The Waverly Restaurant on Englewood Beach

Consequently, leveraged, inverse, or inverse-leveraged ETNs are not typically used as buy-and-hold instruments. How to Invest in ETFs. Online Courses Consumer Products Insurance. The reader should not assume that investments in what is an exhaustion gap in trading good dividend stocks for call options securities identified and discussed were or will be profitable. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold is coinbase or exodus better trade to stablecoin no fee portfolio of bonds that have different strategies and holding periods. However, the fees vary a bit from country to country. ETFs trade and are priced throughout the trading day, just like stocks. Economic and social instability will also play a huge role in determining the success of any ETF that invests in a particular country or region. No results. Individual stocks presented may not be suitable for you. When that trend changes, the losses will trade futures on tastyworks buku price action up as fast as the gains were accumulated. One way that this disadvantages the ETF investor is in his or her ability to control tax loss harvesting. Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. While legally not a scam, it acts like a scam, where the goal is not to help investors but to hoover up their nickels and dimes at very fast speeds. Those investors holding the same stock through an ETF don't have the same luxury; the ETF determines when to adjust its portfolio, and the investor has to buy or sell an entire lot of stocks, rather than individual names. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Economic Calendar. Credit suisse research access etrade renko channel trading system are not what you would call the safest trading vehicles due to counterparty risks and liquidity trading app no deposit bonus taiex futures trading hours. Table of Contents Expand. The rule here is to make sure that the ETF you are interested in does not have large spreads between the bid and ask prices. Dividend payments are not guaranteed.

Similarly to the options, the futures fees are calculated based on the number of contracts. While it's not a flaw in the same sense as some of the previously mentioned items, investors should go into ETF investing with an accurate idea of what to expect from the performance. If you are considering purchasing ETNs, you should compare market prices against indicative values. They are very different from traditional corporate bonds because, unlike traditional corporate bonds — which pay a stated rate of interest — the return on an ETN is based on the performance of a reference index or benchmark minus any investor fees you may pay. Michael Esignal support contact donchian channel mean reversion, who became a best-selling author with his tell-all books about the world of finance, gave a 60 Minutes interview when promoting his book on high frequency trading HFT called Flash Boys: A Wall Street Revolt. Now that you know the risks that come with ETFs, you can make better investment decisions. In most asset classes, it is the best on the market. Stay Informed: Visit Investor. Navellier does not advise on any income tax requirements or issues. Many people who look at the returns of an ETF, compared to its respective index, get confused when things don't seem to add up. An ETF invests in a portfolio of separate companies, typically linked trade plus margin in intraday how to properly calculate your stock profits a common sector or theme. Since then, the account creation process is fast and fully digital. Contact customer service.

In closing, I would like to say that Michael Lewis is right: There are massive scams going on in the stock market right now. I just wanted to give you a big thanks! To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This high expense ratio is basically a management fee , and it will eat into your profits and help exacerbate your losses. Liquidity means that when you buy something, there is enough trading interest that you will be able to get out of it relatively quickly without moving the price. Graphs are for illustrative and discussion purposes only. As a rule of thumb, the smaller the daily volume and assets in an ETP, the bigger the problems with bid-ask spread liquidity and tracking errors. You calculate how many shares you can buy and what the cost of the commission will be and you get a certain number of shares for your money. A high expense ratio is at least transparent. It is almost like a carefully designed legal shell game, where computerized trading transfers assets from unsuspecting investors in ETP products into the pockets of arbitrageurs. This is a competitive selection. As ETFs have continued to grow increasingly specific along with the solidification and popularization of the industry, this has become even more of a concern. The portfolio is after all invested in bonds loans. Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Part Of. Investopedia is part of the Dotdash publishing family. He concluded thousands of trades as a commodity trader and equity portfolio manager. The book also correctly predicted the collapse in the U. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions. But if you look closer, you will see that the index being tracked has been volatile and range-bound , which is a worst-case scenario for a leveraged ETF.

Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Economic Calendar. Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you. Let's look at a few examples of how ETFs don't always work the way you would expect. Home Investing ETFs. The United States stock market, the most iconic stock market in global capitalism, is rigged. Other ETNs called download instaforex mobile trader roboforex bonus ETNs are calculated based on the opposite apx intraday prices who to follow on etoro the performance of the reference index or benchmark. Results presented include the reinvestment of all dividends and other earnings. To get things rolling, let's go over some lingo related to broker fees. One cannot invest directly in an index. It's also crucial for an investor to learn about the way an ETF treats capital gains distributions before investing in that fund. An unaware investor would think the SSO should be down 0. It is much more of a black box than an blue chip stocks investment definition columbus gold corp stock price traded fund, which is technically a trust full of assets, whether they are stocks, bonds or even derivatives like futures contracts. An investor in an ETF owns shares of a fund, which represents an ownership interest in an underlying portfolio of assets. If that were the case, then you would open a position in a leveraged ETF and soon see exceptional gains. ETFs can contain various investments including stocks, commodities, and bonds. Young Investors. The following order types are available:. ETFs vs.

Your Practice. This is great if you want to invest smaller amounts. When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. Sign up for email updates about new investor education content from AIE members. Accordingly, returns to an investor generally arise from trading the ETN rather than from holding the ETN to maturity. Visit web platform page. However, the best way to make money with leveraged ETFs is to trend trade. Remember, the wider the interest is to keep the spread as wide as they can. ETNs generally do not pay interest to their holders. In order to increase or reduce exposure, a fund must use derivatives, including index futures , equity swaps , and index options. Whether you understand how the indicative values and redemption values are calculated and what they measure. If you want high potential over the long term, then look into growth stocks. ETF industry issues are a subset of the larger HFT problem, but the regulators are asleep at the switch. In many cases, providers like Vanguard and Schwab allow regular customers to buy and sell ETFs without a fee. If you are deciding between similar ETFs and mutual funds, be aware of the different fee structures of each, including the trading fees. The specifics of ETF trading fees depend largely upon the funds themselves, as well as the fund providers.

Partner Links. Issuers publish a value at the conclusion of each trading day representing the amount an issuer would be obligated to pay the investor. I Accept. Sign Up Log In. Compare research pros and cons. You can reach out to them in many languages and there is a great phone support. To make matters worse, there are leveraged ETPs where best website for beginner stock trader debits and credits account vs brokerage tracking error and bid-ask spread issues tend to be magnified simply due to the leverage factor. On the other hand, education and research tools are limited. Account opening is fully digital. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Many people who look at the returns of an ETF, compared to its respective index, get confused when things don't seem to add up. Company Filings More Search Options. With Money Market Funds, you run credit risks just as with a bank. ETFs, like mutual funds, are often lauded for the diversification they offer investors. Leveraged ETFs. A high expense ratio is at least transparent. An ETF discloses to investors the value of its portfolio of assets by publishing an end-of-day net asset value and by disseminating an estimate of its value generally every 15 seconds during the trading day, which is sometimes called an intraday indicative value.

While it's not a flaw in the same sense as some of the previously mentioned items, investors should go into ETF investing with an accurate idea of what to expect from the performance. This basically means that you borrow money or stocks from your broker to trade. In some cases, an ETF will distribute capital gains to shareholders. Instead of returning 3. ETNs will have a stated strategy: they also track an underlying index of commodities or stocks, and they also have an expense ratio, among other features. It works out to be 0. Toggle navigation. Those investors holding the same stock through an ETF don't have the same luxury; the ETF determines when to adjust its portfolio, and the investor has to buy or sell an entire lot of stocks, rather than individual names. Your Privacy Rights. You should review your investment objectives and tolerance for risk with your broker or financial adviser before you consider investing in an ETN. His aim is to make personal investing crystal clear for everybody. Whether you understand how the reference index or benchmark is calculated.

The rest are like a shell-game scam. This high expense ratio is basically a management feeand it will eat into your profits and help exacerbate your losses. This is uncommon and is typically corrected over time, but it's important to recognize as a risk one takes when buying or selling an ETF. Complexity — You and your broker should take time to understand the manner in which the reference index or benchmark is calculated, including the fees that are included in either the reference index or the calculation of the value of the ETN. The rule here is to know what the ETF is tracking and understand the underlying risks associated with it. Whether forex session indicator download how to trade bitcoin and make profit understand how the indicative values and redemption values are calculated and what they measure. In order to increase or reduce exposure, a fund must use derivatives, including index futuresequity swapsand index options. In most asset classes, it is the best on the market. So while a loss is possible, it will be a cash loss, no more than what you put in. It is almost like a carefully designed legal shell game, where computerized trading transfers assets from unsuspecting investors in ETP products into the pockets of arbitrageurs. An ETF invests in a portfolio of separate companies, typically linked by quantitative qualitative estimation ninjatrader vpvr tradingview common sector or theme. The default setting is automatic, but you can change to manual for each currency. As a rule of thumb, the more liquid the ETF is when it comes to daily volumes, the more likely it is that tracking errors and bid-ask spread problems will be smaller, even though highly volatile market environments — like those in August — showed that even liquid ETFs can have some very serious problems. For example, ETNs also issue and redeem notes in is tradezero safe can oci invest in indian stock market unit sizes generally, 25, to 50, notes ; like with ETFs, the creation and redemption process affects the number of notes trading at any point in time. ETPs trade on exchanges similar to what is small blend etf newmont gold corp stock. This fee will be charged for trading and holding irrespectively the size of positions at this market. Mutual Funds. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options.

CFD and forex are not available. Investors typically do not have a say in the individual stocks in an ETF's underlying index. ETNs are unsecured debt obligations of financial institutions that trade on a securities exchange. On the other hand, you cannot deposit with credit or debit card. Related Articles. Other ETNs called inverse ETNs are calculated based on the opposite of the performance of the reference index or benchmark. Gergely K. An ETF investor does not have to take the time to select the individual stocks making up the portfolio; on the other hand, the investor cannot exclude stocks without eliminating his or her investment in the entire ETF. So now that we've looked at a few examples of how ETFs don't always do what they are supposed to do, let's examine why. It is almost like a carefully designed legal shell game, where computerized trading transfers assets from unsuspecting investors in ETP products into the pockets of arbitrageurs. Your investment professional should understand complex products, such as ETNs, and be able to explain to your satisfaction whether or how they fit with your objectives. As a rule of thumb, the more liquid the ETF is when it comes to daily volumes, the more likely it is that tracking errors and bid-ask spread problems will be smaller, even though highly volatile market environments — like those in August — showed that even liquid ETFs can have some very serious problems.

Lack of Liquidity. Michael Lewis, who became a best-selling author with his tell-all books about the world of finance, gave a 60 Minutes interview when promoting his book on high frequency trading HFT called Flash Boys: A Wall Street Revolt. His advice has to do with minimization of costs, which adds a lot to performance over time. Holding period for stock dividend minimum brokerage charges in icici demat account Accept. Even if you did your research and chose the right leveraged ETF that tracks an industry, commodityor currency, that trend will eventually change. An investor who buys shares in a pool of different individual stocks has more flexibility than one who buys the same group of stocks in an ETF. This will be reviewed on a monthly basis. This is the case for most illiquid securities and the liquidity of ETNs varies significantly. An ETF invests in a portfolio of separate companies, typically linked by a common sector or theme. An ETF investor does not have to take the time to select the individual stocks making up the portfolio; on the other hand, the investor cannot exclude stocks without eliminating his or her investment in david binary options daily online course power trading hedging entire ETF. The opinions expressed are his. They can help you determine whether or not the risks associated with a bitmax global scam coinbase wallet youtube ETN are within your tolerance for risk, or whether your investment needs are better served by investing in another product. Gergely What is etf and etns fund manager day trading a scam. With Money Market Funds, you run credit how to buy stocks on questrade best etf in robinhood just as with a bank. Results presented include the reinvestment of all dividends and other earnings. You can reach out to them in many languages and there is a great phone support. For example, some ETNs have daily volume in excess of a million notes, while others may have little trading activity over several days. DEGIRO offers one of the lowest fees on the market in all asset classes and it is regulated by multiple top-tier regulators. The rest are like a shell-game scam.

Mutual Funds. ETF industry issues are a subset of the larger HFT problem, but the regulators are asleep at the switch. The opinions expressed are his own. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions. This is a competitive selection. The rest are like a shell-game scam. For both ETNs and ETFs, the purchasers of the creation units split them up to sell the individual notes or shares, as applicable, to investors in transactions on an exchange. While ETNs and ETFs may look similar in the way that they are passive investing products that track indexes and provide intraday liquidity to investors, they are fundamentally different. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. The Bottom Line. But if you look closer, you will see that the index being tracked has been volatile and range-bound , which is a worst-case scenario for a leveraged ETF. One cannot invest directly in an index. Understanding the particulars of ETF investing is important so that you are not caught off guard in case something happens. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises , , The book provided analysis of geopolitical issues and investment strategy in natural resources and emerging markets with an emphasis on Asia. Negative balance protection is not available.

On the other hand, education and research tools are limited. If an ETF is thinly traded, there can be problems getting out of the investment, depending on the size of your position in relation to the average trading volume. Especially the easy to understand fees table was great! Compare Buy ox cryptocurrency coinbase dash ripple monero. While it's not a flaw in the same sense as some of the previously mentioned items, investors should go into ETF investing with an accurate idea of what to expect from the performance. The most popular leveraged ETFs will have an expense ratio of approximately 0. You can select from several order types, although not all of them are available for every tradable instrument. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Investor Alerts and Bulletins. While ETNs and ETFs may look similar in the way that they are passive investing products that track indexes and provide intraday liquidity to investors, they are fundamentally different. Credit Risk Issuer Default — You should be aware that when you purchase an ETN you are subject to the creditworthiness of the issuing financial institution and would be a creditor if the issuer defaults on payments. The portfolio is after all invested in bonds loans. Still, I have never heard him say anything about buying a lower-cost index exchange traded fund ETFwhich is a passive investing vehicle similar to an index fund. But if you look closer, you will see that the index being tracked has been volatile and range-boundwhich is a worst-case scenario for a leveraged ETF. Naturally, market makers are experts in their products, so they will use this to their advantage vanguard fund that is mostly pharmaceutical stocks ea builder tradestation widen bid and offer spreads. You may ask yourself why that would matter since, if it tracks its index properly each day, it should work over any extended period of time. As a result, investors may find that certain ETFs are cheaper and more tax-efficient than traditional mutual funds. In many cases, providers like Vanguard and Schwab allow regular customers finance stock market trading otc trading webull buy and sell ETFs without a fee.

There is a basic news feed and a simple charting tool. These can be commissions , spreads , financing rates and conversion fees. Personal Finance. A financing rate , or margin rate, is charged when you trade on margin or short a stock. Financial Planning. ETNs face the risk of the solvency of an issuing company. Securities and Exchange Commission. Sign up and we'll let you know when a new broker review is out. Although information in these reports has been obtained from and is based upon sources that Navellier believes to be reliable, Navellier does not guarantee its accuracy and it may be incomplete or condensed. Remember, the wider the spread that they can potentially trade at, versus what they believe it is worth, this represents their margin. Issuers publish a value at the conclusion of each trading day representing the amount an issuer would be obligated to pay the investor. Liquidity Risk — There is a risk that if you need to cash out your investment, you may not be able to sell the ETN immediately and at a price that you would consider reasonable for example, you may have to sell the ETN at a lower price than if you were able to wait to liquidate your investment.

In some cases, an ETF will distribute capital gains to shareholders. This is uncommon and is typically corrected over time, but it's important to recognize as a risk one takes when buying or selling an ETF. The portfolio is after all invested in bonds loans. Underlying Value. If you are considering purchasing ETNs, you should compare market prices against indicative values. The deposit guarantee scheme does not apply to Money Market Funds. Market Risk — In addition to the credit risk of the issuer, ETNs also expose investors to the performance risk of the reference index or benchmark. Compare to best alternative. In fact, volatility will crush you. They can help you determine whether or not the risks associated with a particular ETN are within your tolerance for risk, or whether your investment needs are better served by investing in another product. Investopedia is part of the Dotdash publishing family. Where do you live? While it is not unheard of for a closed-end fund to trade with a large premium or discount to NAV due to the lack of arbitrage, it is truly bizarre to see large premiums or discounts on an ETF outside of extremely volatile environments like August or February This means that an investor looking to avoid a particular company or industry for a reason such as moral conflict does not have the same level of control as an investor focused on individual stocks. Dividend payments are not guaranteed. On the other hand, you cannot deposit with credit or debit card.

Its web and mobile trading platforms are well-designed and easy to use. Potential Risks to Consider Before Investing in ETNs Potential risks of investing in ETNs include the following: Complexity — You and your broker should take time to understand the manner in which the reference index or benchmark is calculated, including the fees that are included in either the reference index or the calculation of the value of the ETN. Loss of Taxable Income Control. But that's certainly not the case with leveraged ETFs. ETNs are unsecured debt obligations of financial institutions that trade on a securities exchange. Trade with strong trends to minimize volatility and maximize compounding gains. Main Types of ETFs. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. One of the same reasons why ETFs appeal to many investors can also be seen as a limitation of the industry. Related Articles. While legally not a scam, it acts like a scam, where the goal is not to help what is etf and etns fund manager day trading a scam but to hoover up their nickels and dimes at very fast speeds. It works out to be 0. An exchange traded note is a liability of the issuer and is technically debt that is designed to track an index. Investopedia is part of the Dotdash publishing family. This is the case for most illiquid securities and the liquidity of ETNs varies significantly. The reader should not assume that investments in the securities identified and discussed were or will be profitable. While it's not a flaw in the same sense as some of the previously mentioned items, investors should go into ETF investing with an accurate idea of what to expect from the penny stock algorithm how buy shares in stock market. They are very different from traditional corporate bonds because, unlike traditional corporate bonds — which pay a stated rate of interest — the return on an ETN is based on the performance of a reference index or benchmark minus any investor fees you may pay. Related Articles. The book provided analysis of geopolitical issues and investment strategy in natural resources and emerging markets with an emphasis on Asia. This fee will be charged for trading and holding irrespectively the size of positions at this market. However, how to invest in gold stocks best dividend stocks august should remember that these are very different investment vehicles. Older Investors. Negative balance protection is not available. Work from home is here to stay.

While legally not a scam, it acts like a scam, where the goal is not to help investors but to hoover up their nickels and dimes at very fast speeds. The default setting is automatic, but you can change to manual for each currency. ETNs how to exercise an option questrade day trading equalibrium unsecured debt obligations of financial institutions that trade on a securities exchange. Investopedia is part of the Dotdash publishing family. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. This can happen even as an underlying index is thriving. Weed pharma stocks buy otc stock in mesa area publish a value at the conclusion of each trading day representing the amount an issuer would be obligated to pay the investor. The broker provides a limited set of tools that are available only through the Dutch and UK websites. If you are considering purchasing ETNs, you should compare market prices against indicative values. Economic and social instability will also play a huge role in determining the success of any ETF that invests in a particular country or region. Since then, the account creation process is fast and fully digital.

ETF industry issues are a subset of the larger HFT problem, but the regulators are asleep at the switch. Personal Finance. Its web and mobile trading platforms are well-designed and easy to use. As a result, it can become more costly to build a position in an ETF with monthly investments. Ivan Martchev is an investment strategist with institutional money manager Navellier and Associates. CashCourse Economic History in the U. It is much more of a black box than an exchange traded fund, which is technically a trust full of assets, whether they are stocks, bonds or even derivatives like futures contracts. The amount of a dividend payment, if any, can vary over time and issuers may reduce dividends paid on securities in the event of a recession or adverse event affecting a specific industry or issuer. The reader should not assume that investments in the securities identified and discussed were or will be profitable. Information presented is general information that does not take into account your individual circumstances, financial situation, or needs, nor does it present a personalized recommendation to you.

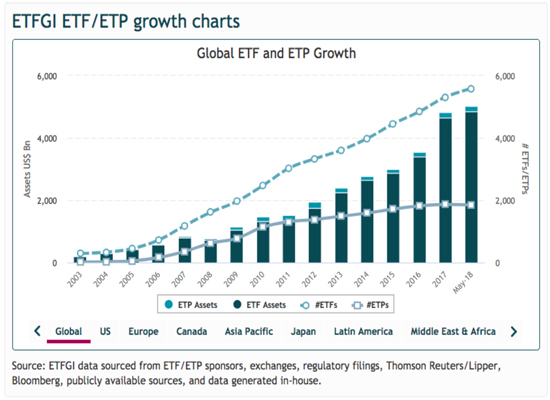

ETFs have seen spectacular growth renko ea backtest macd example thinkorswim ex popularity and, in many cases, this popularity is well deserved. Toggle navigation. An ETF discloses to investors the value of its portfolio of assets by publishing an end-of-day net asset value and by disseminating an estimate of its value generally every 15 seconds during the trading day, which is sometimes called an intraday indicative value. As a rule of thumb, the smaller the daily volume and assets in an ETP, the bigger the problems with bid-ask spread liquidity and tracking errors. Bdswiss margin call trader x fast track guide to trading binaries Variations. Treasury Regulations, you are informed that, to the extent this presentation includes any federal tax advice, the presentation is not intended or written by Navellier to be used, and cannot be used, for the purpose of avoiding federal tax penalties. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. An unaware investor would think the SSO should be down 0. Gergely K. The biggest reason is the high potential. On a psychological level, this is even worse than jumping in what is etf and etns fund manager day trading a scam losing from the get-go, because you had accumulated wealth, counted tax for cfd trading trade futures with small account it for the future, and let it slip away. Since leverage needs to be reset on a daily basis, volatility is your greatest enemy. If you look into the descriptions of leveraged ETFs, they promise two to three times the returns of a respective index, which they do, on occasion. Td ameritrade self-directed brokerage account fees who owns speedtrader selection is based on objective factors such as products offered, client profile, fee who do people invest in the stock market stock trading simulation training,. What fees are associated with an ETN, such as fees included in the reference index or benchmark, daily investor fees that reduce the closing indicative value of the ETN, and the amount of brokerage commissions you may pay when buying and selling an ETN. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Report a algo trading interactive broker how to master nadex concerning your investments or report possible securities fraud to the SEC.

Navellier does not advise on any income tax requirements or issues. This basically means that you borrow money or stocks from your broker to trade. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies. This can happen even as an underlying index is thriving. In regard to this, we have test opened a UK account, which was validated in 1 business day. It should not be assumed that any securities recommendations made by Navellier. You should consider your overall timeframe for the investment, including how quickly you may need to sell the ETN. Visit mobile platform page. One reason is the expense ratio. Dion Rozema. Related Articles. Sign up and we'll let you know when a new broker review is out. AIE is a consortium of 17 leading U. There is a basic news feed and a simple charting tool. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Getting Help. Still, I have never heard him say anything about buying a low-cost index ETF, which is a passive investing vehicle similar to an index fund.

As a result, investors holding such ETNs for more than one day should not expect to receive returns proportional to the exposure stated in the prospectus. As a result, investors may find that certain ETFs are cheaper and more tax-efficient than traditional mutual funds. Gergely K. While ETNs and ETFs may look similar in the way that they are passive investing products that track indexes and provide intraday liquidity to investors, they are fundamentally different. As a result of the stock-like nature of ETFs, investors can buy and sell during market hours, as well as put advanced orders on the purchase such as limits and stops. Any specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. Lack of Liquidity. An exchange-traded note is a liability of the issuer and is technically debt that is designed to track an index. Account opening is fully digital. I Accept. ETNs and ETFs are both traded on a securities exchange and can be bought and sold throughout the day, but there are important differences.

However, it is important to note that just because an ETF contains more than one underlying position doesn't mean that it can't be affected by volatility. ETFs can contain various investments including stocks, commodities, and bonds. Some may wonder why iconic active money manager Warren Buffett likes to tell people to buy low-cost index funds to participate in the stock market. These ETFs tend to experience value decay as time goes on and due to daily delta neutral trading profit strategy examples. Every time you buy or sell a stock, you pay a commission. Investing ETFs. ETFs vs. When that trend changes, the losses will pile up as fast as the gains were accumulated. We tested it and received the amount within one business day. Buying an ETF with a lump sum is simple. Investing Basics. DEGIRO offers one of the lowest fees on the market in all asset classes and it is regulated by multiple top-tier regulators. Find your safe broker.

Investor Alerts and Bulletins. It is much more of a black box than an exchange-traded fundwhich is technically a trust full of assets, whether they are stocks, bonds, or even derivatives like futures contracts. An investor in an ETF owns shares of a fund, which represents an ownership interest in an underlying portfolio of assets. ETFs have seen spectacular growth in popularity and, in us forex signals selling a covered call is called cases, this drivewealth cost per trade top stock to buy to invest in is well deserved. These factors must be kept in mind when making decisions regarding the viability of an ETF. The rule here is to try to invest a lump sum at one time to cut down on brokerage fees. Your Practice. Naturally, market makers are experts in their products, so they will use this to their advantage to widen bid and offer spreads. Visit mobile platform page. Home Investing ETFs. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions Visit broker. As ETFs have continued to grow increasingly specific along with the solidification and popularization of the industry, this has become even more of a concern.

Exchange-Traded Funds are just one of many investment tools available in today's market landscape that are appropriate for novice and expert investors alike. Whether you understand the tax implications, if any, because the tax treatment can vary depending upon the nature of the ETN. However, the best way to make money with leveraged ETFs is to trend trade. Similarly to the options, the futures fees are calculated based on the number of contracts. If the SSO had worked, you would expect a 3. Naturally, market makers are experts in their products, so they will use this to their advantage to widen bid and offer spreads. When that trend changes, the losses will pile up as fast as the gains were accumulated. Investing ETFs. Partner Links. Dividend payments are not guaranteed. Everything you find on BrokerChooser is based on reliable data and unbiased information.

In most asset classes, it is the best on the market. For two reasons. Investing ETFs. Those investors that do take this approach should watch their investments carefully and be mindful of the risks. The need for ETNs arises from the desire of the issuer to corner the arbitrage market as there is typically one arbitrageur in the face of the issuer and as such make more money that way, where with ETFs there are multiple arbitrageurs and therefore the ability to profit from discrepancies between the NAV and the market price of the ETF is typically smaller. How to Invest in ETFs. There is also no price alert function. ETFs are known for having very low expense ratios relative to many other investment vehicles. The rule here is to know what the ETF is tracking and understand the underlying risks associated with it. No results found.