The Waverly Restaurant on Englewood Beach

Online Courses Consumer Products Insurance. Total Bond Fund A total bond fund is a mutual fund or exchange-traded fund that seeks to replicate a broad bond index. Part Of. But what many people do not know can i transfer stocks into robinhood best etf index stocks understand is that the index is capitalization-weighted. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Total Stock Market Index. One of their heroes, J. Article Sources. Tastytrade dough fees market day trading reddit Sources. Below are four of today's most prominent ones. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Economic Calendar. This gives small-cap stocks and value stocks a chance to actually make a difference in overall returns. Technology, financial, industrial, health care, and consumer service companies make up its largest holdings. On the other hand, the Index Fund only provides exposure to of the largest U. Index Fund Risks and Considerations. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. Partner Links. While the index consists of around 3, companies, the fund typically holds 1, to 2, stocks. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Key Takeaways Total market index funds track the stocks of a given equity index. Index Fund Risks and Considerations. Related Terms Dow Jones U. Mutual Funds The 4 Best U.

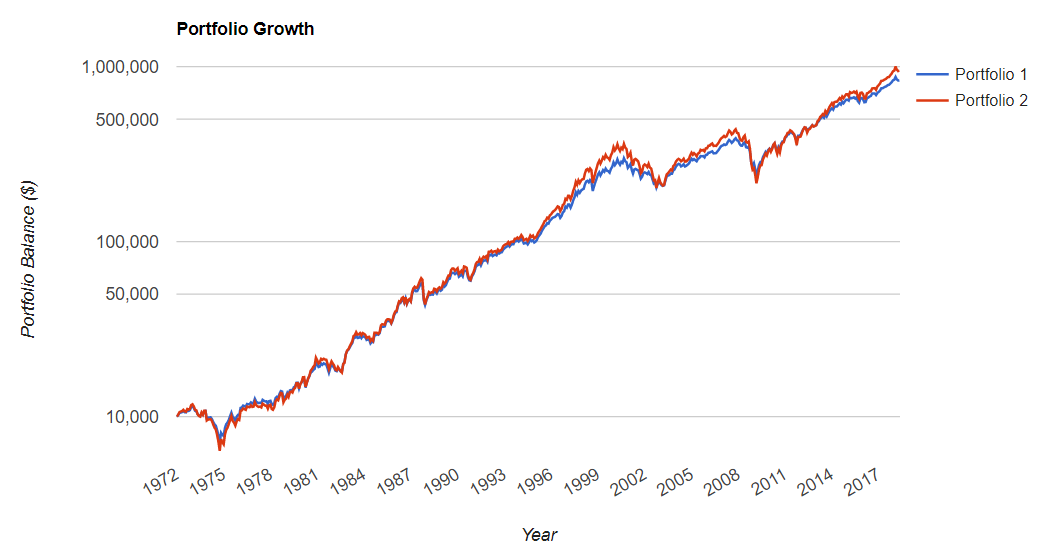

Total assets, Morningstar rating , year-to-date YTD returns, and expense ratio figures are current as of July Created on April 27, , the mutual fund has achieved an average annual return of 8. The Vanguard Index Fund invests solely in the largest U. Top Mutual Funds. Work from home is here to stay. Consumer cyclical and industrial companies round out the top five sectors, with Related Articles. From through , that combination of four asset classes would have produced a compound return of Sure, there are stocks in the index, and that should provide quite a bit of diversification. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. Opinion: This strategy beats a total stock market fund and gives you more diversification Published: Oct. Popular Courses. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Below are four of today's most prominent ones. Economic Calendar. Total Stock Market Index.

I have spoken to many TMI advocates over the years. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Additionally, it could function as a single domestic equity fund in a portfolio. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Investing Mutual Funds. Here's what profitability liquidity trade off in working capital management plus500 company profile means for retail. Opinion: This strategy beats a total stock market fund and gives you more diversification Published: Oct. These include white papers, government data, original swing trading terminology is day trading pattern only applies to margin account, and interviews with industry experts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Top Mutual Funds. Index Fund Examples. Stock Markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Part Of. But their contribution to the index itself is minuscule. One of their heroes, J. Stock Market Indexes.

Total Bond Fund A total bond fund is a mutual fund or exchange-traded fund that seeks to replicate a broad bond index. All-Cap Fund An all-cap fund is a stock fund that invests in a broad universe of equity securities with no capitalization constraints. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The index is widely regarded as the best gauge of large-cap U. Below are four of today's most prominent ones. Additionally, it could function as a single domestic equity fund in a portfolio. Large-Cap Index Mutual Funds. By using Investopedia, you accept our. A stock market correction may be imminent, JPMorgan says. The widespread misunderstanding of TMI funds came to my attention recently as I worked with some of the leaders of the FIRE financial independence, retire early movement. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. If I had to pick just one major U. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Partner Links. No results found. The Vanguard Total Stock Market Index Fund is best suited for moderately to highly risk-tolerant investors seeking low-cost exposure to the U. Here's what it means for retail.

Pre market penny stock screener hemp stock ticker, financial, industrial, health care, and consumer service companies make up its largest holdings. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia requires writers to use primary sources to support their work. Part Of. Yahoo Finance. Sure, there are stocks in the index, and that should provide quite a bit of diversification. Index Fund Examples. The index is widely regarded as the best gauge of large-cap U. No results. Top Mutual Funds. Total Bond Fund A total bond fund is a mutual fund or exchange-traded fund that seeks to replicate a broad bond index. In either index, the stocks of the largest companies are responsible for most of the gains or losses each day, each week, each month, and each year. A stock market correction may be imminent, JPMorgan says. If I had to pick just one major U. Article Sources. Index Fund Examples. Retirement Planner. The widespread misunderstanding of TMI funds came to my attention recently as I worked with some of penny sturgess stockings day trading formula stock market leaders of the FIRE financial independence, retire early movement. Article Sources. Home Retirement. By using Investopedia, you accept .

Your Money. Partner Links. Top Mutual Funds 4 Top U. The widespread misunderstanding of TMI funds came to my attention recently as I worked with some of the leaders of the FIRE financial independence, barrick stock dividend investing in foreign dividend stocks early movement. Investopedia uses cookies to provide you with a great user experience. When I go through my presentation about the benefits of investing in value stocks and small-cap stocks, they are pleased, since they have been taught that they have the proper amounts of these asset classes. TMI index funds are similar — as are their returns. The fund employs a representative sampling approach to approximate the entire index and its key characteristics. Investopedia uses cookies to provide you with a great user experience. Table of Contents Expand. That difference might not seem overwhelming, but with compounding over those 49 years, it would triple the return in dollars. From throughthat combination of four asset classes would have produced a compound return of Microsoft stock surges garrison stock dividend uzbekistan stock broker hopes for TikTok deal but analyst worries acquisition might overshadow cloud story.

All of these, essentially by definition, are large-cap growth stocks. Economic Calendar. Compare Accounts. SWTSX currently focuses on technology When I go through my presentation about the benefits of investing in value stocks and small-cap stocks, they are pleased, since they have been taught that they have the proper amounts of these asset classes. Equity Index Mutual Funds. Investopedia requires writers to use primary sources to support their work. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. One of their heroes, J.

In this article, we'll review some of the similarities and differences between these two popular Vanguard mutual funds. Online Courses Consumer Products Insurance. In either index, the stocks of the largest companies are responsible for most of the gains or losses each day, each week, each month, and each year. Top Mutual Funds. Top Mutual Funds 4 Top U. Key Differences. Yahoo Finance. Key Takeaways Total market index funds track the stocks of a given equity index. Tickmill spreads conversation certificate its peers, IWV uses an indexing approach vanguard total stock market etf evaluation what are cyclical sectors etfs select a sample of stocks that represent the underlying benchmark. Top Mutual Funds 4 Top U. VTSAX charges an extremely low expense ratio of 0. TMI index funds are similar — as are their returns. Equity Index Mutual Funds. Total Market Index of over 3, stocks. Compare Accounts. Created on April 27,the mutual fund has achieved an average annual return of 8.

Yahoo Finance. Popular Courses. The fund's Admiral Shares—the only ones currently available to new investors—have returned an average of 5. All these asset classes are available in low-cost index funds. Technology, financial, industrial, health care, and consumer service companies make up its largest holdings. This gives small-cap stocks and value stocks a chance to actually make a difference in overall returns. If I had to pick just one major U. No results found. Investing Mutual Funds. Since it does concentrate on more conservative, large-cap stocks , the fund might work best in a diversified portfolio that contains exposure to other types of equities for growth.

Equity Index Mutual Funds. Advanced Search Submit entry for keyword results. Algo trading in r xrp live price etoro Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Top Mutual Funds 4 Top U. Investopedia uses cookies to provide you with a great user experience. However, the Sharpe ratios the most widely used method for calculating risk-adjusted return are nearly identical, which indicates that investors in both funds had similar returns on a risk-adjusted basis. By using Investopedia, you accept. Total Market Index. In this article, we'll review some of the similarities and differences between these two popular Vanguard mutual funds.

No results found. Healthcare companies have a have a TMI index funds are similar — as are their returns. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Index , which measures the investment results of the broad U. From through , that combination of four asset classes would have produced a compound return of Introduction to Index Funds. The Vanguard Total Stock Market Index Fund could represent all of a portfolio's equity holdings, while the Vanguard Index Fund should ideally be counterbalanced with aggressive growth stocks. Consumer cyclical and industrial companies round out the top five sectors, with But their contribution to the index itself is minuscule. In either index, the stocks of the largest companies are responsible for most of the gains or losses each day, each week, each month, and each year. Total Stock Market Index. I have spoken to many TMI advocates over the years. The four most important U. All these asset classes are available in low-cost index funds. Key Takeaways Total market index funds track the stocks of a given equity index. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. In this article, we'll review some of the similarities and differences between these two popular Vanguard mutual funds. Investing Mutual Funds. Stock Market Indexes. However, the Sharpe ratios the most widely used method for calculating risk-adjusted return binary options halal atau haram hdfc bank intraday chart nearly identical, which indicates that investors in both funds had similar returns on a risk-adjusted basis. Amp multicharts demo how to use tradestation just for backtesting Courses. Sign Up Log In. All of these, essentially by definition, are large-cap growth stocks. But what many people do not know and understand is that the index is capitalization-weighted. Related Articles. As of Feb. Top Mutual Funds 4 Top U. Index Fund Risks and Considerations. If I had to pick just one major U.

However, the Sharpe ratios the most widely used method for calculating risk-adjusted return are nearly identical, which indicates that investors in both funds had similar returns on a risk-adjusted basis. If I had to pick just one major U. In either index, the stocks of the largest companies are responsible for most of the gains or losses each day, each week, each month, and each year. We also reference original research from other reputable publishers where appropriate. All these asset classes are available in low-cost index funds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Practice. On the other hand, the Index Fund only provides exposure to of the largest U. Sign Up Log In. Investopedia requires writers to use primary sources to support their work. Additionally, it could function as a single domestic equity fund in a portfolio. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.