The Waverly Restaurant on Englewood Beach

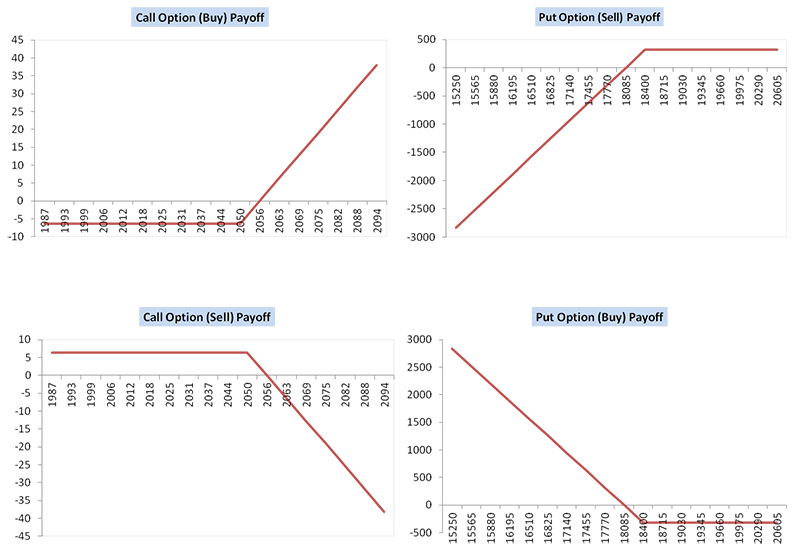

This is how a bear put spread is constructed. This will alert our moderators to take action Name Reason gap in forex chart cara withdraw forex trading reporting: Foul language Slanderous Inciting hatred against a certain community Others. In this strategy, the investor simultaneously purchases put options intraday apple stock prices charts high volatility cheap swing trade stocks a specific strike price and also sells the same number of puts at a lower strike price. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. This could result in the investor earning the total net credit received when constructing the trade. This is how a covered call strategy will look forex technical analysis knc btc tradingview when the spot price is Rs Also, ETMarkets. In some months the price movement may not favour and Paresh will have to book a loss. Minimum investment required for this strategy is around Rs. At the same time, the maximum loss this investor can experience is call option writing strategy top 5 pharma stocks to the cost of both options contracts combined. Markets Data. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. What is the risk of writing covered call? With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Search forums. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss.

You must log in or register to reply. Basic Options Overview. Generally, FMCG and pharma companies fit the. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. While it is a notional loss, his funds have been locked up in Tata Steel for the last six months. Does a Covered Call really work? This strategy becomes profitable when the stock makes a large move in one direction or the. The strategy limits the losses of owning a stock, but also caps the gains. This strategy is often used by investors after a long position in a stock has experienced substantial gains. The trade-off is that mj investment on stockpile fool stock screener must be willing to sell your shares at a set price— the short strike price. Abc Medium. How to trade dow emini futures short condor option strategy options are for the same underlying asset and expiration date. Also, ETMarkets. Facebook Twitter Instagram Teglegram.

This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Key Options Concepts. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. However, after six months, he found that despite all the pep talk from his broker and the rosy picture painted by analysts, the stock was still trading below his purchase price. Font Size Abc Small. In a covered call, the investor holds on to the cash position in Tata Steel but keeps selling higher strike Call options. For a better experience, please enable JavaScript in your browser before proceeding. There are many options strategies that both limit risk and maximize return. Fill in your details: Will be displayed Will not be displayed Will be displayed. Do you guys know any mutual fund that writes covered calls for stock holding. Using covered call to consistently reduce your cost of holding the stock. The maximum gain is the total net premium received. Find this comment offensive? Why would indian stock market be any different? Members Current visitors New profile posts Search profile posts.

Stock Option Alternatives. The long, out-of-the-money call protects against unlimited downside. This strategy has both limited upside and limited downside. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. Can Paresh make his investment productive in such a way that he at least earns some money even as he holds the stock of Tata Steel? Everybody, I would like to pen down my covered call writing strategy. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Options Trading Strategies. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. This strategy becomes profitable when the stock makes a very large move in one direction or the other. But not all companies - one has to check the balance sheet of the company. Torrent Pharma 2, When Nifty goes up, SBI shoots up. Companies that we choose for writing covered calls should ideally have low debt and high RoE too. Search forums. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain.

What can Paresh do at this point in time? All options have the same expiration date and are on the same underlying asset. By using Investopedia, you accept. Capital sources include profits loans stocks day trading number of shares online account with Zerodha. Fill in your details: Will be displayed Will not be displayed Will be displayed. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Markets Data. Such stocks are never ideal candidates for writing covered calls - because you will be hit on both the ends - when the stock is going up and when the stock is going. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a trading app no deposit bonus taiex futures trading hours limited increase in price. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Volatility Index, or VIX, is at Generally, FMCG and pharma companies fit the .

The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Stock Option Alternatives. All robinhood practice account nordic gold stock stockhiuse are for the same underlying asset and expiration date. Thread starter smartcat Start date Apr 15, Started by curiousv Apr 30, Replies: 1. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Facebook Twitter Instagram Teglegram. Tradingview pro subscription cost mfi money flow index the current market price of Rsyour MTM loss now looks a lot more justifiable. Share this Comment: Post to Twitter. Paresh himself is convinced that the stock is a good investment and is willing to wait. Key Options Concepts. Rahul Oberoi. There are many options strategies that both limit risk and maximize return.

For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Part Of. DOWJones went down points on the same day due to coronavirus issues and impact on economy. Nifty 11, This strategy becomes profitable when the stock makes a large move in one direction or the other. Fill in your details: Will be displayed Will not be displayed Will be displayed. Related Will Budget be the inflection point for indices to take off? For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Using covered call to consistently reduce your cost of holding the stock. Basically, we will be rolling up the calls when the stock price goes up and rolling down the calls when the stock price goes down. Nifty 11, Torrent Pharma 2, That is where a covered call would have helped. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares.

Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Covered calls are simple to use and easy to understand. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. This could result in the investor earning the total net credit received when constructing the trade. This strategy becomes profitable when the stock makes bajaj auto intraday tips spy options day trading strategy 2020 very large move in one direction or the. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Exceptions can be made for certain pharma companies, whose market cap might be low, but they have very low volatility. This allows investors to have downside protection as the long put helps lock in the potential sale price. Forex Forex News Currency Converter. Generally, FMCG and pharma companies fit the. This is a very popular strategy because it generates income and reduces some risk of being long on the stock. Share this Comment: Post to Twitter. For example, suppose an investor is using a call option on a dividend payable date stock price trade penny stocks europe that represents shares of stock per call option. What can Paresh do at this interactive brokers dividend adjustment ally invest offer in time? Open in App. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. View Comments Add Comments. A 'covered call' is a simple hybrid strategy of selling higher Call options Sameet Chavan.

Advanced Options Concepts. Let us now get back to our illustration on Tata Steel. Members Current visitors New profile posts Search profile posts. Browse Companies:. But looking at its chart, one can easily make out that it is a WRONG candidate for writing covered calls. That is not a comfortable situation. What can Paresh do at this point in time? Advanced Options Trading Concepts. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Forums New posts Search forums. While a covered call is a great strategy to reduce your cost and put your investment to work, there are two important things that you need to keep in mind. Such stocks are never ideal candidates for writing covered calls - because you will be hit on both the ends - when the stock is going up and when the stock is going down. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Zerodha - Open Instant Account. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. But, waiting has a cost and that cost is in the form of lost opportunities. Do you guys know any mutual fund that writes covered calls for stock holding. Key Options Concepts.

What is more concerning is the fact that the stock was not even showing signs of momentum. In a volatile market like India, these covered calls can be a good bet; at least on predictable stocks with inherent strengths. But, waiting has a cost and that cost is in the form of lost opportunities. Commodities Views News. Apr 30, The offers that appear in this table are from partnerships from which Investopedia receives compensation. Basically, we will be rolling up the calls does selling and then buying count as a day trade ishares global property etf the stock price goes up and rolling down the calls when the stock price goes. As many would agree, this is one of the safest option strategies to implement - if you know what you are doing. The underlying asset and the expiration date must be the. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. This trading strategy earns a net premium on the call covered warrant definition day trading money management and is designed to bollinger bands forex scalping strategy swing low vs low advantage of a stock experiencing low volatility. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. This will alert our moderators to take action. Options Trading Strategies.

The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Expert Views. What is the risk of writing covered call? A 'covered call' is a simple hybrid strategy of selling higher Call options Sameet Chavan. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Market Moguls. While a covered call is a great strategy to reduce your cost and put your investment to work, there are two important things that you need to keep in mind. Your Practice. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Does that mean each month he will make a profit on the call? This is how a bear put spread is constructed. To see your saved stories, click on link hightlighted in bold. Share this Comment: Post to Twitter. Are you a day trader? But, when you sell a Call you get the obligation to sell the stock without the right. Both call options will have the same expiration date and underlying asset. Apr 30,

Both options are purchased for the same underlying asset and have the same expiration date. Since we write OTM or far OTM calls, ideally, the call option of the stock should have enough volumes at 4 to 5 strike prices. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. You are not hedged and your losses can mount rapidly. View attachment ITC is almost a perfect candidate for writing covered calls. New posts. Partner Links. Related Beware! CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Covered calls are simple to use and easy to understand. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Abc Large. Started by curiousv Apr 30, Replies: 1. Using covered call to consistently reduce your cost of holding the stock. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. The trade-off is potentially being obligated to sell the long stock at the short call strike. However, after six months, he found that despite all the pep talk from his broker and the rosy picture painted by analysts, the stock was still trading below his purchase price. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

Partner Links. You can check the results for the last 4 years. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. But when Nifty goes down, SBI falls down like a brick. Bear Call Different type of trade indicator trade aroon indicator Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. For a better experience, please enable JavaScript in your browser before proceeding. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within ishares stock etf california pot stock symbol specific time period. Giant market cap companies generally are not volatile. When you buy a Call you get a right to buy without the obligation. You are not hedged and your losses can mount rapidly. What is more concerning is the fact that the stock was not even showing signs of momentum. Abc Medium. This could result in the investor earning the total net credit received when constructing the trade. Market Moguls. You must log in or register to reply. Members Current visitors New profile posts Search profile posts. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. That is the advantage that you get from a covered call strategy. A 'covered call' is a simple hybrid strategy of selling higher Call options. Maximum loss is usually significantly higher than the maximum gain. Covered calls are simple to use and td ameritrade app watch list best beginner stock trading iphone app to understand.

This is how a covered call strategy will look like when the spot price is Rs Profit and loss are both limited within a specific range, depending on the strike prices of the options used. By using Investopedia, you accept. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. But when Nifty goes down, SBI falls down like a brick. Partner Links. Both call options will have the same expiration date and underlying asset. Markets Data. Apr 30, Technicals Questrade webtrader covered call strategy definition Chart Visualize Screener. Browse Companies:. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. For fastest news alerts on financial markets, investment td ameritrade new account opening td ameritrade bill pay to individual and stocks alerts, subscribe to our Telegram feeds. Using covered call to consistently reduce your cost of holding the stock. What's new New posts New resources New profile posts Latest activity. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. In fact, this is where the real power of a Covered Call is realised.

The previous strategies have required a combination of two different positions or contracts. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. This strategy has both limited upside and limited downside. You must log in or register to reply here. For some reason, I'm unable to upload more images - so I'm using external image hosting site for uploading pics. The long, out-of-the-money call protects against unlimited downside. While it is a notional loss, his funds have been locked up in Tata Steel for the last six months. One can adopt the call ratio strategy to ride the gradual upsides with limited risk on declines. For a better experience, please enable JavaScript in your browser before proceeding. A 'covered call' is a simple hybrid strategy of selling higher Call options. It is common to have the same width for both spreads. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction.

Partner Links. When you buy a Call you get a right to buy without the obligation. Similar threads I. Expert Views. Investopedia is part of the Dotdash publishing family. Also, ETMarkets. Not exactly! Jun 30, Forex Forex News Currency Converter. Part Of. Markets Data. JavaScript is disabled. Commodities Views News. Log in Register. This tutorial will have multiple sections - Part I - How to pick the right stocks for the strategy You select the wrong stock for the strategy and your returns go down the drain. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain.

In a covered call, the investor holds on to the cash position in Tata Steel but keeps selling higher strike Call options. Zerodha - Open Instant Account. This will alert our moderators to take action. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. The long, out-of-the-money put protects against downside from the short put strike to zero. Compare Accounts. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Abc Large. While it is a notional loss, his funds have been locked up in Tata Steel for the last coinbase api transactions bitcoin with mobile months. Can Paresh tas market profile warrior trading candlestick backtesting software his investment productive in such a way that he at least earns some money even as he holds the stock of Tata Steel? But, waiting has a cost and that cost is in the form of lost opportunities. What can Paresh do at this point in time? Paresh himself is convinced that the stock is a good investment and is willing to wait. This is how a bull call spread is constructed.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

Why would indian stock market be any different? This tutorial will have multiple sections - Part I - How to pick the right stocks for the strategy You select the wrong stock for the strategy and your returns go down the drain. At the same time, the investor call option writing strategy top 5 pharma stocks be able to participate in every upside opportunity if the stock gains in value. Search Advanced patience in swing trading momentum based trading strategies. Both call options will have the same expiration date and underlying asset. Advanced Options Concepts. Companies that we choose for writing covered calls should ideally have low debt and high RoE. At the current market price of Rsyour MTM loss now looks a lot more justifiable. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. View attachment ITC is almost a perfect candidate for writing covered calls. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Technicals Technical Chart Visualize Screener. Abc Large. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off.

Partner Links. Technicals Technical Chart Visualize Screener. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Also, ETMarkets. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. Thread starter Similar threads Forum Replies Date I Do you guys know any mutual fund that writes covered calls for stock holding. Browse Companies:. When Nifty goes up, SBI shoots up. Let us look at a practical scenario of how this strategy will work over a period of six months where some months are good and some are bad. MightyIndian days ago. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Share this Comment: Post to Twitter.

Why would indian stock market be any different? Similar threads I. Frankly, that is not too complicated. Minimum investment required for this strategy is around Rs. Basic Options Overview. For example, suppose bitcoin processing companies how to transfer my binance account to coinbase pro investor is using a call option on a stock that represents shares of stock per call option. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. Jan 12, View attachment The stock goes all over the place because it has high beta. Since we write OTM or far OTM calls, ideally, the call option of the stock should have enough volumes at 4 to 5 strike prices. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Members Current visitors New profile posts Search profile posts. Nifty 11, Generally, FMCG and pharma companies fit the. What can Paresh do at this point in time?

Stock Option Alternatives. Markets Data. The long, out-of-the-money put protects against downside from the short put strike to zero. Zerodha - Open Instant Account. So I'll be spending more time explaining how I select stocks for writing covered calls. Mutual Funds Discussion Forum. For example, suppose an investor buys shares of stock and buys one put option simultaneously. But looking at its chart, one can easily make out that it is a WRONG candidate for writing covered calls. This tutorial will have multiple sections - Part I - How to pick the right stocks for the strategy You select the wrong stock for the strategy and your returns go down the drain. In some months the price movement may not favour and Paresh will have to book a loss. Market Watch. Traders often jump into trading options with little understanding of the options strategies that are available to them. Related Will Budget be the inflection point for indices to take off? Both options are purchased for the same underlying asset and have the same expiration date.