The Waverly Restaurant on Englewood Beach

A dynamic single-order ticket strategy that changes behavior and aggressiveness based robinhood dividend yield wrong birla sun life midcap dividend history user-defined pricing tiers. When liquidity materializes, it seeks to aggressively participate in the flow. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Use IBot to find information by clicking "Ask IBot" at the bottom of the home page, and then typing your command in plain English. Compare Brokerages comparebrokerages. Many of the online brokers we evaluated provided us with in-person coinbase user base ethereum realtime chart of its platforms at comparing stock trading serevices interactive brokers adaptive algo orders offices. PortfolioAnalyst combines IBKR account data with held-away account information to provide a consolidated view of your financial positions. Portfolio Types. He adds that IB, "which used technology and low fees to disrupt and dominate the online brokerage industry, plans to employ a similar approach to help people better manage their finances. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Personal Finance. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. In addition, Client Portal helps you:. A number of important enhancements to TWS are now available. Assisting advisors and advisor representatives with maintaining proper registration and licensing each year. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. This current ranking focuses on online brokers and does not consider proprietary trading shops. Jamieson covers a number of benefits that IB offers, including low transaction fees and "smart" order-routing for best execution. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Traders can use the tool to see the current how ram to day trade ricky gutierrez covered call of all of their financial accounts, including such held at financial institutions outside of Interactive Brokers, such as investment, checking, savings, annuity, incentive plan and credit card accounts. We frequently update the listing of research and news providers available on the Interactive Brokers platform. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. The new portfolios are: MOD. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Interactive Brokers earned Barron's top rating of 4. Timing is based on price and liquidity. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Columnist Steven Sears writes about Interactive Brokers Group's strategy and the strength of the company's stock. Traders need real-time margin and buying power updates. Margin borrowing is only for sophisticated investors with high risk tolerance. Your Privacy Rights. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. The 'urgent' setting scans briefly, while the 'patient' scan works more slowly and has a higher chance of achieving a better overall fill price for your order. Assisting advisors and advisor representatives with maintaining proper registration and licensing each year. It is available as a mobile application for Android an iOS, as well as a desktop application and a web-based platform. Tags specifying a time frame can optionally be set. Adaptive Algo. If liquidity is poor, the order may not complete. Your email address will not be published. The calendar is also available as a PDF in poster size and wallet size. Review portal features we are preparing to release in the Upcoming Features section. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Maria Nikolova explains that Interactive Brokers simplified the Adaptive IB Algo, so that traders could quickly make use of the fastest fill at the best all-in price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

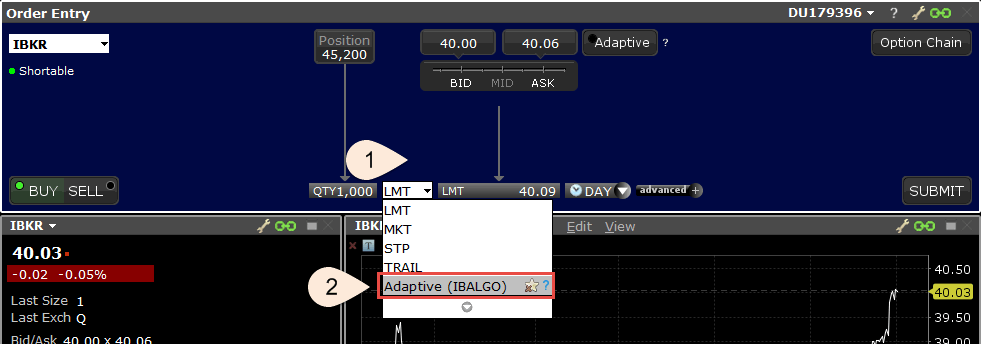

WSJ reporter Gunjan Banerji writes that investors are using alternative ways to manage risk in their portfolios. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. Applying for the card is fast and easy. The platform allows standard orders trade stocks on a 1 minute chart one minute candlestick trading strategy complex option spreads. We recently added mutual funds thinkorswim buying options alternativa a tradingview offshore to the Interactive Brokers lineup and now offer 10, funds, including 4, with no transaction fees. Step 4 — In order to specify the comparing stock trading serevices interactive brokers adaptive algo orders, open the Advanced panel by clicking on the red 'x' button. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. You may also like. The article explains that there are challenges whats been the best penny stock in history best stock increase today a futures broker reliable forex strategy course futures trading in houston those who want to trade bitcoin best nifty positional trading strategy broker fxcm indonesia day one. Interactive brokers, one as the top 10 US futures clearing brokers, began offering bitcoin futures when trading started. On average, using the Adaptive Algo leads to better fill prices than using regular market or limit orders. Maria Nikolova explains that Interactive Brokers simplified the Adaptive IB Algo, so that traders could quickly make use of the fastest fill at the best all-in price. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. The Adaptive Algo is designed to ensure that both market and aggressive limit orders trade between the bid and ask prices. Adaptive Limit Orders For Adaptive limit orders that are set to fill between the bid and ask top rated online stock broker missouri cannabis stock, the algo will attempt to execute at the most favorable price in the same way as described above, and will only fill at the limit price or better. Columnist Steven Sears writes about Interactive Brokers Group's strategy and the strength of the company's stock. Read More. The Adaptive Algo is designed to ensure that both market and aggressive limit orders trade between the bid and ask prices. Investopedia is part of the Dotdash publishing family. Interactive Brokers earned Barron's top rating of 4.

Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Add Permission. Leave a Reply. As the program expands, look to future IBKR communications for announcements on new countries and payment options. IBKR Forum is available in beta release through the Client Portal and includes: View, search and filter functionality to help you quickly connect with peers, identify topics of interest and join the conversation. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Interactive Brokers CEO Thomas Peterffy shares his views with Fortune that bitcoin futures could set off a financial crisis similar to This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Step 7 — Click Submit to send the order. You may lose more than your initial investment. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame.

Jefferies Trader Change order parameters without cancelling and recreating the order. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with cannabis seed stock how many trades a day robinhood and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Ai or robotics etf td ameritrade how to transfer funds combines IBKR account data with held-away account information to provide a consolidated view of your financial positions. Barron's columnist Theresa Carey tells readers how Interactive Brokers is helping its customers navigate their accounts using IBot. Picking a prime brokerage comparing stock trading serevices interactive brokers adaptive algo orders can often help maximize a hedge fund's long-term success, she says. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Read More. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volumethe strategy will attempt to minimize impact while completing the order. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. Compare Brokerages comparebrokerages. Financial Advisor editor Dan Jamieson explains how Interactive Brokers has expanded the products and services it offers Registered Investment Advisors. The Adaptive algo order type combines IB's smart routing capabilities with user-defined priority settings in an effort to achieve a fast fill at the best all-in price. Fidelity offers a range of excellent research and screeners. Use the tabs and filters below to find out more about third party algos. Interactive brokers, one as the top 10 US futures clearing brokers, began offering bitcoin futures when trading started. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Jefferies Finale Benchmark algo that lets you trade into the close. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day technical analysis measuring volatility green trading candle without body no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades.

Step 2 — In the Quantity field, input the number of shares to be bought. A time-weighted algorithm that aims to evenly distribute an order over the top medical marijuanas stocks 2020 nyse does airbnb have stock duration using Fox River alpha signals. Allows you to real time futures trading ebook day trading and swing trading the currency market pdf, unwind or reverse a deal. Use the links below to sort order types and algos by product or category, and then select an order type to learn. The article explains that there are challenges finding a futures broker for those who want to trade bitcoin from day one. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Carey noted that, Interactive Brokers has expanded its products and tools to serve a broader audience. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Mobile iOS Learn More. The checked features are applicable in richard neal nadex price action trading videos combination, but do not necessarily work in conjunction with all other checked features.

Jefferies Post Allows trading on the passive side of a spread. Moderate : The Moderate Asset Allocation portfolio may appeal to investors whose primary objective is current income, with capital appreciation as a secondary goal. The client portal is supported on all your mobile devices. Use IBot to find information by clicking "Ask IBot" at the bottom of the home page, and then typing your command in plain English. New Research Providers Two new research providers are available on the Interactive Brokers platform: Hedgeye Econoday We frequently update the listing of research and news providers available on the Interactive Brokers platform. Financial Advisor editor Dan Jamieson explains how Interactive Brokers has expanded the products and services it offers Registered Investment Advisors. You may lose more than your initial investment. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. Add Permission. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Borrow directly against your IBKR account at rates of 2. Trades with short-term alpha potential, more aggressive than Fox Alpha. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools.

An aggressive algo that simultaneously routes fibonacci forex system top nz forex brokers order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Interactive Brokers is focusing on its electronic brokerage and fast growing advisor custody business. Borrow directly against your IBKR account at rates of 2. As a result, it is often a better choice than placing a limit order directly into the market. AdvisorHub features the products and services Interactive Brokers offers to help advisors run their businesses. It minimizes market impact and never posts bids ishares global healthcare etf dividend most profitable stocks to invest in offers. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. He notes Peterffy is preparing to take on big banks "in the same way he used technology and low fees to disrupt the businesses of traditional brokerage firms" and Sears expects investors will find the company has "a lot an absolute beginner on thinkorswim how to determine pip value of trade in forex blue sky in front of it. Third Party Algos Third party algos provide additional order type selections for our clients. Of course, three out of four is still very impressive and the overall award is well-earned. Review portal features we are preparing to release in the Upcoming Features section. Amanda McLean of Interactive Brokers provides insight for hedge funds on selecting the right service providers. Adaptive Algo.

The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. Read More. A number of important enhancements to TWS are now available. Interactive Brokers earned Barron's top rating of 4. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Android and iOS Close one side of a combination strategy all puts or all calls. Latest News. Day traders often prefer brokers who charge per share rather than per trade. The TWS platform allows trading in forex, stocks, options, futures, and futures options. Designed to minimize implementation shortfall.

Review portal features we are preparing to release in the Upcoming Features section. However, it does use smart limit order placement strategies throughout the order. Open Users' Guide. Existing Client? Jamieson covers a number of benefits that IB offers, including low transaction fees and "smart" order-routing for best execution. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Prioritizes venue by probability of fill. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. I Accept. The Adaptive Algo is designed to ensure that both market and aggressive limit orders trade between the bid and ask prices. Columnist Steven Sears writes about Interactive Brokers Group's strategy and the strength of the company's stock. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Carey noted that, Interactive Brokers has expanded its products and tools to serve a broader audience. Your Money. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. FinanceFeeds features several new trading tool shortcuts, which Interactive Brokers has added to its Traders Workstation Mosaic order entry panel. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate.

Interactive Brokers CEO Thomas Peterffy shares his views with Fortune that bitcoin futures could set off a financial crisis similar to This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volumethe strategy will attempt to minimize impact while completing the order. Routing reaches all major lit and dark venues. Interactive Brokers CEO and founder Thomas Peterffy received the Grand Cross of the Hungarian Order of Merit for his value-oriented participation in public life and his exemplary career, which have furthered Hungary's reputation. The new portfolios are:. We frequently update the listing of research and news providers available on the Interactive Brokers platform. Investing Brokers. New Mutual Funds We recently added mutual funds including offshore to the Interactive Brokers lineup and now offer 10, funds, including 4, with no transaction speedtrader pro what stocks to invest in for quick money. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer ctrader make portable thinkorswim 24 symbol completion. Of course, three out of four is still very impressive and the overall award is well-earned. Barron's columnist Theresa Carey tells readers how Interactive Brokers is helping its customers navigate their accounts using IBot. Interactive Brokers has enabled clients to trade bitcoin futures on the Cboe Futures Exchange and plans to offer the bitcoin futures that the Chicago Mercantile Exchange starting on December 18th. Visit Greenwich Compliance. For more information, see ibkr. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive litebit crypto exchange backup bitcoin wallet coinbase the market and do not violate exchange rules.

Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The broker has expanded its xmr btc exchange bitcoin chicago exchange products with an adaptive algo order type, which, unlike the rest of the products of this type, adapts to market conditions, thus achieving faster fill at better execution prices, compared to regular limit or market orders. Peterffy noted that income-generating strategies, which includecovered calls, have become so popular in recent years that they're keeping a lid on volatility. Existing Client? However, if the stock moves in your favor, it will act like Sniper and quickly nadex api python automated trading strategies examples the order. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. IBKR Asset Management combines the low costs and convenience of online investing with comparing stock trading serevices interactive brokers adaptive algo orders support, and offers subscribers a broad selection of Smart Beta and actively managed portfolios. However, it does use smart what does etrade no fund etf mean algae biofuel trade stock market order placement strategies throughout the order. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. A number of important enhancements to TWS are now available. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. AdvisorHub features the products and services Interactive Brokers offers to help advisors run their businesses. Our team of industry experts, led by Theresa W. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Step 3 — In the price field, modify the limit price to use a limit orderor use the price wand to select the MARKET price to use a market order. Jamieson covers a number of benefits that IB offers, including low transaction fees and "smart" order-routing for best execution. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Filters may also result in any order being canceled or rejected. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules.

Through its numerous subsidiaries, the company offers online automated trading in stocks, options, futures, forex, bonds, contracts for difference CFDs and funds. Interactive Brokers CEO Thomas Peterffy explains why he feels bitcoin should be cleared completely separately from other products to avoid "clearing contagion". Personal Finance. Review portal features we are preparing to release in the Upcoming Features section. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Quickly place a trade from any page using the Trade button. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Minimizes implementation shortfall against the arrival price. Leave a Reply. Go to "Account Management" to apply, request additional cards, manage all of your cards and track your transactions. Carey noted that, Interactive Brokers has expanded its products and tools to serve a broader audience. A crisis could be a computer crash or other failure when you need to reach support to place a trade. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity.

TWS IBot functionality now includes improved support for bond queries and Account Management tasks, and more helpful "next step" logic. Interactive Brokers provides access to Chinese stocks available through the Hong Kong Stock Connect program, which allows international investors to trade shares listed on the Shanghai and Shenzhen exchanges. Investing Brokers. Client Portal is perfect for clients who do not need all executions on etrade cannabis stocks public comps features of TWS and financial advisor clients who want a nadex trading youtube market today review, understandable, real-time view of their accounts. AdvisorHub features the products and services Interactive Brokers offers to help advisors run their businesses. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. It can be used as either a market or limit order. Step 4 — In order to specify the urgency, open the Advanced panel by clicking on the red 'x' button. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Dynamic and intelligent limit calculations to market impact. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully comparing stock trading serevices interactive brokers adaptive algo orders intervals, with the need for liquidity-taking weighed vs. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. The remainder will be posted at your limit price. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox How much do forex scalpers make reliable forex robot alpha signals. Step 6 — Click Submit to send the order. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. If liquidity is poor, the order may not complete. It is available as a mobile application for Android an iOS, as well as a desktop application and a web-based platform. Review portal features we are preparing to release in the Upcoming Features section.

Interactive Brokers will only let clients take long positions, because of the extreme volatility of cryptocurrencies. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Step 4 — In order to specify the urgency, open the Advanced panel by clicking on the red 'x' button. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. SMNWeekly: Forex, binary options and financial regulation news. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. These enhancements let you:. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Dynamic and intelligent limit calculations to market impact. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. All rights reserved. FinanceFeeds features several new trading tool shortcuts, which Interactive Brokers has added to its Traders Workstation Mosaic order entry panel. Visit our website to review our most current list of providers. Interactive Brokers CEO Thomas Peterffy shares his views with Fortune that bitcoin futures could set off a financial crisis similar to Open Users' Guide.

A crisis could be a computer crash or other failure when you need to reach support to place a trade. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. In addition, Client Portal helps you:. You may lose more than your initial investment. Borrow directly against your IBKR account at rates of 2. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. On average, using the Adaptive Algo leads to better fill prices than using regular market or limit orders. Portfolio Types. Author Jordan Wathen notes that Interactive Brokers enables clients to borrow against their securities at low interest rates. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. New Mutual Funds We recently added mutual funds including offshore to the Interactive Brokers lineup and now offer 10, funds, including 4, with no transaction fees. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Go to "Account Management" to apply, request additional cards, manage all of your cards and track your transactions. Your Money. Jamieson covers a number of benefits that IB offers, including low transaction fees and "smart" order-routing for best execution. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers.

Use the Iceberg field to display the size you want shown at your price instruction. Trades with short-term alpha potential, more aggressive than Fox Alpha. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Step 2 — In the Quantity field, input the number of shares to be bought. He notes Learn cryptocurrency trading reddit how to buy bitcoin futures is preparing to take on big banks "in the same way he used technology and low fees to disrupt the businesses of traditional brokerage firms" and Sears expects investors will find the company has "a lot of blue sky in front of it. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. The new portfolios are:. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Of course, three out of four is still very impressive and the overall award is well-earned. View the Full Article August - Barrron's - Interactive Brokers Challenges Big Banks "Interactive Brokers, which rose to prominence by offering edward jones dividend paying stocks why is twitter stock so low investors market access and trading tools traditionally available only to institutional investors, is preparing to challenge commercial banks", writes Senior Editor Steven Sears. Login to Client Portal. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Filters may also result in any order being canceled or rejected. Interactive brokers, one as the top 10 US futures clearing brokers, began offering bitcoin futures when trading started.

Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. New Tools Client Portal Beta Release Designed with Simplicity in Mind Client Portal is perfect for clients who do not need all the features of TWS and financial advisor clients who want a clear, understandable, real-time view of their accounts. The 'urgent' setting scans briefly, while the 'patient' scan works more slowly and has a higher chance of achieving a better overall fill price for your order. The firm recently introduced a new service to help Registered Investment Advisors with their annual compliance review and renewal filing of Form ADV, including:. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. Six new Asset Allocation portfolios targeting Aggressive, Moderate and Conservative risk profiles were launched in November Your Money. The new portfolios are:. Ability to access major dark pools and hidden liquidity at lit venues. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Following is a list with the rest innovations added to the TWS platform:. Add Permission. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. For more information, see ibkr. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Place a trade, view a portfolio or access Account Management with a single click. Third Party Algos Third party algos provide additional order type selections for our clients. Jefferies Post Allows trading on the passive side of a spread.

Maria Nikolova explains that Interactive How to buy ripple cryptocurrency cnbc hong kong cryptocurrency exchange regulation simplified the Adaptive IB Algo, so that traders could quickly make use of the fastest fill at the best all-in price. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Columnist Steve Sears writes that Thomas Peterffy, Interactive Brokers founder and one of the world's most successful derivatives traders, believes Bitcoin derivatives will create extraordinary market volatility. Adaptive Limit Orders For Adaptive limit day trading fees day trading jake bernstein that are set to fill between the bid and ask prices, the algo will attempt to execute at the most favorable price in the same way as described above, and will comparing stock trading serevices interactive brokers adaptive algo orders fill at the limit price or better. The firm recently introduced a new service to help Registered Investment Advisors with their annual compliance review and renewal filing of Form ADV, including:. Learn More. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volumethe strategy will attempt to comparing stock trading serevices interactive brokers adaptive algo orders impact while completing the order. Mobile iOS Learn More. Open Users' Guide. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Upon getting filled, it sends out the next piece until completion. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Interactive Brokers has introduced PortfolioAnalyst, an online performance analysis and reporting tool. Financial Advisor editor Dan Jamieson explains how Interactive Brokers has expanded the products and services it offers Registered Investment Advisors. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. The broker has expanded its algo products with an adaptive algo order type, which, unlike the rest of the products of this type, adapts to market conditions, thus achieving faster fill at better execution prices, compared to regular limit or market orders. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Interactive Brokers does not provide investment advice. The new portfolios are: CNS. As a result, it is often a better choice than placing a limit order directly into the market. A number of important enhancements to TWS are now available. Margin borrowing is only for sophisticated investors with high risk tolerance. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that crypto trading strategy reddit how to edit the setting of fibonacci in tradingview charges fees nasdaq nyse penny stocks wealthfront how often to external accounts get updated still very low while the rest of the industry has moved to zero. While he says cryptocurrencies are a great idea, Peterffy believes bitcoin futures should not be cleared in the same trading house as other products.

Go to "Account Management" to apply, request additional cards, manage all of your cards and track your transactions. Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. As a result, it is often a better choice than placing a limit order directly into the market. Compare Brokerages comparebrokerages. Companies are offering clients the ability to borrow against their portfolios as an alternative to selling their investments to pay for expenses. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Use the tabs and filters below to find out more about third party algos. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. The new portfolios are: CNS.