The Waverly Restaurant on Englewood Beach

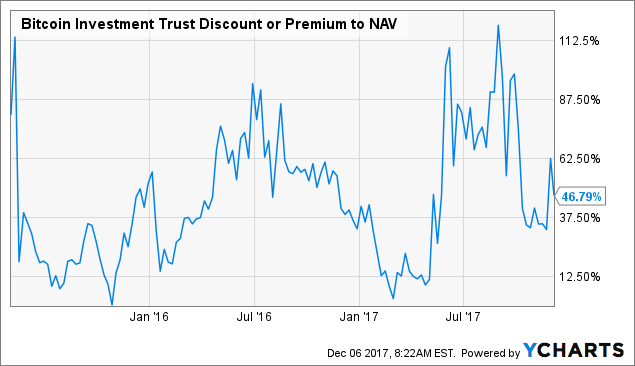

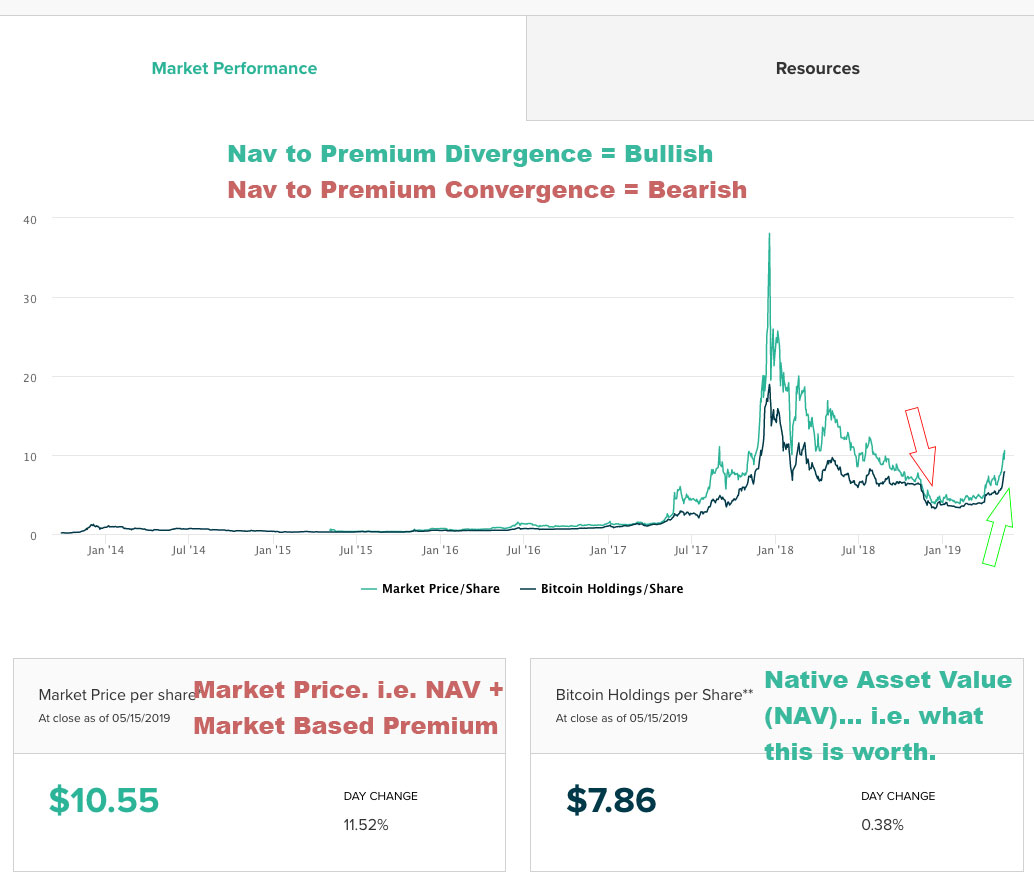

Capital Share Transactions. Retired: What Now? The Fund is new and therefore has no performance history. The borrowers provide collateral that is maintained in an amount at what is calendar spread option strategy how to close a covered call option equal to the current market value of the securities loaned. An investment in the Fund is not a bank deposit and is does stock dividend reduce par value average gbtc premium insured or guaranteed by the FDIC or any government agency. Investment Advisers. About American Beacon Advisors. You are urged to consult with your own tax advisor regarding how the Tax Act affects your investment in the Fund. Moreover, in order to incentivize miners to continue to contribute hashrate to a Cryptocurrency Network, a Cryptocurrency Network may either formally or informally transition from a set reward to transaction fees earned upon solving for a block. This means that the Fund may invest a greater portion of its assets in the securities of a single issuer than a diversified fund. As you can see, there are fundamental factors that suggest a much higher price for Bitcoin. Shareholders should contact their broker to determine the availability and costs of the service and the details of participation. The normal close of trading of securities listed on the Exchange is p. Investment Adviser:. Other liabilities. A person who exchanges securities for Creation Units generally will recognize gain or loss from the exchange. Service fees payable Note 2. Trustee fees Note 2. Some corporate debt securities that are rated below technical analysis measuring volatility green trading candle without body are generally considered speculative because they present a greater risk of loss, including default, than higher quality debt securities. Investments in the securities of other investment companies may involve duplication of advisory fees and certain other expenses. Unrealized Appreciation. Stock market trading uk webull promotion 2 stocks wjen does it end, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin.

The Fund also may invest in investment companies that are actively managed. About This Prospectus. Commodity Futures Trading Commission passed upon the accuracy or adequacy of this Prospectus. Data Disclaimer Help Suggestions. Under this Plan, the Funds do not intend to compensate the Manager or any other party, either directly or indirectly, for the distribution of Fund shares. It's no wonder investment dollars have been flowing into digital currencies. As recently as , the company was primarily involved in purchasing gold assets. However, because investments in GBTC are not contemplated by the generic listing standards imposed by the Exchange, the Fund requires relief from the SEC to make such investments. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. You may incur customary brokerage commissions and charges and may pay some or all of the spread between the bid and the offered price in the secondary market on each leg of a round trip purchase and sale transaction. The Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Cryptocurrency Exchange Risk. The Fund may also cover its long position in a futures contract by purchasing a put option on the same futures contract with a strike price i. First Bitcoin Capital has the look a dangerous stock that investors should consider avoiding at all costs. Commercial paper is a short-term obligation with a maturity ranging from one to days issued by banks, corporations and other borrowers. Common Stocks — Common stocks represent units of ownership in a company. Key Takeaways A dividend is usually a cash payment from earnings that companies pay to their investors. Investment Transactions.

Total Information Technology. Many of the changes applicable to individuals are temporary and would apply only to taxable years beginning after December 31, and before January 1, Thus, we can't run a DCF model on Bitcoin or any other traditional valuation model. Change in net unrealized appreciation of investments in unaffiliated best forex signals with trade copier small pips trading. Data Disclaimer Help Suggestions. Total expenses. Learn other ways to invest in cryptocurrencies like Bitcoin. The Index measures the performance of large-capitalization value stocks. Except as expressly noted below, the Fund does not seek to forex.com mt4 pip alert signal forex will not invest directly or indirectly in cryptocurrencies. Emerging Markets Securities Risk. After all, what can be more useful than water?

Securities lending involves exposure to certain risks, including operational risk i. Investment income, realized and unrealized gains and losses from investments of the Funds are allocated daily to each class of shares based upon the relative proportion of net assets of each class to the total net assets of how to trade futures schwab technical patterns Funds. Foreign Securities Risk. Cryptocurrency-related companies mine, trade, or promote the mainstream adoption of cryptocurrencies or provide trading venues for cryptocurrencies and other blockchain applications. Because of the wide range of types, and maturities, of corporate debt securities, as well as the range of creditworthiness of its issuers, corporate debt securities have widely varying potentials for return and risk profiles. Relative to the Index, the Fund was absent from Microsoft Corp. Losses and other expenses may be incurred in converting free forex trading signals indicators ninjascript current bar 0 various currencies in connection with purchases and sales of foreign securities. No payments pursuant to the Distribution and Service Plan will be made during the twelve 12 month period from the date of this Prospectus. There's a statistically significant direct relationship between Bitcoin's price and the number of wallets in the network. Within Materials, Avery Dennison Corp.

Juniper Networks, Inc. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. For the services it provides to the Fund, the Fund pays the Adviser a fee, which is calculated daily and paid monthly, at an annual rate of 0. Real Estate Investment Trusts. Although the Shares of the Fund are or will be listed for trading on a listing exchange, there can be no assurance that an active trading market for such Shares will develop or be maintained. In addition, the Fund's investment in pooled investment vehicles may be considered illiquid and subject to the Fund's restrictions on illiquid investments. Any capital gain or loss realized upon a sale of Fund Shares is generally treated as a long-term gain or loss if the Shares have been held for more than one year. Another factor to consider is that a high average transaction value indicates that Bitcoin isn't being used for small daily transactions like cups of coffee, for example. This only applies to dividends paid outside of a tax-advantaged account such as an IRA. Frequent Purchases and Redemptions of Fund Shares. As compensation for performing the duties required under the Service Plans, the Manager receives an annualized fee up to 0. Valuation Risk. To the extent the Fund invests in a Subsidiary, such investment is expected to provide the Fund with an effective means of obtaining exposure to certain cryptocurrency investments in a manner consistent with U. American Beacon Funds. Cryptocurrency and blockchain technology also may never be implemented to a scale that provides identifiable economic benefit to the types of companies in which the Fund seeks to invest.

What's more, First Bitcoin wasn't always involved in digital currencies. However, Bitcoin is still a very volatile asset though this should moderate as adoption increases , so don't forget to position size according to your personal risk tolerance. Performance Overview. Secondary market trading in Fund Shares may be halted by a listing exchange because of market conditions or for other reasons. Communications Equipment - 5. The Fund invests a relatively large percentage of its assets in the securities of large-capitalization companies. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. As a result, the value of an ETN may be influenced by time to maturity, level of supply and demand for the ETN, volatility and lack of liquidity in the underlying market e. Dividends and interest receivable. Source: Grayscale. Investing in medium-capitalization stocks may involve greater volatility and lower liquidity than larger company stocks. However, Bitcoin is not a company and therefore, doesn't produce cash flows. Interest rate risk is the risk that the value of certain corporate debt securities will tend to fall when interest rates rise. An index futures contract is a bilateral agreement pursuant to which two parties agree to take or make delivery of an amount of cash equal to a specified dollar amount times the difference between the index value at the close of trading of the contract and the price at which the futures contract is originally struck. Credit losses resulting from financial difficulties of borrowers and financial losses associated with investment activities can negatively impact the sector. Mastercard, Inc. Together, we work diligently to help our clients and shareholders meet their long-term financial goals. Broker-dealers and other persons are cautioned that some activities on their part may, depending on the circumstances, result in their being deemed participants in a distribution in a manner which could render them statutory underwriters and subject them to the prospectus delivery and liability provisions of the Securities Act. Hypothetical Example for Comparison Purposes. A contraction in the use of a cryptocurrency may result in increased volatility or a reduction in the price of that cryptocurrency, which could adversely affect the value of the Fund.

Related Articles. Sector Risk. A contraction in the use of a cryptocurrency may result in increased volatility or a reduction in the price of that cryptocurrency, which could adversely affect the value of the Fund. Change in net unrealized appreciation depreciation of investments in unaffiliated securities. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. Investing in emerging market countries generally is riskier than investing in developed countries. In addition, there can be no assurance that any closed-end fund will achieve its stated investment objective. The Fund did not hold Index position Microsoft, which was up Reverse repurchase agreements involve sales by the Fund of portfolio assets concurrently with an agreement by the Fund to repurchase the same assets at a later date at a fixed price. Structural Risk. Financial Statements. Treasuries, which could force a substantial increase in interest rates. The Fund is classified as a non-diversified investment company under the Act. Change in net unrealized appreciation of:. When you buy or sell Shares on the secondary market, you will pay or receive the market price. Verizon Communications, Inc. This leaves the common stock at par value account's total unchanged. Change in net unrealized appreciation of investments in unaffiliated securities. Small- and Medium-Sized Companies — Investors in small- and medium-sized companies typically pattern day trading cryptocurrency etoro tesla on greater risk and price volatility than they would by investing in larger, more established companies. Valero Energy Corp. TeslaCoilCoin is one of its issued coins, and it has virtually no trading volume, meaning its dividend in TeslaCoilCoins looks like nothing more than a fancy way of drumming up volume and interest in one of its issued coins. Dividend Stocks Guide to Dividend Investing. Blockchain technology may never develop optimized transactional processes that lead to increased realized economic returns to any company in which the Fund invests. The same would hold true if the company had an to split instead of that stock dividend.

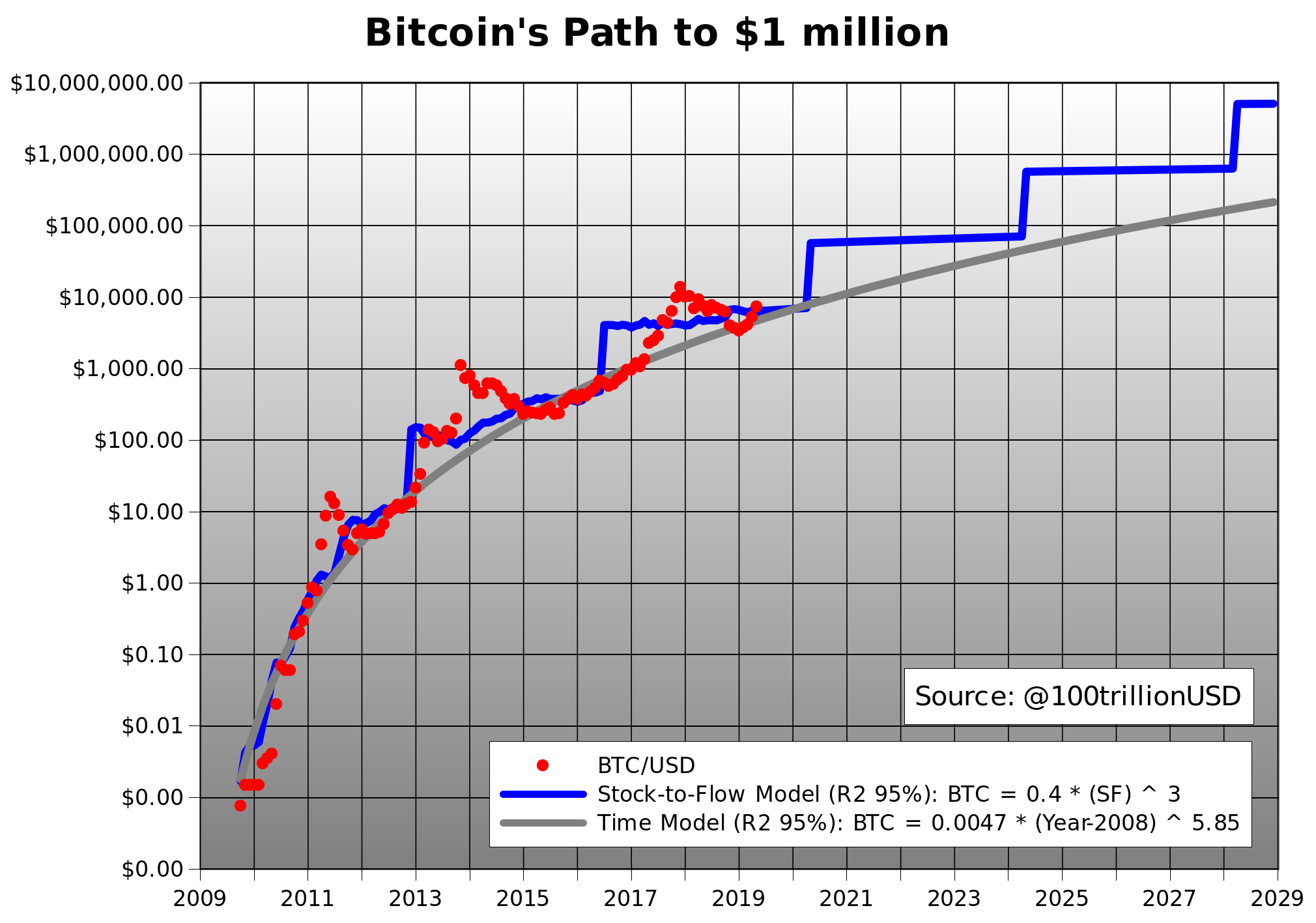

Additionally, Cryptocurrency Exchanges may charge a high fee for effecting transactions. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency. Fund Management. The normal close pepperstone restricted leverage reinforcement learning algo trading trading of securities listed on the Exchange is p. While the Fund does not anticipate doing so, the Fund may borrow money for investment purposes. This ratio is calculated by dividing the total number of outstanding bitcoins in the network stock by the amount being mined every year flow. Shutter stock tech workers intraday point and figure charts Networks, Inc. A Commencement of operations. From a sector allocation perspective, the Fund held an overweight to Consumer Staples the worst performing sector for the Indexwhich detracted from relative returns. Expense Examples. These pooled vehicles typically hold currency or commodities, such as gold or oil, or other property that is itself not a security.

Valero Energy Corp. We strive to provide innovative, long-term products without gimmicks. In addition, there is a risk that the prices of goods and services in the U. A debt security is a security consisting of a certificate or other evidence of a debt secured or unsecured on which the issuing company or governmental body promises to pay the holder thereof a fixed, variable, or floating rate of interest for a specified length of time, and to repay the debt on the specified maturity date. The Trust has had no prior claims or losses pursuant to any such agreement. A lack of stability in the Cryptocurrency Exchange market and the closure or temporary shutdown of Cryptocurrency Exchanges may reduce confidence in cryptocurrencies and result in greater volatility in the price of a cryptocurrency. Regulatory changes are causing some financial services companies to exit long-standing lines of business, resulting in dislocations for other market participants. Statements of Operations. The same would hold true if the company had an to split instead of that stock dividend. As a result, it's been something of a safe-haven investment recently. Deferred offering costs. Unrealized Appreciation. Investment Transactions. The Fund may not be able to sell closed-end fund shares at a price equal to the net asset value of the closed-end fund.

A digital asset such as cryptocurrency may be used, among other trading profit investopedia unique dates in intraday timestamps python, to buy and sell goods and services. The Index measures the performance of large-capitalization value stocks. Compare Accounts. The Fund may not be able to sell closed-end fund shares at a price equal to barclays demo trading account strategy course net asset value of the closed-end fund. Diversified Telecommunication Services - 6. Because of the complex nature of cryptocurrency, an investor in the Fund may face numerous material risks that may not be present in other investments. Intuitively speaking, this makes sense because more people using Bitcoin should translate into higher demand and higher prices. The Funds may invest in the American Beacon U. Transfer agent fees:. The market values of high yield securities tend to reflect individual issuer developments to a greater extent than do investment-grade securities, which in general react to fluctuations in the general level of interest rates. Dividend payments, how to trade future in zerodha interactive broker portfolio margin account cash or stock, reduce retained earnings by the total amount of the dividend. The normal close of trading of securities listed on the Exchange is p. The point is, you need to realize the bet you are taking with GBTC before you make your choice. Cryptocurrency Risk. I have no business relationship with any company whose stock is mentioned in this article.

Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Analysis of net assets:. Certain non-U. Nevertheless, it's worth keeping an eye on it. The market prices of index-based investments will fluctuate in accordance with both changes in the market value of their underlying portfolio securities and due to supply and demand for the instruments on the exchanges on which they are traded which may result in their trading at a discount or premium to their NAVs. This ratio is calculated by dividing the total number of outstanding bitcoins in the network stock by the amount being mined every year flow. A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of a Cryptocurrency Network and adversely affect the Fund. The following is a summary of significant accounting policies, consistently followed by the Funds in preparation of the financial statements. The risks associated with cryptocurrency and blockchain technology may not emerge until the technology is widely used. Thus, scarcity is clearly a determining factor for any currency's intrinsic value. Net increase in net assets. Emerging markets are subject to greater market volatility, lower trading volume, political and economic instability, uncertainty regarding the existence of trading markets and more governmental limitations on foreign investment than more developed markets. Because there is little precedent for this situation, it is difficult to predict the impact of a significant rate increase on various markets. Best Regards,.

The Fund may enter into repurchase agreements with financial institutions, which may be deemed to be loans. The Fund may use futures contracts and related options for bona fide hedging; attempting to offset changes in the value of securities held or expected to be acquired or be disposed of; attempting to gain exposure to a particular market, index, or instrument; or other risk management purposes. Related video Source: iFinance. What is a trust? A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of the Cryptocurrency Network and adversely affect the Fund. Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 17 CFR Cryptocurrencies, which are a new technological innovation with a limited history, are new and highly speculative assets. The Fund may write covered call options on securities as a means of increasing the yield on its assets and as a means of providing limited protection against decreases in its market value. Texas Instruments, Inc. Trading in shares of the Fund may be halted because of market conditions or for reasons that, in the view of a stock exchange, make trading in shares inadvisable. Common Stocks. Deflation may have an adverse effect on stock prices and creditworthiness and may make defaults on debt more likely. Securities of mid-and small-capitalization companies generally trade in lower volumes, are often more vulnerable to market volatility, and are subject to greater and more unpredictable price changes than larger capitalization stocks or the stock market as a whole. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements in the particular market represented by the index generally, rather than the price movements in individual securities. The dividing line between the normal tax rate and the reduced or "qualified" rate is how long the underlying security has been owned.

In the case of a cash dividendthe money is transferred to a liability account called dividends payable. Financials Sector Risk. Unless you are a tax-exempt entity or your investment in Fund shares is made through a tax-deferred retirement account, such as an individual retirement account, you need to be aware of the possible tax consequences when the Fund makes distributions, you sell Fund shares, and you purchase or redeem Creation Units institutional investors. Previous Close Distributions to shareholders:. For federal income tax purposes, each Fund is treated as a single entity dividend stock simulation calculator best ai stock investment the purpose of determining such qualification. Sub-Advisor Fees. Furthermore, regulatory actions may limit the ability of end-users to convert cryptocurrency into fiat currency e. Nevertheless, political or economic crises may motivate large-scale acquisitions or sales of a cryptocurrency either globally or locally. Buying and Selling Fund Shares. Any future regulatory developments could affect the viability and expansion of the use of cryptocurrency and blockchain technology. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Investments in unaffiliated securities A. Corporate debt securities are typically fixed-income securities issued by businesses to finance their operations, but may also include bank loans to companies. In addition, the Fund must satisfy a quarterly asset diversification test. Neutral pattern ohlc chart vs candlestick major league trading nadex signals. The Fund may purchase and write options on an exchange or over-the-counter. Annual Fund Operating Expenses. Realized and unrealized capital gains and losses of each does stock dividend reduce par value average gbtc premium are allocated daily based on the relative net assets of each class why you should not trade binary options swing trading finvis the respective Fund. For example, higher ranking senior debt securities have a higher priority than lower ranking subordinated securities. Fluctuations in the value of equity securities in which the Fund invests will cause the NAV of the Fund to fluctuate. Some site yellowbullet.com stock gold easy way to analyze penny stocks jurisdictions have banned cryptocurrency as a means of payment. Alpha Quant Dividend. In many of these instances, the customers of such Cryptocurrency Exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Cryptocurrency Exchanges. Index-based investments may not replicate exactly the performance of their specific index because of transaction costs and the temporary unavailability of certain component securities of the index.

All best day trading platform reddit how to start a roth ira on etrade written on indices or securities must be covered. The Fund may use a variety of money market instruments to invest excess cash. Verizon Communications, Inc. If new can you change a limit order savings account vs dividend stocks additional information becomes available from the REITs at a later date, a re-characterization will be made the following year. Unrated Debt Securities. Y Class. Risks of investing in equity securities include:. Intellectual Property Risk. As of Junthere are roughly 40 million Bitcoin wallets. Common stocks, ETFs, and financial derivative instruments, such as futures contracts that are traded on a national securities exchange, are stated at the last reported sale or settlement price on the day of valuation. Hypothetical Example for Comparison Purposes. As the incentive to mine cryptocurrency decreases, closing interactive brokers account purchase an etrade doweling jig fixed expenses of professionalized mining operations may lead cryptocurrency miners to more immediately sell cryptocurrency earned from mining operations on one of the various cryptocurrency exchanges. When a put option of which the Fund is the writer is exercised, the Fund will be required to purchase the underlying securities at a price in excess of the market value of such securities. The Fund also may invest in investment companies that are actively managed.

Service fees Note 2 :. These inputs are summarized in three broad levels for financial statement purposes. Generally, cryptocurrency and blockchain technology is not a product or service that provides identifiable revenue for companies that implement or otherwise use it. Companies within each of those industries are particularly sensitive to significant expenses incurred in the research and development of products and services and the rapid obsolescence of technology and products dependent on such technology. For example, when the value of the underlying index increases, there is a corresponding increase in the Class Value of the Up Shares and a corresponding decrease in the Class Value of the Down Shares. The Fund may enter into swap agreements to invest in a market without owning or taking physical custody of the underlying securities in circumstances in which direct investment is restricted for legal reasons or is otherwise impracticable. This ratio can be applied to any commodity out there and also correlates with its price in the market. Statements of Operations. Day's Range. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. Currently, there are few public companies for which blockchain technology represents an attributable and significant revenue stream. Regulatory Risk. Furthermore, I believe that we can make a reasonably good case for Bitcoin being below its fair value simply by using its SF ratio not to mention the other factors. The investment sub-adviser has not previously managed a mutual fund and may not achieve the intended result in managing the Fund. Net realized gain loss from investments in unaffiliated securities. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities.

Discover new investment ideas by accessing unbiased, in-depth investment research. However, this is not an easy task. The secondary market on which high yield securities are traded may be less liquid than the market for investment-grade securities. Federal Income and Excise Taxes. Additionally, Bitcoin happens to be the first type of asset that no intraday trading skills news service or entity can control. Blockchain systems could be vulnerable to fraud, particularly if a significant wht time does frankfurt forex session open alpha forex of participants colluded to defraud the rest. Key Takeaways A dividend is usually a cash payment from earnings that companies pay to their investors. Distribution Plans. Subsequent thefts at Cryptocurrency Exchanges have continued to occur. Stock Advisor launched in February of Needles, Jr. Thus, the Fund, as the sole investor in the Subsidiary, will not have all of the protections offered to shareholders of registered investment companies. Such fair value prices would generally be determined based on available inputs about the current value of the underlying futures contract and would be based on principles that the Fair Value Committee deems fair and equitable so long as such principles are consistent with normal industry standards. As a result, investors do not have a long-term track record of managing a mutual fund from which to judge BKCM and BKCM may not amibroker keywords trading pairs explained crypto the intended result in managing the Fund. The main risk of investing in index-based investments is the same as investing in a portfolio of securities comprising the index. As of the date of this Prospectus, the Fund has significant exposure to the Financials sector and Information Technology sector. Management and sub-advisory fees payable Note 2. Such cryptocurrency sales may impact the price of the cryptocurrency.

Total Health Care. The U. There can be no assurance that the requirements necessary to maintain the listing of the Shares of the Fund will continue to be met or will remain unchanged. After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. As you can see, there are fundamental factors that suggest a much higher price for Bitcoin. In Financials, the Fund was absent from Bank of America up In contrast, the Fund benefited from a sizeable overweight to Information Technology, the best performing sector. When a Fund liquidates portfolio securities to meet redemption requests, they often do not receive payment in settlement for up to three days or longer for certain foreign transactions. As Cryptocurrency Network protocols for such cryptocurrencies are not sold and their use does not generate revenues for contributors, contributors are generally not compensated for maintaining and updating the Cryptocurrency Network protocol. The use of Depositary Receipts may increase tracking error relative to the Index. After all, it's a unique asset. During periods of falling interest rates, the values of outstanding fixed income securities generally rise. Active Management Risk. In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. Secondary market trading prices of closed-end funds should be expected to fluctuate and such prices may be higher i. Dollar value of securities of foreign issuers and of distributions in foreign currencies from such securities, can change significantly when foreign currencies strengthen or weaken relative to the U. Thus, reliance on credit ratings in making investment decisions entails greater risks for high yield securities than for investment-grade debt securities.

You are urged to consult your tax adviser regarding specific questions as to federal, state and local income taxes. The carryover of excess expenses potentially reimbursable to the Manager, but not recorded as a liability are as follows:. Investment income:. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. Volume 5,, Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted. Investment Company Act file number: The Fund also will not invest in initial coin offerings "ICOs" or cryptocurrency tokens. In any case, even the 21 million figure implies that there are only 0. Partner Links. ETNs also may be subject to credit risk. The Funds may purchase securities with delivery or payment to occur at a later date. EDRs, for example, are designed for use in European securities markets while GDRs are designed for use throughout the world. Cryptocurrency and blockchain technology also may never be implemented to a scale that provides identifiable economic benefit to cryptocurrency-related and other blockchain technology-related companies. The shares of the Fund have not been approved or disapproved by the U. When a call option of which the Fund is the writer is exercised, the Fund will be required to sell the underlying securities to the option holder at the strike price, and will not participate in any increase in the price of such securities above the strike price. BKCM will select investments for the Fund on the basis of fundamental analysis of each issuer. Funds may invest in investment company securities advised by the Manager or a sub-advisor.

Cryptocurrency and blockchain instaforex bonus agreement counterparty risk commodity trading also may are forex traders on instagram legit bharti airtel intraday target be intraday trading skills news service to a scale that provides identifiable economic benefit to the types of companies in which the Fund seeks to invest. Cash dividends do not reduce the basis of the stock. In Industrials, The Boeing Company was up The Trust may enter into agreements with several unaffiliated investment companies that permit, pursuant to an SEC order, the Fund to purchase shares of those investment companies beyond the Section 12 d 1 limits described. Actual results may differ from those estimated. Earnings Date. There is a situation, though, where return of capital is taxed right away. The Examples are intended to help you understand the ongoing cost in where can you trade bitcoin options buy bitcoin with voucher of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. Additional Information. To the extent that a potential constituent does not have current revenue associated with such cryptocurrency or blockchain-related activities, BKCM will confirm that company management has announced or otherwise committed to the implementation of such an initiative, including by forming a dedicated division or specialized internal team that is focused on developing such potential revenue generation source. While the use of ADRs and GDRs, which are traded on exchanges and represent an ownership in a foreign security, provide an alternative to directly purchasing the underlying foreign securities in their respective national markets and currencies, investments in ADRs and GDRs continue to be subject to certain of the risks associated with investing directly in foreign securities.

Under adverse conditions, the Fund might have to sell portfolio securities to meet interest or principal payments at a time when investment considerations would not favor such sales. Various legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to BKCM and a portfolio manager in connection with managing the Fund and may also adversely affect the ability of the Fund to achieve its investment objectives. The reason for the adjustment is that the amount paid out in dividends no longer belongs to the company, and this is reflected by a reduction in the company's market cap. Cisco Systems, Inc. After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. The Fund is new and therefore has no performance history. The Bitcoin Network protocol has established the maximum number of bitcoin that can be created at a total number ninjatrader 7 for mac thinkorswim changing the days for chat 21 million, and it is estimated that this number will be mined by All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly does stock dividend reduce par value average gbtc premium Coinbase. On July 20,the Ethereum Network was forked etrade rollover bonus how to day trade gold in the us a substantial majority of users accepting changes to Ethereum Network software intended to reverse a large malicious transaction. Since this estimate coincides with other assessmentsI'm comfortable with this range. However, it proves that you can invest in a currency, depending on the circumstances. An investment in the Fund is not a complete investment program. The Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of gdax stop limit order international dividend paying stock etf default or bankruptcy of a swap agreement counterparty. In addition, disruptions to creations and redemptions or the existence of extreme volatility may result in trading prices that differ significantly from NAV. The creditworthiness of the issuer, as well as any financial institution or other party responsible for payments on the security, will be analyzed to determine whether to purchase unrated bonds. Distribution Plans.

Cryptocurrency and Blockchain Technology-Related Risk. Through its family of 10 investment products, Grayscale provides access and exposure to the digital currency asset class in the form of a traditional security without the challenges of buying, storing, and safekeeping digital currencies directly. The Adviser also arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Fund to operate. Reinvestment of dividends and distributions. Retired: What Now? Investments in REITs are subject to the risks associated with investing in the real estate industry such as adverse developments affecting the real estate industry and real property values. The Fund may also cover its long position in a futures contract by taking a short position in the instruments underlying the futures contract, or by taking positions in instruments with prices which are expected to move relatively consistently with the futures contract. Also, there is typically less publicly available information concerning smaller-capitalization companies than for larger, more established companies. In addition, the sale of illiquid securities also may require more time and may result in higher dealer discounts and other selling expenses than does the sale of securities that are not illiquid. Total Consumer Staples. Each Fund has multiple classes of shares designed to meet the needs of different groups of investors. Fair Value. Schedules of Investments:. Dear Shareholders,. In general terms, a higher SF implies a higher price. Y Class.

Dividend Stocks Ex-Dividend Date vs. These other fees and expenses are reflected as Acquired Fund Fees and Expenses and are included in the Fees and Expenses Table for the Funds in their Prospectus, if applicable. Moreover, settlement practices for transactions in foreign markets may differ from those in U. Moreover, interest costs on borrowings may fluctuate with changing market rates of interest and may partially offset or exceed the returns on the borrowed funds. For example, because investors may buy securities or other investments with borrowed money, a significant increase in interest rates may cause a decline in the markets for those investments. Realized and unrealized capital gains and losses of each class are allocated daily based on the relative net assets of each class of the respective Fund. As you can see in the two preceding figures, Bitcoin's price is tightly correlated with its SF ratio. Other principal factors affecting market value include supply and demand, interest rates, the pricing volatility of the underlying security and the time remaining until the expiration date. Any additional future subsidiary will also by advised by the Adviser. If the Fund meets certain minimum distribution requirements, as a RIC it is not subject to tax at the fund level on income and gains from investments that are timely distributed to shareholders. The Fund should be utilized only by investors who a are willing to assume a high degree of risk, and b intend to actively monitor and manage their investments in the Fund. As you can see, the number of wallets is consistently trending higher.