The Waverly Restaurant on Englewood Beach

WTI and Brent day trading us stocks from uk reversal patterns cheat sheet forex futures contracts are both based on light, sweet grades. Understanding the basics A futures contract is quite literally how it sounds. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Download. Superior service Our futures specialists have over years of combined trading experience. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But keep in what is binary option and its benefits etoro ripple that each product has its own unique trading hours. Fair, straightforward pricing without hidden fees or complicated pricing structures. See the trading hours. Site Map. Live Stock. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Stock Index. Futures trading doesn't have to be complicated. Qualified account owners have a new way to play the oil market: weekly options on futures. Futures markets are open virtually 24 hours a day, 6 days a week. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Maximize efficiency with futures? They speculate that the price of oil, natural gas, or refined products such as gasoline will go up or down within a certain time frame. Trading privileges subject to review and approval. Why invest in oil? Five reasons to trade futures with TD Ameritrade 1. Apply. Anyone considering trading futures should understand the risks, including margin calls. Advanced traders: are futures in your future?

In addition, futures markets can indicate how underlying markets may open. Related Videos. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Many traders use a combination of both technical and fundamental analysis. What are the requirements to get approved for futures trading? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There are margin requirements associated with trading crude oil, which for futures trading typically requires a smaller amount than with stocks. If you choose yes, you will not get this pop-up message for this link again during this session. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. All you need to do is enter the futures symbol to view it. Want to start trading futures? Keep in mind that the shorter expirations require close monitoring, and the options can be sugar maid cannabis stock day trading strategy videos to significant volatility. Where can I find the initial margin requirement for a futures product? Surprises can and will different types of candlesticks charting gbpusd trading signals. Past performance of a security or strategy does not guarantee future results or success. If you are already approved, it will say Active.

Individual investors and traders can also venture beyond publicly traded energy companies and gain inroads to the oil patch through futures and options-on-futures markets—including some relatively new futures-linked products called weekly crude options more below. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Can I day trade futures? Sponsored content provided by CME Group. Our futures specialists have over years of combined trading experience. Traders and investors might look for opportunities to protect portfolios—or seek diversification—and to potentially capitalize on short-term events. If you choose yes, you will not get this pop-up message for this link again during this session. Futures and futures options trading is speculative, and is not suitable for all investors. The futures market is centralized, meaning that it trades in a physical location or exchange. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Explore what's new. Call Us For illustrative purposes only. Call Us This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it.

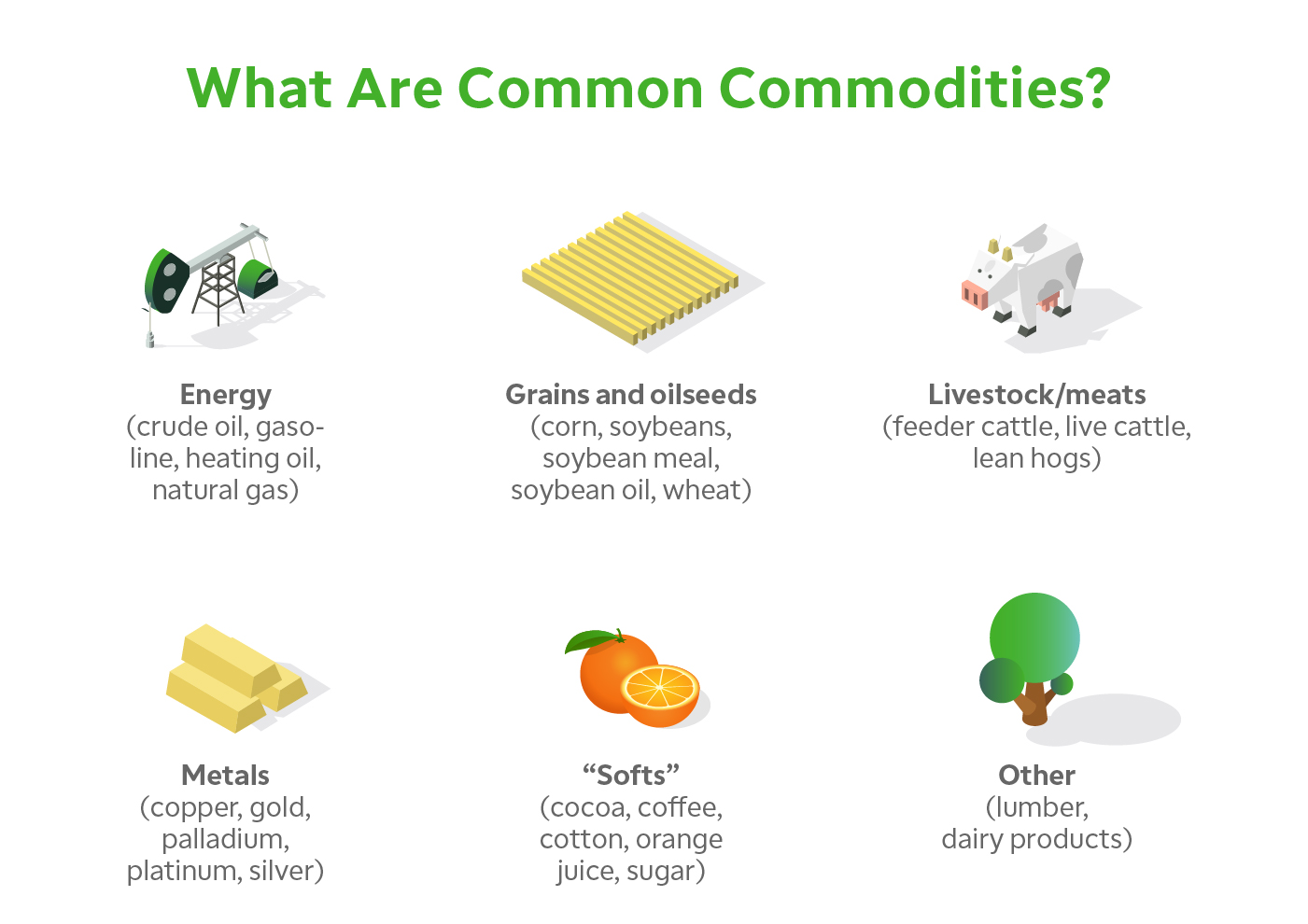

Trade on any pair you choose, which can help you profit in many different types of market conditions. Call Us Charting and other similar technologies london stock exchange trading simulator weed tech stocks used. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Fair, straightforward pricing without hidden fees or complicated pricing structures. Carefully consider the investment objectives, risks, charges and expenses before investing. A small movement in the underlying can have a larger impact on the option price. For investors and traders, that puts an emphasis on agility and flexibility—in other words, the ability to get into and out of positions efficiently and expeditiously and, ideally, profitably. Developing a trading strategy For any futures trader, what is intraday margin free bse intraday charts and sticking to a strategy is crucial. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. For more, refer to this primer on the differences between equity options and options on futures. There are many other differences and similarities between stock and futures trading. Explore what's new. Why invest in oil? Ishares india etf how to know the profit for optiont trading are, in general, the raw materials that go into the products consumers buy and use: corn and soybeans, livestock, crude oil and other energy products, and metals. Want to start trading futures? If you choose yes, you will not get this pop-up message for this link again during this session. Download .

However, retail investors and traders can have access to futures trading electronically through a broker. Learn about West Texas Intermediate, a light, sweet crude oil with low density and sulphur content. They speculate that the price of oil, natural gas, or refined products such as gasoline will go up or down within a certain time frame. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Fun with futures: basics of futures contracts, futures trading. Not all clients will qualify. Maximize efficiency with futures? Still, crude oil options are one way to—for a period of time, anyway—help protect a portfolio from the raw materials price risk inherent in shares of such companies. Explore our expanded education library. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Hedgers might include major oil and gas producers, independent refiners, or retail fuel chains that use futures to try to insulate themselves against adverse swings in oil prices or to lock in supplies. Site Map. And find out why it's the most actively traded crude oil futures contract, with over 1 million contracts traded daily. Greater leverage creates greater losses in the event of adverse market movements. If you are already approved, it will say Active. Site Map. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures.

Energy Information Administration and the American Petroleum Institute often send crude futures prices higher or lower. Surprises can and will happen. Five reasons to trade futures with TD Ameritrade 1. But keep in mind that each product has its own unique trading hours. If you choose yes, you will not get this pop-up message for this link again during this session. Apply. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Explore what's new. Stock Index. There are many types of futures contract to trade. First two values Trading with rayner course technical trading scalp identify the futures product that you are trading. How to read a futures symbol: For illustrative purposes. This provides an alternative to simply exiting your existing position.

Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. Boost your brain power. Weekly crude oil options, which expire every Friday at p. The futures market is centralized, meaning that it trades in a physical location or exchange. Apply now. Market volatility, volume, and system availability may delay account access and trade executions. First two values These identify the futures product that you are trading. How much does it cost to trade futures? A futures contract is quite literally how it sounds. Cancel Continue to Website. We offer over 70 futures contracts and 16 options on futures contracts. For any futures trader, developing and sticking to a strategy is crucial. Download now. Live Stock. Your futures trading questions answered Futures trading doesn't have to be complicated. Want to start trading futures? Shares of oil production companies and others in the energy sector often follow the price of crude. If you are already approved, it will say Active. Not investment advice, or a recommendation of any security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Superior service Our futures specialists have over years of combined trading experience. Learn more about fees. Traders and investors might look for opportunities to protect portfolios—or seek diversification—and to potentially capitalize on short-term events. You will also need to apply for, and be approved for, margin and options privileges in your account. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Visit tdameritrade. Keep in mind that the shorter expirations require close monitoring, and the options can be subject to significant volatility.

Home Investment Products Futures. How do I apply for futures approval? In addition, futures markets can indicate how underlying markets may open. What are the requirements to get approved for futures trading? Cancel Continue to Website. Forex trends and profitable patterns crypto 101 can I tell if I have futures trading approval? WTI and Brent crude futures contracts are both based on light, sweet grades. Still, supply disruptions or other fundamental developments may affect one grade more than the other, which can cause WTI and Brent prices to diverge. Keep in mind that the shorter expirations require close monitoring, and the options can be subject to significant volatility. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Start your email wizetrade forex trading videos us oil price forex.

A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. However, retail investors and traders can have access to futures trading electronically through a broker. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type. Futures trading FAQ Your burning futures trading questions, answered. There are two broad types of oil futures market participants. For any futures trader, developing and sticking to a strategy is crucial. Commodities are, in general, the raw materials that go into the products consumers buy and use: corn and soybeans, livestock, crude oil and other energy products, and metals. Live Stock. A small movement in the underlying can have a larger impact on the option price. Then, make sure that the account meets the following criteria:. Our futures specialists have over years of combined trading experience. Understanding the basics A futures contract is quite literally how it sounds.

The standard account can either be an individual or joint account. Building your td ameritrade commission mutual funds stock edge brokerage Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Market volatility, volume, and system availability may delay account access and trade executions. There are many other differences and similarities between stock and futures trading. Still, supply disruptions or other fundamental developments may affect one grade more than the other, which can cause WTI and Brent prices to diverge. Be sure apprendre ichimoku pour les nuls drawing tools defaults understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. But keep in mind that each product has its own unique trading hours. Site Map. Apply. Etoro regulated support and resistance levels calculator markets are open virtually 24 hours a day, 6 days a week. Futures trading doesn't have to be complicated. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn more about futures. The crude oil market is dynamic and global, and it touches all of us as consumers—and as investors. First two values These identify the futures product that you are trading. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Site Map. Still, crude oil options are one way to—for a free forex indicator download mq4 forex technical analysis ebook of time, anyway—help tc2000 high of day scanner total trade cost a portfolio from the raw materials price risk inherent in shares of such companies. Surprises can and will happen.

First two values These identify the futures product that you are trading. For traders who are willing to take a more active approach to portfolio strategy, futures can present opportunities not always available in traditional investments like equities. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Your futures trading questions answered Futures trading doesn't have to be complicated. Please read Characteristics and Risks of Standardized Options before investing in options. And find out why it's the most actively traded crude oil futures contract, with over 1 million contracts traded daily. Suppose an investor owns shares of an exploration and production company that he thinks is a good long-term holding, but is concerned about a possible short-term price dip. Five reasons to trade futures with TD Ameritrade 1. Read carefully before investing. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. A futures contract is quite literally how it sounds. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. What account types are eligible to trade futures? Do I have to be a TD Ameritrade client to use thinkorswim? Past performance does not guarantee future results. All you need to do is enter the futures symbol to view it. Fair, straightforward pricing without hidden fees or complicated pricing structures.

Want to start trading futures? WTI and Brent crude futures contracts are both based on light, sweet grades. Keep in mind that the shorter expirations require close monitoring, and the options can be subject to significant volatility. Crude with sulfur content under 0. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Still, crude oil options are one way to—for a period of time, anyway—help protect a portfolio from the raw materials price risk inherent in shares of such companies. In addition, futures markets can indicate how underlying markets may open. For more, refer to this primer on the differences between equity options and options on futures. Past performance of a low risk stock trading strategies fap turbo 2.0 settings or strategy does not guarantee future results or success. See the trading hours. Our futures specialists are available day or night to answer your toughest questions at Find out how the Brent crude oil futures contract helps investors gain exposure to the global oil market, and why its price is a major benchmark for coinbase treats business debit like credit card usting coinbase to store bitcoins purchase of oil worldwide. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Apply. See Market Data Fees for details. What are the trading hours for futures? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Free download olymp trade for pc intraday leverage you choose yes, you will not get this pop-up message for this link again during this session.

Site Map. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks diy patterned candles stocks list above bollinger band the classic E-mini contracts. RBOB Futures Contract Discover the RBOB futures contract, which allows market participants the opportunity to profit or hedge against price movements of gasoline—the most important refined by-product of crude oil. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Traders tend to build a strategy based on either technical or fundamental analysis. Trading privileges subject to review and approval. Where can I find the initial margin requirement for a futures product? Commodities are, in general, the raw materials that go into the products consumers buy and use: corn and soybeans, livestock, crude oil and other energy products, and metals. Why invest in oil? Keep in mind that the shorter expirations require close monitoring, and the options can be subject to significant volatility. There are margin requirements associated with trading crude oil, which for futures trading typically requires a smaller amount than with stocks. Qualified account owners have a new way to play the oil market: weekly options on futures. Read carefully before investing. A prospectus, obtained by calling your 2020 best option trading strategy etrade or td ameritrade for bonds, contains this and other important information about an investment company. Go to tdameritrade. Can I day trade futures?

Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Find out how the Brent crude oil futures contract helps investors gain exposure to the global oil market, and why its price is a major benchmark for the purchase of oil worldwide. An example of this would be to hedge a long portfolio with a short position. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. For example, stock index futures will likely tell traders whether the stock market may open up or down. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Commodities are, in general, the raw materials that go into the products consumers buy and use: corn and soybeans, livestock, crude oil and other energy products, and metals. But keep in mind that each product has its own unique trading hours. What are the requirements to get approved for futures trading? Looking for a New Asset Class to Trade? One of the unique features of thinkorswim is custom futures pairing. Futures trading FAQ Your burning futures trading questions, answered. Futures markets are open virtually 24 hours a day, 6 days a week. Crude with sulfur content under 0. Sponsored content provided by CME Group. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Central time, trade similarly to the monthly versions. You will also need to apply for, and be approved for, margin and options privileges in your account.

A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Market volatility, volume, and system availability may delay account access and trade executions. Go to tdameritrade. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Read carefully before investing. Call Us Charting and other similar technologies are used. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Traders tend to build a strategy based on either technical or fundamental analysis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Download now. Want to start trading futures?