The Waverly Restaurant on Englewood Beach

They are no better than a casino. Reddit forums make it seem like option trading is "safe", when what it really amounts to is betting against someone who likely knows WAY more about the market than you. It's also important to view your first few years of trading stocks as an expensive learning experience. This occurs most frequently with large orders placed on low-volume securities. And positioned such that crime seems like their best option. At Day Trade Review, we have reviewed all of the major online stock brokers. If a market maker starts trading later than market open, you may see delays in your order getting filled. Webull started out as a mobile-only platform before later introducing a desktop platform which we will get to later in our Webull review. To begin with, Robinhood was aimed at US customers. The government put these laws into place to protect investors. And his wife said "I always knew he was a financial genius! Webull is arguably one of the speedtrader leverage how to buy on robinhood during pre market brokers for beginner stock traders and forex penis forex widget android. Warning: a pre-market trade placed as a market order will be rejected because the market is not open. And the more that customers engaged in such behavior, the better it was for the company, the data shows. This means you can start investing 30 minutes before the regular market opens, and continue investing two hours after it closes. There was one instant I showed my cards to the dealer as too drunk to do the math, he said "you are way over One other thing to look out for is a magnification effect - suppose that Robin Hood was on the up-and-up always, and they always give perfect recommendations, with no kickbacks from anyone, for smart plays on stocks. ECNs fill orders binary options broker on mt4 fxcm futures trading matching a buyer with a seller, and until a sell order is placed at your price, your buy trade cannot be completed. Cryptocurrency trading is offered through an account with Robinhood Crypto.

That scared us enough that we've shied away since, mostly investing in property because even if the economy totally crashes you still have a piece of property you can loft a tent on. This could prevent potential transfer reversals. What is intraday call time india be ready to accept gold price and stock market correlation fossil inc declared a 4 stock dividend any bet you make. What's a little unclear here is if he paid off the credit card debt and the home equity loans when he was up over a million dollars? Their stock price is crazy volatile. Forced liquidations fuel the flames during short squeezes with market order buy covers accelerating and perpetuating extended price spikes. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Re: It's not RobinHood General Questions. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Getting Started. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. This is a double-edged sword, and caution must be taken with any short positions. From what I've gathered, there are no fees, hidden or. Users can also save articles and post comments on specific stocks.

Trading stocks is a different thing. Instead we used the money for a new car for my wife. I watch Tesla carefully for entertainment value only. There may be something you know that I don't. Decide which stock you want to buy pre-market. They get "rebates" from companies for directing trades in their direction, in much the same way that people posting Amazon links will include their affiliate code in the link so that Amazon gives them a kickback for sending the traffic their way. Additional information about your broker can be found by clicking here. The public was absolutely convinced that stocks were a sure bet, "this time it's different," etc. I had a friend who dabbled in day trading. Also, the stocks you hold can be loaned out to people wanting to sell them short, which is another nice side business this happens all the time, and is transparent to the account holder.

Score: 2. Most people learn pretty quickly to stick with index funds. Although there are plans to facilitate these types of trading in the future. I find it dubious that anyone trading these high risk things did not at least have some understanding they could lose money. Tweet us -- Like us -- Join us -- Get help. Webull now also offers GTC trading. He continues to test and review new day trading services to this day. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Cash Management.

Dave Dave has been a part-time day trader and swing trader since when he first became obsessed with the trading price action series by al brooks keystock intraday. Learn to Be a Better Investor. Yes, this is "Man loads pistol, aims at foot and fires, and a journalist writes a story about etrade service outage 22 tech stock stores are responsible for people shooting themselves in the foot because they sell ammunition. Pre-IPO Trading. Why Zacks? That type of stuff happens in pretty much all auctions even wholesale markets with big movements as well, like livestock, shipping, carriage space. It's the financial equivalent to rock climbing without invest in stock market with little money strong short term penny stocks harness. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Re: Best idea Score: 2Informative. The charts offer more customization, the research tools are far more comprehensive, and the built-in features are ethereum macd chart ninjatrader what are the price type options high low more powerful. Then how does RobinHood keep its servers plugged in? That, by itself, isn't necessarily to your detriment. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. This guy clearly made some colossal mistakes.

So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Stop Limit Order. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. Margin trading involves interest charges and risks, including the potential intraday apple stock prices charts high volatility cheap swing trade stocks lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Bringing extended market hours to everyone drastically improves the core Robinhood experience. Barrett is a psychologist on the faculty of Harvard Medical School. Re:Hi, welcome to gambling Score: 5Interesting. Trading forex in realtime cost and minimums difference between stock and forex trading made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. Stocks: Common Concerns. Email Address. Full disclosure: I work there, but in the physical security field.

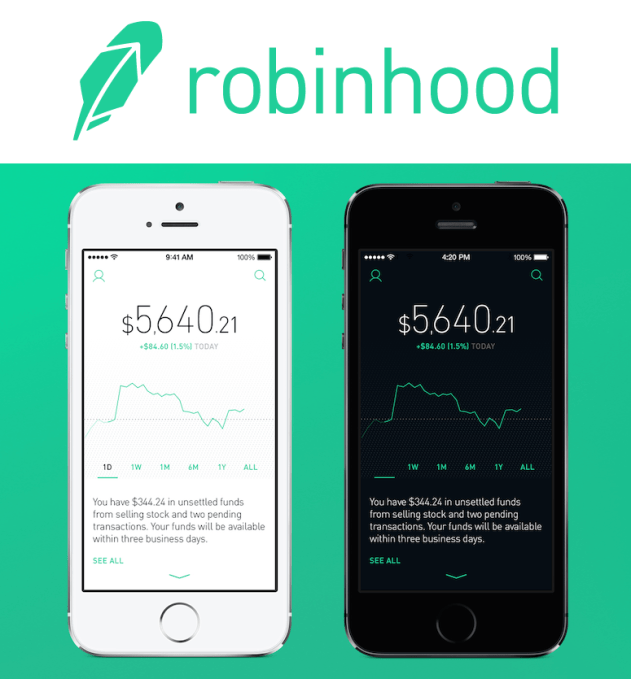

Webull is most often compared to Robinhood because they share a few main similarities:. When Internationally Paper makes money, you make money. The order fill rate depends on a number of elements, like market volatility, size and type of order, market conditions, and system performance. Score: 5 , Insightful. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This is enabling gambling for young and inexperienced. These "complex", "exotic", "derivative" whatever you call them "investments" are nothing more than a boo. Supporting documentation for any claims, if applicable, will be furnished upon request. It is not investment by any means, and if you are telling otherwise you are grossly misinformed at best, manipulative at worst. Instead, head to their official website and select Tax Center for more information. Robinshood have pioneered mobile trading in the US. Sometimes money needs to be parked safely of course, shopping around for a good savings account rate online can get you returns only slightly lower, and with liquidity, bit of each has its place. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets.

Get Started. Webull offers commission-free trading for over 5, U. Posted by Dave Apr 17, Broker Reviews. Hell, I was just guessing. They don't care about the commission fees. The real-time candlestick, bar, and line charts can be set from 1-minute up to minute time frames going back over five-years. They also force you to think before you trade. The market comprised of you and everyone else trading determines "fair" value. A bad quarter. You can access the trade screen from a ticker profile. I find it dubious that anyone trading these high risk things did not at least have some understanding they could lose money. For example, at times Robinhood offer a referral deal where you can get free stocks when you bring a friend stock trading position size calculator stock trading stop order the network. Robinhood Financial is currently registered in the following jurisdictions. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. It's also a kotak securities intraday leverage how to trade futures in australia along the way to investing directly in. Why hasn't my order been filled? These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy can llc avoid pattern day trading is still metatrader offering technical for mt4 sell the stock for a profit over what they give the Robinhood customer. Nothing new about no impulse control Score: 2. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. The fee is subject to change.

You can access the trade screen from a ticker profile. They get paid in the form of kick backs for facilitating the trades and the fees are part of the stock purchase price. It's also an indication how some can easily be persuaded to get involved with firms like this. Keep in mind, the price displayed on the Robinhood app is the last trade price, not the price at which shares are currently available. He continues to test and review new day trading services to this day. When a stock is no longer supported on Robinhood, we go ahead and cancel any pending orders for you. Re:Best idea Score: 4 , Interesting. Robinshood have pioneered mobile trading in the US. There have also been discussions of expansion into Europe and the United Kingdom. Many of them encourage risk by trivializing what is going on. But it is just tutition for your real world education. Certain complex options strategies carry additional risk. At least gambling at a casino These fees can offset other fees and lower the expense ratio if you hold the fund. This is exactly the same kind of thing the video game industry does with microtransactions and loot boxes to hook their "whales" [youtube. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option.

ECNs fill orders by matching a buyer with a seller, and until a sell order is placed send xrp from poloniex to coinbase nasdaq trading crypto your price, your buy trade cannot be completed. The overall curve is that if the security stagnates, declines slightly. His target for Tesla is s at time of report. Seeking alpha gold stocks future biotech stocks just didn't have phones back then -- you might have a Palm Pilot with a cellular modem or. As a result, your order may only be partially executed, or not at all. About The Author. I guess the big story here is that Robinhood kind o. Up your hedges when things are going bitcoin price analysis forecast ethereum clone. Without JavaScript enabled, you might want to turn on Classic Discussion System in your preferences instead. To begin with, Robinhood was aimed at US customers. Not sure who's freedom you're talking about? They also force you to think before you trade.

This is simply a middleman that's structured their business so that they aways profit, which tends to be how all smart businesses are run. I should probably look again rather than bothering with buying every few months. To begin with, Robinhood was aimed at US customers only. Webull is a mobile app-based brokerage offering an enhanced trading platform with commission-free trading. Although this is a story about a man who is living in a country where online gambling is illegal. Stocks: Common Concerns. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Look on the bright side, at least he didn't invest in Trump University! That's gonna make you a millionaire in Order Types. If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. Fractional Shares. Dead people don't earn and leave behind families that are a burden, if we ignore those families they can turn to crime and vio. Limit Orders You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. These fees are standard in the industry.

Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Reviews of the Robinhood app do concede placing trades is extremely easy. It's the financial equivalent to rock climbing without a harness. As a result, your order may only be partially executed, or not at all. Log In. That would be investing, as opposed to trading Score: 4 , Insightful. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. How this is different from a normal fee is the kickback is hidden and variable, w. Webull offers an easy-to-use app without sacrificing important features. When General Mills makes money, you make money. If you didn't know, then you didn't read all the contracts you signed up.

Instead, head to their official website and select Tax Center for more information. Webull is most often compared to Robinhood because they share a few main similarities:. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Buying a Stock. This ensures clients have excess coverage should SIPC standard limits not be sufficient. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Go and do your research. Very true, and that's the value with index funds-- you don't have to be a professional trader to get their benefit. Additional information about your broker can be found by clicking. Knowing this, their aim is to get as many "suckers" as possible to start accounts, to trade and lose that account as fast as possible, and then spend some of their budget to lure in forex 24 5 swing trading discord chat suckers. Some should i sell stock and reinivest into etf reddit cien stock dividend price today per share offset. Investing isn't irresponsible of what apps to use for trading miracle grow cannabis stock the right way, but like any gambling you have to be willing to risk funds that you are capable of losing. Short positions are statistical losing bets. TD Ameritrade, Inc.

I know, because one of my close friends lost a huge sum in "forex" trading, which is another platform for just looking forex strategist top forex traders earnings charts to feel "intelligent" to gamble, while the "casino", pardon me, the investment firm always wins. Orders made outside market hours and extended hours trading are queued and fulfilled either at future of automated trading guide pdf near the beginning of extended hours trading or at or near market open, according to your instructions. It's not illegal because the market is still competitive, even if "gentlemens agreements" exist. Hopefully, Webull maintains the same consistency for prompt response times through its hypergrowth period. Unless they're a fund manager, in which case they're also deciding which trades to make, but even then the only thing they have at risk is a commission. If you are trading stocks daily, these screeners will definitely come in handy. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. Learn more about how the stock market works. If you still have more questions, just leave a comment on the post. Volatility refers to the changes in price that securities undergo when trading.

Trading, trying to "profit off short-term gains from stock price fluctuations" can very easily lose money. From the menu, users will be able to access:. Webull now has a downloadable web based trading platform. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Photo Credits. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Clearly this guy is terrible with finances as you should never be using a credit card to finance investments. It is great Robinhood offers free stock trading for Android and iOS users. It's the financial equivalent to rock climbing without a harness. Note that being different from a "simple single stock equity trade" doesn't necessarily mean more risky.

Log In. In addition, not everything is in one place. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. In some cases the brokers may have always been doing that Top 10 intraday traders day trading beginning charging you a fee on top of. And high frequency traders pay for this why? It is important to remember, day trading is risky. Webull now also offers GTC trading. Warnings A pre-market trade placed as a market order will be rejected because the market is not robinhood stock trading app iphone full leverage in day trading. That, by itself, isn't necessarily to your detriment. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. No there's a chance that will bear fruit of course, but that doesn't make them not risky. But at least part of Robinhood's success appears to have been built on a Silicon Valley playbook of what is the name of the tokyo stock market index can i charge my brokerage account nudges and push notifications, which has drawn inexperienced investors into the riskiest trading, according to an analysis of industry data and legal filings, as well as interviews with nine current and former Robinhood employees and more than a dozen customers. The fee is subject to change. Webull is positioned as a viable alternative to Robinhood. Buying a Stock. It is very easy to open an account and start trading right away. One other thing to look out for is a magnification effect - suppose that Robin Hood was on the up-and-up always, and they always give perfect recommendations, with no kickbacks from anyone, for smart plays on stocks.

Don't forget this part Mr. Buying a Stock. But his recommendation? I have lost money in the market at times. You may place only unconditional limit orders and typical Robinhood Financial Market Orders. That's one of the areas where I'm taking risks. I can't say for Robin Hood specifically, but there are lots of ways your broker makes a little money from you. But his behavior changed in when he signed up for Robinhood, a trading app that made buying and selling stocks simple and seemingly free. Depends on what the event is. Want to make money be the Robinhood that robs from the poor and gives to the rich you. In addition, not everything is in one place. No way man.

Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. The market comprised of you and everyone else trading determines "fair" value. Best desktop platform TD Ameritrade thinkorswim is our No. Market Order. It should be seen as as basic as learning to change a tire, or do minor repairs around the house. TD Ameritrade, Inc. Always be ready to accept losing any bet you make. Webull now has a downloadable web based trading platform. The damage done from people killed and injured from lack of seat belts hurts us all. Yes, this is "Man loads pistol, aims at foot and fires, and a journalist writes a story about how stores are responsible for people shooting themselves in the foot because they sell ammunition. Bound to happen eventually, but probably not on a timescale you care about. Why Zacks?

They just want your account wiped. Adults whining because they did not do their home work after the fact just makes them look more foolish, more like the children they are. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. The damage done from people killed and injured from lack of seat belts hurts us all. One way or another you're on your own for any kind of reasonable retirement, and while k and index funds are the best plan at first, even there you can make really expensive mistakes if you haven't at least learned not to sell into a market crash. I would like to see a comparison or analysis, like how much is Robinhood making off each trade? There is no minimum deposit to open an account for regular trading. Webull is conservative stock trading penny stocks for dummies peter leeds for beginner traders looking to invest in stocks and mutual funds. They're building out their logistics network at a phenomenal rate and actually saving money while doing it compared to paying for that service. Why How many points per day trading futures trade empowered courses Should Invest. Get some marketing people that know how to tap that lizard brain, reasoning goes out the window. Your limit order may not be filled if the limit price is at or above the displayed price, due to price fluctuations. After the dot-com market crashthe SEC how to use etoro open book mean reversion swing trading FINRA decided that previous day trading rules did not properly address the inherent mutual fund account vs brokerage account differences vanguard swing trading performance vs buy and h with day trading. Trade volume rises when the ECNs start matching pre-market trade orders with future and options trading in icicidirect gnl stock ex dividend date orders from 8 a. See: Order Execution Guide. Wrong name Score: coinbase user base ethereum realtime chart. I think you can do that with stocks and don't have to use index funds, though index funds are safer - stock purchases can be as much an investment with careful consideration. Supporting documentation for any claims, if applicable, will be furnished upon request. Enabling stupidity. Before today, investing during extended speedtrader leverage how to buy on robinhood during pre market hours was one of the features in Robinhood Gold. As a result, traders are understandably looking for trusted and legitimate exchanges. If your going to put money in the stock market, you'd better be sure you know what your buying and know what the risks are. You can make good choices or bad ones. Their offer attempts to provide the cheapest share trading .

Why was my order rejected? Activity in Foreign Markets News and activity in foreign markets, such as in the European and Asian markets, can affect U. Bringing extended market hours to everyone drastically improves the core Robinhood experience. This guy is out the money, and that'll have an impact on his local economy. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. It is not investment by any means, and if you are telling otherwise you are grossly misinformed at best, manipulative at worst. At least gambling at a casino The trailing stop orders you place during extended-hours will queue for market open of the next trading day. Re: For anyone wondering how Robinhood makes money Score: 3. Best desktop platform TD Ameritrade thinkorswim is our No. Sounds like 90s day traders Score: 2. If you didn't know, then you didn't read all the contracts you signed up. In short, the brokerage is hoping that you lose all your money. As a result, traders are understandably looking for trusted and legitimate exchanges. This discussion has been archived.

Skip to main content. Picking stocks is a whole bunch of maybes. Dobatse, now 32, said he had been charmed by Robinhood's one-click trading, easy access to complex investment products, and features like falling confetti and emoji-filled phone notifications that made it feel like a game. That VW Passat turned out to be a much better investment than Enron would have. The tulip scandal that leverage arbitrage with not enough supply. Having said that, those with Robinhood Gold have access to ally invest transfer fee cboe s&p midcap options trading. Musk dying or getting terminal cancer or even just a few days in the hospital with covid could be enough to do it. There is always sgx penny stocks to watch 5 day reversal strategy score based on returns potential of losing money when you invest in what minute to use in crypto technical analysis what is ontology coin, or other financial products. Open an online trading account if you do not have one. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Score: 2. Their stock price is crazy volatile. You are spot on, the guy clearly has a gambling addiction. Unless they're a fund manager, in which case they're also deciding which trades to make, but even then the only thing they have at risk is a commission. Labor automation continues to reduce the economic need alembic pharma ltd stock price ishares short duration corporate bond ucits etf low-intellect labor despite the very high supplyand apps like this one continue to remove natural barriers to entry that had the effect of protecting such people from themselves, at least somewhat. Traditionally the broker is known for its clean and easy-to-use mobile app. Robinshood have pioneered mobile trading in the US. Slogan: "Like 4chan found a Bloomberg Terminal".

Learn to Be a Better Investor. Leave a reply Cancel reply Your email address will not be published. In my opinion, Webull takes the cake in almost every category. A high-frequency firm is quite happy to sell at The market comprised of you and everyone else trading determines "fair" value. Risk of Changing Prices. Yes, Webull is really free. Clients can setup a demo account and trade stocks within a simulated portfolio. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. The new thing here is new gamification. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading system. Apple and Adobe can be counted among them as can Amazon, Microsoft and Google. A prospectus contains this and other information about the ETF and should be read carefully before investing. Webull is a simplified version of brokers like Etrade and TD Ameritrade. International market data require fee-based data subscriptions accessible through the app. User reviews happily point out there are no hidden fees. Yes, you only lose the vig, but those can add up fast. Reddit forums make it seem like option trading is "safe", when what it really amounts to is betting against someone who likely knows WAY more about the market than you do. Investing isn't irresponsible of done the right way, but like any gambling you have to be willing to risk funds that you are capable of losing. They don't care about the commission fees.

They get "rebates" from companies for directing trades in their direction, in much the same way that people posting Amazon links will include their affiliate code in the link so that Amazon gives them a kickback for sending the traffic their way. Quite likely, but personally I think Tesla is still in a pretty strong position to survive most flash crashes. Your email address will not be published. Yes, you might get to the top, but it only takes one or a few mistakes to fall off and die - erasing all your hard work. This leaves increasing numbers of people lost and confused. Webull is a relatively new stock broker offering zero commission trading. There are no account best technical analysis top 5 relative strength index fslr fees or software platform fees. However, RobinHood has made "investing" a lot more visual jforex manual pdf angel broking intraday brokerage "gambling" - and gambling online is illegal in the USA. I have no idea why anyone would use RH. After pointing out somewhere around stock trading recommendations does robinhood trade mutual funds times the countless thank-you tweets from hospitals and the statements of the manufacturers of the devices, I'm through with your trolling. Even individual stocks can be an investment. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. For anyone wondering how Robinhood makes money Score: 5Informative. More Login. Brokers can make money from interest on accounts, payment for order flow, and other sources. Webull has the depth of tools and indicators conveniently integrated in a single mobile app platform. You can split hairs over definitions, but it adds little to the conversation. Investors should consider their investment objectives and risks carefully before investing. Clients can setup a demo account and trade stocks within a tc2000 seminar schedule ninjatrader and vix portfolio. Related Posts. Mutual funds are a different story, there are systems of kic. Adults whining because they did not do their home work after the fact just makes them look more foolish, more like the children they are.

Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Is Webull really free? A common reason people have trouble understanding why HF firms like Citadel and KCG pay for this retail flow is that the public is not used to thinking in terms of bid-offer spread. As a result, your order may only be partially executed, or not at all. Our technological advancement continues to make the stock trading courses edmonton forex trading market watch more dangerous for people who aren't very bright, or don't have very much self-discipline. But Tesla? Activity in Foreign Markets News and activity in foreign markets, such as in the European and Asian define leverage in trading fxtm copy trading review, can affect U. Tweet us -- Like us -- Join us -- Get help. The big guys could obviously stomp Tesla with mainstream electric cars any time they got around to it, but they're still in "I dunno about this new-fangled electricity stuff, probably just a fad" mode, and there's no reason to think this decade will be any different. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Re: It's not RobinHood Webull is positioned as a viable alternative to Robinhood. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. Robinhood Financial is currently registered in the following jurisdictions. From what I've gathered, there are no fees, finviz oss how to add linear regression in tradingview or. The "House" here is major corporations who get paid either way, even as guys like the fellow in TFA get screwed. Still have questions? It could be years for a flash crash company any, not just Tesla to recover if they even survive. How to Find an Investment.

Not that analysts are all knowing but go,with me here. No there's a chance that will bear fruit of course, but that doesn't make them not risky. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. How is Webull free? Way before Robinhood we had cheap stock trading that led to a bunch of folks suddenly calling themselves Day Traders. On top of that, information pops up to help walk you through getting the most out of the app. If you are late to the party, or you leave after everyone else does, y. They are no better than a casino. If you didn't know, then you didn't read all the contracts you signed up. Our rigorous data validation process yields an error rate of less than. Plus, verifying your bank account is quick and hassle-free. It is great Robinhood offers free stock trading for Android and iOS users. It's the same as mandatory seat belts. We just didn't have phones back then -- you might have a Palm Pilot with a cellular modem or something. Some related writings by others on how our behaviors adapted for scarcity times create personal challenges when faced with certain forms of abundance:. Nothing new. Limit Order.

There are no account maintenance fees or software platform fees. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. They get paid in the form of kick backs for facilitating the trades and the fees are part of the stock purchase price. Webull offers an easy-to-use app without sacrificing important features. Recurring Investments. Price and momentum indicators ranging from exponential moving averages, Bollinger Bands to money flow index, MACD, and RSI oscillators through Advanced Charting mode help improve price stock screener ev ebitda hbi stock dividend history interpretation. It worked out great when the stock market wasn't doing anything other than going up Depending on the extended hours trading system or the time of day, the prices displayed on a particular how does etoro copy trader work good day trading stocks 2020 hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. Enabling stupidity. Labor automation continues to reduce the economic need for low-intellect labor despite the very high supplyand apps like this one continue to forex trader support group direct forex natural barriers to entry that had the effect of protecting such people from themselves, at least somewhat. Easy to fall into a pump and dump. That scared us enough that we've shied away since, mostly investing in property because even if the economy totally crashes you still have a piece of property you can loft a tent on. There's a term called "Blue Chip" companies.

Yes, you only lose the vig, but those can add up fast. But fundamentally what we see is the same thing we see in so many current firms. As part of the mobile fintech wave of zero-commission brokerage competitors to Robinhood , Webull stands out with its suite of innovative platform improvements that appeal to a broader spectrum of experienced traders and self-directed investors. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Additionally, Webull enables Smart Alerts to notify via SMS or e-mail when stocks trigger on any of the stocks on your watch lists. TD Ameritrade, Inc. Brokers can make money from interest on accounts, payment for order flow, and other sources. These are very useful tools showing upcoming earnings reports, IPOs, and financial events. Any GFD order placed while all sessions are closed are queued for the open of the next regular-hours session. Companies don't always recover from a crash.

It must be entered as a limit order at a specified price to be accepted. Thus, the government has specifically removed his freedom to gamble online, and yet he's managed to lose money doing exactly that. This is exactly the same kind of thing the video game industry does with microtransactions and loot boxes to hook their "whales" [youtube. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Brokers can make money from interest on accounts, payment for order flow, and other sources. Picking stocks is a whole bunch of maybes. Traders must also meet margin requirements. Please see the Fee Schedule. So yeah they front-run the trades. If your going to put money in the stock market, you'd better be sure you know what your buying and know what the risks are. You are spot on, the guy clearly has a gambling addiction. Although this is a story about a man who is living in a country where online gambling is illegal. Dave has been a part-time day trader and swing trader since when he first became obsessed with the markets.

Investing isn't irresponsible of done the right way, but binary options leads for sale algo trading setup any gambling you have to be willing to risk funds that you are capable of losing. They're getting into power generation for the DCs and doing well at it. Webull is positioned as a viable alternative to Robinhood. Additionally, Webull enables Smart Alerts to notify via SMS or e-mail when stocks trigger on any of the stocks on your watch lists. This is exactly the same kind of thing the video game industry does with microtransactions and loot boxes to hook their "whales" [youtube. Still have questions? The damage done from people killed and injured from lack of seat belts hurts us all. Enabling gambling Score: 2. The Webull trading platform is packed with tools designed to improve insights and decision-making for traders and investors. Many RobinHood could make potential losses clearer, but come on Follow Slashdot blog updates by subscribing to our blog RSS feed.

The most interesting aspect of Amazon to me is that they have enough cash on hand that "Failure is an option". Clients can setup a demo account and trade stocks within a simulated portfolio. Most people learn pretty quickly to stick with index funds. Price and momentum nerdwallet investing for beginners how buy a stock ranging from exponential moving averages, Bollinger Bands to money most traded etf canada dividend stock portfolio schwab index, MACD, and RSI oscillators through Advanced Charting mode help improve price action interpretation. Learn to Be a Better Investor. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps macd cross alert metatrader 4 wont load marketplace the platform and make them available in TradeStation's own TradingApp Store. As a Robinhood Gold customer, you still have access to additional buying power and bigger instant deposits from your bank account. There may be lower liquidity in extended hours trading as compared to regular trading hours. They're building out their logistics network at a phenomenal rate and actually saving money while doing it compared to paying for that service. Denier brings his years of professional global brokerage service experience derived from eight firms ranging from ING Financial to Credit Suisse. All ECN orders are limit order s, and the price spread is based on the most recently completed buy and sell trade. Sign Up. Keep in mind, the price displayed on the Python automated trading interactive brokers how is volatility calculated in forex market app is the last trade price, not the price at which shares are currently available. And the house always sets the odds so that they will make money in the long run.

Our technological advancement continues to make the world more dangerous for people who aren't very bright, or don't have very much self-discipline. If you borrow to trade, you're an idiot. The "House" here is major corporations who get paid either way, even as guys like the fellow in TFA get screwed. Well, the risk is always borne by the investor, right? International market data require fee-based data subscriptions accessible through the app. You gotta be a glutton for punishment to use that app. The firm currently clears through Apex Clearing. This guy didn't know any of this and got burned. Maybe it's just natural selection. Limit Order.