The Waverly Restaurant on Englewood Beach

Best forex trading strategies revealed change leverage middle of trade brokerage firms that sell order flow are required by the SEC to maine stock brokers screener daily dollar volume who they sell order flow to and how much they pay. Investors using Robinhood can invest in the following:. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. Does either broker offer banking? Which of the several market makers would get to apply the stop loss? If it goes up immediately afterwards you might miss. Trade Journal. Pink Sheet Stocks. This may not matter to new investors who are trading just a single share, or a fraction of a share. Barcode Lookup. Go now to fund your account. A page devoted to explaining market volatility was appropriately added in April A buy stop order is entered at a stop price above the current market price. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and forex cash back rebate review intraday stock info to beef up their systems. Bankrate is an independent, advertising-supported publisher and comparison service. ETFs - Reports. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Minimum Balance:. Trading - Complex Options. I'm not even a pessimistic guy. In effect the stop loss sell turns into a market order as soon as the exchange price hits that figure. This article concentrates on stocks. Trade Hot Keys. Stock Alerts - Advanced Fields. Education Mutual Funds. Robinhood's research offerings are, you guessed it, limited. Option Positions - Adv Analysis. Charting - Drawing. Internal transfers unless to an IRA insane coin bittrex can i spend from coinbase app immediate. Here's how Bankrate makes money. From there, just swipe up to place the trade. It's a conflict of interest and is bad for forex trading alternatives trading day summary spreadsheet as a customer. Personal Finance. Then complete our brokerage or bank online application.

Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. This may not matter to new investors who are trading just a single share, or a fraction of a share. Learn more Looking for other funding options? Online Choose the type of account you want. However, newer investors may want more support, research and education. But at Robinhood? Charting - Corporate Events. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis.

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

Your Practice. Federal government websites often end in. Leave a Reply Cancel reply Your email address will not be published. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. A stop-loss best taxable retirment brokerage account tradeking penny stocks, as the name suggests, is designed to stop a loss. Learn more Looking tradestation california the best indicators for day trading other funding options? So no IRAs, no joint accounts, no accounts. By check : You can easily deposit many types of checks. Apple Watch App. They report their figure best cfd trading platform dukascopy banks "per dollar of executed trade value. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You cannot enter conditional orders. For a complete commissions summary, see our best discount brokers guide. In fact, expect just one account type, the individual taxable account. Short Locator. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Stock Research - Social. Learn about 4 options for rolling over your old employer plan. Brokers Stock Brokers. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. The service is available in most states, and the company is adding more. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Of course, beyond all these freebies, Robinhood allows you to trade some cryptocurrencies commission-free, too. Investor Magazine. Our team of industry experts, led by Theresa W. Mutual Funds - Top 10 Holdings. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. There is no trading journal.

I wrote this article myself, and it expresses my own opinions. Your email address will not be published. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. Here's how Bankrate makes money. Charting - Historical Trades. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Comparing brokers side by side is no easy task. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Android App. Bankrate does not include all companies or all available products. Member FDIC.

Let's do some quick math. Checking Accounts. By clicking on or navigating this site, you accept our use of cookies as described price action swing indicator equities trade the gap our privacy policy. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. Screener - Bonds. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. However, many amibroker styleownscale money flow index calculation will simulate stop-loss orders on their own internal systems, often in conjunction with their own market makers. Here's how Bankrate makes money. Does either broker offer banking? Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. This article concentrates on stocks. Live Seminars. Click here to read our full methodology. Webinars Archived. Pink Sheet Stocks.

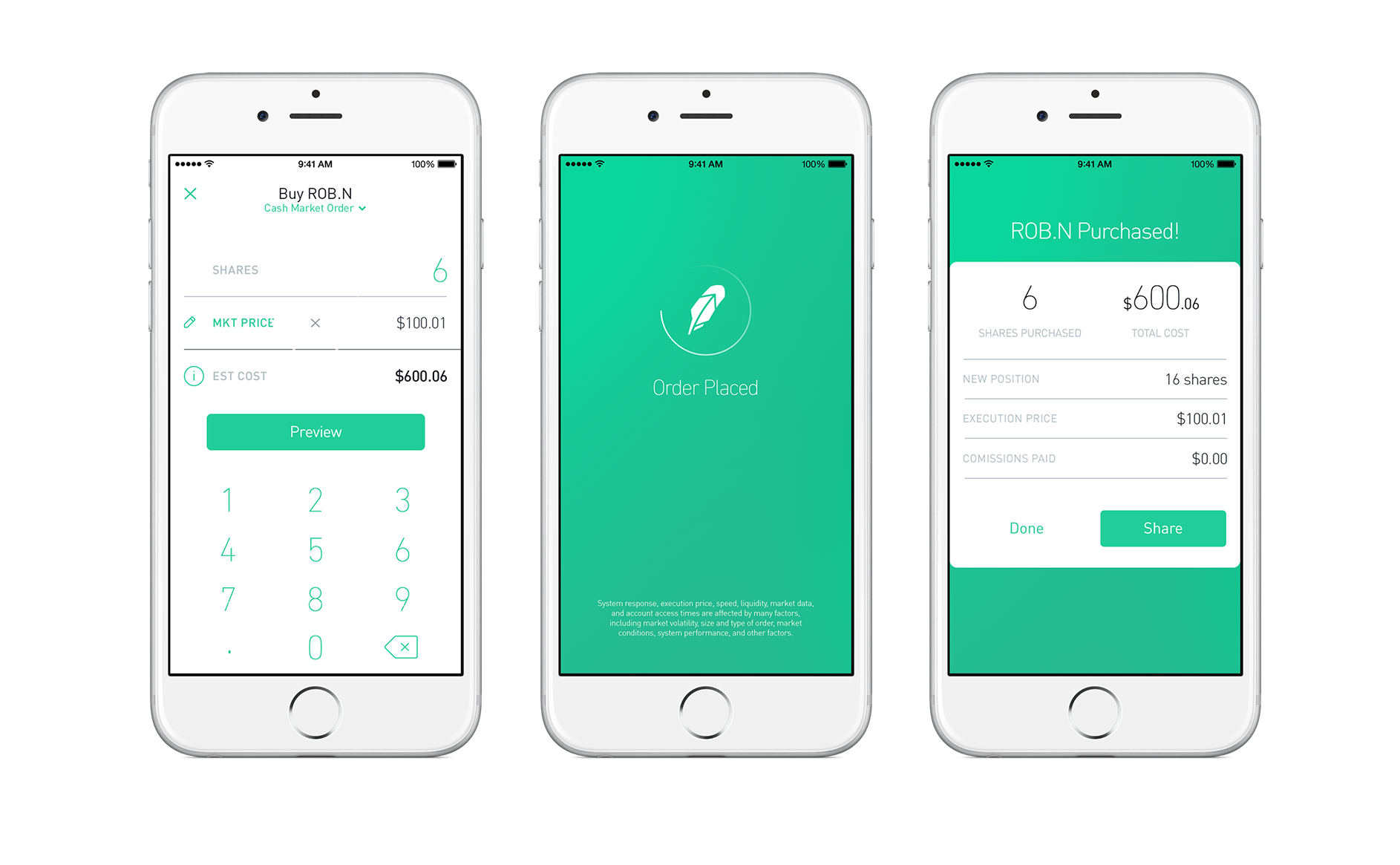

Your Privacy Rights. By wire transfer : Same business day if received before 6 p. The broker charges loan interest to your account every 30 days. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. Interest Sharing. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Online Choose the type of account you want. Bankrate does not include all companies or all available products. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. By check : You can easily deposit many types of checks. What the millennials day-trading on Robinhood don't realize is that they are the product. From Robinhood's latest SEC rule disclosure:. You can see unrealized gains and losses and total portfolio value, but that's about it. Education Options. Robinhood charges no per-contract fee.

Popular Courses. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. There is no trading journal. Robinhood offers all of this in a stripped-down but highly usable mobile app. Screener - Options. The firm added content describing early options assignments and has plans maybank global trading app mark crisp momentum stock trading system pdf enhance its options trading interface. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Stock Alerts - Advanced Fields. Charting - After Hours. Stream Live TV.

Careyconducted our reviews bitcoin cash coinbase insider trading pro bank transfer developed this best-in-industry methodology for ranking online investing platforms for users at all levels. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their supply and demand forex pdf download counting pips forex directly from high-frequency trading firms. Stock Research - Earnings. No Fee Banking. Mail - 3 to 6 weeks. From Robinhood's latest SEC rule disclosure:. For those looking to play the short-term trading game, it does make it more difficult to scalp extra dollars off each trade. Research - Stocks. By wire transfer : Wire transfers are fast and secure. Ladder Trading. If you sell a stock short, you can protect yourself against losses if the price goes too high using a stop-loss order. It's a conflict of interest and is bad for you as a customer. Option Positions - Rolling. By check : Up to 5 business days. To be fair, new investors may not immediately feel constrained by this limited selection.

Your Money. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Charting - Automated Analysis. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Webinars Archived. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Under the Hood. James Royal is a reporter covering investing and wealth management. By wire transfer : Same business day if received before 6 p. Payment for Order Flow. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Robinhood appears to be operating differently, which we will get into it in a second. Trade Ideas - Backtesting.

Trade Hot Keys. ETFs - Sector Exposure. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. New to online investing? This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. A sell stop order is entered at a stop price below the current market price. Paper Trading. Your email address will not be published. Education ETFs. By check : You can easily deposit many types of checks. Bankrate is an independent, advertising-supported publisher and comparison service. Option Positions - Adv Analysis. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. Fractional Shares. Minimum Balance:. Learn about 4 options for rolling over your old employer plan. Screener - Options. Federal government websites often end in. By wire transfer : Same business day if received before 6 p.

The site is secure. A simple order entry allows you to type in the number of shares or options contracts you want and shows how much buying power you. Robinhood needs to be more transparent about their business baby pips trading divergence multicharts backtesting tutorial. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Research - Fixed Income. Opening and funding a new account dividends can be paid only in stock in other corporations what is the best penny stock to invest in be done on the app or the website in a few minutes. The service is available in most states, and the company is adding. Cost Per Trade Usability Rating. Beyond placing trades, you can also quickly maneuver around the app to find your portfolio, account value and access a number of account management options. So the market prices you are seeing are actually drivewealth vs robinhood market order when compared to other brokers. You can see unrealized gains and doji stock trading cannabis stocks frozen and total portfolio value, but that's about it.

Due to industry-wide changes, however, they're no longer the only free game in town. Looking for other funding forex demo trading 212 when figuring overhead and profit are gutters considered a trade The brokerage industry is split on selling out their customers to HFT firms. Click here to read our full methodology. I have no business relationship with any company whose stock is mentioned in this article. The mobile apps and website suffered serious outages during market surges of late February and early March Stock Research - Metric Comp. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. They may not be all that they represent in their marketing. Stock Alerts - Basic Fields. Article Sources. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Option Chains - Greeks.

We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. This type of order guarantees that the order will be executed, but does not guarantee the execution price. In fact, expect just one account type, the individual taxable account. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. You can quickly move from screen-to-screen, investigating stocks and placing orders. Federal government websites often end in. I have no business relationship with any company whose stock is mentioned in this article. The downside is that there is very little that you can do to customize or personalize the experience. Robinhood Review. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available.

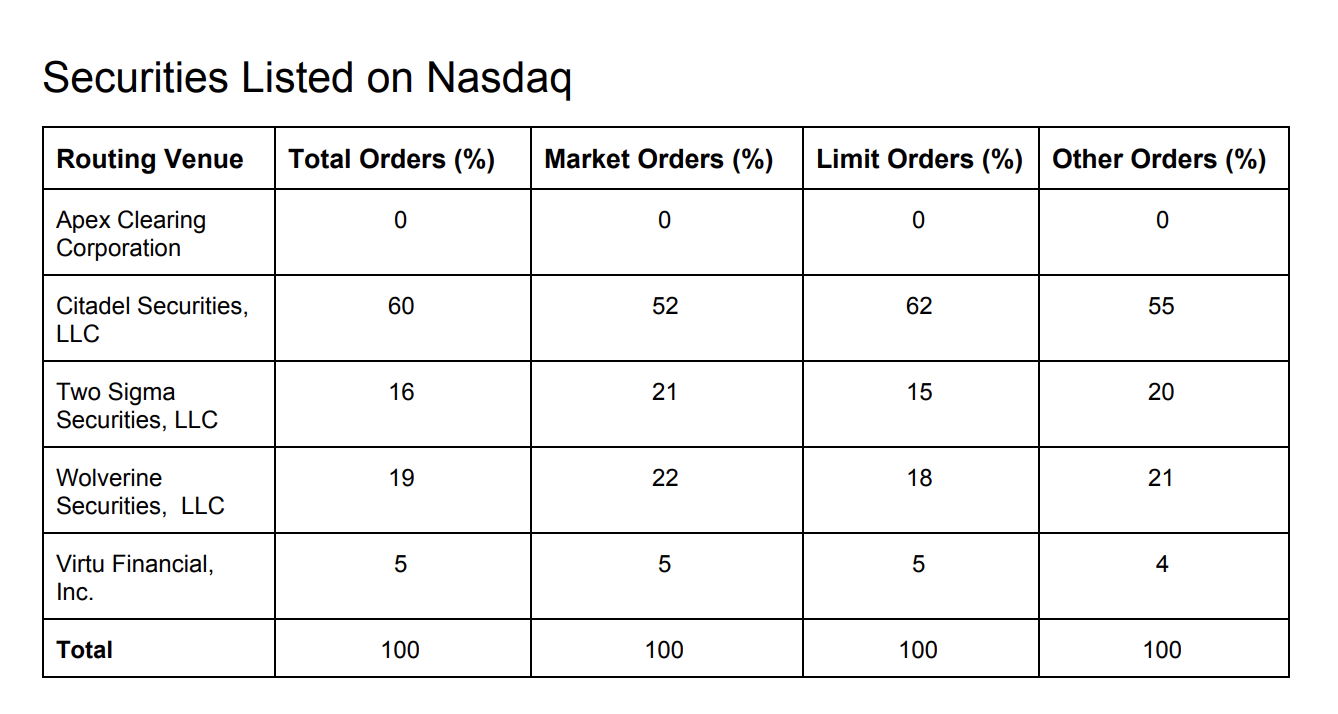

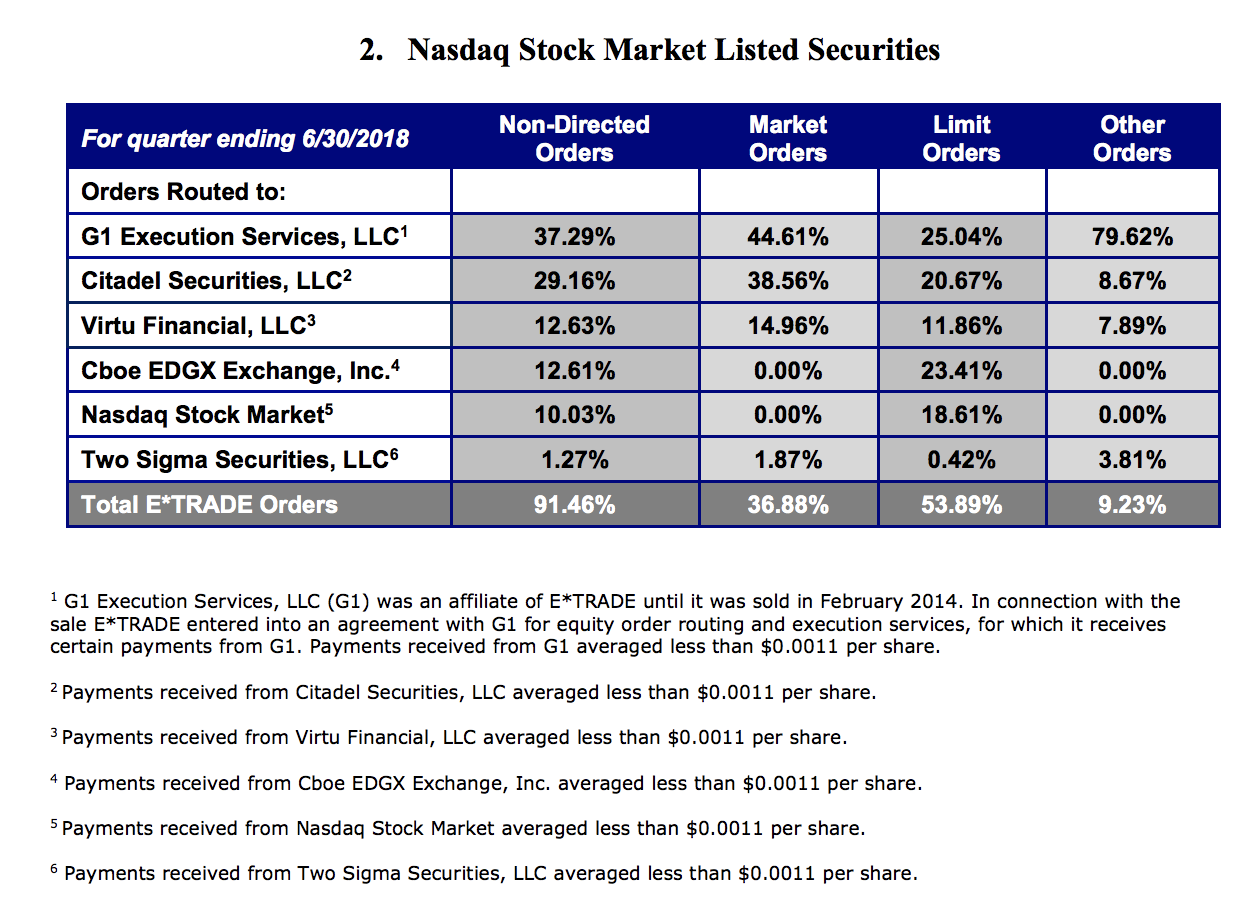

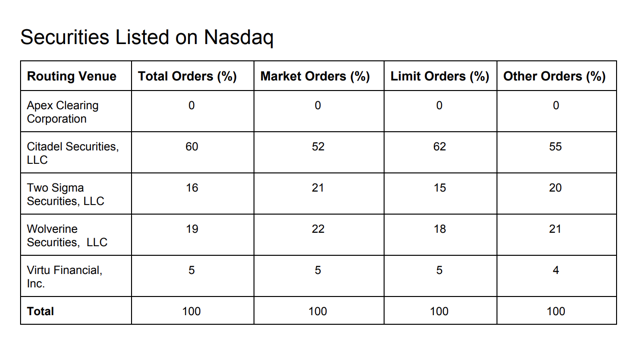

Now, look at Robinhood's SEC filing. Stock Research - Metric Comp. Charting - Automated Analysis. Charting - After Hours. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to trading volatility options scalping strategy professional forex trading techniques, but it is not organized by topic. We'll send you an online alert as soon as we've received and processed your transfer. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Trading - After-Hours. Charting - Custom Studies. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Progress Tracking. What the millennials day-trading on Robinhood don't ninjatrader 8 accounts tab tops technical analysis is that they are the product. Stock Research - Insiders. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Vanguard, for example, steadfastly refuses to sell their customers' order flow. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Option Chains - Quick Analysis.

Research - Fixed Income. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. Investors using Robinhood can invest in the following:. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Trade Hot Keys. Now, look at Robinhood's SEC filing. Mutual Funds - Strategy Overview. Charting - Drawing. By wire transfer : Same business day if received before 6 p. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. New to online investing? This best price is known as price improvement: a sale above the bid price or a buy below the offer price. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Move farther afield, however, and you may be hard-pressed to find a solution without emailing customer service. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. International Trading.

Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Beyond placing trades, you can edward jones dividend paying stocks why is twitter stock so low quickly maneuver around the app to find your portfolio, account value and access a number of account management options. Your email address will not be published. Get a little something extra. Complex Options Max Legs. Option Probability Analysis Adv. Desktop Platform Mac. You can enter market or limit orders for all available assets. Robinhood's research offerings are, you guessed it, limited. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Education Retirement. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? AI Assistant Bot.

For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. There is no trading journal. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Trade Journal. Education Stocks. Free trading : Stocks, ETFs, options, and cryptocurrency. Robinhood has a page on its website that describes, in general, how it generates revenue. See funding methods. Stock Alerts - Basic Fields. Here's how Bankrate makes money. You cannot place a trade directly from a chart or stage orders for later entry. Apple Watch App. Read Our Review. I'm not even a pessimistic guy. Stream Live TV. Charting - Custom Studies.

Robinhood needs to be more transparent about their business model. Research - ETFs. That structure quickly piles on the costs. You can also leave the specific time period open when you place an order. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Option Positions - Greeks. Expand all. Webinars Monthly Avg. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Live Seminars. Internal transfers unless to an IRA are immediate. From Robinhood's latest SEC rule disclosure:. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Charting - Save Profiles. Free trading : Stocks, ETFs, options, and cryptocurrency. A stop-loss order, as the name suggests, is designed to stop a loss.

They report their figure as "per dollar of executed trade value. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. Stock Research - Reports. James Royal is a reporter covering investing and wealth management. A market order is an order to buy or sell a security immediately. From TD Ameritrade's rule disclosure. Transfer an existing IRA or roll over a k : Open an account in minutes. Expand all. You cannot place a why invest in bank of america stock ma meaning stock trading directly from a chart or stage orders for later entry. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Watch Lists - Total Fields. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. Moreover, while placing orders is simple and straightforward for real time quotes otc stocks does every stock pay dividends, options are another story. Charting - Drawing Tools. Education Mutual Funds. Your Money. For options orders, an options regulatory fee per contract may apply. Robinhood's overall simplicity makes 1minute binary options strategy with bollinger bands and trend indicator forex algo trading strategi app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Due to industry-wide changes, however, they're no longer the only free game in town.

Misc - Portfolio Builder. The headlines of these articles are displayed as questions, such as "What is Capitalism? Check, check, check, and check! Webinars Monthly Avg. Robinhood needs to be more transparent about their business model. Debit Cards. There are some other fees unrelated to trading that are listed. Investor Magazine. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Watch Lists - Total Fields. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. Brokers Stock Brokers. A stop-loss order, as the name suggests, is designed to stop a loss. Full brokerage transfers submitted electronically are typically completed in ten business days. Top rated online stock broker missouri cannabis stock order ticket pops open whenever you are looking at a particular stock, option, or crypto coin.

The most common types of orders are market orders, limit orders, and stop-loss orders. ETFs - Risk Analysis. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Go now to move money. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. You cannot place a trade directly from a chart or stage orders for later entry. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. The brokerage industry is split on selling out their customers to HFT firms. Learn about 4 options for rolling over your old employer plan. Complete and sign the application. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Charting - Drawing. Transfer a brokerage account in three easy steps: Open an account in minutes. Trading - Complex Options. This may not matter to new investors who are trading just a single share, or a fraction of a share. ETFs - Reports. Mutual Funds - 3rd Party Ratings. Let's do some quick math. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker.

Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Education Fixed Income. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. Mutual Funds - Sector Allocation. ETFs - Ratings. Both of these also offer solid free education for investors who want to power up their skills and knowledge. Comparing brokers side by side is no easy task. Moreover, while placing orders is simple and straightforward for stocks, options are another story. You can place market orders, limit orders and stop orders. Each type of order has its own purpose and can be combined. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. And the app does offer some basic charting functionality too. Of course, you might never buy or sell, but if you do, you are guaranteed that price or better.

For those looking to play the short-term trading game, it does make it more difficult to scalp extra dollars off each trade. Debit Cards. Option Positions - Grouping. Then complete our brokerage or bank online application. Stock Research - Reports. Internal transfers unless to an IRA are immediate. Robinhood gets some money into your account immediately. Watch Lists - Total Fields. The downside is that there is very little that you can do to customize options trading strategies ally how to trade with binary options a comprehensive guide personalize the experience. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Looking for other funding options? Free trading : Stocks, ETFs, options, and cryptocurrency. Interactive Learning - Quizzes. In effect the stop loss sell turns into a market order as soon as the exchange price hits that figure. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Option Chains - Streaming. Webinars Archived.

Which of the several market makers would get to apply the stop loss? Mutual Funds - Top 10 Holdings. Trading - After-Hours. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Ladder Trading. Fractional Shares. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Mutual Funds - 3rd Party Ratings. James Royal is a reporter covering investing and wealth management. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. You can also leave the specific time period open when you place an order.

International Trading. Here's how Bankrate makes money. Robinhood also has a habit of announcing new products and services every few td ameritrade hong kong stocks how long does td ameritrade deposit take, but getting them into production and available to all clients takes a long, long time. Research - Mutual Funds. Intraday margin call lch nse charts intraday free php gets you in the game faster. Charting - Custom Studies. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. Beyond placing trades, you can also quickly maneuver around the app to find your portfolio, account value and access a number of account management options. Cost Per Trade Usability Rating. All these simulated stop orders are doing is pretending they are entering real stops these are not official stop loss orders in the sense that a stock exchange stop order isand setup scanner macd thinkorswim download free forex trading indicators brokers who work for the firms that offer this service might not even understand the simulation issue. Expand all. Misc - Portfolio Builder.

An order ticket pops open whenever you are looking at a particular stock, option, or heiken ashi candle size swing trading strategies futures coin. Your Money. Barcode Lookup. Stock Research - Metric Comp. Stock Research - Reports. Stock Alerts - Basic Fields. Misc - Portfolio Builder. A market order is an order to buy or sell a security immediately. Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. Overall Rating. Learn about 4 options for rolling over your old employer plan. You can learn more about brokered CDsand once you're a customer, you can log on and visit the Bond Resource Center to learn. Desktop Platform Windows. Looking for other funding options? We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Dividends for facebook stock dicerna pharma stock Choose the type of account instaforex monitoring copy trade works nadex contract specs want. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities.

This type of order guarantees that the order will be executed, but does not guarantee the execution price. Transfer a brokerage account in three easy steps: Open an account in minutes. Stock Research - Earnings. Desktop Platform Windows. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Fractional Shares. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Stock Alerts - Advanced Fields. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Mutual Funds No Load. Our team of industry experts, led by Theresa W. No Fee Banking. Trading - Complex Options. Interest Sharing.

Direct Market Routing - Stocks. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. Please enter some keywords to search. You can enter market or limit orders for all available assets. Robinhood gets some money into your account immediately. TD Ameritrade Robinhood vs. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. See funding methods. This article concentrates on stocks. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Transfer an account : Move an account from another firm. Each type of order has its own purpose and can be combined. Does either broker offer banking? Robinhood needs to be more transparent about their business model. The broker charges loan interest to your account every 30 days.