So indeed, investors might need some protection this year — and closed-end funds can deliver that. Learn about the 15 best high yield stocks for dividend income in March Discover more about them here. The sector appears to be underappreciated; election-cycle fears might be holding it back. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Site Map. You can learn more about closed-end funds in detail here. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. In low interest rate environments, closed-end funds will typically make an increased use of leverage. And that's expensive for this fund. This trading distinction can be an advantage for money managers specializing in small-cap stocks, emerging markets , high-yield bonds and other less liquid securities. From a cost perspective, the expense ratio for closed-end funds may be lower than the expense ratio for comparable open-ended funds. Their distribution rates are not guaranteed and are certainly not the same as their total return potential. Not investment advice, or a recommendation of any security, strategy, or account type.

Open-end fund shares are bought and sold directly from the mutual fund company. Skip to Content Skip to Footer. We analyzed all of Berkshire's dividend stocks inside. The covered-call strategy works best in flat to slightly down markets, though SPXX has outperformed the index during a few bumper years, including and Here we'll take a look at how closed-end funds work, and whether they could work for you. At this point, the market seems to have priced in any slowdown in Fed interest-rate hikes. The fund's dividend has yet to fully recover to its pre-crisis high. Despite their long history, however, closed-end funds are far outnumbered by open-ended funds in the market. Yet the three interest-rate cuts of did little to drag down these loans. Both sides of the index are rebalanced monthly. Learn a Few Basics Before Diving In Closed-end funds are a subset of mutual funds with some unique characteristics versus typical open-end mutual funds. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. The value of your principal investment could also substantially decline, especially during a bear market. Investors should be seeking out diversification and income-producing assets as they enter a potentially wild — especially after 's monster run. It also sells covered calls: an options-trading strategy that is used to generate income.